EXHIBIT (C)(7)

Published on August 1, 2022

Exhibit (c)(7)

Confidential Draft Project Gemini: Confidential Discussion Materials June 10, 2022

Confidential Draft Disclaimer This presentation has been prepared by Centerview Partners LLC (Centerview) for use solely by the Special Committee of the Board of Directors of Gemini in connection with its evaluation of a proposed share reclassification and for no other purpose. The information contained herein is based upon information supplied by or on behalf of Gemini and publicly available information, and portions of the information contained herein may be based upon statements, estimates and forecasts provided by Gemini. Centerview has relied upon the accuracy and completeness of the foregoing information, and has not assumed any responsibility for any independent verification of such information or for any independent evaluation or appraisal of any of the assets or liabilities (contingent or otherwise) of Gemini or any other entity, or concerning the solvency or fair value of Gemini or any other entity. With respect to financial forecasts, including with respect to estimates of potential synergies, Centerview has assumed that such forecasts have been reasonably prepared on bases reflecting the best currently available estimates and judgments of the managements of Gemini as to their respective future financial performances, and at your direction Centerview has relied upon such forecasts, as provided by Geminis management, with respect to both Gemini, including as to expected synergies. Centerview assumes no responsibility for and expresses no view as to such forecasts or the assumptions on which they are based. The information set forth herein is based upon economic, monetary, market and other conditions as in effect on, and the information made available to us as of, the date hereof, unless indicated otherwise and Centerview assumes no obligation to update or otherwise revise these materials. The financial analysis in this presentation is complex and is not necessarily susceptible to a partial analysis or summary description. In performingthis financial analysis, Centerview has considered the results of its analysis as a whole and did not necessarily attribute a particular weight to any particular portion of the analysis considered. Furthermore, selecting any portion of Centerviews analysis, without considering the analysis as a whole, wouldcreate an incomplete view of the process underlying its financial analysis. Centerview may have deemed various assumptions more or less probable than other assumptions, so the reference ranges resulting from any particular portion of the analysis described above should not be taken to be Centerviews view of the actual value of Gemini. These materials and the information contained herein are confidential, were not prepared with a view toward public disclosure, and may not be disclosed publicly or made available to third parties without the prior written consent of Centerview. These materials and any other advice, written or oral, rendered by Centerview are intended solely for the benefit and use of the Special Committee of the Board of Directors of Gemini (in its capacity as such) in its consideration of the proposed share reclassification, and are not for the benefit of, and do not convey any rights or remedies for any holder of securities of Gemini or any other person. Centerview will not be responsible for and has not provided any tax, accounting, actuarial, legal or other specialist advice. These materials are not intended to provide the sole basis for evaluating the proposed transaction, and this presentation does not represent a fairness opinion, recommendation, valuation or opinion of any kind, and is necessarily incomplete and should be viewed solely in conjunction with the oral presentation provided by Centerview. 1

Confidential Draft Class A Voting Illustration Total Class A shares of 161.0mm as of 2022 preliminary proxy Record Date Sands family holds 7.1mm Class A shares and other directors & executives hold 0.1mm Class A shares Of the remaining 153.8mm non-family and non-director/executive Class A shares, a majority (>50%) of the shares must vote to approve the reclassification (>76.9mm) Analysis below illustrates at various percentages of total votes cast, what percentage must vote yes in order to reach various percentages of approval in the vote results Illustrative Percentage Of Votes Cast Required To Approve Reclassification % Of Eligible Class A Shares Sought / Implied # Of Shares (mm) 50% 55% 60% 65% 70% 75% 80% 76.9 84.6 92.3 100.0 107.7 115.4 123.1 / (mm) 80% 123.1 63% 69% 75% 81% 88% 94% 100% Cast Cast 85% 130.8 59% 65% 71% 76% 82% 88% 94% Votes Votes 90% 138.5 56% 61% 67% 72% 78% 83% 89% Of % Of # 95% 146.1 53% 58% 63% 68% 74% 79% 84% 2 Source: Company filings and FactSet. Note: Excludes all outstanding Class 1 given limited voting rights.

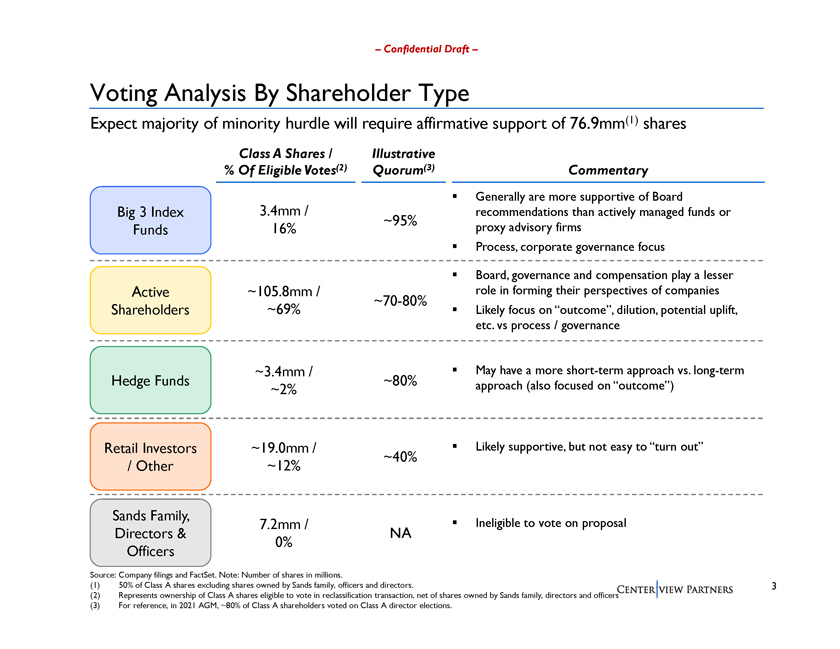

Confidential Draft Voting Analysis By Shareholder Type Expect majority of minority hurdle will require affirmative support of 76.9mm(1) shares Class A Shares / Illustrative % Of Eligible Votes(2) Quorum(3) Commentary Generally are more supportive of Board Big 3 Index 3.4mm / recommendations than actively managed funds or ~95% proxy advisory firms Funds 16% Process, corporate governance focus Board, governance and compensation play a lesser Active ~105.8mm / role in forming their perspectives of companies ~70-80% Shareholders ~69% Likely focus on outcome, dilution, potential uplift, etc. vs process / governance ~3.4mm / May have a more short-term approach vs. long-term Hedge Funds ~80% approach (also focused on outcome) ~2% Retail Investors ~19.0mm / Likely supportive, but not easy to turn out ~40% / Other ~12% Sands Family, 7.2mm / Ineligible to vote on proposal Directors & NA 0% Officers Source: Company filings and FactSet. Note: Number of shares in millions. (1) 50% of Class A shares excluding shares owned by Sands family, officers and directors. 3 (2) Represents ownership of Class A shares eligible to vote in reclassification transaction, net of shares owned by Sands family, directors and officers (3) For reference, in 2021 AGM, ~80% of Class A shareholders voted on Class A director elections.

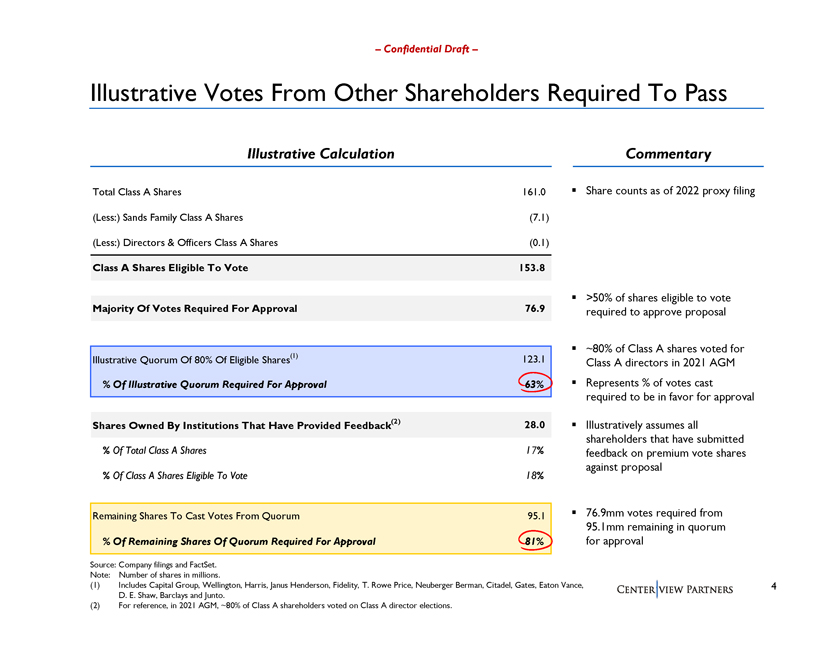

Confidential Draft Illustrative Votes From Other Shareholders Required To Pass Illustrative Calculation Total Class A Shares 161.0 (Less:) Sands Family Class A Shares (7.1) (Less:) Directors & Officers Class A Shares (0.1) Class A Shares Eligible To Vote 153.8 Majority Of Votes Required For Approval 76.9 Illustrative Quorum Of 80% Of Eligible Shares(1) 123.1 % Of Illustrative Quorum Required For Approval 63% Shares Owned By Institutions That Have Provided Feedback(2) 28.0 % Of Total Class A Shares 17% % Of Class A Shares Eligible To Vote 18% Remaining Shares To Cast Votes From Quorum 95.1 % Of Remaining Shares Of Quorum Required For Approval 81% Source: Company filings and FactSet. Note: Number of shares in millions. (1) Includes Capital Group, Wellington, Harris, Janus Henderson, Fidelity, T. Rowe Price, Neuberger Berman, Citadel, Gates, Eaton D. E. Shaw, Barclays and Junto. (2) For reference, in 2021 AGM, ~80% of Class A shareholders voted on Class A director elections. Commentary Share counts as of 2022 proxy filing >50% of shares eligible to vote required to approve proposal ~80% of Class A shares voted for Class A directors in 2021 AGM Represents % of votes cast required to be in favor for approval Illustratively assumes all shareholders that have submitted feedback on premium vote shares against proposal 76.9mm votes required from 95.1mm remaining in quorum for approval Vance, 4

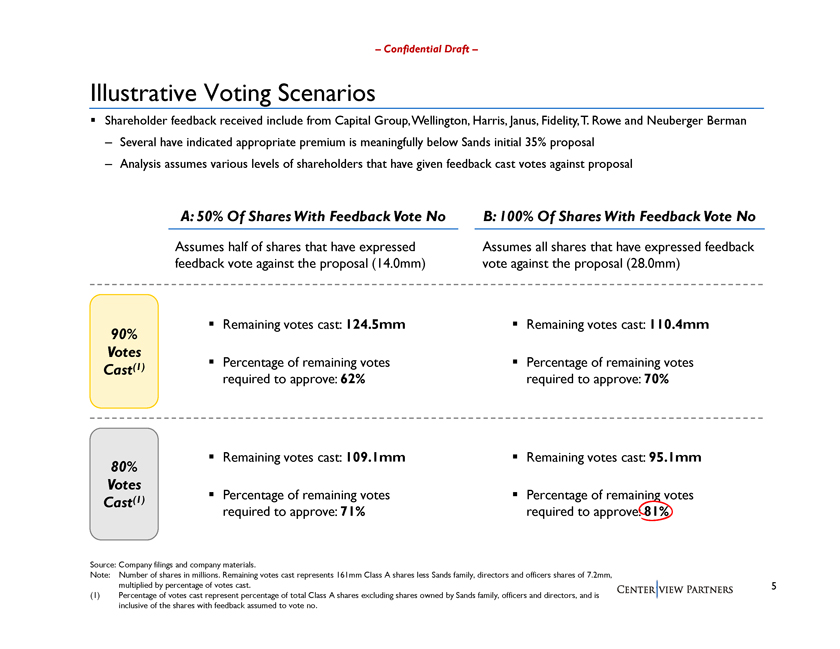

Confidential Draft Illustrative Voting Scenarios Shareholder feedback received include from Capital Group, Wellington, Harris, Janus, Fidelity, T. Rowe and Neuberger Berman Several have indicated appropriate premium is meaningfully below Sands initial 35% proposal Analysis assumes various levels of shareholders that have given feedback cast votes against proposal A: 50% Of Shares With Feedback Vote No B: 100% Of Shares With Feedback Vote No Assumes half of shares that have expressed Assumes all shares that have expressed feedback feedback vote against the proposal (14.0mm) vote against the proposal (28.0mm) Remaining votes cast: 124.5mm Remaining votes cast: 110.4mm 90% Votes (1) Percentage of remaining votes Percentage of remaining votes Cast required to approve: 62% required to approve: 70% Remaining votes cast: 109.1mm Remaining votes cast: 95.1mm 80% Votes (1) Percentage of remaining votes Percentage of remaining votes Cast required to approve: 71% required to approve: 81% Source: Company filings and company materials. Note: Number of shares in millions. Remaining votes cast represents 161mm Class A shares less Sands family, directors and officers shares of 7.2mm, multiplied by percentage of votes cast. 5 (1) Percentage of votes cast represent percentage of total Class A shares excluding shares owned by Sands family, officers and directors, and is inclusive of the shares with feedback assumed to vote no.

Confidential Draft Illustrative Solicitation Process If Board Approves Reclassification Proposal A B C D Finalize Proxy Follow-up With Initial Communication Statement & Proxy Advisor & Shareholder Shareholders, To The Market Shareholder Meetings Pull & Refile If Solicitation Materials Necessary Announce Prepare Solicitation (30-45 days) Special Meeting Coordinated roll-out The Proxy Statement Through IR / proxy solicitor, the Approximately 24-48 including press release, IR background, rationale, company will offer large / vocal hours ahead of the talking points for SH and and fairness opinions, shareholders the opportunity to meeting, the vote analyst inbounds, and PR will form the basis for engage with committee members outcome will be clear backgrounding with key shareholder judgement (in-person or via Zoom) ISS / Glass Potential to pull / press Lewis will expect conference calls / Working group will renegotiate subject to zoom meetings Objective is for the design a shareholder legal requirements market to absorb (and engagement strategy Committee should plan for 10-20 accept) the outcome shareholder discussions lasting 30- Creation of a upfront 60 minutes, and a 1-2 hour session presentation deck for with each proxy advisor Similar to M&A the committee to use transactions, the stock in discussions with Shareholders are unlikely vote well price reaction and any shareholders ahead of the meeting, although the key shareholder feedback ISS recommendation (10-15 days Several live prep will inform go-forward prior to meeting) will be a key sessions communications strategy indication of likely support 6

Appendix

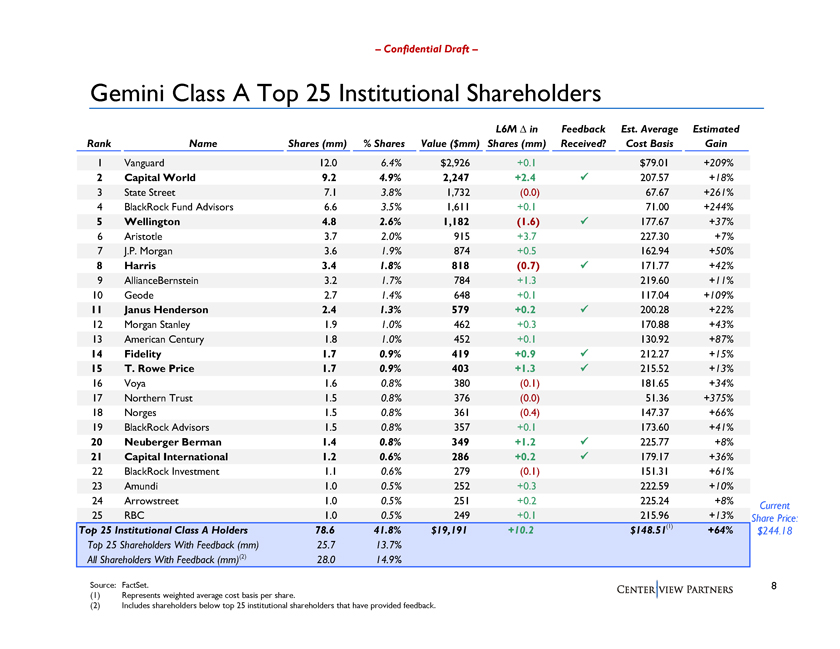

Confidential Draft Gemini Class A Top 25 Institutional Shareholders L6M â^ in Feedback Est. Average Estimated Rank Name Shares (mm) % Shares Value ($mm) Shares (mm) Received? Cost Basis Gain 1 Vanguard 12.0 6.4% $2,926 +0.1 $79.01 +209% 2 Capital World 9.2 4.9% 2,247 +2.4 207.57 +18% 3 State Street 7.1 3.8% 1,732 (0.0) 67.67 +261% 4 BlackRock Fund Advisors 6.6 3.5% 1,611 +0.1 71.00 +244% 5 Wellington 4.8 2.6% 1,182 (1.6) 177.67 +37% 6 Aristotle 3.7 2.0% 915 +3.7 227.30 +7% 7 J.P. Morgan 3.6 1.9% 874 +0.5 162.94 +50% 8 Harris 3.4 1.8% 818 (0.7) 171.77 +42% 9 AllianceBernstein 3.2 1.7% 784 +1.3 219.60 +11% 10 Geode 2.7 1.4% 648 +0.1 117.04 +109% 11 Janus Henderson 2.4 1.3% 579 +0.2 200.28 +22% 12 Morgan Stanley 1.9 1.0% 462 +0.3 170.88 +43% 13 American Century 1.8 1.0% 452 +0.1 130.92 +87% 14 Fidelity 1.7 0.9% 419 +0.9 212.27 +15% 15 T. Rowe Price 1.7 0.9% 403 +1.3 215.52 +13% 16 Voya 1.6 0.8% 380 (0.1) 181.65 +34% 17 Northern Trust 1.5 0.8% 376 (0.0) 51.36 +375% 18 Norges 1.5 0.8% 361 (0.4) 147.37 +66% 19 BlackRock Advisors 1.5 0.8% 357 +0.1 173.60 +41% 20 Neuberger Berman 1.4 0.8% 349 +1.2 225.77 +8% 21 Capital International 1.2 0.6% 286 +0.2 179.17 +36% 22 BlackRock Investment 1.1 0.6% 279 (0.1) 151.31 +61% 23 Amundi 1.0 0.5% 252 +0.3 222.59 +10% 24 Arrowstreet 1.0 0.5% 251 +0.2 225.24 +8% Current 25 RBC 1.0 0.5% 249 +0.1 215.96 +13% Share Price: Top 25 Institutional Class A Holders 78.6 41.8% $19,191 +10.2 $148.51(1) +64% $244.18 Top 25 Shareholders With Feedback (mm) 25.7 13.7% All Shareholders With Feedback (mm)(2) 28.0 14.9% Source: FactSet. 8 (1) Represents weighted average cost basis per share. (2) Includes shareholders below top 25 institutional shareholders that have provided feedback.