EXHIBIT (C)(16)

Published on August 1, 2022

Exhibit (c)(16)

Confidential Draft Project Gemini: Confidential Discussion Materials For The Special Committee April 15, 2022

Confidential Draft Disclaimer This presentation has been prepared by Centerview Partners LLC (Centerview) for use solely by the Special Committee of the Board of Directors of Gemini in connection with its evaluation of a proposed share reclassification and for no other purpose. The information contained herein is based upon information supplied by or on behalf of Gemini and publicly available information, and portions of the information contained herein may be based upon statements, estimates and forecasts provided by Gemini. Centerview has relied upon the accuracy and completeness of the foregoing information, and has not assumed any responsibility for any independent verification of such information or for any independent evaluation or appraisal of any of the assets or liabilities (contingent or otherwise) of Gemini or any other entity, or concerning the solvency or fair value of Gemini or any other entity. With respect to financial forecasts, including with respect to estimates of potential synergies, Centerview has assumed that such forecasts have been reasonably prepared on bases reflecting the best currently available estimates and judgments of the managements of Gemini as to their respective future financial performances, and at your direction Centerview has relied upon such forecasts, as provided by Geminis management, with respect to both Gemini, including as to expected synergies. Centerview assumes no responsibility for and expresses no view as to such forecasts or the assumptions on which they are based. The information set forth herein is based upon economic, monetary, market and other conditions as in effect on, and the information made available to us as of, the date hereof, unless indicated otherwise and Centerview assumes no obligation to update or otherwise revise these materials. The financial analysis in this presentation is complex and is not necessarily susceptible to a partial analysis or summary description. In performingthis financial analysis, Centerview has considered the results of its analysis as a whole and did not necessarily attribute a particular weight to any particular portion of the analysis considered. Furthermore, selecting any portion of Centerviews analysis, without considering the analysis as a whole, wouldcreate an incomplete view of the process underlying its financial analysis. Centerview may have deemed various assumptions more or less probable than other assumptions, so the reference ranges resulting from any particular portion of the analysis described above should not be taken to be Centerviews view of the actual value of Gemini. These materials and the information contained herein are confidential, were not prepared with a view toward public disclosure, and may not be disclosed publicly or made available to third parties without the prior written consent of Centerview. These materials and any other advice, written or oral, rendered by Centerview are intended solely for the benefit and use of the Special Committee of the Board of Directors of Gemini (in its capacity as such) in its consideration of the proposed share reclassification, and are not for the benefit of, and do not convey any rights or remedies for any holder of securities of Gemini or any other person. Centerview will not be responsible for and has not provided any tax, accounting, actuarial, legal or other specialist advice. These materials are not intended to provide the sole basis for evaluating the proposed transaction, and this presentation does not represent a fairness opinion, recommendation, valuation or opinion of any kind, and is necessarily incomplete and should be viewed solely in conjunction with the oral presentation provided by Centerview.

Confidential Draft Situation Overview To assist the Special Committee in a potential response to the Sands proposal regarding a reclassification, we have continued to evaluate selected data / benchmarks, including: 1 Selected prior share reclassification situations Nine prior reclassifications situations with a family / founder controlling shareholder(1) Premiums range from 0%57%, with a median of 22%; Board composition and ongoing family / founder involvement varies across situations 2 Geminis corporate governance profile Comparison of key governance policies vs. S&P 500 companies and review of key ISS concerns Potential governance policy updates to evaluate in conjunction with a reclassification 3 Market benchmarks and considerations Market implied reclassification premium following the announcement of the proposal Dividend considerations for Class B holders Summary of selected Wall Street analyst and Gemini investor feedback Given the uniqueness of each potential reclassification situation, the Committee may factor several qualitative and quantitative factors into a potential response 4 In addition to potential premium percentage / exchange ratio, response may include factors such as Board representation, ongoing roles, compensation & benefits and other governance items 2 (1) Reflects prior reclassification situations since 2001 for companies with greater than $500 million market capitalization.

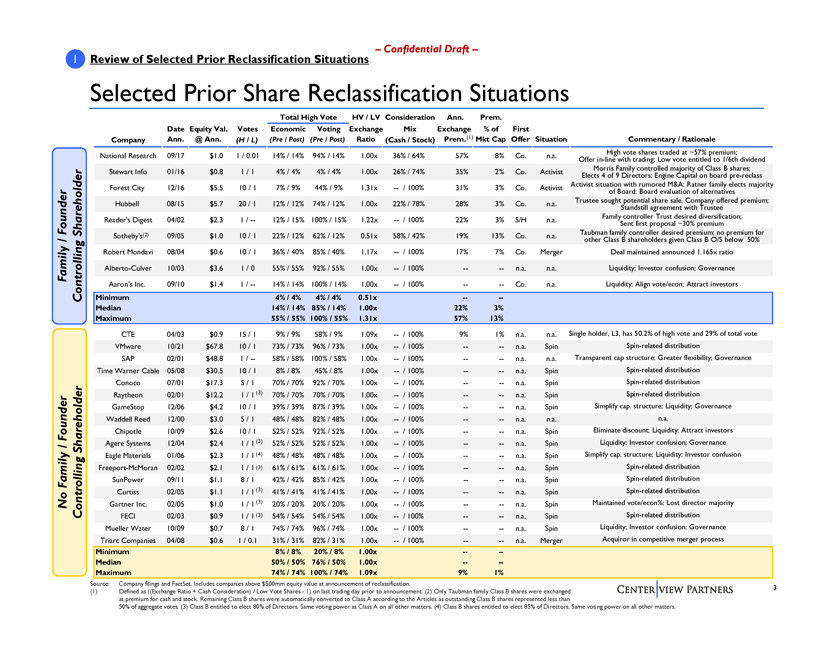

1 Review of Selected Prior Reclassification Situations Confidential Draft Selected Prior Share Reclassification Situations Total High Vote HV / LV Consideration Ann. Prem. Date Equity Val. Votes Economic Voting Exchange Mix Exchange % of First Company Ann. @ Ann. (H / L) (Pre / Post) (Pre / Post) Ratio (Cash / Stock) Prem.(1) Mkt Cap Offer Situation Commentary / Rationale National Research 09/17 $1.0 1 / 0.01 14% / 14% 94% / 14% 1.00x 36% / 64% 57% 8% Co. n.a. Offer in-line High with vote trading; shares Low traded vote at entitled ~57% premium; to 1/6th dividend Stewart Info 01/16 $0.8 1 / 1 4% / 4% 4% / 4% 1.00x 26% / 74% 35% 2% Co. Activist Elects Morris 4 of 9 Family Directors; controlled Engine majority Capital of on Class board B pre shares; -reclass Activist situation with rumored M&A; Ratner family elects majority Forest City 12/16 $5.5 10 / 1 7% / 9% 44% / 9% 1.31x / 100% 31% 3% Co. Activist of Board; Board evaluation of alternatives Trustee sought potential share sale, Company offered premium; Hubbell 08/15 $5.7 20 / 1 12% / 12% 74% / 12% 1.00x 22% / 78% 28% 3% Co. n.a. Standstill agreement with Trustee Family controller Trust desired diversification; Readers Digest 04/02 $2.3 1 / 12% / 15% 100% / 15% 1.22x / 100% 22% 3% S/H n.a. Sent first proposal ~30% premium Founder Shareholder (2) Taubman family controller desired premium; no premium for Sothebys 09/05 $1.0 10 / 1 22% / 12% 62% / 12% 0.51x 58% / 42% 19% 13% Co. n.a. / other Class B shareholders given Class B O/S below 50% Robert Mondavi 08/04 $0.6 10 / 1 36% / 40% 85% / 40% 1.17x / 100% 17% 7% Co. Merger Deal maintained announced 1.165x ratio Family Alberto-Culver 10/03 $3.6 1 / 0 55% / 55% 92% / 55% 1.00x / 100% -- n.a. n.a. Liquidity; Investor confusion; Governance Aarons Inc. 09/10 $1.4 1 / 14% / 14% 100% / 14% 1.00x / 100% -- Co. n.a. Liquidity; Align vote/econ; Attract investors Controlling Minimum 4% / 4% 4% / 4% 0.51x --Median 14% / 14% 85% / 14% 1.00x 22% 3% Maximum 55% / 55% 100% / 55% 1.31x 57% 13% CTE 04/03 $0.9 15 / 1 9% / 9% 58% / 9% 1.09x / 100% 9% 1% n.a. n.a. Single holder, L3, has 50.2% of high vote and 29% of total vote VMware 10/21 $67.8 10 / 1 73% / 73% 96% / 73% 1.00x / 100% -- n.a. Spin Spin-related distribution SAP 02/01 $48.8 1 / 58% / 58% 100% / 58% 1.00x / 100% -- n.a. n.a. Transparent cap structure; Greater flexibility; Governance Time Warner Cable 05/08 $30.5 10 / 1 8% / 8% 45% / 8% 1.00x / 100% -- n.a. Spin Spin-related distribution Conoco 07/01 $17.3 5 / 1 70% / 70% 92% / 70% 1.00x / 100% -- n.a. Spin Spin-related distribution Raytheon 02/01 $12.2 1 / 1 (3) 70% / 70% 70% / 70% 1.00x / 100% -- n.a. Spin Spin-related distribution GameStop 12/06 $4.2 10 / 1 39% / 39% 87% / 39% 1.00x / 100% -- n.a. Spin Simplify cap. structure; Liquidity; Governance Waddell Reed 12/00 $3.0 5 / 1 48% / 48% 82% / 48% 1.00x / 100% -- n.a. n.a. n.a. Founder Chipotle 10/09 $2.6 10 / 1 52% / 52% 92% / 52% 1.00x / 100% -- n.a. Spin Eliminate discount; Liquidity; Attract investors (3) Liquidity; Investor confusion; Governance / Agere Systems 12/04 $2.4 1 / 1 52% / 52% 52% / 52% 1.00x / 100% -- n.a. Spin Shareholder Eagle Materials 01/06 $2.3 1 / 1 (4) 48% / 48% 48% / 48% 1.00x / 100% -- n.a. Spin Simplify cap. structure; Liquidity; Investor confusion Freeport-McMoran 02/02 $2.1 1 / 1 (3) 61% / 61% 61% / 61% 1.00x / 100% -- n.a. Spin Spin-related distribution Family SunPower 09/11 $1.1 8 / 1 42% / 42% 85% / 42% 1.00x / 100% -- n.a. Spin Spin-related distribution Curtiss 02/05 $1.1 1 / 1 (3) 41% / 41% 41% / 41% 1.00x / 100% -- n.a. Spin Spin-related distribution No Gartner Inc. 02/05 $1.0 1 / 1 (3) 20% / 20% 20% / 20% 1.00x / 100% -- n.a. Spin Maintained vote/econ%; Lost director majority Controlling FECI 02/03 $0.9 1 / 1 (3) 54% / 54% 54% / 54% 1.00x / 100% -- n.a. Spin Spin-related distribution Mueller Water 10/09 $0.7 8 / 1 74% / 74% 96% / 74% 1.00x / 100% -- n.a. Spin Liquidity; Investor confusion; Governance Triarc Companies 04/08 $0.6 1 / 0.1 31% / 31% 82% / 31% 1.00x / 100% -- n.a. Merger Acquiror in competitive merger process Minimum 8% / 8% 20% / 8% 1.00x --Median 50% / 50% 76% / 50% 1.00x --Maximum 74% / 74% 100% / 74% 1.09x 9% 1% Source: Company filings and FactSet. Includes companies above $500mm equity value at announcement of reclassification. 3 (1) Defined as ((Exchange Ratio + Cash Consideration) / Low Vote Shares1) on last trading day prior to announcement. (2) Only Taubman family Class B shares were exchanged at premium for cash and stock. Remaining Class B shares were automatically converted to Class A according to the Articles as outstanding Class B shares represented less than 50% of aggregate votes. (3) Class B entitled to elect 80% of Directors. Same voting power as Class A on all other matters. (4) Class B shares entitled to elect 85% of Directors. Same voting power on all other matters.

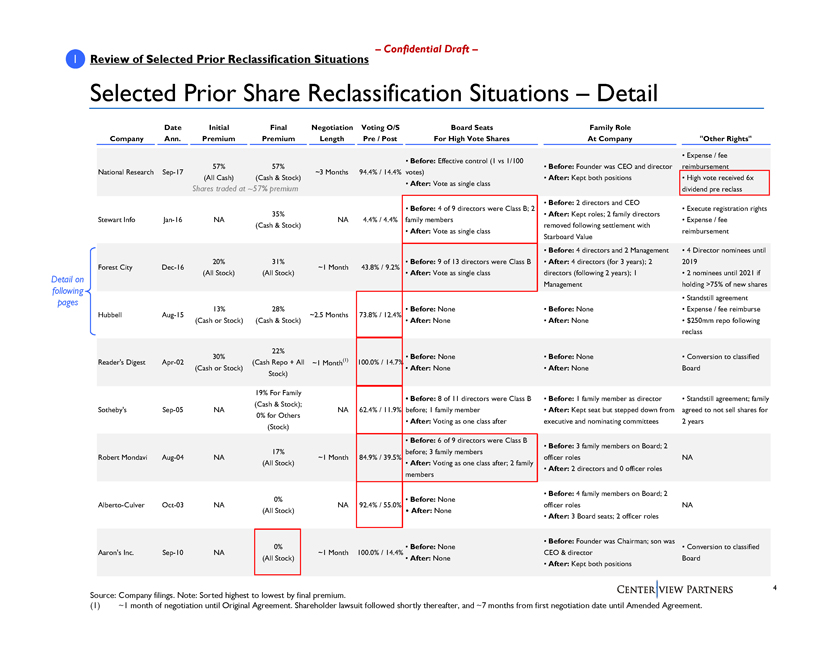

1 Review of Selected Prior Reclassification Situations Confidential Draft Selected Prior Share Reclassification Situations Detail Date Initial Final Negotiation Voting O/S Board Seats Family Role Company Ann. Premium Premium Length Pre / Post For High Vote Shares At Company Other Rights Expense / fee Before: Effective control (1 vs 1/100 57% 57% Before: Founder was CEO and director reimbursement National Research Sep-17 ~3 Months 94.4% / 14.4% votes) (All Cash) (Cash & Stock) After: Kept both positions High vote received 6x After: Vote as single class Shares traded at ~57% premium dividend pre reclass Before: 2 directors and CEO Before: 4 of 9 directors were Class B; 2 Execute registration rights 35% After: Kept roles; 2 family directors Stewart Info Jan-16 NA NA 4.4% / 4.4% family members Expense / fee (Cash & Stock) removed following settlement with After: Vote as single class reimbursement Starboard Value Before: 4 directors and 2 Management 4 Director nominees until 20% 31% Before: 9 of 13 directors were Class B After: 4 directors (for 3 years); 2 2019 Forest City Dec-16 ~1 Month 43.8% / 9.2% (All Stock) (All Stock) After: Vote as single class directors (following 2 years); 1 2 nominees until 2021 if Detail on Management holding >75% of new shares following Standstill agreement pages 13% 28% Before: None Before: None Expense / fee reimburse Hubbell Aug-15 ~2.5 Months 73.8% / 12.4% (Cash or Stock) (Cash & Stock) After: None After: None $250mm repo following reclass 22% 30% Before: None Before: None Conversion to classified Readers Digest Apr-02 (Cash Repo + All ~1 Month(1) 100.0% / 14.7% (Cash or Stock) After: None After: None Board Stock) 19% For Family Before: 8 of 11 directors were Class B Before: 1 family member as director Standstill agreement; family (Cash & Stock); Sothebys Sep-05 NA NA 62.4% / 11.9% before; 1 family member After: Kept seat but stepped down from agreed to not sell shares for 0% for Others After: Voting as one class after executive and nominating committees 2 years (Stock) Before: 6 of 9 directors were Class B Before: 3 family members on Board; 2 17% before; 3 family members Robert Mondavi Aug-04 NA ~1 Month 84.9% / 39.5% officer roles NA (All Stock) After: Voting as one class after; 2 family After: 2 directors and 0 officer roles members Before: 4 family members on Board; 2 0% Before: None Alberto-Culver Oct-03 NA NA 92.4% / 55.0% officer roles NA (All Stock) After: None After: 3 Board seats; 2 officer roles Before: Founder was Chairman; son was 0% Before: None Conversion to classified Aarons Inc. Sep-10 NA ~1 Month 100.0% / 14.4% CEO & director (All Stock) After: None Board After: Kept both positions Source: Company filings. Note: Sorted highest to lowest by final premium. 4 (1) ~1 month of negotiation until Original Agreement. Shareholder lawsuit followed shortly thereafter, and ~7 months from first negotiation date until Amended Agreement.

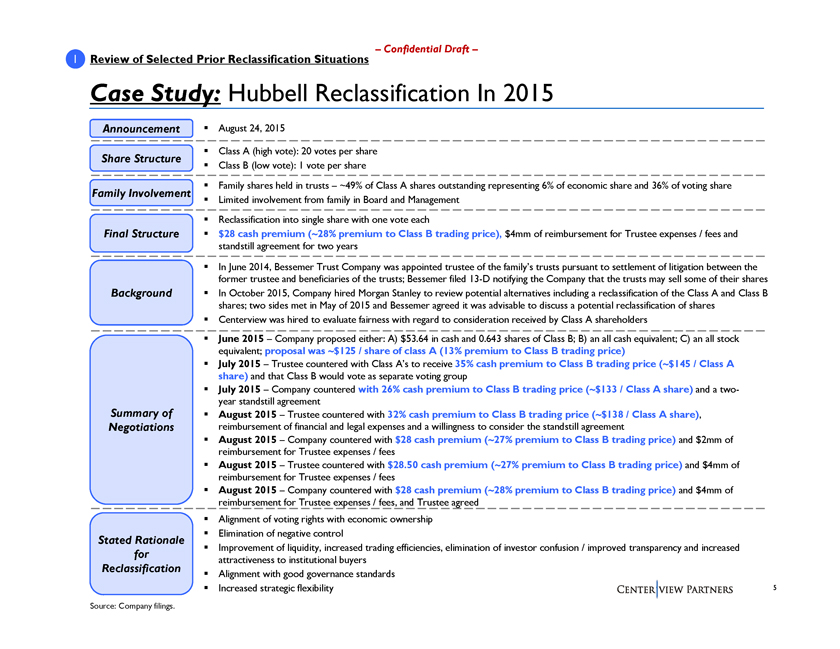

1 Review of Selected Prior Reclassification Situations Confidential Draft Case Study: Hubbell Reclassification In 2015 Announcementï,§ August 24, 2015 ï,§ Class A (high vote): 20 votes per share Share Structure ï,§ Class B (low vote): 1 vote per share ï,§ Family shares held in trusts ~49% of Class A shares outstanding representing 6% of economic share and 36% of voting share Family Involvement ï,§ Limited involvement from family in Board and Managementï,§ Reclassification into single share with one vote each Final Structureï,§ $28 cash premium (~28% premium to Class B trading price), $4mm of reimbursement for Trustee expenses / fees and standstill agreement for two yearsï,§ In June 2014, Bessemer Trust Company was appointed trustee of the familys trusts pursuant to settlement of litigation between the former trustee and beneficiaries of the trusts; Bessemer filed 13-D notifying the Company that the trusts may sell some of their shares Backgroundï,§ In October 2015, Company hired Morgan Stanley to review potential alternatives including a reclassification of the Class A and Class B shares; two sides met in May of 2015 and Bessemer agreed it was advisable to discuss a potential reclassification of sharesï,§ Centerview was hired to evaluate fairness with regard to consideration received by Class A shareholdersï,§ June 2015 Company proposed either: A) $53.64 in cash and 0.643 shares of Class B; B) an all cash equivalent; C) an all stock equivalent; proposal was ~$125 / share of class A (13% premium to Class B trading price)ï,§ July 2015 Trustee countered with Class As to receive 35% cash premium to Class B trading price (~$145 / Class A share) and that Class B would vote as separate voting group ï,§ July 2015 Company countered with 26% cash premium to Class B trading price (~$133 / Class A share) and a two-year standstill agreement Summary of ï,§ August 2015 Trustee countered with 32% cash premium to Class B trading price (~$138 / Class A share), Negotiations reimbursement of financial and legal expenses and a willingness to consider the standstill agreement ï,§ August 2015 Company countered with $28 cash premium (~27% premium to Class B trading price) and $2mm of reimbursement for Trustee expenses / fees ï,§ August 2015 Trustee countered with $28.50 cash premium (~27% premium to Class B trading price) and $4mm of reimbursement for Trustee expenses / fees ï,§ August 2015 Company countered with $28 cash premium (~28% premium to Class B trading price) and $4mm of reimbursement for Trustee expenses / fees, and Trustee agreedï,§ Alignment of voting rights with economic ownershipï,§ Elimination of negative control Stated Rationale ï,§ Improvement of liquidity, increased trading efficiencies, elimination of investor confusion / improved transparency and increased for attractiveness to institutional buyers Reclassification ï,§ Alignment with good governance standards ï,§ Increased strategic flexibility 5 Source: Company filings.

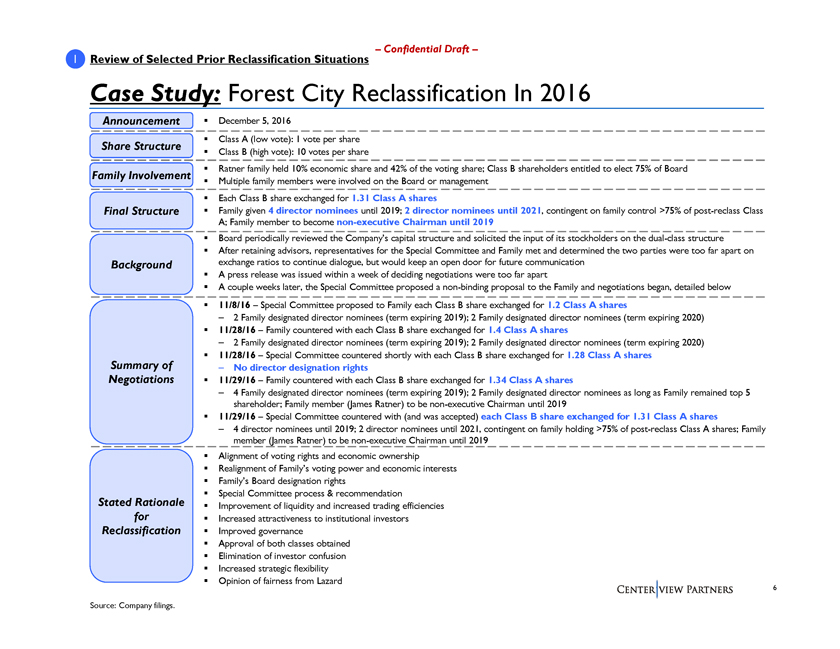

1 Review of Selected Prior Reclassification Situations Confidential Draft Case Study: Forest City Reclassification In 2016 Announcementï,§ December 5, 2016 ï,§ Class A (low vote): 1 vote per share Share Structure ï,§ Class B (high vote): 10 votes per share ï,§ Ratner family held 10% economic share and 42% of the voting share; Class B shareholders entitled to elect 75% of Board Family Involvement ï,§ Multiple family members were involved on the Board or managementï,§ Each Class B share exchanged for 1.31 Class A shares Final Structureï,§ Family given 4 director nominees until 2019; 2 director nominees until 2021, contingent on family control >75% of post-reclass Class A; Family member to become non-executive Chairman until 2019 ï,§ Board periodically reviewed the Companys capital structure and solicited the input of its stockholders on the dual-class structureï,§ After retaining advisors, representatives for the Special Committee and Family met and determined the two parties were too far apart on Background exchange ratios to continue dialogue, but would keep an open door for future communicationï,§ A press release was issued within a week of deciding negotiations were too far apartï,§ A couple weeks later, the Special Committee proposed a non-binding proposal to the Family and negotiations began, detailed belowï,§ 11/8/16 Special Committee proposed to Family each Class B share exchanged for 1.2 Class A shares 2 Family designated director nominees (term expiring 2019); 2 Family designated director nominees (term expiring 2020)ï,§ 11/28/16 Family countered with each Class B share exchanged for 1.4 Class A shares 2 Family designated director nominees (term expiring 2019); 2 Family designated director nominees (term expiring 2020) Summary of ï,§ 11/28/16 Special Committee countered shortly with each Class B share exchanged for 1.28 Class A shares No director designation rights Negotiationsï,§ 11/29/16 Family countered with each Class B share exchanged for 1.34 Class A shares 4 Family designated director nominees (term expiring 2019); 2 Family designated director nominees as long as Family remained top 5 shareholder; Family member (James Ratner) to be non-executive Chairman until 2019 ï,§ 11/29/16 Special Committee countered with (and was accepted) each Class B share exchanged for 1.31 Class A shares 4 director nominees until 2019; 2 director nominees until 2021, contingent on family holding >75% of post-reclass Class A shares; Family member (James Ratner) to be non-executive Chairman until 2019ï,§ Alignment of voting rights and economic ownershipï,§ Realignment of Familys voting power and economic interestsï,§ Familys Board designation rightsï,§ Special Committee process & recommendation Stated Rationale ï,§ Improvement of liquidity and increased trading efficiencies for ï,§ Increased attractiveness to institutional investors Reclassificationï,§ Improved governanceï,§ Approval of both classes obtainedï,§ Elimination of investor confusionï,§ Increased strategic flexibilityï,§ Opinion of fairness from Lazard 6 Source: Company filings.

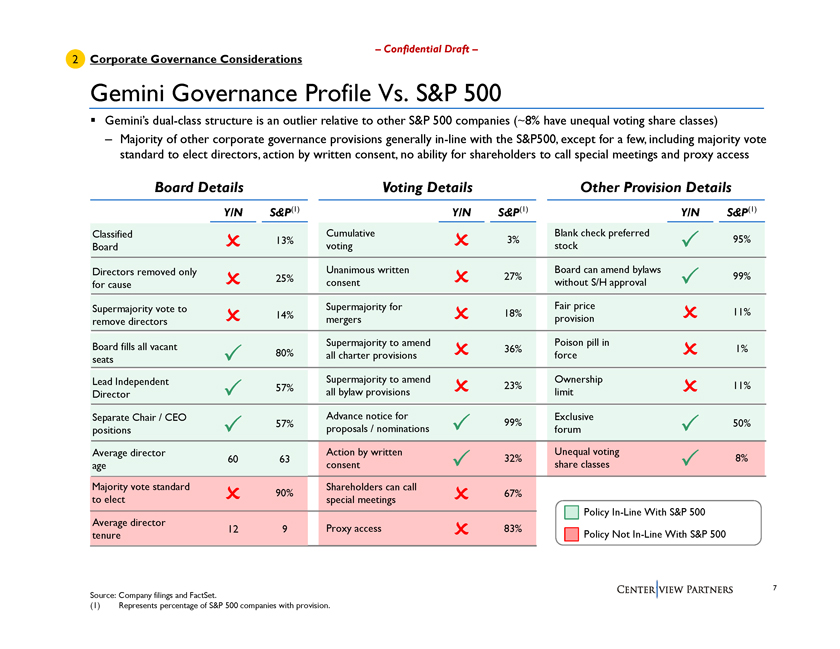

2 Corporate Governance Considerations Confidential Draft Gemini Governance Profile Vs. S&P 500 ï,§ Geminis dual-class structure is an outlier relative to other S&P 500 companies (~8% have unequal voting share classes) Majority of other corporate governance provisions generally in-line with the S&P500, except for a few, including majority vote standard to elect directors, action by written consent, no ability for shareholders to call special meetings and proxy access Board Details Voting Details Other Provision Details Y/N S&P(1) Y/N S&P(1) Y/N S&P(1) Classified Cumulative Blank check preferred 13% 3% 95% Board voting stock Directors removed only Unanimous written Board can amend bylaws 25% 27% 99% for cause consent without S/H approval Supermajority vote to Supermajority for Fair price 14% 18% 11% remove directors mergers provision Board fills all vacant Supermajority to amend Poison pill in 80% 36% 1% seats all charter provisions force Lead Independent Supermajority to amend Ownership 57% 23% 11% Director all bylaw provisions limit Separate Chair / CEO Advance notice for Exclusive 57% 99% 50% positions proposals / nominations forum Average director Action by written Unequal voting 60 63 32% 8% age consent share classes Majority vote standard Shareholders can call 90% 67% to elect special meetings Policy In-Line With S&P 500 Average director 12 9 Proxy access 83% tenure Policy Not In-Line With S&P 500 Source: Company filings and FactSet. 7 (1) Represents percentage of S&P 500 companies with provision.

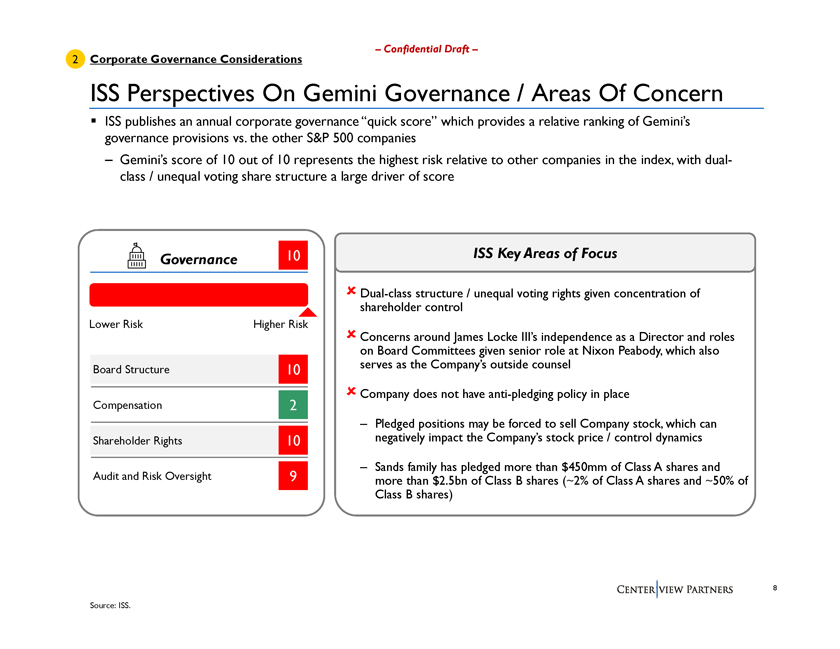

2 Corporate Governance Considerations Confidential Draft ISS Perspectives On Gemini Governance / Areas Of Concern ï,§ ISS publishes an annual corporate governance quick score which provides a relative ranking of Geminis governance provisions vs. the other S&P 500 companies Geminis score of 10 out of 10 represents the highest risk relative to other companies in the index, with dual-class / unequal voting share structure a large driver of score Governance 10 ISS Key Areas of Focus Dual-class structure / unequal voting rights given concentration of shareholder control Lower Risk Higher Risk Concerns around James Locke IIIs independence as a Director and roles on Board Committees given senior role at Nixon Peabody, which also Board Structure 10 serves as the Companys outside counsel Compensation Company does not have anti-pledging policy in place 2 Pledged positions may be forced to sell Company stock, which can Shareholder Rights 10 negatively impact the Companys stock price / control dynamics Sands family has pledged more than $450mm of Class A shares and Audit and Risk Oversight 9 more than $2.5bn of Class B shares (~2% of Class A shares and ~50% of Class B shares) 8 Source: ISS.

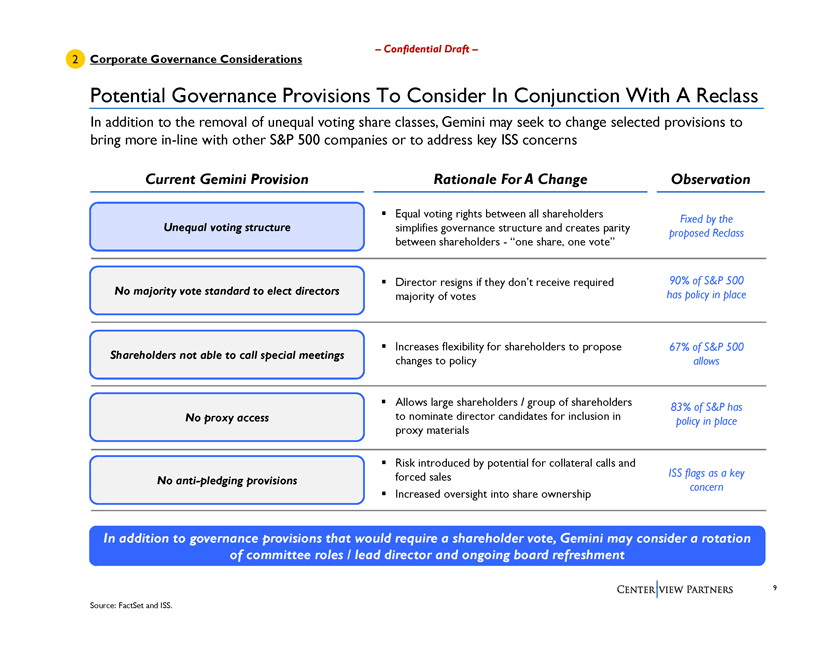

2 Corporate Governance Considerations Confidential Draft Potential Governance Provisions To Consider In Conjunction With A Reclass In addition to the removal of unequal voting share classes, Gemini may seek to change selected provisions to bring more in-line with other S&P 500 companies or to address key ISS concerns Current Gemini Provision Rationale For A Change Observation Equal voting rights between all shareholders Fixed by the Unequal voting structure simplifies governance structure and creates parity proposed Reclass between shareholdersone share, one vote No majority vote standard to elect directorsï,§ Director resigns if they dont receive required 90% of S&P 500 majority of votes has policy in place Increases flexibility for shareholders to propose 67% of S&P 500 Shareholders not able to call special meetings changes to policy allows Allows large shareholders / group of shareholders 83% of S&P has No proxy access to nominate director candidates for inclusion in policy in place proxy materials ï,§ Risk introduced by potential for collateral calls and forced sales ISS flags as a key No anti-pledging provisions concern Increased oversight into share ownership In addition to governance provisions that would require a shareholder vote, Gemini may consider a rotation of committee roles / lead director and ongoing board refreshment 9 Source: FactSet and ISS.

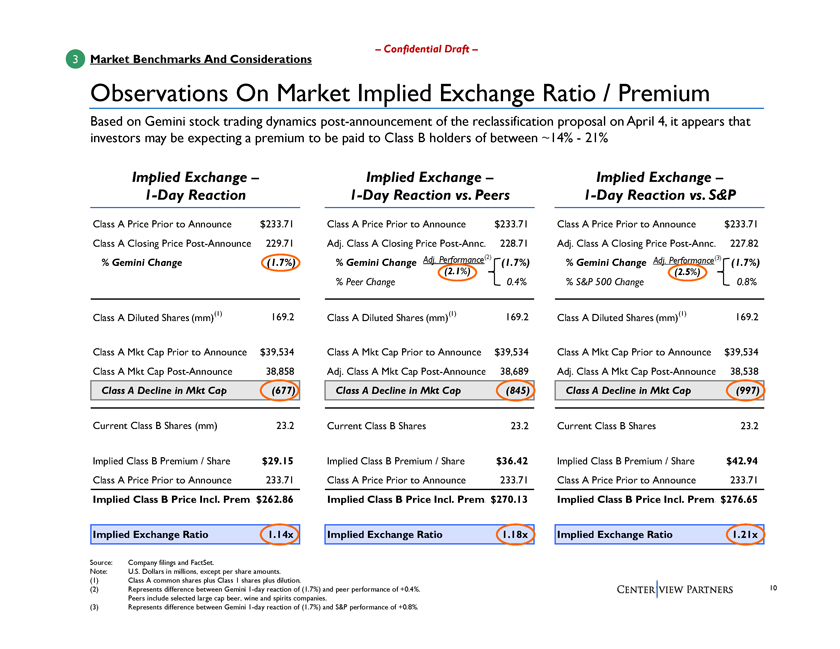

3 Market Benchmarks And Considerations Confidential Draft Observations On Market Implied Exchange Ratio / Premium Based on Gemini stock trading dynamics post-announcement of the reclassification proposal on April 4, it appears that investors may be expecting a premium to be paid to Class B holders of between ~14%21% Implied Exchange Implied Exchange Implied Exchange 1-Day Reaction 1-Day Reaction vs. Peers 1-Day Reaction vs. S&P Class A Price Prior to Announce $233.71 Class A Price Prior to Announce $233.71 Class A Price Prior to Announce $233.71 Class A Closing Price Post-Announce 229.71 Adj. Class A Closing Price Post-Annc. 228.71 Adj. Class A Closing Price Post-Annc. 227.82 Adj. Performance(2) Adj. Performance(3) % Gemini Change (1.7%) % Gemini Change (1.7%) % Gemini Change (1.7%) (2.1%) (2.5%) % Peer Change 0.4% % S&P 500 Change 0.8% Class A Diluted Shares (mm)(1) 169.2 Class A Diluted Shares (mm)(1) 169.2 Class A Diluted Shares (mm)(1) 169.2 Class A Mkt Cap Prior to Announce $39,534 Class A Mkt Cap Prior to Announce $39,534 Class A Mkt Cap Prior to Announce $39,534 Class A Mkt Cap Post-Announce 38,858 Adj. Class A Mkt Cap Post-Announce 38,689 Adj. Class A Mkt Cap Post-Announce 38,538 Class A Decline in Mkt Cap (677) Class A Decline in Mkt Cap (845) Class A Decline in Mkt Cap (997) Current Class B Shares (mm) 23.2 Current Class B Shares 23.2 Current Class B Shares 23.2 Implied Class B Premium / Share $29.15 Implied Class B Premium / Share $36.42 Implied Class B Premium / Share $42.94 Class A Price Prior to Announce 233.71 Class A Price Prior to Announce 233.71 Class A Price Prior to Announce 233.71 Implied Class B Price Incl. Prem $262.86 Implied Class B Price Incl. Prem $270.13 Implied Class B Price Incl. Prem $276.65 Implied Exchange Ratio 1.14x Implied Exchange Ratio 1.18x Implied Exchange Ratio 1.21x Source: Company filings and FactSet. Note: U.S. Dollars in millions, except per share amounts. (1) Class A common shares plus Class 1 shares plus dilution. (2) Represents difference between Gemini 1-day reaction of (1.7%) and peer performance of +0.4%. 10 Peers include selected large cap beer, wine and spirits companies. (3) Represents difference between Gemini 1-day reaction of (1.7%) and S&P performance of +0.8%.

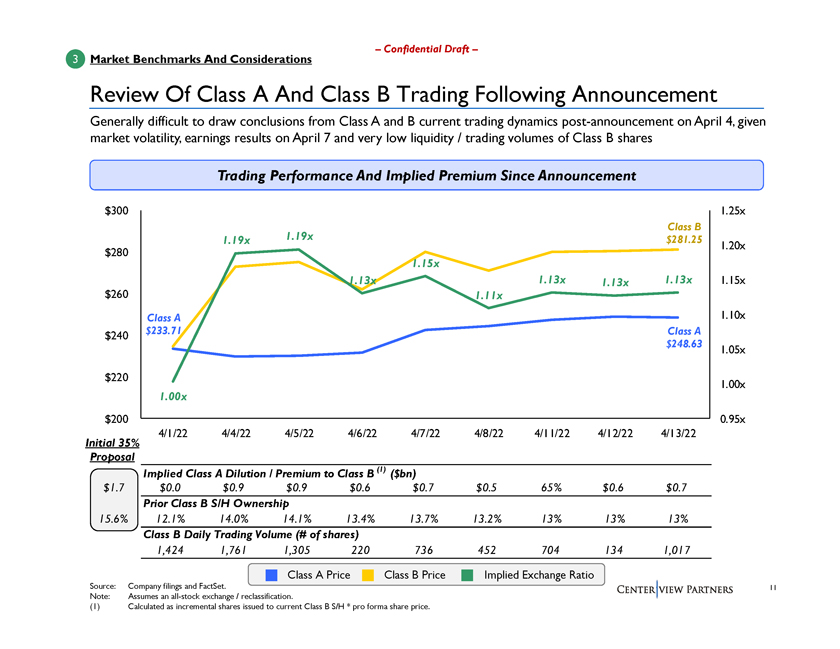

3 Market Benchmarks And Considerations Confidential Draft Review Of Class A And Class B Trading Following Announcement Generally difficult to draw conclusions from Class A and B current trading dynamics post-announcement on April 4, given market volatility, earnings results on April 7 and very low liquidity / trading volumes of Class B shares Trading Performance And Implied Premium Since Announcement $300 1.25x Class B 1.19x 1.19x $281.25 1.20x $280 1.15x 1.13x 1.13x 1.13x 1.13x 1.15x $260 1.11x Class A 1.10x $240 $233.71 Class A $248.63 1.05x $220 1.00x 1.00x $200 0.95x 4/1/22 4/4/22 4/5/22 4/6/22 4/7/22 4/8/22 4/11/22 4/12/22 4/13/22 Initial 35% Proposal Implied Class A Dilution / Premium to Class B (1) ($bn) $1.7 $0.0 $0.9 $0.9 $0.6 $0.7 $0.5 65% $0.6 $0.7 Prior Class B S/H Ownership 15.6% 12.1% 14.0% 14.1% 13.4% 13.7% 13.2% 13% 13% 13% Class B Daily Trading Volume (# of shares) 1,424 1,761 1,305 220 736 452 704 134 1,017 Class A Price Class B Price Implied Exchange Ratio Source: Company filings and FactSet. 11 Note: Assumes an all-stock exchange / reclassification. (1) Calculated as incremental shares issued to current Class B S/H * pro forma share price.

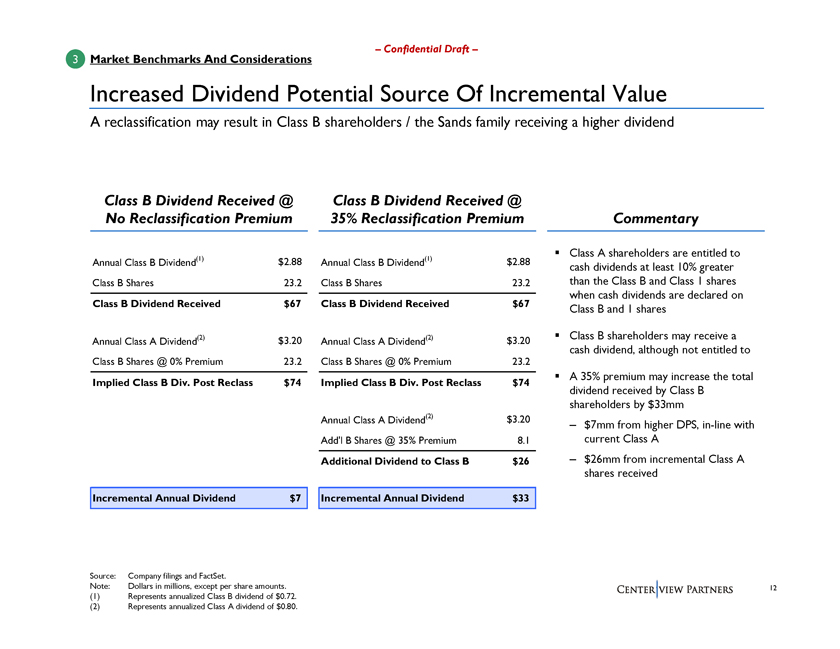

3 Market Benchmarks And Considerations Confidential Draft Increased Dividend Potential Source Of Incremental Value A reclassification may result in Class B shareholders / the Sands family receiving a higher dividend Class B Dividend Received @ Class B Dividend Received @ No Reclassification Premium 35% Reclassification Premium Commentary ï,§ Class A shareholders are entitled to Annual Class B Dividend(1) $2.88 Annual Class B Dividend(1) $2.88 cash dividends at least 10% greater Class B Shares 23.2 Class B Shares 23.2 than the Class B and Class 1 shares when cash dividends are declared on Class B Dividend Received $67 Class B Dividend Received $67 Class B and 1 shares (2) $3.20 (2) $3.20ï,§ Class B shareholders may receive a Annual Class A Dividend Annual Class A Dividend cash dividend, although not entitled to Class B Shares @ 0% Premium 23.2 Class B Shares @ 0% Premium 23.2 ï,§ A 35% premium may increase the total Implied Class B Div. Post Reclass $74 Implied Class B Div. Post Reclass $74 dividend received by Class B shareholders by $33mm Annual Class A Dividend(2) $3.20 $7mm from higher DPS, in-line with Addl B Shares @ 35% Premium 8.1 current Class A Additional Dividend to Class B $26 $26mm from incremental Class A shares received Incremental Annual Dividend $7 Incremental Annual Dividend $33 Source: Company filings and FactSet. Note: Dollars in millions, except per share amounts. 12 (1) Represents annualized Class B dividend of $0.72. (2) Represents annualized Class A dividend of $0.80.

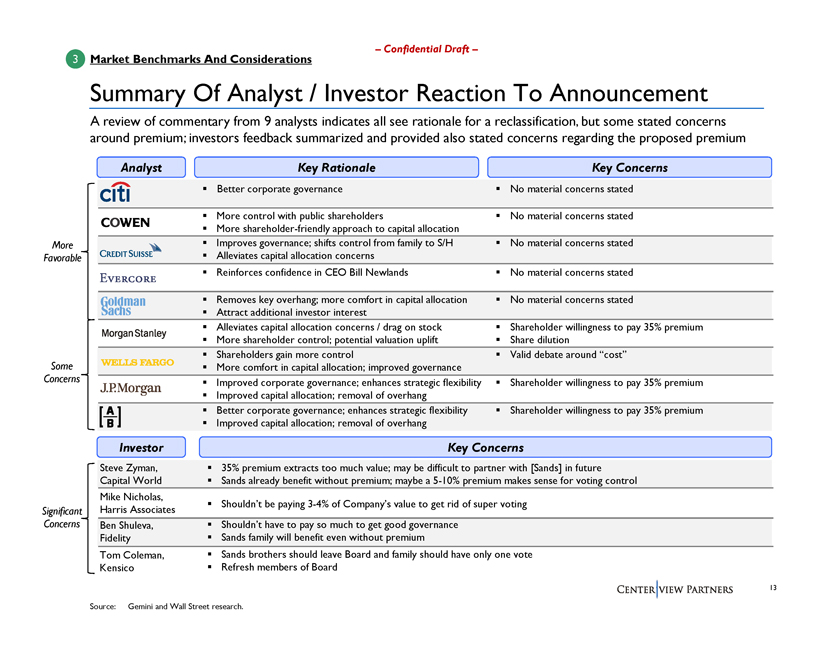

3 Market Benchmarks And Considerations Confidential Draft Summary Of Analyst / Investor Reaction To Announcement A review of commentary from 9 analysts indicates all see rationale for a reclassification, but some stated concerns around premium; investors feedback summarized and provided also stated concerns regarding the proposed premium Analyst Key Rationale Key Concerns ï,§ Better corporate governanceï,§ No material concerns stated ï,§ More control with public shareholdersï,§ No material concerns statedï,§ More shareholder-friendly approach to capital allocation More ï,§ Improves governance; shifts control from family to S/Hï,§ No material concerns stated Favorableï,§ Alleviates capital allocation concernsï,§ Reinforces confidence in CEO Bill Newlandsï,§ No material concerns stated ï,§ Removes key overhang; more comfort in capital allocationï,§ No material concerns statedï,§ Attract additional investor interest ï,§ Alleviates capital allocation concerns / drag on stockï,§ Shareholder willingness to pay 35% premiumï,§ More shareholder control; potential valuation upliftï,§ Share dilutionï,§ Shareholders gain more controlï,§ Valid debate around cost Some ï,§ More comfort in capital allocation; improved governance Concernsï,§ Improved corporate governance; enhances strategic flexibilityï,§ Shareholder willingness to pay 35% premiumï,§ Improved capital allocation; removal of overhangï,§ Better corporate governance; enhances strategic flexibilityï,§ Shareholder willingness to pay 35% premiumï,§ Improved capital allocation; removal of overhang Investor Key Concerns Steve Zyman, ï,§ 35% premium extracts too much value; may be difficult to partner with [Sands] in future Capital Worldï,§ Sands already benefit without premium; maybe a 5-10% premium makes sense for voting control Mike Nicholas, ï,§ Shouldnt be paying 3-4% of Companys value to get rid of super voting Significant Harris Associates Concerns Ben Shuleva, ï,§ Shouldnt have to pay so much to get good governance Fidelityï,§ Sands family will benefit even without premium Tom Coleman, ï,§ Sands brothers should leave Board and family should have only one vote Kensicoï,§ Refresh members of Board 13 Source: Gemini and Wall Street research.

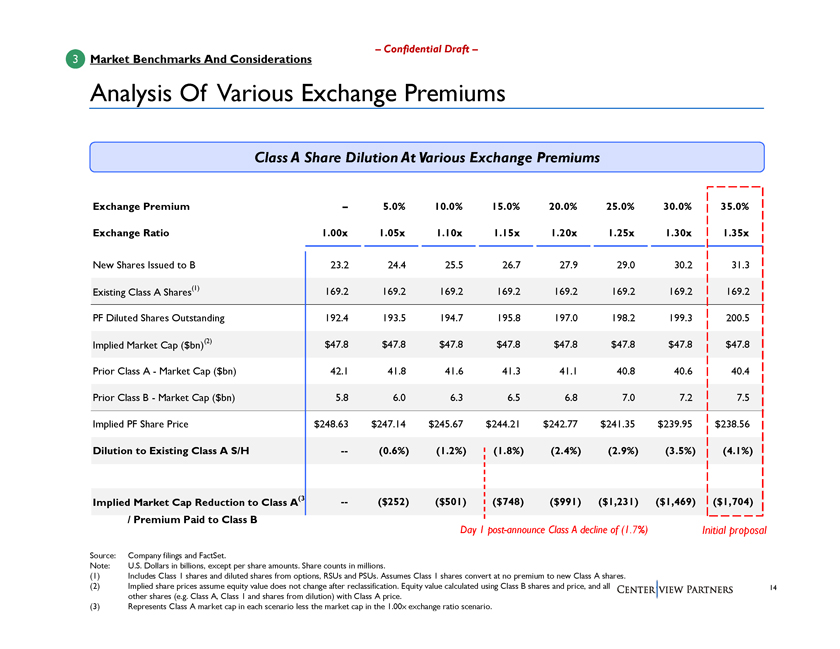

3 Market Benchmarks And Considerations Confidential Draft Analysis Of Various Exchange Premiums Class A Share Dilution At Various Exchange Premiums Exchange Premium 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% Exchange Ratio 1.00x 1.05x 1.10x 1.15x 1.20x 1.25x 1.30x 1.35x New Shares Issued to B 23.2 24.4 25.5 26.7 27.9 29.0 30.2 31.3 Existing Class A Shares(1) 169.2 169.2 169.2 169.2 169.2 169.2 169.2 169.2 PF Diluted Shares Outstanding 192.4 193.5 194.7 195.8 197.0 198.2 199.3 200.5 Implied Market Cap ($bn)(2) $47.8 $47.8 $47.8 $47.8 $47.8 $47.8 $47.8 $47.8 Prior Class AMarket Cap ($bn) 42.1 41.8 41.6 41.3 41.1 40.8 40.6 40.4 Prior Class BMarket Cap ($bn) 5.8 6.0 6.3 6.5 6.8 7.0 7.2 7.5 Implied PF Share Price $248.63 $247.14 $245.67 $244.21 $242.77 $241.35 $239.95 $238.56 Dilution to Existing Class A S/H (0.6%) (1.2%) (1.8%) (2.4%) (2.9%) (3.5%) (4.1%) Implied Market Cap Reduction to Class A(3 ($252) ($501) ($748) ($991) ($1,231) ($1,469) ($1,704) / Premium Paid to Class B Day 1 post-announce Class A decline of (1.7%) Initial proposal Source: Company filings and FactSet. Note: U.S. Dollars in billions, except per share amounts. Share counts in millions. (1) Includes Class 1 shares and diluted shares from options, RSUs and PSUs. Assumes Class 1 shares convert at no premium to new Class A shares. (2) Implied share prices assume equity value does not change after reclassification. Equity value calculated using Class B shares and price, and all 14 other shares (e.g. Class A, Class 1 and shares from dilution) with Class A price. (3) Represents Class A market cap in each scenario less the market cap in the 1.00x exchange ratio scenario.

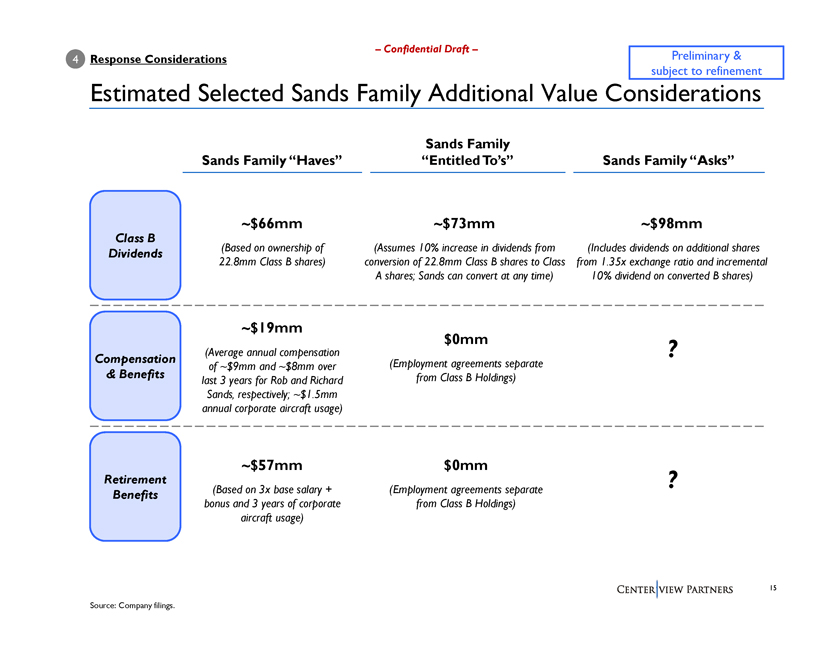

Confidential Draft 4 Response Considerations Preliminary & subject to refinement Estimated Selected Sands Family Additional Value Considerations Sands Family Sands Family Haves Entitled Tos Sands Family Asks ~$66mm ~$73mm ~$98mm Class B Dividends (Based on ownership of (Assumes 10% increase in dividends from (Includes dividends on additional shares 22.8mm Class B shares) conversion of 22.8mm Class B shares to Class from 1.35x exchange ratio and incremental A shares; Sands can convert at any time) 10% dividend on converted B shares) ~$19mm $0mm (Average annual compensation ? Compensation (Employment agreements separate of ~$9mm and ~$8mm over & Benefits from Class B Holdings) last 3 years for Rob and Richard Sands, respectively; ~$1.5mm annual corporate aircraft usage) ~$57mm $0mm Retirement ? Benefits (Based on 3x base salary + (Employment agreements separate bonus and 3 years of corporate from Class B Holdings) aircraft usage) 15 Source: Company filings.

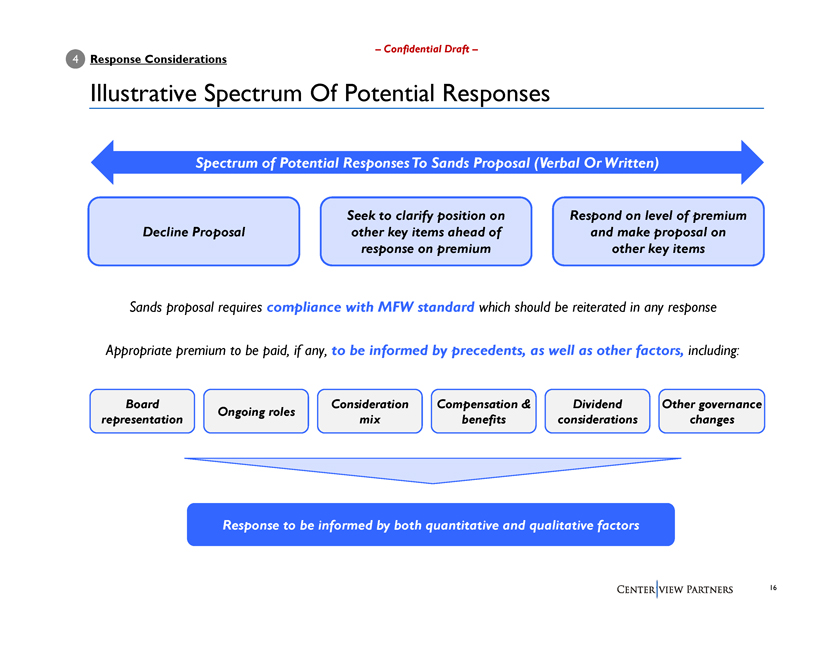

4 Response Considerations Confidential Draft Illustrative Spectrum Of Potential Responses Spectrum of Potential Responses To Sands Proposal (Verbal Or Written) Seek to clarify position on Respond on level of premium Decline Proposal other key items ahead of and make proposal on response on premium other key items Sands proposal requires compliance with MFW standard which should be reiterated in any response Appropriate premium to be paid, if any, to be informed by precedents, as well as other factors, including: Board Consideration Compensation & Dividend Other governance Ongoing roles representation mix benefits considerations changes Response to be informed by both quantitative and qualitative factors 16

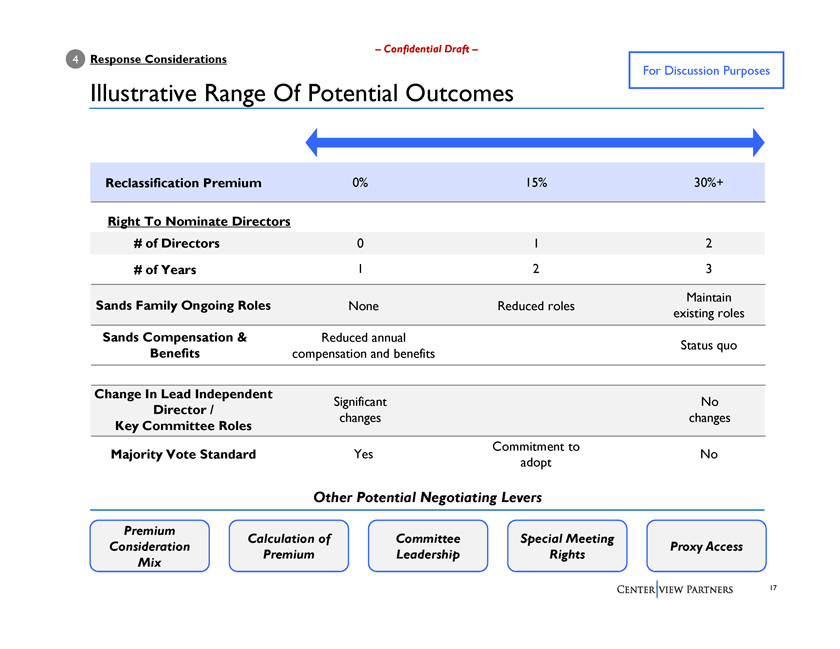

4 Response Considerations Confidential Draft For Discussion Purposes Illustrative Range Of Potential Outcomes Less Accommodative Reclassification Premium 0% 15% 30%+ Right To Nominate Directors # of Directors 02 1 # of Years 132 Maintain Sands Family Ongoing Roles None Reduced roles existing roles Sands Compensation & Reduced annual Status quo Benefits compensation and benefits Change In Lead Independent Significant No Director / changes changes Key Committee Roles Commitment to Majority Vote Standard Yes No adopt Other Potential Negotiating Levers Premium Calculation of Committee Special Meeting Consideration Proxy Access Premium Leadership Rights Mix 17

Appendix

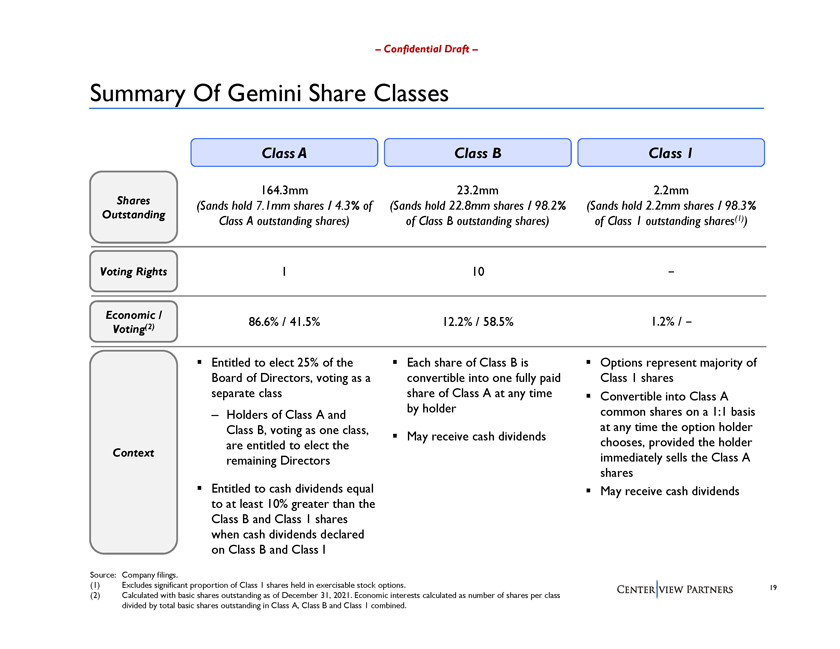

Confidential Draft Summary Of Gemini Share Classes Class A Class B Class 1 164.3mm 23.2mm 2.2mm Shares (Sands hold 7.1mm shares / 4.3% of (Sands hold 22.8mm shares / 98.2% (Sands hold 2.2mm shares / 98.3% Outstanding (1) Class A outstanding shares) of Class B outstanding shares) of Class 1 outstanding shares ) Voting Rights 110 Economic / (2) 86.6% / 41.5% 12.2% / 58.5% 1.2% / Voting Entitled to elect 25% of the Each share of Class B is Options represent majority of Board of Directors, voting as a convertible into one fully paid Class 1 shares separate class share of Class A at any time Convertible into Class A by holder common shares on a 1:1 basis Holders of Class A and at any time the option holder Class B, voting as one class, May receive cash dividends chooses, provided the holder are entitled to elect the Context immediately sells the Class A remaining Directors shares Entitled to cash dividends equal May receive cash dividends to at least 10% greater than the Class B and Class 1 shares when cash dividends declared on Class B and Class I Source: Company filings. (1) Excludes significant proportion of Class 1 shares held in exercisable stock options. 19 (2) Calculated with basic shares outstanding as of December 31, 2021. Economic interests calculated as number of shares per class divided by total basic shares outstanding in Class A, Class B and Class 1 combined.