EXHIBIT (C)(21)

Published on August 1, 2022

Exhibit (c)(21)

PROJECT BEACH Discussion Materials MAY 2022 STRICTLY PRIVATE & CONFIDENTIAL

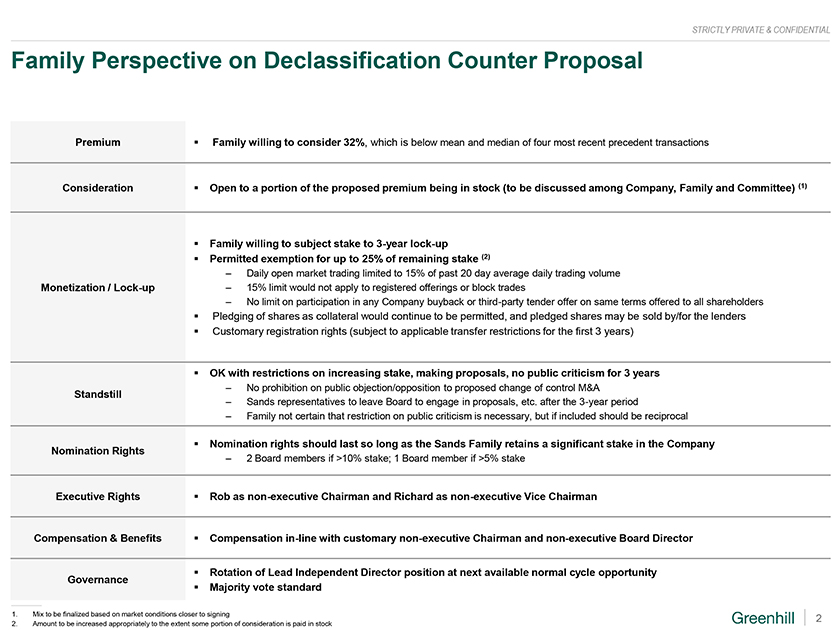

STRICTLY PRIVATE & CONFIDENTIAL Family Perspective on Declassification Counter Proposal Premium Family willing to consider 32%, which is below mean and median of four most recent precedent transactions Consideration Open to a portion of the proposed premium being in stock (to be discussed among Company, Family and Committee) (1) Family willing to subject stake to 3-year lock-up Permitted exemption for up to 25% of remaining stake (2) Daily open market trading limited to 15% of past 20 day average daily trading volume Monetization / Lock-up 15% limit would not apply to registered offerings or block trades No limit on participation in any Company buyback or third-party tender offer on same terms offered to all shareholders Pledging of shares as collateral would continue to be permitted, and pledged shares may be sold by/for the lenders Customary registration rights (subject to applicable transfer restrictions for the first 3 years) OK with restrictions on increasing stake, making proposals, no public criticism for 3 years No prohibition on public objection/opposition to proposed change of control M&A Standstill Sands representatives to leave Board to engage in proposals, etc. after the 3-year period Family not certain that restriction on public criticism is necessary, but if included should be reciprocal Nomination rights should last so long as the Sands Family retains a significant stake in the Company Nomination Rights 2 Board members if >10% stake; 1 Board member if >5% stake Executive Rights Rob as non-executive Chairman and Richard as non-executive Vice Chairman Compensation & Benefits Compensation in-line with customary non-executive Chairman and non-executive Board Director Rotation of Lead Independent Director position at next available normal cycle opportunity Governance Majority vote standard 1. Mix to be finalized based on market conditions closer to signing 2 2. Amount to be increased appropriately to the extent some portion of consideration is paid in stock

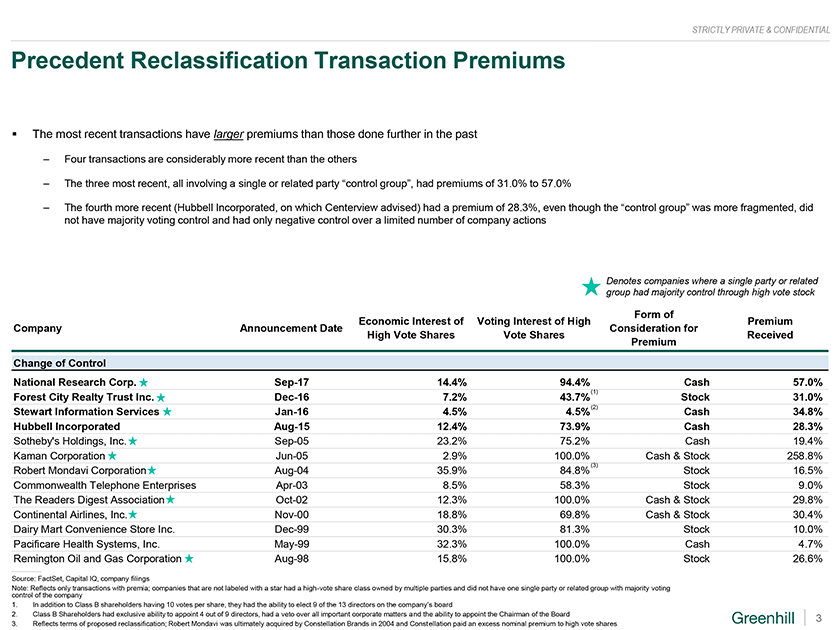

STRICTLY PRIVATE & CONFIDENTIAL Precedent Reclassification Transaction Premiums The most recent transactions have larger premiums than those done further in the past Four transactions are considerably more recent than the others The three most recent, all involving a single or related party control group, had premiums of 31.0% to 57.0% The fourth more recent (Hubbell Incorporated, on which Centerview advised) had a premium of 28.3%, even though the control group was more fragmented, did not have majority voting control and had only negative control over a limited number of company actions Denotes companies where a single party or related group had majority control through high vote stock Form of Economic Interest of Voting Interest of High Premium Company Announcement Date Consideration for High Vote Shares Vote Shares Received Premium Change of Control National Research Corp. Sep-17 14.4% 94.4% Cash 57.0% (1) Forest City Realty Trust Inc. Dec-16 7.2% 43.7% Stock 31.0% Stewart Information Services Jan-16 4.5% 4.5%(2) Cash 34.8% Hubbell Incorporated Aug-15 12.4% 73.9% Cash 28.3% Sothebys Holdings, Inc. Sep-05 23.2% 75.2% Cash 19.4% Kaman Corporation Jun-05 2.9% 100.0% Cash & Stock 258.8% (3) Robert Mondavi Corporation Aug-04 35.9% 84.8% Stock 16.5% Commonwealth Telephone Enterprises Apr-03 8.5% 58.3% Stock 9.0% The Readers Digest Association Oct-02 12.3% 100.0% Cash & Stock 29.8% Continental Airlines, Inc. Nov-00 18.8% 69.8% Cash & Stock 30.4% Dairy Mart Convenience Store Inc. Dec-99 30.3% 81.3% Stock 10.0% Pacificare Health Systems, Inc. May-99 32.3% 100.0% Cash 4.7% Remington Oil and Gas Corporation Aug-98 15.8% 100.0% Stock 26.6% Source: FactSet, Capital IQ, company filings Note: Reflects only transactions with premia; companies that are not labeled with a star had a high-vote share class owned by multiple parties and did not have one single party or related group with majority voting control of the company 1. In addition to Class B shareholders having 10 votes per share, they had the ability to elect 9 of the 13 directors on the companys board 2. Class B Shareholders had exclusive ability to appoint 4 out of 9 directors, had a veto over all important corporate matters and the ability to appoint the Chairman of the Board 3 3. Reflects terms of proposed reclassification; Robert Mondavi was ultimately acquired by Constellation Brands in 2004 and Constellation paid an excess nominal premium to high vote shares

STRICTLY PRIVATE & CONFIDENTIAL Disclaimer This document has been prepared by Greenhill & Co., LLC (Greenhill) exclusively for the benefit and internal use of the Wildstar Partners LLC and the Family Holders (the Recipient) solely for its use in evaluating the transaction described herein and may not be used for any other purpose or copied, distributed, reproduced, disclosed or otherwise made available to any other person without Greenhills prior written consent. This document may only be relied upon by the Recipient and no other person. Greenhill is acting solely for the Recipient in connection with any arrangements, services or transactions referred to in this document. Greenhill is not and will not be responsible to anyone other than the Recipient for providing the protections afforded to the clients of Greenhill or for providing advice in relation to the arrangements, services or transactions referred to in this document. This document is delivered subject to the terms of the engagement letter entered into between the Recipient and Greenhill. This document is delivered as at the date specified on the cover; Greenhill does not have any obligation to provide any update to or correct any inaccuracies in the information in this document. This document is private and confidential; by accepting this document, you are deemed to agree to treat it and its contents confidentially. This document does not constitute an opinion, and is not intended to be and does not constitute a recommendation to the Recipient as to whether to approve or undertake or take any other action in respect of any transactions contemplated in this document. The commercial merits or suitability or expected profitability or benefit of such transactions should be independently determined by the Recipient based on its own assessment of the legal, tax, accounting, regulatory, financial, credit and other related aspects of the transaction, relying on such information and advice from the Recipients own professional advisors and such other experts as it deems relevant. Greenhill does not provide accounting, tax, legal or regulatory advice. 4