EXHIBIT (C)(10)

Published on August 1, 2022

Exhibit (c)(10)

Confidential Draft Project Gemini: Confidential Discussion Materials May 20, 2022

Confidential Draft Disclaimer This presentation has been prepared by Centerview Partners LLC (Centerview) for use solely by the Special Committee of the Board of Directors of Gemini in connection with its evaluation of a proposed share reclassification and for no other purpose. The information contained herein is based upon information supplied by or on behalf of Gemini and publicly available information, and portions of the information contained herein may be based upon statements, estimates and forecasts provided by Gemini. Centerview has relied upon the accuracy and completeness of the foregoing information, and has not assumed any responsibility for any independent verification of such information or for any independent evaluation or appraisal of any of the assets or liabilities (contingent or otherwise) of Gemini or any other entity, or concerning the solvency or fair value of Gemini or any other entity. With respect to financial forecasts, including with respect to estimates of potential synergies, Centerview has assumed that such forecasts have been reasonably prepared on bases reflecting the best currently available estimates and judgments of the managements of Gemini as to their respective future financial performances, and at your direction Centerview has relied upon such forecasts, as provided by Geminis management, with respect to both Gemini, including as to expected synergies. Centerview assumes no responsibility for and expresses no view as to such forecasts or the assumptions on which they are based. The information set forth herein is based upon economic, monetary, market and other conditions as in effect on, and the information made available to us as of, the date hereof, unless indicated otherwise and Centerview assumes no obligation to update or otherwise revise these materials. The financial analysis in this presentation is complex and is not necessarily susceptible to a partial analysis or summary description. In performingthis financial analysis, Centerview has considered the results of its analysis as a whole and did not necessarily attribute a particular weight to any particular portion of the analysis considered. Furthermore, selecting any portion of Centerviews analysis, without considering the analysis as a whole, wouldcreate an incomplete view of the process underlying its financial analysis. Centerview may have deemed various assumptions more or less probable than other assumptions, so the reference ranges resulting from any particular portion of the analysis described above should not be taken to be Centerviews view of the actual value of Gemini. These materials and the information contained herein are confidential, were not prepared with a view toward public disclosure, and may not be disclosed publicly or made available to third parties without the prior written consent of Centerview. These materials and any other advice, written or oral, rendered by Centerview are intended solely for the benefit and use of the Special Committee of the Board of Directors of Gemini (in its capacity as such) in its consideration of the proposed share reclassification, and are not for the benefit of, and do not convey any rights or remedies for any holder of securities of Gemini or any other person. Centerview will not be responsible for and has not provided any tax, accounting, actuarial, legal or other specialist advice. These materials are not intended to provide the sole basis for evaluating the proposed transaction, and this presentation does not represent a fairness opinion, recommendation, valuation or opinion of any kind, and is necessarily incomplete and should be viewed solely in conjunction with the oral presentation provided by Centerview. 1

Confidential Draft Summary List Of Prior Share Reclassifications Centerview Greenhill Company Date Mkt Cap $ Premium % Mkt Cap % Premium % Premium Focus Commentary National High vote traded at ~57% premium to Sep-17 $840 $69 8.3% 57% 57% Research low vote prior to deal; 6x dividend rights Forest City Dec-16 4,764 107 2.2% 31% 31% Stewart Jan-16 779 12 1.5% 35% 35% Information Greenhill indicated family only had Hubbell Aug-15 5,820 201 3.4% 28% 28% negative control Greenhill excluded 0% premium Aarons Inc. Sep-10 1,346 0 0.0% 0% Not Included transactions Sothebys Sep-05 1,119 48 4.3% 19% 19% Robert Greenhill indicated Mondavi retained Aug-04 593 35 5.9% 17% 17% Mondavi effective control CTE Apr-03 939 7 0.8% 9% 9% Did not involve family / founder Greenhill excluded 0% premium Alberto-Culver Apr-03 3,577 0 0.0% 0% Not Included transactions Readers (1) Competing bidder for family shares, Oct-02 1,532 42 2.7% 22% 30% Digest resulted in higher premium to family Kaman Jun-05 259% Below $500mm market cap Continental Nov-00 30% Airlines Greenhill Dairy Mart Not Included Only Dec-99 10% Convenience Pacificare Health May-99 5% Remington Oil Aug-98 27% and Gas Median 2.5% 21% 28% Committee Proposal $44,451 $872 2.0% 16% 16% Sands Proposal 44,451 1,744 3.9% 32% 32% 2 Source: Company filings, Wall Street research and FactSet. Note: U.S. Dollars in millions. Centerview list includes prior share reclassifications over the last twenty years of companies with a family / founder controlling shareholder and above $500mm market cap. (1) Based on 1.22x exchange ratio offered for portion of family shares and other shareholders representing 50% of high vote shares. Excludes additional cash premium for portion of family shares.

Confidential Draft M&A Premiums Paid Decreases With Size Of Transaction 1,357 U.S. M&A transactions with public target >$200mm over last 10 years, includes deals with cash or stock consideration % Premium (Vs. 1-Day Prior To Announcement) n = 304 230 507 316 45.4% 35.9% 31.3% 24.0% $200mm$500mm$1bn$5bn+ $500mm $1bn $5bn Transaction Value 3 Source: Capital IQ. Note: Represents M&A transactions with public U.S. targets with >$200mm transaction value since May 19, 2012.

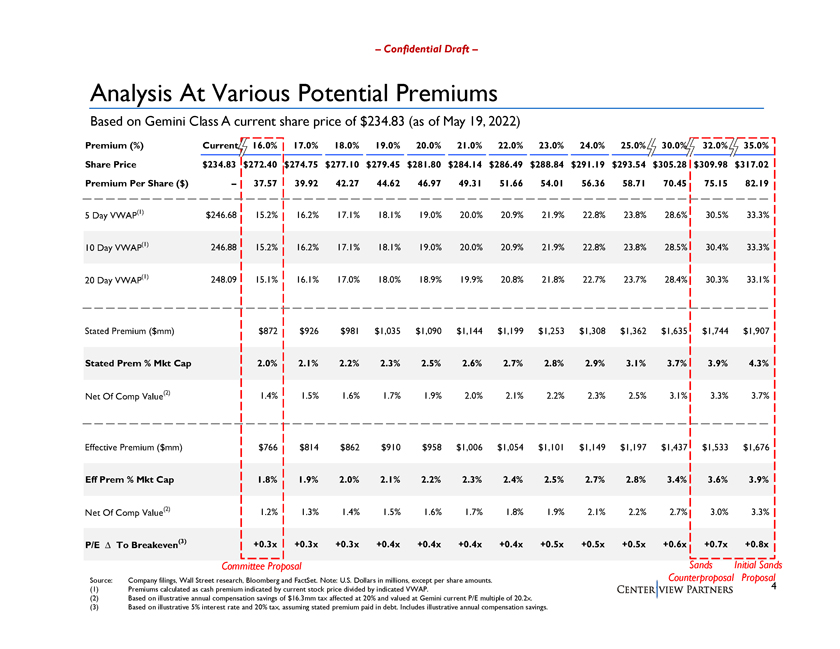

Confidential Draft Analysis At Various Potential Premiums Based on Gemini Class A current share price of $234.83 (as of May 19, 2022) Premium (%) Current 16.0% 17.0% 18.0% 19.0% 20.0% 21.0% 22.0% 23.0% 24.0% 25.0% 30.0% 32.0% 35.0% Share Price $234.83 $272.40 $274.75 $277.10 $279.45 $281.80 $284.14 $286.49 $288.84 $291.19 $293.54 $305.28 $309.98 $317.02 Premium Per Share ($) 37.57 39.92 42.27 44.62 46.97 49.31 51.66 54.01 56.36 58.71 70.45 75.15 82.19 5 Day VWAP(1) $246.68 15.2% 16.2% 17.1% 18.1% 19.0% 20.0% 20.9% 21.9% 22.8% 23.8% 28.6% 30.5% 33.3% 10 Day VWAP(1) 246.88 15.2% 16.2% 17.1% 18.1% 19.0% 20.0% 20.9% 21.9% 22.8% 23.8% 28.5% 30.4% 33.3% 20 Day VWAP(1) 248.09 15.1% 16.1% 17.0% 18.0% 18.9% 19.9% 20.8% 21.8% 22.7% 23.7% 28.4% 30.3% 33.1% Stated Premium ($mm) $872 $926 $981 $1,035 $1,090 $1,144 $1,199 $1,253 $1,308 $1,362 $1,635 $1,744 $1,907 Stated Prem % Mkt Cap 2.0% 2.1% 2.2% 2.3% 2.5% 2.6% 2.7% 2.8% 2.9% 3.1% 3.7% 3.9% 4.3% Net Of Comp Value(2) 1.4% 1.5% 1.6% 1.7% 1.9% 2.0% 2.1% 2.2% 2.3% 2.5% 3.1% 3.3% 3.7% Effective Premium ($mm) $766 $814 $862 $910 $958 $1,006 $1,054 $1,101 $1,149 $1,197 $1,437 $1,533 $1,676 Eff Prem % Mkt Cap 1.8% 1.9% 2.0% 2.1% 2.2% 2.3% 2.4% 2.5% 2.7% 2.8% 3.4% 3.6% 3.9% Net Of Comp Value(2) 1.2% 1.3% 1.4% 1.5% 1.6% 1.7% 1.8% 1.9% 2.1% 2.2% 2.7% 3.0% 3.3% P/E To Breakeven(3) +0.3x +0.3x +0.3x +0.4x +0.4x +0.4x +0.4x +0.5x +0.5x +0.5x +0.6x +0.7x +0.8x Committee Proposal Sands Initial Sands Source: Company filings, Wall Street research, Bloomberg and FactSet. Note: U.S. Dollars in millions, except per share amounts. Counterproposal Proposal (1) Premiums calculated as cash premium indicated by current stock price divided by indicated VWAP. 4 (2) Based on illustrative annual compensation savings of $16.3mm tax affected at 20% and valued at Gemini current P/E multiple of 20.2x. (3) Based on illustrative 5% interest rate and 20% tax, assuming stated premium paid in debt. Includes illustrative annual compensation savings.

Appendix: Selected Precedents

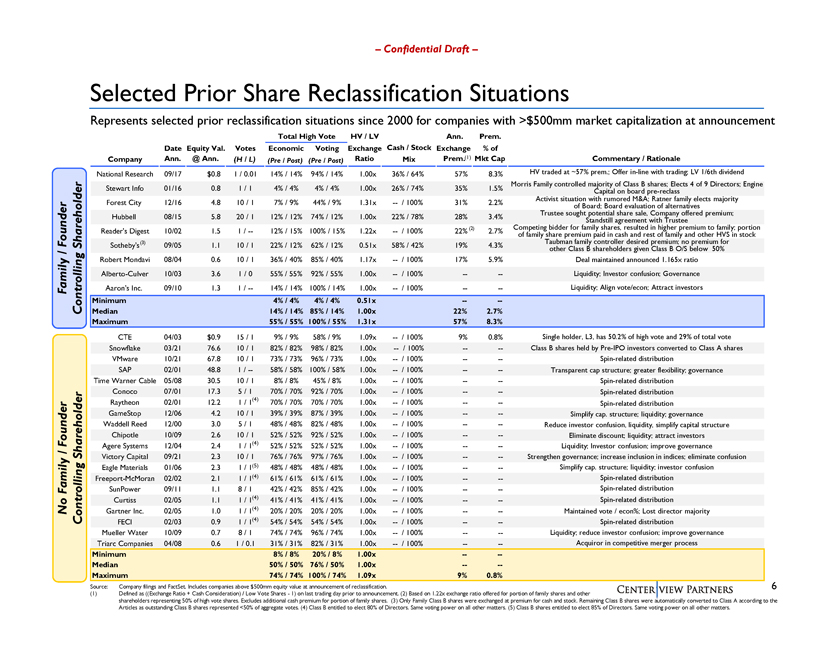

Confidential Draft Selected Prior Share Reclassification Situations Represents selected prior reclassification situations since 2000 for companies with >$500mm market capitalization at announcement Total High Vote HV / LV Ann. Prem. Date Equity Val. Votes Economic Voting Exchange Cash / Stock Exchange % of Company Ann. @ Ann. (H / L) (Pre / Post) (Pre / Post) Ratio Mix Prem.(1) Mkt Cap Commentary / Rationale National Research 09/17 $0.8 1 / 0.01 14% / 14% 94% / 14% 1.00x 36% / 64% 57% 8.3% HV traded at ~57% prem.; Offer in-line with trading; LV 1/6th dividend Morris Family controlled majority of Class B shares; Elects 4 of 9 Directors; Engine Stewart Info 01/16 0.8 1 / 1 4% / 4% 4% / 4% 1.00x 26% / 74% 35% 1.5% Capital on board pre-reclass Activist situation with rumored M&A; Ratner family elects majority Forest City 12/16 4.8 10 / 1 7% / 9% 44% / 9% 1.31x / 100% 31% 2.2% of Board; Board evaluation of alternatives Trustee sought potential share sale, Company offered premium; Hubbell 08/15 5.8 20 / 1 12% / 12% 74% / 12% 1.00x 22% / 78% 28% 3.4% Standstill agreement with Trustee (2) Competing bidder for family shares, resulted in higher premium to family; portion Readers Digest 10/02 1.5 1 / 12% / 15% 100% / 15% 1.22x / 100% 22% 2.7% of family share premium paid in cash and rest of family and other HVS in stock Founder (3) Taubman family controller desired premium; no premium for Shareholder Sothebys 09/05 1.1 10 / 1 22% / 12% 62% / 12% 0.51x 58% / 42% 19% 4.3% / other Class B shareholders given Class B O/S below 50% Robert Mondavi 08/04 0.6 10 / 1 36% / 40% 85% / 40% 1.17x / 100% 17% 5.9% Deal maintained announced 1.165x ratio Alberto-Culver 10/03 3.6 1 / 0 55% / 55% 92% / 55% 1.00x / 100% -- Liquidity; Investor confusion; Governance Family Aarons Inc. 09/10 1.3 1 / 14% / 14% 100% / 14% 1.00x / 100% -- Liquidity; Align vote/econ; Attract investors Minimum 4% / 4% 4% / 4% 0.51x --Controlling Median 14% / 14% 85% / 14% 1.00x 22% 2.7% Maximum 55% / 55% 100% / 55% 1.31x 57% 8.3% CTE 04/03 $0.9 15 / 1 9% / 9% 58% / 9% 1.09x / 100% 9% 0.8% Single holder, L3, has 50.2% of high vote and 29% of total vote Snowflake 03/21 76.6 10 / 1 82% / 82% 98% / 82% 1.00x / 100% -- Class B shares held by Pre-IPO investors converted to Class A shares VMware 10/21 67.8 10 / 1 73% / 73% 96% / 73% 1.00x / 100% -- Spin-related distribution SAP 02/01 48.8 1 / 58% / 58% 100% / 58% 1.00x / 100% -- Transparent cap structure; greater flexibility; governance Time Warner Cable 05/08 30.5 10 / 1 8% / 8% 45% / 8% 1.00x / 100% -- Spin-related distribution Conoco 07/01 17.3 5 / 1 70% / 70% 92% / 70% 1.00x / 100% -- Spin-related distribution Raytheon 02/01 12.2 1 / 1(4) 70% / 70% 70% / 70% 1.00x / 100% -- Spin-related distribution GameStop 12/06 4.2 10 / 1 39% / 39% 87% / 39% 1.00x / 100% -- Simplify cap. structure; liquidity; governance Waddell Reed 12/00 3.0 5 / 1 48% / 48% 82% / 48% 1.00x / 100% -- Reduce investor confusion, liquidity, simplify capital structure Chipotle 10/09 2.6 10 / 1 52% / 52% 92% / 52% 1.00x / 100% -- Eliminate discount; liquidity; attract investors Founder Agere Systems 12/04 2.4 1 / 1(4) 52% / 52% 52% / 52% 1.00x / 100% -- Liquidity; Investor confusion; improve governance / Shareholder Victory Capital 09/21 2.3 10 / 1 76% / 76% 97% / 76% 1.00x / 100% -- Strengthen governance; increase inclusion in indices; eliminate confusion Eagle Materials 01/06 2.3 1 / 1(5) 48% / 48% 48% / 48% 1.00x / 100% -- Simplify cap. structure; liquidity; investor confusion Freeport-McMoran 02/02 2.1 1 / 1(4) 61% / 61% 61% / 61% 1.00x / 100% -- Spin-related distribution Family SunPower 09/11 1.1 8 / 1 42% / 42% 85% / 42% 1.00x / 100% -- Spin-related distribution Curtiss 02/05 1.1 1 / 1(4) 41% / 41% 41% / 41% 1.00x / 100% -- Spin-related distribution No Gartner Inc. 02/05 1.0 1 / 1(4) 20% / 20% 20% / 20% 1.00x / 100% -- Maintained vote / econ%; Lost director majority Controlling FECI 02/03 0.9 1 / 1(4) 54% / 54% 54% / 54% 1.00x / 100% -- Spin-related distribution Mueller Water 10/09 0.7 8 / 1 74% / 74% 96% / 74% 1.00x / 100% -- Liquidity; reduce investor confusion; improve governance Triarc Companies 04/08 0.6 1 / 0.1 31% / 31% 82% / 31% 1.00x / 100% -- Acquiror in competitive merger process Minimum 8% / 8% 20% / 8% 1.00x --Median 50% / 50% 76% / 50% 1.00x --Maximum 74% / 74% 100% / 74% 1.09x 9% 0.8% Source: Company filings and FactSet. Includes companies above $500mm equity value at announcement of reclassification. 6 (1) Defined as ((Exchange Ratio + Cash Consideration) / Low Vote Shares1) on last trading day prior to announcement. (2) Based on 1.22x exchange ratio offered for portion of family shares and other shareholders representing 50% of high vote shares. Excludes additional cash premium for portion of family shares. (3) Only Family Class B shares were exchanged at premium for cash and stock. Remaining Class B shares were automatically converted to Class A according to the Articles as outstanding Class B shares represented <50% of aggregate votes. (4) Class B entitled to elect 80% of Directors. Same voting power on all other matters. (5) Class B shares entitled to elect 85% of Directors. Same voting power on all other matters.