EXHIBIT (C)(2)

Published on August 1, 2022

Exhibit (c)(2)

Confidential Draft Project Gemini: Confidential Discussion Materials June 28, 2022

Confidential Draft Disclaimer This presentation has been prepared by Centerview Partners LLC (Centerview) for use solely by the Special Committee of the Board of Directors of Gemini in connection with its evaluation of a proposed share reclassification and for no other purpose. The information contained herein is based upon information supplied by or on behalf of Gemini and publicly available information, and portions of the information contained herein may be based upon statements, estimates and forecasts provided by Gemini. Centerview has relied upon the accuracy and completeness of the foregoing information, and has not assumed any responsibility for any independent verification of such information or for any independent evaluation or appraisal of any of the assets or liabilities (contingent or otherwise) of Gemini or any other entity, or concerning the solvency or fair value of Gemini or any other entity. With respect to financial forecasts, including with respect to estimates of potential synergies, Centerview has assumed that such forecasts have been reasonably prepared on bases reflecting the best currently available estimates and judgments of the managements of Gemini as to their respective future financial performances, and at your direction Centerview has relied upon such forecasts, as provided by Geminis management, with respect to both Gemini, including as to expected synergies. Centerview assumes no responsibility for and expresses no view as to such forecasts or the assumptions on which they are based. The information set forth herein is based upon economic, monetary, market and other conditions as in effect on, and the information made available to us as of, the date hereof, unless indicated otherwise and Centerview assumes no obligation to update or otherwise revise these materials. The financial analysis in this presentation is complex and is not necessarily susceptible to a partial analysis or summary description. In performingthis financial analysis, Centerview has considered the results of its analysis as a whole and did not necessarily attribute a particular weight to any particular portion of the analysis considered. Furthermore, selecting any portion of Centerviews analysis, without considering the analysis as a whole, wouldcreate an incomplete view of the process underlying its financial analysis. Centerview may have deemed various assumptions more or less probable than other assumptions, so the reference ranges resulting from any particular portion of the analysis described above should not be taken to be Centerviews view of the actual value of Gemini. These materials and the information contained herein are confidential, were not prepared with a view toward public disclosure, and may not be disclosed publicly or made available to third parties without the prior written consent of Centerview. These materials and any other advice, written or oral, rendered by Centerview are intended solely for the benefit and use of the Special Committee of the Board of Directors of Gemini (in its capacity as such) in its consideration of the proposed share reclassification, and are not for the benefit of, and do not convey any rights or remedies for any holder of securities of Gemini or any other person. Centerview will not be responsible for and has not provided any tax, accounting, actuarial, legal or other specialist advice. These materials are not intended to provide the sole basis for evaluating the proposed transaction, and this presentation does not represent a fairness opinion, recommendation, valuation or opinion of any kind, and is necessarily incomplete and should be viewed solely in conjunction with the oral presentation provided by Centerview. 1

Confidential Draft Situation Background On April 4, Gemini announced that it had received a letter from its controlling shareholders, the Sands family, proposing a reclassification whereby each share of Class B stock (10 votes) would be converted into 1.35 shares of Class A stock (1 vote) Gemini also announced that it had established a Special Committee to evaluate the proposal The Sands letter (disclosed in a 13-D filing) indicated that a reclassification would result in decreased Sands voting control from ~60% to ~20%, a structure that is better aligned with one vote per share governance & increased market demand for the stock The letter also indicated that the Sands family would be pleased to maintain its ability to control the Company through its holdings of Class A and Class B shares, if the Board or shareholders preferred The letter did not address any potential corporate governance changes to shift the Companys governance policies toward the policies of a public non-controlled company following the proposed reclassification Centerview was engaged by the Special Committee to help evaluate and negotiate the proposed share reclassification transaction Throughout May and June, the Special Committees advisors had numerous back-and-forth discussions with the Sands advisors regarding the potential premium and corporate governance changes / other restrictions that would occur following the reclass Today the Special Committee is recommending to the Board a reclassification transaction whereby each share of Class B stock will be exchanged for 1 share of Class A stock plus $64.64 per share in cash ($1.50 billion of aggregate cash consideration) Implies a premium of 26% based on the Class A closing stock price on June 28 and a premium of 27% based on the Class A volume weighted average price since the public disclosure of the Sands letter on April 4 Sands family voting control to decline from ~60% to ~16% following the reclassification, in-line with their current economic ownership given the premium will be paid in cash 2 Source: Company filings.

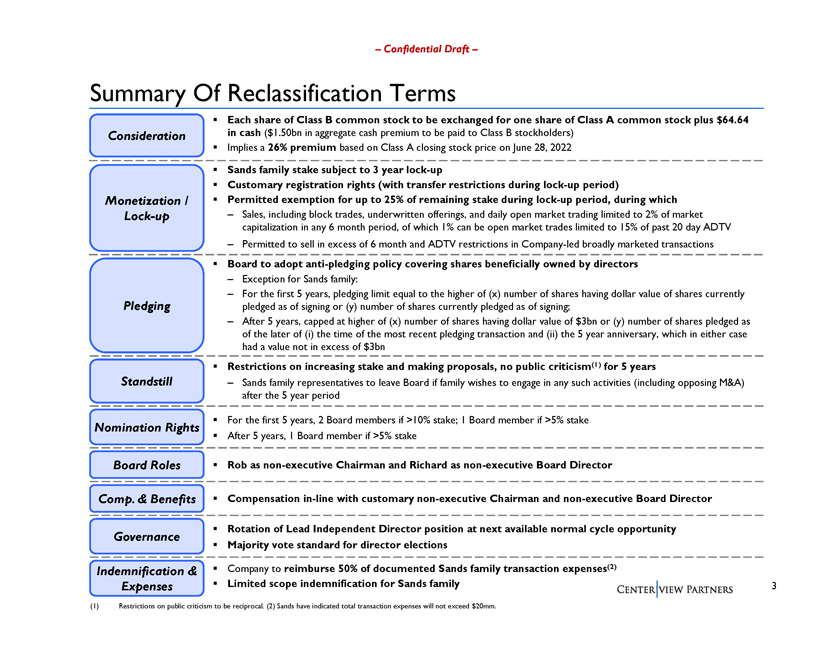

Confidential Draft Summary Of Reclassification Terms Each share of Class B common stock to be exchanged for one share of Class A common stock plus $64.64 Consideration in cash ($1.50bn in aggregate cash premium to be paid to Class B stockholders) Implies a 26% premium based on Class A closing stock price on June 28, 2022 Sands family stake subject to 3 year lock-up Customary registration rights (with transfer restrictions during lock-up period) Monetization / Permitted exemption for up to 25% of remaining stake during lock-up period, during which Lock-up Sales, including block trades, underwritten offerings, and daily open market trading limited to 2% of market capitalization in any 6 month period, of which 1% can be open market trades limited to 15% of past 20 day ADTV Permitted to sell in excess of 6 month and ADTV restrictions in Company-led broadly marketed transactions Board to adopt anti-pledging policy covering shares beneficially owned by directors Exception for Sands family: For the first 5 years, pledging limit equal to the higher of (x) number of shares having dollar value of shares currently Pledging pledged as of signing or (y) number of shares currently pledged as of signing; After 5 years, capped at higher of (x) number of shares having dollar value of $3bn or (y) number of shares pledged as of the later of (i) the time of the most recent pledging transaction and (ii) the 5 year anniversary, which in either case had a value not in excess of $3bn Restrictions on increasing stake and making proposals, no public criticism(1) for 5 years Standstill Sands family representatives to leave Board if family wishes to engage in any such activities (including opposing M&A) after the 5 year period For the first 5 years, 2 Board members if >10% stake; 1 Board member if >5% stake Nomination Rights After 5 years, 1 Board member if >5% stake Board Roles Rob as non-executive Chairman and Richard as non-executive Board Director Comp. & Benefits Compensation in-line with customary non-executive Chairman and non-executive Board Director Rotation of Lead Independent Director position at next available normal cycle opportunity Governance Majority vote standard for director elections Indemnification & Company to reimburse 50% of documented Sands family transaction expenses(2) Expenses Limited scope indemnification for Sands family 3 (1) Restrictions on public criticism to be reciprocal. (2) Sands have indicated total transaction expenses will not exceed $20mm.

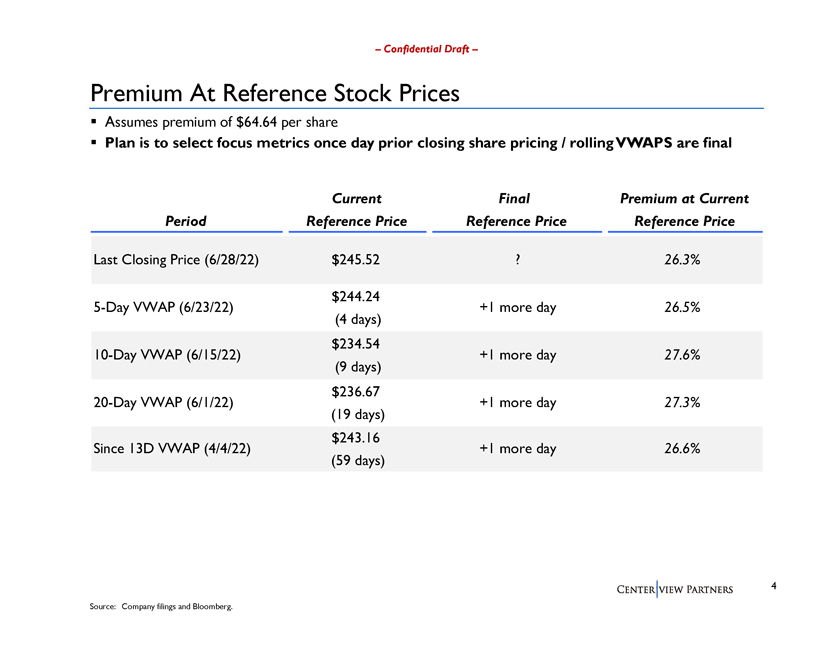

Confidential Draft Premium At Reference Stock Prices Assumes premium of $64.64 per share Plan is to select focus metrics once day prior closing share pricing / rolling VWAPS are final Current Final Premium at Current Period Reference Price Reference Price Reference Price Last Closing Price (6/28/22) $245.52 ? 26.3% $244.24 5-Day VWAP (6/23/22) +1 more day 26.5% (4 days) $234.54 10-Day VWAP (6/15/22) +1 more day 27.6% (9 days) $236.67 20-Day VWAP (6/1/22) +1 more day 27.3% (19 days) $243.16 Since 13D VWAP (4/4/22) +1 more day 26.6% (59 days) 4 Source: Company filings and Bloomberg.

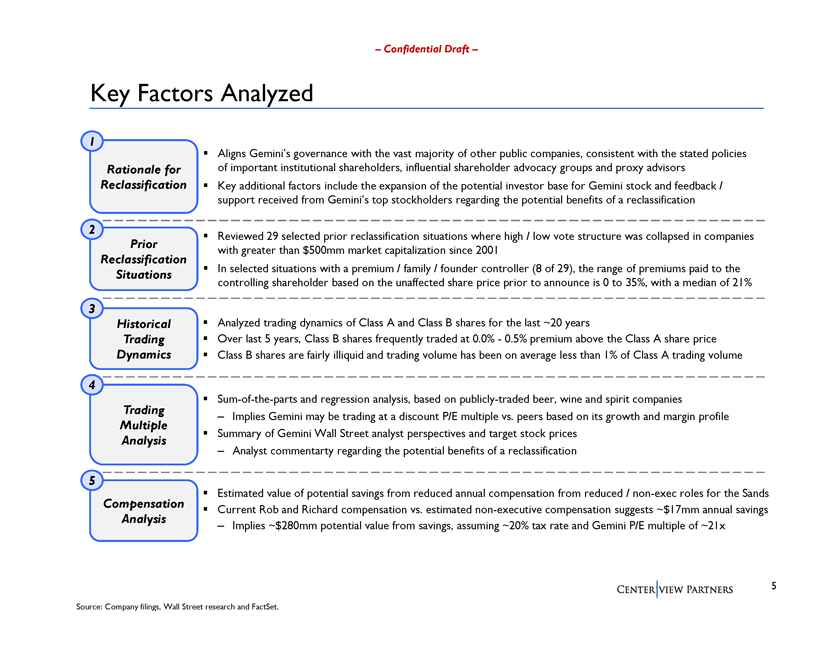

Confidential Draft Key Factors Analyzed 1 Aligns Geminis governance with the vast majority of other public companies, consistent with the stated policies Rationale for of important institutional shareholders, influential shareholder advocacy groups and proxy advisors Reclassification Key additional factors include the expansion of the potential investor base for Gemini stock and feedback / support received from Geminis top stockholders regarding the potential benefits of a reclassification 2 Reviewed 29 selected prior reclassification situations where high / low vote structure was collapsed in companies Prior with greater than $500mm market capitalization since 2001 Reclassification In selected situations with a premium / family / founder controller (8 of 29), the range of premiums paid to the Situations controlling shareholder based on the unaffected share price prior to announce is 0 to 35%, with a median of 21% 3 Historical Analyzed trading dynamics of Class A and Class B shares for the last ~20 years Trading Over last 5 years, Class B shares frequently traded at 0.0%0.5% premium above the Class A share price Dynamics Class B shares are fairly illiquid and trading volume has been on average less than 1% of Class A trading volume 4 Sum-of-the-parts and regression analysis, based on publicly-traded beer, wine and spirit companies Trading Implies Gemini may be trading at a discount P/E multiple vs. peers based on its growth and margin profile Multiple Summary of Gemini Wall Street analyst perspectives and target stock prices Analysis Analyst commentarty regarding the potential benefits of a reclassification Estimated value of potential savings from reduced annual compensation from reduced / non-exec roles for the Sands Compensation Current Rob and Richard compensation vs. estimated non-executive compensation suggests ~$17mm annual savings Analysis Implies ~$280mm potential value from savings, assuming ~20% tax rate and Gemini P/E multiple of ~21x 5 Source: Company filings, Wall Street research and FactSet. 5

1 Rationale For Reclassification Confidential Draft Summary Rationale For The Share Reclassification Aligns Gemini with the vast majority of other public companies, consistent with the stated policies of Shareholder Friendly / important institutional shareholders, influential shareholder advocacy groups and proxy advisors One Share One Vote Simplified capital structure with a single class of stock Alignment of voting power and economic ownership for all shareholders 26% premium(1) is below the premium paid to the controlling shareholder in each of the three most recent / Reasonable Premium relevant reclassification transactions vs. Precedents Includes Forest City in 2016 (31%), Stewart Information in 2016 (35%) and Hubbell in 2015 (28%) Non-executive roles for Robert and Richard Sands, including removal of Vice Chair role Modern Annual compensation and benefits to be in-line with non-executive roles Governance Rotation of Lead Independent Director position at next available normal cycle opportunity Policies Adoption of majority vote standard for director elections Adoption of an anti-pledging policy, with limitations that increase over time for Sands family Expand Potential Potential to increase / diversify shareholder base Investor Base Some investors / funds may not hold company stock with dual class structures Sum-of-the-parts and regression analyses indicate Gemini may be trading at a discount vs. peers Potential Addresses investor questions about impact of control on strategy and capital allocation For Additional Wall Street analyst perspectives are favorable / supportive of a reclassification Shareholder Value Reduction of Rob and Richard Sands compensation and benefits by estimated ~$17mm annually Creation Implies ~$280mm potential value from savings, assuming ~20% tax rate and Gemini P/E multiple of ~21x Following the receipt of the Sands initial proposal, the Special Committee conducted an in-depth analytical review over numerous meetings together with its financial and legal advisors Analysis and Heavily negotiated the reclassification terms and governance improvements over multiple rounds of back-Evaluation by the and-forth discussions, securing the best transaction for the Class A stockholders and in the long-term Special Committee interest of the Company Evaluated feedback from several of Geminis top stockholders regarding the potential benefits of a reclassification to the Company 6 Source: Company filings, Wall Street research and FactSet. (1) Based on prior day Class A closing stock price.

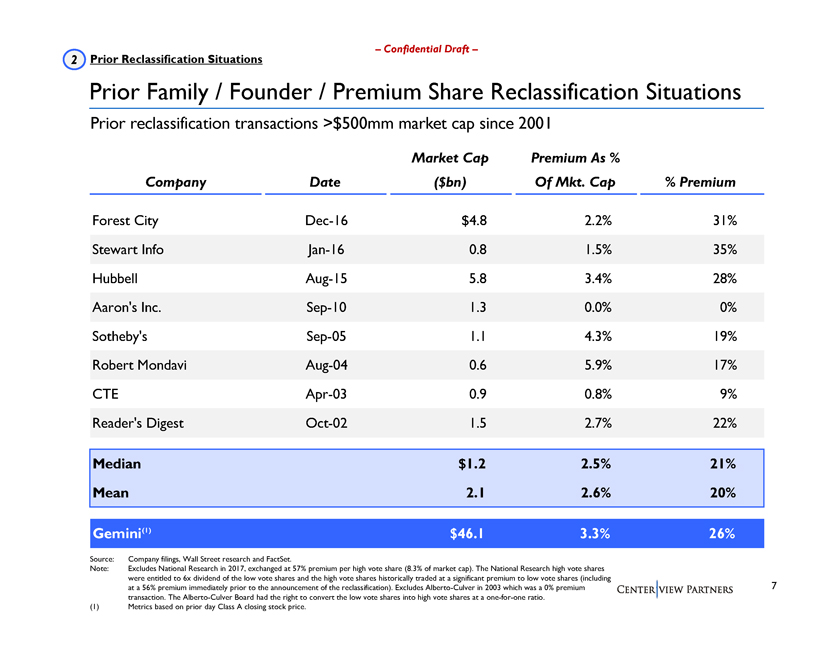

2 Prior Reclassification Situations Confidential Draft Prior Family / Founder / Premium Share Reclassification Situations Prior reclassification transactions >$500mm market cap since 2001 Market Cap Premium As % Company Date ($bn) Of Mkt. Cap % Premium Forest City Dec-16 $4.8 2.2% 31% Stewart Info Jan-16 0.8 1.5% 35% Hubbell Aug-15 5.8 3.4% 28% Aarons Inc. Sep-10 1.3 0.0% 0% Sothebys Sep-05 1.1 4.3% 19% Robert Mondavi Aug-04 0.6 5.9% 17% CTE Apr-03 0.9 0.8% 9% Readers Digest Oct-02 1.5 2.7% 22% Median $1.2 2.5% 21% Mean 2.1 2.6% 20% Gemini(1) $46.1 3.3% 26% Source: Company filings, Wall Street research and FactSet. Note: Excludes National Research in 2017, exchanged at 57% premium per high vote share (8.3% of market cap). The National Research high vote shares were entitled to 6x dividend of the low vote shares and the high vote shares historically traded at a significant premium to low vote shares (including at a 56% premium immediately prior to the announcement of the reclassification). Excludes Alberto-Culver in 2003 which was a 0% premium 7 transaction. The Alberto-Culver Board had the right to convert the low vote shares into high vote shares at a one-for-one ratio. (1) Metrics based on prior day Class A closing stock price.

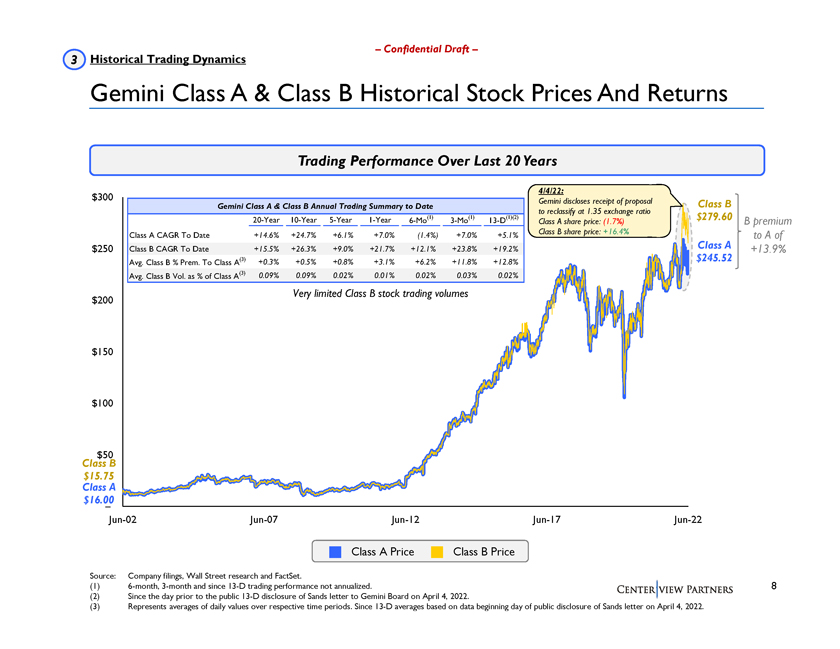

3 Historical Trading Dynamics Confidential Draft Gemini Class A & Class B Historical Stock Prices And Returns Trading Performance Over Last 20 Years 4/4/22: $300 Gemini discloses receipt of proposal Gemini Class A & Class B Annual Trading Summary to Date Class B (1) (1) (1)(2) to reclassify at 1.35 exchange ratio 20-Year 10-Year 5-Year 1-Year 6-Mo 3-Mo 13-D $279.60 Class A share price: (1.7%) B premium Class A CAGR To Date +14.6% +24.7% +6.1% +7.0% (1.4%) +7.0% +5.1% Class B share price: +16.4% to A of $250 Class B CAGR To Date +15.5% +26.3% +9.0% +21.7% +12.1% +23.8% +19.2% Class A +13.9% Avg. Class B % Prem. To Class A(3) +0.3% +0.5% +0.8% +3.1% +6.2% +11.8% +12.8% $245.52 Avg. Class B Vol. as % of Class A(3) 0.09% 0.09% 0.02% 0.01% 0.02% 0.03% 0.02% Very limited Class B stock trading volumes $200 $150 $100 $50 Class B $15.75 Class A $16.00 Jun-02 Jun-07 Jun-12 Jun-17 Jun-22 Class A Price Class B Price Source: Company filings, Wall Street research and FactSet. (1) 6-month, 3-month and since 13-D trading performance not annualized. 8 (2) Since the day prior to the public 13-D disclosure of Sands letter to Gemini Board on April 4, 2022. (3) Represents averages of daily values over respective time periods. Since 13-D averages based on data beginning day of public disclosure of Sands letter on April 4, 2022.

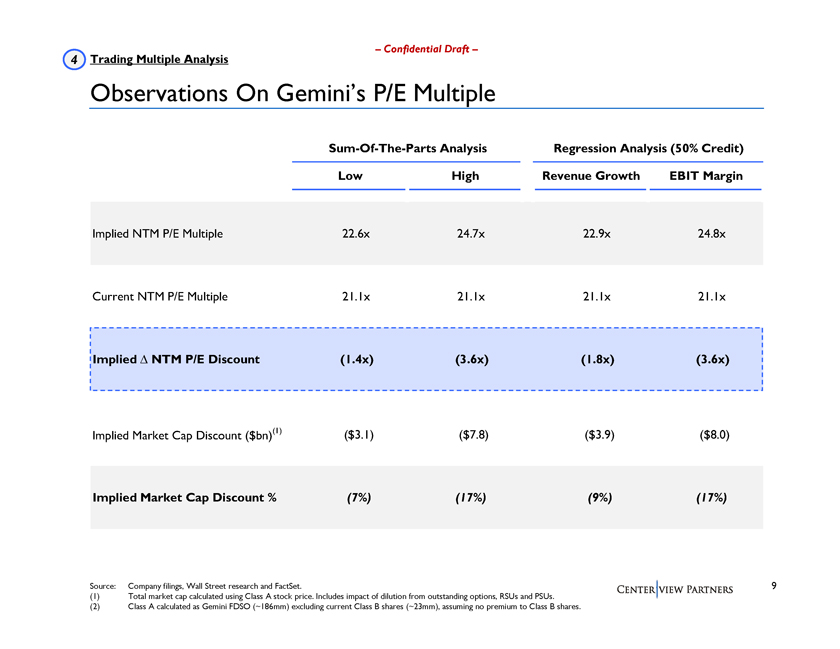

4 Trading Multiple Analysis Confidential Draft Observations On Geminis P/E Multiple Sum-Of-The-Parts Analysis Regression Analysis (50% Credit) Low High Revenue Growth EBIT Margin Implied NTM P/E Multiple 22.6x 24.7x 22.9x 24.8x Current NTM P/E Multiple 21.1x 21.1x 21.1x 21.1x Implied â^ NTM P/E Discount (1.4x) (3.6x) (1.8x) (3.6x) Implied Market Cap Discount ($bn)(1) ($3.1) ($7.8) ($3.9) ($8.0) Implied Market Cap Discount % (7%) (17%) (9%) (17%) Source: Company filings, Wall Street research and FactSet. 9 (1) Total market cap calculated using Class A stock price. Includes impact of dilution from outstanding options, RSUs and PSUs. (2) Class A calculated as Gemini FDSO (~186mm) excluding current Class B shares (~23mm), assuming no premium to Class B shares.

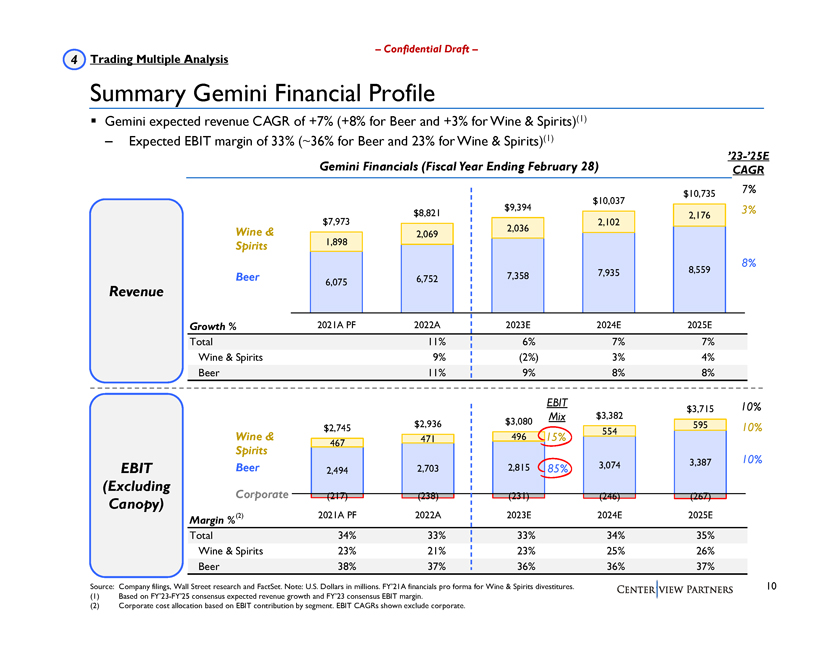

4 Trading Multiple Analysis Confidential Draft Summary Gemini Financial Profile Gemini expected revenue CAGR of +7% (+8% for Beer and +3% for Wine & Spirits)(1) Expected EBIT margin of 33% (~36% for Beer and 23% for Wine & Spirits)(1) 23-25E Gemini Financials (Fiscal Year Ending February 28) CAGR $10,735 7% $10,037 $9,394 3% $8,821 2,176 $7,973 2,102 Wine & 2,036 2,069 Spirits 1,898 8% 7,935 8,559 Beer 6,752 7,358 6,075 Revenue Growth % 2021A PF 2022A 2023E 2024E 2025E Total 11% 6% 7% 7% Wine & Spirits 9% (2%) 3% 4% Beer 11% 9% 8% 8% EBIT 10% $3,715 Mix $3,382 $2,936 $3,080 595 $2,745 496 554 10% Wine & 471 15% 467 Spirits 3,387 10% EBIT Beer 2,703 2,815 85% 3,074 2,494 (Excluding Corporate (217) (238) (231) (246) (267) Canopy) Margin %(2) 2021A PF 2022A 2023E 2024E 2025E Total 34% 33% 33% 34% 35% Wine & Spirits 23% 21% 23% 25% 26% Beer 38% 37% 36% 36% 37% Source: Company filings, Wall Street research and FactSet. Note: U.S. Dollars in millions. FY21A financials pro forma for Wine & Spirits divestitures. 10 (1) Based on FY23-FY25 consensus expected revenue growth and FY23 consensus EBIT margin. (2) Corporate cost allocation based on EBIT contribution by segment. EBIT CAGRs shown exclude corporate.

4 Trading Multiple Analysis Confidential Draft Gemini Benchmarking vs. Publicly Traded Alcohol Companies CY22-24E Revenue CY22E EBIT Margin Price / NTM EPS Gemini (Beer) 8% Gemini (Beer) 36% (1) Boston Beer 23.1x Heineken 6% AB InBev 26% Carlsberg 18.6x Boston Beer 6% Heineken 16% Heineken 18.5x Carlsberg 5% Carlsberg 15% AB InBev 15.5x Beer AB InBev 5% Molson Coors 13% Kirin 14.8x Asahi 3% Boston Beer 9% Asahi 14.3x Kirin 3% Asahi 9% Molson Coors 13.4x Molson Coors 1% Kirin 8% Median: 15.5x Median: 5% Median: 13% Vintage Wine 17% Brown-Forman 31% Brown-Forman 35.6x (2) Duckhorn 9% Diageo 31% Campari 31.0x Remy Cointreau 9% Pernod Ricard 28% Remy Cointreau 30.0x Becle 9% Duckhorn 28% Duckhorn 29.5x Wine & FY25 Treasury Wine 7% Remy Cointreau 27% expected 26% Becle 22.9x Spirits (W&S) Diageo 7% Gemini (W&S) 22%(1) Diageo 22.7x Campari 6% Treasury Wine 22% Treasury Wine 21.1x Pernod Ricard 6% Campari 20% Pernod Ricard 20.4x Brown-Forman 5% Becle 20% Vintage Wine 18.3x Gemini (W&S) 3% Vintage Wine 11% Median: 7% Median: 27% Median: 22.9x 11 Source: Company filings, Wall Street research and FactSet. (1) Corporate cost allocation based on EBIT contribution by segment. (2) Represents CY22E CY23E growth rates due to lack of availability of CY24E estimates.

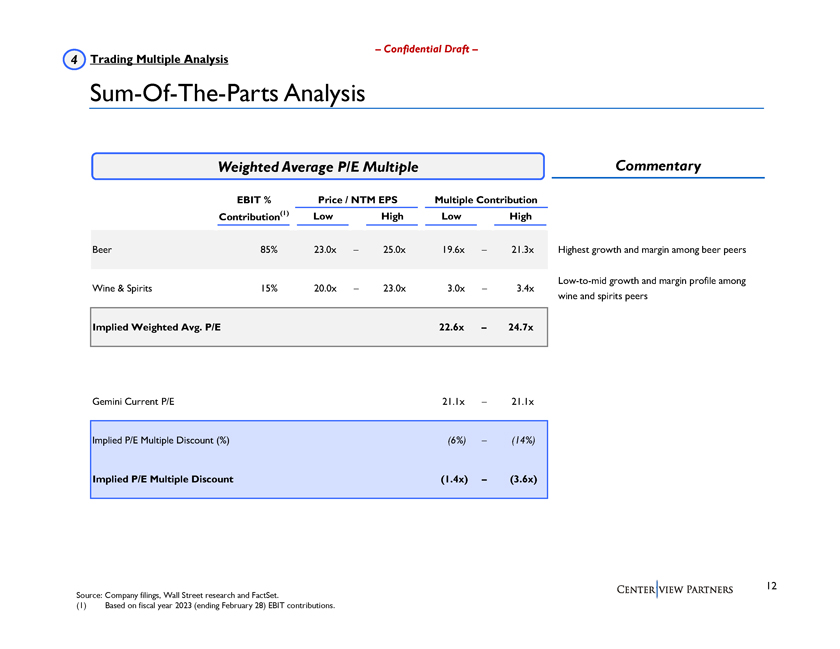

4 Trading Multiple Analysis Confidential Draft Sum-Of-The-Parts Analysis Weighted Average P/E Multiple Commentary EBIT % Price / NTM EPS Multiple Contribution Contribution(1) Low High Low High Beer 85% 23.0x 25.0x 19.6x 21.3x Highest growth and margin among beer peers Low-to-mid growth and margin profile among Wine & Spirits 15% 20.0x 23.0x 3.0x 3.4x wine and spirits peers Implied Weighted Avg. P/E 22.6x 24.7x Gemini Current P/E 21.1x 21.1x Implied P/E Multiple Discount (%) (6%) (14%) Implied P/E Multiple Discount (1.4x) (3.6x) 12 Source: Company filings, Wall Street research and FactSet. (1) Based on fiscal year 2023 (ending February 28) EBIT contributions.

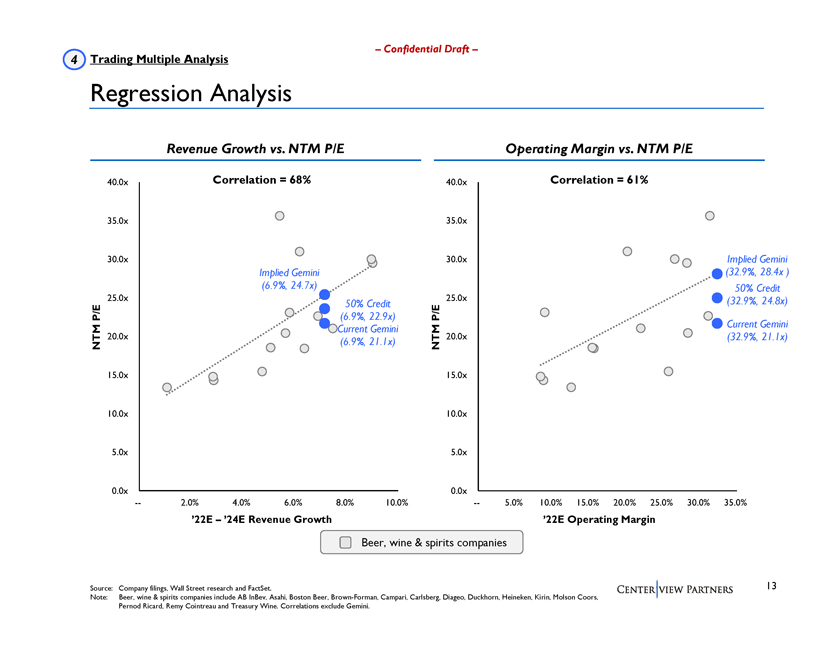

4 Trading Multiple Analysis Confidential Draft Regression Analysis Revenue Growth vs. NTM P/E Operating Margin vs. NTM P/E 40.0x Correlation = 68% 40.0x Correlation = 61% 35.0x 35.0x 30.0x 30.0x Implied Gemini Implied Gemini (32.9%, 28.4x ) (6.9%, 24.7x) 50% Credit 25.0x 25.0x (32.9%, 24.8x) 50% Credit P/E (6.9%, 22.9x) P/E Current Gemini Current Gemini 20.0x 20.0x (32.9%, 21.1x) NTM (6.9%, 21.1x) NTM 15.0x 15.0x 10.0x 10.0x 5.0x 5.0x 0.0x 0.0x 2.0% 4.0% 6.0% 8.0% 10.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 22E 24E Revenue Growth 22E Operating Margin Beer, wine & spirits companies Source: Company filings, Wall Street research and FactSet. 13 Note: Beer, wine & spirits companies include AB InBev, Asahi, Boston Beer, Brown-Forman, Campari, Carlsberg, Diageo, Duckhorn, Heineken, Kirin, Molson Coors, Pernod Ricard, Remy Cointreau and Treasury Wine. Correlations exclude Gemini.

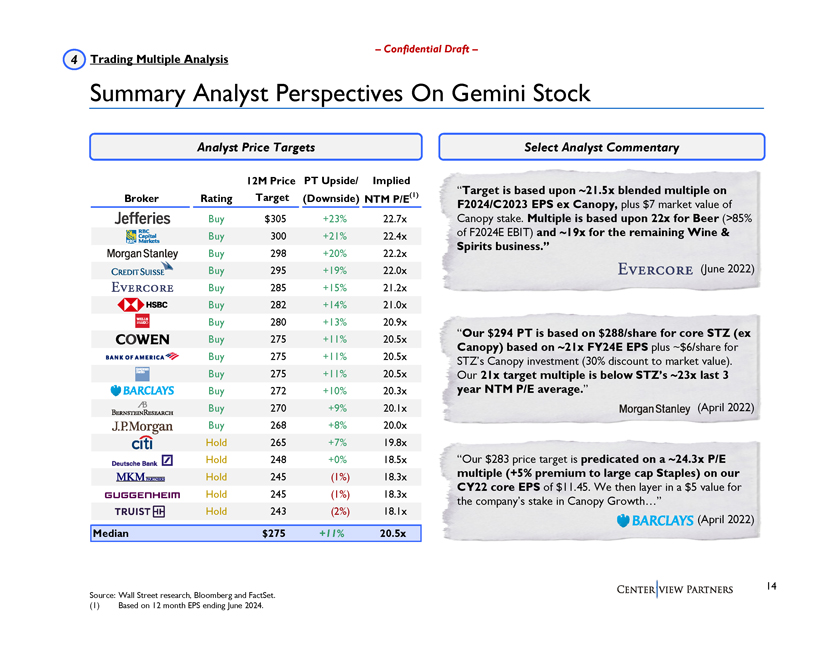

4 Trading Multiple Analysis Confidential Draft Summary Analyst Perspectives On Gemini Stock Analyst Price Targets Select Analyst Commentary 12M Price PT Upside/ Implied (1) Target is based upon ~21.5x blended multiple on Broker Rating Target (Downside) NTM P/E F2024/C2023 EPS ex Canopy, plus $7 market value of Buy $305 +23% 22.7x Canopy stake. Multiple is based upon 22x for Beer (>85% Buy 300 +21% 22.4x of F2024E EBIT) and ~19x for the remaining Wine & Spirits business. Buy 298 +20% 22.2x Buy 295 +19% 22.0x (June 2022) Buy 285 +15% 21.2x Buy 282 +14% 21.0x Buy 280 +13% 20.9x Our $294 PT is based on $288/share for core STZ (ex Buy 275 +11% 20.5x Canopy) based on ~21x FY24E EPS plus ~$6/share for Buy 275 +11% 20.5x STZs Canopy investment (30% discount to market value). Buy 275 +11% 20.5x Our 21x target multiple is below STZs ~23x last 3 Buy 272 +10% 20.3x year NTM P/E average. Buy 270 +9% 20.1x (April 2022) Buy 268 +8% 20.0x Hold 265 +7% 19.8x Hold 248 +0% 18.5x Our $283 price target is predicated on a ~24.3x P/E Hold 245 (1%) 18.3x multiple (+5% premium to large cap Staples) on our CY22 core EPS of $11.45. We then layer in a $5 value for Hold 245 (1%) 18.3x Hold 243 (2%) 18.1x the companys stake in Canopy Growth (April 2022) Median $275 +11% 20.5x 14 Source: Wall Street research, Bloomberg and FactSet. (1) Based on 12 month EPS ending June 2024.

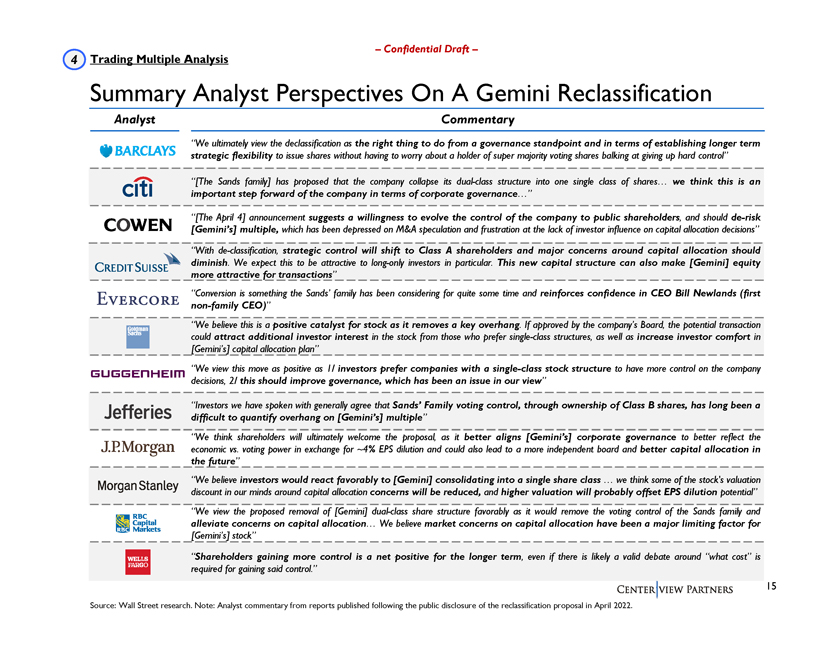

4 Trading Multiple Analysis Confidential Draft Summary Analyst Perspectives On A Gemini Reclassification Analyst Commentary We ultimately view the declassification as the right thing to do from a governance standpoint and in terms of establishing longer term strategic flexibility to issue shares without having to worry about a holder of super majority voting shares balking at giving up hard control [The Sands family] has proposed that the company collapse its dual-class structure into one single class of shares we thinkthisisan important step forward of the company in terms of corporate governance [The April 4] announcement suggests a willingness to evolve the control of the company to public shareholders, and should de-risk [Geminis] multiple, which has been depressed on M&A speculation and frustration at the lack of investor influence on capital allocation decisions With de-classification, strategic control will shift to Class A shareholders and major concerns around capital allocation should diminish. Weexpectthistobeattractivetolong-only investors inparticular. This new capital structure can also make [Gemini] equity more attractive for transactions Conversion is something the Sands family has been considering for quite some time and reinforces confidence in CEO Bill Newlands (first non-family CEO) We believe this is a positive catalyst for stock as it removes a key overhang. If approved by the companys Board, the potential transaction could attract additional investor interest in the stock from those who prefer single-class structures, as well as increase investor comfort in [Geminis] capital allocation plan Weviewthismoveaspositiveas1/ investors prefer companies with a single-class stock structure to have more control on the company decisions, 2/ this should improve governance, which has been an issue in our view Investors we have spoken with generally agree that Sands Family voting control, through ownership of Class B shares, has long been a difficult to quantify overhang on [Geminis] multiple We think shareholders will ultimately welcome the proposal, as it better aligns [Geminis] corporate governance to better reflect the economic vs. voting power in exchange for ~4% EPS dilution and could also lead to a more independent board and better capital allocation in the future We believe investors would react favorably to [Gemini] consolidating into a single share class we think some of the stocks valuation discount in our minds around capital allocation concerns will be reduced, and higher valuation will probably offset EPS dilution potential We view the proposed removal of [Gemini] dual-class share structure favorably as it would remove the voting control of the Sands family and alleviate concerns on capital allocation We believe market concerns on capital allocation have been a major limiting factor for [Geminis] stock Shareholders gaining more control is a net positive for the longer term, even if there is likely a valid debate around what cost is required for gaining said control. 15 Source: Wall Street research. Note: Analyst commentary from reports published following the public disclosure of the reclassification proposal in April 2022.

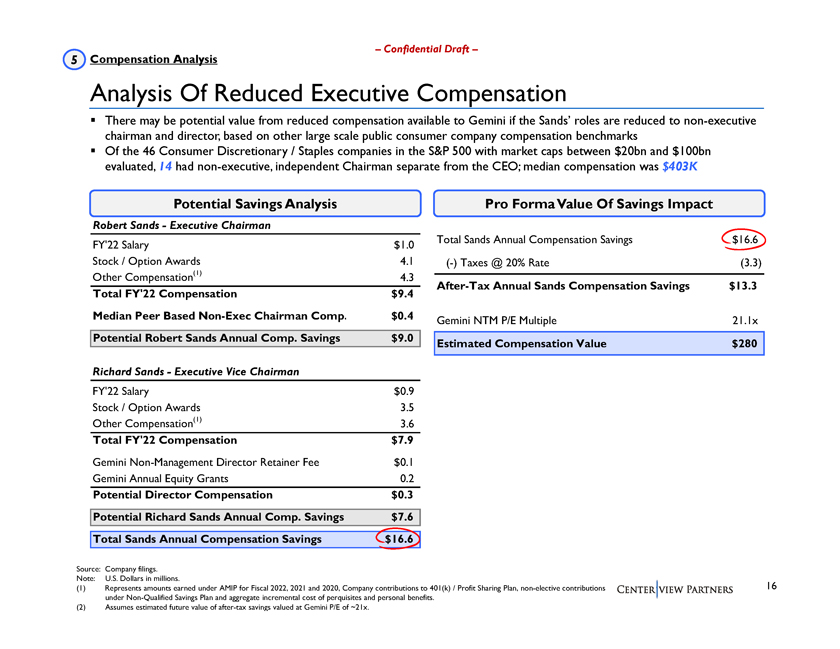

5 Compensation Analysis Confidential Draft Analysis Of Reduced Executive Compensation There may be potential value from reduced compensation available to Gemini if the Sands roles are reduced to non-executive chairman and director, based on other large scale public consumer company compensation benchmarks Of the 46 Consumer Discretionary / Staples companies in the S&P 500 with market caps between $20bn and $100bn evaluated, 14 had non-executive, independent Chairman separate from the CEO; median compensation was $403K Potential Savings Analysis Pro Forma Value Of Savings Impact Robert SandsExecutive Chairman Total Sands Annual Compensation Savings $16.6 FY22 Salary $1.0 Stock / Option Awards 4.1 (-) Taxes @ 20% Rate (3.3) Other Compensation(1) 4.3 After-Tax Annual Sands Compensation Savings $13.3 Total FY22 Compensation $9.4 Median Peer Based Non-Exec Chairman Comp. $0.4 Gemini NTM P/E Multiple 21.1x Potential Robert Sands Annual Comp. Savings $9.0 Estimated Compensation Value $280 Richard SandsExecutive Vice Chairman FY22 Salary $0.9 Stock / Option Awards 3.5 Other Compensation(1) 3.6 Total FY22 Compensation $7.9 Gemini Non-Management Director Retainer Fee $0.1 Gemini Annual Equity Grants 0.2 Potential Director Compensation $0.3 Potential Richard Sands Annual Comp. Savings $7.6 Total Sands Annual Compensation Savings $16.6 Source: Company filings. Note: U.S. Dollars in millions. (1) Represents amounts earned under AMIP for Fiscal 2022, 2021 and 2020, Company contributions to 401(k) / Profit Sharing Plan, non-elective contributions 16 under Non-Qualified Savings Plan and aggregate incremental cost of perquisites and personal benefits. (2) Assumes estimated future value of after-tax savings valued at Gemini P/E of ~21x.

Appendix

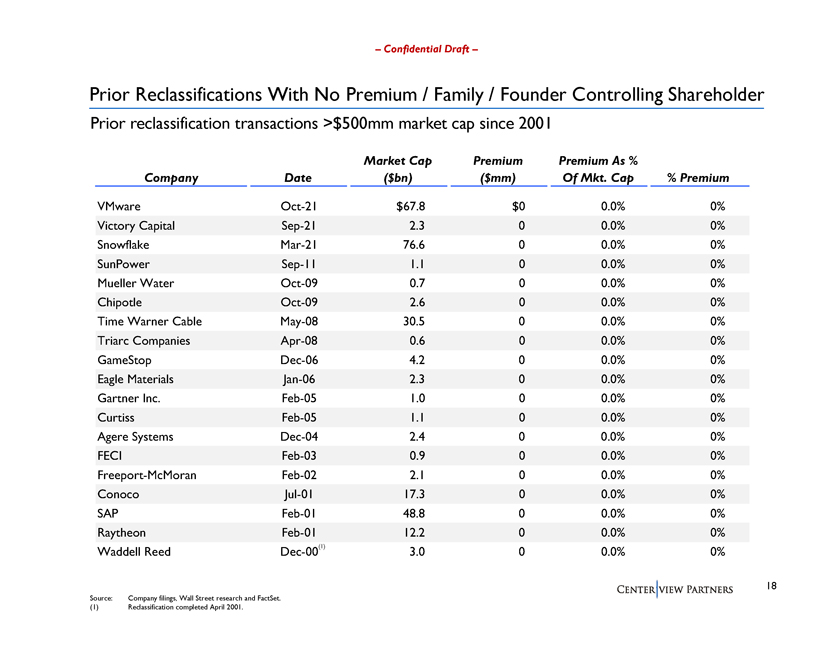

Confidential Draft Prior Reclassifications With No Premium / Family / Founder Controlling Shareholder Prior reclassification transactions >$500mm market cap since 2001 Market Cap Premium Premium As % Company Date ($bn) ($mm) Of Mkt. Cap % Premium VMware Oct-21 $67.8 $0 0.0% 0% Victory Capital Sep-21 2.3 0 0.0% 0% Snowflake Mar-21 76.6 0 0.0% 0% SunPower Sep-11 1.1 0 0.0% 0% Mueller Water Oct-09 0.7 0 0.0% 0% Chipotle Oct-09 2.6 0 0.0% 0% Time Warner Cable May-08 30.5 0 0.0% 0% Triarc Companies Apr-08 0.6 0 0.0% 0% GameStop Dec-06 4.2 0 0.0% 0% Eagle Materials Jan-06 2.3 0 0.0% 0% Gartner Inc. Feb-05 1.0 0 0.0% 0% Curtiss Feb-05 1.1 0 0.0% 0% Agere Systems Dec-04 2.4 0 0.0% 0% FECI Feb-03 0.9 0 0.0% 0% Freeport-McMoran Feb-02 2.1 0 0.0% 0% Conoco Jul-01 17.3 0 0.0% 0% SAP Feb-01 48.8 0 0.0% 0% Raytheon Feb-01 12.2 0 0.0% 0% Waddell Reed Dec-00(1) 3.0 0 0.0% 0% 18 Source: Company filings, Wall Street research and FactSet. (1) Reclassification completed April 2001.

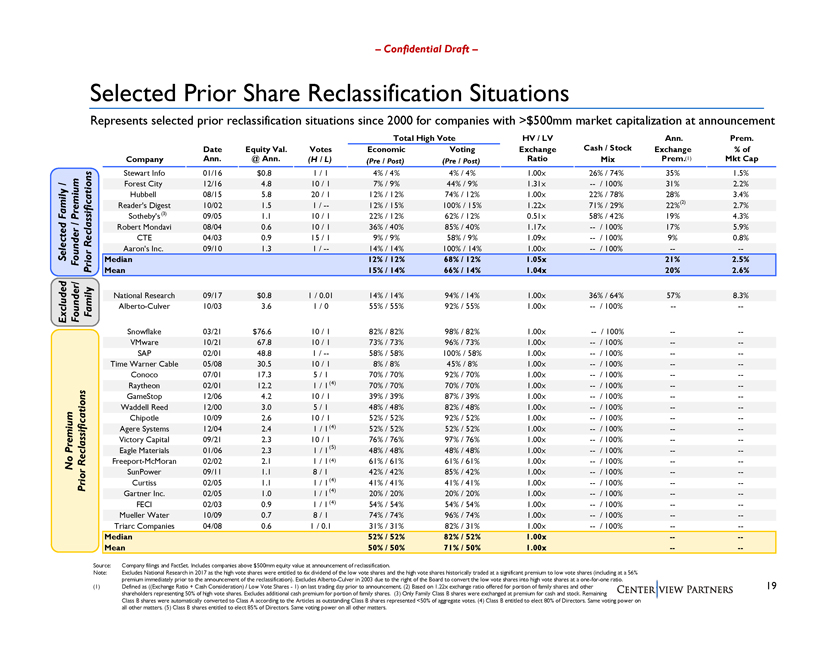

Confidential Draft Selected Prior Share Reclassification Situations Represents selected prior reclassification situations since 2000 for companies with >$500mm market capitalization at announcement Total High Vote HV / LV Ann. Prem. Date Equity Val. Votes Economic Voting Exchange Cash / Stock Exchange % of Company Ann. @ Ann. (H / L) (Pre / Post) (Pre / Post) Ratio Mix Prem.(1) Mkt Cap Stewart Info 01/16 $0.8 1 / 1 4% / 4% 4% / 4% 1.00x 26% / 74% 35% 1.5% / Forest City 12/16 4.8 10 / 1 7% / 9% 44% / 9% 1.31x / 100% 31% 2.2% Hubbell 08/15 5.8 20 / 1 12% / 12% 74% / 12% 1.00x 22% / 78% 28% 3.4% Readers Digest 10/02 1.5 1 / 12% / 15% 100% / 15% 1.22x 71% / 29% 22%(2) 2.7% Family Premium Sothebys(3) 09/05 1.1 10 / 1 22% / 12% 62% / 12% 0.51x 58% / 42% 19% 4.3% / Robert Mondavi 08/04 0.6 10 / 1 36% / 40% 85% / 40% 1.17x / 100% 17% 5.9% Reclassifications CTE 04/03 0.9 15 / 1 9% / 9% 58% / 9% 1.09x / 100% 9% 0.8% Selected Aarons Inc. 09/10 1.3 1 / 14% / 14% 100% / 14% 1.00x / 100% -- Founder Median 12% / 12% 68% / 12% 1.05x 21% 2.5% Prior Mean 15% / 14% 66% / 14% 1.04x 20% 2.6% National Research 09/17 $0.8 1 / 0.01 14% / 14% 94% / 14% 1.00x 36% / 64% 57% 8.3% Excluded Founder/ Family Alberto-Culver 10/03 3.6 1 / 0 55% / 55% 92% / 55% 1.00x / 100% --Snowflake 03/21 $76.6 10 / 1 82% / 82% 98% / 82% 1.00x / 100% --VMware 10/21 67.8 10 / 1 73% / 73% 96% / 73% 1.00x / 100% --SAP 02/01 48.8 1 / 58% / 58% 100% / 58% 1.00x / 100% --Time Warner Cable 05/08 30.5 10 / 1 8% / 8% 45% / 8% 1.00x / 100% --Conoco 07/01 17.3 5 / 1 70% / 70% 92% / 70% 1.00x / 100% --Raytheon 02/01 12.2 1 / 1(4) 70% / 70% 70% / 70% 1.00x / 100% --GameStop 12/06 4.2 10 / 1 39% / 39% 87% / 39% 1.00x / 100% --Waddell Reed 12/00 3.0 5 / 1 48% / 48% 82% / 48% 1.00x / 100% --Chipotle 10/09 2.6 10 / 1 52% / 52% 92% / 52% 1.00x / 100% --Agere Systems 12/04 2.4 1 / 1(4) 52% / 52% 52% / 52% 1.00x / 100% --Victory Capital 09/21 2.3 10 / 1 76% / 76% 97% / 76% 1.00x / 100% --Premium Eagle Materials 01/06 2.3 1 / 1(5) 48% / 48% 48% / 48% 1.00x / 100% --Reclassifications Freeport-McMoran 02/02 2.1 1 / 1(4) 61% / 61% 61% / 61% 1.00x / 100% --No SunPower 09/11 1.1 8 / 1 42% / 42% 85% / 42% 1.00x / 100% --Prior Curtiss 02/05 1.1 1 / 1(4) 41% / 41% 41% / 41% 1.00x / 100% --Gartner Inc. 02/05 1.0 1 / 1(4) 20% / 20% 20% / 20% 1.00x / 100% --FECI 02/03 0.9 1 / 1(4) 54% / 54% 54% / 54% 1.00x / 100% --Mueller Water 10/09 0.7 8 / 1 74% / 74% 96% / 74% 1.00x / 100% --Triarc Companies 04/08 0.6 1 / 0.1 31% / 31% 82% / 31% 1.00x / 100% -- Median 52% / 52% 82% / 52% 1.00x --Mean 50% / 50% 71% / 50% 1.00x -- Source: Company filings and FactSet. Includes companies above $500mm equity value at announcement of reclassification. Note: Excludes National Research in 2017 as the high vote shares were entitled to 6x dividend of the low vote shares and the high vote shares historically traded at a significant premium to low vote shares (including at a 56% premium immediately prior to the announcement of the reclassification). Excludes Alberto-Culver in 2003 due to the right of the Board to convert the low vote shares into high vote shares at a one-for-one ratio. (1) Defined as ((Exchange Ratio + Cash Consideration) / Low Vote Shares1) on last trading day prior to announcement. (2) Based on 1.22x exchange ratio offered for portion of family shares and other 19 shareholders representing 50% of high vote shares. Excludes additional cash premium for portion of family shares. (3) Only Family Class B shares were exchanged at premium for cash and stock. Remaining Class B shares were automatically converted to Class A according to the Articles as outstanding Class B shares represented <50% of aggregate votes. (4) Class B entitled to elect 80% of Directors. Same voting power on all other matters. (5) Class B shares entitled to elect 85% of Directors. Same voting power on all other matters.

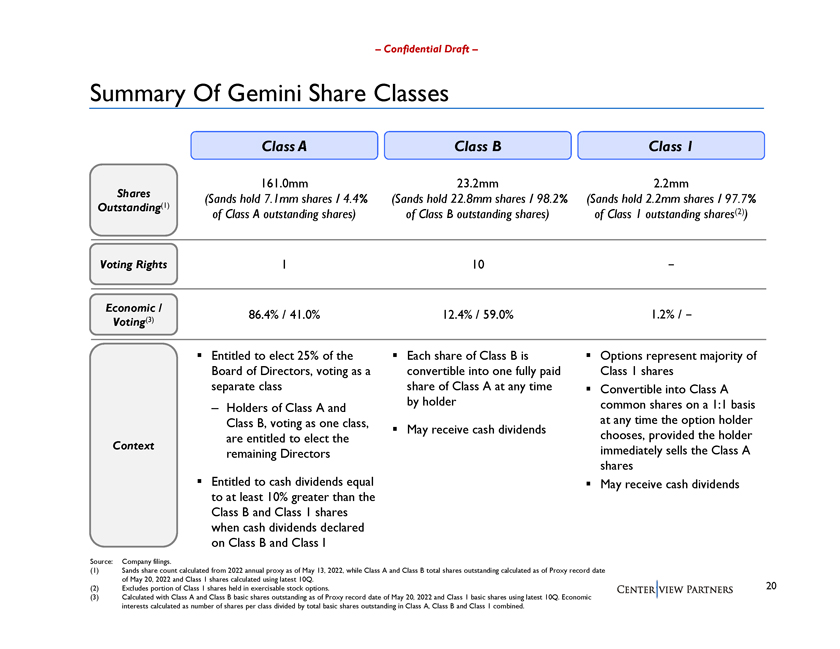

Confidential Draft Summary Of Gemini Share Classes Class A Class B Class 1 161.0mm 23.2mm 2.2mm Shares (Sands hold 7.1mm shares / 4.4% (Sands hold 22.8mm shares / 98.2% (Sands hold 2.2mm shares / 97.7% Outstanding(1) of Class A outstanding shares) of Class B outstanding shares) of Class 1 outstanding shares(2)) Voting Rights 110Economic / (3) 86.4% / 41.0% 12.4% / 59.0% 1.2% /Voting Entitled to elect 25% of the Each share of Class B is Options represent majority of Board of Directors, voting as a convertible into one fully paid Class 1 shares separate class share of Class A at any time Convertible into Class A by holder common shares on a 1:1 basis Holders of Class A and at any time the option holder Class B, voting as one class, May receive cash dividends chooses, provided the holder are entitled to elect the Context immediately sells the Class A remaining Directors shares Entitled to cash dividends equal May receive cash dividends to at least 10% greater than the Class B and Class 1 shares when cash dividends declared on Class B and Class I Source: Company filings. (1) Sands share count calculated from 2022 annual proxy as of May 13, 2022, while Class A and Class B total shares outstanding calculated as of Proxy record date of May 20, 2022 and Class 1 shares calculated using latest 10Q. (2) Excludes portion of Class 1 shares held in exercisable stock options. 20 (3) Calculated with Class A and Class B basic shares outstanding as of Proxy record date of May 20, 2022 and Class 1 basic shares using latest 10Q. Economic interests calculated as number of shares per class divided by total basic shares outstanding in Class A, Class B and Class 1 combined.