EXHIBIT (C)(25)

Published on August 1, 2022

Exhibit (c)(25) Declassification Transaction Precedents March 2021 CONFIDENTIAL DRAFT

Notice to Recipient Confidential “Bank of America” and “BofA Securities” are the marketing names used by the Global Banking and Global Markets divisions of Bank of America Corporation. Lending, other commercial banking activities, and trading in certain financial instruments are performed globally by banking affiliates of Bank of America Corporation, including Bank of America, N.A., Member FDIC. Trading in securities and financial instruments, and strategic advisory, and other investment banking activities, are performed globally by investment banking affiliates of Bank of America Corporation (“Investment Banking Affiliates”), including, in the United States, BofA Securities, Inc. and Merrill Lynch Professional Clearing Corp., both of which are registered broker-dealers and Members of SIPC, and, in other jurisdictions, by locally registered entities. BofA Securities, Inc. and Merrill Lynch Professional Clearing Corp. are registered as futures commission merchants with the CFTC and are members of the NFA. Bank of America and BofA Securities entities (for example Bank of America Europe Designated Activity Company and BofA Securities Europe SA) and branches provide financial services to the clients of Bank of America and BofA Securities and may outsource/delegate the marketing and/or provision of certain services or aspects of services to other branches or members of the BAC Group (for example in the UK). Your service provider will remain the entity/branch specified in your onboarding documentation and/or other contractual or marketing documentation even where you communicate with staff that operate from a different entity or branch which is acting for and on behalf of your contractual service provider in their communications with you. If you are unsure who your contractual service provider is or will be please contact your usual contact. For Bank of America or BofA Securities entities in EMEA, please see additional information via the following link: www.bofaml.com/mifid2 . Note please that BofA Securities Europe SA, with registered address at 51, rue La Boétie, 75008 Paris is registered under no. 842 602 690 RCS Paris, and its share capital can be found at https://www.bofaml.com/en-us/content/BofASE.html. Investment products offered by Investment Banking Affiliates: Are Not FDIC Insured * May Lose Value * Are Not Bank Guaranteed. These materials have been prepared by one or more subsidiaries of Bank of America Corporation for the client or potential client to whom such materials are directly addressed and delivered (the “Company”) in connection with an actual or potential mandate or engagement and may not be used or relied upon for any purpose other than as specifically contemplated by a written agreement with us. These materials are based on information provided by or on behalf of the Company and/or other potential transaction participants, from public sources or otherwise reviewed by us. We assume no responsibility for independent investigation or verification of such information (including, without limitation, data from third party suppliers) and have relied on such information being complete and accurate in all material respects. To the extent such information includes estimates and forecasts of future financial performance prepared by or reviewed with the managements of the Company and/or other potential transaction participants or obtained from public sources, we have assumed that such estimates and forecasts have been reasonably prepared on bases reflecting the best currently available estimates and judgments of such managements (or, with respect to estimates and forecasts obtained from public sources, represent reasonable estimates). No representation or warranty, express or implied, is made as to the accuracy or completeness of such information and nothing contained herein is, or shall be relied upon as, a representation, whether as to the past, the present or the future. These materials were designed for use by specific persons familiar with the business and affairs of the Company and are being furnished and should be considered only in connection with other information, oral or written, being provided by us in connection herewith. These materials are not intended to provide the sole basis for evaluating, and should not be considered a recommendation with respect to, any transaction or other matter. These materials do not constitute an offer or solicitation to sell or purchase any securities and are not a commitment by Bank of America Corporation or any of its affiliates to provide or arrange any financing for any transaction or to purchase any security in connection therewith. These materials are for discussion purposes only and are subject to our review and assessment from a legal, compliance, accounting policy and risk perspective, as appropriate, following our discussion with the Company. We assume no obligation to update or otherwise revise these materials. These materials have not been prepared with a view toward public disclosure under applicable securities laws or otherwise, are intended for the benefit and use of the Company, and may not be reproduced, disseminated, quoted or referred to, in whole or in part, without our prior written consent. These materials may not reflect information known to other professionals in other business areas of Bank of America Corporation and its affiliates. Any League Tables referenced within these materials have been prepared using data sourced from external third party providers as outlined in the relevant footnotes where applicable. For persons wishing to request further information regarding these third party providers and the criteria and methodology used to prepare a league table please contact your usual Bank of America or BofA Securities representative/Relationship Manager. Bank of America Corporation and its affiliates (collectively, the “BAC Group”) comprise a full service securities firm and commercial bank engaged in securities, commodities and derivatives trading, foreign exchange and other brokerage activities, and principal investing as well as providing investment, corporate and private banking, asset and investment management, financing and strategic advisory services and other commercial services and products to a wide range of corporations, governments and individuals, domestically and offshore, from which conflicting interests or duties, or a perception thereof, may arise. In the ordinary course of these activities, parts of the BAC Group at any time may invest on a principal basis or manage funds that invest, make or hold long or short positions, finance positions or trade or otherwise effect transactions, for their own accounts or the accounts of customers, in debt, equity or other securities or financial instruments (including derivatives, bank loans or other obligations) of the Company, potential counterparties or any other company that may be involved in a transaction. Products and services that may be referenced in the accompanying materials may be provided through one or more affiliates of Bank of America Corporation. We have adopted policies and guidelines designed to preserve the independence of our research analysts. The BAC Group prohibits employees from, directly or indirectly, offering a favorable research rating or specific price target, or offering to change a rating or price target to a subject company as consideration or inducement for the receipt of business or for compensation and the BAC Group prohibits research analysts from being directly compensated for involvement in investment banking transactions. The views expressed herein are the views solely of Global Corporate and Investment Banking, and no inference should be made that the views expressed represent the view of the firm’s research department. We are required to obtain, verify and record certain information that identifies the Company, which information includes the name and address of the Company and other information that will allow us to identify the Company in accordance, as applicable, with the USA Patriot Act (Title III of Pub. L. 107-56 (signed into law October 26, 2001)) and such other laws, rules and regulations as applicable within and outside the United States. We do not provide legal, compliance, tax or accounting advice. Accordingly, any statements contained herein as to tax matters were neither written nor intended by us to be used and cannot be used by any taxpayer for the purpose of avoiding tax penalties that may be imposed on such taxpayer. If any person uses or refers to any such tax statement in promoting, marketing or recommending a partnership or other entity, investment plan or arrangement to any taxpayer, then the statement expressed herein is being delivered to support the promotion or marketing of the transaction or matter addressed and the recipient should seek advice based on its particular circumstances from an independent tax advisor. Notwithstanding anything that may appear herein or in other materials to the contrary, the Company shall be permitted to disclose the tax treatment and tax structure of a transaction (including any materials, opinions or analyses relating to such tax treatment or tax structure, but without disclosure of identifying information or any nonpublic commercial or financial information (except to the extent any such information relates to the tax structure or tax treatment)) on and after the earliest to occur of the date of (i) public announcement of discussions relating to such transaction, (ii) public announcement of such transaction or (iii) execution of a definitive agreement (with or without conditions) to enter into such transaction; provided, however, that if such transaction is not consummated for any reason, the provisions of this sentence shall cease to apply. CONFIDENTIAL DRAFT

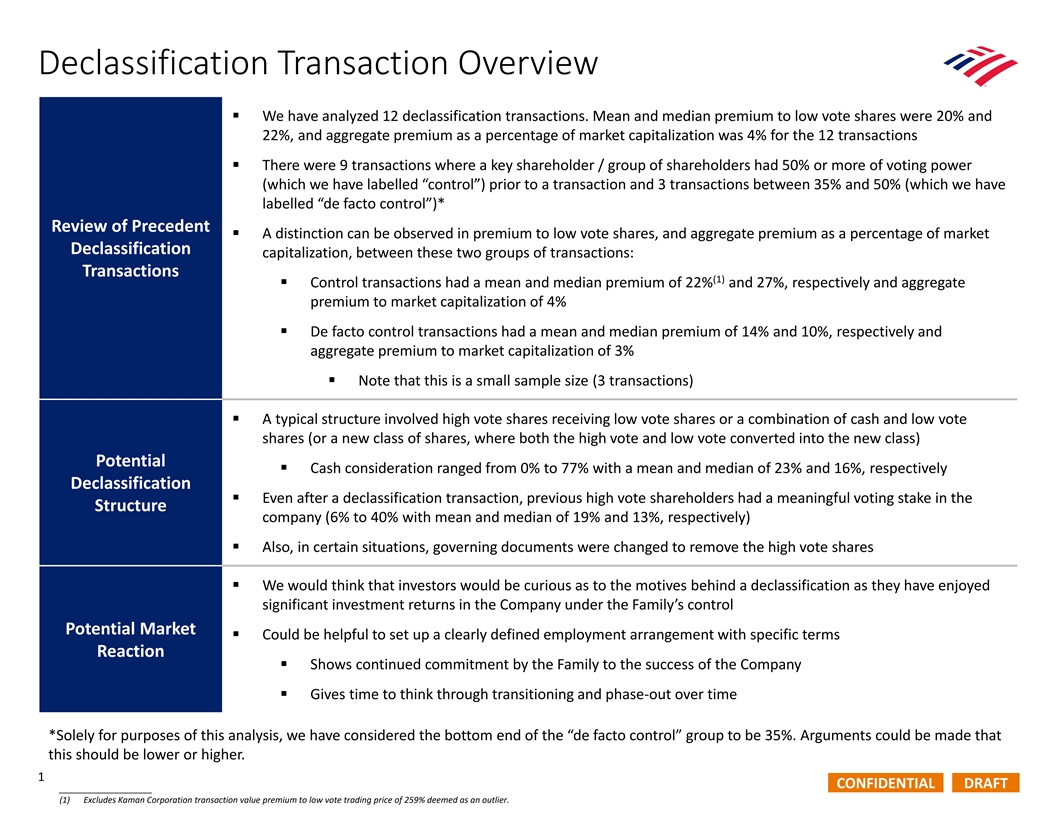

Declassification Transaction Overview § We have analyzed 12 declassification transactions. Mean and median premium to low vote shares were 20% and 22%, and aggregate premium as a percentage of market capitalization was 4% for the 12 transactions § There were 9 transactions where a key shareholder / group of shareholders had 50% or more of voting power (which we have labelled “control”) prior to a transaction and 3 transactions between 35% and 50% (which we have labelled “de facto control”)* Review of Precedent § A distinction can be observed in premium to low vote shares, and aggregate premium as a percentage of market Declassification capitalization, between these two groups of transactions: Transactions (1) § Control transactions had a mean and median premium of 22% and 27%, respectively and aggregate premium to market capitalization of 4% § De facto control transactions had a mean and median premium of 14% and 10%, respectively and aggregate premium to market capitalization of 3% § Note that this is a small sample size (3 transactions) § A typical structure involved high vote shares receiving low vote shares or a combination of cash and low vote shares (or a new class of shares, where both the high vote and low vote converted into the new class) Potential § Cash consideration ranged from 0% to 77% with a mean and median of 23% and 16%, respectively Declassification § Even after a declassification transaction, previous high vote shareholders had a meaningful voting stake in the Structure company (6% to 40% with mean and median of 19% and 13%, respectively) § Also, in certain situations, governing documents were changed to remove the high vote shares § We would think that investors would be curious as to the motives behind a declassification as they have enjoyed significant investment returns in the Company under the Family’s control Potential Market § Could be helpful to set up a clearly defined employment arrangement with specific terms Reaction § Shows continued commitment by the Family to the success of the Company § Gives time to think through transitioning and phase-out over time *Solely for purposes of this analysis, we have considered the bottom end of the “de facto control” group to be 35%. Arguments could be made that this should be lower or higher. 1 CONFIDENTIAL DRAFT ____________________ (1) Excludes Kaman Corporation transaction value premium to low vote trading price of 259% deemed as an outlier.

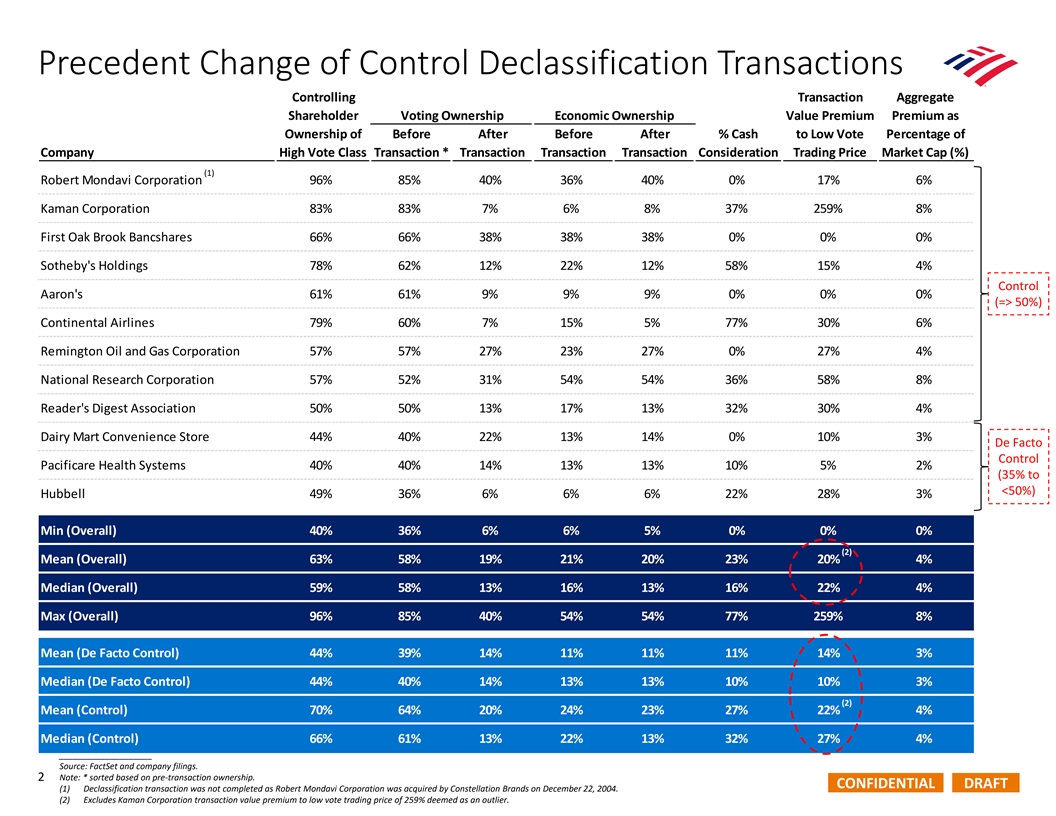

Precedent Change of Control Declassification Transactions Controlling Transaction Aggregate Shareholder Voting Ownership Economic Ownership Value Premium Premium as Ownership of Before After Before After % Cash to Low Vote Percentage of Company High Vote Class Transaction * Transaction Transaction Transaction Consideration Trading Price Market Cap (%) (1) Robert Mondavi Corporation 96% 85% 40% 36% 40% 0% 17% 6% Kaman Corporation 83% 83% 7% 6% 8% 37% 259% 8% First Oak Brook Bancshares 66% 66% 38% 38% 38% 0% 0% 0% Sotheby's Holdings 78% 62% 12% 22% 12% 58% 15% 4% Control Aaron's 61% 61% 9% 9% 9% 0% 0% 0% (=> 50%) Continental Airlines 79% 60% 7% 15% 5% 77% 30% 6% Remington Oil and Gas Corporation 57% 57% 27% 23% 27% 0% 27% 4% National Research Corporation 57% 52% 31% 54% 54% 36% 58% 8% Reader's Digest Association 50% 50% 13% 17% 13% 32% 30% 4% Dairy Mart Convenience Store 44% 40% 22% 13% 14% 0% 10% 3% De Facto Control Pacificare Health Systems 40% 40% 14% 13% 13% 10% 5% 2% (35% to <50%) Hubbell 49% 36% 6% 6% 6% 22% 28% 3% Min (Overall) 40% 36% 6% 6% 5% 0% 0% 0% (2) Mean (Overall) 63% 58% 19% 21% 20% 23% 20% 4% Median (Overall) 59% 58% 13% 16% 13% 16% 22% 4% Max (Overall) 96% 85% 40% 54% 54% 77% 259% 8% Mean (De Facto Control) 44% 39% 14% 11% 11% 11% 14% 3% Median (De Facto Control) 44% 40% 14% 13% 13% 10% 10% 3% (2) Mean (Control) 70% 64% 20% 24% 23% 27% 22% 4% Median (Control) 66% 61% 13% 22% 13% 32% 27% 4% ____________________ Source: FactSet and company filings. Note: * sorted based on pre-transaction ownership. 2 CONFIDENTIAL DRAFT (1) Declassification transaction was not completed as Robert Mondavi Corporation was acquired by Constellation Brands on December 22, 2004. (2) Excludes Kaman Corporation transaction value premium to low vote trading price of 259% deemed as an outlier.

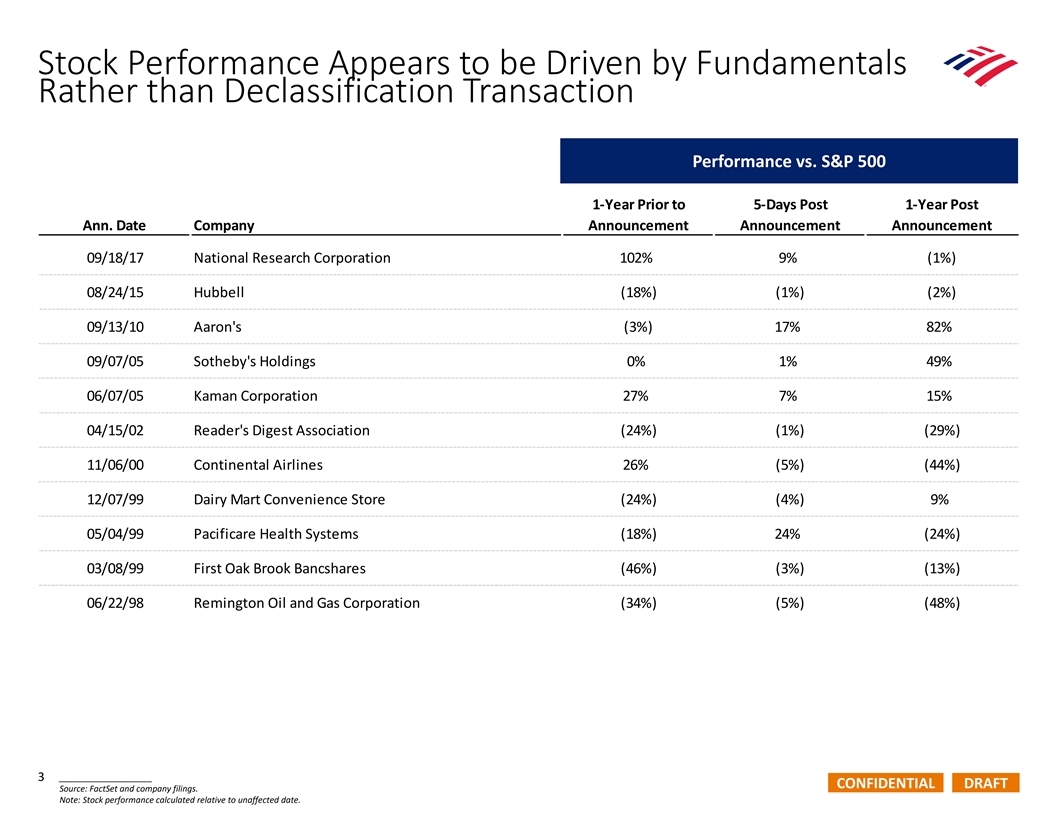

Stock Performance Appears to be Driven by Fundamentals Rather than Declassification Transaction Performance vs. S&P 500 1-Year Prior to 5-Days Post 1-Year Post Ann. Date Company Announcement Announcement Announcement 09/18/17 National Research Corporation 102% 9% (1%) 08/24/15 Hubbell (18%) (1%) (2%) 09/13/10 Aaron's (3%) 17% 82% 09/07/05 Sotheby's Holdings 0% 1% 49% 06/07/05 Kaman Corporation 27% 7% 15% 04/15/02 Reader's Digest Association (24%) (1%) (29%) 11/06/00 Continental Airlines 26% (5%) (44%) 12/07/99 Dairy Mart Convenience Store (24%) (4%) 9% 05/04/99 Pacificare Health Systems (18%) 24% (24%) 03/08/99 First Oak Brook Bancshares (46%) (3%) (13%) 06/22/98 Remington Oil and Gas Corporation (34%) (5%) (48%) ____________________ 3 CONFIDENTIAL DRAFT Source: FactSet and company filings. Note: Stock performance calculated relative to unaffected date.

Appendix

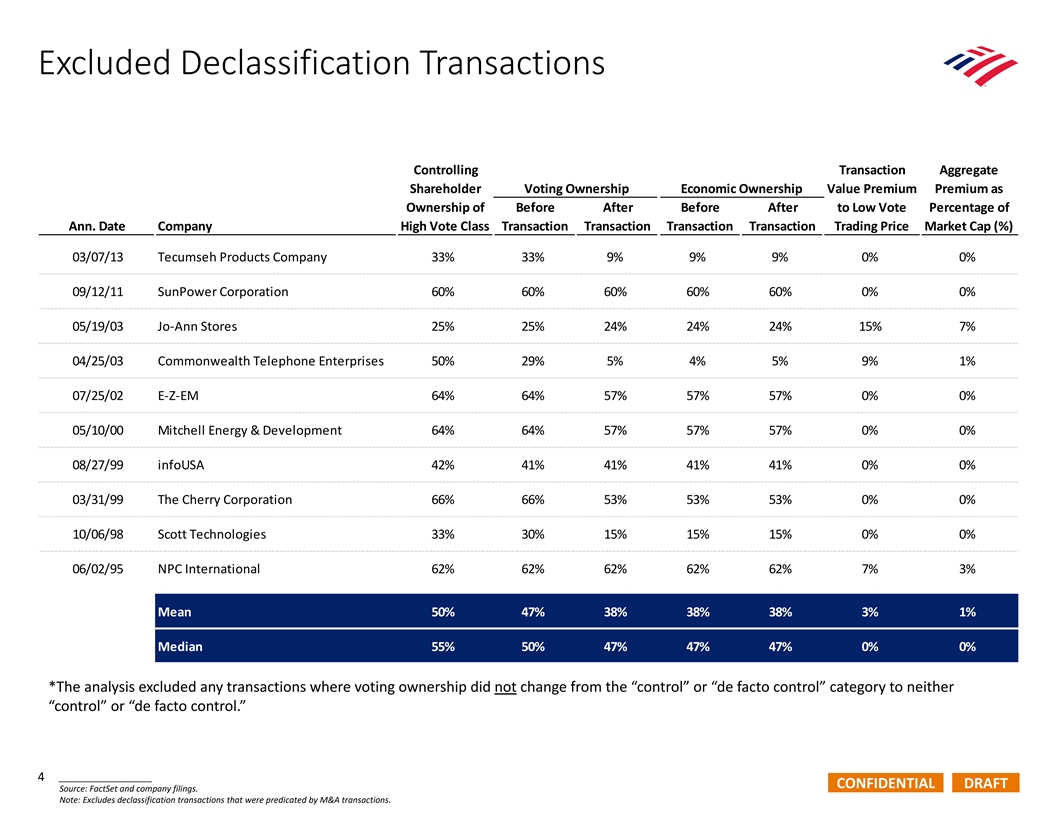

Excluded Declassification Transactions Controlling Transaction Aggregate Shareholder Voting Ownership Economic Ownership Value Premium Premium as Ownership of Before After Before After to Low Vote Percentage of Ann. Date Company High Vote Class Transaction Transaction Transaction Transaction Trading Price Market Cap (%) 03/07/13 Tecumseh Products Company 33% 33% 9% 9% 9% 0% 0% 09/12/11 SunPower Corporation 60% 60% 60% 60% 60% 0% 0% 05/19/03 Jo-Ann Stores 25% 25% 24% 24% 24% 15% 7% 04/25/03 Commonwealth Telephone Enterprises 50% 29% 5% 4% 5% 9% 1% 07/25/02 E-Z-EM 64% 64% 57% 57% 57% 0% 0% 05/10/00 Mitchell Energy & Development 64% 64% 57% 57% 57% 0% 0% 08/27/99 infoUSA 42% 41% 41% 41% 41% 0% 0% 03/31/99 The Cherry Corporation 66% 66% 53% 53% 53% 0% 0% 10/06/98 Scott Technologies 33% 30% 15% 15% 15% 0% 0% 06/02/95 NPC International 62% 62% 62% 62% 62% 7% 3% Mean 50% 47% 38% 38% 38% 3% 1% Median 55% 50% 47% 47% 47% 0% 0% *The analysis excluded any transactions where voting ownership did not change from the “control” or “de facto control” category to neither “control” or “de facto control.” ____________________ 4 CONFIDENTIAL DRAFT Source: FactSet and company filings. Note: Excludes declassification transactions that were predicated by M&A transactions.

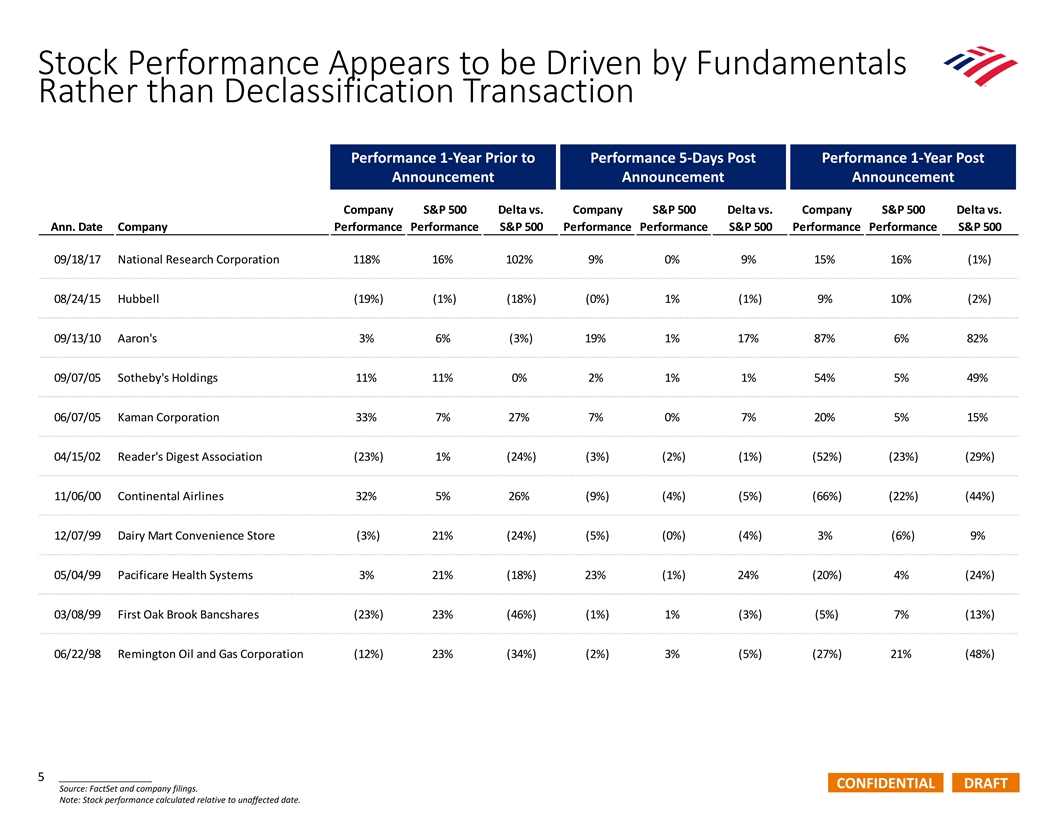

Stock Performance Appears to be Driven by Fundamentals Rather than Declassification Transaction Performance 1-Year Prior to Performance 5-Days Post Performance 1-Year Post Announcement Announcement Announcement Company S&P 500 Delta vs. Company S&P 500 Delta vs. Company S&P 500 Delta vs. Ann. Date Company Performance Performance S&P 500 Performance Performance S&P 500 Performance Performance S&P 500 09/18/17 National Research Corporation 118% 16% 102% 9% 0% 9% 15% 16% (1%) 08/24/15 Hubbell (19%) (1%) (18%) (0%) 1% (1%) 9% 10% (2%) 09/13/10 Aaron's 3% 6% (3%) 19% 1% 17% 87% 6% 82% 09/07/05 Sotheby's Holdings 11% 11% 0% 2% 1% 1% 54% 5% 49% 06/07/05 Kaman Corporation 33% 7% 27% 7% 0% 7% 20% 5% 15% 04/15/02 Reader's Digest Association (23%) 1% (24%) (3%) (2%) (1%) (52%) (23%) (29%) 11/06/00 Continental Airlines 32% 5% 26% (9%) (4%) (5%) (66%) (22%) (44%) 12/07/99 Dairy Mart Convenience Store (3%) 21% (24%) (5%) (0%) (4%) 3% (6%) 9% 05/04/99 Pacificare Health Systems 3% 21% (18%) 23% (1%) 24% (20%) 4% (24%) 03/08/99 First Oak Brook Bancshares (23%) 23% (46%) (1%) 1% (3%) (5%) 7% (13%) 06/22/98 Remington Oil and Gas Corporation (12%) 23% (34%) (2%) 3% (5%) (27%) 21% (48%) ____________________ 5 CONFIDENTIAL DRAFT Source: FactSet and company filings. Note: Stock performance calculated relative to unaffected date.