EXHIBIT (C)(17)

Published on August 1, 2022

Exhibit (c)(17)

CONFIDENTIAL DRAFT Confidential Discussion Materials For The Special Committee April 8, 2022

CONFIDENTIAL DRAFT Disclaimer This presentation has been prepared by Centerview Partners LLC (Centerview) for use solely by the Special Committee of the Board of Directors of Gemini in connection with its evaluation of a proposed share reclassification and for no other purpose. The information contained herein is based upon information supplied by or on behalf of Gemini and publicly available information, and portions of the information contained herein may be based upon statements, estimates and forecasts provided by Gemini. Centerview has relied upon the accuracy and completeness of the foregoing information, and has not assumed any responsibility for any independent verification of such information or for any independent evaluation or appraisal of any of the assets or liabilities (contingent or otherwise) of Gemini or any other entity, or concerning the solvency or fair value of Gemini or any other entity. With respect to financial forecasts, including with respect to estimates of potential synergies, Centerview has assumed that such forecasts have been reasonably prepared on bases reflecting the best currently available estimates and judgments of the managements of Gemini as to their respective future financial performances, and at your direction Centerview has relied upon such forecasts, as provided by Geminis management, with respect to both Gemini, including as to expected synergies. Centerview assumes no responsibility for and expresses no view as to such forecasts or the assumptions on which they are based. The information set forth herein is based upon economic, monetary, market and other conditions as in effect on, and the information made available to us as of, the date hereof, unless indicated otherwise and Centerview assumes no obligation to update or otherwise revise these materials. The financial analysis in this presentation is complex and is not necessarily susceptible to a partial analysis or summary description. In performingthis financial analysis, Centerview has considered the results of its analysis as a whole and did not necessarily attribute a particular weight to any particular portion of the analysis considered. Furthermore, selecting any portion of Centerviews analysis, without considering the analysis as a whole, wouldcreate an incomplete view of the process underlying its financial analysis. Centerview may have deemed various assumptions more or less probable than other assumptions, so the reference ranges resulting from any particular portion of the analysis described above should not be taken to be Centerviews view of the actual value of Gemini. These materials and the information contained herein are confidential, were not prepared with a view toward public disclosure, and may not be disclosed publicly or made available to third parties without the prior written consent of Centerview. These materials and any other advice, written or oral, rendered by Centerview are intended solely for the benefit and use of the Special Committee of the Board of Directors of Gemini (in its capacity as such) in its consideration of the proposed share reclassification, and are not for the benefit of, and do not convey any rights or remedies for any holder of securities of Gemini or any other person. Centerview will not be responsible for and has not provided any tax, accounting, actuarial, legal or other specialist advice. These materials are not intended to provide the sole basis for evaluating the proposed transaction, and this presentation does not represent a fairness opinion, recommendation, valuation or opinion of any kind, and is necessarily incomplete and should be viewed solely in conjunction with the oral presentation provided by Centerview.

CONFIDENTIAL DRAFT Situation Overview On April 4, Constellation announced that it has received a letter from the Sands family proposing a declassification transaction whereby each share of Class B stock would be converted into 1.35 shares of Class A stock The Sands family has committed to MFW framework Constellation also announced it has established a Special Committee to evaluate the proposal ï,§ The Sands letter indicates that a declassification would result in decreased Sands voting control from ~59.5% to ~19.7%, a structure that is better aligned with one vote per share governance and increased market demand for the stock Letter also indicates that the Sands family would be pleased to maintain its ability to control the Company through its holdings of Class A and Class B shares, if the Board or shareholders preferred ï,§ The Sands letter does not address certain items which are important for the Committee in the evaluation of the proposal: Ongoing roles / titles for the Sands Ongoing Board representation Proposed timing for response and transaction process Potential for any premium paid, if any, to be in cash vs. stock ï,§ Other considerations include: Potential timing / scenarios for negotiation, recommendation to the Board, solicitation and voting Situation as a catalyst for activism / contested solicitation Resulting pro forma governance and implications ï,§ At next weeks meeting, Centerview to review relevant precedents with the Special Committee and determine initial response approach 2

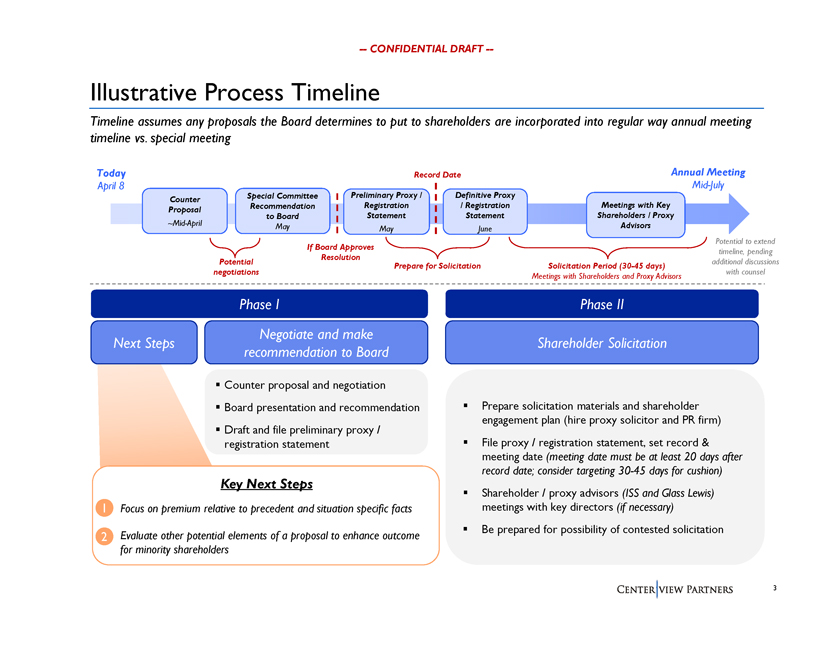

CONFIDENTIAL DRAFT Illustrative Process Timeline Timeline assumes any proposals the Board determines to put to shareholders are incorporated into regular way annual meeting timeline vs. special meeting Today Record Date Annual Meeting April 8 Mid-July Special Committee Preliminary Proxy / Definitive Proxy Counter Recommendation Registration / Registration Meetings with Key Proposal ~Mid-April to Board Statement Statement Shareholders / Proxy May May June Advisors Potential to extend If Board Approves timeline, pending Resolution Potential additional discussions Prepare for Solicitation Solicitation Period (30-45 days) negotiations with counsel Meetings with Shareholders and Proxy Advisors Phase I Phase II Negotiate and make Next Steps Shareholder Solicitation recommendation to Board Counter proposal and negotiation Board presentation and recommendation Prepare solicitation materials and shareholder engagement plan (hire proxy solicitor and PR firm) Draft and file preliminary proxy / registration statement File proxy / registration statement, set record & meeting date (meeting date must be at least 20 days after record date; consider targeting 30-45 days for cushion) Key Next Steps Shareholder / proxy advisors (ISS and Glass Lewis) 1 Focus on premium relative to precedent and situation specific facts meetings with key directors (if necessary) Be prepared for possibility of contested solicitation 2 Evaluate other potential elements of a proposal to enhance outcome for minority shareholders 3

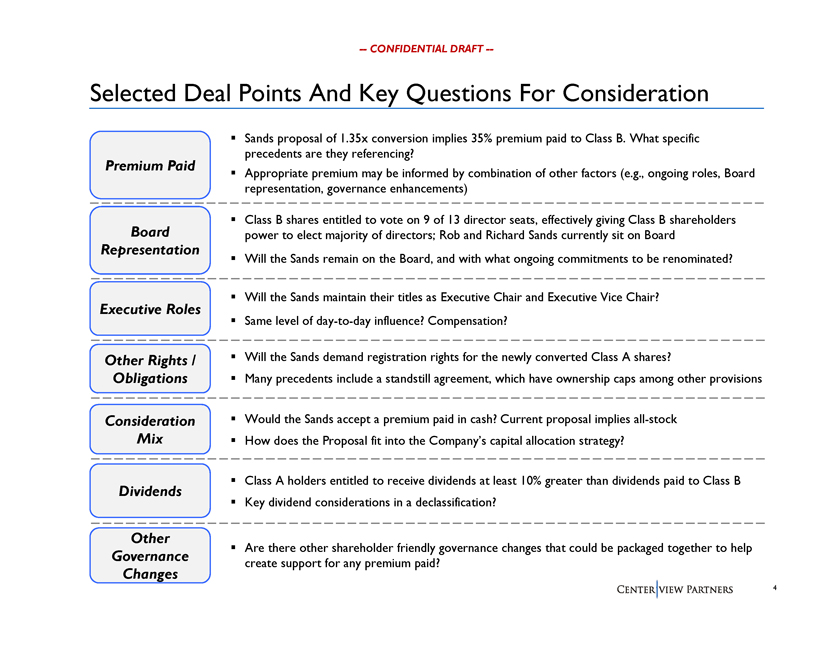

CONFIDENTIAL DRAFT Selected Deal Points And Key Questions For Consideration ï,§ Sands proposal of 1.35x conversion implies 35% premium paid to Class B. What specific precedents are they referencing? Premium Paid ï,§ Appropriate premium may be informed by combination of other factors (e.g., ongoing roles, Board representation, governance enhancements) ï,§ Class B shares entitled to vote on 9 of 13 director seats, effectively giving Class B shareholders Board power to elect majority of directors; Rob and Richard Sands currently sit on Board Representation ï,§ Will the Sands remain on the Board, and with what ongoing commitments to be renominated? ï,§ Will the Sands maintain their titles as Executive Chair and Executive Vice Chair? Executive Roles ï,§ Same level of day-to-day influence? Compensation? Other Rights / ï,§ Will the Sands demand registration rights for the newly converted Class A shares? Obligationsï,§ Many precedents include a standstill agreement, which have ownership caps among other provisions Consideration ï,§ Would the Sands accept a premium paid in cash? Current proposal implies all-stock Mixï,§ How does the Proposal fit into the Companys capital allocation strategy? ï,§ Class A holders entitled to receive dividends at least 10% greater than dividends paid to Class B Dividends ï,§ Key dividend considerations in a declassification? Other ï,§ Are there other shareholder friendly governance changes that could be packaged together to help Governance create support for any premium paid? Changes 4

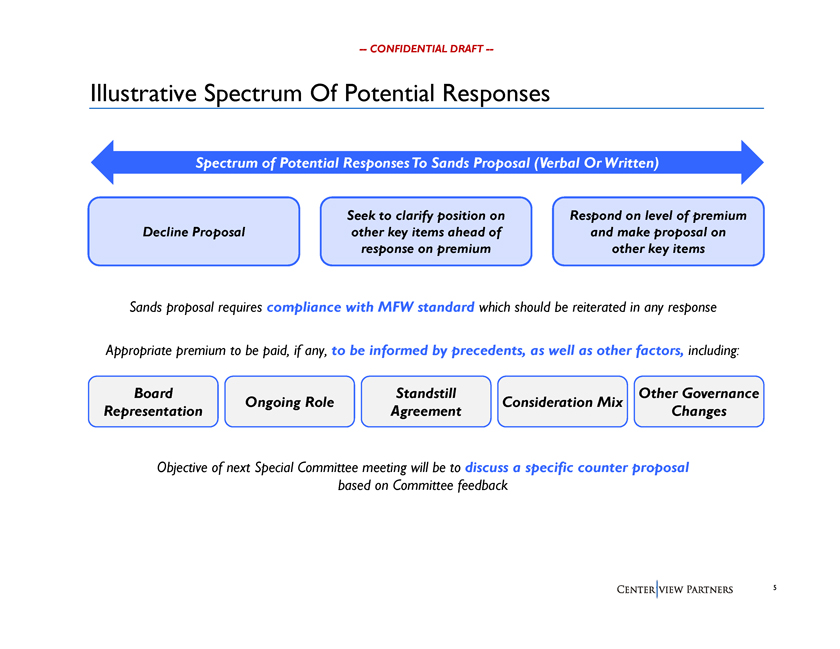

CONFIDENTIAL DRAFT Illustrative Spectrum Of Potential Responses Spectrum of Potential Responses To Sands Proposal (Verbal Or Written) Seek to clarify position on Respond on level of premium Decline Proposal other key items ahead of and make proposal on response on premium other key items Sands proposal requires compliance with MFW standard which should be reiterated in any response Appropriate premium to be paid, if any, to be informed by precedents, as well as other factors, including: Board Standstill Other Governance Ongoing Role Consideration Mix Representation Agreement Changes Objective of next Special Committee meeting will be to discuss a specific counter proposal based on Committee feedback 5

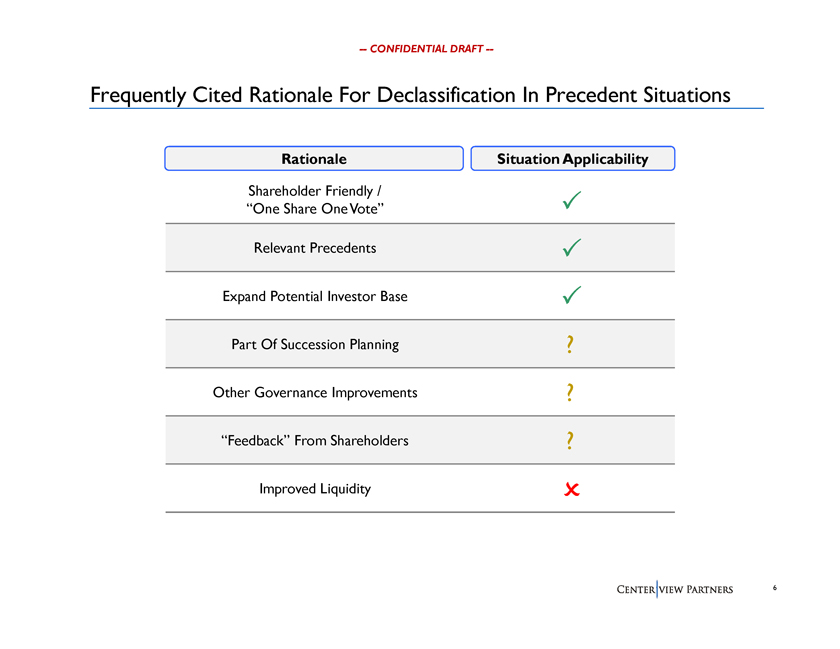

CONFIDENTIAL DRAFT Frequently Cited Rationale For Declassification In Precedent Situations Rationale Situation Applicability Shareholder Friendly / One Share One Vote Relevant Precedents Expand Potential Investor Base Part Of Succession Planning ? Other Governance Improvements ? Feedback From Shareholders ? Improved Liquidity

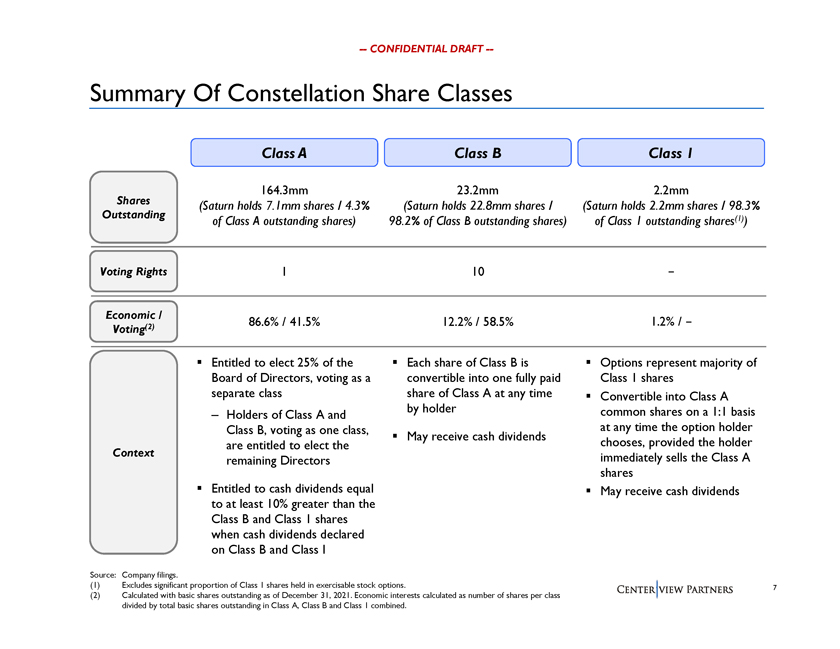

CONFIDENTIAL DRAFT Summary Of Constellation Share Classes Class A Class B Class 1 164.3mm 23.2mm 2.2mm Shares (Saturn holds 7.1mm shares / 4.3% (Saturn holds 22.8mm shares / (Saturn holds 2.2mm shares / 98.3% Outstanding (1) of Class A outstanding shares) 98.2% of Class B outstanding shares) of Class 1 outstanding shares ) Voting Rights 110 Economic / (2) 86.6% / 41.5% 12.2% / 58.5% 1.2% / Voting Entitled to elect 25% of the Each share of Class B is Options represent majority of Board of Directors, voting as a convertible into one fully paid Class 1 shares separate class share of Class A at any time Convertible into Class A by holder common shares on a 1:1 basis Holders of Class A and at any time the option holder Class B, voting as one class, May receive cash dividends chooses, provided the holder are entitled to elect the Context immediately sells the Class A remaining Directors shares Entitled to cash dividends equal May receive cash dividends to at least 10% greater than the Class B and Class 1 shares when cash dividends declared on Class B and Class I Source: Company filings. (1) Excludes significant proportion of Class 1 shares held in exercisable stock options. 7 (2) Calculated with basic shares outstanding as of December 31, 2021. Economic interests calculated as number of shares per class divided by total basic shares outstanding in Class A, Class B and Class 1 combined.

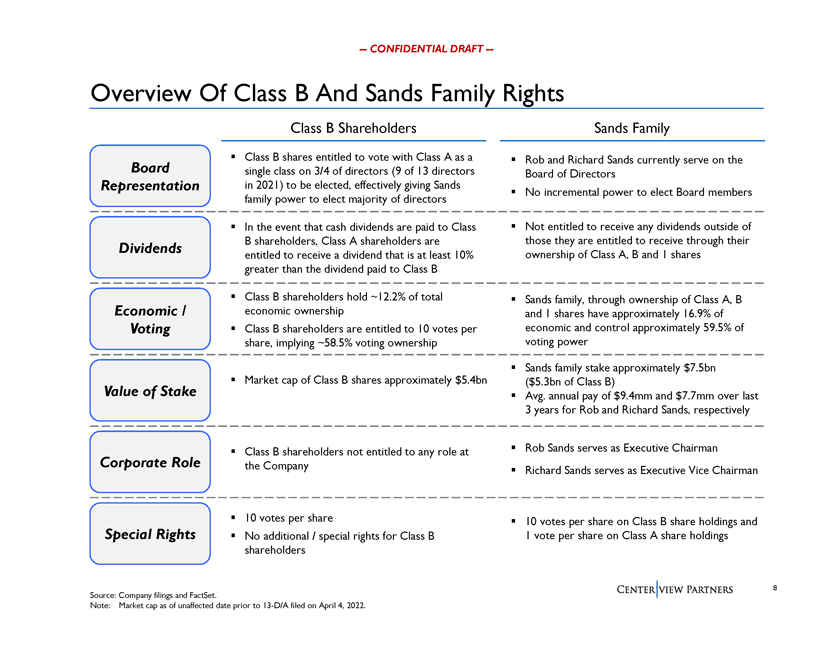

CONFIDENTIAL DRAFT Overview Of Class B And Sands Family Rights Class B Shareholders Sands Family Class B shares entitled to vote with Class A as a Rob and Richard Sands currently serve on the Board single class on 3/4 of directors (9 of 13 directors Board of Directors Representation in 2021) to be elected, effectively giving Sands No incremental power to elect Board members family power to elect majority of directors In the event that cash dividends are paid to Class Not entitled to receive any dividends outside of B shareholders, Class A shareholders are those they are entitled to receive through their Dividends entitled to receive a dividend that is at least 10% ownership of Class A, B and 1 shares greater than the dividend paid to Class B Class B shareholders hold ~12.2% of total Sands family, through ownership of Class A, B Economic / economic ownership and 1 shares have approximately 16.9% of Voting Class B shareholders are entitled to 10 votes per economic and control approximately 59.5% of share, implying ~58.5% voting ownership voting power Sands family stake approximately $7.5bn Market cap of Class B shares approximately $5.4bn ($5.3bn of Class B) Value of Stake Avg. annual pay of $9.4mm and $7.7mm over last 3 years for Rob and Richard Sands, respectively Class B shareholders not entitled to any role at Rob Sands serves as Executive Chairman Corporate Role the Company Richard Sands serves as Executive Vice Chairman 10 votes per share 10 votes per share on Class B share holdings and Special Rights No additional / special rights for Class B 1 vote per share on Class A share holdings shareholders Source: Company filings and FactSet. 8 Note: Market cap as of unaffected date prior to 13-D/A filed on April 4, 2022.

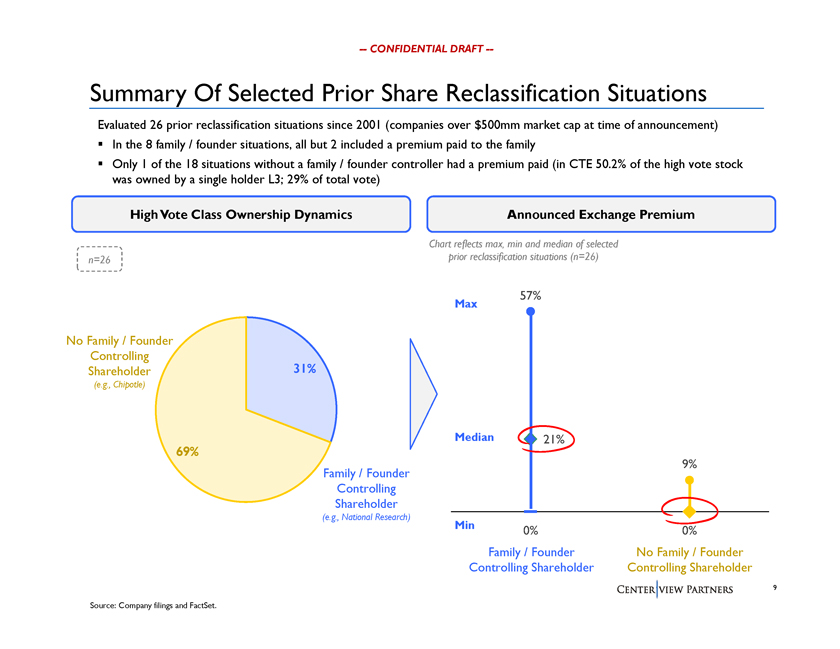

CONFIDENTIAL DRAFT Summary Of Selected Prior Share Reclassification Situations Evaluated 26 prior reclassification situations since 2001 (companies over $500mm market cap at time of announcement)ï,§ In the 8 family / founder situations, all but 2 included a premium paid to the familyï,§ Only 1 of the 18 situations without a family / founder controller had a premium paid (in CTE 50.2% of the high vote stock was owned by a single holder L3; 29% of total vote) High Vote Class Ownership Dynamics Announced Exchange Premium Chart reflects max, min and median of selected n=26 prior reclassification situations (n=26) 57% Max No Family / Founder Controlling Shareholder 31% (e.g., Chipotle) Median 21% 69% 9% Family / Founder Controlling Shareholder (e.g., National Research) Min 0% 0% Family / Founder No Family / Founder Controlling Shareholder Controlling Shareholder 9 Source: Company filings and FactSet.

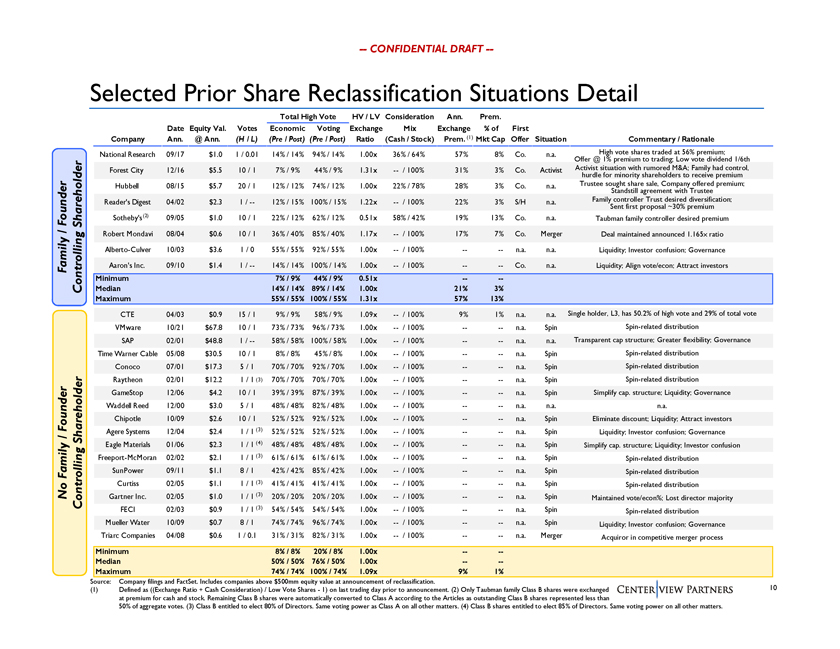

CONFIDENTIAL DRAFT Selected Prior Share Reclassification Situations Detail Total High Vote HV / LV Consideration Ann. Prem. Date Equity Val. Votes Economic Voting Exchange Mix Exchange % of First Company Ann. @ Ann. (H / L) (Pre / Post) (Pre / Post) Ratio (Cash / Stock) Prem.(1) Mkt Cap Offer Situation Commentary / Rationale National Research 09/17 $1.0 1 / 0.01 14% / 14% 94% / 14% 1.00x 36% / 64% 57% 8% Co. n.a. Offer @High 1% premium vote shares to trading; traded at Low 56% vote premium; dividend 1/6th Forest City 12/16 $5.5 10 / 1 7% / 9% 44% / 9% 1.31x / 100% 31% 3% Co. Activist Activist hurdlesituation for minority with shareholders rumored M&A; to Family receive had premium control, Hubbell 08/15 $5.7 20 / 1 12% / 12% 74% / 12% 1.00x 22% / 78% 28% 3% Co. n.a. Trustee sought share sale, Company offered premium; Standstill agreement with Trustee Readers Digest 04/02 $2.3 1 / 12% / 15% 100% / 15% 1.22x / 100% 22% 3% S/H n.a. FamilySent controller first proposal Trust desired ~30% premium diversification; Founder Shareholder Sothebys(2) 09/05 $1.0 10 / 1 22% / 12% 62% / 12% 0.51x 58% / 42% 19% 13% Co. n.a. Taubman family controller desired premium / Robert Mondavi 08/04 $0.6 10 / 1 36% / 40% 85% / 40% 1.17x / 100% 17% 7% Co. Merger Deal maintained announced 1.165x ratio Alberto-Culver 10/03 $3.6 1 / 0 55% / 55% 92% / 55% 1.00x / 100% -- n.a. n.a. Liquidity; Investor confusion; Governance Family Aarons Inc. 09/10 $1.4 1 / 14% / 14% 100% / 14% 1.00x / 100% -- Co. n.a. Liquidity; Align vote/econ; Attract investors Minimum 7% / 9% 44% / 9% 0.51x --Controlling Median 14% / 14% 89% / 14% 1.00x 21% 3% Maximum 55% / 55% 100% / 55% 1.31x 57% 13% CTE 04/03 $0.9 15 / 1 9% / 9% 58% / 9% 1.09x / 100% 9% 1% n.a. n.a. Single holder, L3, has 50.2% of high vote and 29% of total vote VMware 10/21 $67.8 10 / 1 73% / 73% 96% / 73% 1.00x / 100% -- n.a. Spin Spin-related distribution SAP 02/01 $48.8 1 / 58% / 58% 100% / 58% 1.00x / 100% -- n.a. n.a. Transparent cap structure; Greater flexibility; Governance Time Warner Cable 05/08 $30.5 10 / 1 8% / 8% 45% / 8% 1.00x / 100% -- n.a. Spin Spin-related distribution Conoco 07/01 $17.3 5 / 1 70% / 70% 92% / 70% 1.00x / 100% -- n.a. Spin Spin-related distribution Raytheon 02/01 $12.2 1 / 1 (3) 70% / 70% 70% / 70% 1.00x / 100% -- n.a. Spin Spin-related distribution GameStop 12/06 $4.2 10 / 1 39% / 39% 87% / 39% 1.00x / 100% -- n.a. Spin Simplify cap. structure; Liquidity; Governance Waddell Reed 12/00 $3.0 5 / 1 48% / 48% 82% / 48% 1.00x / 100% -- n.a. n.a. n.a. Chipotle 10/09 $2.6 10 / 1 52% / 52% 92% / 52% 1.00x / 100% -- n.a. Spin Eliminate discount; Liquidity; Attract investors Founder Agere Systems 12/04 $2.4 1 / 1 (3) 52% / 52% 52% / 52% 1.00x / 100% -- n.a. Spin Liquidity; Investor confusion; Governance / Shareholder (4) Eagle Materials 01/06 $2.3 1 / 1 48% / 48% 48% / 48% 1.00x / 100% -- n.a. Spin Simplify cap. structure; Liquidity; Investor confusion Freeport-McMoran 02/02 $2.1 1 / 1 (3) 61% / 61% 61% / 61% 1.00x / 100% -- n.a. Spin Spin-related distribution Family SunPower 09/11 $1.1 8 / 1 42% / 42% 85% / 42% 1.00x / 100% -- n.a. Spin Spin-related distribution Curtiss 02/05 $1.1 1 / 1 (3) 41% / 41% 41% / 41% 1.00x / 100% -- n.a. Spin Spin-related distribution No Gartner Inc. 02/05 $1.0 1 / 1 (3) 20% / 20% 20% / 20% 1.00x / 100% -- n.a. Spin Maintained vote/econ%; Lost director majority Controlling FECI 02/03 $0.9 1 / 1 (3) 54% / 54% 54% / 54% 1.00x / 100% -- n.a. Spin Spin-related distribution Mueller Water 10/09 $0.7 8 / 1 74% / 74% 96% / 74% 1.00x / 100% -- n.a. Spin Liquidity; Investor confusion; Governance Triarc Companies 04/08 $0.6 1 / 0.1 31% / 31% 82% / 31% 1.00x / 100% -- n.a. Merger Acquiror in competitive merger process Minimum 8% / 8% 20% / 8% 1.00x --Median 50% / 50% 76% / 50% 1.00x --Maximum 74% / 74% 100% / 74% 1.09x 9% 1% Source: Company filings and FactSet. Includes companies above $500mm equity value at announcement of reclassification. 10 (1) Defined as ((Exchange Ratio + Cash Consideration) / Low Vote Shares1) on last trading day prior to announcement. (2) Only Taubman family Class B shares were exchanged at premium for cash and stock. Remaining Class B shares were automatically converted to Class A according to the Articles as outstanding Class B shares represented less than 50% of aggregate votes. (3) Class B entitled to elect 80% of Directors. Same voting power as Class A on all other matters. (4) Class B shares entitled to elect 85% of Directors. Same voting power on all other matters.

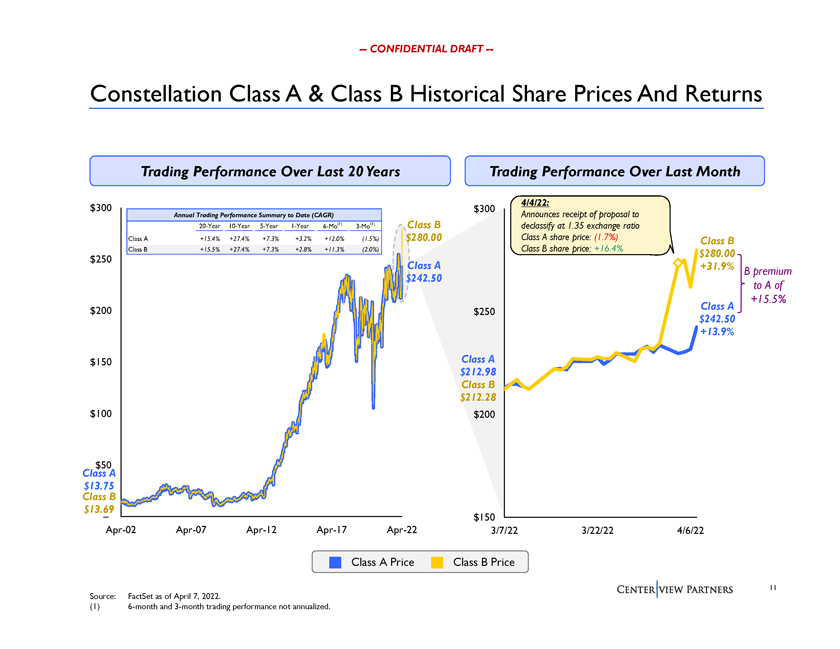

CONFIDENTIAL DRAFT Constellation Class A & Class B Historical Share Prices And Returns Trading Performance Over Last 20 Years Trading Performance Over Last Month $300 4/4/22: $300 Annual Trading Performance Summary to Date (CAGR) Announces receipt of proposal to 20-Year 10-Year 5-Year 1-Year 6-Mo(1) 3-Mo(1) Class B declassify at 1.35 exchange ratio Class A +15.4% +27.4% +7.3% +3.2% +12.0% (1.5%) $280.00 Class A share price: (1.7%) Class B Class B +15.5% +27.4% +7.3% +2.8% +11.3% (2.0%) Class B share price: +16.4% $280.00 $250 Class A +31.9% B premium $242.50 to A of +15.5% $200 Class A $250 $242.50 +13.9% $150 Class A $212.98 Class B $212.28 $100 $200 $50 Class A $13.75 Class B $13.69 $150 Apr-02 Apr-07 Apr-12 Apr-17 Apr-22 3/7/22 3/22/22 4/6/22 Class A Price Class B Price 11 Source: FactSet as of April 7, 2022. (1) 6-month and 3-month trading performance not annualized.

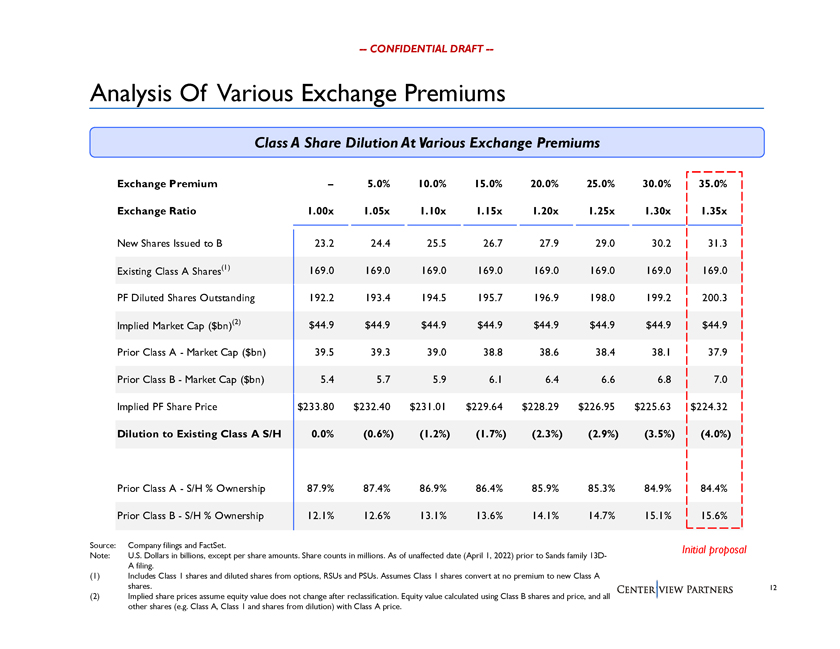

CONFIDENTIAL DRAFT Analysis Of Various Exchange Premiums Class A Share Dilution At Various Exchange Premiums Exchange Premium 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% Exchange Ratio 1.00x 1.05x 1.10x 1.15x 1.20x 1.25x 1.30x 1.35x New Shares Issued to B 23.2 24.4 25.5 26.7 27.9 29.0 30.2 31.3 Existing Class A Shares(1) 169.0 169.0 169.0 169.0 169.0 169.0 169.0 169.0 PF Diluted Shares Outstanding 192.2 193.4 194.5 195.7 196.9 198.0 199.2 200.3 Implied Market Cap ($bn)(2) $44.9 $44.9 $44.9 $44.9 $44.9 $44.9 $44.9 $44.9 Prior Class AMarket Cap ($bn) 39.5 39.3 39.0 38.8 38.6 38.4 38.1 37.9 Prior Class BMarket Cap ($bn) 5.4 5.7 5.9 6.1 6.4 6.6 6.8 7.0 Implied PF Share Price $233.80 $232.40 $231.01 $229.64 $228.29 $226.95 $225.63 $224.32 Dilution to Existing Class A S/H 0.0% (0.6%) (1.2%) (1.7%) (2.3%) (2.9%) (3.5%) (4.0%) Prior Class AS/H % Ownership 87.9% 87.4% 86.9% 86.4% 85.9% 85.3% 84.9% 84.4% Prior Class BS/H % Ownership 12.1% 12.6% 13.1% 13.6% 14.1% 14.7% 15.1% 15.6% Source: Company filings and FactSet. Initial proposal Note: U.S. Dollars in billions, except per share amounts. Share counts in millions. As of unaffected date (April 1, 2022) prior to Sands family 13D-A filing. (1) Includes Class 1 shares and diluted shares from options, RSUs and PSUs. Assumes Class 1 shares convert at no premium to new Class A shares. 12 (2) Implied share prices assume equity value does not change after reclassification. Equity value calculated using Class B shares and price, and all other shares (e.g. Class A, Class 1 and shares from dilution) with Class A price.

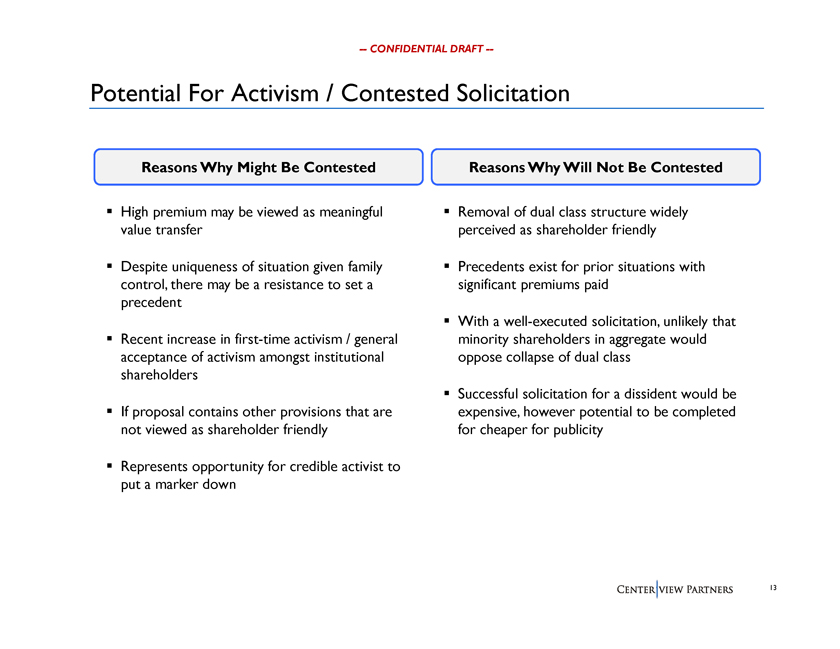

CONFIDENTIAL DRAFT Potential For Activism / Contested Solicitation Reasons Why Might Be Contested Reasons Why Will Not Be Contested ï,§ High premium may be viewed as meaningful ï,§ Removal of dual class structure widely value transfer perceived as shareholder friendly ï,§ Despite uniqueness of situation given family ï,§ Precedents exist for prior situations with control, there may be a resistance to set a significant premiums paid precedentï,§ With a well-executed solicitation, unlikely that ï,§ Recent increase in first-time activism / general minority shareholders in aggregate would acceptance of activism amongst institutional oppose collapse of dual class shareholdersï,§ Successful solicitation for a dissident would be ï,§ If proposal contains other provisions that are expensive, however potential to be completed not viewed as shareholder friendly for cheaper for publicity ï,§ Represents opportunity for credible activist to put a marker down