EXHIBIT (C)(3)

Published on August 1, 2022

Exhibit (c)(3)

Confidential Draft Project Gemini: Confidential Discussion Materials June 27, 2022

Confidential Draft Disclaimer This presentation has been prepared by Centerview Partners LLC (Centerview) for use solely by the Special Committee of the Board of Directors of Gemini in connection with its evaluation of a proposed share reclassification and for no other purpose. The information contained herein is based upon information supplied by or on behalf of Gemini and publicly available information, and portions of the information contained herein may be based upon statements, estimates and forecasts provided by Gemini. Centerview has relied upon the accuracy and completeness of the foregoing information, and has not assumed any responsibility for any independent verification of such information or for any independent evaluation or appraisal of any of the assets or liabilities (contingent or otherwise) of Gemini or any other entity, or concerning the solvency or fair value of Gemini or any other entity. With respect to financial forecasts, including with respect to estimates of potential synergies, Centerview has assumed that such forecasts have been reasonably prepared on bases reflecting the best currently available estimates and judgments of the managements of Gemini as to their respective future financial performances, and at your direction Centerview has relied upon such forecasts, as provided by Geminis management, with respect to both Gemini, including as to expected synergies. Centerview assumes no responsibility for and expresses no view as to such forecasts or the assumptions on which they are based. The information set forth herein is based upon economic, monetary, market and other conditions as in effect on, and the information made available to us as of, the date hereof, unless indicated otherwise and Centerview assumes no obligation to update or otherwise revise these materials. The financial analysis in this presentation is complex and is not necessarily susceptible to a partial analysis or summary description. In performingthis financial analysis, Centerview has considered the results of its analysis as a whole and did not necessarily attribute a particular weight to any particular portion of the analysis considered. Furthermore, selecting any portion of Centerviews analysis, without considering the analysis as a whole, wouldcreate an incomplete view of the process underlying its financial analysis. Centerview may have deemed various assumptions more or less probable than other assumptions, so the reference ranges resulting from any particular portion of the analysis described above should not be taken to be Centerviews view of the actual value of Gemini. These materials and the information contained herein are confidential, were not prepared with a view toward public disclosure, and may not be disclosed publicly or made available to third parties without the prior written consent of Centerview. These materials and any other advice, written or oral, rendered by Centerview are intended solely for the benefit and use of the Special Committee of the Board of Directors of Gemini (in its capacity as such) in its consideration of the proposed share reclassification, and are not for the benefit of, and do not convey any rights or remedies for any holder of securities of Gemini or any other person. Centerview will not be responsible for and has not provided any tax, accounting, actuarial, legal or other specialist advice. These materials are not intended to provide the sole basis for evaluating the proposed transaction, and this presentation does not represent a fairness opinion, recommendation, valuation or opinion of any kind, and is necessarily incomplete and should be viewed solely in conjunction with the oral presentation provided by Centerview. 1

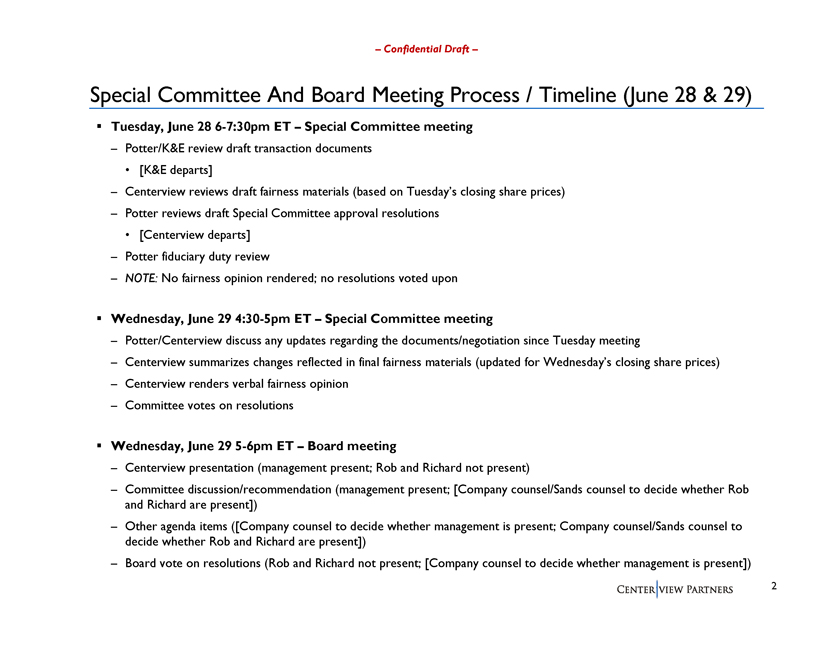

Confidential Draft Special Committee And Board Meeting Process / Timeline (June 28 & 29) Tuesday, June 28 6-7:30pm ET Special Committee meeting Potter/K&E review draft transaction documents [K&E departs] Centerview reviews draft fairness materials (based on Tuesdays closing share prices) Potter reviews draft Special Committee approval resolutions [Centerview departs] Potter fiduciary duty review NOTE: No fairness opinion rendered; no resolutions voted upon Wednesday, June 29 4:30-5pm ET Special Committee meeting Potter/Centerview discuss any updates regarding the documents/negotiation since Tuesday meeting Centerview summarizes changes reflected in final fairness materials (updated for Wednesdays closing share prices) Centerview renders verbal fairness opinion Committee votes on resolutions Wednesday, June 29 5-6pm ET Board meeting Centerview presentation (management present; Rob and Richard not present) Committee discussion/recommendation (management present; [Company counsel/Sands counsel to decide whether Rob and Richard are present]) Other agenda items ([Company counsel to decide whether management is present; Company counsel/Sands counsel to decide whether Rob and Richard are present]) Board vote on resolutions (Rob and Richard not present; [Company counsel to decide whether management is present]) 2

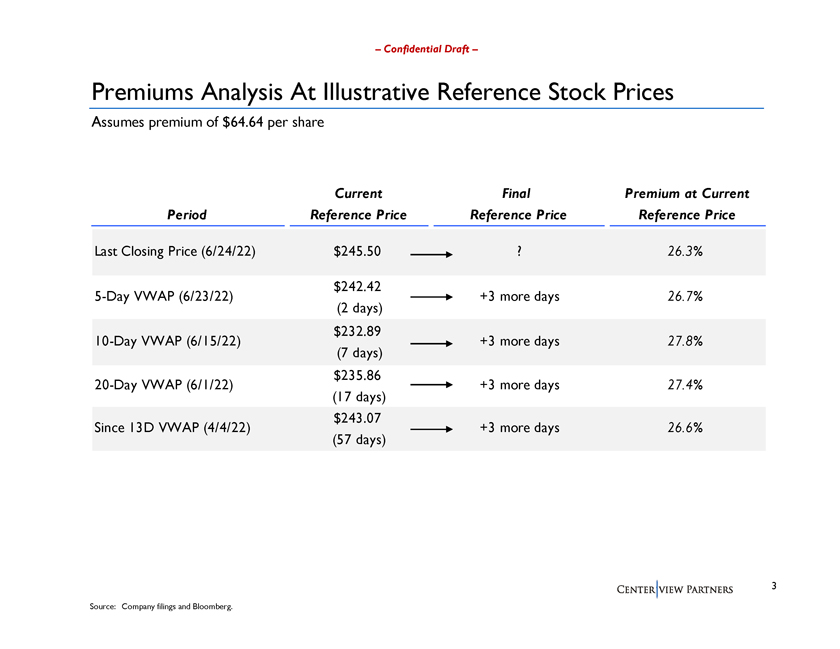

Confidential Draft Premiums Analysis At Illustrative Reference Stock Prices Assumes premium of $64.64 per share Current Final Premium at Current Period Reference Price Reference Price Reference Price Last Closing Price (6/24/22) $245.50 ? 26.3% $242.42 5-Day VWAP (6/23/22) +3 more days 26.7% (2 days) $232.89 10-Day VWAP (6/15/22) +3 more days 27.8% (7 days) $235.86 20-Day VWAP (6/1/22) +3 more days 27.4% (17 days) $243.07 Since 13D VWAP (4/4/22) +3 more days 26.6% (57 days) 3 Source: Company filings and Bloomberg.

Confidential Draft Summary Rationale For The Share Declassification Aligns Constellation with the vast majority of other public companies, consistent with the stated policies of Shareholder Friendly / important institutional shareholders, influential shareholder advocacy groups and proxy advisors One Share One Vote Simplified capital structure with a single class of stock Alignment of voting power and economic ownership for all shareholders [26%] premium is below the premium paid to the controlling shareholder in each of the three most recent / Attractive Premium relevant declassification transactions vs. Precedents Includes Forest City in 2016 (31%), Stewart Information in 2016 (35%) and Hubbell in 2015 (28%) Non-executive roles for Robert and Richard Sands, including removal of Vice Chair role Modern Annual compensation and benefits to be in-line with non-executive roles Governance Rotation of Lead Independent Director position Policies Adoption of majority vote standard for director elections Adoption of an anti-pledging policy, with limitations that increase over time for Sands family Expand Potential Potential to increase / diversify shareholder base Investor Base Some investors / funds may not hold company stock with dual class structures Potential Potential for multiple expansion from removal of controlled-company structure For Additional Addresses investor questions about impact of control on strategy and capital allocation Shareholder Value Reduction of Robert and Richard Sands compensation and benefits by ~$17mm annually Creation ~$280mm of potential value from savings, assuming a 20% tax rate and 21x current P/E multiple Following the receipt of the Sands initial proposal, the Special Committee conducted an in-depth analytical review over numerous meetings together with its financial and legal advisors Analysis and Heavily negotiated the declassification terms and governance improvements over multiple rounds of back-Evaluation by the and-forth discussions, securing the best transaction for the Class A stockholders and in the long-term Special Committee interest of the Company Evaluated feedback from several of Constellations top stockholders regarding the potential benefits of a declassification to the Company 4 Source: Company filings.

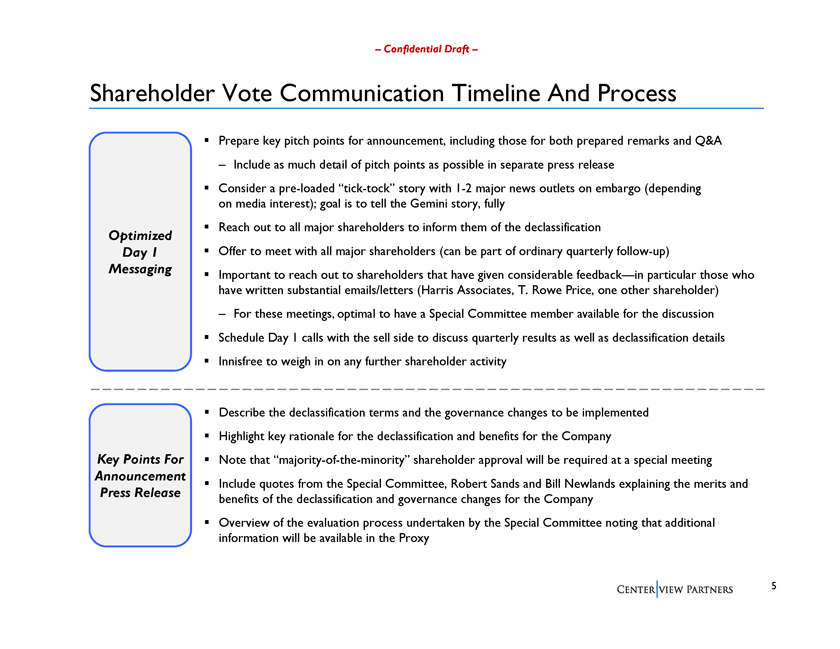

Confidential Draft Shareholder Vote Communication Timeline And Process Prepare key pitch points for announcement, including those for both prepared remarks and Q&A Include as much detail of pitch points as possible in separate press release Consider a pre-loaded tick-tock story with 1-2 major news outlets on embargo (depending on media interest); goal is to tell the Gemini story, fully Reach out to all major shareholders to inform them of the declassification Optimized Day 1 Offer to meet with all major shareholders (can be part of ordinary quarterly follow-up) Messaging those Important to reach out to shareholders that have given considerable feedbackin particular who have written substantial emails/letters (Harris Associates, T. Rowe Price, one other shareholder) For these meetings, optimal to have a Special Committee member available for the discussion Schedule Day 1 calls with the sell side to discuss quarterly results as well as declassification details Innisfree to weigh in on any further shareholder activity Describe the declassification terms and the governance changes to be implemented Highlight key rationale for the declassification and benefits for the Company Key Points For Note that majority-of-the-minority shareholder approval will be required at a special meeting Announcement Include quotes from the Special Committee, Robert Sands and Bill Newlands explaining the merits and Press Release benefits of the declassification and governance changes for the Company Overview of the evaluation process undertaken by the Special Committee noting that additional information will be available in the Proxy 5

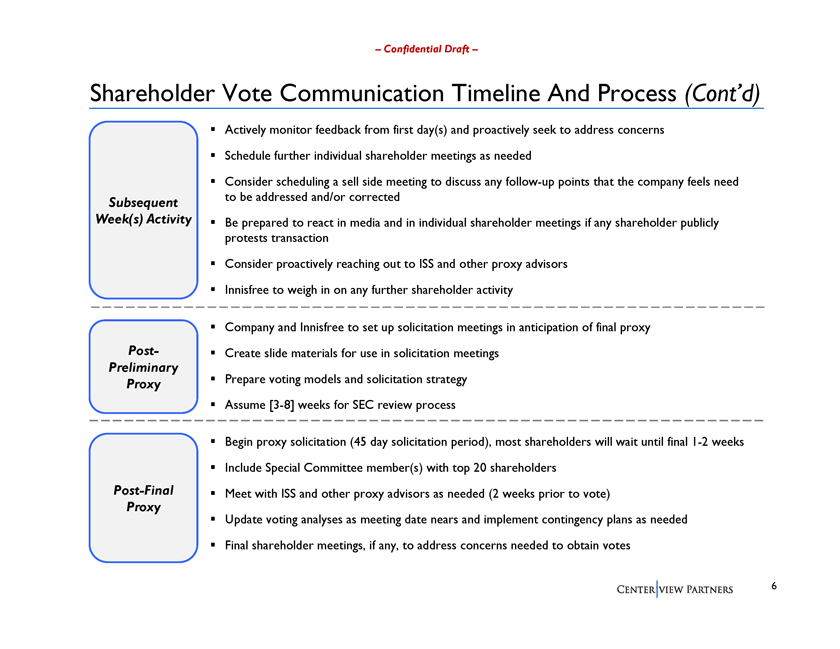

Confidential Draft Shareholder Vote Communication Timeline And Process (Contd) Actively monitor feedback from first day(s) and proactively seek to address concerns Schedule further individual shareholder meetings as needed Consider scheduling a sell side meeting to discuss any follow-up points that the company feels need Subsequent to be addressed and/or corrected Week(s) Activity Be prepared to react in media and in individual shareholder meetings if any shareholder publicly protests transaction Consider proactively reaching out to ISS and other proxy advisors Innisfree to weigh in on any further shareholder activity Company and Innisfree to set up solicitation meetings in anticipation of final proxy Post- Create slide materials for use in solicitation meetings Preliminary Prepare voting models and solicitation strategy Proxy Assume [3-8] weeks for SEC review process Begin proxy solicitation (45 day solicitation period), most shareholders will wait until final 1-2 weeks Include Special Committee member(s) with top 20 shareholders Post-Final Meet with ISS and other proxy advisors as needed (2 weeks prior to vote) Proxy Update voting analyses as meeting date nears and implement contingency plans as needed Final shareholder meetings, if any, to address concerns needed to obtain votes 6