EXHIBIT (C)(11)

Published on August 1, 2022

Exhibit (c)(11)

Confidential Draft Project Gemini: Confidential Discussion Materials May 15, 2022

Confidential Draft Disclaimer This presentation has been prepared by Centerview Partners LLC (Centerview) for use solely by the Special Committee of the Board of Directors of Gemini in connection with its evaluation of a proposed share reclassification and for no other purpose. The information contained herein is based upon information supplied by or on behalf of Gemini and publicly available information, and portions of the information contained herein may be based upon statements, estimates and forecasts provided by Gemini. Centerview has relied upon the accuracy and completeness of the foregoing information, and has not assumed any responsibility for any independent verification of such information or for any independent evaluation or appraisal of any of the assets or liabilities (contingent or otherwise) of Gemini or any other entity, or concerning the solvency or fair value of Gemini or any other entity. With respect to financial forecasts, including with respect to estimates of potential synergies, Centerview has assumed that such forecasts have been reasonably prepared on bases reflecting the best currently available estimates and judgments of the managements of Gemini as to their respective future financial performances, and at your direction Centerview has relied upon such forecasts, as provided by Geminis management, with respect to both Gemini, including as to expected synergies. Centerview assumes no responsibility for and expresses no view as to such forecasts or the assumptions on which they are based. The information set forth herein is based upon economic, monetary, market and other conditions as in effect on, and the information made available to us as of, the date hereof, unless indicated otherwise and Centerview assumes no obligation to update or otherwise revise these materials. The financial analysis in this presentation is complex and is not necessarily susceptible to a partial analysis or summary description. In performingthis financial analysis, Centerview has considered the results of its analysis as a whole and did not necessarily attribute a particular weight to any particular portion of the analysis considered. Furthermore, selecting any portion of Centerviews analysis, without considering the analysis as a whole, wouldcreate an incomplete view of the process underlying its financial analysis. Centerview may have deemed various assumptions more or less probable than other assumptions, so the reference ranges resulting from any particular portion of the analysis described above should not be taken to be Centerviews view of the actual value of Gemini. These materials and the information contained herein are confidential, were not prepared with a view toward public disclosure, and may not be disclosed publicly or made available to third parties without the prior written consent of Centerview. These materials and any other advice, written or oral, rendered by Centerview are intended solely for the benefit and use of the Special Committee of the Board of Directors of Gemini (in its capacity as such) in its consideration of the proposed share reclassification, and are not for the benefit of, and do not convey any rights or remedies for any holder of securities of Gemini or any other person. Centerview will not be responsible for and has not provided any tax, accounting, actuarial, legal or other specialist advice. These materials are not intended to provide the sole basis for evaluating the proposed transaction, and this presentation does not represent a fairness opinion, recommendation, valuation or opinion of any kind, and is necessarily incomplete and should be viewed solely in conjunction with the oral presentation provided by Centerview. 1

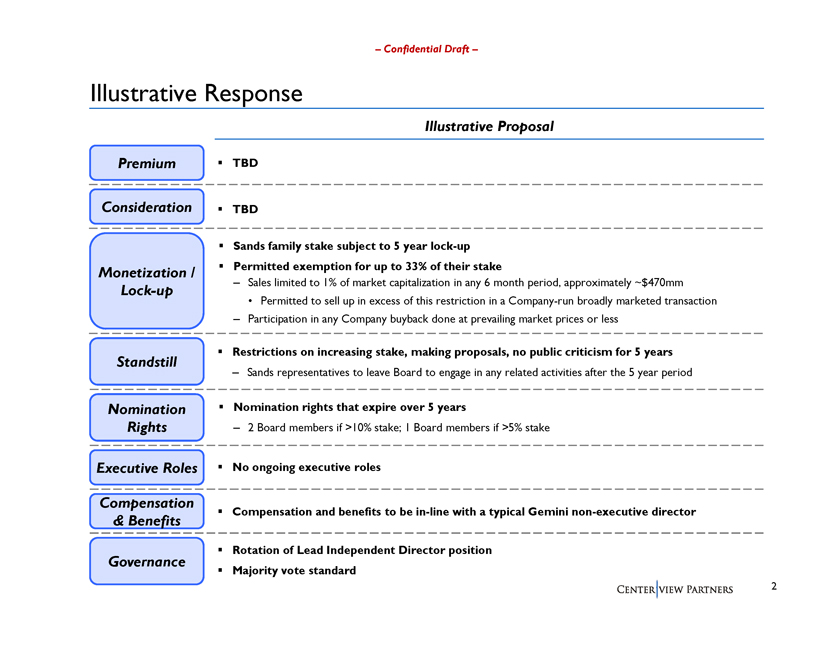

Confidential Draft Illustrative Response Illustrative Proposal Premiumï,§ TBD Considerationï,§ TBD ï,§ Sands family stake subject to 5 year lock-up Monetization / ï,§ Permitted exemption for up to 33% of their stake Sales limited to 1% of market capitalization in any 6 month period, approximately ~$470mm Lock-up Permitted to sell up in excess of this restriction in a Company-run broadly marketed transaction Participation in any Company buyback done at prevailing market prices or less ï,§ Restrictions on increasing stake, making proposals, no public criticism for 5 years Standstill Sands representatives to leave Board to engage in any related activities after the 5 year period Nomination ï,§ Nomination rights that expire over 5 years Rights 2 Board members if >10% stake; 1 Board members if >5% stake Executive Rolesï,§ No ongoing executive roles Compensation ï,§ Compensation and benefits to be in-line with a typical Gemini non-executive director & Benefits ï,§ Rotation of Lead Independent Director position Governance ï,§ Majority vote standard 2

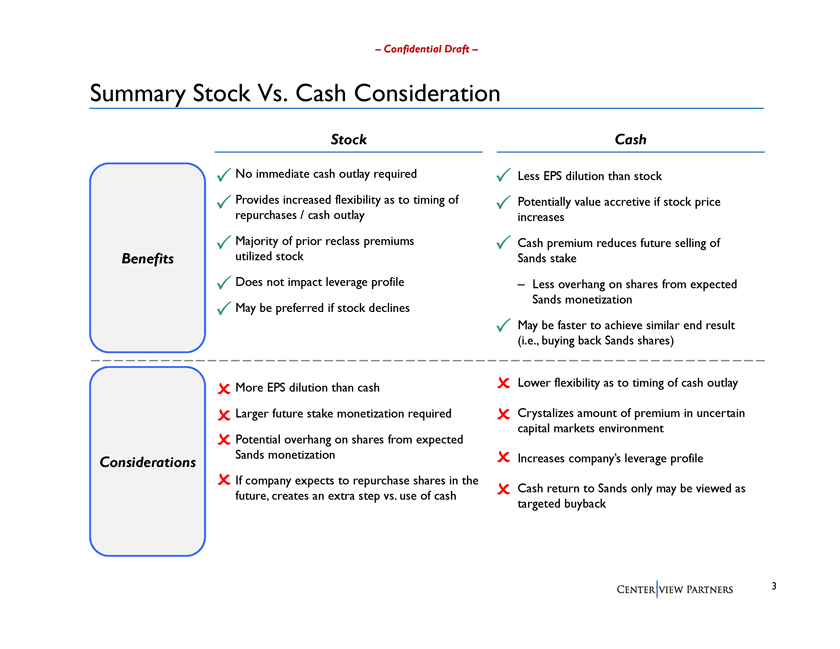

Confidential Draft Summary Stock Vs. Cash Consideration Stock Cash No immediate cash outlay required Less EPS dilution than stock Provides increased flexibility as to timing of Potentially value accretive if stock price repurchases / cash outlay increases Majority of prior reclass premiums Cash premium reduces future selling of Benefits utilized stock Sands stake Does not impact leverage profile Less overhang on shares from expected Sands monetization May be preferred if stock declines May be faster to achieve similar end result (i.e., buying back Sands shares) ï,§ More EPS dilution than cashï,§ Lower flexibility as to timing of cash outlayï,§ Larger future stake monetization requiredï,§ Crystalizes amount of premium in uncertain capital markets environmentï,§ Potential overhang on shares from expected Sands monetizationï,§ Increases companys leverage profile Considerations ï,§ If company expects to repurchase shares in the ï,§ Cash return to Sands only may be viewed as future, creates an extra step vs. use of cash targeted buyback

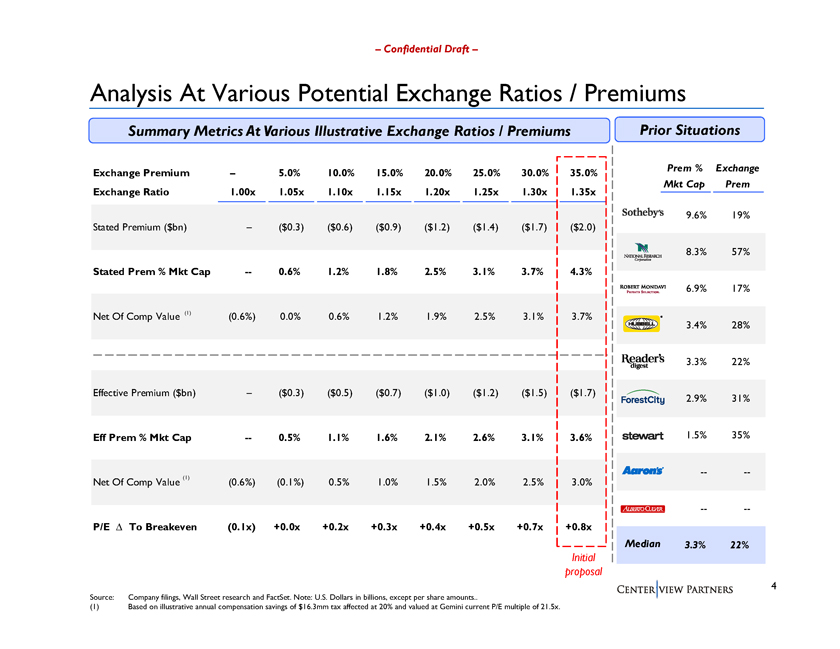

Confidential Draft Analysis At Various Potential Exchange Ratios / Premiums Summary Metrics At Various Illustrative Exchange Ratios / Premiums Prior Situations Prem % Exchange Exchange Premium 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% Mkt Cap Prem Exchange Ratio 1.00x 1.05x 1.10x 1.15x 1.20x 1.25x 1.30x 1.35x 9.6% 19% Stated Premium ($bn) ($0.3) ($0.6) ($0.9) ($1.2) ($1.4) ($1.7) ($2.0) 8.3% 57% Stated Prem % Mkt Cap 0.6% 1.2% 1.8% 2.5% 3.1% 3.7% 4.3% 6.9% 17% Net Of Comp Value (1) (0.6%) 0.0% 0.6% 1.2% 1.9% 2.5% 3.1% 3.7% 3.4% 28% 3.3% 22% Effective Premium ($bn) ($0.3) ($0.5) ($0.7) ($1.0) ($1.2) ($1.5) ($1.7) 2.9% 31% Eff Prem % Mkt Cap 0.5% 1.1% 1.6% 2.1% 2.6% 3.1% 3.6% 1.5% 35% --Net Of Comp Value (1) (0.6%) (0.1%) 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% -- P/E â^ To Breakeven (0.1x) +0.0x +0.2x +0.3x +0.4x +0.5x +0.7x +0.8x Median 3.3% 22% Initial proposal 4 Source: Company filings, Wall Street research and FactSet. Note: U.S. Dollars in billions, except per share amounts.. (1) Based on illustrative annual compensation savings of $16.3mm tax affected at 20% and valued at Gemini current P/E multiple of 21.5x.

Appendix: Selected Precedents

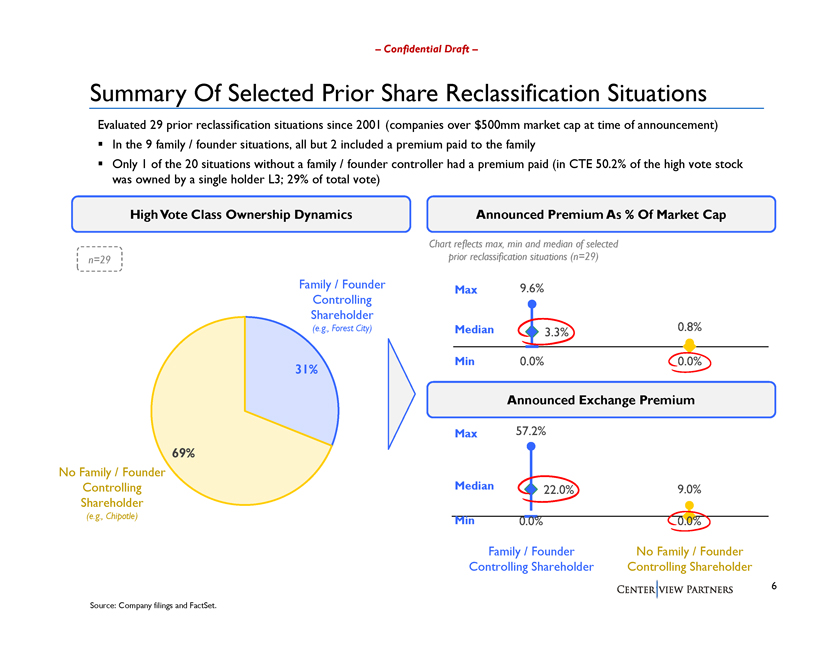

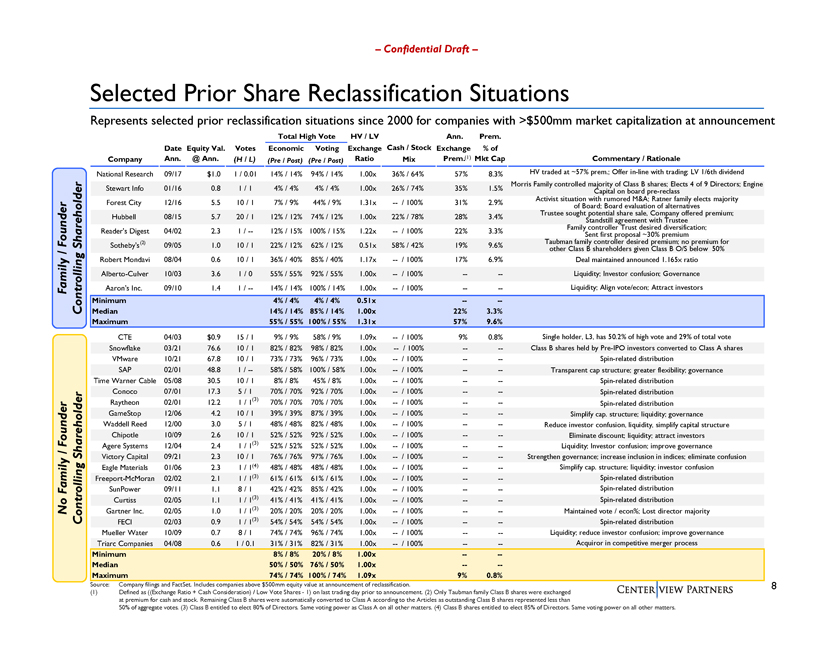

Confidential Draft Summary Of Selected Prior Share Reclassification Situations Evaluated 29 prior reclassification situations since 2001 (companies over $500mm market cap at time of announcement) In the 9 family / founder situations, all but 2 included a premium paid to the family Only 1 of the 20 situations without a family / founder controller had a premium paid (in CTE 50.2% of the high vote stock was owned by a single holder L3; 29% of total vote) High Vote Class Ownership Dynamics Announced Premium As % Of Market Cap Chart reflects max, min and median of selected n=29 prior reclassification situations (n=29) Family / Founder Max 9.6% Controlling Shareholder 0.8% (e.g., Forest City) Median 3.3% Min 0.0% 0.0% 31% Announced Exchange Premium Max 57.2% 69% No Family / Founder Controlling Median 22.0% 9.0% Shareholder (e.g., Chipotle) Min 0.0% 0.0% Family / Founder No Family / Founder Controlling Shareholder Controlling Shareholder 6 Source: Company filings and FactSet.

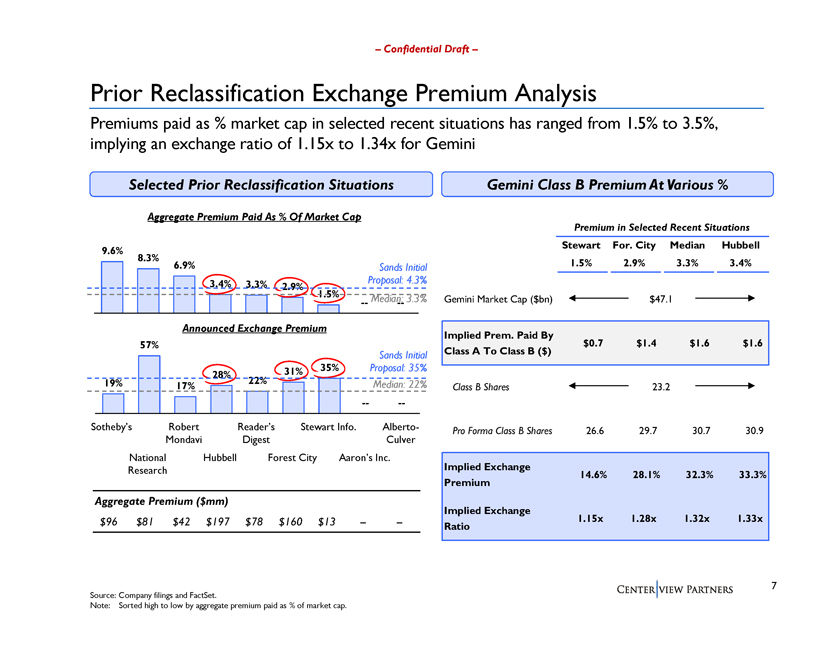

Confidential Draft Prior Reclassification Exchange Premium Analysis Premiums paid as % market cap in selected recent situations has ranged from 1.5% to 3.5%, implying an exchange ratio of 1.15x to 1.34x for Gemini Selected Prior Reclassification Situations Gemini Class B Premium At Various % Aggregate Premium Paid As % Of Market Cap Premium in Selected Recent Situations Stewart For. City Median Hubbell 9.6% 8.3% 6.9% Sands Initial 1.5% 2.9% 3.3% 3.4% 3.4% 3.3% Proposal: 4.3% 2.9% 1.5% Median: 3.3% -- Gemini Market Cap ($bn) $47.1 Announced Exchange Premium Implied Prem. Paid By 57% $0.7 $1.4 $1.6 $1.6 Sands Initial Class A To Class B ($) 31% 35% Proposal: 35% 28% 19% 22% Median: 22% 17% Class B Shares 23.2 -- Sothebys Robert Readers Stewart Info. Alberto- Pro Forma Class B Shares 26.6 29.7 30.7 30.9 Mondavi Digest Culver National Hubbell Forest City Aarons Inc. Research Implied Exchange 14.6% 28.1% 32.3% 33.3% Premium Aggregate Premium ($mm) Implied Exchange $96 $81 $42 $197 $78 $160 $13 -- 1.15x 1.28x 1.32x 1.33x Ratio 7 Source: Company filings and FactSet. Note: Sorted high to low by aggregate premium paid as % of market cap.

Confidential Draft Selected Prior Share Reclassification Situations Represents selected prior reclassification situations since 2000 for companies with >$500mm market capitalization at announcement Total High Vote HV / LV Ann. Prem. Date Equity Val. Votes Economic Voting Exchange Cash / Stock Exchange % of Company Ann. @ Ann. (H / L) (Pre / Post) (Pre / Post) Ratio Mix Prem.(1) Mkt Cap Commentary / Rationale National Research 09/17 $1.0 1 / 0.01 14% / 14% 94% / 14% 1.00x 36% / 64% 57% 8.3% HV traded at ~57% prem.; Offer in-line with trading; LV 1/6th dividend Morris Family controlled majority of Class B shares; Elects 4 of 9 Directors; Engine Stewart Info 01/16 0.8 1 / 1 4% / 4% 4% / 4% 1.00x 26% / 74% 35% 1.5% Capital on board pre-reclass Activist situation with rumored M&A; Ratner family elects majority Forest City 12/16 5.5 10 / 1 7% / 9% 44% / 9% 1.31x / 100% 31% 2.9% of Board; Board evaluation of alternatives Trustee sought potential share sale, Company offered premium; Hubbell 08/15 5.7 20 / 1 12% / 12% 74% / 12% 1.00x 22% / 78% 28% 3.4% Standstill agreement with Trustee Family controller Trust desired diversification; Readers Digest 04/02 2.3 1 / 12% / 15% 100% / 15% 1.22x / 100% 22% 3.3% Sent first proposal ~30% premium Founder (2) Taubman family controller desired premium; no premium for Shareholder Sothebys 09/05 1.0 10 / 1 22% / 12% 62% / 12% 0.51x 58% / 42% 19% 9.6% / other Class B shareholders given Class B O/S below 50% Robert Mondavi 08/04 0.6 10 / 1 36% / 40% 85% / 40% 1.17x / 100% 17% 6.9% Deal maintained announced 1.165x ratio Alberto-Culver 10/03 3.6 1 / 0 55% / 55% 92% / 55% 1.00x / 100% -- Liquidity; Investor confusion; Governance Family Aarons Inc. 09/10 1.4 1 / 14% / 14% 100% / 14% 1.00x / 100% -- Liquidity; Align vote/econ; Attract investors Minimum 4% / 4% 4% / 4% 0.51x --Controlling Median 14% / 14% 85% / 14% 1.00x 22% 3.3% Maximum 55% / 55% 100% / 55% 1.31x 57% 9.6% CTE 04/03 $0.9 15 / 1 9% / 9% 58% / 9% 1.09x / 100% 9% 0.8% Single holder, L3, has 50.2% of high vote and 29% of total vote Snowflake 03/21 76.6 10 / 1 82% / 82% 98% / 82% 1.00x / 100% -- Class B shares held by Pre-IPO investors converted to Class A shares VMware 10/21 67.8 10 / 1 73% / 73% 96% / 73% 1.00x / 100% -- Spin-related distribution SAP 02/01 48.8 1 / 58% / 58% 100% / 58% 1.00x / 100% -- Transparent cap structure; greater flexibility; governance Time Warner Cable 05/08 30.5 10 / 1 8% / 8% 45% / 8% 1.00x / 100% -- Spin-related distribution Conoco 07/01 17.3 5 / 1 70% / 70% 92% / 70% 1.00x / 100% -- Spin-related distribution Raytheon 02/01 12.2 1 / 1(3) 70% / 70% 70% / 70% 1.00x / 100% -- Spin-related distribution GameStop 12/06 4.2 10 / 1 39% / 39% 87% / 39% 1.00x / 100% -- Simplify cap. structure; liquidity; governance Waddell Reed 12/00 3.0 5 / 1 48% / 48% 82% / 48% 1.00x / 100% -- Reduce investor confusion, liquidity, simplify capital structure Chipotle 10/09 2.6 10 / 1 52% / 52% 92% / 52% 1.00x / 100% -- Eliminate discount; liquidity; attract investors Founder Agere Systems 12/04 2.4 1 / 1(3) 52% / 52% 52% / 52% 1.00x / 100% -- Liquidity; Investor confusion; improve governance / Shareholder Victory Capital 09/21 2.3 10 / 1 76% / 76% 97% / 76% 1.00x / 100% -- Strengthen governance; increase inclusion in indices; eliminate confusion Eagle Materials 01/06 2.3 1 / 1(4) 48% / 48% 48% / 48% 1.00x / 100% -- Simplify cap. structure; liquidity; investor confusion Freeport-McMoran 02/02 2.1 1 / 1(3) 61% / 61% 61% / 61% 1.00x / 100% -- Spin-related distribution Family SunPower 09/11 1.1 8 / 1 42% / 42% 85% / 42% 1.00x / 100% -- Spin-related distribution Curtiss 02/05 1.1 1 / 1(3) 41% / 41% 41% / 41% 1.00x / 100% -- Spin-related distribution No Gartner Inc. 02/05 1.0 1 / 1(3) 20% / 20% 20% / 20% 1.00x / 100% -- Maintained vote / econ%; Lost director majority Controlling FECI 02/03 0.9 1 / 1(3) 54% / 54% 54% / 54% 1.00x / 100% -- Spin-related distribution Mueller Water 10/09 0.7 8 / 1 74% / 74% 96% / 74% 1.00x / 100% -- Liquidity; reduce investor confusion; improve governance Triarc Companies 04/08 0.6 1 / 0.1 31% / 31% 82% / 31% 1.00x / 100% -- Acquiror in competitive merger process Minimum 8% / 8% 20% / 8% 1.00x --Median 50% / 50% 76% / 50% 1.00x --Maximum 74% / 74% 100% / 74% 1.09x 9% 0.8% Source: Company filings and FactSet. Includes companies above $500mm equity value at announcement of reclassification. 8 (1) Defined as ((Exchange Ratio + Cash Consideration) / Low Vote Shares1) on last trading day prior to announcement. (2) Only Taubman family Class B shares were exchanged at premium for cash and stock. Remaining Class B shares were automatically converted to Class A according to the Articles as outstanding Class B shares represented less than 50% of aggregate votes. (3) Class B entitled to elect 80% of Directors. Same voting power as Class A on all other matters. (4) Class B shares entitled to elect 85% of Directors. Same voting power on all other matters.

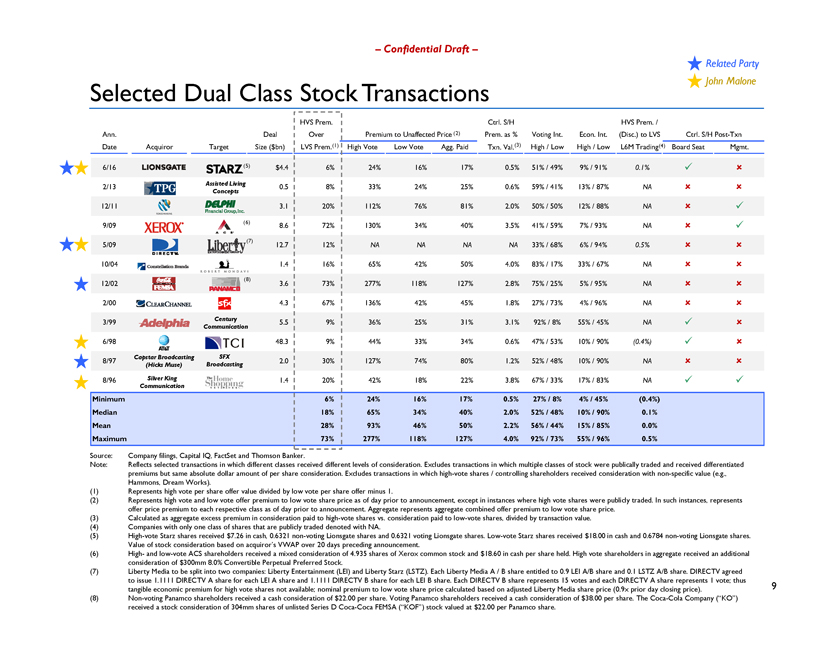

Confidential Draft Related Party Selected Dual Class Stock Transactions John Malone HVS Prem. Ctrl. S/H HVS Prem. / Ann. Deal Over Premium to Unaffected Price (2) Prem. as % Voting Int. Econ. Int. (Disc.) to LVS Ctrl. S/H Post-Txn Date Acquiror Target Size ($bn) LVS Prem.(1) High Vote Low Vote Agg. Paid Txn. Val.(3) High / Low High / Low L6M Trading(4) Board Seat Mgmt. 6/16 (5) $4.4 6% 24% 16% 17% 0.5% 51% / 49% 9% / 91% 0.1%ï¼ï» 2/13 Assisted Living 0.5 8% 33% 24% 25% 0.6% 59% / 41% 13% / 87% NAï»ï» Concepts 12/11 3.1 20% 112% 76% 81% 2.0% 50% / 50% 12% / 88% NAï»ï¼ 9/09 (6) 8.6 72% 130% 34% 40% 3.5% 41% / 59% 7% / 93% NAï»ï¼ (7) 5/09 12.7 12% NA NA NA NA 33% / 68% 6% / 94% 0.5%ï»ï» 10/04 1.4 16% 65% 42% 50% 4.0% 83% / 17% 33% / 67% NAï»ï» (8) 12/02 3.6 73% 277% 118% 127% 2.8% 75% / 25% 5% / 95% NAï»ï» 2/00 4.3 67% 136% 42% 45% 1.8% 27% / 73% 4% / 96% NAï»ï» 3/99 Century 5.5 9% 36% 25% 31% 3.1% 92% / 8% 55% / 45% NAï¼ï» Communication 6/98 48.3 9% 44% 33% 34% 0.6% 47% / 53% 10% / 90% (0.4%)ï¼ï» Capstar Broadcasting SFX 8/97 2.0 30% 127% 74% 80% 1.2% 52% / 48% 10% / 90% NAï»ï» (Hicks Muse) Broadcasting 8/96 Silver King 1.4 20% 42% 18% 22% 3.8% 67% / 33% 17% / 83% NAï¼ï¼ Communication Minimum 6% 24% 16% 17% 0.5% 27% / 8% 4% / 45% (0.4%) Median 18% 65% 34% 40% 2.0% 52% / 48% 10% / 90% 0.1% Mean 28% 93% 46% 50% 2.2% 56% / 44% 15% / 85% 0.0% Maximum 73% 277% 118% 127% 4.0% 92% / 73% 55% / 96% 0.5% Source: Company filings, Capital IQ, FactSet and Thomson Banker. Note: Reflects selected transactions in which different classes received different levels of consideration. Excludes transactions in which multiple classes of stock were publically traded and received differentiated premiums but same absolute dollar amount of per share consideration. Excludes transactions in which high-vote shares / controlling shareholders received consideration with non-specific value (e.g., Hammons, Dream Works). (1) Represents high vote per share offer value divided by low vote per share offer minus 1. (2) Represents high vote and low vote offer premium to low vote share price as of day prior to announcement, except in instances where high vote shares were publicly traded. In such instances, represents offer price premium to each respective class as of day prior to announcement. Aggregate represents aggregate combined offer premium to low vote share price. (3) Calculated as aggregate excess premium in consideration paid to high-vote shares vs. consideration paid to low-vote shares, divided by transaction value. (4) Companies with only one class of shares that are publicly traded denoted with NA. (5) High-vote Starz shares received $7.26 in cash, 0.6321 non-voting Lionsgate shares and 0.6321 voting Lionsgate shares. Low-vote Starz shares received $18.00 in cash and 0.6784 non-voting Lionsgate shares. Value of stock consideration based on acquirors VWAP over 20 days preceding announcement. (6) High- and low-vote ACS shareholders received a mixed consideration of 4.935 shares of Xerox common stock and $18.60 in cash per share held. High vote shareholders in aggregate received an additional consideration of $300mm 8.0% Convertible Perpetual Preferred Stock. (7) Liberty Media to be split into two companies: Liberty Entertainment (LEI) and Liberty Starz (LSTZ). Each Liberty Media A / B share entitled to 0.9 LEI A/B share and 0.1 LSTZ A/B share. DIRECTV agreed to issue 1.1111 DIRECTV A share for each LEI A share and 1.1111 DIRECTV B share for each LEI B share. Each DIRECTV B share represents 15 votes and each DIRECTV A share represents 1 vote; thus tangible economic premium for high vote shares not available; nominal premium to low vote share price calculated based on adjusted Liberty Media share price (0.9x prior day closing price). 9 (8) Non-voting Panamco shareholders received a cash consideration of $22.00 per share. Voting Panamco shareholders received a cash consideration of $38.00 per share. The Coca-Cola Company (KO) received a stock consideration of 304mm shares of unlisted Series D Coca-Coca FEMSA (KOF) stock valued at $22.00 per Panamco share.

Appendix: Supporting Analyses

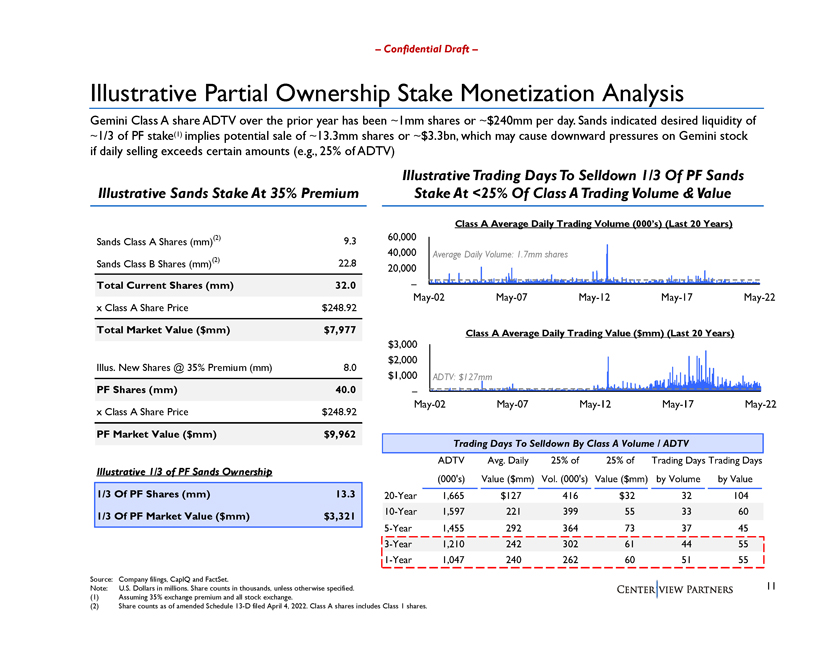

Confidential Draft Illustrative Partial Ownership Stake Monetization Analysis Gemini Class A share ADTV over the prior year has been ~1mm shares or ~$240mm per day. Sands indicated desired liquidity of ~1/3 of PF stake(1) implies potential sale of ~13.3mm shares or ~$3.3bn, which may cause downward pressures on Gemini stock if daily selling exceeds certain amounts (e.g., 25% of ADTV) Illustrative Trading Days To Selldown 1/3 Of PF Sands Illustrative Sands Stake At 35% Premium Stake At <25% Of Class A Trading Volume & Value Class A Average Daily Trading Volume (000s) (Last 20 Years) Sands Class A Shares (mm)(2) 9.3 60,000 (2) 40,000 Average Daily Volume: 1.7mm shares Sands Class B Shares (mm) 22.8 20,000 Total Current Shares (mm) 32.0 May-02 May-07 May-12 May-17 May-22 x Class A Share Price $248.92 Total Market Value ($mm) $7,977 Class A Average Daily Trading Value ($mm) (Last 20 Years) $3,000 $2,000 Illus. New Shares @ 35% Premium (mm) 8.0 $1,000 ADTV: $127mm PF Shares (mm) 40.0 May-02 May-07 May-12 May-17 May-22 x Class A Share Price $248.92 PF Market Value ($mm) $9,962 Trading Days To Selldown By Class A Volume / ADTV ADTV Avg. Daily 25% of 25% of Trading Days Trading Days Illustrative 1/3 of PF Sands Ownership (000s) Value ($mm) Vol. (000s) Value ($mm) by Volume by Value 1/3 Of PF Shares (mm) 13.3 20-Year 1,665 $127 416 $32 32 104 1/3 Of PF Market Value ($mm) $3,321 10-Year 1,597 221 399 55 33 60 5-Year 1,455 292 364 73 37 45 3-Year 1,210 242 302 61 44 55 1-Year 1,047 240 262 60 51 55 Source: Company filings, CapIQ and FactSet. Note: U.S. Dollars in millions. Share counts in thousands, unless otherwise specified. 11 (1) Assuming 35% exchange premium and all stock exchange. (2) Share counts as of amended Schedule 13-D filed April 4, 2022. Class A shares includes Class 1 shares.

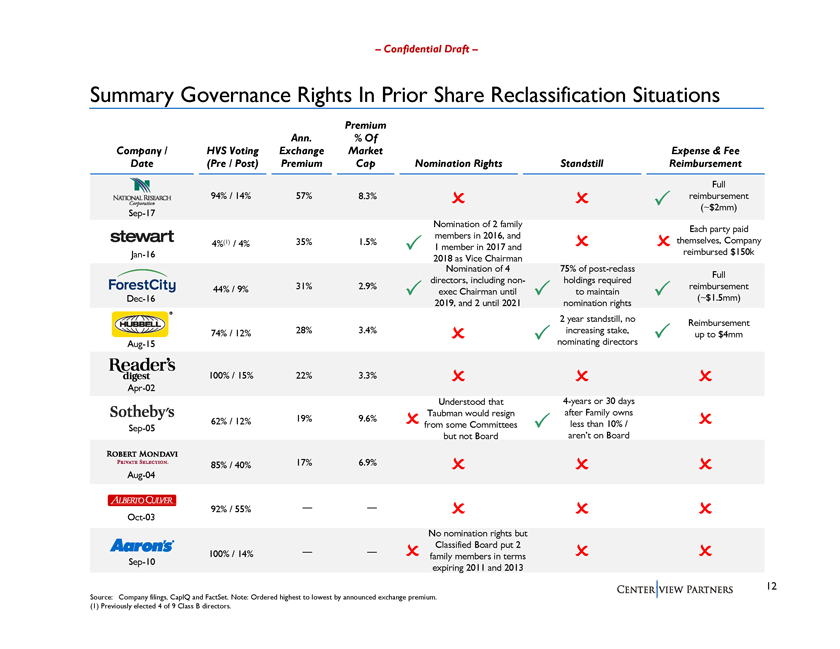

Confidential Draft Summary Governance Rights In Prior Share Reclassification Situations Premium Ann. % Of Company / HVS Voting Exchange Market Expense & Fee Date (Pre / Post) Premium Cap Nomination Rights Standstill Reimbursement Full 94% / 14% 57% 8.3% reimbursement (~$2mm) Sep-17 Nomination of 2 family Each party paid members in 2016, and 4%(1) / 4% 35% 1.5% themselves, Company 1 member in 2017 and Jan-16 reimbursed $150k 2018 as Vice Chairman Nomination of 4 75% of post-reclass Full directors, including non- holdings required 44% / 9% 31% 2.9% reimbursement exec Chairman until to maintain Dec-16 (~$1.5mm) 2019, and 2 until 2021 nomination rights 2 year standstill, no Reimbursement 74% / 12% 28% 3.4% increasing stake, up to $4mm Aug-15 nominating directors 100% / 15% 22% 3.3% Apr-02 Understood that 4-years or 30 days Taubman would resign after Family owns 62% / 12% 19% 9.6% Sep-05 from some Committees less than 10% / but not Board arent on Board 85% / 40% 17% 6.9% Aug-04 92% / 55% Oct-03 No nomination rights but Classified Board put 2 100% / 14% family members in terms Sep-10 expiring 2011 and 2013 12 Source: Company filings, CapIQ and FactSet. Note: Ordered highest to lowest by announced exchange premium. (1) Previously elected 4 of 9 Class B directors.

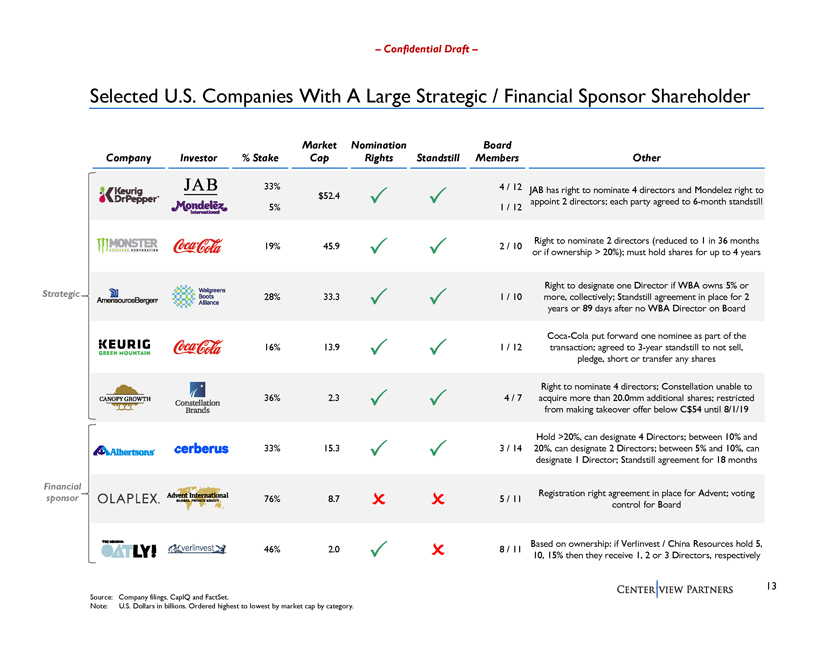

Confidential Draft Selected U.S. Companies With A Large Strategic / Financial Sponsor Shareholder Market Nomination Board Company Investor % Stake Cap Rights Standstill Members Other 33% $52.4 4 / 12 JAB has right to nominate 4 directors and Mondelez right to appoint 2 directors; each party agreed to 6-month standstill 5% 1 / 12 Right to nominate 2 directors (reduced to 1 in 36 months 19% 45.9 2 / 10 or if ownership > 20%); must hold shares for up to 4 years Strategic Right to designate one Director if WBA owns 5% or 28% 33.3 1 / 10 more, collectively; Standstill agreement in place for 2 years or 89 days after no WBA Director on Board Coca-Cola put forward one nominee as part of the 16% 13.9 1 / 12 transaction; agreed to 3-year standstill to not sell, pledge, short or transfer any shares Right to nominate 4 directors; Constellation unable to 36% 2.3 4 / 7 acquire more than 20.0mm additional shares; restricted from making takeover offer below C$54 until 8/1/19 Hold >20%, can designate 4 Directors; between 10% and 33% 15.3 3 / 14 20%, can designate 2 Directors; between 5% and 10%, can designate 1 Director; Standstill agreement for 18 months Financial Registration right agreement in place for Advent; voting sponsor 76% 8.7 5 / 11 control for Board Based on ownership: if Verlinvest / China Resources hold 5, 46% 2.0 8 / 11 10, 15% then they receive 1, 2 or 3 Directors, respectively 13 Source: Company filings, CapIQ and FactSet. Note: U.S. Dollars in billions. Ordered highest to lowest by market cap by category.

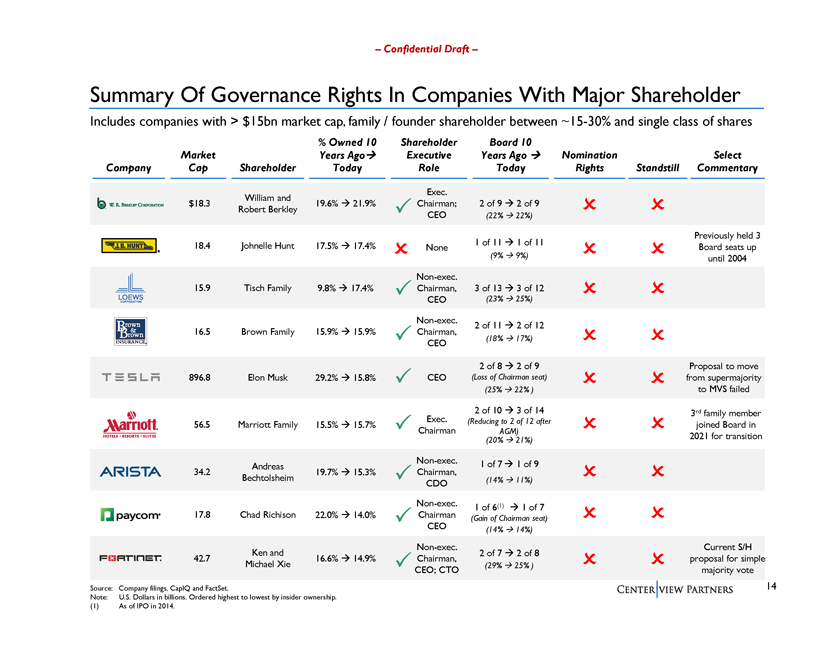

Confidential Draft Summary Of Governance Rights In Companies With Major Shareholder Includes companies with > $15bn market cap, family / founder shareholder between ~15-30% and single class of shares % Owned 10 Shareholder Board 10 Market Years Agoï Executive Years Ago ï Nomination Select Company Cap Shareholder Today Role Today Rights Standstill Commentary Exec. William and $18.3 19.6% ï 21.9% Chairman; 2 of 9 ï 2 of 9 Robert Berkley CEO (22%ï 22%) Previously held 3 18.4 Johnelle Hunt 17.5% ï 17.4% 1 of 11 ï 1 of 11 None (9%ï 9%) Board seats up until 2004 Non-exec. 15.9 Tisch Family 9.8% ï 17.4% Chairman, 3 of 13 ï 3 of 12 CEO (23%ï 25%) Non-exec. 2 of 11 ï 2 of 12 16.5 Brown Family 15.9% ï 15.9% Chairman, (18%ï 17%) CEO 2 of 8 ï 2 of 9 Proposal to move 896.8 Elon Musk 29.2% ï 15.8% CEO (Loss of Chairman seat) from supermajority (25%ï 22% ) to MVS failed Exec. 2 of 10 ï 3 of 14 3rd family member 56.5 Marriott Family 15.5% ï 15.7% (Reducing to 2 of 12 after joined Board in Chairman AGM) (20%ï 21%) 2021 for transition Non-exec. 1 of 7ï 1 of 9 Andreas 34.2 19.7% ï 15.3% Chairman, Bechtolsheim (14%ï 11%) CDO Non-exec. 1 of 6(1)ï 1 of 7 17.8 Chad Richison 22.0% ï 14.0% Chairman (Gain of Chairman seat) CEO (14%ï 14%) Non-exec. Current S/H Ken and 2 of 7 ï 2 of 8 42.7 16.6% ï 14.9% Chairman, proposal for simple Michael Xie (29%ï 25% ) CEO; CTO majority vote Source: Company filings, CapIQ and FactSet. 14 Note: U.S. Dollars in billions. Ordered highest to lowest by insider ownership. (1) As of IPO in 2014.

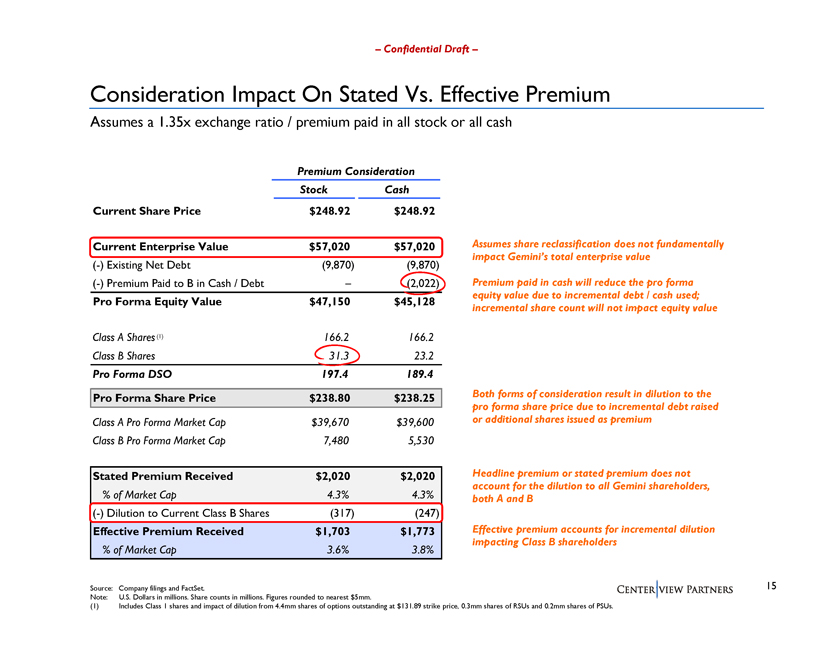

Confidential Draft Consideration Impact On Stated Vs. Effective Premium Assumes a 1.35x exchange ratio / premium paid in all stock or all cash Premium Consideration Stock Cash Current Share Price $248.92 $248.92 Current Enterprise Value $57,020 $57,020 Assumes share reclassification does not fundamentally impact Geminis total enterprise value (-) Existing Net Debt (9,870) (9,870) (-) Premium Paid to B in Cash / Debt (2,022) Premium paid in cash will reduce the pro forma equity value due to incremental debt / cash used; Pro Forma Equity Value $47,150 $45,128 incremental share count will not impact equity value Class A Shares(1) 166.2 166.2 Class B Shares 31.3 23.2 Pro Forma DSO 197.4 189.4 Pro Forma Share Price $238.80 $238.25 Both forms of consideration result in dilution to the pro forma share price due to incremental debt raised Class A Pro Forma Market Cap $39,670 $39,600 or additional shares issued as premium Class B Pro Forma Market Cap 7,480 5,530 Stated Premium Received $2,020 $2,020 Headline premium or stated premium does not account for the dilution to all Gemini shareholders, % of Market Cap 4.3% 4.3% both A and B (-) Dilution to Current Class B Shares (317) (247) Effective Premium Received $1,703 $1,773 Effective premium accounts for incremental dilution impacting Class B shareholders % of Market Cap 3.6% 3.8% Source: Company filings and FactSet. 15 Note: U.S. Dollars in millions. Share counts in millions. Figures rounded to nearest $5mm. (1) Includes Class 1 shares and impact of dilution from 4.4mm shares of options outstanding at $131.89 strike price, 0.3mm shares of RSUs and 0.2mm shares of PSUs.

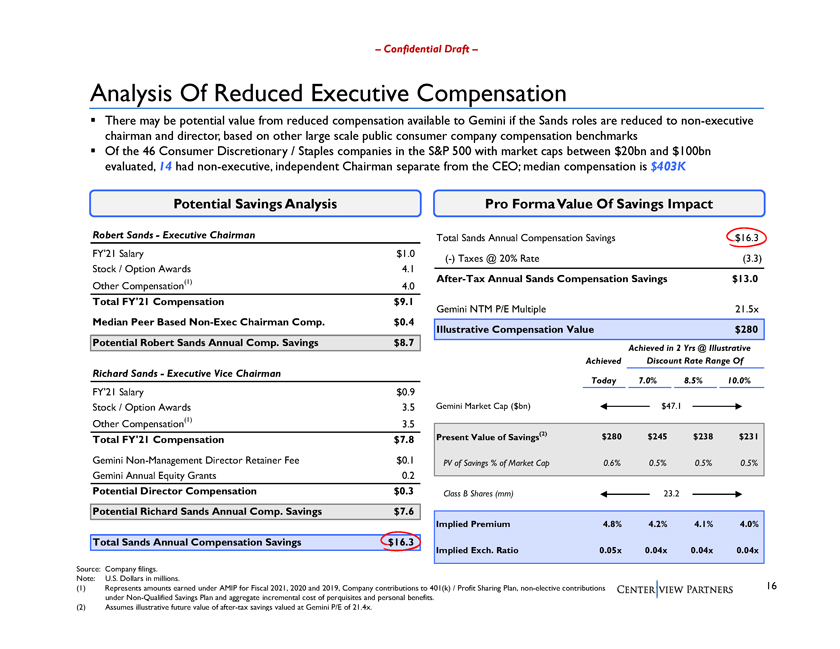

Confidential Draft Analysis Of Reduced Executive Compensation ï,§ There may be potential value from reduced compensation available to Gemini if the Sands roles are reduced to non-executive chairman and director, based on other large scale public consumer company compensation benchmarksï,§ Of the 46 Consumer Discretionary / Staples companies in the S&P 500 with market caps between $20bn and $100bn evaluated, 14 had non-executive, independent Chairman separate from the CEO; median compensation is $403K Potential Savings Analysis Pro Forma Value Of Savings Impact Robert SandsExecutive Chairman Total Sands Annual Compensation Savings $16.3 FY21 Salary $1.0 (-) Taxes @ 20% Rate (3.3) Stock / Option Awards 4.1 After-Tax Annual Sands Compensation Savings $13.0 Other Compensation(1) 4.0 Total FY21 Compensation $9.1 Gemini NTM P/E Multiple 21.5x Median Peer Based Non-Exec Chairman Comp. $0.4 Illustrative Compensation Value $280 Potential Robert Sands Annual Comp. Savings $8.7 Achieved in 2 Yrs @ Illustrative Achieved Discount Rate Range Of Richard SandsExecutive Vice Chairman Today 7.0% 8.5% 10.0% FY21 Salary $0.9 Stock / Option Awards 3.5 Gemini Market Cap ($bn) $47.1 Other Compensation(1) 3.5 Present Value of Savings(2) $280 $245 $238 $231 Total FY21 Compensation $7.8 Gemini Non-Management Director Retainer Fee $0.1 PV of Savings % of Market Cap 0.6% 0.5% 0.5% 0.5% Gemini Annual Equity Grants 0.2 Potential Director Compensation $0.3 Class B Shares (mm) 23.2 Potential Richard Sands Annual Comp. Savings $7.6 Implied Premium 4.8% 4.2% 4.1% 4.0% Total Sands Annual Compensation Savings $16.3 Implied Exch. Ratio 0.05x 0.04x 0.04x 0.04x Source: Company filings. Note: U.S. Dollars in millions. (1) Represents amounts earned under AMIP for Fiscal 2021, 2020 and 2019, Company contributions to 401(k) / Profit Sharing Plan, non-elective contributions 16 under Non-Qualified Savings Plan and aggregate incremental cost of perquisites and personal benefits. (2) Assumes illustrative future value of after-tax savings valued at Gemini P/E of 21.4x.

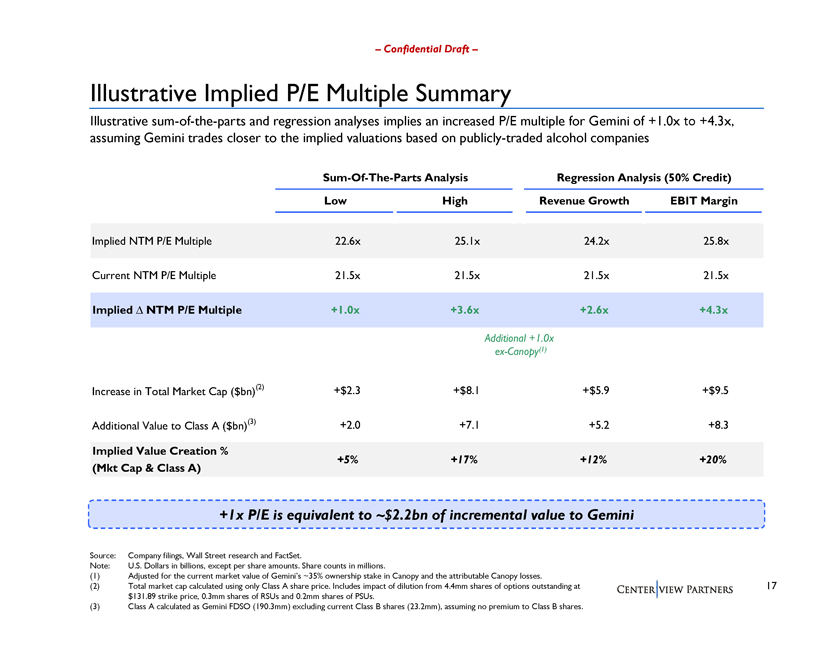

Confidential Draft Illustrative Implied P/E Multiple Summary Illustrative sum-of-the-parts and regression analyses implies an increased P/E multiple for Gemini of +1.0x to +4.3x, assuming Gemini trades closer to the implied valuations based on publicly-traded alcohol companies Sum-Of-The-Parts Analysis Regression Analysis (50% Credit) Low High Revenue Growth EBIT Margin Implied NTM P/E Multiple 22.6x 25.1x 24.2x 25.8x Current NTM P/E Multiple 21.5x 21.5x 21.5x 21.5x Implied â^ NTM P/E Multiple +1.0x +3.6x +2.6x +4.3x Additional +1.0x ex-Canopy(1) Increase in Total Market Cap ($bn)(2) +$2.3 +$8.1 +$5.9 +$9.5 Additional Value to Class A ($bn)(3) +2.0 +7.1 +5.2 +8.3 Implied Value Creation % +5% +17% +12% +20% (Mkt Cap & Class A) +1x P/E is equivalent to ~$2.2bn of incremental value to Gemini Source: Company filings, Wall Street research and FactSet. Note: U.S. Dollars in billions, except per share amounts. Share counts in millions. (1) Adjusted for the current market value of Geminis ~35% ownership stake in Canopy and the attributable Canopy losses. (2) Total market cap calculated using only Class A share price. Includes impact of dilution from 4.4mm shares of options outstanding at 17 $131.89 strike price, 0.3mm shares of RSUs and 0.2mm shares of PSUs. (3) Class A calculated as Gemini FDSO (190.3mm) excluding current Class B shares (23.2mm), assuming no premium to Class B shares.

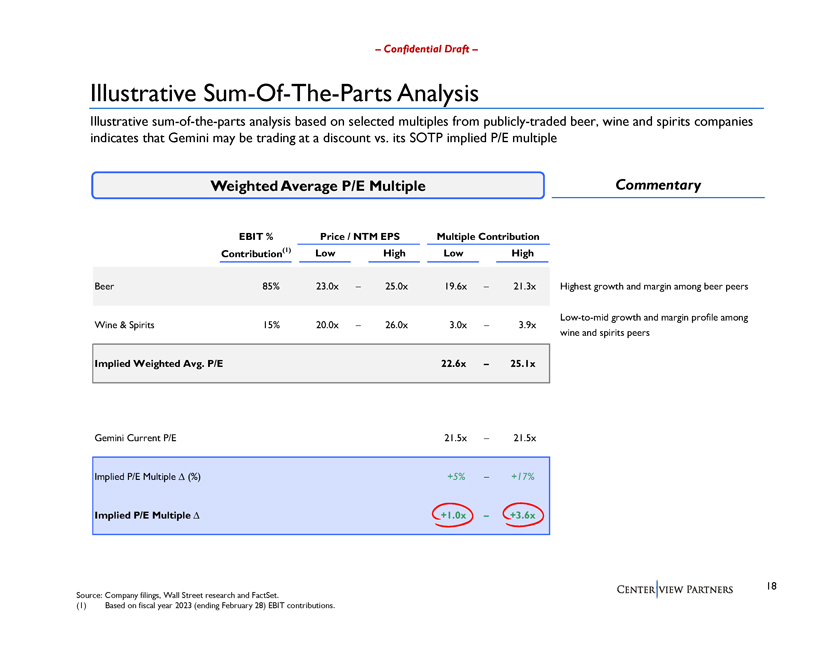

Confidential Draft Illustrative Sum-Of-The-Parts Analysis Illustrative sum-of-the-parts analysis based on selected multiples from publicly-traded beer, wine and spirits companies indicates that Gemini may be trading at a discount vs. its SOTP implied P/E multiple Weighted Average P/E Multiple Commentary EBIT % Price / NTM EPS Multiple Contribution Contribution(1) Low High Low High Beer 85% 23.0x 25.0x 19.6x 21.3x Highest growth and margin among beer peers Low-to-mid growth and margin profile among Wine & Spirits 15% 20.0x 26.0x 3.0x 3.9x wine and spirits peers Implied Weighted Avg. P/E 22.6x 25.1x Gemini Current P/E 21.5x 21.5x Implied P/E Multiple â^ (%) +5% +17% Implied P/E Multiple â^ +1.0x +3.6x 18 Source: Company filings, Wall Street research and FactSet. (1) Based on fiscal year 2023 (ending February 28) EBIT contributions.

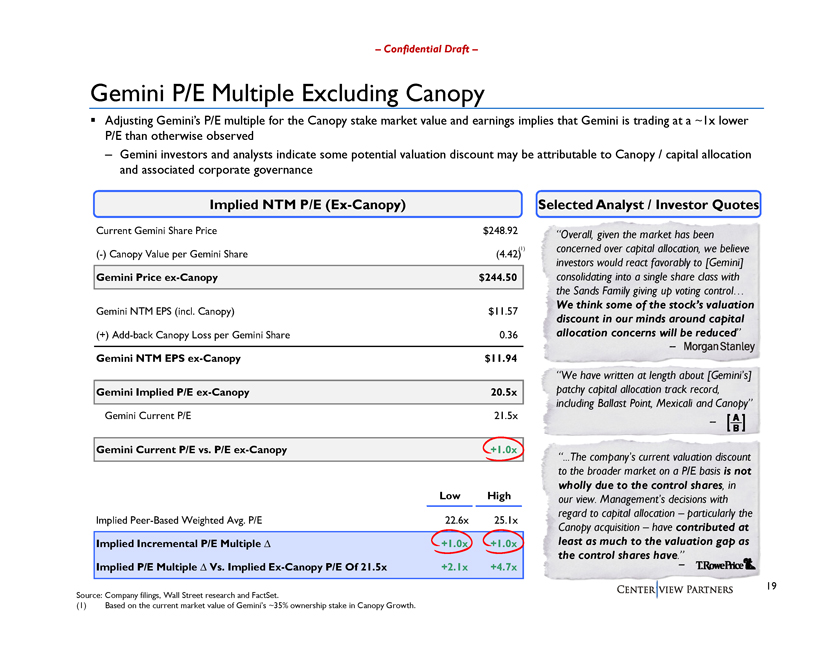

Confidential Draft Gemini P/E Multiple Excluding Canopy Adjusting Geminis P/E multiple for the Canopy stake market value and earnings implies that Gemini is trading at a ~1x lower P/E than otherwise observed Gemini investors and analysts indicate some potential valuation discount may be attributable to Canopy / capital allocation and associated corporate governance Implied NTM P/E (Ex-Canopy) Selected Analyst / Investor Quotes Current Gemini Share Price $248.92 Overall, given the market has been (-) Canopy Value per Gemini Share (4.42)(1) concerned over capital allocation, we believe investors would react favorably to [Gemini] Gemini Price ex-Canopy $244.50 consolidating into a single share class with the Sands Family giving up voting control We think some of the stocks valuation Gemini NTM EPS (incl. Canopy) $11.57 discount in our minds around capital (+) Add-back Canopy Loss per Gemini Share 0.36 allocation concerns will be reduced Gemini NTM EPS ex-Canopy $11.94 We have written at length about [Geminis] Gemini Implied P/E ex-Canopy 20.5x patchy capital allocation track record, including Ballast Point, Mexicali and Canopy Gemini Current P/E 21.5x Gemini Current P/E vs. P/E ex-Canopy +1.0x ...The companys current valuation discount to the broader market on a P/E basis is not wholly due to the control shares, in Low High our view. Managements decisions with regard to capital allocation particularly the Implied Peer-Based Weighted Avg. P/E 22.6x 25.1x Canopy acquisition have contributed at Implied Incremental P/E Multiple +1.0x +1.0x least as much to the valuation gap as the control shares have. Implied P/E Multiple Vs. Implied Ex-Canopy P/E Of 21.5x +2.1x +4.7x 19 Source: Company filings, Wall Street research and FactSet. (1) Based on the current market value of Geminis ~35% ownership stake in Canopy Growth.

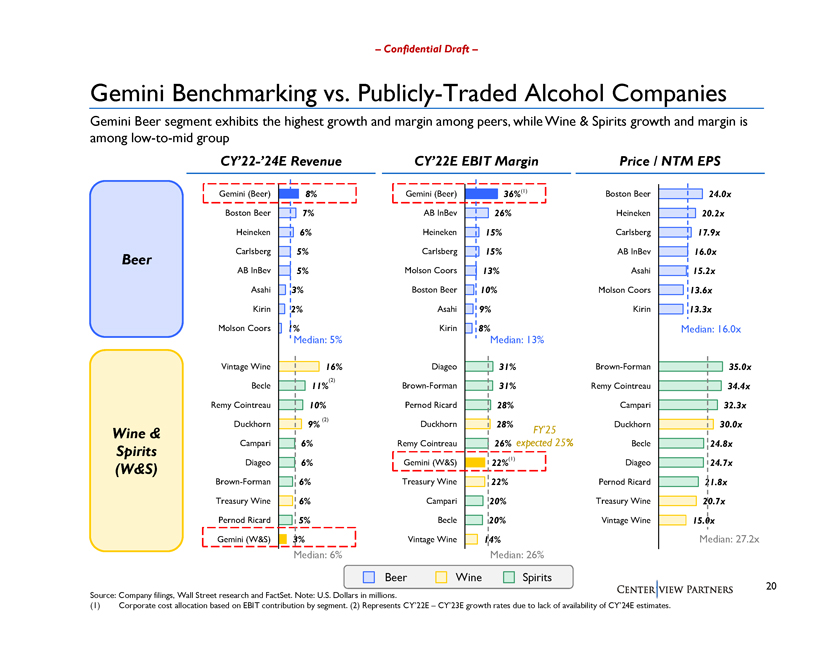

Confidential Draft Gemini Benchmarking vs. Publicly-Traded Alcohol Companies Gemini Beer segment exhibits the highest growth and margin among peers, while Wine & Spirits growth and margin is among low-to-mid group CY22-24E Revenue CY22E EBIT Margin Price / NTM EPS Gemini (Beer) 8% Gemini (Beer) 36% (1) Boston Beer 24.0x Boston Beer 7% AB InBev 26% Heineken 20.2x Heineken 6% Heineken 15% Carlsberg 17.9x Carlsberg 5% Carlsberg 15% AB InBev 16.0x Beer AB InBev 5% Molson Coors 13% Asahi 15.2x Asahi 3% Boston Beer 10% Molson Coors 13.6x Kirin 2% Asahi 9% Kirin 13.3x Molson Coors 1% Kirin 8% Median: 16.0x Median: 5% Median: 13% Vintage Wine 16% Diageo 31% Brown-Forman 35.0x (2) Becle 11% Brown-Forman 31% Remy Cointreau 34.4x Remy Cointreau 10% Pernod Ricard 28% Campari 32.3x Duckhorn 9% (2) Duckhorn 28% Duckhorn 30.0x Wine & FY25 Campari 6% Remy Cointreau 26% expected 25% Becle 24.8x Spirits (W&S) Diageo 6% Gemini (W&S) 22%(1) Diageo 24.7x Brown-Forman 6% Treasury Wine 22% Pernod Ricard 21.8x Treasury Wine 6% Campari 20% Treasury Wine 20.7x Pernod Ricard 5% Becle 20% Vintage Wine 15.0x Gemini (W&S) 3% Vintage Wine 14% Median: 27.2x Median: 6% Median: 26% Beer Wine Spirits 20 Source: Company filings, Wall Street research and FactSet. Note: U.S. Dollars in millions. (1) Corporate cost allocation based on EBIT contribution by segment. (2) Represents CY22E CY23E growth rates due to lack of availability of CY24E estimates.

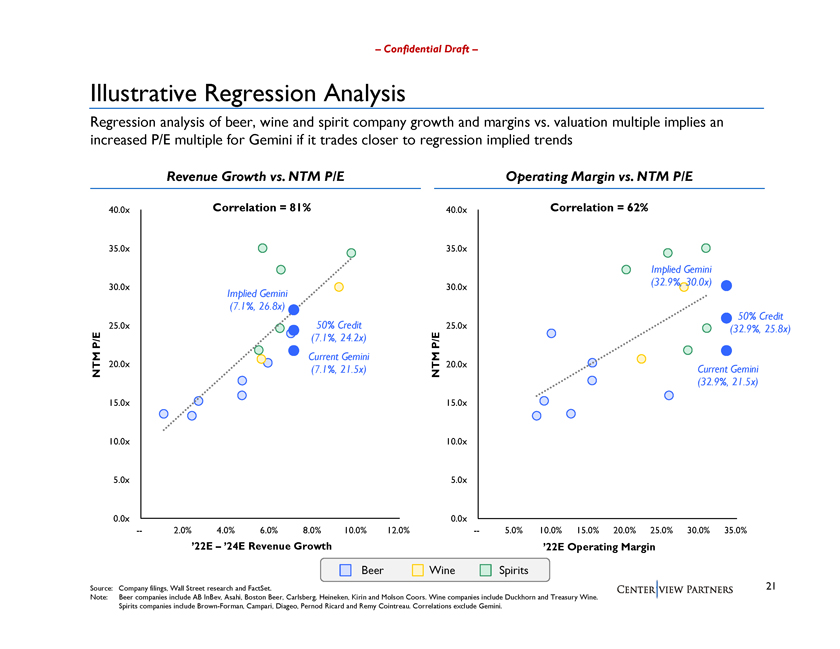

Confidential Draft Illustrative Regression Analysis Regression analysis of beer, wine and spirit company growth and margins vs. valuation multiple implies an increased P/E multiple for Gemini if it trades closer to regression implied trends Revenue Growth vs. NTM P/E Operating Margin vs. NTM P/E 40.0x Correlation = 81% 40.0x Correlation = 62% 35.0x 35.0x Implied Gemini (32.9%, 30.0x) 30.0x 30.0x Implied Gemini (7.1%, 26.8x) 50% Credit 25.0x 50% Credit 25.0x (32.9%, 25.8x) P/E (7.1%, 24.2x) P/E Current Gemini 20.0x 20.0x Current Gemini NTM (7.1%, 21.5x) NTM (32.9%, 21.5x) 15.0x 15.0x 10.0x 10.0x 5.0x 5.0x 0.0x 0.0x 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 22E 24E Revenue Growth 22E Operating Margin Beer Wine Spirits Source: Company filings, Wall Street research and FactSet. 21 Note: Beer companies include AB InBev, Asahi, Boston Beer, Carlsberg, Heineken, Kirin and Molson Coors. Wine companies include Duckhorn and Treasury Wine. Spirits companies include Brown-Forman, Campari, Diageo, Pernod Ricard and Remy Cointreau. Correlations exclude Gemini.

Appendix: Gemini Class A & Class B Trading Dynamics

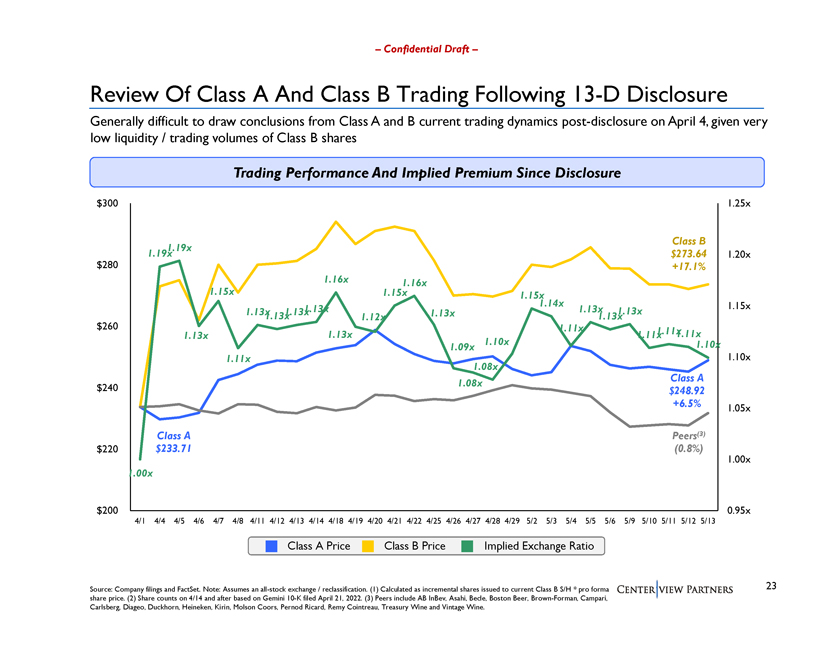

Confidential Draft Review Of Class A And Class B Trading Following 13-D Disclosure Generally difficult to draw conclusions from Class A and B current trading dynamics post-disclosure on April 4, given very low liquidity / trading volumes of Class B shares Trading Performance And Implied Premium Since Disclosure $300 1.25x Class B 1.19x 1.19x $273.64 1.20x $280 +17.1% 1.16x 1.16x 1.15x 1.15x 1.15x 1.14x 1.15x 1.13x 1.13x 1.13x 1.13x 1.13x 1.13x $260 1.13x 1.12x 1.13x 1.11x 1.11x 1.13x 1.13x 1.11x 1.11x 1.10x 1.10x 1.09x 1.10x 1.11x 1.08x Class A $240 1.08x $248.92 +6.5% 1.05x Class A Peers(3) $220 $233.71 (0.8%) 1.00x 1.00x $200 0.95x 4/1 4/4 4/5 4/6 4/7 4/8 4/11 4/12 4/13 4/14 4/18 4/19 4/20 4/21 4/22 4/25 4/26 4/27 4/28 4/29 5/2 5/3 5/4 5/5 5/6 5/9 5/10 5/11 5/12 5/13 Class A Price Class B Price Implied Exchange Ratio Source: Company filings and FactSet. Note: Assumes an all-stock exchange / reclassification. (1) Calculated as incremental shares issued to current Class B S/H * pro forma 23 share price. (2) Share counts on 4/14 and after based on Gemini 10-K filed April 21, 2022. (3) Peers include AB InBev, Asahi, Becle, Boston Beer, Brown-Forman, Campari, Carlsberg, Diageo, Duckhorn, Heineken, Kirin, Molson Coors, Pernod Ricard, Remy Cointreau, Treasury Wine and Vintage Wine.

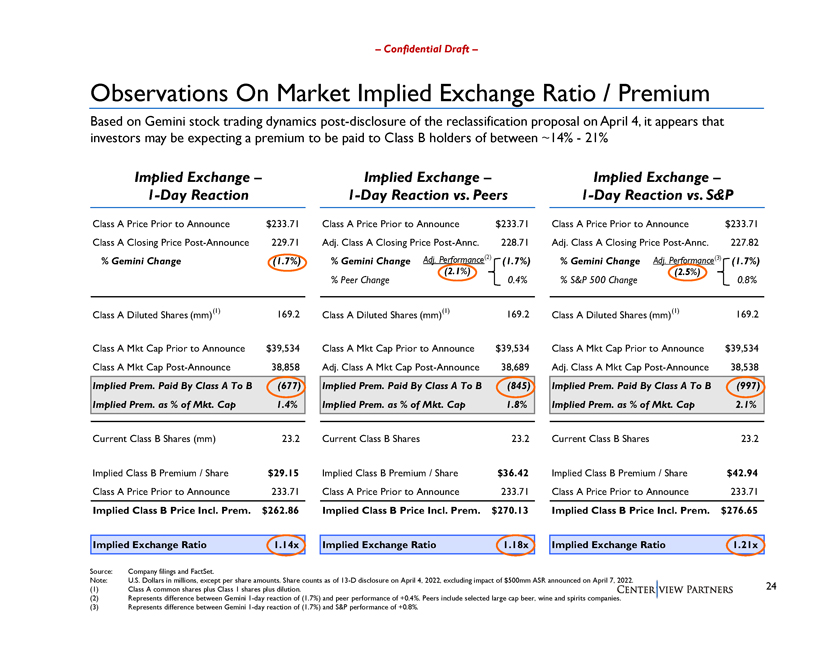

Confidential Draft Observations On Market Implied Exchange Ratio / Premium Based on Gemini stock trading dynamics post-disclosure of the reclassification proposal on April 4, it appears that investors may be expecting a premium to be paid to Class B holders of between ~14%21% Implied Exchange Implied Exchange Implied Exchange 1-Day Reaction 1-Day Reaction vs. Peers 1-Day Reaction vs. S&P Class A Price Prior to Announce $233.71 Class A Price Prior to Announce $233.71 Class A Price Prior to Announce $233.71 Class A Closing Price Post-Announce 229.71 Adj. Class A Closing Price Post-Annc. 228.71 Adj. Class A Closing Price Post-Annc. 227.82 % Gemini Change (1.7%) % Gemini Change Adj. Performance(2) (1.7%) % Gemini Change Adj. Performance(3) (1.7%) (2.1%) (2.5%) % Peer Change 0.4% % S&P 500 Change 0.8% Class A Diluted Shares (mm)(1) 169.2 Class A Diluted Shares (mm)(1) 169.2 Class A Diluted Shares (mm)(1) 169.2 Class A Mkt Cap Prior to Announce $39,534 Class A Mkt Cap Prior to Announce $39,534 Class A Mkt Cap Prior to Announce $39,534 Class A Mkt Cap Post-Announce 38,858 Adj. Class A Mkt Cap Post-Announce 38,689 Adj. Class A Mkt Cap Post-Announce 38,538 Implied Prem. Paid By Class A To B (677) Implied Prem. Paid By Class A To B (845) Implied Prem. Paid By Class A To B (997) Implied Prem. as % of Mkt. Cap 1.4% Implied Prem. as % of Mkt. Cap 1.8% Implied Prem. as % of Mkt. Cap 2.1% Current Class B Shares (mm) 23.2 Current Class B Shares 23.2 Current Class B Shares 23.2 Implied Class B Premium / Share $29.15 Implied Class B Premium / Share $36.42 Implied Class B Premium / Share $42.94 Class A Price Prior to Announce 233.71 Class A Price Prior to Announce 233.71 Class A Price Prior to Announce 233.71 Implied Class B Price Incl. Prem. $262.86 Implied Class B Price Incl. Prem. $270.13 Implied Class B Price Incl. Prem. $276.65 Implied Exchange Ratio 1.14x Implied Exchange Ratio 1.18x Implied Exchange Ratio 1.21x Source: Company filings and FactSet. Note: U.S. Dollars in millions, except per share amounts. Share counts as of 13-D disclosure on April 4, 2022, excluding impact of $500mm ASR announced on April 7, 2022. (1) Class A common shares plus Class 1 shares plus dilution. 24 (2) Represents difference between Gemini 1-day reaction of (1.7%) and peer performance of +0.4%. Peers include selected large cap beer, wine and spirits companies. (3) Represents difference between Gemini 1-day reaction of (1.7%) and S&P performance of +0.8%.

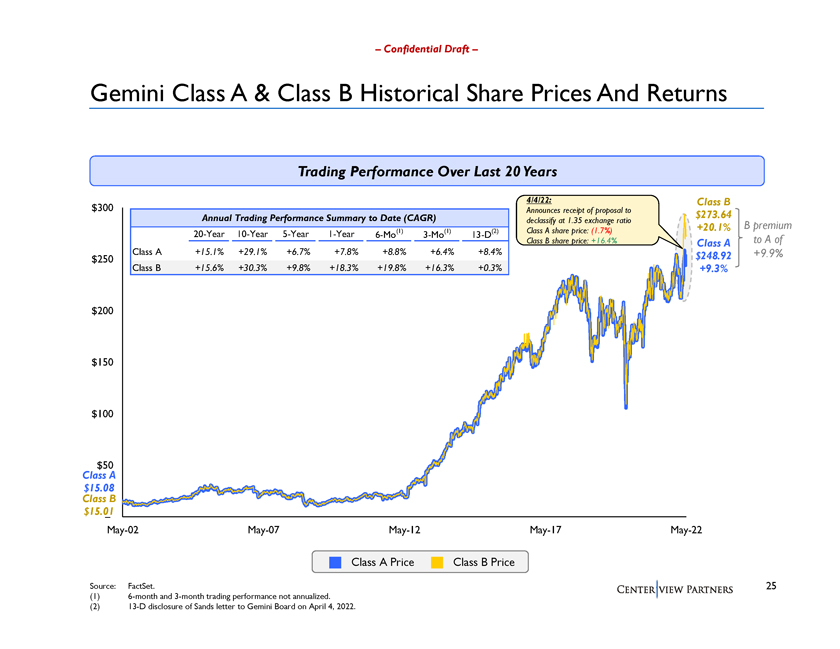

Confidential Draft Gemini Class A & Class B Historical Share Prices And Returns Trading Performance Over Last 20 Years 4/4/22: Class B $300 Announces receipt of proposal to Annual Trading Performance Summary to Date (CAGR) $273.64 declassify at 1.35 exchange ratio B premium (1) (1) (2) Class A share price: (1.7%) +20.1% 20-Year 10-Year 5-Year 1-Year 6-Mo 3-Mo 13-D to A of Class B share price: +16.4% Class A Class A +15.1% +29.1% +6.7% +7.8% +8.8% +6.4% +8.4% $248.92 +9.9% $250 Class B +15.6% +30.3% +9.8% +18.3% +19.8% +16.3% +0.3% +9.3% $200 $150 $100 Class $50 A $15.08 Class B $15.01 May-02 May-07 May-12 May-17 May-22 Class A Price Class B Price Source: FactSet. 25 (1) 6-month and 3-month trading performance not annualized. (2) 13-D disclosure of Sands letter to Gemini Board on April 4, 2022.

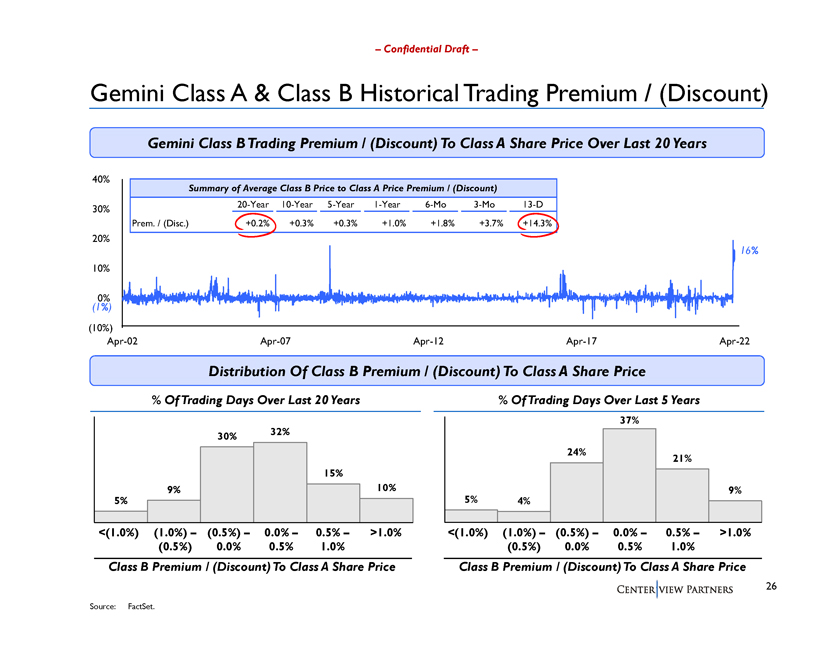

Confidential Draft Gemini Class A & Class B Historical Trading Premium / (Discount) Gemini Class B Trading Premium / (Discount) To Class A Share Price Over Last 20 Years 40% Summary of Average Class B Price to Class A Price Premium / (Discount) 30% 20-Year 10-Year 5-Year 1-Year 6-Mo 3-Mo 13-D Prem. / (Disc.) +0.2% +0.3% +0.3% +1.0% +1.8% +3.7% +14.3% 20% 16% 10% 0% (1%) (10%) Apr-02 Apr-07 Apr-12 Apr-17 Apr-22 Distribution Of Class B Premium / (Discount) To Class A Share Price % Of Trading Days Over Last 20 Years % Of Trading Days Over Last 5 Years 37% 30% 32% 24% 21% 15% 9% 10% 9% 5% 5% 4% <(1.0%) (1.0%) (0.5%) 0.0% 0.5% >1.0% <(1.0%) (1.0%) (0.5%) 0.0% 0.5% >1.0% (0.5%) 0.0% 0.5% 1.0% (0.5%) 0.0% 0.5% 1.0% Class B Premium / (Discount) To Class A Share Price Class B Premium / (Discount) To Class A Share Price

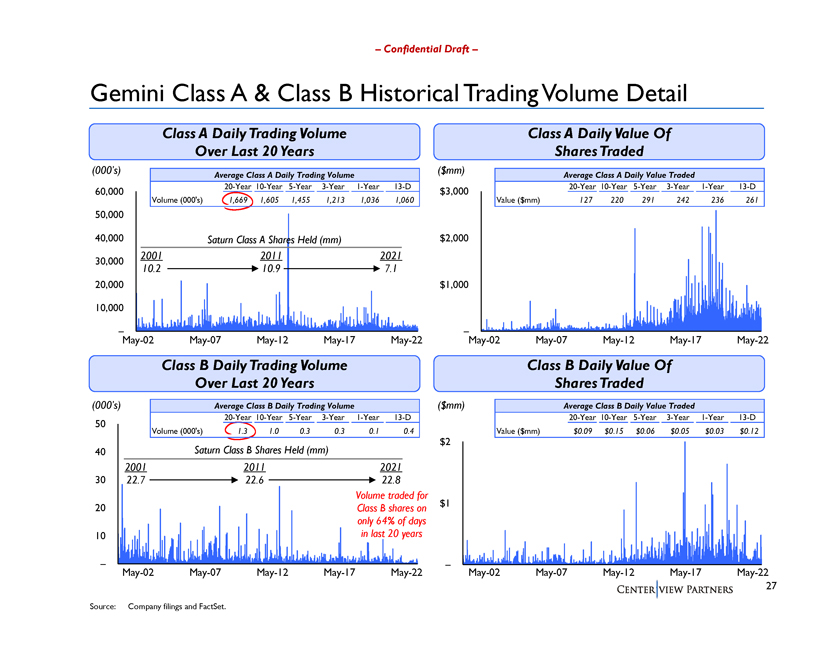

Confidential Draft Gemini Class A & Class B Historical Trading Volume Detail Class A Daily Trading Volume Class A Daily Value Of Over Last 20 Years Shares Traded (000s) ($mm) Average Class A Daily Trading Volume Average Class A Daily Value Traded 60,000 20-Year 10-Year 5-Year 3-Year 1-Year 13-D $3,000 20-Year 10-Year 5-Year 3-Year 1-Year 13-D Volume (000s) 1,669 1,605 1,455 1,213 1,036 1,060 Value ($mm) 127 220 291 242 236 261 50,000 40,000 Saturn Class A Shares Held (mm) $2,000 2001 2011 2021 30,000 10.2 10.9 7.1 20,000 $1,000 10,000 May-02 May-07 May-12 May-17 May-22 May-02 May-07 May-12 May-17 May-22 Class B Daily Trading Volume Class B Daily Value Of Over Last 20 Years Shares Traded (000s) Average Class B Daily Trading Volume ($mm) Average Class B Daily Value Traded 20-Year 10-Year 5-Year 3-Year 1-Year 13-D 20-Year 10-Year 5-Year 3-Year 1-Year 13-D 50 Volume (000s) 1.3 1.0 0.3 0.3 0.1 0.4 Value ($mm) $0.09 $0.15 $0.06 $0.05 $0.03 $0.12 $2 40 Saturn Class B Shares Held (mm) 2001 2011 2021 30 22.7 22.6 22.8 Volume traded for 20 $1 Class B shares on only 64% of days 10 in last 20 years May-02 May-07 May-12 May-17 May-22 May-02 May-07 May-12 May-17 May-22 Source: Company filings and FactSet.