EXHIBIT (C)(22)

Published on August 1, 2022

Exhibit (c)(22)

PROJECT BEACH Discussion Materials APRIL 2022 STRICTLY PRIVATE & CONFIDENTIAL

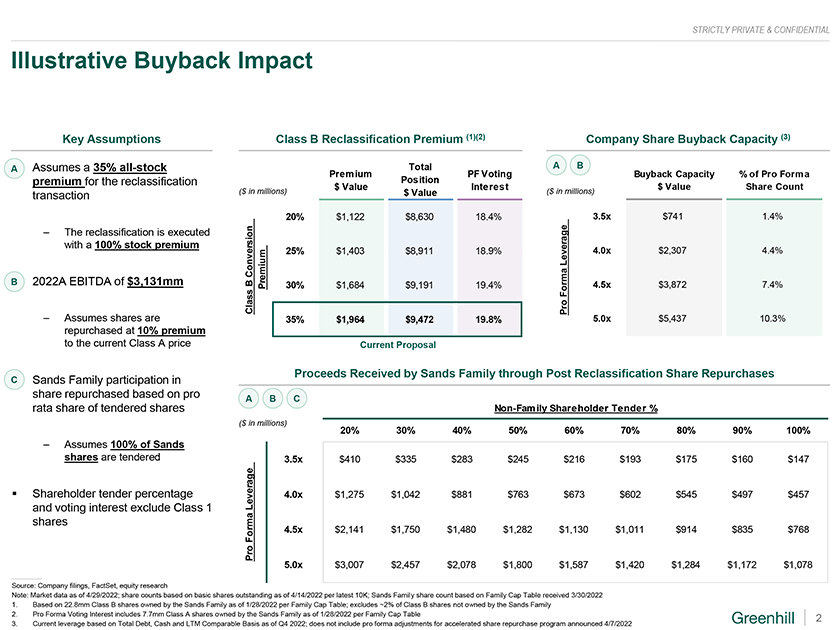

STRICTLY PRIVATE & CONFIDENTIAL Illustrative Buyback Impact Key Assumptions Class B Reclassification Premium (1)(2) Company Share Buyback Capacity (3) A Assumes a 35% all-stock Premium Total PF Voting A B Buyback Capacity % of Pro Forma premium for the reclassification Position $ Value Interest $ Value Share Count transaction ($ in millions) $ Value ($ in millions) 20% $1,122 $8,630 18.4% 3.5x $741 1.4% n The reclassification is executed o a ge with a 100% stock premium si r r e ve m 25% $1,403 $8,911 18.9% Lev 4.0x $2,307 4.4% on miu BC e ma 2022A EBITDA of $3,131mm B Pr 30% $1,684 $9,191 19.4% 4.5x $3,872 7.4% or assF o C l r P Assumes shares are 35% $1,964 $9,472 19.8% 5.0x $5,437 10.3% repurchased at 10% premium to the current Class A price Current Proposal Proceeds Received by Sands Family through Post Reclassification Share Repurchases C Sands Family participation in share repurchased based on pro A B C rata share of tendered shares Non-Family Shareholder Tender % ($ in millions) 20% 30% 40% 50% 60% 70% 80% 90% 100% Assumes 100% of Sands shares are tendered 3.5x $410 $335 $283 $245 $216 $193 $175 $160 $147 Shareholder tender percentage Leverage 4.0x $1,275 $1,042 $881 $763 $673 $602 $545 $497 $457 and voting interest exclude Class 1 shares Forma 4.5x $2,141 $1,750 $1,480 $1,282 $1,130 $1,011 $914 $835 $768 Pro 5.0x $3,007 $2,457 $2,078 $1,800 $1,587 $1,420 $1,284 $1,172 $1,078 Source: Company filings, FactSet, equity research Note: Market data as of 4/29/2022; share counts based on basic shares outstanding as of 4/14/2022 per latest 10K; Sands Family share count based on Family Cap Table received 3/30/2022 1. Based on 22.8mm Class B shares owned by the Sands Family as of 1/28/2022 per Family Cap Table; excludes ~2% of Class B shares not owned by the Sands Family 2. Pro Forma Voting Interest includes 7.7mm Class A shares owned by the Sands Family as of 1/28/2022 per Family Cap Table 2 3. Current leverage based on Total Debt, Cash and LTM Comparable Basis as of Q4 2022; does not include pro forma adjustments for accelerated share repurchase program announced 4/7/2022

STRICTLY PRIVATE & CONFIDENTIAL Disclaimer This document has been prepared by Greenhill & Co., LLC (Greenhill) exclusively for the benefit and internal use of the Wildstar Partners LLC and the Family Holders (the Recipient) solely for its use in evaluating the transaction described herein and may not be used for any other purpose or copied, distributed, reproduced, disclosed or otherwise made available to any other person without Greenhills prior written consent. This document may only be relied upon by the Recipient and no other person. Greenhill is acting solely for the Recipient in connection with any arrangements, services or transactions referred to in this document. Greenhill is not and will not be responsible to anyone other than the Recipient for providing the protections afforded to the clients of Greenhill or for providing advice in relation to the arrangements, services or transactions referred to in this document. This document is delivered subject to the terms of the engagement letter entered into between the Recipient and Greenhill. This document is delivered as at the date specified on the cover; Greenhill does not have any obligation to provide any update to or correct any inaccuracies in the information in this document. This document is private and confidential; by accepting this document, you are deemed to agree to treat it and its contents confidentially. This document does not constitute an opinion, and is not intended to be and does not constitute a recommendation to the Recipient as to whether to approve or undertake or take any other action in respect of any transactions contemplated in this document. The commercial merits or suitability or expected profitability or benefit of such transactions should be independently determined by the Recipient based on its own assessment of the legal, tax, accounting, regulatory, financial, credit and other related aspects of the transaction, relying on such information and advice from the Recipients own professional advisors and such other experts as it deems relevant. Greenhill does not provide accounting, tax, legal or regulatory advice. 3