EXHIBIT (C)(23)

Published on August 1, 2022

Exhibit (c)(23)

PROJECT BEACH Discussion Materials MARCH 2022 STRICTLY PRIVATE & CONFIDENTIAL

STRICTLY PRIVATE & CONFIDENTIAL Reclassification Negotiation Dynamics Market precedents provide identified ranges for potential outcomes Reclassifications involving a change of control by high vote holders are uncommon, but public examples provide clear ranges of outcomes For reclassifications independent of a sale of the company involving premia: Median premium over low vote shares for reclassification transactions deemed to be a change of control is 28.3% ~40% of transactions involve 30%+ premium over low vote shares Nearly half of such transactions imply premium values of 4.0%+ of the companys market cap (median is 3.6%) Premium range was 6.5% to 21.7% over low vote shares for reclassification transactions deemed to be a non-change of control (4 transactions) For acquisitions of dual class companies where differential consideration was paid to high vote shares: Premium range was 9.1% to 72.0% over low vote shares Half of the transactions imply excess nominal premium values of 4.0%+ of the companys market cap Importantly, situations in which a concentrated controlling ownership level is involved, premia both on an absolute basis and as an implied percentage of market cap tend to be measurably higher The Class B shares, which are more than 98% owned by the Family, hold nearly 60% of the voting power, while representing ~12% of the economic ownership Median premium for reclassification transactions deemed to be a change of control is 30.4% for cases where a single party held majority control, and 2/3 of such transactions imply premium values of 4.0%+ of the companys market cap (with a median of 4.5%) An initial proposal of a 35% premium for Class B shares would imply a premium of 4.2% of Constellations market cap (aggregate premium of ~$1.9bn) Source: Company filings 2 Note: Share counts based on shares outstanding as of 12/31/2021 per latest 10Q

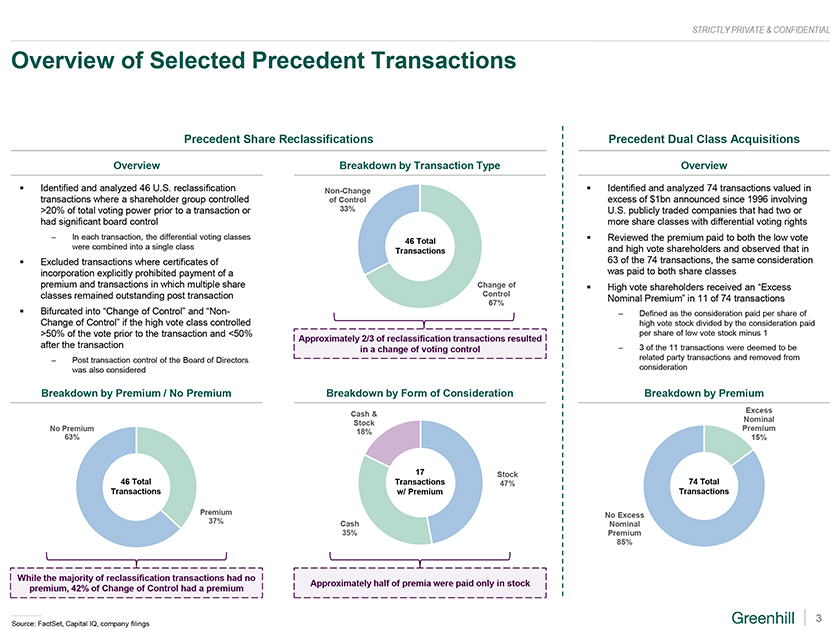

STRICTLY PRIVATE & CONFIDENTIAL Overview of Selected Precedent Transactions Precedent Share Reclassifications Precedent Dual Class Acquisitions Overview Breakdown by Transaction Type Overview Identified and analyzed 46 U.S. reclassification Non-Change Identified and analyzed 74 transactions valued in transactions where a shareholder group controlled of Control excess of $1bn announced since 1996 involving >20% of total voting power prior to a transaction or 33% U.S. publicly traded companies that had two or had significant board control more share classes with differential voting rights In each transaction, the differential voting classes Reviewed the premium paid to both the low vote 46 Total were combined into a single class and high vote shareholders and observed that in Transactions Excluded transactions where certificates of 63 of the 74 transactions, the same consideration incorporation explicitly prohibited payment of a was paid to both share classes premium and transactions in which multiple share Change of High vote shareholders received an Excess classes remained outstanding post transaction Control Nominal Premium in 11 of 74 transactions 67% Bifurcated into Change of Control and Non- Defined as the consideration paid per share of Change of Control if the high vote class controlled high vote stock divided by the consideration paid >50% of the vote prior to the transaction and <50% per share of low vote stock minus 1 Approximately 2/3 of reclassification transactions resulted after the transaction 3 of the 11 transactions were deemed to be in a change of voting control Post transaction control of the Board of Directors related party transactions and removed from was also considered consideration Breakdown by Premium / No Premium Breakdown by Form of Consideration Breakdown by Premium Excess Cash & Nominal Stock No Premium Premium 18% 63% 15% 17 Stock 46 Total Transactions 47% 74 Total Transactions w/ Premium Transactions Premium No Excess 37% Cash Nominal 35% Premium 85% While the majority of reclassification transactions had no Approximately half of premia were paid only in stock premium, 42% of Change of Control had a premium 3 Source: FactSet, Capital IQ, company filings

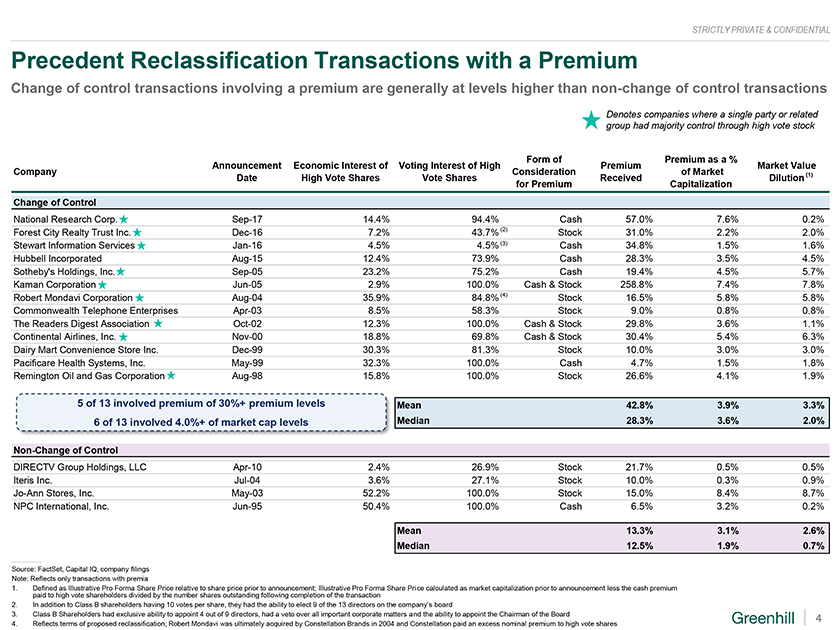

STRICTLY PRIVATE & CONFIDENTIAL Precedent Reclassification Transactions with a Premium Change of control transactions involving a premium are generally at levels higher than non-change of control transactions Denotes companies where a single party or related group had majority control through high vote stock Form of Premium as a % Announcement Economic Interest of Voting Interest of High Premium Market Value Company Consideration of Market (1) Date High Vote Shares Vote Shares Received Dilution for Premium Capitalization Change of Control National Research Corp. Sep-17 14.4% 94.4% Cash 57.0% 7.6% 0.2% Forest City Realty Trust Inc. Dec-16 7.2% 43.7% (2) Stock 31.0% 2.2% 2.0% Stewart Information Services Jan-16 4.5% 4.5% (3) Cash 34.8% 1.5% 1.6% Hubbell Incorporated Aug-15 12.4% 73.9% Cash 28.3% 3.5% 4.5% Sothebys Holdings, Inc. Sep-05 23.2% 75.2% Cash 19.4% 4.5% 5.7% Kaman Corporation Jun-05 2.9% 100.0% Cash & Stock 258.8% 7.4% 7.8% Robert Mondavi Corporation Aug-04 35.9% 84.8% (4) Stock 16.5% 5.8% 5.8% Commonwealth Telephone Enterprises Apr-03 8.5% 58.3% Stock 9.0% 0.8% 0.8% The Readers Digest Association Oct-02 12.3% 100.0% Cash & Stock 29.8% 3.6% 1.1% Continental Airlines, Inc. Nov-00 18.8% 69.8% Cash & Stock 30.4% 5.4% 6.3% Dairy Mart Convenience Store Inc. Dec-99 30.3% 81.3% Stock 10.0% 3.0% 3.0% Pacificare Health Systems, Inc. May-99 32.3% 100.0% Cash 4.7% 1.5% 1.8% Remington Oil and Gas Corporation Aug-98 15.8% 100.0% Stock 26.6% 4.1% 1.9% 5 of 13 involved premium of 30%+ premium levels Mean 42.8% 3.9% 3.3% 6 of 13 involved 4.0%+ of market cap levels Median 28.3% 3.6% 2.0% Non-Change of Control DIRECTV Group Holdings, LLC Apr-10 2.4% 26.9% Stock 21.7% 0.5% 0.5% Iteris Inc. Jul-04 3.6% 27.1% Stock 10.0% 0.3% 0.9% Jo-Ann Stores, Inc. May-03 52.2% 100.0% Stock 15.0% 8.4% 8.7% NPC International, Inc. Jun-95 50.4% 100.0% Cash 6.5% 3.2% 0.2% Mean 13.3% 3.1% 2.6% Median 12.5% 1.9% 0.7% Source: FactSet, Capital IQ, company filings Note: Reflects only transactions with premia 1. Defined as Illustrative Pro Forma Share Price relative to share price prior to announcement; Illustrative Pro Forma Share Price calculated as market capitalization prior to announcement less the cash premium paid to high vote shareholders divided by the number shares outstanding following completion of the transaction 2. In addition to Class B shareholders having 10 votes per share, they had the ability to elect 9 of the 13 directors on the companys board 3. Class B Shareholders had exclusive ability to appoint 4 out of 9 directors, had a veto over all important corporate matters and the ability to appoint the Chairman of the Board 4 4. Reflects terms of proposed reclassification; Robert Mondavi was ultimately acquired by Constellation Brands in 2004 and Constellation paid an excess nominal premium to high vote shares

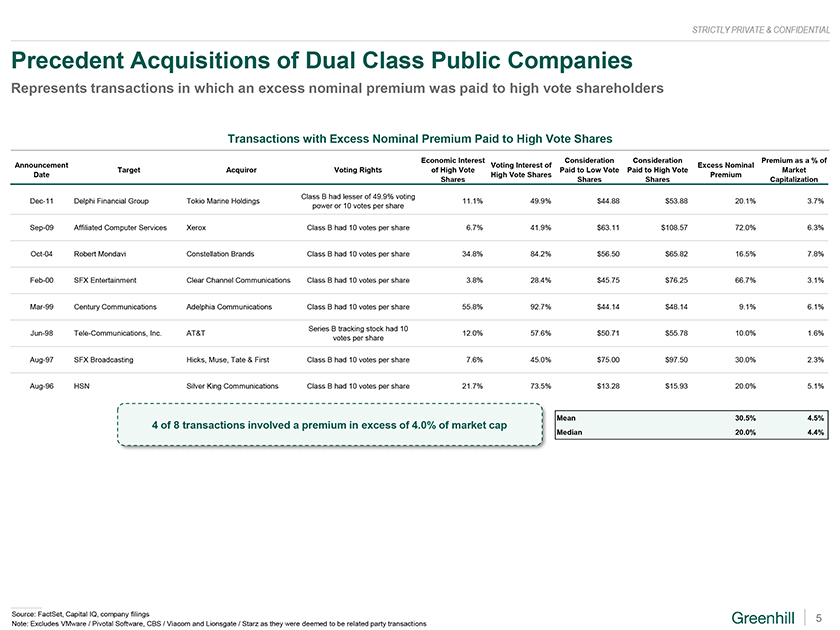

STRICTLY PRIVATE & CONFIDENTIAL Precedent Acquisitions of Dual Class Public Companies Represents transactions in which an excess nominal premium was paid to high vote shareholders Transactions with Excess Nominal Premium Paid to High Vote Shares Economic Interest Consideration Consideration Premium as a % of Announcement Voting Interest of Excess Nominal Target Acquiror Voting Rights of High Vote Paid to Low Vote Paid to High Vote Market Date High Vote Shares Premium Shares Shares Shares Capitalization Class B had lesser of 49.9% voting Dec-11 Delphi Financial Group Tokio Marine Holdings 11.1% 49.9% $44.88 $53.88 20.1% 3.7% power or 10 votes per share Sep-09 Affiliated Computer Services Xerox Class B had 10 votes per share 6.7% 41.9% $63.11 $108.57 72.0% 6.3% Oct-04 Robert Mondavi Constellation Brands Class B had 10 votes per share 34.8% 84.2% $56.50 $65.82 16.5% 7.8% Feb-00 SFX Entertainment Clear Channel Communications Class B had 10 votes per share 3.8% 28.4% $45.75 $76.25 66.7% 3.1% Mar-99 Century Communications Adelphia Communications Class B had 10 votes per share 55.8% 92.7% $44.14 $48.14 9.1% 6.1% Series B tracking stock had 10 Jun-98 Tele-Communications, Inc. AT&T 12.0% 57.6% $50.71 $55.78 10.0% 1.6% votes per share Aug-97 SFX Broadcasting Hicks, Muse, Tate & First Class B had 10 votes per share 7.6% 45.0% $75.00 $97.50 30.0% 2.3% Aug-96 HSN Silver King Communications Class B had 10 votes per share 21.7% 73.5% $13.28 $15.93 20.0% 5.1% Mean 30.5% 4.5% 4 of 8 transactions involved a premium in excess of 4.0% of market cap Median 20.0% 4.4% Source: FactSet, Capital IQ, company filings 5 Note: Excludes VMware / Pivotal Software, CBS / Viacom and Lionsgate / Starz as they were deemed to be related party transactions

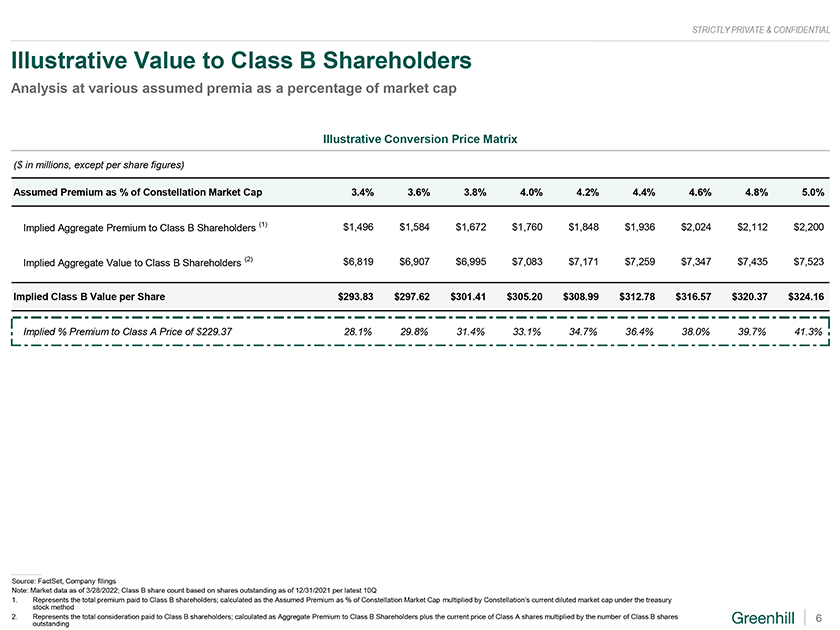

STRICTLY PRIVATE & CONFIDENTIAL Illustrative Value to Class B Shareholders Analysis at various assumed premia as a percentage of market cap Illustrative Conversion Price Matrix ($ in millions, except per share figures) Assumed Premium as % of Constellation Market Cap 3.4% 3.6% 3.8% 4.0% 4.2% 4.4% 4.6% 4.8% 5.0% Implied Aggregate Premium to Class B Shareholders (1) $1,496 $1,584 $1,672 $1,760 $1,848 $1,936 $2,024 $2,112 $2,200 Implied Aggregate Value to Class B Shareholders (2) $6,819 $6,907 $6,995 $7,083 $7,171 $7,259 $7,347 $7,435 $7,523 Implied Class B Value per Share $293.83 $297.62 $301.41 $305.20 $308.99 $312.78 $316.57 $320.37 $324.16 Implied % Premium to Class A Price of $229.37 28.1% 29.8% 31.4% 33.1% 34.7% 36.4% 38.0% 39.7% 41.3% Source: FactSet, Company filings Note: Market data as of 3/28/2022; Class B share count based on shares outstanding as of 12/31/2021 per latest 10Q 1. Represents the total premium paid to Class B shareholders; calculated as the Assumed Premium as % of Constellation Market Cap multiplied by Constellations current diluted market cap under the treasury stock method 2. Represents the total consideration paid to Class B shareholders; calculated as Aggregate Premium to Class B Shareholders plus the current price of Class A shares multiplied by the number of Class B shares 6 outstanding

STRICTLY PRIVATE & CONFIDENTIAL Disclaimer This document has been prepared by Greenhill & Co., LLC (Greenhill) exclusively for the benefit and internal use of the Wildstar Partners LLC and the Family Holders (the Recipient) solely for its use in evaluating the transaction described herein and may not be used for any other purpose or copied, distributed, reproduced, disclosed or otherwise made available to any other person without Greenhills prior written consent. This document may only be relied upon by the Recipient and no other person. Greenhill is acting solely for the Recipient in connection with any arrangements, services or transactions referred to in this document. Greenhill is not and will not be responsible to anyone other than the Recipient for providing the protections afforded to the clients of Greenhill or for providing advice in relation to the arrangements, services or transactions referred to in this document. This document is delivered subject to the terms of the engagement letter entered into between the Recipient and Greenhill. This document is delivered as at the date specified on the cover; Greenhill does not have any obligation to provide any update to or correct any inaccuracies in the information in this document. This document is private and confidential; by accepting this document, you are deemed to agree to treat it and its contents confidentially. This document does not constitute an opinion, and is not intended to be and does not constitute a recommendation to the Recipient as to whether to approve or undertake or take any other action in respect of any transactions contemplated in this document. The commercial merits or suitability or expected profitability or benefit of such transactions should be independently determined by the Recipient based on its own assessment of the legal, tax, accounting, regulatory, financial, credit and other related aspects of the transaction, relying on such information and advice from the Recipients own professional advisors and such other experts as it deems relevant. Greenhill does not provide accounting, tax, legal or regulatory advice. 7