EXHIBIT (C)(18)

Published on August 1, 2022

Exhibit (c)(18)

Exhibit (c)(18) PROJECT BEACH Discussion Materials JUNE 29, 2022 STRICTLY PRIVATE & CONFIDENTIAL

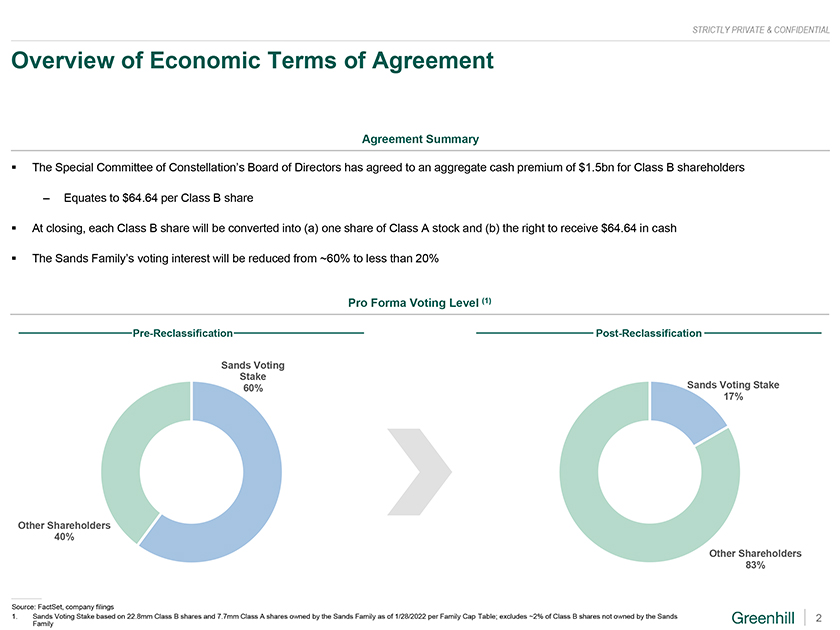

STRICTLY PRIVATE & CONFIDENTIAL Overview of Economic Terms of Agreement Agreement Summary The Special Committee of Constellations Board of Directors has agreed to an aggregate cash premium of $1.5bn for Class B shareholders Equates to $64.64 per Class B share At closing, each Class B share will be converted into (a) one share of Class A stock and (b) the right to receive $64.64 in cash The Sands Familys voting interest will be reduced from ~60% to less than 20% Pro Forma Voting Level (1) Pre-Reclassification Post-Reclassification Sands Voting Stake Sands Voting Stake 60% 17% Other Shareholders 40% Other Shareholders 83% Source: FactSet, company filings 1. Sands Voting Stake based on 22.8mm Class B shares and 7.7mm Class A shares owned by the Sands Family as of 1/28/2022 per Family Cap Table; excludes ~2% of Class B shares not owned by the Sands 2 Family

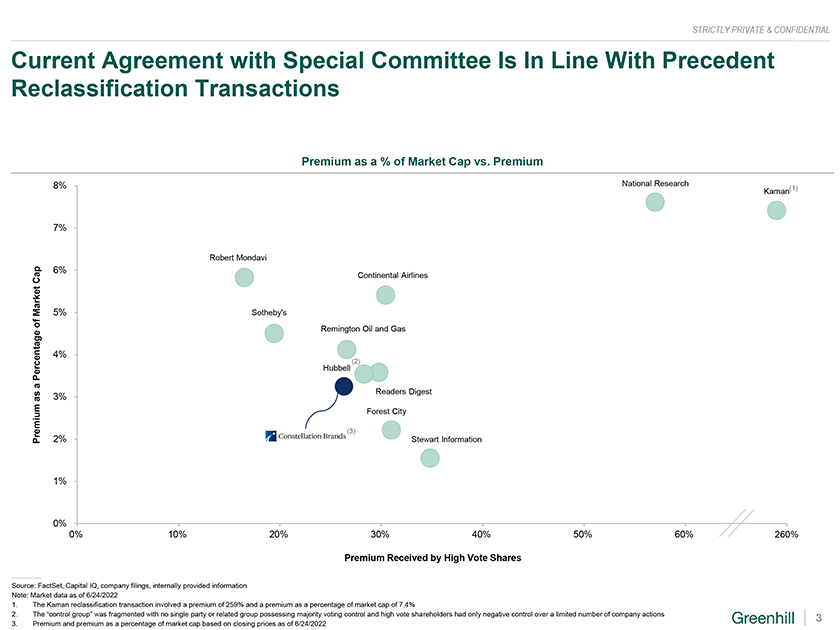

STRICTLY PRIVATE & CONFIDENTIAL Current Agreement with Special Committee Is In Line With Precedent Reclassification Transactions Premium as a % of Market Cap vs. Premium 8% National Research Kaman(1) 7% Robert Mondavi ap 6% Continental Airlines C Market 5% Sothebys of ge Remington Oil and Gas a nt 4% rc e (2) Hubbell P e a s Readers Digest a 3% mium Forest City re 2% (3) P Stewart Information 1% 0% 0% 10% 20% 30% 40% 50% 60% 260% 70% Premium Received by High Vote Shares Source: FactSet, Capital IQ, company filings, internally provided information Note: Market data as of 6/24/2022 1. The Kaman reclassification transaction involved a premium of 259% and a premium as a percentage of market cap of 7.4% 2. The control group was fragmented with no single party or related group possessing majority voting control and high vote shareholders had only negative control over a limited number of company actions 3 3. Premium and premium as a percentage of market cap based on closing prices as of 6/24/2022

STRICTLY PRIVATE & CONFIDENTIAL Disclaimer This document has been prepared by Greenhill & Co., LLC (Greenhill) exclusively for the benefit and internal use of the Wildstar Partners LLC and the Family Holders (the Recipient) solely for its use in evaluating the transaction described herein and may not be used for any other purpose or copied, distributed, reproduced, disclosed or otherwise made available to any other person without Greenhills prior written consent. This document may only be relied upon by the Recipient and no other person. Greenhill is acting solely for the Recipient in connection with any arrangements, services or transactions referred to in this document. Greenhill is not and will not be responsible to anyone other than the Recipient for providing the protections afforded to the clients of Greenhill or for providing advice in relation to the arrangements, services or transactions referred to in this document. This document is delivered subject to the terms of the engagement letter entered into between the Recipient and Greenhill. This document is delivered as at the date specified on the cover; Greenhill does not have any obligation to provide any update to or correct any inaccuracies in the information in this document. This document is private and confidential; by accepting this document, you are deemed to agree to treat it and its contents confidentially. This document does not constitute an opinion, and is not intended to be and does not constitute a recommendation to the Recipient as to whether to approve or undertake or take any other action in respect of any transactions contemplated in this document. The commercial merits or suitability or expected profitability or benefit of such transactions should be independently determined by the Recipient based on its own assessment of the legal, tax, accounting, regulatory, financial, credit and other related aspects of the transaction, relying on such information and advice from the Recipients own professional advisors and such other experts as it deems relevant. Greenhill does not provide accounting, tax, legal or regulatory advice. 4