ADMINISTRATIVE SERVICES AGREEMENT

Published on January 3, 2007

EXHIBIT 99.3

EXECUTION COPY

ADMINISTRATIVE SERVICES AGREEMENT

between

BARTON INCORPORATED

and

CROWN IMPORTS LLC

Dated: January 2, 2007

TABLE OF CONTENTS

| Page | ||||

| ARTICLE I DEFINITIONS | 1 | |||

| ARTICLE II SERVICES | 2 | |||

| 2.1 |

Provision of Services | 2 | ||

| 2.2 |

Standard of Care for Performance of Services | 2 | ||

| ARTICLE III OFFICE SPACE | 2 | |||

| 3.1 |

License | 2 | ||

| 3.2 |

Utilities | 3 | ||

| 3.3 |

Restrictions on Use; Insurance | 3 | ||

| 3.4 |

Condition of Company Space | 3 | ||

| 3.5 |

Surrender | 3 | ||

| 3.6 |

Assignments and Sublicenses | 3 | ||

| ARTICLE IV REPRESENTATIONS AND WARRANTIES | 3 | |||

| 4.1 |

Representations and Warranties | 3 | ||

| ARTICLE V FEE | 5 | |||

| ARTICLE VI INDEMNIFICATION | 5 | |||

| 6.1 |

Indemnification | 5 | ||

| 6.2 |

Procedure | 5 | ||

| 6.3 |

No Consequential Damages | 6 | ||

| 6.4 |

Limitation on Damages | 6 | ||

| 6.5 |

Exclusive Remedies | 6 | ||

| ARTICLE VII TERM | 6 | |||

| 7.1 |

Term | 6 | ||

| 7.2 |

Termination | 7 | ||

| ARTICLE VIII TRANSITION OF REQUISITE LICENSES | 7 | |||

| ARTICLE IX GOVERNING LAW; CHOICE OF FORUM | 8 | |||

| ARTICLE X MISCELLANEOUS | 8 | |||

| 10.1 |

Notices | 8 | ||

| 10.2 |

Counterparts and Facsimile Signatures | 9 | ||

| 10.3 |

Assignment | 9 | ||

| 10.4 |

Entire Agreement | 9 | ||

| 10.5 |

Severability | 9 | ||

| 10.6 |

Waiver; Amendment | 10 | ||

- i -

| 10.7 |

Parties in Interest; No Third Party Rights | 10 | ||

| 10.8 |

Independent Contractors | 10 | ||

| 10.9 |

Binding Effect | 10 |

| SCHEDULES | ||

| A | Services | |

| B | Company Space | |

- ii -

ADMINISTRATIVE SERVICES AGREEMENT

This ADMINISTRATIVE SERVICES AGREEMENT (the Agreement), dated this 2nd day of Jauary, 2007, by and between CROWN IMPORTS LLC, a Delaware limited liability company (the Company), and BARTON INCORPORATED, a corporation incorporated under the laws of the State of Delaware (BI).

W I T N E S S E T H:

WHEREAS, pursuant to an Agreement to Establish Joint Venture, dated July , 2006 (the Joint Venture Agreement), Barton Beers, Ltd., a corporation incorporated under the laws of the State of Maryland (Barton Beers), and Diblo, S.A. de C.V., a sociedad anónima de capital variable organized under the laws of the Country of Mexico (Diblo), have agreed to form the Company, a joint venture between Barton Beers and GModelo Corporation; and

WHEREAS, execution and delivery of this Agreement is one of the conditions precedent to the Closing (as defined in the Joint Venture Agreement) of the transactions contemplated by the Joint Venture Agreement;

NOW, THEREFORE, in consideration of the promises contained herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

ARTICLE I

DEFINITIONS

1.1 Definitions. All capitalized terms used but not otherwise defined in this Agreement shall have the meanings assigned thereto in the Joint Venture Agreement, which meanings are incorporated herein and made a part hereof by reference.

1.2 Construction.

(a) Unless the context of this Agreement otherwise requires, (i) words of any gender include each other gender; (ii) words using the singular or plural number also include the plural or singular number, respectively; (iii) the terms hereof, herein, hereby and derivative or similar words refer to this entire Agreement; (iv) the terms Article, Section, Schedule or Exhibit refer to the specified Article, Section, Schedule or Exhibit of this Agreement, unless otherwise specifically stated; (v) the words include or including shall mean include, without limitation or including, without limitation; and (vi) the word or shall be disjunctive but not exclusive.

(b) References to agreements and other documents shall be deemed to include all subsequent amendments and other modifications thereto.

(c) References to statutes shall include all regulations promulgated thereunder and, except to the extent specifically provided below, references to statutes or regulations shall be construed as including all statutory and regulatory provisions consolidating, amending or replacing the statute or regulation.

(d) The language used in this Agreement shall be deemed to be the language chosen by the parties to express their mutual intent, and no rule of strict construction shall be applied against any party. This Agreement is the joint drafting product of the parties hereto and each provision has been subject to negotiation and agreement and shall not be construed for or against any party as drafter thereof.

(e) All accounting terms used herein and not expressly defined herein shall have the meanings given to them under GAAP.

(f) All amounts in this Agreement are stated and shall be paid in United States dollars.

ARTICLE II

SERVICES

2.1 Provision of Services. BI shall provide the Company [****] (collectively, the Services).

2.2 Standard of Care for Performance of Services. In performing the Services: (i) BI shall provide the same level of services and use the same degree of care as BIs personnel provide and use in providing similar services to BIs internal business units; and (ii) neither BI nor any of its employees shall be deemed to owe any fiduciary duties to the Company.

ARTICLE III

OFFICE SPACE

3.1 License.

(a) Subject to the terms and conditions of this Agreement, BI hereby grants to the Company, and the Company hereby accepts from BI, a license to use and occupy a portion of the office space currently leased by BI (the total space so leased by BI is referred to herein as the Office Space) and located at One South Dearborn Street in Chicago, Illinois, as described in Schedule B hereto (such portion of the Office Space so licensed to the Company and any additional office space at such location hereinafter occupied or used by the Company at the request of the Company with BIs consent is referred to collectively herein as the Company Space), together with access to the common areas of the Office Space. The parties acknowledge that if BI moves its offices during the term of this Agreement, which BI shall be permitted to do at any time in its sole and absolute discretion, the foregoing license shall apply to a similar sized portion of such new office space.

(b) Upon termination of this Agreement, BI and the Company shall cooperate to reach a mutually agreeable arrangement under which the Company will, at the Companys

| [****] | Confidential materials omitted and filed separately with the Securities and Exchange Commission. Asterisks denote such omission. |

- 2 -

expense, possess the rights and benefits and bear the obligations and liabilities of a tenant occupying the Company Space, including without limitation, entering into a sublease with or partial assignment from BI containing such terms and conditions as are customary for such agreements among unaffiliated parties or entering into a prime lease directly with the landlord under BIs lease for the Office Space (the Office Space Lease). Such arrangement shall continue until the Office Space Lease expires.

3.2 Utilities. BI shall provide all HVAC, water, power, telecommunications, and other customary utilities (the Utilities) in the Company Space to the extent such Utilities are provided to BI in the Office Space pursuant to the Office Space Lease.

3.3 Restrictions on Use; Insurance. The Company shall use the Company Space for office purposes only in a manner that is not inconsistent with any obligations and restrictions that may be imposed upon BI pursuant to the Office Space Lease. The Company shall not make any repairs, alterations, additions or improvements to the Company Space without the consent of BI, which consent shall not be unreasonably withheld. Any such repairs, alterations, additions or improvements shall be at the sole cost and expense of the Company. The Company shall acquire and maintain all policies of insurance with the minimal coverage limits required to be maintained by the tenant under the Office Space Lease, naming BI as an additional insured.

3.4 Condition of Company Space. The Company agrees to take the Company Space as is. The Company shall maintain the Company Space in good and clean condition at all times.

3.5 Surrender. Upon termination of Companys use of the Company Space, except to the extent superseded by the arrangement set forth in Section 3.1(b), the Company (i) shall remove all property of the Company (including but not limited to trade fixtures or other removable fixtures installed by the Company on the Company Space), (ii) shall restore the Company Space to its original condition as at the commencement of the term hereof, reasonable wear and tear excepted, and (iii) shall surrender the Company Space. In the event the Company fails to remove any of its property, such property shall be deemed abandoned and shall become the property of BI. In the event the Company fails to restore the Company Space to its original condition, reasonable wear and tear excepted, the Company shall reimburse BI for any and all costs incurred by BI in order to restore the Company Space to such condition. The provisions of this Section 3.5 shall survive the expiration or termination of this Agreement.

3.6 Assignments and Sublicenses. The Company may not assign or transfer its license hereunder nor sublicense the Company Space without the prior written consent of BI, in its sole discretion. Any attempted assignment, transfer or sublet without the consent of BI shall be null and void.

ARTICLE IV

REPRESENTATIONS AND WARRANTIES

4.1 Representations and Warranties. Each party to this Agreement represents and warrants to the other party to this Agreement that as of the date hereof:

- 3 -

(a) Due Organization. Such party is duly incorporated or otherwise duly organized or formed, validly existing and in good standing under the laws of the jurisdiction of its incorporation, organization or formation and has the power and lawful authority to execute, deliver and perform this Agreement.

(b) Due Qualification. Such party is duly licensed or qualified to do business and is in good standing in each jurisdiction in which it transacts business, except where the failure to be so licensed or qualified would not, individually or in the aggregate, have a material adverse effect on its ability to perform its obligations hereunder.

(c) Authority to Execute and Perform Agreement. This Agreement has been duly authorized, executed and delivered by such party. This Agreement constitutes a legal, valid and binding obligation of such party, enforceable against such party in accordance with its terms, except as such enforceability may be limited by applicable bankruptcy, insolvency, reorganization, moratorium, fraudulent transfer and other similar laws affecting creditors rights generally and subject to general principles of equity, including, without limitation, concepts of materiality, reasonableness, good faith and fair dealing, regardless of whether considered in a proceeding in equity or at law.

(d) No Consents. No approval or consent of any governmental authority or of any other Person is required in connection with the execution and delivery by such party of this Agreement and the consummation by such party of the transactions contemplated hereby.

(e) No Conflicts. The execution and delivery of this Agreement, the consummation of the transactions contemplated hereunder and the performance by such party of this Agreement in accordance with its terms and conditions will not conflict with or result in the breach or violation of any of the terms or conditions of, or constitute (or with notice or lapse of time or both would constitute) a default under, (i) the certificate of incorporation, by-laws or other charter or governing documents of such party; (ii) any instrument, contract or other agreement to which such party is a party or by or to which it or its assets or properties are bound or subject; or (iii) any statute or any regulation, order, judgment or decree of any governmental authority except, in the case of clauses (ii) and (iii), for breaches, violations or defaults that would not, individually or in the aggregate, materially impair its ability to perform its obligations under this Agreement.

(f) No Proceedings. There are no actions, suits, proceedings or investigations pending or, to the knowledge of such party, threatened against or affecting such party or its respective properties, assets or businesses in, before or by any governmental authority, with respect to this Agreement or the transactions contemplated hereby which could, if adversely determined (or, in the case of an investigation could lead to any action, suit or proceeding, which if adversely determined could) reasonably be expected to materially impair such partys ability to perform its obligations under this Agreement.

- 4 -

ARTICLE V

FEE

[****]

ARTICLE VI

INDEMNIFICATION

6.1 Indemnification. The Company shall indemnify and hold harmless BI and its officers, directors, employees, agents and representatives from and against any and all Loss and Litigation Expense, which any of them may suffer or incur as a result of or arising from (a) the failure of the Company to perform any of its obligations set forth in this Agreement, or (b) the Companys use or occupancy of the Company Space. BI shall indemnify and hold harmless the Company and its officers, directors, employees, agents and representatives from and against any and all Loss and Litigation Expense, which any of them may suffer or incur as a result of or arising from the failure of BI to perform the Services in the manner described in Section 2.2.

6.2 Procedure.

(a) Promptly after acquiring knowledge of any Loss or Claim, the party seeking indemnity (the Indemnitee) shall give written notice thereof to the party from whom indemnity is sought (the Indemnitor).

(b) The Indemnitor shall have the right, at its expense, to defend, contest or compromise such Claim through counsel of its choice (unless such Indemnitor is relieved of its liability hereunder with respect to such Claim, Loss and Litigation Expense by the Indemnitee) and shall not then be liable for fees or expenses of the Indemnitees attorneys (unless the Indemnitor and Indemnitee are both parties to the action and there exists a conflict of interest between the Indemnitor and the Indemnitee, in which event the Indemnitor shall be responsible for the reasonable fees and expenses of one additional firm), and the Indemnitee and the Indemnitor shall provide to each other all necessary and reasonable cooperation in said defense including, but not limited to, the services of employees who are familiar with the transactions out of which such Claim or Loss may have arisen. In the event that the Indemnitor shall undertake to compromise or defend any Claim, it shall promptly notify the Indemnitee of its intention to do so. In the event that the Indemnitor fails to take timely action to defend the same, the Indemnitee shall have the right to defend the same by counsel of its own choosing but at the cost and expense of the Indemnitor. No settlement of a Claim by Indemnitee shall be effected without the consent of the Indemnitor, which shall not be unreasonably withheld or delayed, unless Indemnitee waives any right to indemnification therefor. The Indemnitor may, with the consent of the Indemnitee, which shall not be unreasonably withheld, settle or compromise any action or consent to the entry of any judgment which (i) includes, without limitation, the unconditional release by the person asserting the Claim and any related claimants of Indemnitee from all liability with respect to such Claim in form and substance reasonably satisfactory to Indemnitee, and (ii) would not adversely affect the right of Indemnitee to own, hold, use and operate their respective assets and businesses.

| [****] | Confidential materials omitted and filed separately with the Securities and Exchange Commission. Asterisks denote such omission. |

- 5 -

6.3 No Consequential Damages. NEITHER BARTON NOR THE COMPANY SHALL BE LIABLE FOR INDIRECT, INCIDENTAL OR CONSEQUENTIAL DAMAGES SUFFERED BY THE OTHER, OR FOR PUNITIVE DAMAGES, WITH RESPECT TO ANY TERM OR THE SUBJECT MATTER OF THIS AGREEMENT, EVEN IF INFORMED OF THE POSSIBILITY THEREOF IN ADVANCE. THIS LIMITATION APPLIES TO ALL CAUSES OF ACTION, INCLUDING, WITHOUT LIMITATION, BREACH OF CONTRACT, BREACH OF WARRANTY, NEGLIGENCE, STRICT LIABILITY, FRAUD, MISREPRESENTATION AND OTHER TORTS.

6.4 Limitation on Damages. Notwithstanding anything in this Agreement to the contrary, the monetary liability of BI for all claims resulting from its performance or non-performance under this Agreement, regardless of the form of the action, and whether in contract, tort (including, but not limited to, negligence), warranty or other legal or equitable grounds, will be limited to amounts actually paid to BI by the Company hereunder.

6.5 Exclusive Remedies. Except as provided below, the indemnification, as provided in this Article VI, shall be the exclusive remedy for any and all breaches of any representation, warranty, covenant or agreement contained in this Agreement. Notwithstanding the foregoing, BI and the Company acknowledge that a breach or threatened breach by them of any provision of this Agreement will result in the other entity suffering irreparable harm which cannot be calculated or fully or adequately compensated by recovery of damages alone. Accordingly, BI and the Company agree that the other shall be entitled to interim and permanent injunctive relief, specific performance and other equitable remedies, in addition to any other relief to which the other may become entitled for breach or threatened breach of any covenant or agreement to be performed by the other on or prior to the Closing.

ARTICLE VII

TERM

7.1 Term. The term of this Agreement shall expire on the earliest of (i) the fifth (5th) anniversary of the date of this Agreement, (ii) the date the Barton Membership Interest (as defined in the Company LLC Agreement) is transferred to Modelo pursuant to the Company LLC Agreement, and (iii) the date this Agreement is terminated pursuant to Section 7.2. [****]

| [****] | Confidential materials omitted and filed separately with the Securities and Exchange Commission. Asterisks denote such omission. |

- 6 -

7.2 Termination.

(a) The parties may terminate this Agreement as follows:

(i) BI and the Company may terminate this Agreement by mutual agreement; or

(ii) Either party may terminate this Agreement due to materially poor performance by the other party of its obligations, or failure to perform payment obligations, in accordance with the terms of this Agreement; provided (a) the breaching party is given written notice of the alleged breach of the Agreement, with specifics as to such assertions, and (b) such party does not, within thirty (30) days (ten (10) days for payment defaults) after receipt of such written notice, cure such defaults to the other partys reasonable satisfaction.

(b) Upon termination of this Agreement, all unpaid sums for Services performed as of the date of termination, whether or not invoiced at that date, shall become immediately due and payable. Further, the Company shall be responsible for all costs and expenses, whether incurred or to be incurred by the Company, BI or an Affiliate of BI, associated with any termination and transition of services to a substitute service provider or the Company itself, including, without limitation, all costs BI incurs with respect to the termination of any employees substantially dedicated by BI to the performance of the Services under this Agreement and early termination of any per seat software license associated with such employees.

ARTICLE VIII

TRANSITION OF REQUISITE LICENSES

If the Company has not obtained the Authorizations required for the Company to conduct its business, BI shall cause Barton Beers to maintain in full force and effect its current Authorizations until such time as is necessary but not for a period to exceed six months from the date hereof. To the extent permissible, BI shall, or shall cause Barton Beers to, further make such reasonable accommodations as necessary (including, without limitation, executing required reporting forms) to allow the continuation of the operations of the Business of the Company under such Authorizations. The Company shall reimburse BI and Barton Beers for any reasonable costs it incurs in connection with providing services described in this Article VIII. The Company shall indemnify and hold BI and Barton Beers harmless from and against any and all costs or damages incurred by BI or Barton Beers resulting from any administrative action against BI, Barton or any of BIs or Barton Beers permits or alcoholic beverage licenses arising out of the Companys conduct of its business during such time period. Such damages shall include, but are not limited to, any fines, assessments, judgments, legal expenses (including attorneys fees and court costs), offers-in-compromise, or monetary penalties that may be imposed upon or suffered by BI or Barton Beers.

- 7 -

ARTICLE IX

GOVERNING LAW; CHOICE OF FORUM

This Agreement shall be governed by and construed in accordance with the laws of the State of New York, without reference to its principles of conflicts of law that would require application of the substantive laws of any other jurisdiction. BI and the Company irrevocably consent to the exclusive personal jurisdiction and venue of the courts of the State of New York or the federal courts of the United States, in each case sitting in New York County, in connection with any action or proceeding arising out of or relating to this Agreement. BI and the Company hereby irrevocably waive, to the fullest extent permitted by law, any objection that it may now or hereafter have to the laying of the venue of such action or proceeding brought in such a court and any claim that any such action or proceeding brought in such court has been brought in an inconvenient forum. BI and the Company irrevocably consent, to the fullest extent permitted by law, to the service of process with respect to any such action or proceeding in the manner provided for the giving of notices under Article X, provided, the foregoing shall not affect the right of either BI or Company to serve process in any other manner permitted by law. BI and Company hereby agree that a final judgment in any suit, action or proceeding shall be conclusive and may be enforced in any jurisdiction by suit on the judgment or in any manner provided by applicable law.

ARTICLE X

MISCELLANEOUS

10.1 Notices. Any notice, claims, request, demands, or other communication required or permitted to be given hereunder shall be in writing and will be duly given if: (a) personally delivered, (b) sent by facsimile or (c) sent by Federal Express or other reputable overnight courier (for next business day delivery), shipping prepaid as follows:

| If to BI: | Barton Incorporated | |

| One South Dearborn Street | ||

| Suite 1700 | ||

| Chicago, IL 60603 | ||

| Attention: General Counsel | ||

| Telephone: (312) 346-9200 | ||

| Facsimile: (312) 346-7488 | ||

| With a copy to: | Nixon Peabody LLP | |

| 1300 Clinton Square | ||

| Rochester, NY 14604 | ||

| Attention: James A. Locke III | ||

| Telephone: (585) 263-1000 | ||

| Facsimile: (585) 263-1600 | ||

- 8 -

| If to the Company: | ||

| To each of BI and : | Crown Imports LLC | |

| One South Dearborn St., #1700 | ||

| Chicago, IL 60603 | ||

| Attention: President | ||

| Telephone: (312) 873-9600 | ||

| Facsimile: (312) 346-7488 | ||

| With a copy to: | Cravath, Swaine & Moore LLP | |

| 825 Eighth Avenue | ||

| New York, NY 10019 | ||

| Attention: David Mercado | ||

| Telephone: (212) 474-1000 | ||

| Facsimile: (212) 474-3700 | ||

or such other address or addresses or facsimile number as the person to whom notice is to be given may have previously furnished to the others in writing in the manner set forth above. Notices will be deemed given at the time of personal delivery, if sent by facsimile, when sent with electronic notification of delivery or other confirmation of delivery or receipt, or, if sent by Federal Express or other reputable overnight courier, on the day of delivery.

10.2 Counterparts and Facsimile Signatures. This Agreement may be executed in counterparts, each of which when so executed and delivered shall be deemed an original, and such counterparts, taken together, shall constitute one and the same instrument. Signatures sent by facsimile shall constitute and be binding to the same extent as originals.

10.3 Assignment. This Agreement shall not be assignable (by operation of law or otherwise) by the Company or BI without the prior written consent of the other, except that BI may assign this Agreement or any of its obligations hereunder to any direct or indirect, wholly-owned subsidiary of CBI, so long as BI remains liable for performance of the Services and its other obligations under this Agreement.

10.4 Entire Agreement. This Agreement and the various schedules and exhibits thereto embody all of the understandings and agreements of every kind and nature existing between the parties hereto with respect to the transactions contemplated hereby and supersede any and all other prior arrangements or understandings with respect thereto.

10.5 Severability. The provisions of this Agreement shall be deemed severable and the invalidity or unenforceability of any provision shall not affect the validity or enforceability of the other provisions of this Agreement. If any provision of this Agreement, or the application thereof to any person or in any circumstance, is invalid or unenforceable, (a) a suitable and equitable provision shall be substituted therefore in order to carry out, as far as may be valid and enforceable, the intent and purpose of such invalid or unenforceable provision, and (b) the remainder of this Agreement and the application of all its provisions to other persons or circumstances shall not be affected by such invalidity or unenforceability.

- 9 -

10.6 Waiver; Amendment. Except as expressly provided in this Agreement, no amendment to or waiver of any provision of this Agreement shall be binding unless executed in writing by the Company and BI. No waiver of any provision of this Agreement shall constitute a waiver of any other provision nor shall any waiver of any provision of this Agreement constitute a continuing waiver unless expressly so provided. The failure by any person to exercise any right under, or to object to any breach by the other party of, any term, provision or condition of this Agreement shall not constitute a waiver thereof and shall not preclude such party from thereafter exercising that or any other right, or from thereafter objecting to that or any prior or subsequent breach of the same or any other term, provision or condition of this Agreement. Any waiver or consent granted under this Agreement shall be a consent only to the transaction, act or agreement specifically referred to in the consent and not to other similar transactions, acts or agreements.

10.7 Parties in Interest; No Third Party Rights. This Agreement is binding upon and shall inure to the benefit of the parties hereto and their successors and permitted assigns. Nothing in this Agreement, except as expressly provided in the indemnification provisions of Article VI with respect to the persons specified therein, shall give any other person any legal or equitable right, remedy or claim under or with respect to this Agreement or the transactions contemplated hereby.

10.8 Independent Contractors. The parties are acting as independent contractors under this Agreement and shall not be construed to be joint venturers, partners, agents or representatives of each other. Neither party shall have any right, power, or authority to enter into any agreement for or on behalf of the other party or to incur otherwise any obligation or liability on behalf of or against the other party. Neither party shall be liable for the debts of the other party unless agreed to in writing by the party sought to be bound.

10.9 Binding Effect. The provisions of this Agreement shall be binding upon and inure to the benefit of the parties hereto and their respective successors and permitted assigns; provided, however, that nothing contained in this Section 10.9 shall be construed to permit any attempted assignment or other transfer which would be prohibited or void pursuant to any other provision of this Agreement.

[Signature Page Follows]

- 10 -

IN WITNESS WHEREOF, the Parties have executed this Administrative Services Agreement on the date first written above.

| BARTON INCORPORATED | CROWN IMPORTS LLC | |||||

| By: | /s/ Alexander L. Berk |

By: | /s/ William F. Hackett |

|||

| Name: | Alexander L. Berk | Name: | William F. Hackett | |||

| Title: | President and C.E.O. | Title: | President | |||

[Signature Page to Administrative Services Agreement]

- 11 -

Schedule A

SERVICES

[****]

| [****] | Confidential materials omitted and filed separately with the Securities and Exchange Commission. Asterisks denote such omission. |

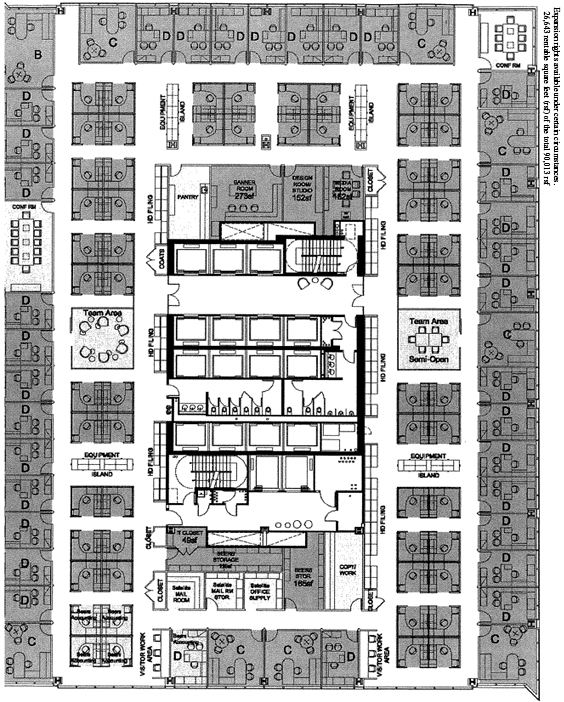

Schedule B

COMPANY SPACE

Company Space:

Schedule B to Administrative Services Agreement

LEVEL 15- FLOOR PLAN