EX-99.1

Published on August 23, 2018

STZ INVESTOR PRESENTATION Q1 FY19 August 22, 2018 Exhibit 99.1

FORWARD-LOOKING STATEMENTS This presentation contains “forward-looking information” and “forward-looking statements” (which we refer to collectively as forward-looking information) within the meaning of applicable Canadian securities legislation, and “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 (collectively referred to as “forward-looking information”). All statements, other than statements of historical fact, may be forward-looking information. Forward looking information can be identified by the use of statements that include words such as “anticipate”, “plan”, “continue” ,”estimate”, “expect”, “exceed”, “may”, “will”, “project”, “predict”, “propose”, “potential”, “targeting”, “exploring”, “scheduled”, “implementing”, “intend”, “could”, “might”, “should”, “believe” and similar words or expressions, although not all forward-looking statements contain such identifying words. These statements may relate to business strategy, future operations, prospects, plans and objectives of management, as well as information concerning expected actions of third parties. Information provided in this presentation is necessarily summarized and may not contain all available material information. Such forward-looking information is subject to various risks and uncertainties that could cause actual results to differ materially from those set forth in, or implied by, such forward-looking statements. The forward-looking statements are based on current expectations of the management of Constellation and of Canopy and should not be construed in any manner as a guarantee that such results will occur or will occur on the timetables contemplated hereby. Forward-looking information in this presentation includes, but is not limited to, statements with respect to: (i) the anticipated effects and benefits of, timing and completion, including satisfaction of all necessary conditions, of each component of Constellation’s investment in Canopy; (ii) the ability of Canopy to grow its business, operations and activities; (iii) the benefits of the investment to Canopy; (iv) the potential impact on Canopy’s growth prospects; (v) potential opportunities in the Canadian, U.S. and global cannabis markets, including for growth in sales, supply, revenue, cultivation and processing; (vi) the potential for future product development; (vii) the availability or benefit of Canopy’s existing contractual relationships, including provincial supply agreements; (viii) the ability of Canopy to achieve market scale; (ix) the impact of the transaction on Canopy’s outstanding share capital, exercise by Constellation of any warrants and expected accounting method; (x) the abilities of management of Canopy; (xi) potential future market shares and operating margins to be achieved in medical and recreational cannabis markets and estimated timeframes; (xii) product development; (xiii) clinical trial work, (xiv) current and future acquisition and investment activities, including with respect to pending acquisitions; (xv) amount and timing of future Constellation dividends or share repurchases; (xvi) Constellation’s ability and timetable to achieve expected cash flows and expected target debt leverage ratios and net debt to LTM EBITDA ratios; (xvii) source of funds to finance Constellation’s investment in Canopy; (xviii) composition of Canopy’s management team; and (xix) cannabis legalization; as well as forward-looking statements also applicable to future global economic conditions; market conditions; other regulatory conditions; unanticipated environmental liabilities and costs; changes to international trade agreements or tariffs; timing of accounting elections or assertions or changes in accounting elections, assertions, or standards; changes in tax laws, tax rates, interest rates and foreign exchange rates; the actions of competitors; and consumer preferences. Forward looking information is based on certain assumptions, estimates, expectations, analyses and opinions made by management in light of their experience and perception of historical trends, current conditions and expected future developments, as well as other factors management believes are appropriate in the circumstances. Many of these factors are beyond the control of Constellation or Canopy. Forward looking information is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information, including, but not limited to, accuracy of all projections; risks relating to the cannabis industry, including legalization; risks relating to the demand for cannabis products; risks relating to being a controlled company; risks relating to future growth; risks relating to competition in the industry; risks relating to necessary approvals to completion of the transaction; financing risks; market risks; risks to the economy; regulatory risks; risks relating to global financial conditions; reliance on key personnel; operational risks inherent in the conduct of cannabis activities; increases in capital or operating costs; risks relating to Canopy’s ability to use the proceeds effectively; the risk of delays or increased costs that may be encountered during Canopy’s growth; risks relating to completion of the transaction, including being able to complete the transaction on satisfactory terms or at all; environmental risks; Constellation’s ability to achieve expected cash flows and target debt leverage ratios and net debt to LTM EBITDA ratios and timeframe in which expected cash flows and target debt leverage ratio will be achieved will depend upon actual financial performance; exact elements of Constellation’s permanent financing will depend upon market conditions; expected benefits of the transaction may not materialize in the manner or timeframe expected, or at all; amount and timing of future Constellation dividends are subject to the determination and discretion of its Board of Directors; changes to international trade agreements or tariffs; beer operations expansion, construction, and optimization activities take place on expected scope, terms, costs and timetables; the accuracy of supply projections, including those relating to beer operations expansion, construction, and optimization activities, glass sourcing, and raw materials and water supply expectations; receipt of any other necessary regulatory approvals; operating and financial risks related to managing growth; the amount, timing and source of funds of any share repurchases; and the accuracy of projections associated with previously announced acquisitions, investments and divestitures; and accuracy of forecasts relating to joint venture businesses and the additional risks identified in the “Risk Factors” section of Canopy’s annual information form and Constellation’s annual report on Form 10-K and other reports and filings filed with applicable securities regulators in Canada and the United States. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements are made as of the date hereof and neither Constellation nor Canopy intends, and expressly disclaims any obligation to, update or revise the forward-looking information contained in this presentation, except as required by law. Accordingly, readers are cautioned not to place undue reliance on forward-looking information.

Use of Non-Gaap Financial Measures, DISCLAIMER AND Caution regarding OUTDATED MATERIAL This presentation may contain non-GAAP financial measures. These measures, the purposes for which management uses them, why management believes they are useful to investors, and a reconciliation to the most directly comparable GAAP financial measures can be found in the appendix of this presentation. All references to profit measures and earnings per share on a comparable basis exclude items that affect comparability. Non-GAAP financial measures are also referred to as being presented on a comparable, organic or constant currency basis. The notes offered under the Company’s commercial paper program have not been and will not be registered under the Securities Act and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements. This presentation shall not constitute an offer to sell or the solicitation of an offer to buy the Company’s notes under the commercial paper program. Unless otherwise indicated, the information presented is as of August 22, 2018. Thereafter, it should be considered historical and not subject to further update by the Company.

BUILDING SHAREHOLDER value SUSTAINING PROFITABLE growth Innovation, Brand Building, emerging categories & Execution focus Financial strength & attractive growth profile Driving tba growth through premiumization & scale Key takeaways TBA = Total Beverage Alcohol PURSUING NEW GROWTH OPPORTUNITIES

Pursuing new growth opportunity Business Investment GROW DIVIDEND Bolt-on M&A SHARE REPURCHASE Cannabis: once-a-century disruptive market transition (1) Constellation estimates, Marijuana Business Daily Factbook 2017 and validated by top tier global consulting firm BOTTOM-LINE: A SINGLE GLOBAL CANNABIS PLATFORM TO ADDRESS ALL MARKETS & FORMATS IS ESSENTIAL TO WIN IN THE CATEGORY Global cannabis landscape is highly complex Global markets are evolving rapidly and expected to grow to greater than $200B(1) in retail revenue within 15 years Cannabis expected to demonstrate similar category dynamics to Total Beverage Alcohol: plays to Constellation’s strengths of building premium consumer brands with leading channel, distribution and production capabilities A significant opportunity exists, which is expected to influence the global market, steward the category, and accelerate Canopy Growth’s global expansion plans Each country is currently navigating various dimensions from cultivation / production licenses to distribution for medical, tax implications, and permitted form factors Markets for different product formats, other than dry flower, are developing: Vape is emerging as the predominant delivery form in the most mature markets Executing ‘safety science’ is key to unlocking edibles / beverages Clinical research unlocking opportunities for cannabis-based medical treatments

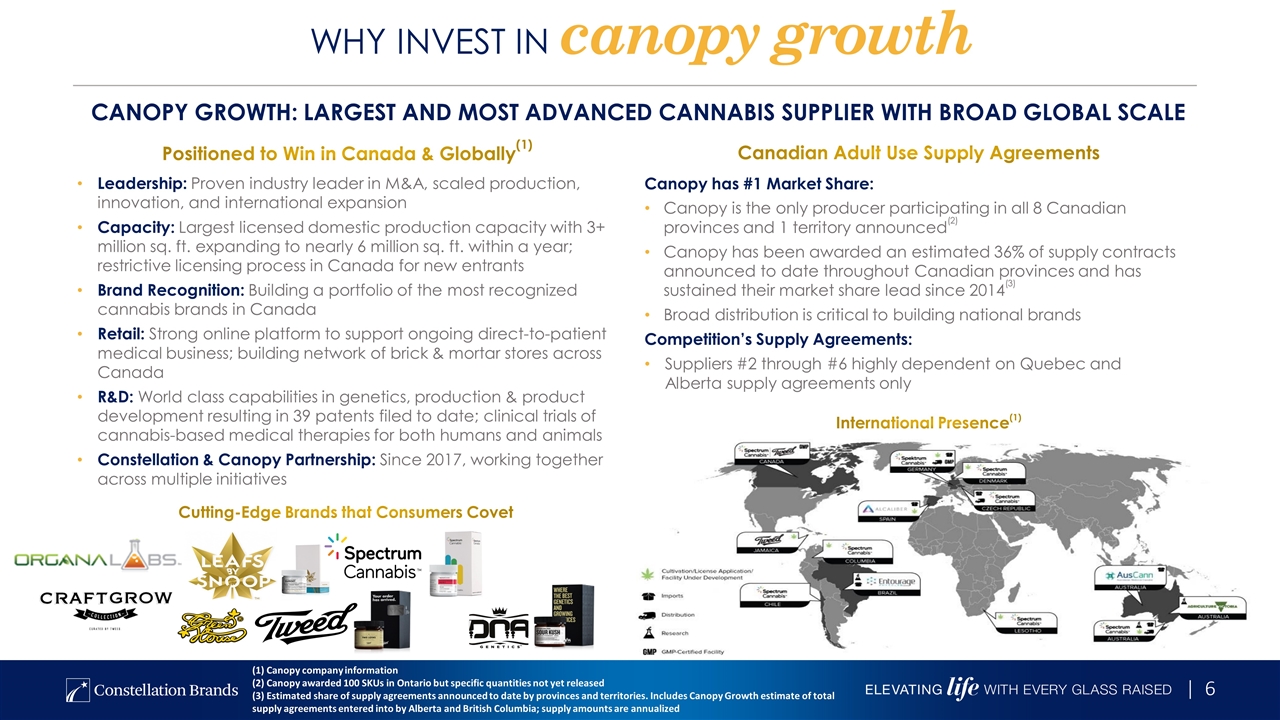

Why invest in canopy growth Business Investment Bolt-on M&A SHARE REPURCHASE Canopy Growth: Largest and Most Advanced Cannabis Supplier with broad Global Scale Positioned to Win in Canada & Globally(1) Leadership: Proven industry leader in M&A, scaled production, innovation, and international expansion Capacity: Largest licensed domestic production capacity with 3+ million sq. ft. expanding to nearly 6 million sq. ft. within a year; restrictive licensing process in Canada for new entrants Brand Recognition: Building a portfolio of the most recognized cannabis brands in Canada Retail: Strong online platform to support ongoing direct-to-patient medical business; building network of brick & mortar stores across Canada R&D: World class capabilities in genetics, production & product development resulting in 39 patents filed to date; clinical trials of cannabis-based medical therapies for both humans and animals Constellation & Canopy Partnership: Since 2017, working together across multiple initiatives International Presence(1) (1) Canopy company information (2) Canopy awarded 100 SKUs in Ontario but specific quantities not yet released (3) Estimated share of supply agreements announced to date by provinces and territories. Includes Canopy Growth estimate of total supply agreements entered into by Alberta and British Columbia; supply amounts are annualized Canadian Adult Use Supply Agreements Canopy has #1 Market Share: Canopy is the only producer participating in all 8 Canadian provinces and 1 territory announced(2) Canopy has been awarded an estimated 36% of supply contracts announced to date throughout Canadian provinces and has sustained their market share lead since 2014(3) Broad distribution is critical to building national brands Competition’s Supply Agreements: Suppliers #2 through #6 highly dependent on Quebec and Alberta supply agreements only Cutting-Edge Brands that Consumers Covet

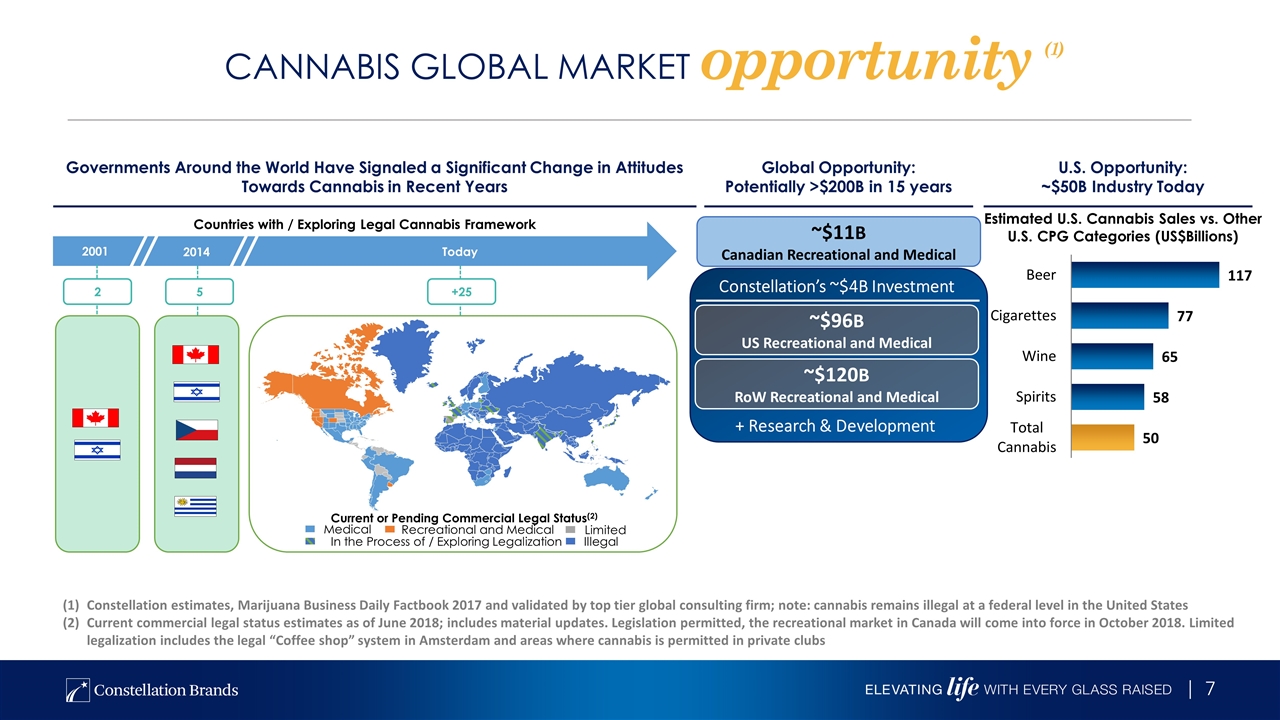

Cannabis Global market opportunity (1) SHARE REPURCHASE Constellation estimates, Marijuana Business Daily Factbook 2017 and validated by top tier global consulting firm; note: cannabis remains illegal at a federal level in the United States Current commercial legal status estimates as of June 2018; includes material updates. Legislation permitted, the recreational market in Canada will come into force in October 2018. Limited legalization includes the legal “Coffee shop” system in Amsterdam and areas where cannabis is permitted in private clubs Governments Around the World Have Signaled a Significant Change in Attitudes Towards Cannabis in Recent Years U.S. Opportunity: ~$50B Industry Today Global Opportunity: Potentially >$200B in 15 years Estimated U.S. Cannabis Sales vs. Other U.S. CPG Categories (US$Billions) Business Investment 2001 2014 Today Current or Pending Commercial Legal Status(2) Medical Limited Recreational and Medical Illegal Countries with / Exploring Legal Cannabis Framework In the Process of / Exploring Legalization 2 5 +25 ~$11B Canadian Recreational and Medical ~$96B US Recreational and Medical ~$120B RoW Recreational and Medical Constellation’s ~$4B Investment + Research & Development

Cannabis Global market opportunity (1) Statistics Canada, 2015 (2) Constellation estimates, Marijuana Business Daily Factbook 2017 and validated by top tier global consulting firm (3) Based on channel mix of direct to consumer, direct to retail, and three-tier sales (4) Addressable market and revenue pool estimates include only the 21 countries where cannabis is either currently legal or trending towards legalization; also, only includes estimates for medicinal and recreational usage - estimates do not factor in potential size of nutraceuticals, wellness, pet supply, or cosmetics products Constellation Estimates Canada U.S. Rest of World Current Illicit Market $5-6B(1) $50B(2) Addressable Market (retail sales within 15 years)(2)(4) $11B $100B $120B Supplier Revenue Pool (within 15 years) (3)(4) $7B $60B $72B Canopy Gross Profit Margin 60% - 70% 60% - 70% 50% - 60% Canopy Operating Profit Margin 30% - 40% 30% - 40% 20% - 30% Canopy Market Share 30% - 40% 5% - 15% 5% - 15%

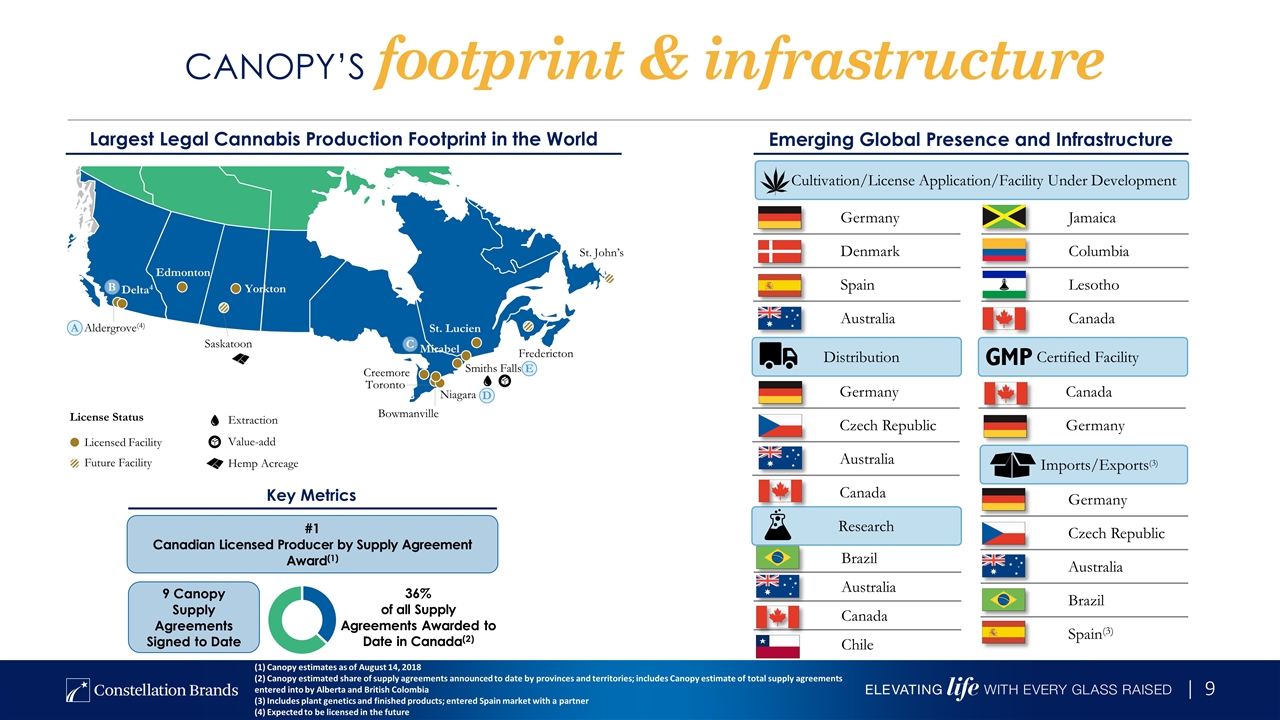

Canopy’s footprint & infrastructure Edmonton Key Metrics 36% of all Supply Agreements Awarded to Date in Canada(2) 9 Canopy Supply Agreements Signed to Date #1 Canadian Licensed Producer by Supply Agreement Award(1) Largest Legal Cannabis Production Footprint in the World C B A Fredericton St. John’s Saskatoon Aldergrove(4) Smiths Falls Niagara Toronto Creemore Bowmanville Delta4 Edmonton Yorkton St. Lucien Mirabel License Status Extraction Future Facility Hemp Acreage Licensed Facility Value-add D E Brazil Australia Canada Chile Canada Germany Emerging Global Presence and Infrastructure Cultivation/License Application/Facility Under Development Distribution Research Certified Facility Imports/Exports(3) Germany Denmark Spain Australia Jamaica Columbia Lesotho Canada Germany Czech Republic Australia Canada Germany Czech Republic Australia Brazil Spain(3) (1) Canopy estimates as of August 14, 2018 (2) Canopy estimated share of supply agreements announced to date by provinces and territories; includes Canopy estimate of total supply agreements entered into by Alberta and British Colombia (3) Includes plant genetics and finished products; entered Spain market with a partner (4) Expected to be licensed in the future

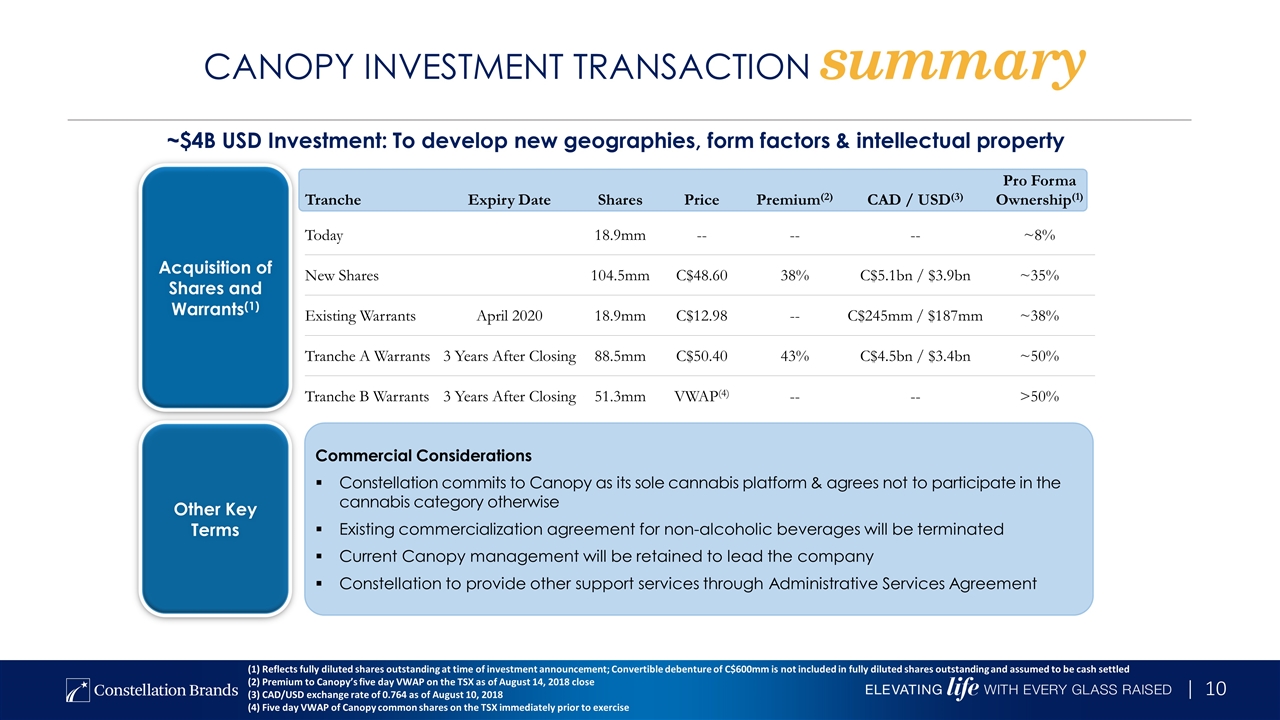

Tranche Expiry Date Shares Price Premium(2) CAD / USD(3) Pro Forma Ownership(1) Today 18.9mm -- -- -- ~8% New Shares 104.5mm C$48.60 38% C$5.1bn / $3.9bn ~35% Existing Warrants April 2020 18.9mm C$12.98 -- C$245mm / $187mm ~38% Tranche A Warrants 3 Years After Closing 88.5mm C$50.40 43% C$4.5bn / $3.4bn ~50% Tranche B Warrants 3 Years After Closing 51.3mm VWAP(4) -- -- >50% Canopy investment TRANSACTION summary Beer Capacity Expansion Activities Investment to Support Growth 1 Business Investment Commercial Considerations Constellation commits to Canopy as its sole cannabis platform & agrees not to participate in the cannabis category otherwise Existing commercialization agreement for non-alcoholic beverages will be terminated Current Canopy management will be retained to lead the company Constellation to provide other support services through Administrative Services Agreement (1) Reflects fully diluted shares outstanding at time of investment announcement; Convertible debenture of C$600mm is not included in fully diluted shares outstanding and assumed to be cash settled (2) Premium to Canopy’s five day VWAP on the TSX as of August 14, 2018 close (3) CAD/USD exchange rate of 0.764 as of August 10, 2018 (4) Five day VWAP of Canopy common shares on the TSX immediately prior to exercise Acquisition of Shares and Warrants(1) Other Key Terms ~$4B USD Investment: To develop new geographies, form factors & intellectual property

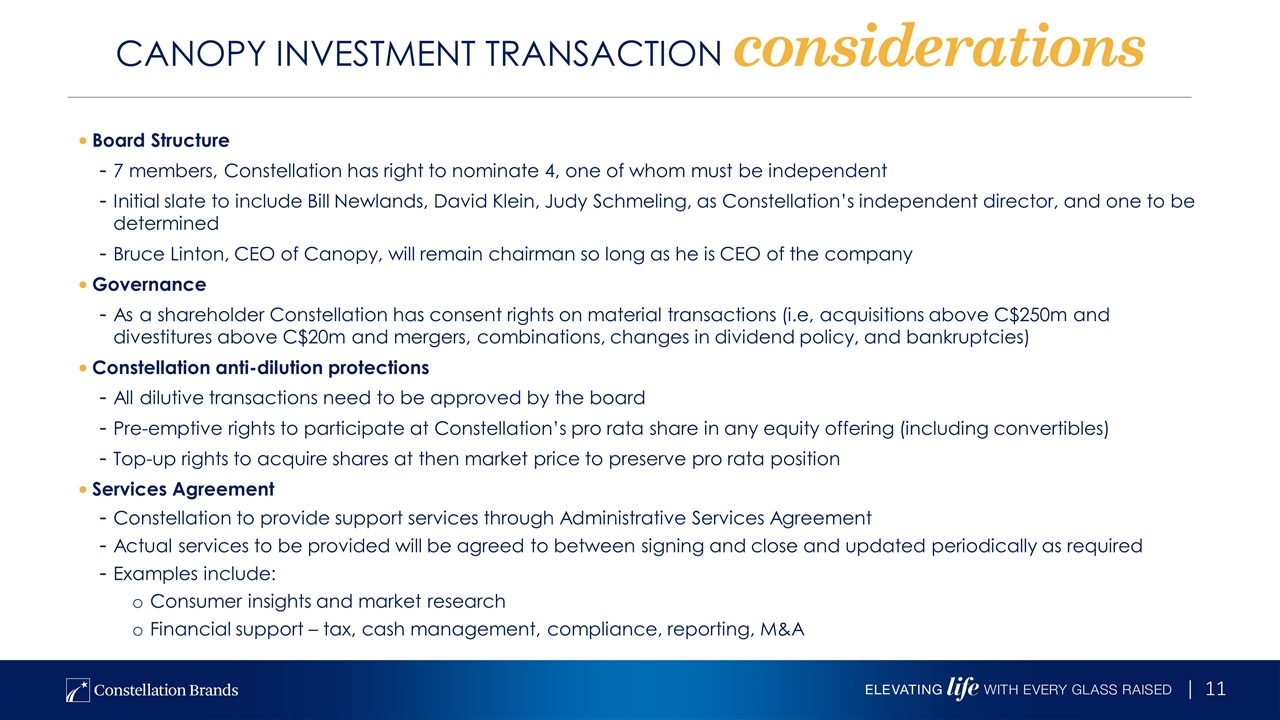

canopy investment transaction considerations Board Structure 7 members, Constellation has right to nominate 4, one of whom must be independent Initial slate to include Bill Newlands, David Klein, Judy Schmeling, as Constellation’s independent director, and one to be determined Bruce Linton, CEO of Canopy, will remain chairman so long as he is CEO of the company Governance As a shareholder Constellation has consent rights on material transactions (i.e, acquisitions above C$250m and divestitures above C$20m and mergers, combinations, changes in dividend policy, and bankruptcies) Constellation anti-dilution protections All dilutive transactions need to be approved by the board Pre-emptive rights to participate at Constellation’s pro rata share in any equity offering (including convertibles) Top-up rights to acquire shares at then market price to preserve pro rata position Services Agreement Constellation to provide support services through Administrative Services Agreement Actual services to be provided will be agreed to between signing and close and updated periodically as required Examples include: Consumer insights and market research Financial support – tax, cash management, compliance, reporting, M&A

total beverage alcohol

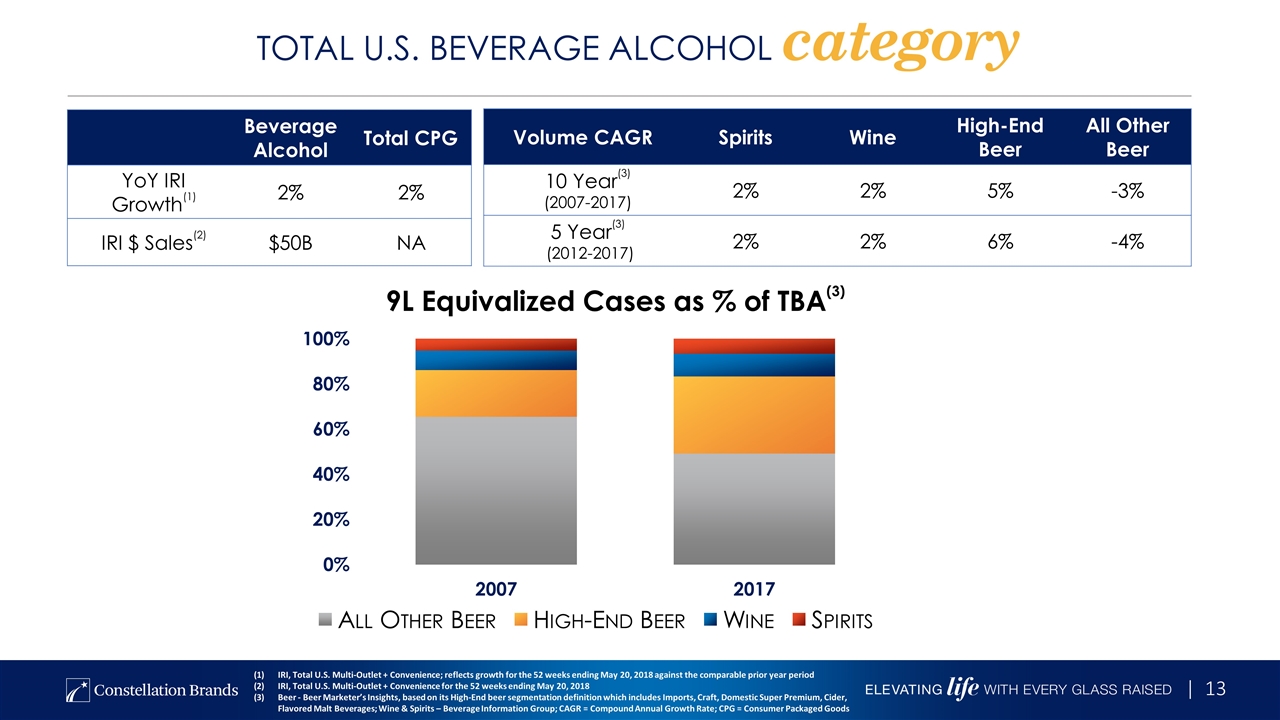

TOTAL U.S. BEVERAGE ALCOHOL category Volume CAGR Spirits Wine High-End Beer All Other Beer 10 Year(3) (2007-2017) 2% 2% 5% -3% 5 Year(3) (2012-2017) 2% 2% 6% -4% Beverage Alcohol Total CPG YoY IRI Growth(1) 2% 2% IRI $ Sales(2) $50B NA 9L Equivalized Cases as % of TBA(3) IRI, Total U.S. Multi-Outlet + Convenience; reflects growth for the 52 weeks ending May 20, 2018 against the comparable prior year period IRI, Total U.S. Multi-Outlet + Convenience for the 52 weeks ending May 20, 2018 Beer - Beer Marketer’s Insights, based on its High-End beer segmentation definition which includes Imports, Craft, Domestic Super Premium, Cider, Flavored Malt Beverages; Wine & Spirits – Beverage Information Group; CAGR = Compound Annual Growth Rate; CPG = Consumer Packaged Goods

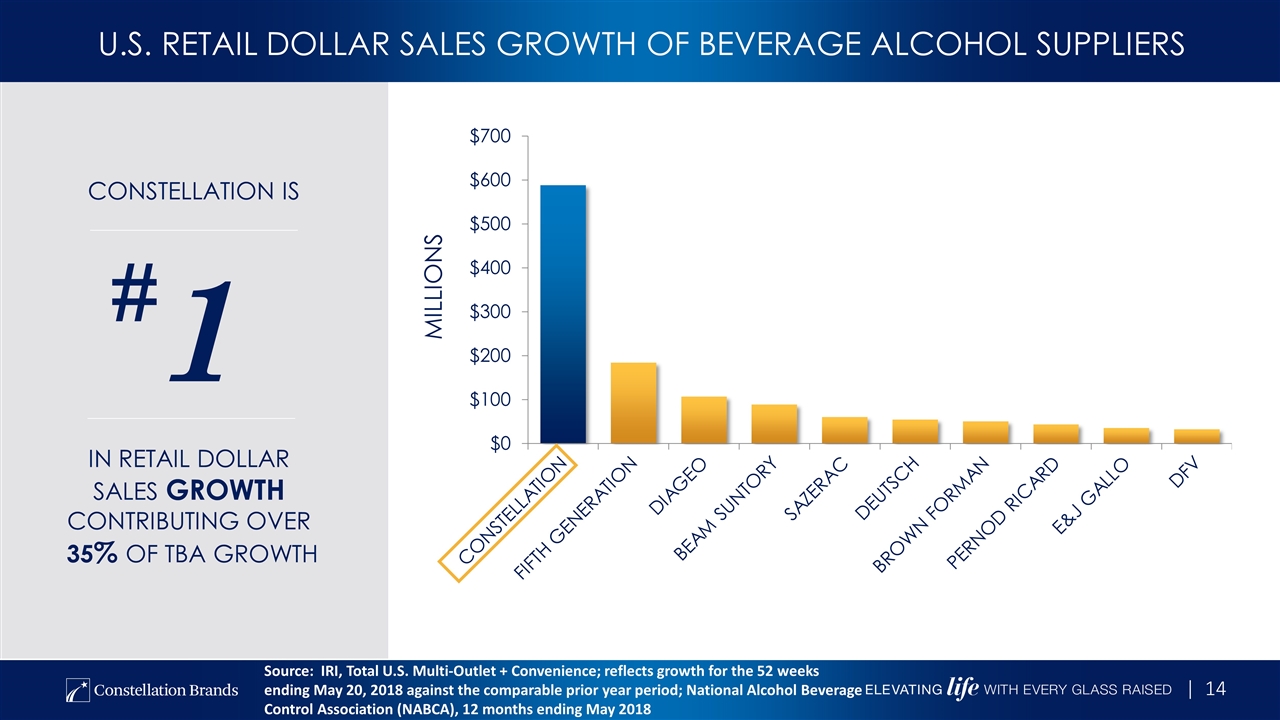

IN RETAIL DOLLAR SALES GROWTH Contributing over 35% of tba growth #1 U.S. RETAIL DOLLAR SALES GROWTH OF BEVERAGE ALCOHOL SUPPLIERS Constellation is Source: IRI, Total U.S. Multi-Outlet + Convenience; reflects growth for the 52 weeks ending May 20, 2018 against the comparable prior year period; National Alcohol Beverage Control Association (NABCA), 12 months ending May 2018

#1 multi-category supplier in U.S. 80+ premium consumer brands ~10,000 employees ~40 facilities World’s leading premium wine company #1 imported vodka in U.S. - SVEDKA Leading New Zealand and Italian wine positions in U.S. ~20,000 vineyard acres #1 high-end beer company in U.S. #1 imported beer company in U.S. #3 beer company in U.S. Beer Business Total Beverage Alcohol Leader Wine & Spirits Business Source: IRI, National Alcohol Beverage Control Association (NABCA), International Wine and Spirit Research (IWSR) as of Calendar Year 2017 and company estimates as of May 20, 2018 Constellation brands scale

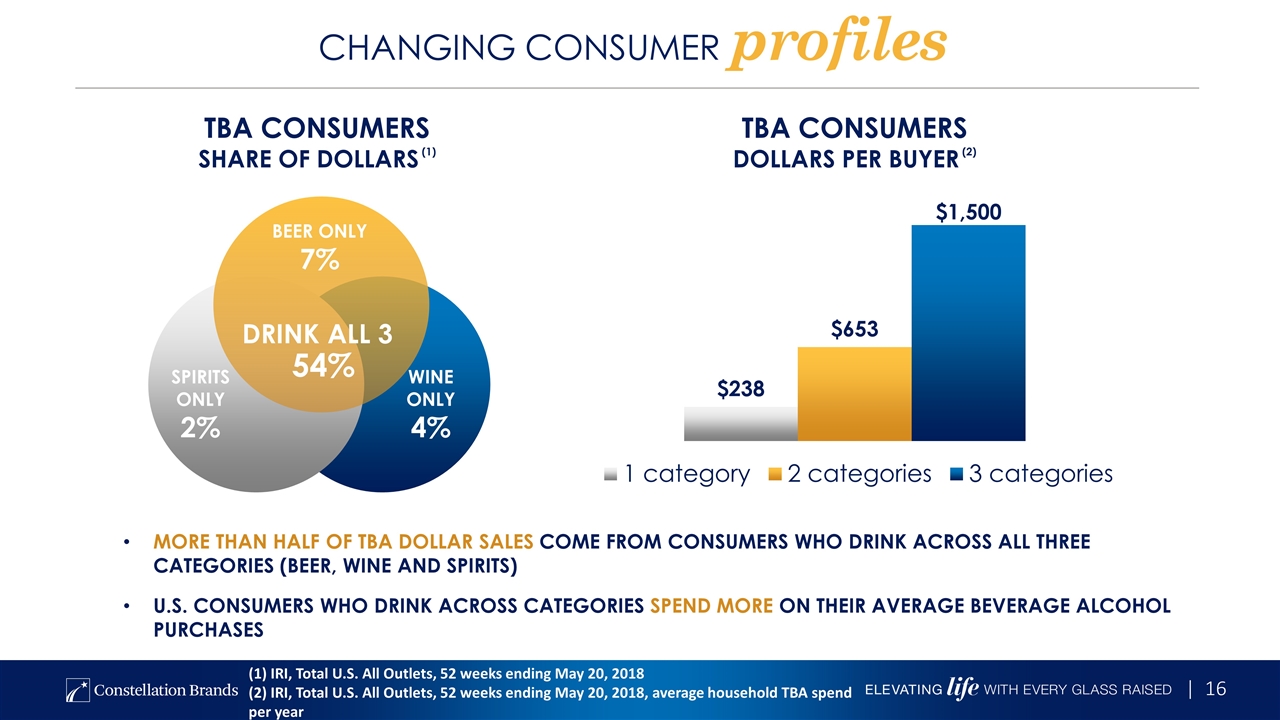

changing consumer profiles MORE THAN HALF OF TBA DOLLAR SALES COME FROM CONSUMERS WHO DRINK ACROSS ALL THREE CATEGORIES (BEER, WINE AND SPIRITS) U.S. CONSUMERS WHO DRINK ACROSS CATEGORIES SPEND MORE ON THEIR AVERAGE BEVERAGE ALCOHOL PURCHASES TBA CONSUMERS DOLLARS PER BUYER (2) (1) IRI, Total U.S. All Outlets, 52 weeks ending May 20, 2018 (2) IRI, Total U.S. All Outlets, 52 weeks ending May 20, 2018, average household TBA spend per year TBA CONSUMERS SHARE OF DOLLARS (1) SPIRITS ONLY 2% WINE ONLY 4% BEER ONLY 7% 54% DRINK ALL 3

tba growth leadership platform BRINGING ACTIONABLE CAPABILITIES TO CUSTOMERS INNOVATION INSIGHTS CATEGORY MANAGEMENT STRATEGIC CUSTOMER TEAMS / SALES EXECUTION On trend new product development & merchandising TBA thought leadership for consumers, categories & channels Premier category management tools & analytics Best in class sales force and customer teams with TBA category expertise

Constellation growth organization LEVERAGING CONSUMER-LED TRENDS, SENSORY & INSIGHTS ACROSS TBA TO DRIVE INNOVATION HYBRID DRINKS KEY FOCUS AREAS PACKAGING EFFERVESCENSE FLAVORS E-COMMERCE

Constellation ventures Constellation Ventures is identifying and investing in early stage brands and technologies that have proven to resonate with consumers, while also displaying a proven track record of success and the potential for scalability. “ “

PREMIUMIZATION & SCALE BUSINESS strategy beer spirits wine Lead the High-End U.S. Beer Market Broaden Portfolio of Premium Spirits Brands Be the Leader in Premium Wine

beer Lead the High-End U.S. Beer Market

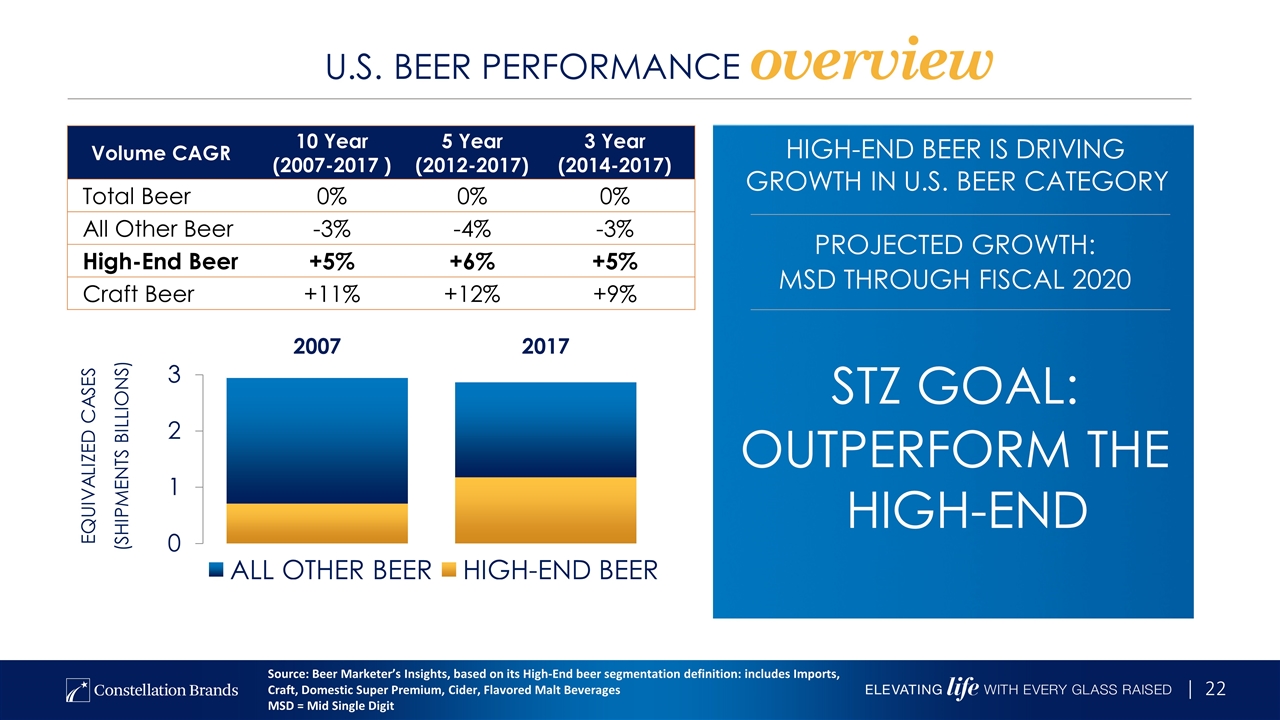

U.S. beer performance overview EQUIVALIZED CASES Volume CAGR 10 Year (2007-2017 ) 5 Year (2012-2017) 3 Year (2014-2017) Total Beer 0% 0% 0% All Other Beer -3% -4% -3% High-End Beer +5% +6% +5% Craft Beer +11% +12% +9% (SHIPMENTS BILLIONS) STZ GOAL: OUTPERFORM THE HIGH-END HIGH-END BEER IS DRIVING GROWTH IN U.S. BEER CATEGORY PROJECTED GROWTH: MSD THROUGH FISCAL 2020 Source: Beer Marketer’s Insights, based on its High-End beer segmentation definition: includes Imports, Craft, Domestic Super Premium, Cider, Flavored Malt Beverages MSD = Mid Single Digit

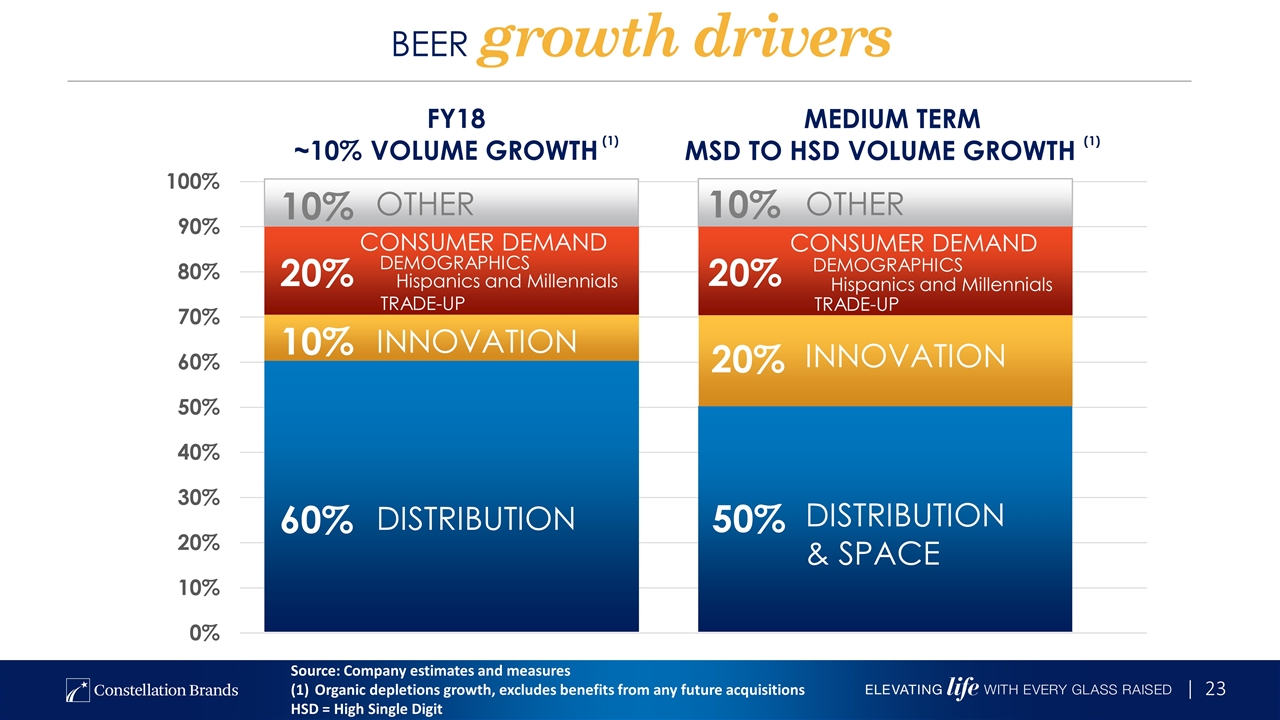

Beer growth drivers FY18 ~10% VOLUME GROWTH (1) 60% DISTRIBUTION 50% DISTRIBUTION & SPACE 20% 10% INNOVATION INNOVATION 10% OTHER 20% 10% OTHER 20% CONSUMER DEMAND DEMOGRAPHICS DEMOGRAPHICS Hispanics and Millennials TRADE-UP CONSUMER DEMAND Hispanics and Millennials TRADE-UP Source: Company estimates and measures Organic depletions growth, excludes benefits from any future acquisitions HSD = High Single Digit MEDIUM TERM MSD TO HSD VOLUME GROWTH (1)

distribution opportunities (~50% of future growth) PRECISE TARGETS, EXACT EXECUTION SUPPORTED BY BRAND BUILDING INVESTMENTS Cans Incremental Packages Draft / On Premise General Market Accounts Incremental Packages Draft / On-Premise National Distribution Cans Draft / On-Premise

high-end beer thought leadership platform DATA CONSUMER INSIGHTS Market Structure Consumer Path to Purchase Hispanic Insights Shelf Research Point of Sale (POS) Customer Loyalty IRI Syndicated Distributor Predictive Analytics Analytical Tools Virtual Shelf Simulation ACTION Shelf Flow Optimization Space Opportunity Assortment Solutions Industry Outlook On-Premise Experience

shopper first beer SHELF ABA = Alternative Beverage Alcohol

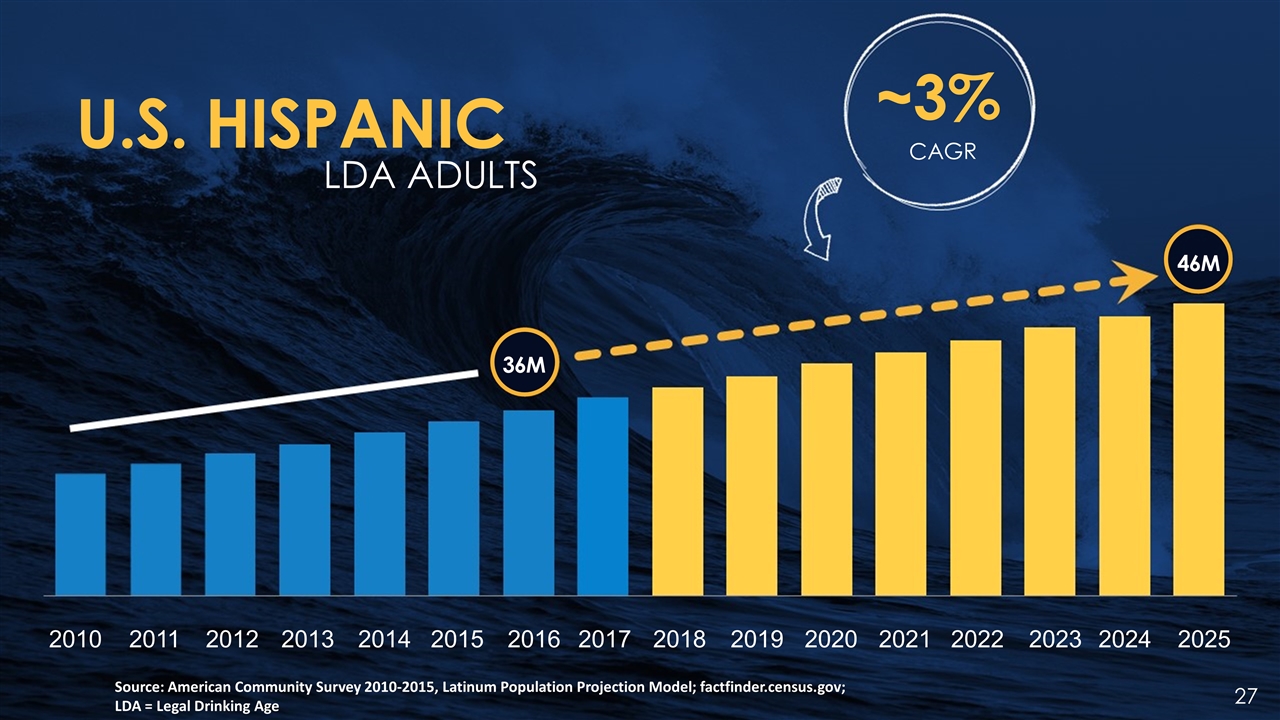

LDA ADULTS U.S. HISPANIC ~3% Cagr Source: American Community Survey 2010-2015, Latinum Population Projection Model; factfinder.census.gov; LDA = Legal Drinking Age 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 36M 46M

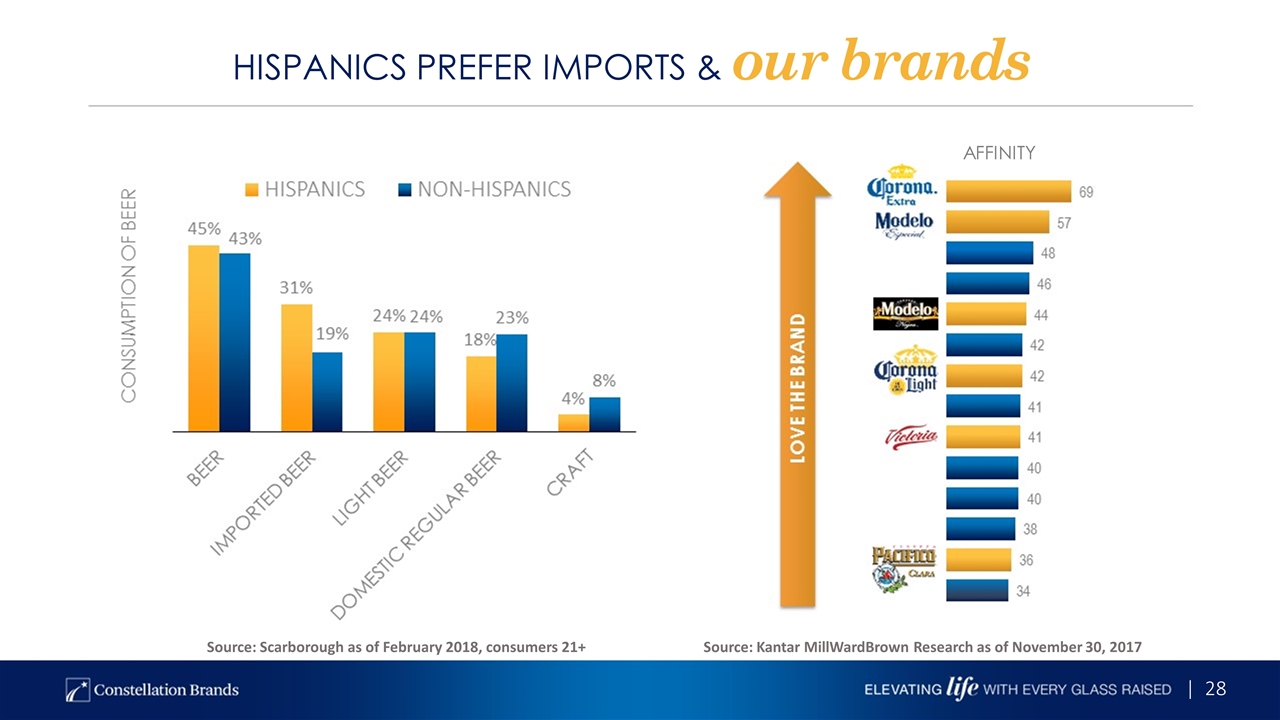

Hispanics prefer imports & our brands Source: Kantar MillWardBrown Research as of November 30, 2017 Affinity Source: Scarborough as of February 2018, consumers 21+ | 28

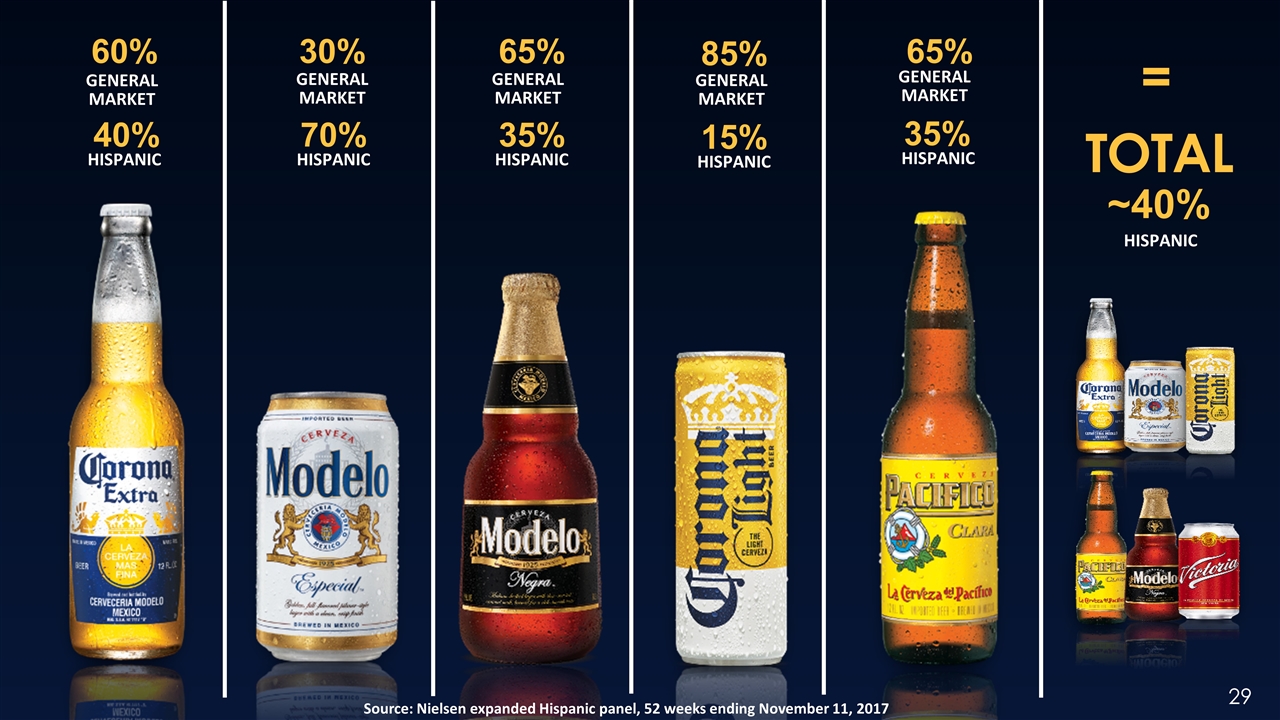

60% GENERAL MARKET 40% HISPANIC 30% GENERAL MARKET 70% HISPANIC 65% GENERAL MARKET 35% HISPANIC 85% GENERAL MARKET 15% HISPANIC 65% GENERAL MARKET 35% HISPANIC Source: Nielsen expanded Hispanic panel, 52 weeks ending November 11, 2017 TOTAL ~40% HISPANIC =

marketing for our beer brands MISSION: Build CONSUMER DEMAND Drives Increase in Equity Consumer Loyalty Higher Repurchase Rates Reduced Price Sensitivity Leads to More space More distribution Increased velocity Pricing power

CORONA BRAND FAMILY Corona Light “The Light Cerveza” ~138M Cases +4% Source: Depletion cases and trends FY18 company measures Corona Extra “Find Your Beach” Corona Premier Corona Familiar “Strong Bonds Over Shared Experiences” “The Refined, Light Beer Experience”

CASA MODELO “The Fighting Spirit” High-End #3 Import #2 Tenacious, straight-forward, genuine, proud, loyal, confident ~110M Cases +18% Source: Depletion cases and trends FY18 company measures Rankings from IRI, Total U.S. Multi-Outlet + Convenience; for the 52 weeks ending May 20, 2018

PACIFICO Adventurous, laid-back, unpretentious, confident, rugged “The Independent Spirit” High-End #24 Import #9 ~9M Cases +18% Source: Depletion cases and trends FY18 company measures Rankings from IRI, Total U.S. Multi-Outlet + Convenience; for the 52 weeks ending May 20, 2018

Discovery FLAGSHIP Recruit new drinkers explorer Premium trade-up Hard-core craft enthusiast Launch of 6 Pack & 12 Pack Cans Expansion to Six Southeastern States Redesign of Brand Packaging craft & specialty Portfolio Segmentation Tap Rooms Increased Marketing ballast point INITIATIVES funky buddha INITIATIVES Role …

beer innovation Line Extensions on Existing Brands ABA Craft Domestic Super Premium

OUR BEER BUSINESS POWERFUL brands innovation runway DISTRIBUTION opportunity favorable demographics Lead the high-end

wine Be the Leader in premium wine & spirits Broaden portfolio of premium spirits brands

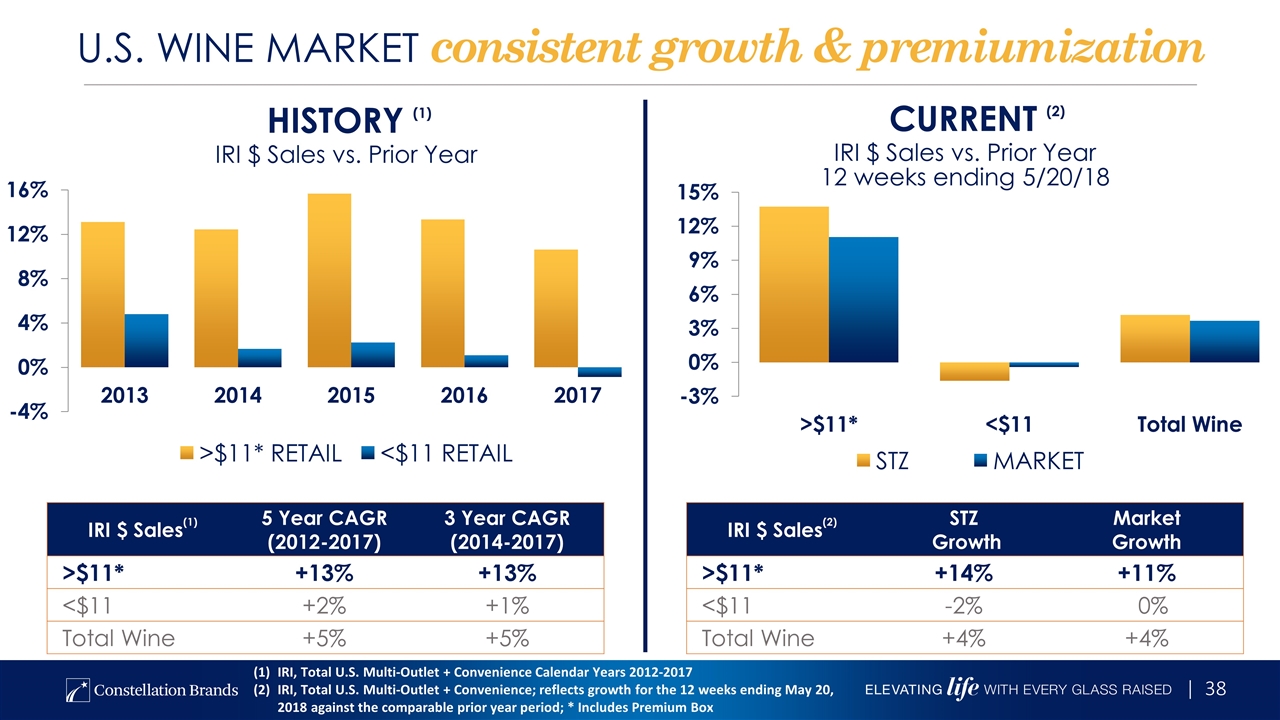

U.S. Wine market consistent growth & premiumization IRI, Total U.S. Multi-Outlet + Convenience Calendar Years 2012-2017 IRI, Total U.S. Multi-Outlet + Convenience; reflects growth for the 12 weeks ending May 20, 2018 against the comparable prior year period; * Includes Premium Box IRI $ Sales vs. Prior Year 12 weeks ending 5/20/18 IRI $ Sales(1) 5 Year CAGR (2012-2017) 3 Year CAGR (2014-2017) >$11* +13% +13% <$11 +2% +1% Total Wine +5% +5% History (1) CURRENT (2) IRI $ Sales(2) STZ Growth Market Growth >$11* +14% +11% <$11 -2% 0% Total Wine +4% +4% IRI $ Sales vs. Prior Year

Wine & spirits medium term growth drivers Net sales: low to Mid Single Digit GROWTH (1) Topline growth driven by: + Executing steady evolution to the high-end + Driving focus brands + Accelerating consumer-led innovation & brand building + Building spirits, sparkling & fine wine portfolio + Executing 3-tier eCommerce TBA strategy + Renovating select core brands - Continued SKU rationalization Organic growth, excludes benefits from any future acquisitions

+16% +23% +21% Wine & spirits focus brands STRATEGY DRIVES STRONG GROWTH ~70% of wine & spirits profitability ~60% of wine & spirits volume Select Focus brands IRI $ Sales Growth vs. Prior Year (1) FOCUS BRANDS REPRESENT (2) (1) IRI, Total U.S. Multi-Outlet + Convenience; reflects growth for the 52 weeks ending May 20, 2018 against the comparable prior year period (2) 12 months ending February 28, 2018 company measures +19%

Wine & Spirits focus brands strategy drives strong growth attractive Operating roic ~400BPS Operating MARGIN EXPANSION (FY15 - FY18) (1) Long term OPERATING MARGIN goal = 30% (1) Reflects an adjustment for the divestiture of the Canadian wine business as further detailed in the Company’s Annual Report on Form 10-K for the fiscal year ended February 28, 2018 BPS = Basis Points

Consumer-led 360° brand activation: Wine & Spirits brand building KIM CRAWFORD: Our MOST PROFITABLE Established wine Brand (2) Kim Crawford 9LE Depletions (1) Depletion trends based on company measures Based on FY18 company measures ~15% CAGR 1st ever national tv program elevated pr investment Unique partnerships

Wine & Spirits Developing industry-leading innovation Our innovation priorities: Capture consumer centric trends Build big bets Lead with luxury

Wine & Spirits premiumization through m&a Source: IRI, Total U.S. Multi-Outlet + Convenience; reflects growth for the 52 weeks ending May 20, 2018 against the comparable prior year period PRUDENT CAPITAL RESOURCE MANAGEMENT +88% +19% +19% +77% HIGHER MARGIN HIGHER GROWTH

spirits portfolio evolution ACQUISITIONS VENTURES ENHANCING & PREMIUMIZING

OUR WINE & SPIRITS BUSINESS FANTASTIC categories focus brands strength consumers trading up Strong innovation pipeline Steady Evolution to the high-end

FINANCIAL SUMMARY

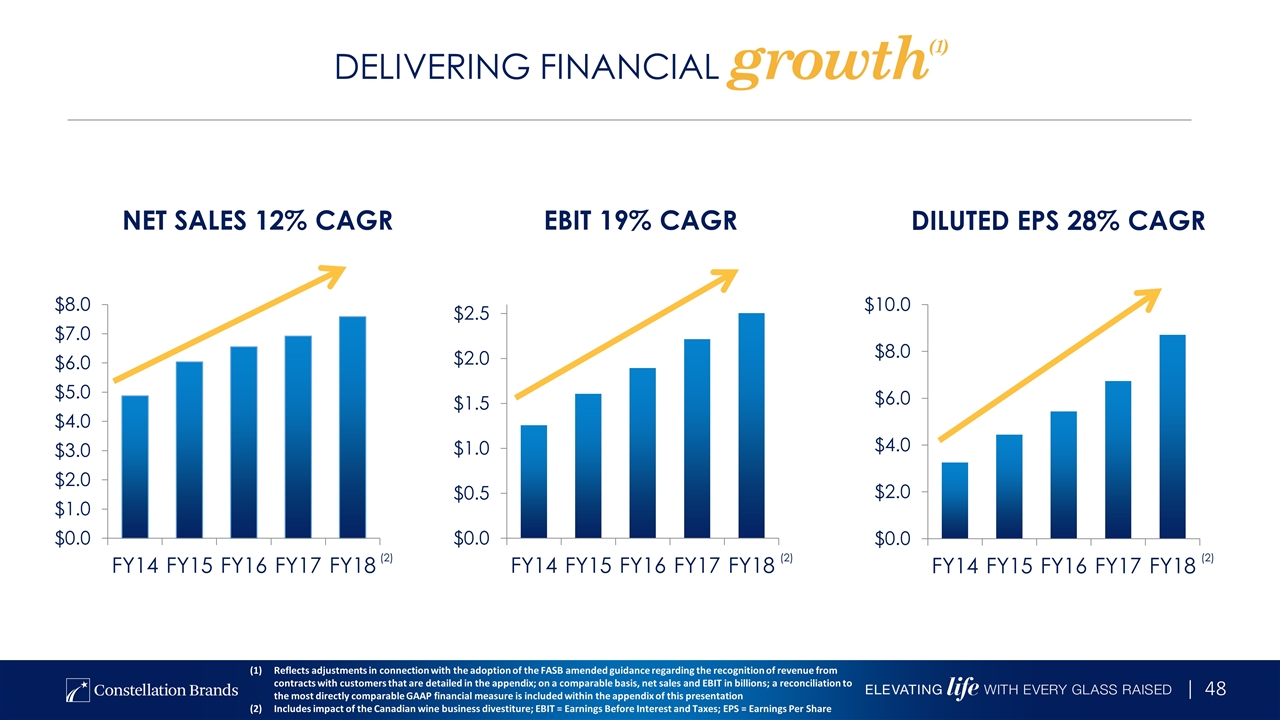

Delivering financial growth(1) Net Sales 12% CAGR EBIT 19% CAGR Diluted EPS 28% CAGR (2) (2) (2) Reflects adjustments in connection with the adoption of the FASB amended guidance regarding the recognition of revenue from contracts with customers that are detailed in the appendix; on a comparable basis, net sales and EBIT in billions; a reconciliation to the most directly comparable GAAP financial measure is included within the appendix of this presentation Includes impact of the Canadian wine business divestiture; EBIT = Earnings Before Interest and Taxes; EPS = Earnings Per Share

Medium term growth vision(1) WINE & SPIRITS SALES low to mid Single Digit GROWTH + LSD Volume Growth; In-Line/Better Than U.S. Wine and Spirits Category + Mix / Price Benefits - Continued SKU Rationalization BEER SALES High Single Digit GROWTH + MSD-HSD Volume Growth; Greater Than High-End U.S. Beer Category + Annual Pricing of 1-2% Consolidated NET Sales : Mid to High Single Digit growth BEER EBIT HIGH single TO LOW DOUBLE DIGIT growth + Pricing Benefits + Expansion of Owned Glass Supply + Operational Efficiencies - Depreciation ramp-up, Normalization of FX / Commodities, Marketing Investments WINE & SPIRITS EBIT MID SINGLE DIGIT GROWTH + Mix / Price Benefits + Margin Accretive Innovation + Improved Operating Asset Utilization + General & Administrative Expense Management - Marketing Investments Consolidated EBIT : High Single Digit growth DILUTED EPS : Organic growth, excludes benefits from any future acquisitions Cash tax rate defined as cash paid for income taxes divided by income before income taxes LSD = Low Single Digit; FX = Foreign Currency; ETR = Effective Tax Rate ~10% CAGR Effective Tax Rate target: 18% - 20% cash Tax Rate(2) target: at least 7% lower than etR

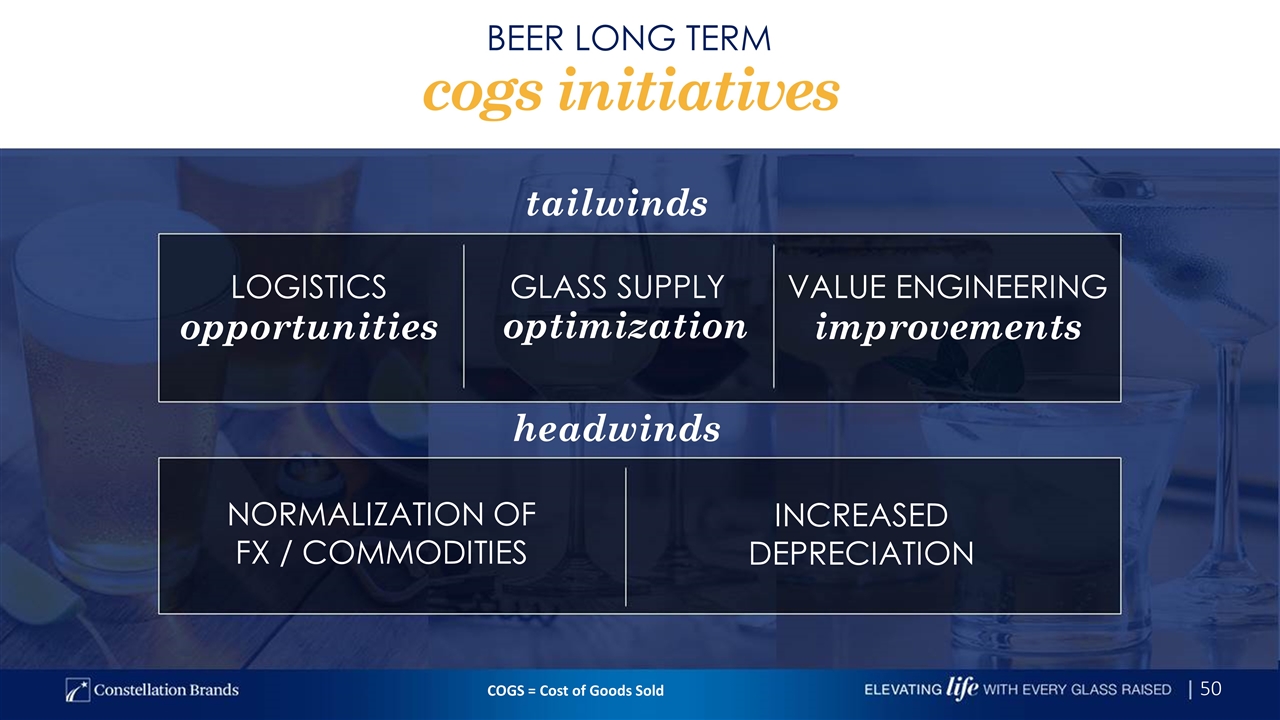

Beer long term cogs initiatives tailwinds Normalization of fx / Commodities Value engineering opportunities Glass supply optimization improvements Logistics headwinds Increased depreciation COGS = Cost of Goods Sold

yield optimization blend opportunities improvement SUPPLY Wine & Spirits long term cogs initiatives NETWORK enhancements packaging simplification reduce inventory

RESOURCE PRIORITIZATION INTEGRATED TECHNOLOGY ENABLEMENT STREAMLINE PROCESSES & IMPROVE CAPABILITIES LINK STRATEGY & EXECUTION Fit for growth SG&A efficiencies

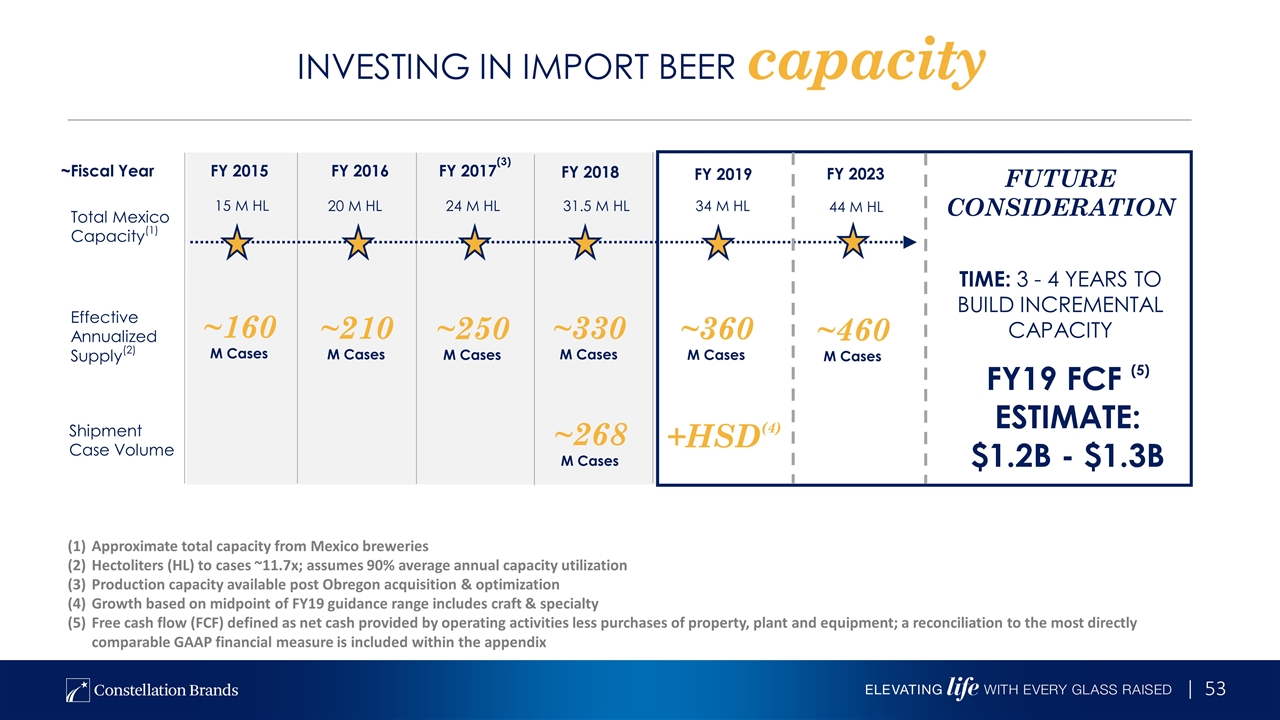

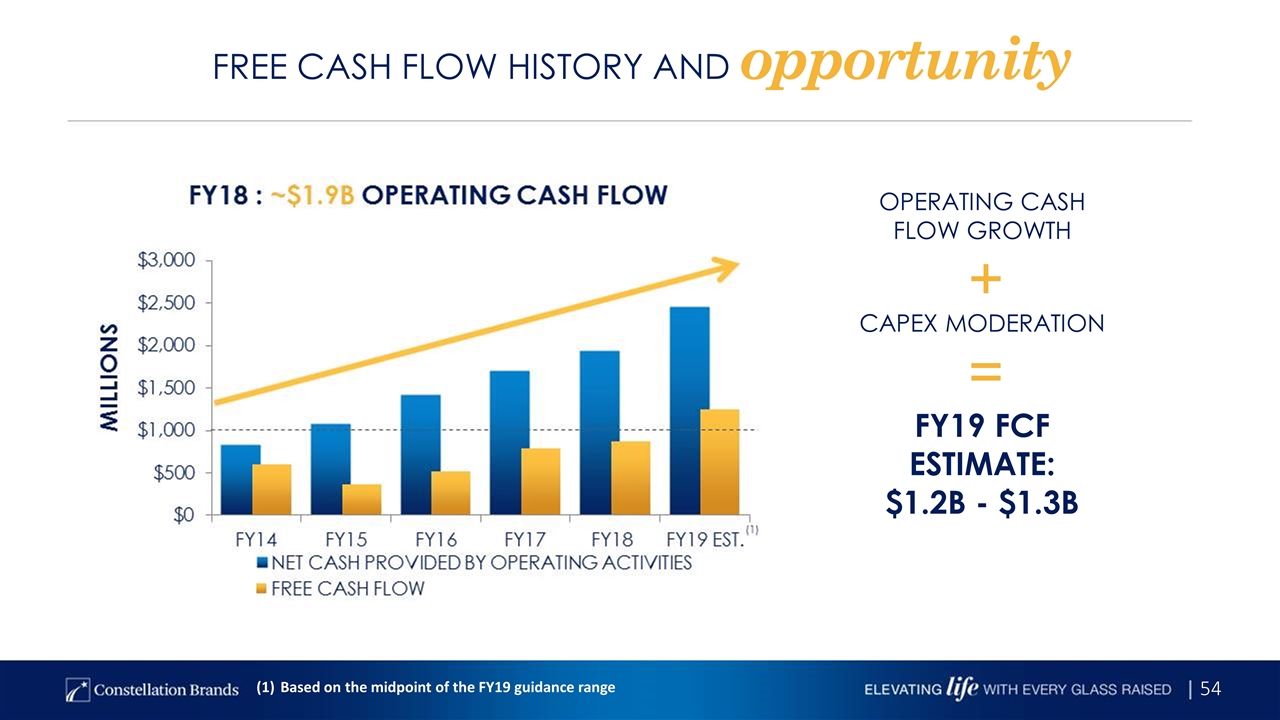

Investing in import BEER capacity Effective Annualized Supply(2) ~160 M Cases ~210 M Cases ~330 M Cases ~250 M Cases FUTURE CONSIDERATION ~Fiscal Year FY 2015 FY 2016 FY 2018 Total Mexico Capacity(1) 15 M HL 20 M HL 31.5 M HL FY 2017(3) 24 M HL Approximate total capacity from Mexico breweries Hectoliters (HL) to cases ~11.7x; assumes 90% average annual capacity utilization Production capacity available post Obregon acquisition & optimization Growth based on midpoint of FY19 guidance range includes craft & specialty Free cash flow (FCF) defined as net cash provided by operating activities less purchases of property, plant and equipment; a reconciliation to the most directly comparable GAAP financial measure is included within the appendix TIME: 3 - 4 YEARS TO BUILD INCREMENTAL CAPACITY Shipment Case Volume ~268 M Cases +HSD(4) 34 M HL ~360 M Cases FY19 FCF (5) ESTIMATE: $1.2B - $1.3B FY 2023 44 M HL ~460 M Cases FY 2019

Free cash flow history and opportunity OPERATING CASH FLOW GROWTH + CAPEX MODERATION = Based on the midpoint of the FY19 guidance range FY19 FCF ESTIMATE: $1.2B - $1.3B

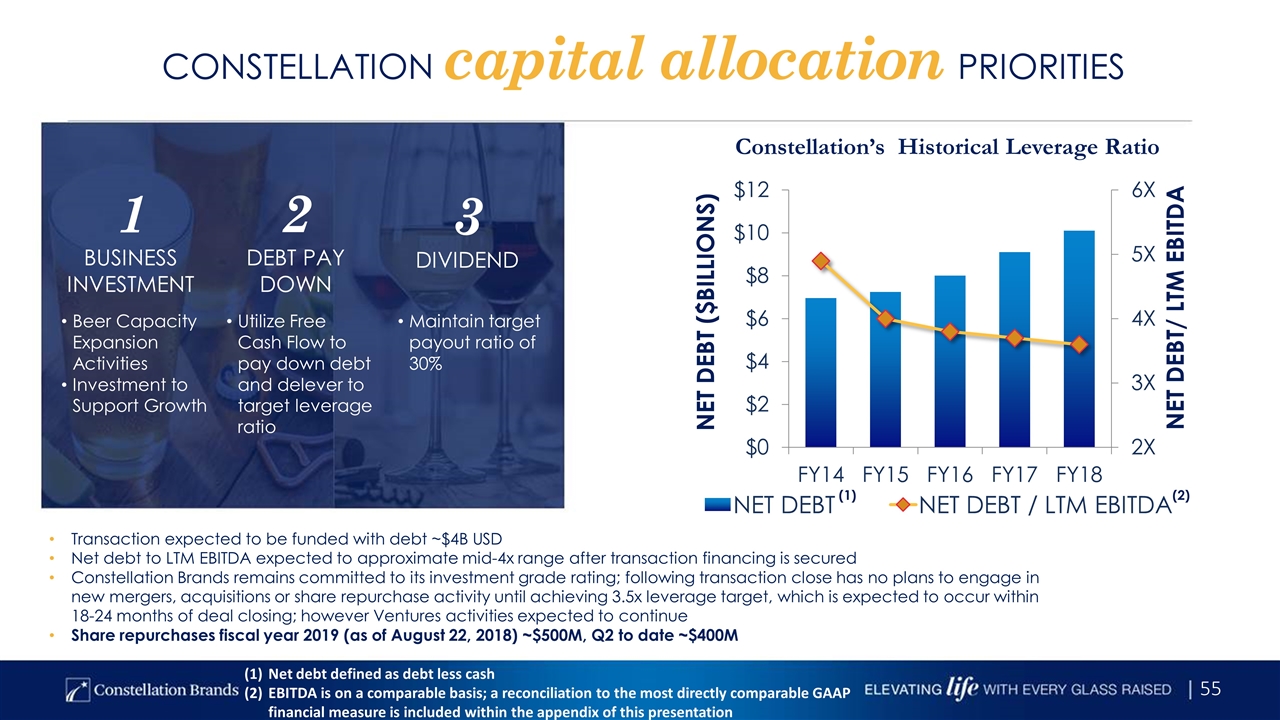

constellation capital allocation priorities Beer Capacity Expansion Activities Investment to Support Growth 2 DEBT PAY DOWN Utilize Free Cash Flow to pay down debt and delever to target leverage ratio Maintain target payout ratio of 30% 3 DIVIDEND Transaction expected to be funded with debt ~$4B USD Net debt to LTM EBITDA expected to approximate mid-4x range after transaction financing is secured Constellation Brands remains committed to its investment grade rating; following transaction close has no plans to engage in new mergers, acquisitions or share repurchase activity until achieving 3.5x leverage target, which is expected to occur within 18-24 months of deal closing; however Ventures activities expected to continue Share repurchases fiscal year 2019 (as of August 22, 2018) ~$500M, Q2 to date ~$400M Net debt defined as debt less cash EBITDA is on a comparable basis; a reconciliation to the most directly comparable GAAP financial measure is included within the appendix of this presentation Constellation’s Historical Leverage Ratio 1 Business Investment (1) (2)

long-term investment case Attractive growth categories within Consumer Space BEST IN CLASS GROWTH & profit margin profiles in CPG Significant cash generation & shareholder return opportunities

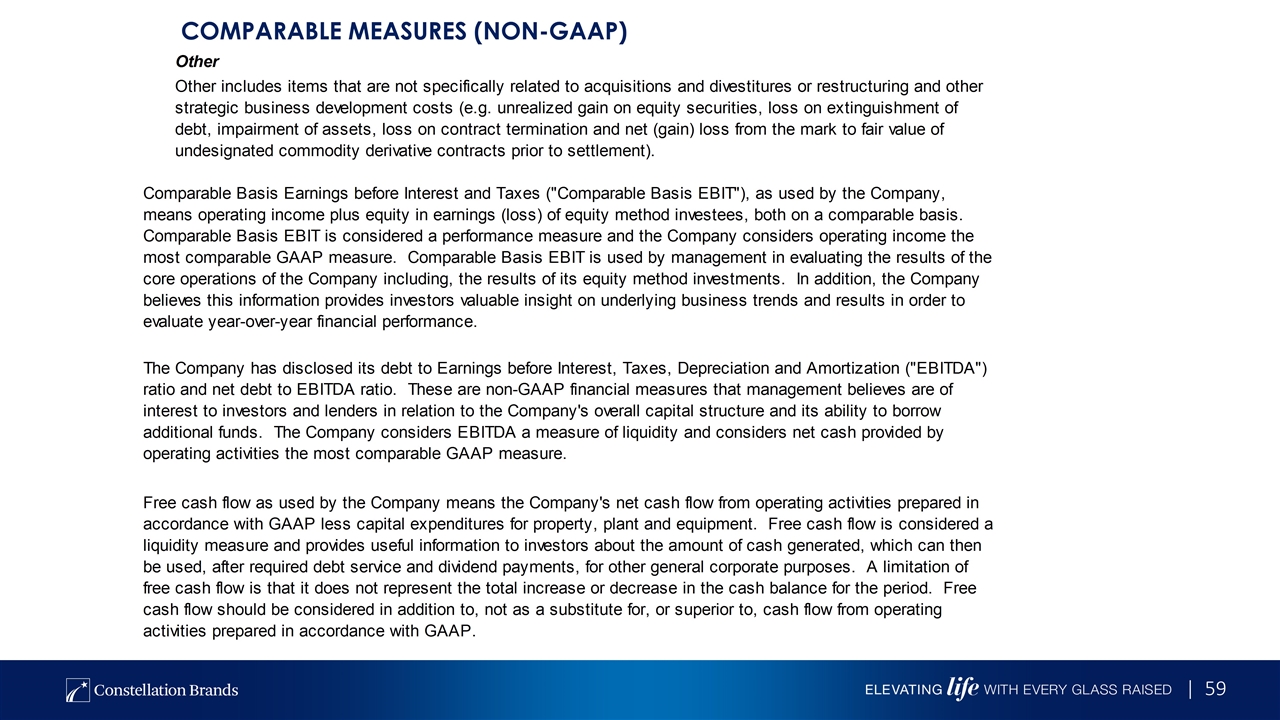

BEST IN CLASS GROWTH & profit margin profiles in CPG Comparable Measures (Non-GAAP) APPENDIX

BEST IN CLASS GROWTH & profit margin profiles in CPG Comparable Measures (Non-GAAP)

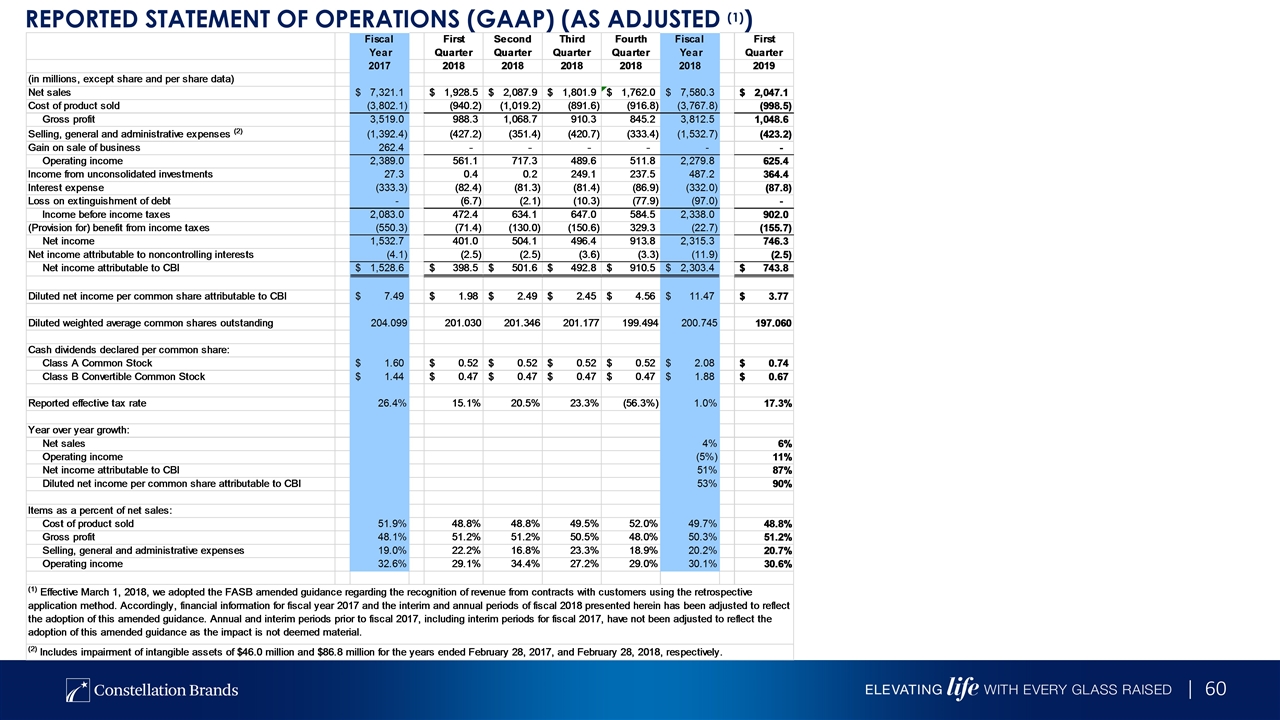

REPORTED STATEMENT OF OPERATIONS (GAAP) (as adjusted (1))

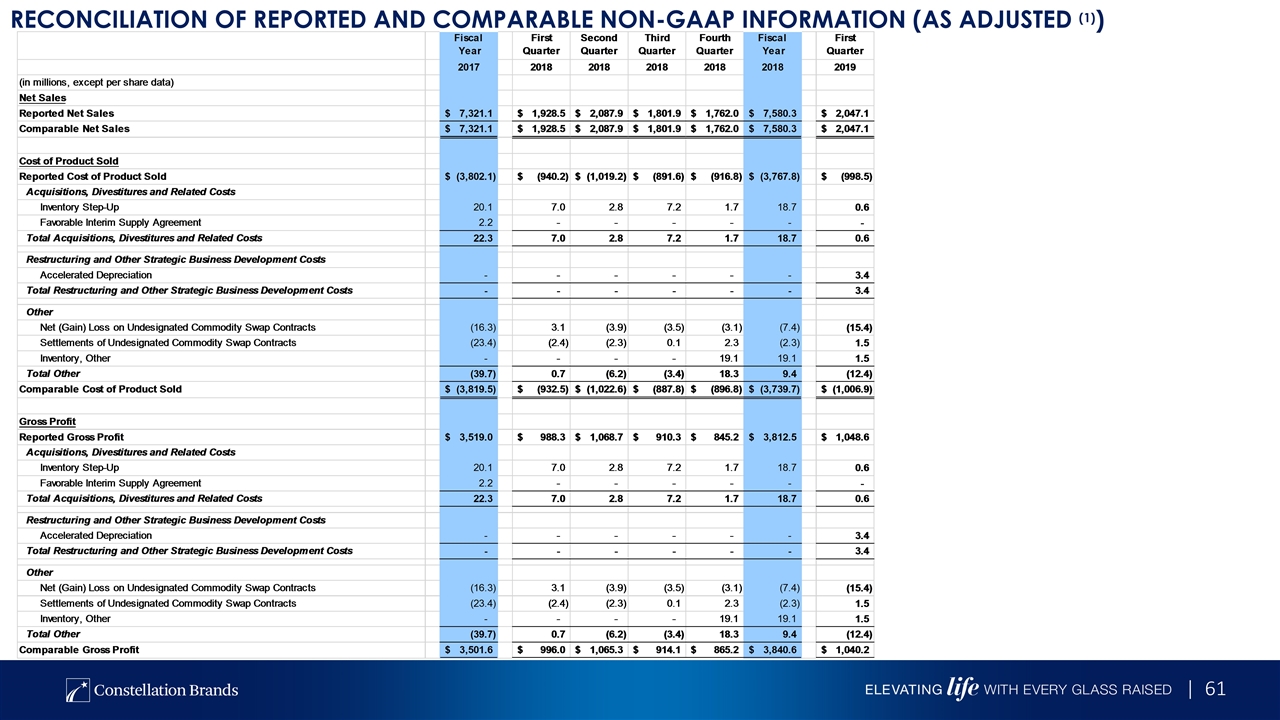

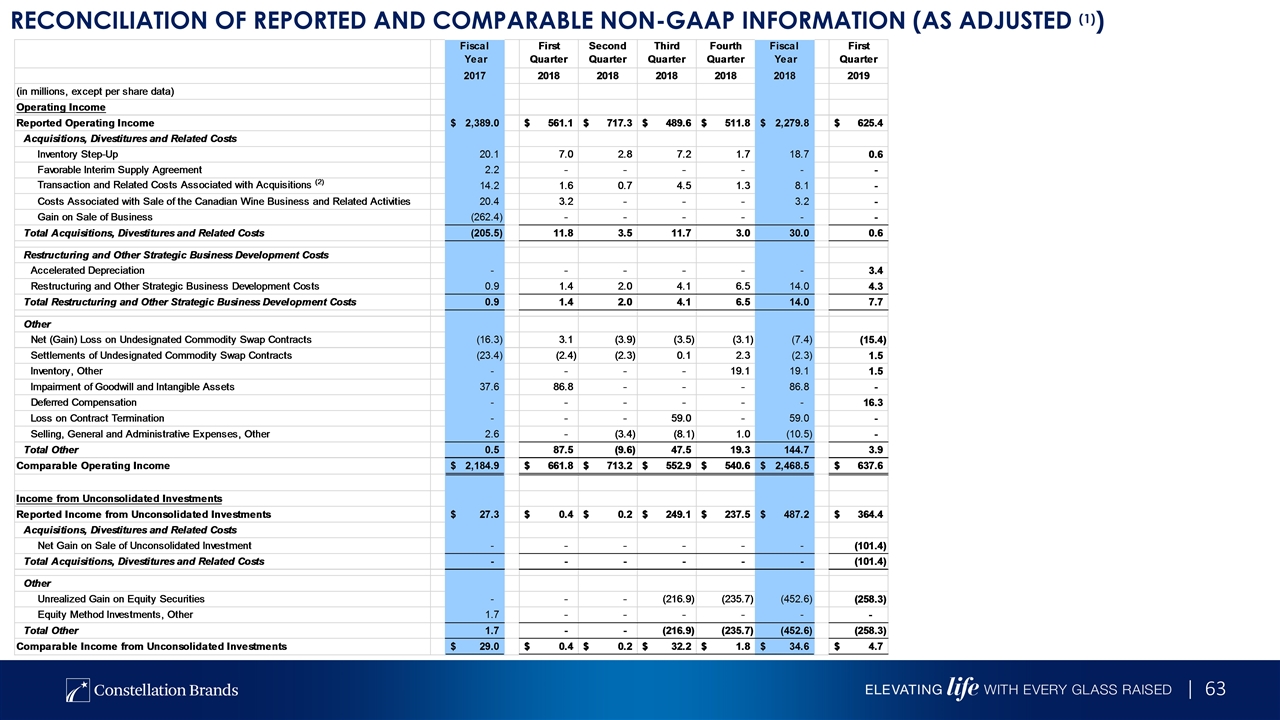

BEST IN CLASS GROWTH & profit margin profiles in CPG Reconciliation of reported and comparable non-gaap information (as adjusted (1))

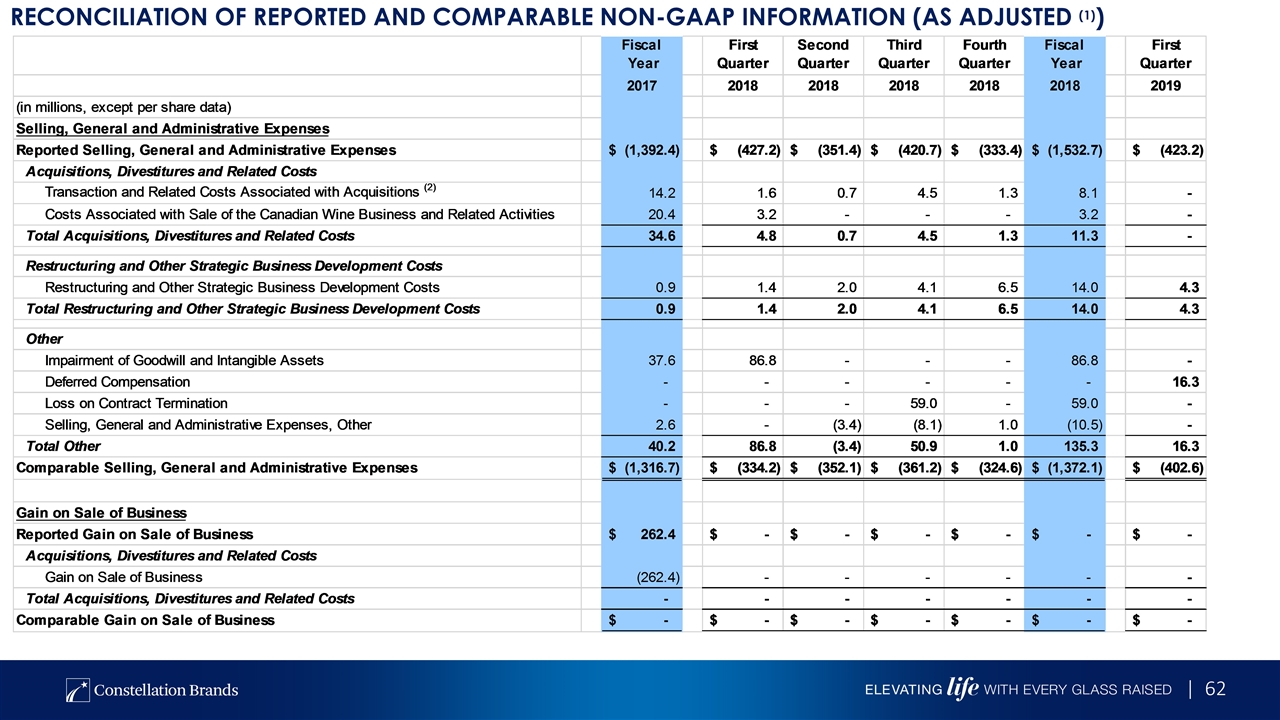

BEST IN CLASS GROWTH & profit margin profiles in CPG Reconciliation of reported and comparable non-gaap information (as adjusted (1))

BEST IN CLASS GROWTH & profit margin profiles in CPG Reconciliation of reported and comparable non-gaap information (as adjusted (1))

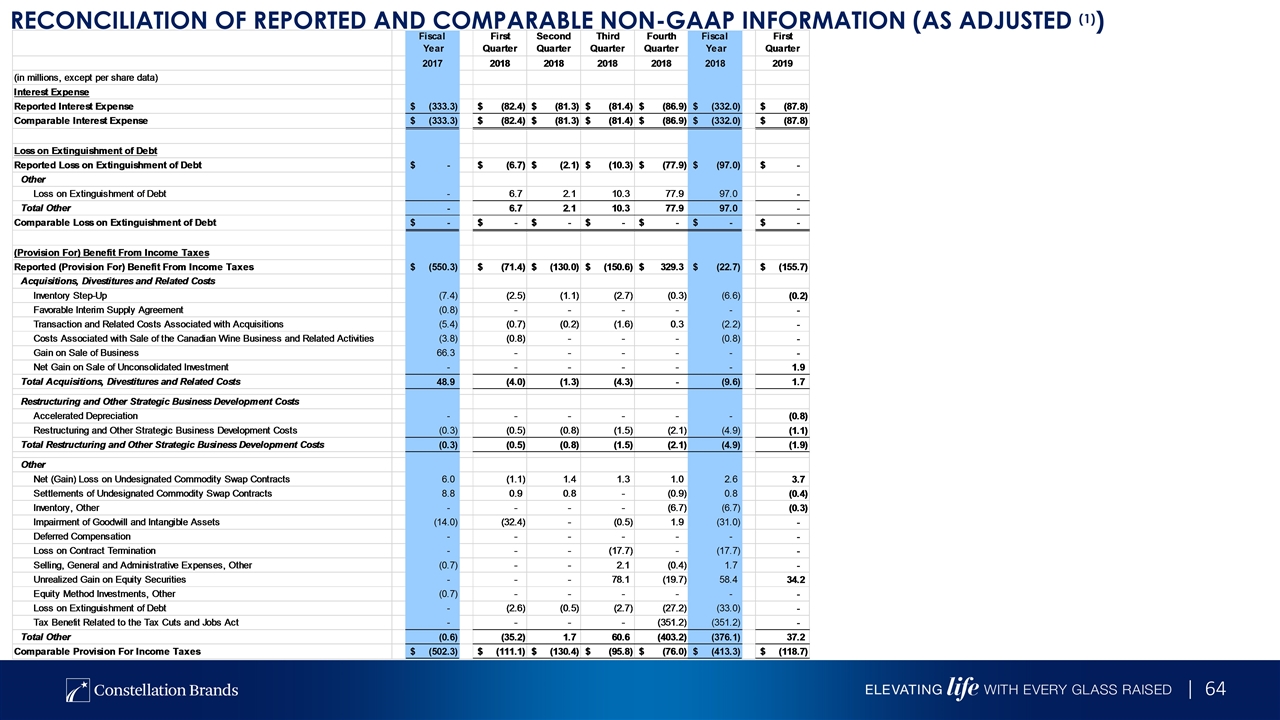

Reconciliation of reported and comparable non-gaap information (as adjusted (1))

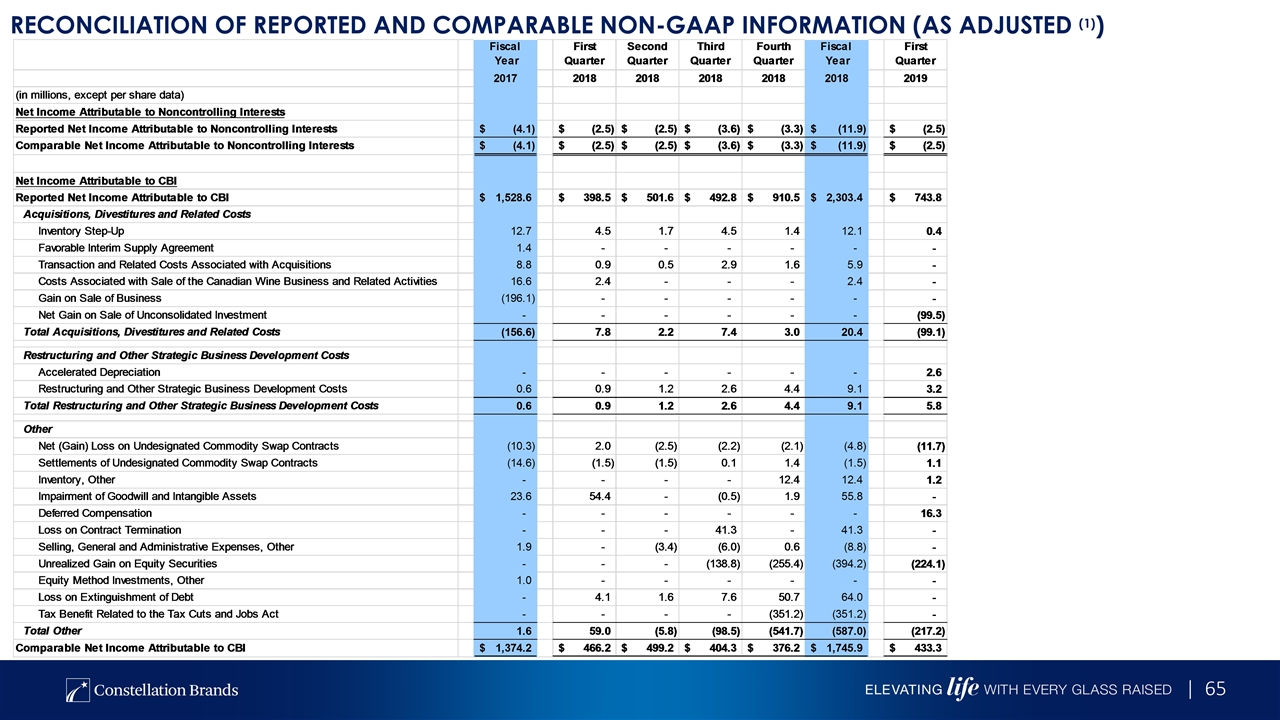

Reconciliation of reported and comparable non-gaap information (as adjusted (1))

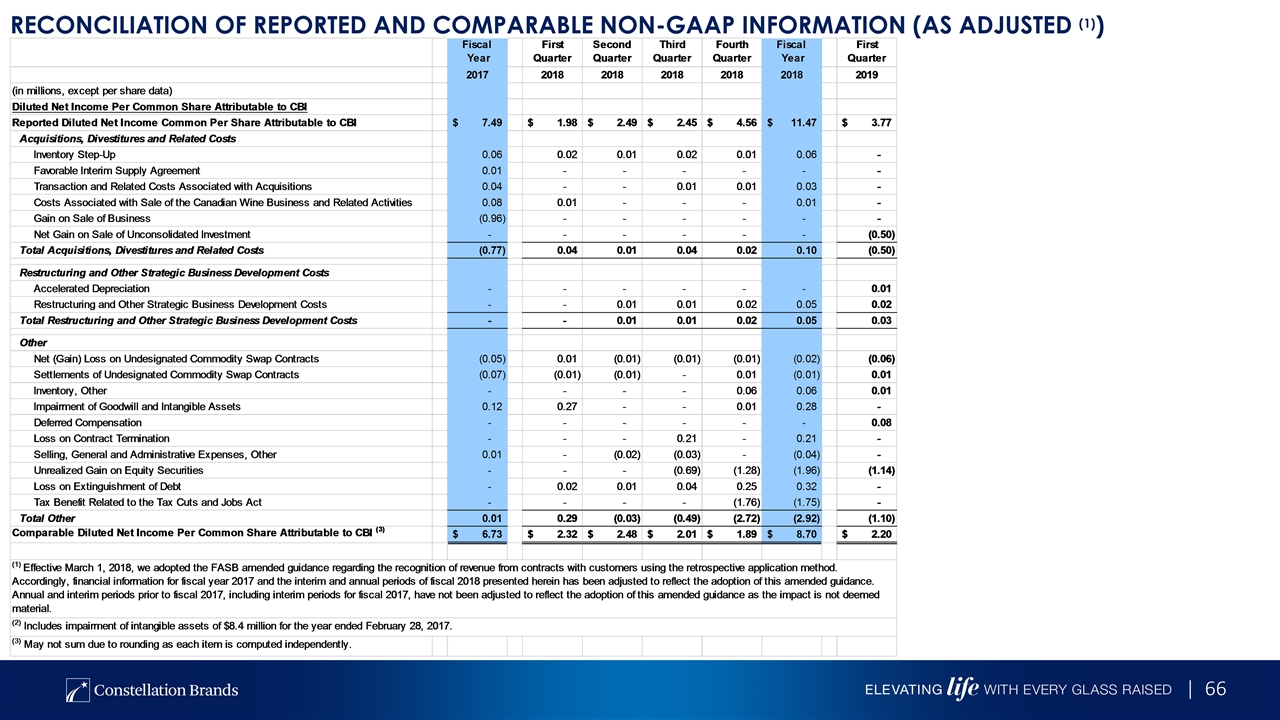

Reconciliation of reported and comparable non-gaap information (as adjusted (1))

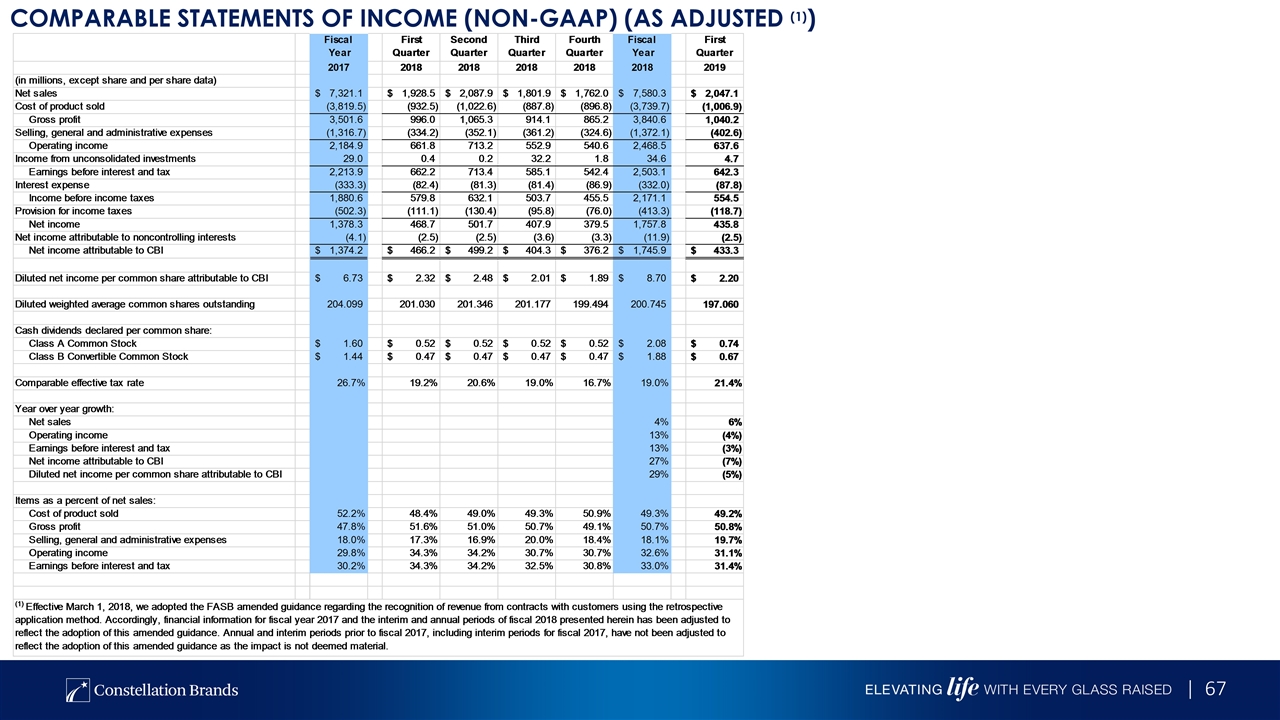

COMPARABLE STATEMENTs OF INCOME (Non-GAAP) (as adjusted (1))

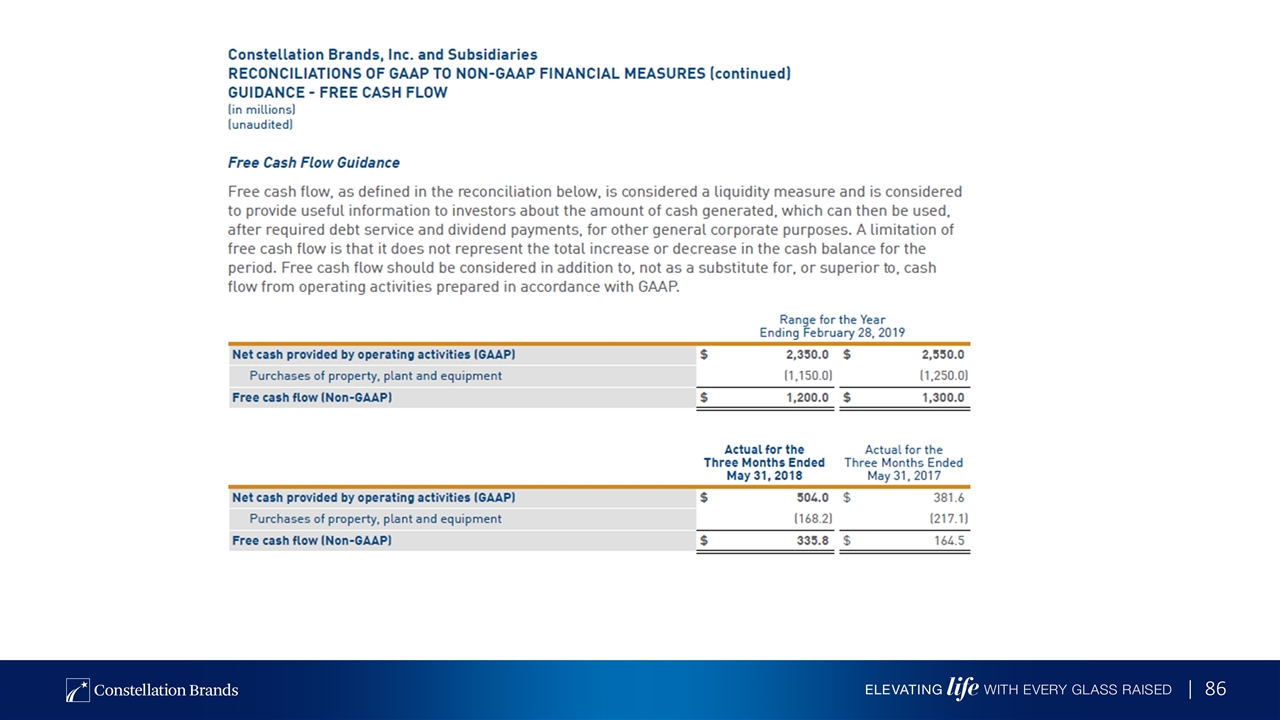

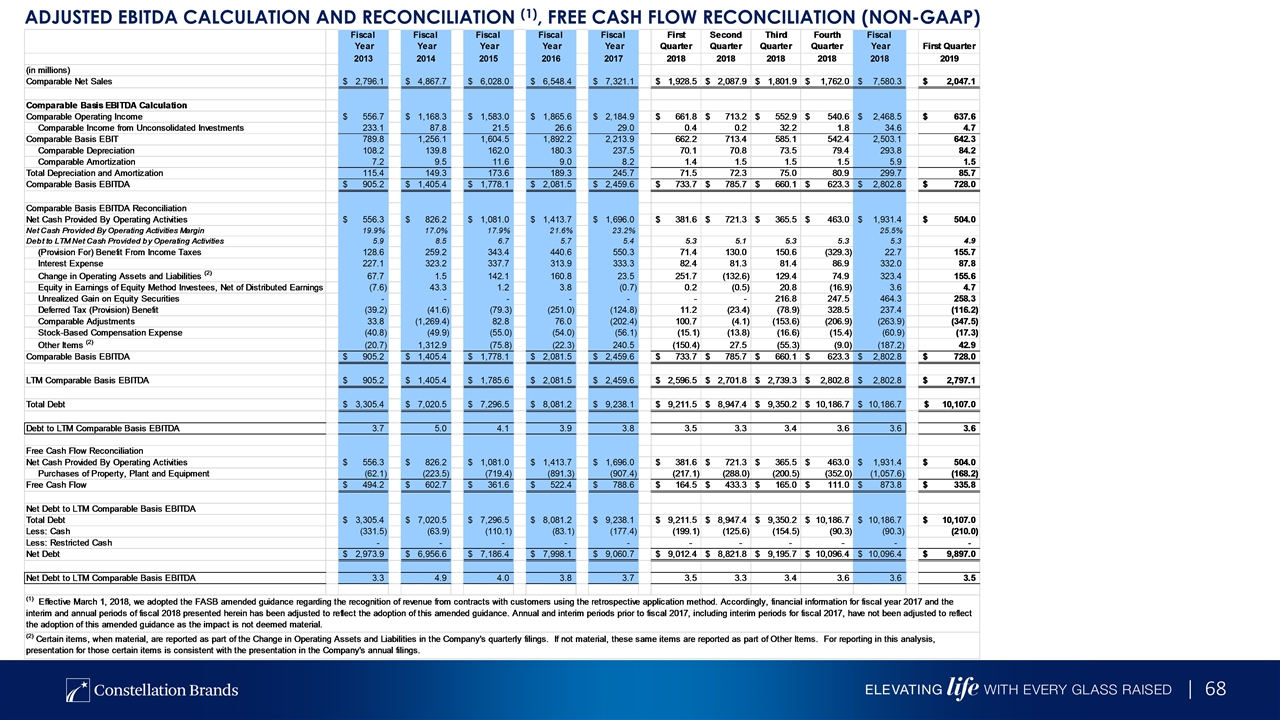

ADJUSTED EBITDA CALCULATION AND Reconciliation (1), FREE CASH FLOW RECONCILIATION (NON-gaap)

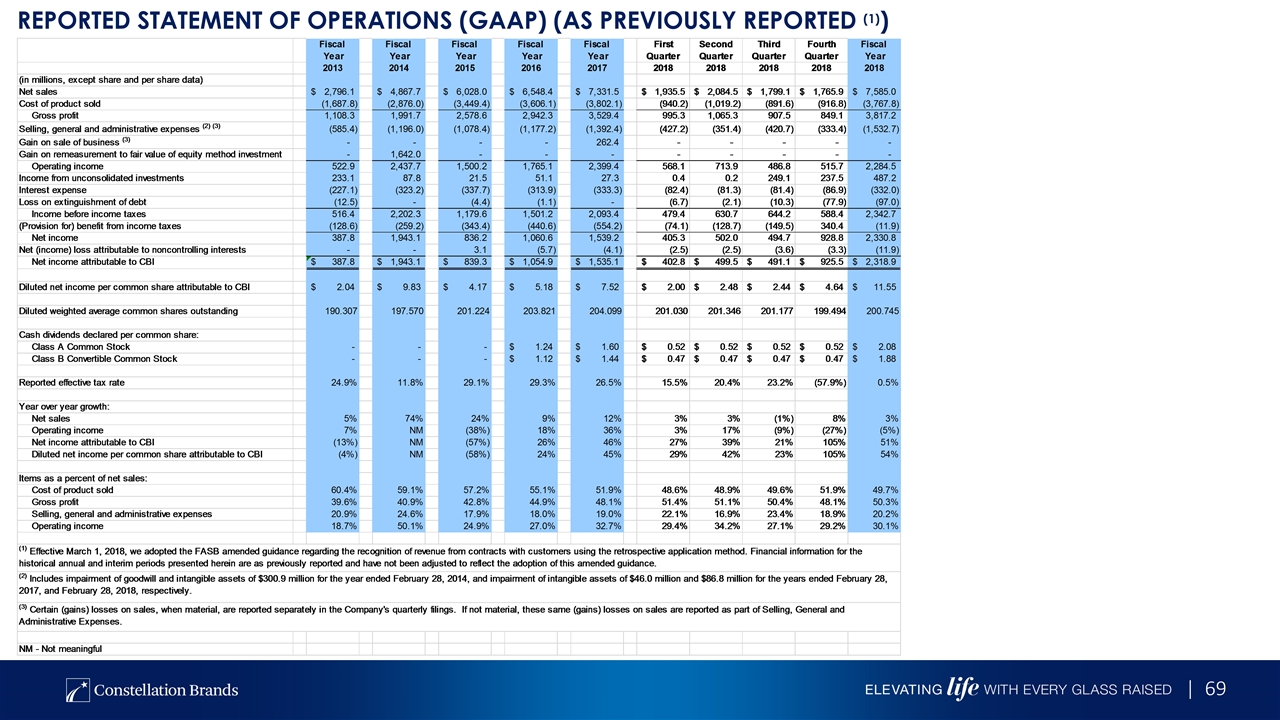

REPORTED STATEMENT OF OPERATIONS (GAAP) (as previously reported (1))

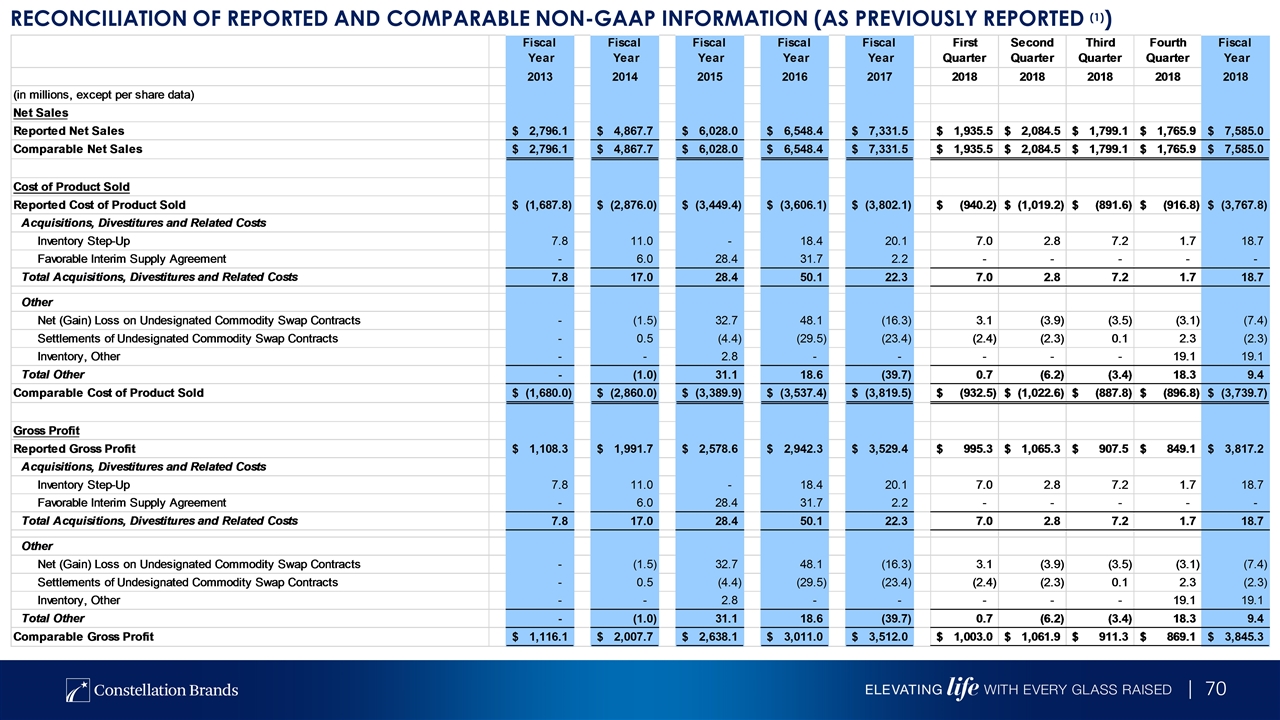

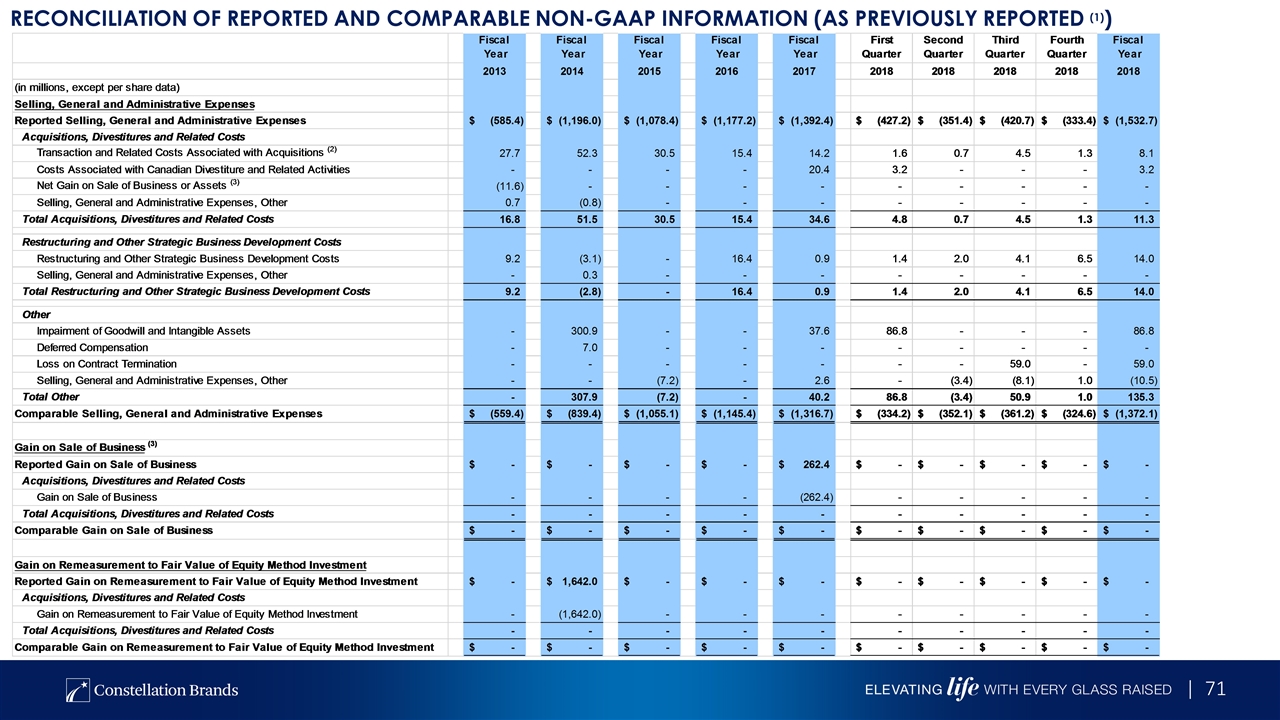

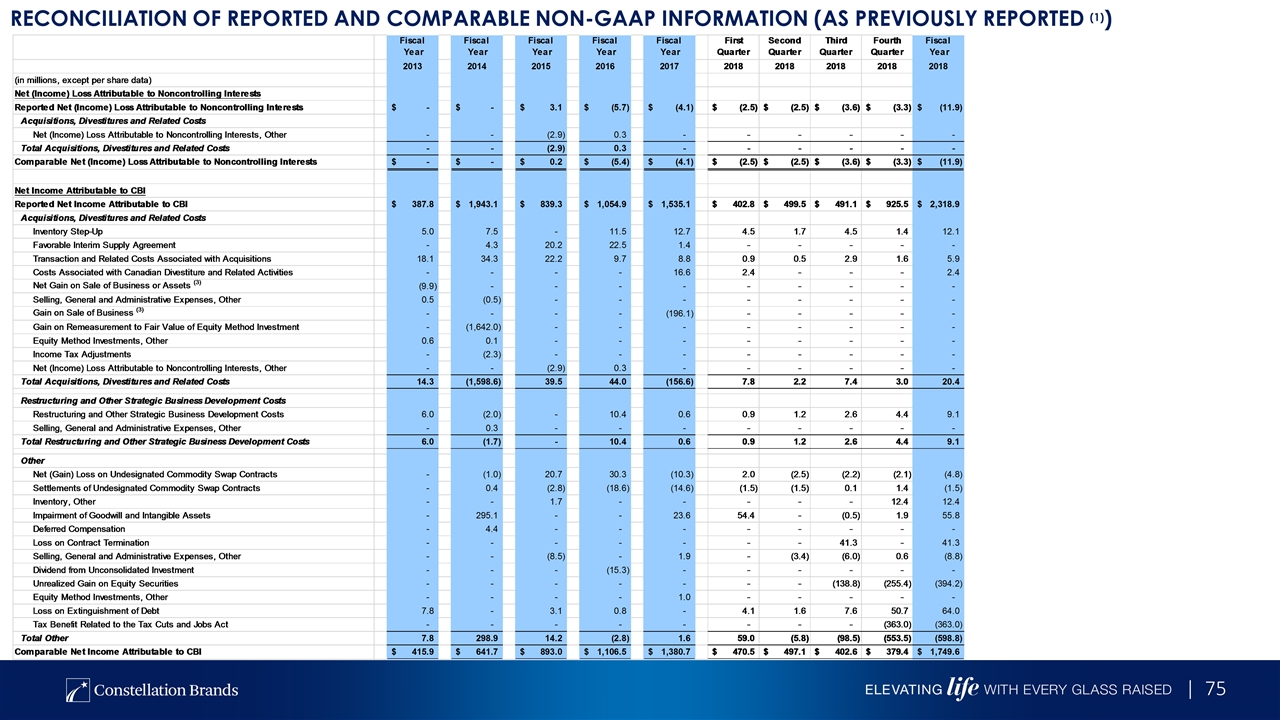

Reconciliation of reported and comparable non-gaap information (as previously reported (1))

Reconciliation of reported and comparable non-gaap information (as previously reported (1))

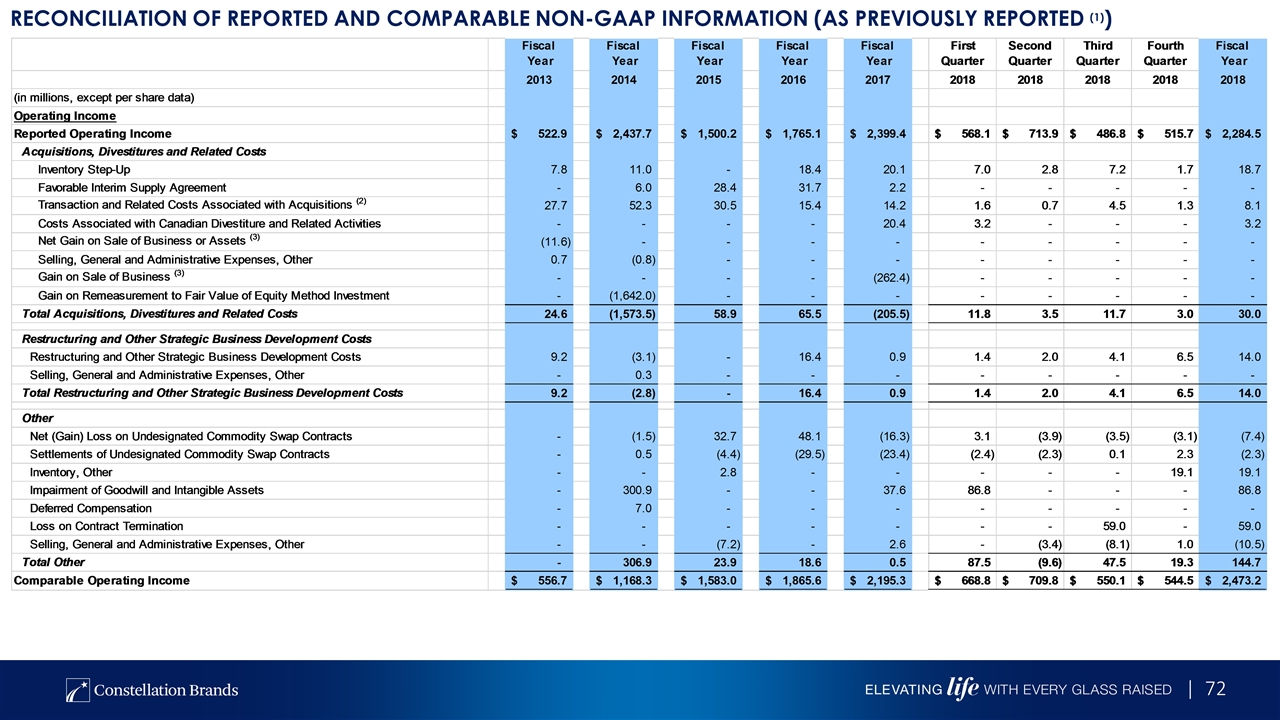

Reconciliation of reported and comparable non-gaap information (as previously reported (1))

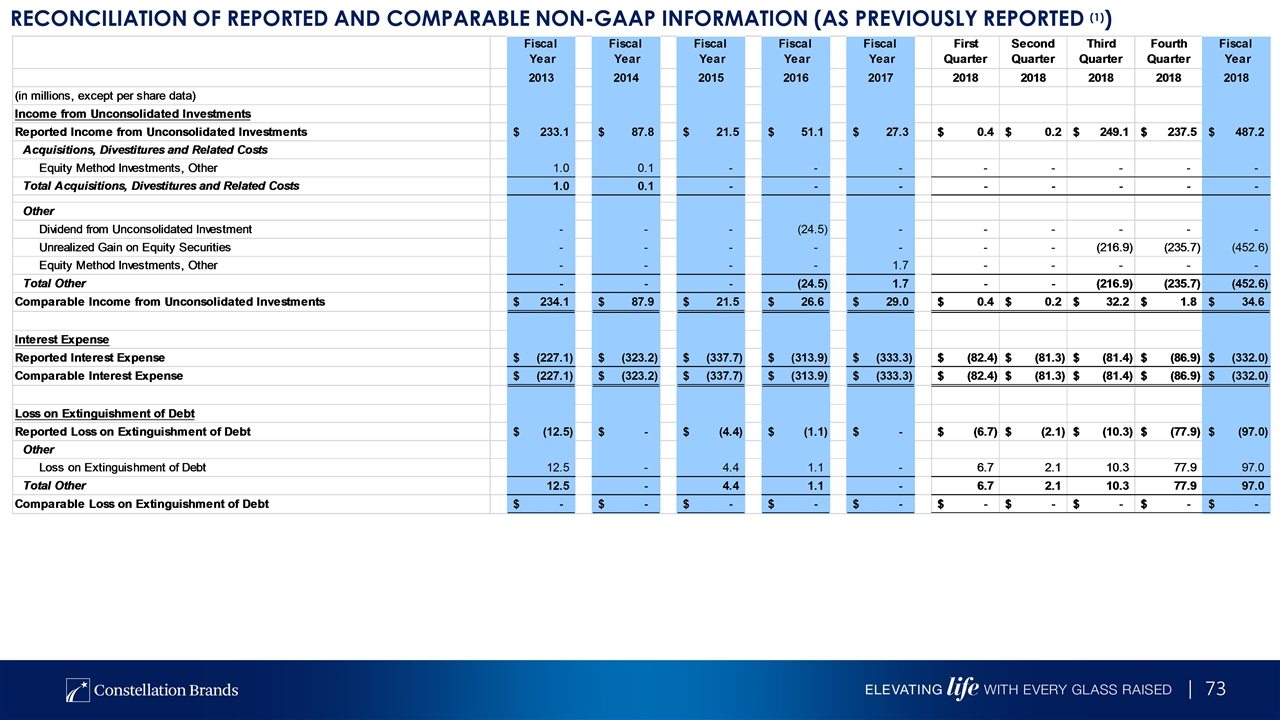

Reconciliation of reported and comparable non-gaap information (as previously reported (1))

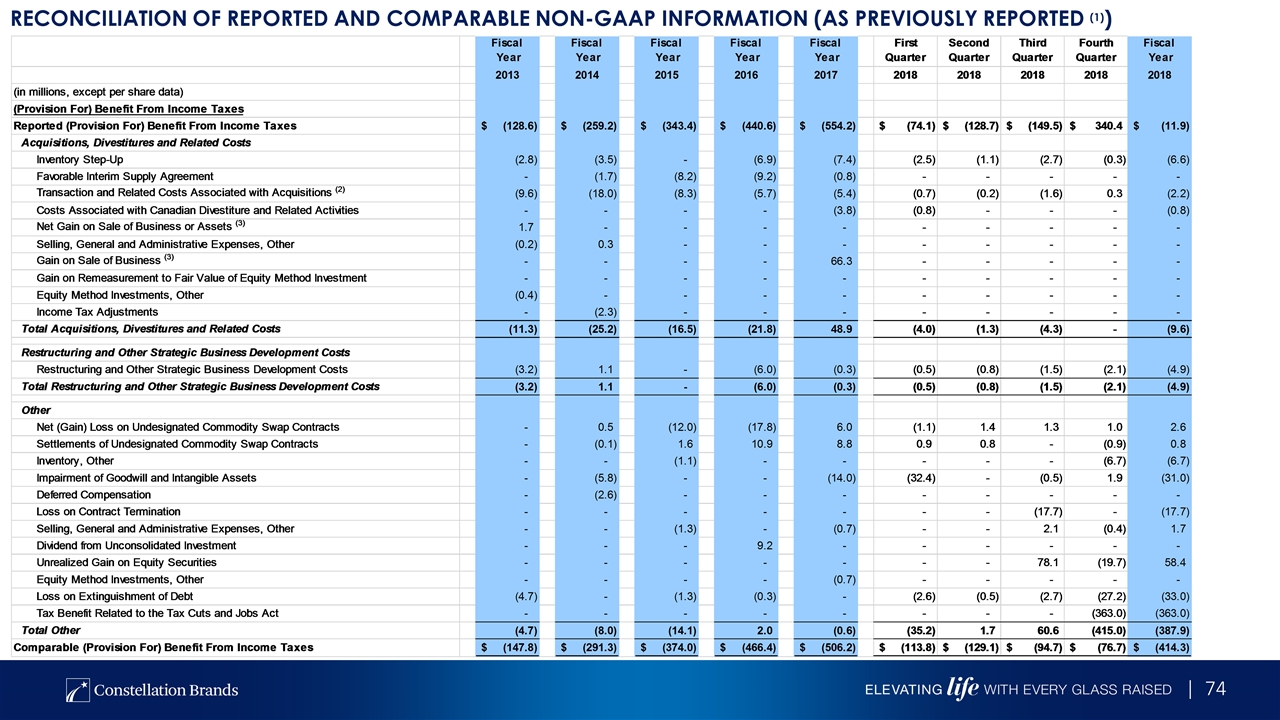

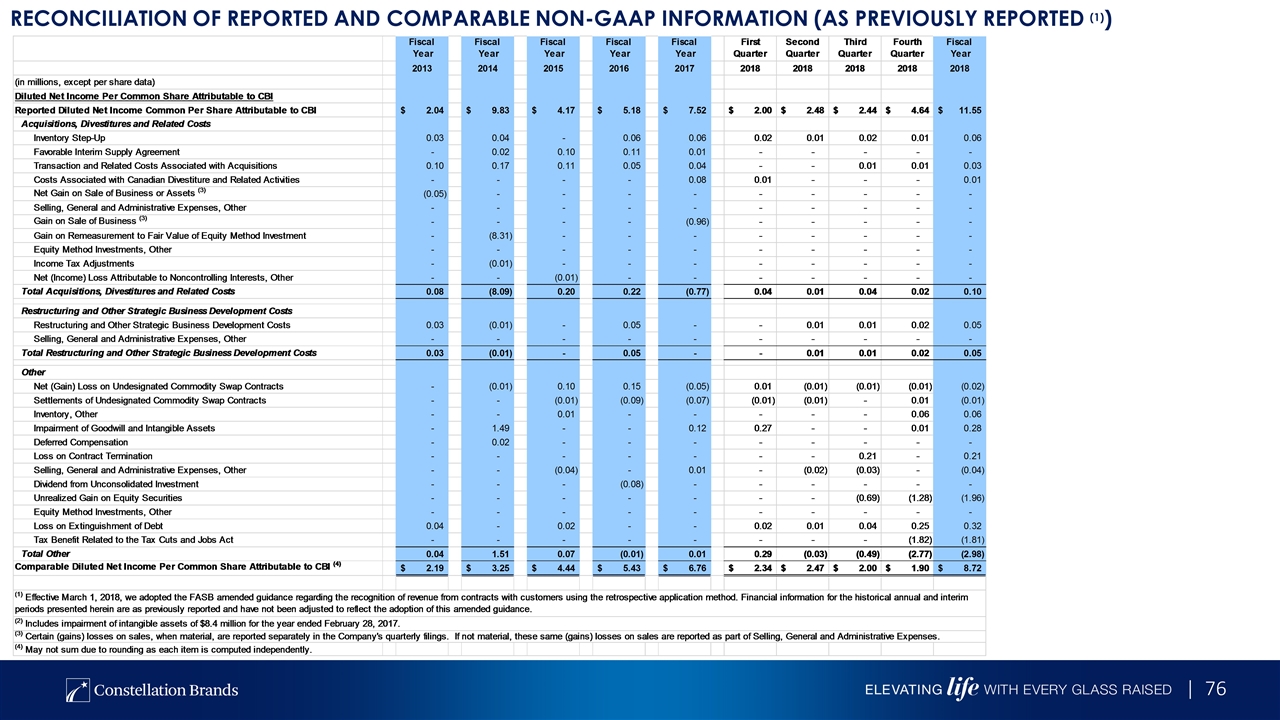

Reconciliation of reported and comparable non-gaap information (as previously reported (1))

BEST IN CLASS GROWTH & profit margin profiles in CPG Reconciliation of reported and comparable non-gaap information (as previously reported (1))

BEST IN CLASS GROWTH & profit margin profiles in CPG Reconciliation of reported and comparable non-gaap information (as previously reported (1))

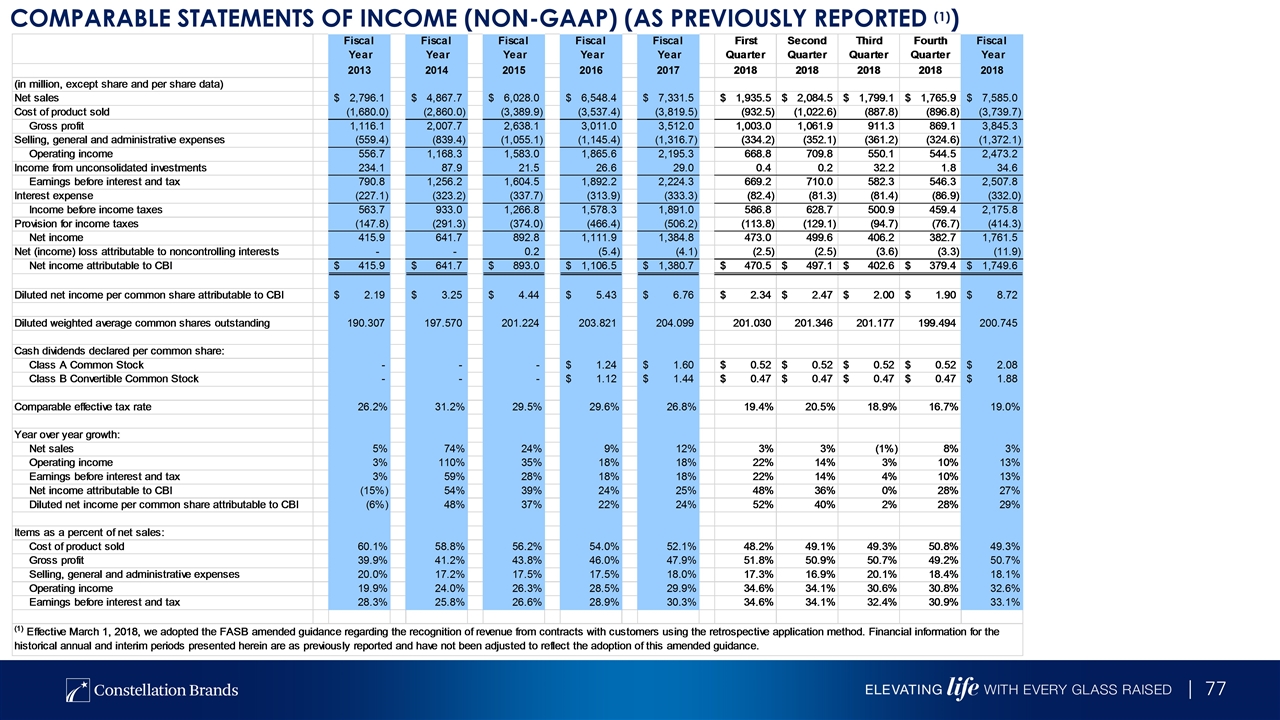

BEST IN CLASS GROWTH & profit margin profiles in CPG COMPARABLE STATEMENTs OF INCOME (Non-GAAP) (as previously reported (1))

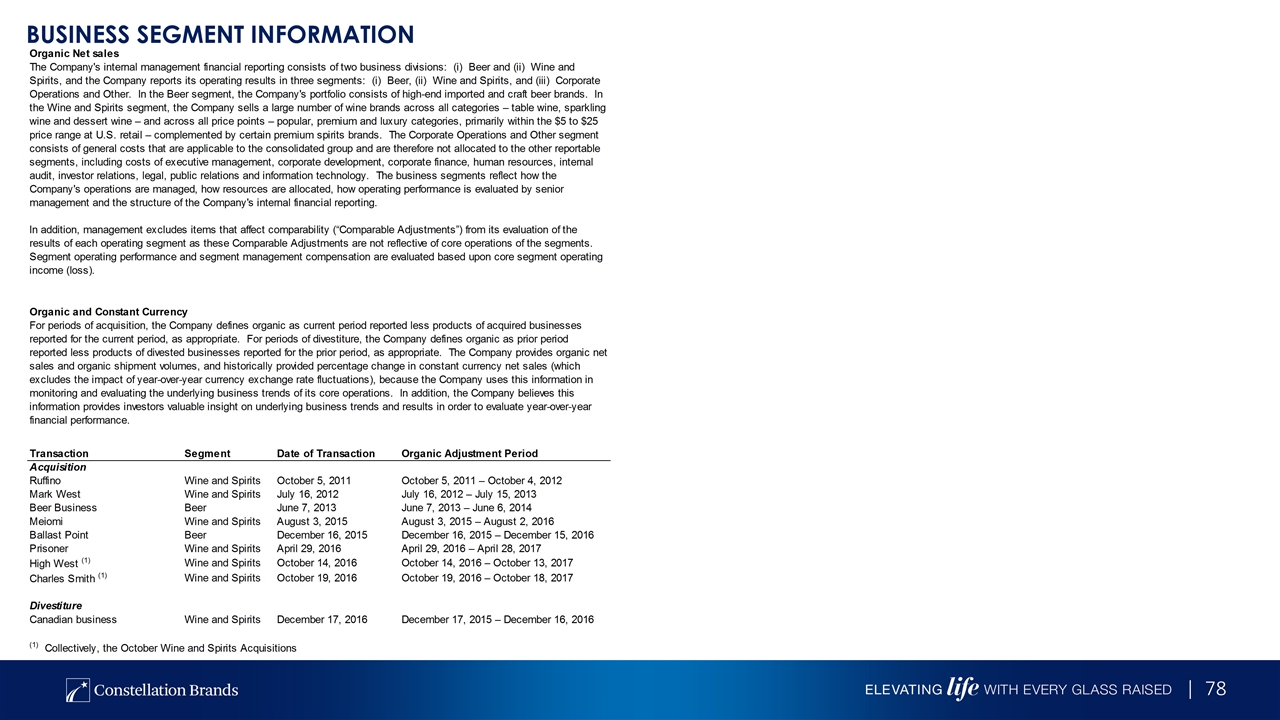

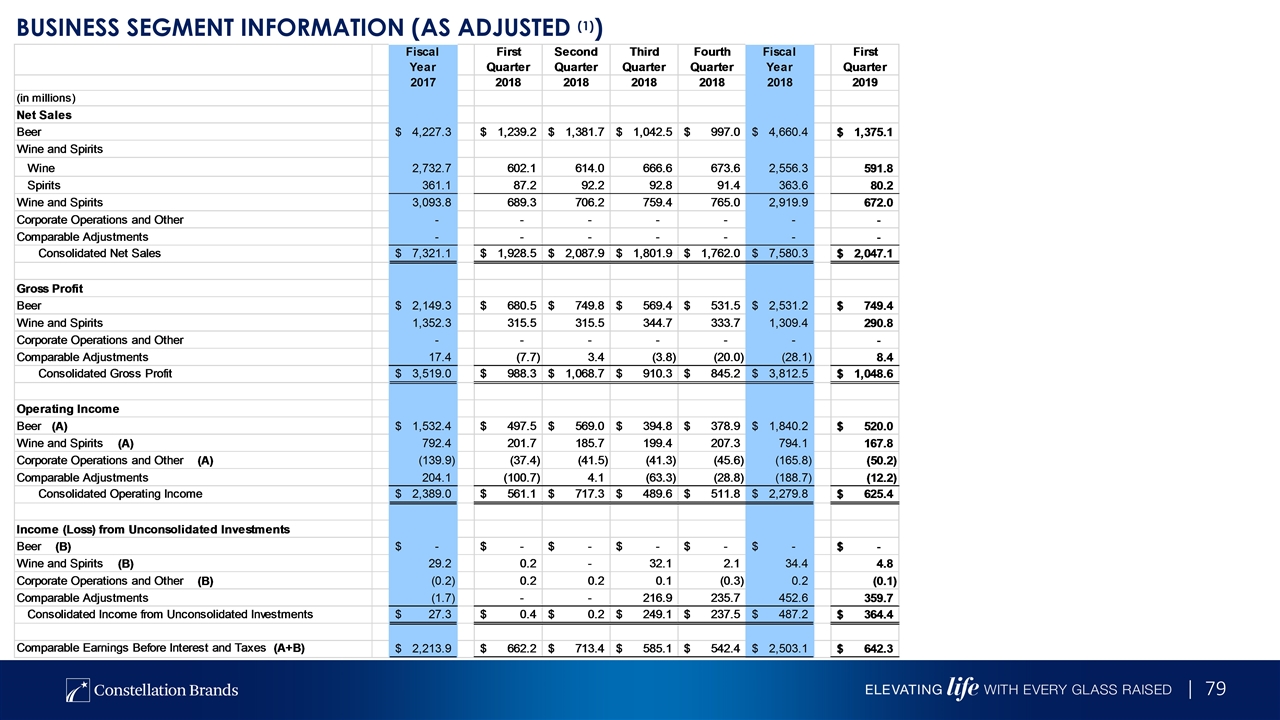

Business segment information

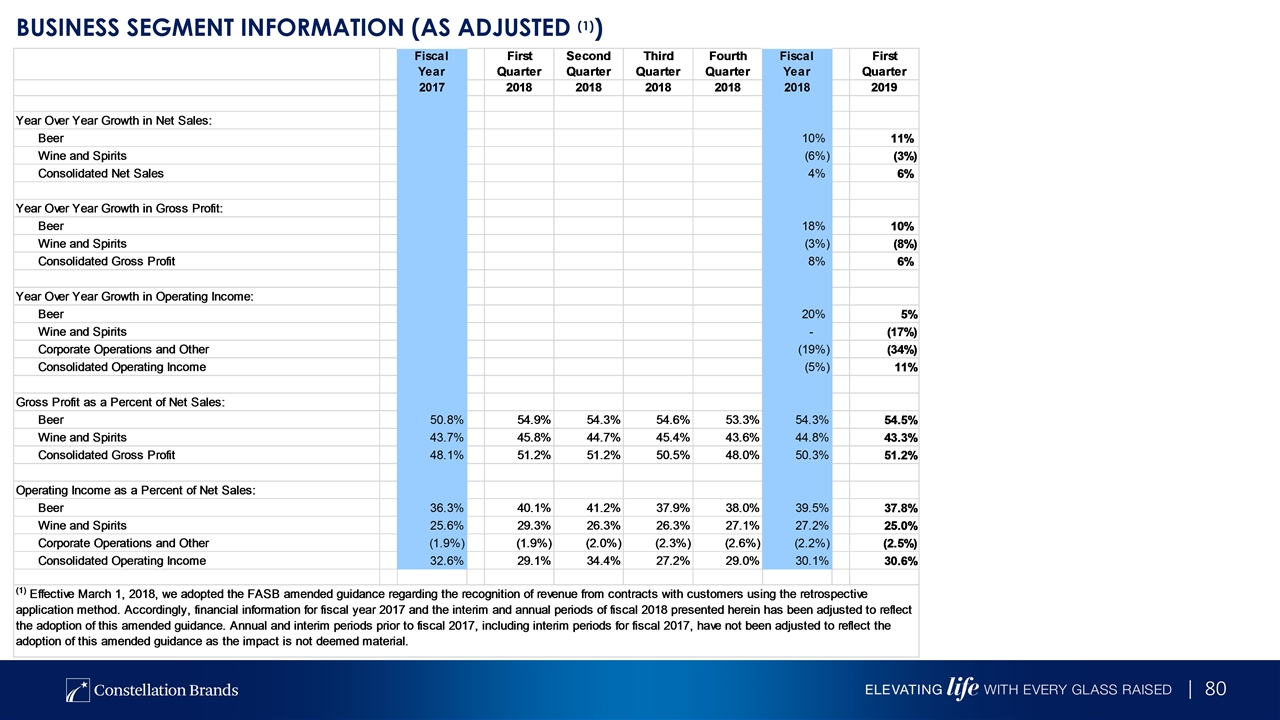

Business segment information (as adjusted (1))

Business segment information (as adjusted (1))

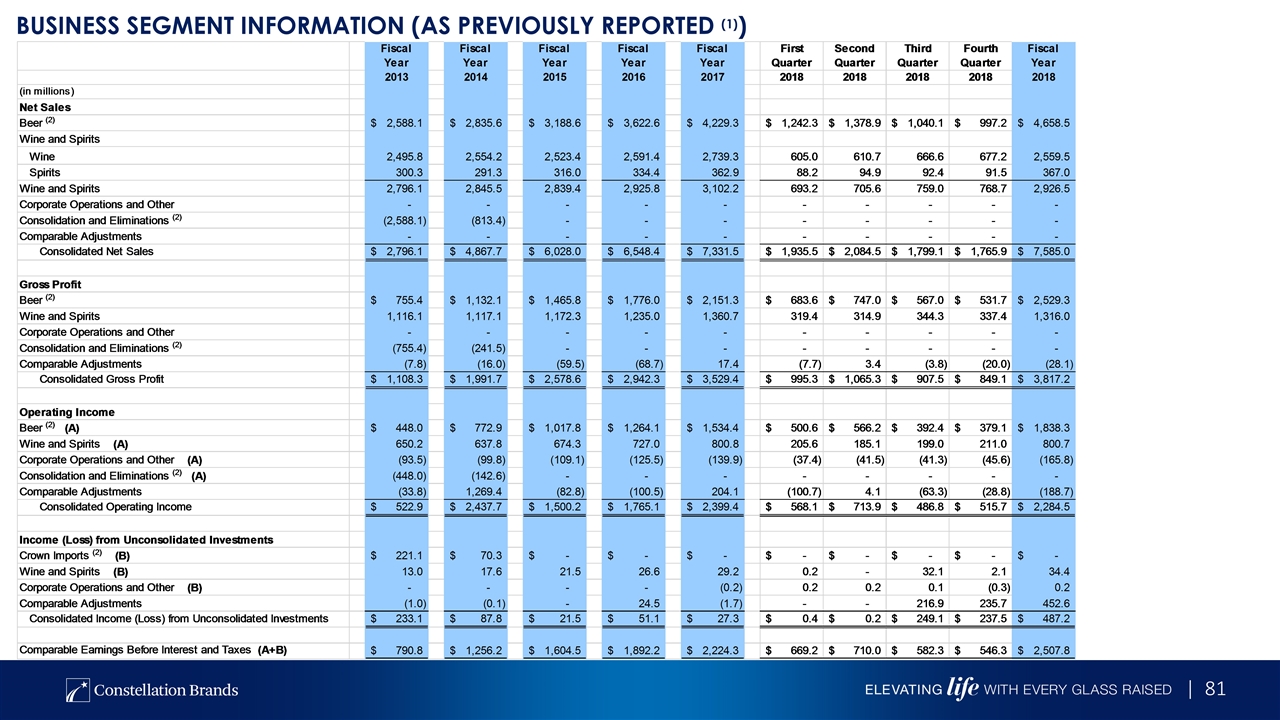

Business segment information (as previously reported (1))

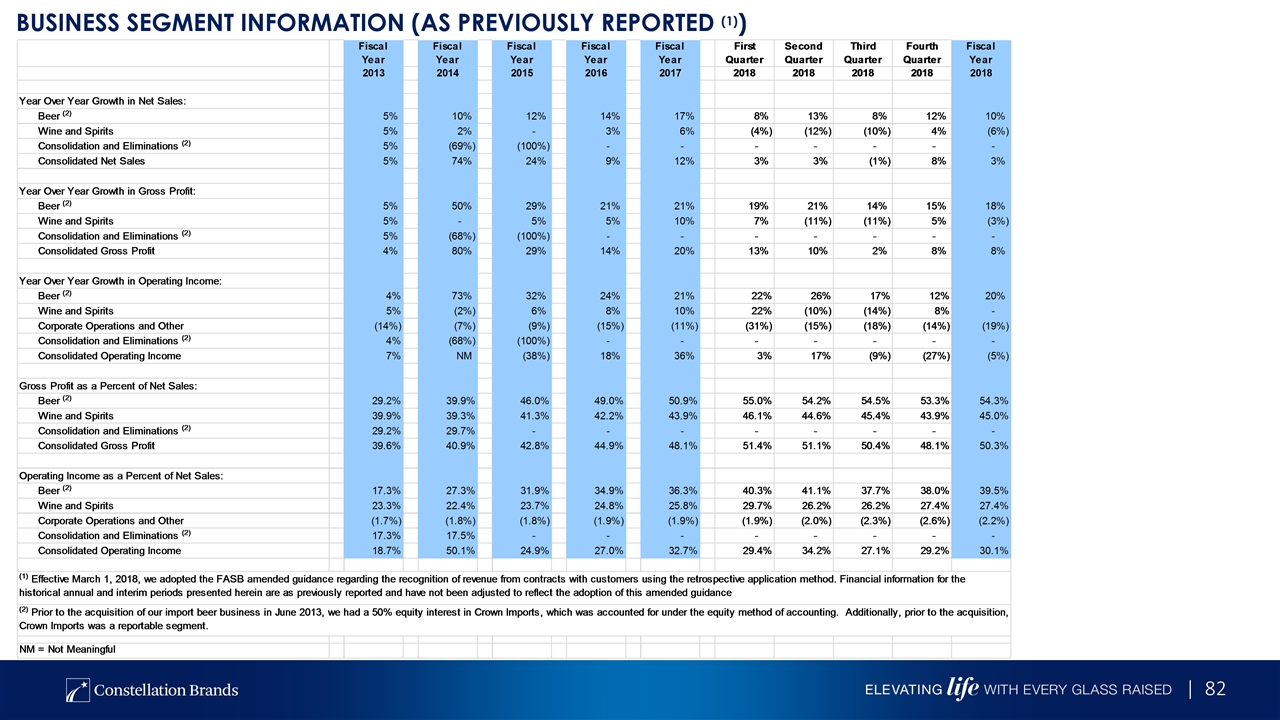

Business segment information (as previously reported (1))

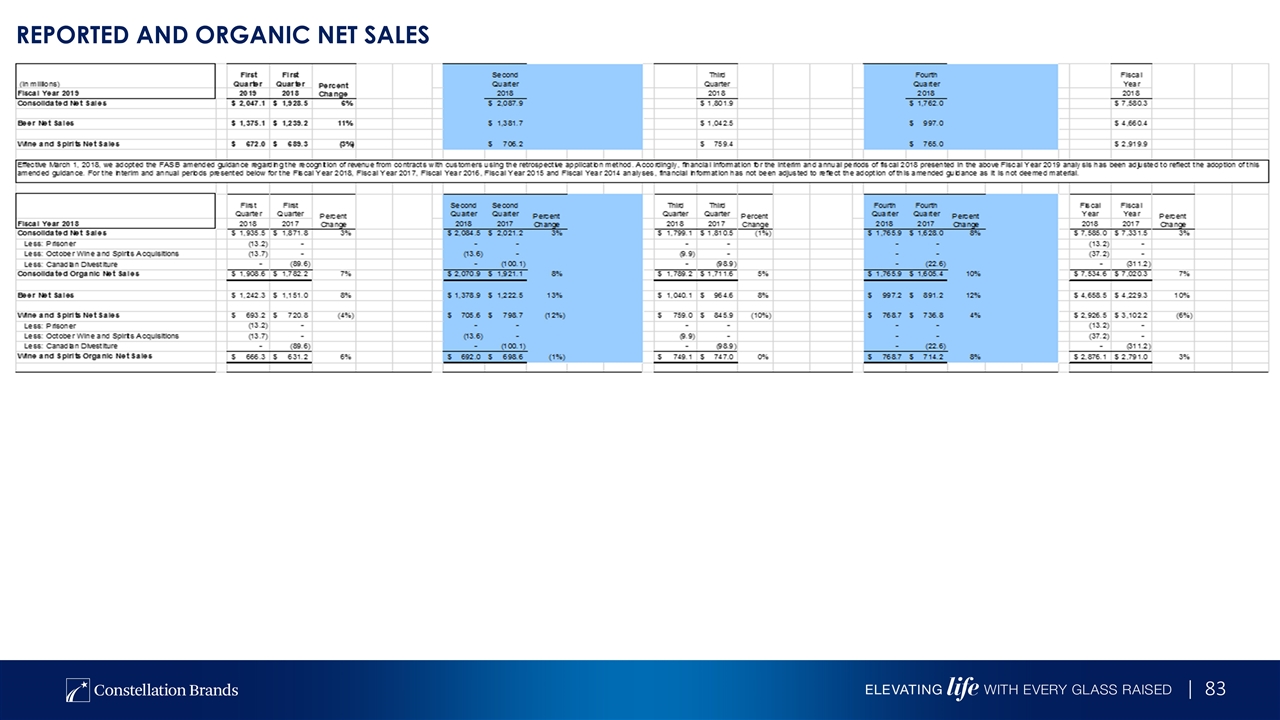

REPORTED AND ORGANIC Net sales

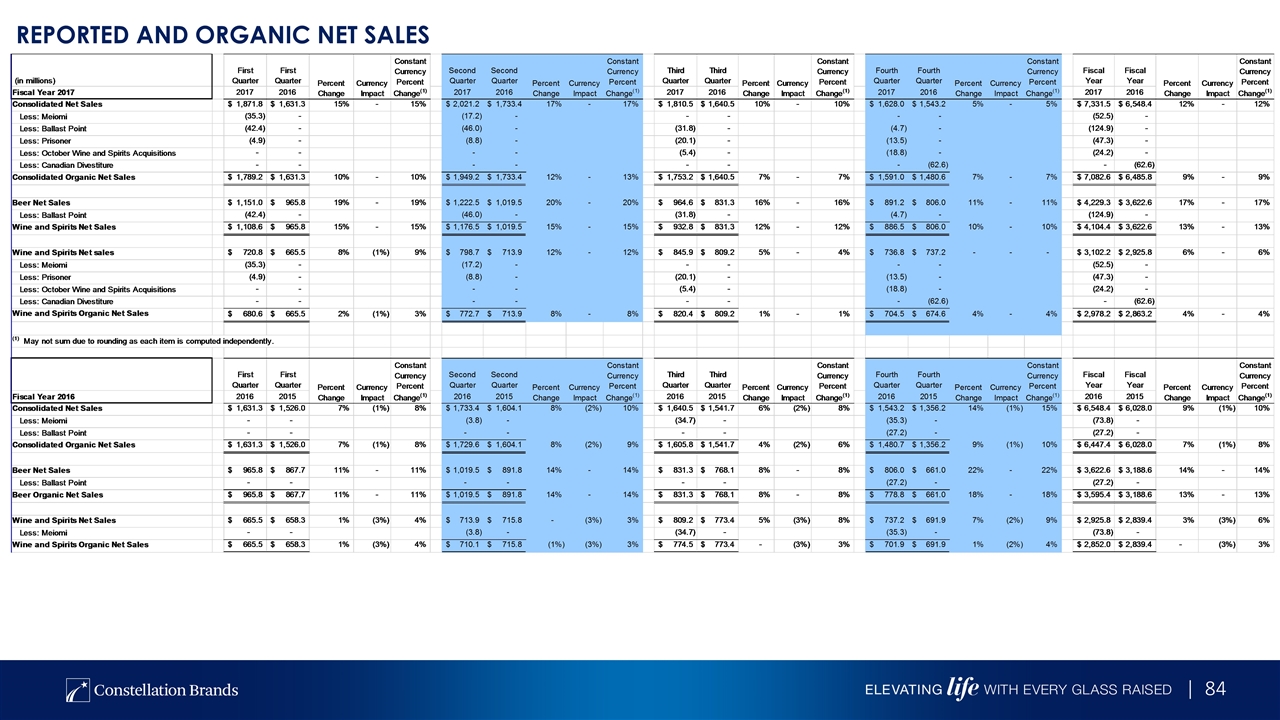

REPORTED AND ORGANIC Net sales

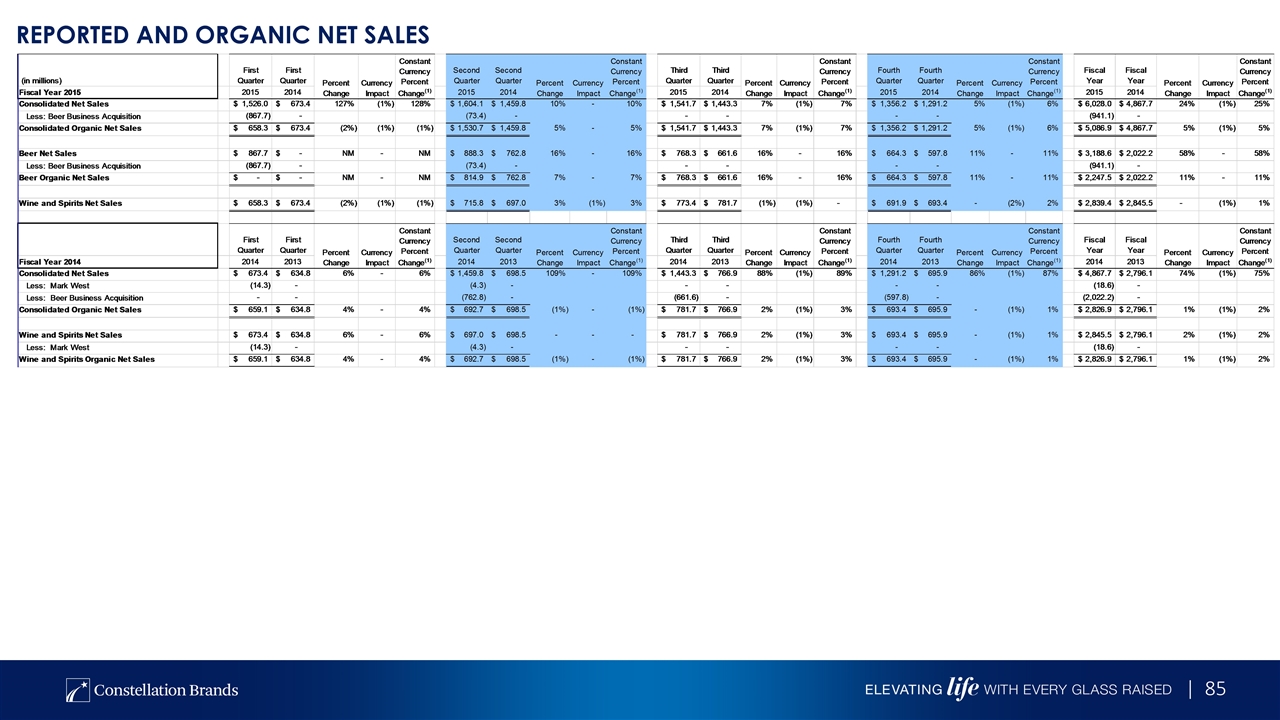

REPORTED AND ORGANIC Net sales