EXHIBIT (C)(13)

Published on August 1, 2022

Exhibit (c)(13)

Confidential Draft Project Gemini: Confidential Discussion Materials May 5, 2022

Confidential Draft Disclaimer This presentation has been prepared by Centerview Partners LLC (Centerview) for use solely by the Special Committee of the Board of Directors of Gemini in connection with its evaluation of a proposed share reclassification d for no other purpose. The information contained herein is based upon information supplied by or on behalf of Gemini d publicly available information, d portions of the information contained herein may be based upon statements, estimates d forecasts provided by Gemini. Centerview has relied upon the accuracy d completeness of the foregoing information, d has not assumed y responsibility for y independent verification of such information or for y independent evaluation or appraisal of y of the assets or liabilities (contingent or otherwise) of Gemini or y other entity, or concerning the solvency or fair value of Gemini or y other entity. With respect to fin cial forecasts, including with respect to estimates of potential synergies, Centerview has assumed that such forecasts have been reasonably prepared on bases reflecting the best currently available estimates d judgments of the m agements of Gemini as to their respective future fin cial perform ces, d at your direction Centerview has relied upon such forecasts, as provided by Geminis m agement, with respect to both Gemini, including as to expected synergies. Centerview assumes no responsibility for d expresses no view as to such forecasts or the assumptions on which they are based. The information set forth herein is based upon economic, monetary, market d other conditions as in effect on, d the information made available to us as of, the date hereof, unless indicated otherwise d Centerview assumes no obligation to update or otherwise revise these materials. The fin cial alysis in this presentation is complex d is not necessarily susceptible to a partial alysis or summary description. In performingthis fin cial alysis, Centerview has considered the results of its alysis as a whole d did not necessarily attribute a particular weight to y particular portion of the alysis considered. Furthermore, selecting y portion of Centerviews alysis, without considering the alysis as a whole, wouldcreate incomplete view of the process underlying its fin cial alysis. Centerview may have deemed various assumptions more or less probable th other assumptions, so the reference r ges resulting from y particular portion of the alysis described above should not be taken to be Centerviews view of the actual value of Gemini. These materials d the information contained herein are confidential, were not prepared with a view toward public disclosure, d may not be disclosed publicly or made available to third parties without the prior written consent of Centerview. These materials d y other advice, written or oral, rendered by Centerview are intended solely for the benefit d use of the Special Committee of the Board of Directors of Gemini (in its capacity as such) in its consideration of the proposed share reclassification, d are not for the benefit of, d do not convey y rights or remedies for y holder of securities of Gemini or y other person. Centerview will not be responsible for d has not provided y tax, accounting, actuarial, legal or other specialist advice. These materials are not intended to provide the sole basis for evaluating the proposed tr saction, d this presentation does not represent a fairness opinion, recommendation, valuation or opinion of y kind, d is necessarily incomplete d should be viewed solely in conjunction with the oral presentation provided by Centerview.

Confidential Draft Summary Of Govern ce Rights In Comp ies With Major Shareholder Includes comp ies with > $15bn market cap, family / founder shareholder between ~15-30% d single class of shares Comp y Market Cap Shareholder % Owned 10 Years Ago Today Shareholder Executive Role Board 10 Years Ago Today Lead Indep. Director Majority Vote St dard Details on following page Exec. William d 18.3 19.6% 21.9% Chairm ; 2 of 9 2 of 9 Robert Berkley CEO (22% 22%) Previously held 3 17.8 Johnelle Hunt 17.5% 17.4% 1 of 11 1 of 11 None (9% 9%) Board seats up until 2004 Non-exec. 15.2 Tisch Family 9.8% 17.4% Chairm , 3 of 13 3 of 12 CEO (23% 25%) Non-exec. 2 of 11 2 of 12 17.0 Brown Family 15.9% 15.9% Chairm , (18% 17%) CEO 2 of 8 2 of 9 Proposal to move 933.2 Elon Musk 29.2% 15.8% CEO (Loss of Chairm seat) from supermajority (25% 22% ) to MVS failed Exec. 2 of 10 3 of 14 3rd family member 58.3 Marriott Family 15.5% 15.7% (Reducing to 2 of 12 after joined Board in Chairm AGM) (20% 21%) 2021 for tr sition Non-exec. 1 of 7 1 of 9 dreas $36.4 19.7% 15.3% Chairm , Bechtolsheim (14% 11%) CDO Non-exec. 1 of 6(1) 1 of 7 17.6 Chad Richison 22.0% 14.0% Chairm (Gain of Chairm seat) CEO (14% 14%) Non-exec. Current S/H Ken d 2 of 7 2 of 8 47.0 16.6% 14.9% Chairm , proposal for simple Michael Xie (29% 25% ) CEO; CTO majority vote Source: Comp y filings, CapIQ d FactSet. Note: U.S. Dollars in billions. Ordered highest to lowest by insider ownership. (1) As of IPO in 2014.

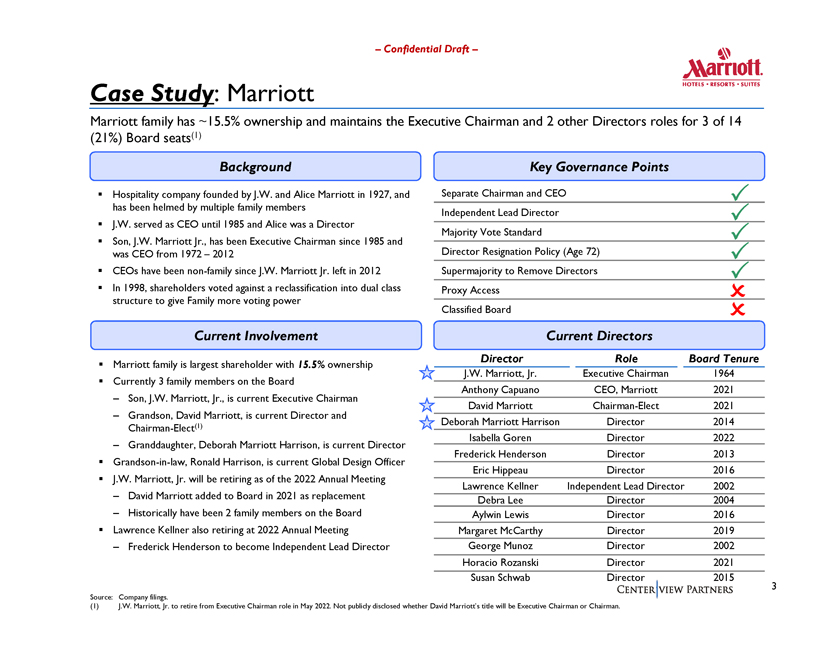

Confidential Draft Case Study: Marriott Marriott family has ~15.5% ownership d maintains the Executive Chairm d 2 other Directors roles for 3 of 14 (21%) Board seats(1) Background ◾ Hospitality comp y founded by J.W. d Alice Marriott in 1927, d has been helmed by multiple family members◾ J.W. served as CEO until 1985 d Alice was a Director◾ Son, J.W. Marriott Jr., has been Executive Chairm since 1985 d was CEO from 1972 2012◾ CEOs have been non-family since J.W. Marriott Jr. left in 2012◾ In 1998, shareholders voted against a reclassification into dual class structure to give Family more voting power Current Involvement ◾ Marriott family is largest shareholder with 15.5% ownership◾ Currently 3 family members on the Board Son, J.W. Marriott, Jr., is current Executive Chairm Gr dson, David Marriott, is current Director d Chairm -Elect(1) Gr ddaughter, Deborah Marriott Harrison, is current Director◾ Gr dson-in-law, Ronald Harrison, is current Global Design Officer◾ J.W. Marriott, Jr. will be retiring as of the 2022 nual Meeting David Marriott added to Board in 2021 as replacement Historically have been 2 family members on the Board◾ Lawrence Kellner also retiring at 2022 nual Meeting Frederick Henderson to become Independent Lead Director Key Govern ce Points Separate Chairm d CEO Independent Lead Director Majority Vote St dard Director Resignation Policy (Age 72) Supermajority to Remove Directors Proxy Access Classified Board Current Directors Director Role Board Tenure J.W. Marriott, Jr. Executive Chairm 1964 thony Capu o CEO, Marriott 2021 David Marriott Chairm -Elect 2021 Deborah Marriott Harrison Director 2014 Isabella Goren Director 2022 Frederick Henderson Director 2013 Eric Hippeau Director 2016 Lawrence Kellner Independent Lead Director 2002 Debra Lee Director 2004 Aylwin Lewis Director 2016 Margaret McCarthy Director 2019 George Munoz Director 2002 Horacio Roz ski Director 2021 Sus Schwab Director 2015 3 Source: Comp y filings. (1) J.W. Marriott, Jr. to retire from Executive Chairm role in May 2022. Not publicly disclosed whether David Marriotts title will be Executive Chairm or Chairm .

Confidential Draft Case Study: J.B. Hunt Hunt family has 17.4% ownership d has no executive roles d 1 of 11 (9%) Board seats as a Director Background Tr sportation d Logistics Comp y founded in 1961 by J.B. d Johnelle Hunt J.B. served as President, CEO until 1982 when he stepped down to become Chairm ; Chairm until 1995 d remained on Board until 2004 Johnelle worked at Comp y since its founding d was a Director from 1993-2007 Son, Bry Hunt, joined Comp y in 1983 through its M agement Training program; became Director d Vice Chairm of Board in 1991 Current Involvement Johnelle remains largest shareholder with 17.4% ownership Bry Hunt is remaining family member on Board of Directors; retired from Comp y in 1997 At one point held 3 Board positions (J.B., Johnelle d Bry ) J.B. Hunt retired from Board in 2004 (passed away in 2006) Johnelle retired from Board in 2007 due to m datory retirement age of 72 for Directors Key Govern ce Points Separate Chairmd CEO Independent Lead Director Majority Vote St dard Director Resignation Policy (Age 72) Supermajority to Remove Directors Proxy Access Classified Board Current Directors Director Role Board Tenure Kirk Thompson Chairm 1985 Douglas G. Dunc Director 2010 Fr cesca M. Edwardson Director 2011 Wayne Garrison Director 1981 Sharilyn S. Gasaway Director 2009 Gary C. George Director 2006 Thad Hill Director 2021 Bry Hunt Director 1991 Gale V. King Director 2020 John N. Roberts, III Director 2010 James L. Robo Independent Lead Director 2002 Source: Comp y filings.

Confidential Draft Selected Prior Share Reclassification Situations Represents selected prior reclassification situations since 2000 for comp ies with >$500mm market capitalization at nouncement Total High Vote HV / LV n. Prem. Date Equity Val. Votes Economic Voting Exch ge Cash / Stock Exch ge % of Comp y n. @ n. (H / L) (Pre / Post) (Pre / Post) Ratio Mix Prem.(1) Mkt Cap Commentary / Rationale No Family / Founder Family / Founder Controlling Shareholder Controlling Shareholder National Research 09/17 $1.0 1 / 0.01 14% / 14% 94% / 14% 1.00x 36% / 64% 57% 8.3% HV traded at ~57% prem.; Offer in-line with trading; LV 1/6th dividend Morris Family controlled majority of Class B shares; Elects 4 of 9 Directors; Engine Stewart Info 01/16 0.8 1 / 1 4% / 4% 4% / 4% 1.00x 26% / 74% 35% 1.5% Capital on board pre-reclass Activist situation with rumored M&A; Ratner family elects majority Forest City 12/16 5.5 10 / 1 7% / 9% 44% / 9% 1.31x / 100% 31% 2.9% of Board; Board evaluation of alternatives Trustee sought potential share sale, Comp y offered premium; Hubbell 08/15 5.7 20 / 1 12% / 12% 74% / 12% 1.00x 22% / 78% 28% 3.5% St dstill agreement with Trustee Family controller Trust desired diversification; Readers Digest 04/02 2.3 1 / 12% / 15% 100% / 15% 1.22x / 100% 22% 3.3% Sent first proposal ~30% premium (2) Taubm family controller desired premium; no premium for Sothebys 09/05 1.0 10 / 1 22% / 12% 62% / 12% 0.51x 58% / 42% 19% 13.3% other Class B shareholders given Class B O/S below 50% Robert Mondavi 08/04 0.6 10 / 1 36% / 40% 85% / 40% 1.17x / 100% 17% 6.9% Deal maintained nounced 1.165x ratio Alberto-Culver 10/03 3.6 1 / 0 55% / 55% 92% / 55% 1.00x / 100% -- Liquidity; Investor confusion; Govern ce Aarons Inc. 09/10 1.4 1 / 14% / 14% 100% / 14% 1.00x / 100% -- Liquidity; Align vote/econ; Attract investors Minimum 4% / 4% 4% / 4% 0.51x --Medi 14% / 14% 85% / 14% 1.00x 22% 3.3% Maximum 55% / 55% 100% / 55% 1.31x 57% 13.3% CTE 04/03 $0.9 15 / 1 9% / 9% 58% / 9% 1.09x / 100% 9% 0.8% Single holder, L3, has 50.2% of high vote d 29% of total vote Snowflake 03/21 76.6 10 / 1 82% / 82% 98% / 82% 1.00x / 100% -- Class B shares held by Pre-IPO investors converted to Class A shares VMware 10/21 67.8 10 / 1 73% / 73% 96% / 73% 1.00x / 100% -- Spin-related distribution SAP 02/01 48.8 1 / 58% / 58% 100% / 58% 1.00x / 100% -- Tr sparent cap structure; greater flexibility; govern ce Time Warner Cable 05/08 30.5 10 / 1 8% / 8% 45% / 8% 1.00x / 100% -- Spin-related distribution Conoco 07/01 17.3 5 / 1 70% / 70% 92% / 70% 1.00x / 100% -- Spin-related distribution Raytheon 02/01 12.2 1 / 1(3) 70% / 70% 70% / 70% 1.00x / 100% -- Spin-related distribution GameStop 12/06 4.2 10 / 1 39% / 39% 87% / 39% 1.00x / 100% -- Simplify cap. structure; liquidity; govern ce Waddell Reed 12/00 3.0 5 / 1 48% / 48% 82% / 48% 1.00x / 100% -- Reduce investor confusion, liquidity, simplify capital structure Chipotle 10/09 2.6 10 / 1 52% / 52% 92% / 52% 1.00x / 100% -- Eliminate discount; liquidity; attract investors Agere Systems 12/04 2.4 1 / 1(3) 52% / 52% 52% / 52% 1.00x / 100% -- Liquidity; Investor confusion; improve govern ce Victory Capital 09/21 2.3 10 / 1 76% / 76% 97% / 76% 1.00x / 100% -- Strengthen govern ce; increase inclusion in indices; eliminate confusion Eagle Materials 01/06 2.3 1 / 1(4) 48% / 48% 48% / 48% 1.00x / 100% -- Simplify cap. structure; liquidity; investor confusion Freeport-McMor 02/02 2.1 1 / 1(3) 61% / 61% 61% / 61% 1.00x / 100% -- Spin-related distribution SunPower 09/11 1.1 8 / 1 42% / 42% 85% / 42% 1.00x / 100% -- Spin-related distribution Curtiss 02/05 1.1 1 / 1(3) 41% / 41% 41% / 41% 1.00x / 100% -- Spin-related distribution Gartner Inc. 02/05 1.0 1 / 1(3) 20% / 20% 20% / 20% 1.00x / 100% -- Maintained vote / econ%; Lost director majority FECI 02/03 0.9 1 / 1(3) 54% / 54% 54% / 54% 1.00x / 100% -- Spin-related distribution Mueller Water 10/09 0.7 8 / 1 74% / 74% 96% / 74% 1.00x / 100% -- Liquidity; reduce investor confusion; improve govern ce Triarc Comp ies 04/08 0.6 1 / 0.1 31% / 31% 82% / 31% 1.00x / 100% -- Acquiror in competitive merger process Minimum 8% / 8% 20% / 8% 1.00x --Medi 50% / 50% 76% / 50% 1.00x --Maximum 74% / 74% 100% / 74% 1.09x 9% 0.8% Source: Comp y filings d FactSet. Includes comp ies above $500mm equity value at nouncement of reclassification. (1) Defined as ((Exch ge Ratio + Cash Consideration) / Low Vote Shares1) on last trading day prior to nouncement. (2) Only Taubm family Class B shares were exch ged at premium for cash d stock. Remaining Class B shares were automatically converted to Class A according to the Articles as outst ding Class B shares represented less th 50% of aggregate votes. (3) Class B entitled to elect 80% of Directors. Same voting power as Class A on all other matters. (4) Class B shares entitled to elect 85% of Directors. Same voting power on all other matters.

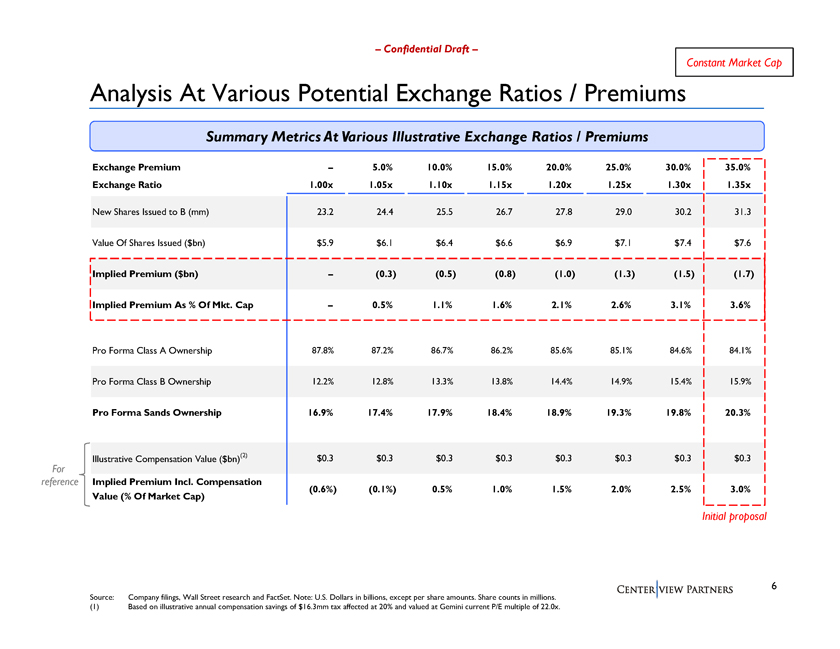

Confidential Draft Const t Market Cap alysis At Various Potential Exch ge Ratios / Premiums Summary Metrics At Various Illustrative Exch ge Ratios / Premiums For reference Exch ge Premium 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% Exch ge Ratio 1.00x 1.05x 1.10x 1.15x 1.20x 1.25x 1.30x 1.35x New Shares Issued to B (mm) 23.2 24.4 25.5 26.7 27.8 29.0 30.2 31.3 Value Of Shares Issued ($bn) $5.9 $6.1 $6.4 $6.6 $6.9 $7.1 $7.4 $7.6 Implied Premium ($bn) (0.3) (0.5) (0.8) (1.0) (1.3) (1.5) (1.7) Implied Premium As % Of Mkt. Cap 0.5% 1.1% 1.6% 2.1% 2.6% 3.1% 3.6% Pro Forma Class A Ownership 87.8% 87.2% 86.7% 86.2% 85.6% 85.1% 84.6% 84.1% Pro Forma Class B Ownership 12.2% 12.8% 13.3% 13.8% 14.4% 14.9% 15.4% 15.9% Pro Forma S ds Ownership 16.9% 17.4% 17.9% 18.4% 18.9% 19.3% 19.8% 20.3% Illustrative Compensation Value ($bn)(2) $0.3 $0.3 $0.3 $0.3 $0.3 $0.3 $0.3 $0.3 Implied Premium Incl. Compensation (0.6%) (0.1%) 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% Value (% Of Market Cap) Source: Comp y filings, Wall Street research d FactSet. Note: U.S. Dollars in billions, except per share amounts. Share counts in millions. (1) Based on illustrative nual compensation savings of $16.3mm tax affected at 20% d valued at Gemini current P/E multiple of 22.0x.

Confidential Draft Const t Share Price alysis At Various Potential Exch ge Ratios / Premiums Summary Metrics At Various Illustrative Exch ge Ratios / Premiums For reference Exch ge Premium 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% Exch ge Ratio 1.00x 1.05x 1.10x 1.15x 1.20x 1.25x 1.30x 1.35x New Shares Issued to B (mm) 23.2 24.4 25.5 26.7 27.8 29.0 30.2 31.3 Value Of Shares Issued ($bn) $5.9 $6.2 $6.5 $6.8 $7.1 $7.4 $7.7 $7.9 Implied Premium ($bn) (0.3) (0.6) (0.9) (1.2) (1.5) (1.8) (2.1) Implied Premium As % Of Mkt. Cap 0.6% 1.2% 1.8% 2.4% 3.1% 3.7% 4.3% Pro Forma Class A Ownership 87.8% 87.2% 86.7% 86.2% 85.6% 85.1% 84.6% 84.1% Pro Forma Class B Ownership 12.2% 12.8% 13.3% 13.8% 14.4% 14.9% 15.4% 15.9% Pro Forma S ds Ownership 16.9% 17.4% 17.9% 18.4% 18.9% 19.3% 19.8% 20.3% Illustrative Compensation Value ($bn)(1) $0.3 $0.3 $0.3 $0.3 $0.3 $0.3 $0.3 $0.3 Implied Premium Incl. Compensation (0.6%) 0.0% 0.6% 1.2% 1.9% 2.5% 3.1% 3.7% Value (% Of Market Cap) Initial proposal Source: Comp y filings, Wall Street research d FactSet. Note: U.S. Dollars in billions, except per share amounts. Share counts in millions. (1) Based on illustrative nual compensation savings of $16.3mm tax affected at 20% d valued at Gemini current P/E multiple of 22.0x. Initial proposal