EXHIBIT (C)(20)

Published on August 1, 2022

Exhibit (c)(20)

PROJECT BEACH Discussion Materials MAY 2022 STRICTLY PRIVATE & CONFIDENTIAL

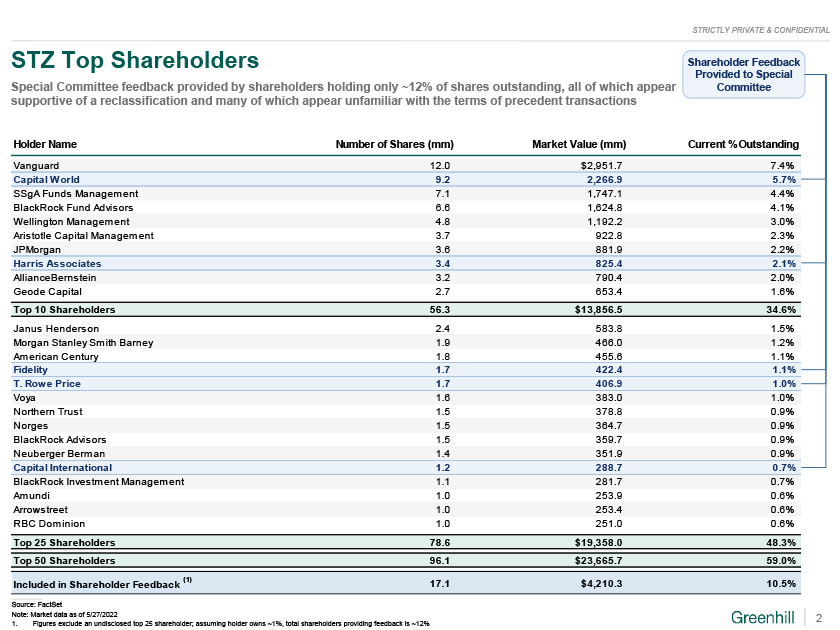

STRICTLY PRIVATE & CONFIDENTIAL STZ Top Shareholders Shareholder Feedback Provided to Special Special Committee feedback provided by shareholders holding only ~12% of shares outstanding, all of which appear Committee supportive of a reclassification and many of which appear unfamiliar with the terms of precedent transactions Holder Name Number of Shares (mm) Market Value (mm) Current % Outstanding Vanguard 12.0 $2,951.7 7.4% Capital World 9.2 2,266.9 5.7% SSgA Funds Management 7.1 1,747.1 4.4% BlackRock Fund Advisors 6.6 1,624.8 4.1% Wellington Management 4.8 1,192.2 3.0% Aristotle Capital Management 3.7 922.8 2.3% JPMorgan 3.6 881.9 2.2% Harris Associates 3.4 825.4 2.1% AllianceBernstein 3.2 790.4 2.0% Geode Capital 2.7 653.4 1.6% Top 10 Shareholders 56.3 $13,856.5 34.6% Janus Henderson 2.4 583.8 1.5% Morgan Stanley Smith Barney 1.9 466.0 1.2% American Century 1.8 455.6 1.1% Fidelity 1.7 422.4 1.1% T. Rowe Price 1.7 406.9 1.0% Voya 1.6 383.0 1.0% Northern Trust 1.5 378.8 0.9% Norges 1.5 364.7 0.9% BlackRock Advisors 1.5 359.7 0.9% Neuberger Berman 1.4 351.9 0.9% Capital International 1.2 288.7 0.7% BlackRock Investment Management 1.1 281.7 0.7% Amundi 1.0 253.9 0.6% Arrowstreet 1.0 253.4 0.6% RBC Dominion 1.0 251.0 0.6% Top 25 Shareholders 78.6 $19,358.0 48.3% Top 50 Shareholders 96.1 $23,665.7 59.0% Included in Shareholder Feedback (1) 17.1 $4,210.3 10.5% Source: FactSet Note: Market data as of 5/27/2022 2 1. Figures exclude an undisclosed top 25 shareholder; assuming holder owns ~1%, total shareholders providing feedback is ~12%

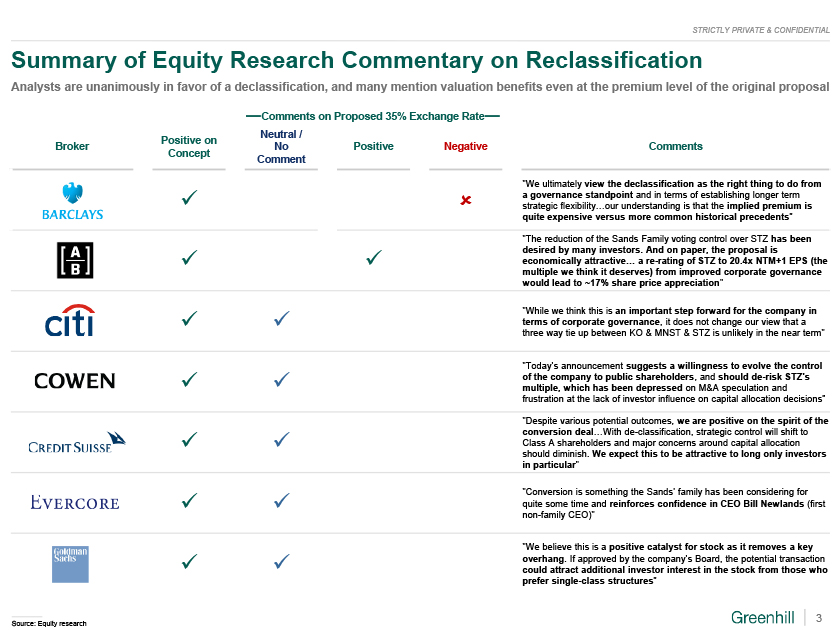

STRICTLY PRIVATE & CONFIDENTIAL Summary of Equity Research Commentary on Reclassification Analysts are unanimously in favor of a declassification, and many mention valuation benefits even at the premium level of the original proposal Comments on Proposed 35% Exchange Rate Neutral / Positive on Broker No Positive Negative Comments Concept Comment We ultimately view the declassification as the right thing to do from ✓ a governance standpoint and in terms of establishing longer term strategic flexibility our understanding is that the implied premium is quite expensive versus more common historical precedents The reduction of the Sands Family voting control over STZ has been desired by many investors. And on paper, the proposal is ✓ ✓ economically attractive a re-rating of STZ to 20.4x NTM+1 EPS (the multiple we think it deserves) from improved corporate governance would lead to ~17% share price appreciation While we think this is an important step forward for the company in ✓ ✓ terms of corporate governance, it does not change our view that a three way tie up between KO & MNST & STZ is unlikely in the near term Todays announcement suggests a willingness to evolve the control ✓ ✓ of the company to public shareholders, and should de-risk STZs multiple, which has been depressed on M&A speculation and frustration at the lack of investor influence on capital allocation decisions Despite various potential outcomes, we are positive on the spirit of the conversion deal With de-classification, strategic control will shift to ✓ ✓ Class A shareholders and major concerns around capital allocation should diminish. We expect this to be attractive to long only investors in particular Conversion is something the Sands family has been considering for ✓ ✓ quite some time and reinforces confidence in CEO Bill Newlands (first non-family CEO) We believe this is a positive catalyst for stock as it removes a key ✓ ✓ overhang. If approved by the companys Board, the potential transaction could attract additional investor interest in the stock from those who prefer single-class structures 3 Source: Equity research

STRICTLY PRIVATE & CONFIDENTIAL Summary of Equity Research Commentary on Reclassification (contd) Analysts are unanimously in favor of a declassification, and many mention valuation benefits even at the premium level of the original proposal Comments on Proposed 35% Exchange Rate Neutral / Positive on Broker No Positive Negative Comments Concept Comment While the suggested premium is not inconsequential, it deserves ✓ ✓ serious consideration from the BOD/shareholders and would help lift the long discussed M&A overhang on STZs multiple Despite the hefty 35% premium (in our view), we think shareholders ✓ ✓ will ultimately welcome the proposal, as it better aligns STZs corporate governance [and] earnings dilution [will be] offset by removal of perceived overhang We think some of the stocks valuation discount in our minds ✓ ✓ around capital allocation concerns will be reduced, and higher valuation will probably offset EPS dilution potential We view the proposed removal of STZ dual-class share structure favorably... While the market responded negatively to the proposed 35% ✓ premium in the Sands familys initial offer we believe ultimately a compromise could be found in a 10-20% premium, consistent with our analysis of prior transactions Shareholders gaining more control is a net positive for the longer ✓ ✓ term, even if there is likely a valid debate around what cost is required for gaining said control. Total 12 8 2 2 4 Source: Equity research

STRICTLY PRIVATE & CONFIDENTIAL Disclaimer This document has been prepared by Greenhill & Co., LLC (Greenhill) exclusively for the benefit and internal use of the Wildstar Partners LLC and the Family Holders (the Recipient) solely for its use in evaluating the transaction described herein and may not be used for any other purpose or copied, distributed, reproduced, disclosed or otherwise made available to any other person without Greenhills prior written consent. This document may only be relied upon by the Recipient and no other person. Greenhill is acting solely for the Recipient in connection with any arrangements, services or transactions referred to in this document. Greenhill is not and will not be responsible to anyone other than the Recipient for providing the protections afforded to the clients of Greenhill or for providing advice in relation to the arrangements, services or transactions referred to in this document. This document is delivered subject to the terms of the engagement letter entered into between the Recipient and Greenhill. This document is delivered as at the date specified on the cover; Greenhill does not have any obligation to provide any update to or correct any inaccuracies in the information in this document. This document is private and confidential; by accepting this document, you are deemed to agree to treat it and its contents confidentially. This document does not constitute an opinion, and is not intended to be and does not constitute a recommendation to the Recipient as to whether to approve or undertake or take any other action in respect of any transactions contemplated in this document. The commercial merits or suitability or expected profitability or benefit of such transactions should be independently determined by the Recipient based on its own assessment of the legal, tax, accounting, regulatory, financial, credit and other related aspects of the transaction, relying on such information and advice from the Recipients own professional advisors and such other experts as it deems relevant. Greenhill does not provide accounting, tax, legal or regulatory advice. 5