EXHIBIT 99.1

Published on February 13, 2003

Exhibit 99.1

|

|

|

|

|

|

|

Scheme Booklet |

|

|

|

This document is important and requires your immediate attention

If you are in doubt as to how to deal with it, please contact your legal, financial or other professional adviser immediately |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Scheme Booklet |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

for the Schemes of Arrangement between |

|

BRL Hardy Limited |

|

|

(ACN 008 273 907) |

|

|

|

|

|

|

|

|

|

|

and |

|

the holders of ordinary shares in BRL Hardy Limited and the holders of options to subscribe for ordinary shares in BRL Hardy Limited |

|

|

|

|

|

|

|

|

|

in relation to the proposed Merger with |

|

Constellation Australia |

|

|

Pty Limited |

|

|

|

(ACN 103 362 232) |

|

|

|

|

|

|

|

(a company incorporated in the Australian Capital Territory which is an indirect wholly owned subsidiary of Constellation Brands, Inc.) |

|

|

|

|

|

|

|

|

|

|

|

Explanatory Statement |

|

|

|

|

|

|

|

Notices of Scheme Meetings and General Meeting |

|

|

|

|

|

|

|

IMPORTANT |

|

|

|

These notices are set out in Sections 16 and 17 of this Scheme Booklet |

|

|

Table of Contents |

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

2 |

|

|

|

|

|

3 |

|

|

|

|

|

4 |

|

|

|

|

|

5 |

|

|

|

|

|

10 |

|

|

|

|

|

12 |

|

|

|

|

|

14 |

|

Key Features of Share Scheme and Considerations for BRL Shareholders |

17 |

||

|

|

18 |

||

|

|

18 |

||

|

|

20 |

||

|

|

20 |

||

|

|

21 |

||

|

|

23 |

||

|

|

24 |

||

|

|

24 |

||

|

|

24 |

||

|

|

|

|

|

|

25 |

|||

|

|

26 |

||

|

|

26 |

||

|

|

26 |

||

|

|

26 |

||

|

|

27 |

||

|

|

27 |

||

|

|

27 |

||

|

|

28 |

||

|

|

Determination of persons entitled to Share Scheme Consideration |

28 |

|

|

|

29 |

||

|

|

29 |

||

|

|

29 |

||

|

|

29 |

||

|

|

|

|

|

|

31 |

|||

|

|

32 |

||

|

|

32 |

||

|

|

33 |

||

|

|

37 |

||

|

|

Managements Discussion and Analysis of Financial Condition and Results of Operations |

39 |

|

i

|

|

50 |

||

|

|

53 |

||

|

|

56 |

||

|

|

|

|

|

|

57 |

|||

|

|

|

|

|

|

59 |

|||

|

|

60 |

||

|

|

62 |

||

|

|

63 |

||

|

|

63 |

||

|

|

64 |

||

|

|

64 |

||

|

|

64 |

||

|

|

65 |

||

|

|

|

|

|

|

75 |

|||

|

|

76 |

||

|

|

Risks relating to the Merger and investing in Constellation Scrip |

79 |

|

|

|

|

|

|

|

Information concerning the consideration to be provided under the Schemes |

81 |

||

|

|

82 |

||

|

|

Information about and rights attaching to Constellation CDIs |

82 |

|

|

|

84 |

||

|

|

85 |

||

|

|

89 |

||

|

|

89 |

||

|

|

89 |

||

|

|

92 |

||

|

|

92 |

||

|

|

|

|

|

|

Key Features of Option Scheme and Considerations for BRL Option Holders |

93 |

||

|

|

94 |

||

|

|

94 |

||

|

|

94 |

||

|

|

95 |

||

|

|

95 |

||

|

|

95 |

||

|

|

95 |

||

|

|

96 |

||

|

|

96 |

||

|

|

96 |

||

|

|

|

|

|

|

97 |

|||

|

|

98 |

||

|

|

Classes of creditors of BRL Hardy affected by the Option Scheme |

98 |

|

|

|

98 |

||

|

|

99 |

||

|

|

99 |

||

|

|

99 |

||

|

|

99 |

||

|

|

100 |

||

|

|

100 |

||

|

|

100 |

||

ii

|

101 |

|||||

|

|

102 |

||||

|

|

105 |

||||

|

|

105 |

||||

|

|

|

|

|||

|

107 |

|||||

|

|

108 |

||||

|

|

108 |

||||

|

|

108 |

||||

|

|

108 |

||||

|

|

110 |

||||

|

|

110 |

||||

|

|

111 |

||||

|

|

111 |

||||

|

|

111 |

||||

|

|

111 |

||||

|

|

112 |

||||

|

|

112 |

||||

|

|

113 |

||||

|

|

114 |

||||

|

|

114 |

||||

|

|

114 |

||||

|

|

114 |

||||

|

|

114 |

||||

|

|

114 |

||||

|

|

114 |

||||

|

|

|

|

|

||

|

115 |

|||||

|

145 |

|||||

|

155 |

|||||

|

161 |

|||||

|

169 |

|||||

|

173 |

|||||

|

177 |

|||||

|

181 |

|||||

|

|

|

|

|||

|

Annexure 1 - Constellation Consolidated Financial Statements |

301 |

||||

|

|

|

|

|||

|

Annexure 2 - Summary of Material ASX disclosures by BRL Hardy |

361 |

||||

|

|

|

|

|||

|

365 |

|||||

|

|

|

|

|||

|

Inside back cover |

|||||

iii

Important Dates for BRL Shareholders and Option Holders

|

18 March 2003 |

|

Proxy forms for the Share Scheme Meeting, the General Meeting and the Option Scheme Meeting must be received no later than 10.30 am (for the Share Scheme Meeting and the General Meeting) and 11.00 am (for the Option Scheme Meeting) (Adelaide time) |

|

|

|

|

|

18 March 2003 |

|

Eligibility to vote at the Share Scheme Meeting, the Option Scheme Meeting and the General Meeting determined at 10.00 pm (Adelaide time) |

|

|

|

|

|

20 March 2003 |

|

Share Scheme Meeting to be held at The Auditorium, Adelaide Town Hall, King William Street, Adelaide, South Australia, Australia at 10.00 am (Adelaide time) |

|

|

|

|

|

20 March 2003 |

|

General Meeting to be held at The Auditorium, Adelaide Town Hall, King William Street, Adelaide, South Australia, Australia at 10.30 am (Adelaide time) or as soon thereafter as the Share Scheme Meeting is concluded or adjourned |

|

|

|

|

|

20 March 2003 |

|

Option Scheme Meeting to be held at The Auditorium, Adelaide Town Hall, King William Street, Adelaide, South Australia, Australia at 11.00 am (Adelaide time) or as soon thereafter as the General Meeting is concluded or adjourned |

|

|

|

|

|

26 March 2003 |

|

Announce to the ASX the Constellation VWAP and the Scrip Exchange Ratio |

|

|

|

|

|

27 March 2003 |

|

Publish notice of Constellation VWAP and Scrip Exchange Ratio |

|

|

|

|

|

27 March 2003 |

|

Court hearing for approval of the Share Scheme and the Option Scheme |

|

|

|

|

|

27 March 2003 |

|

Effective Date of the Share Scheme and the Option Scheme |

|

|

|

|

|

27 March 2003 |

|

Last day of trading in BRL Shares |

|

|

|

|

|

4 April 2003 |

|

Election as to form of consideration for BRL Shareholders must be received no later than 5.00pm (Adelaide time) |

|

|

|

|

|

4 April 2003 |

|

Record Date |

|

|

|

|

|

7 April 2003 |

|

Announce to the ASX details of scale back (if any) and allocation of consideration between cash and scrip |

|

|

|

|

|

7 April 2003 |

|

Commencement of trading in Constellation CDIs on a deferred settlement basis on the ASX |

|

|

|

|

|

9 April 2003 |

|

Implementation Date |

|

|

|

|

|

No later than |

|

Despatch of holding statements and cheques to BRL |

|

16 April 2003 |

|

Shareholders and Option Holders (as the case may be). |

|

|

|

|

|

|

|

This Scheme Booklet is dated 10 February 2003 |

|

|

|

|

|

|

|

All dates following the date of the Share Scheme Meeting, the General Meeting and the Option Scheme Meeting are indicative only and, among other things, are subject to all necessary approvals from the Supreme Court of South Australia, the ASX and other regulatory authorities. Any changes to the above timetable will be notified on BRL Hardys website www.brlhardy.com.au. |

1

|

|

10 February 2003

Dear Shareholder and Option holder,

On 17 January 2003 your Board announced the proposal to merge BRL Hardy with Constellation Brands, our partner in the successful US based Pacific Wine Partners joint venture, since mid 2001.

The merger will result in the creation of a leading international wine and beverages company, with strong market positions in the key markets of Australia, North America and the United Kingdom.

Under the merger proposal, BRL Hardy shareholders can choose to receive the following forms of consideration in exchange for their BRL Hardy shares:

cash of $10.50 per share;

Constellation Scrip; or

a combination of cash and Constellation Scrip.

Details of the precise number of Constellation Scrip that BRL Hardy shareholders can elect to receive under the merger proposal are set out in this Scheme Booklet.

The merger consideration represents a premium of 37% to BRL Hardys closing share price on the day prior to announcement that the parties were in merger discussions and a 52% premium to the volume weighted average price of BRL Hardy shares for the two months up to that date.

Under the proposal, BRL Hardy option holders will receive cash consideration for the cancellation of their BRL Hardy options.

After considering the proposal in detail, the Directors of BRL Hardy have formed the view that the proposal is in the best interests of shareholders and in the best interests of option holders as a whole. Accordingly, the Directors of BRL Hardy unanimously recommend that, in the absence of a higher offer, BRL Hardy shareholders and option holders vote in favour of the proposal.

The reasons behind the Directors recommendation are set out in the Scheme Booklet. The Board has appointed an independent expert, Deloitte Corporate Finance, to review the proposal. The independent expert concluded that, in the absence of a higher offer, the merger proposal is in the best interests of shareholders and in the best interests of option holders as a whole.

The merger will be implemented via Schemes of Arrangement and requires the approval of BRL Hardy shareholders and option holders and the Supreme Court of South Australia. The Schemes of Arrangement will be considered at meetings of BRL Hardy shareholders and BRL Hardy option holders to be held at The Auditorium, Adelaide Town Hall, King William Street Adelaide, South Australia, on 20 March 2003.

Each director of BRL Hardy intends to vote all BRL Hardy shares and BRL Hardy options controlled by that director in favour of the relevant resolutions.

This Scheme Booklet which follows sets out the full details of the merger proposal. I encourage you to read it carefully and to vote on the important resolutions to be considered at the Meetings.

If you have any queries about the merger proposal, please call the BRL Hardy toll free information line on 1300 666 724.

|

Yours sincerely, |

|

|

|

|

|

/s/ John Pendrigh |

|

|

|

|

|

John Pendrigh AM |

|

|

Chairman |

|

|

Head Office Adelaide Telephone Facsimile |

|

|

|

|

|

|

|

|

|

|

|

I.J. Pendrigh AM, |

|

|

|

|

2

|

|

|

|

|

Constellation

Brands, Inc. |

10 February 2003

Dear Shareholder and Option Holder

Proposed Merger of BRL Hardy and Constellation

On 17 January 2003, the respective boards of directors of BRL Hardy and Constellation announced their intention to merge through Schemes of Arrangement.

If approved, the merger will create the worlds largest wine company by sales. The merger will provide the ability to capture growth for both companies at a faster rate in growing New World wine markets. The merger will enhance Constellations position as a leading global diversified beverage alcohol company.

Constellation is offering for BRL shares either cash of $10.50 per BRL share, or a number of Constellation shares, determined based on the volume weighted average Constellation share price and the US$/A$ exchange rate during a price setting period before the merger becomes effective. The Constellation shares will also be listed on the Australian Stock Exchange in the form of CHESS Depositary interests (CDIs) for those shareholders wishing to trade their holdings on the Australian market. Full details of the offer are set out in this Scheme Booklet.

By accepting Constellation shares as consideration in this merger, you can also participate in the benefits of combining two highly successful growth companies, and the exciting future of the worlds leading wine company. Following the merger:

Constellation will benefit from the bringing together of two complementary businesses that share a common growth orientation and operating philosophies.

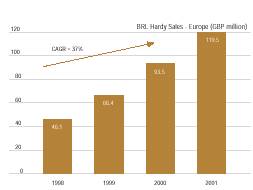

Constellation will enhance its revenue growth potential in the UK, Europe and other strategic international markets.

Constellation will gain significant scale, with more than US$3.2 billion in group sales, of which wine sales will represent US$1.7 billion.

In wine, Constellation will emerge with the number 1 position by volume in the United Kingdom, with 8 of the top 20 off-premise brands. Constellation will also hold the number 1 position by volume in Australia, and will strengthen its number 2 position by volume in the United States.

Constellation will continue to benefit from a broad portfolio across categories, with strong businesses in imported beer and spirits in the United States and as the number one independent drinks wholesaler in the UK.

Constellations aggregated portfolio will have an even broader range of products and a greater geographic reach.

We are extremely excited about the opportunity to merge our two companies and to build on the successful partnership which started with the establishment of the Pacific Wine Partners joint venture in 2001.

For BRL shareholders electing to accept consideration in full, or part, through Constellation shares, we look forward to welcoming you as a shareholder in Constellation.

|

Yours sincerely, |

|

|

|

|

|

|

|

|

/s/ Richard Sands |

|

|

|

|

|

Richard Sands |

|

|

Chairman of the Board and Chief Executive Officer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Richard Sands |

|

Chairman of the Board and Chief Executive Officer Constellation Brands, Inc. |

3

at a glance

This summary provides an overview of the Merger proposal. You should read this Scheme Booklet in full before making any voting decisions.

Background

On 17 January 2003, BRL Hardy announced a proposal to merge with Constellation, BRL Hardys U.S. joint venture partner, by way of schemes of arrangement. The merged group will be the worlds largest wine company by sales, and will enjoy strong positions in the United States, Europe and Australia.

Merger Consideration

Under the Merger proposal, BRL Shareholders can elect to receive in exchange for their BRL Shares, either:

Cash Consideration, being $10.50 per BRL Share;

Scrip Consideration, being a number of Constellation Shares or Constellation CDIs per BRL Share determined as set out in Section 1.2 of this Scheme Booklet; or

a combination of Cash Consideration and Scrip Consideration.

Option Holders will receive cash as set out in Section 8.3 of this Scheme Booklet, in exchange for the cancellation of their Options.

If the total number of Constellation Shares which Constellation would otherwise be required to issue to satisfy Elections from BRL Hardy Shareholders for Scrip Consideration exceeds 15,000,000 shares, then the number of Constellation Shares each such BRL Shareholder is entitled to receive will be scaled back on a pro rata basis and such BRL Shareholders will receive Cash Consideration with respect to such BRL Shares subjected to such scale-back. For further details refer to Section 1.2.

Implementation and Timetable

The Share Scheme is to be implemented by a scheme of arrangement, which will be voted on by BRL Shareholders at a meeting to be held at The Auditorium, Adelaide Town Hall, King William Street, Adelaide, South Australia, Australia on 20 March 2003, commencing at 10.00 am.

The Option Scheme is to be implemented by a scheme of arrangement, which will be voted on by Option Holders at a meeting to be held at The Auditorium, Adelaide Town Hall, King William Street, Adelaide, South Australia, Australia on 20 March 2003 commencing at 11.00 am or at such later time as the General Meeting concludes or is adjourned.

Each Scheme also requires Court approval, which is expected to be sought on 27 March 2003 if the Schemes are approved by BRL Shareholders and Option Holders.

Trading on the ASX

If the Merger proposal is implemented, Constellation will cause Constellation CDIs representing Constellation Shares to be listed for trading on the ASX. Constellation CDIs are expected to commence trading on the ASX on a deferred settlement basis on 7 April 2003.

4

The Merger - Your Questions Answered

This section provides summary answers to some basic questions that BRL Shareholders may have. It should be read in conjunction with the whole Scheme Booklet. Option Holders should refer to Sections 8 and 9 for a summary of the Option Scheme which should also be read in conjunction with the entire Scheme Booklet.

Q & A

Questions about the Merger consideration

Q1

What will I receive if the Merger is approved?

A

You are being offered the following choice of consideration in exchange for your BRL Shares:

Cash Consideration, being $10.50 per BRL Share;

Scrip Consideration, being a number of Constellation Shares or Constellation CDIs per BRL Share determined as set out in Section 1.2 of this Scheme Booklet; or

a combination of Cash Consideration and Scrip Consideration.

Q2

When do I have to make an Election?

A

You will need to make an Election on your Election Form which must be returned to the BRL Share Registry before 5.00pm (Adelaide time) on 4 April 2003.

Q3

What form of consideration will I receive if I do not make an Election?

A

If you do not make an Election you will be paid Cash Consideration for your BRL Shares.

Q4

If I elect to receive Scrip Consideration, does this mean that I will receive Constellation Shares?

A

If you make an Election to receive Scrip Consideration and your address on the Register is in Australia, Hong Kong, New Zealand, Singapore or the United Kingdom you will receive Constellation CDIs traded in Australia on the ASX.

If you make an Election to receive Scrip Consideration and your address on the Register is in the United States, you will receive Constellation Shares traded on the NYSE.

If you make an Election to receive Scrip Consideration and your address on the Register is in any other country, you will not be entitled to receive any Scrip Consideration and you will instead receive in cash the proceeds of sale of the Constellation Shares which you elected to receive (less any applicable brokerage, taxes and any other costs of sale).

5

Q5

What is a Constellation CDI?

A

Constellation CDIs are CHESS Depositary Interests (CDIs) in Constellation Shares. CDIs are beneficial interests in securities traded on the ASX under the electronic transfer and settlement system operated by the ASX. CDIs are issued to enable the electronic transfer and settlement on the ASX of shares issued by foreign companies such as Constellation. CDI holders receive all the economic benefits of actual ownership of the underlying shares.

Q6

How many Constellation Shares does one Constellation CDI represent?

A

It is currently expected that the ratio of Constellation CDIs to underlying Constellation Shares will be 10 to 1. For example, if you elect to receive Scrip Consideration and you are otherwise entitled to receive 100 Constellation Shares for your BRL Shares you will receive 1,000 Constellation CDIs. This ratio will, however, be subject to the ASXs approval upon the listing of Constellation CDIs.

Q7

If I receive Constellation CDIs, can I trade them other than on the ASX?

A

If you wish, you can trade the underlying Constellation Shares which your Constellation CDIs represent on the NYSE. To do this, you must first convert the Constellation CDIs into shares simply by notifying Constellations Australian share registry who will arrange for the Constellation CDIs to be converted into the underlying Constellation Shares.

Q8

Is there a limit on the amount of Scrip Consideration I can receive?

A

The maximum number of shares Constellation will issue to BRL Shareholders who elect to receive Scrip Consideration under the Share Scheme is 15,000,000 Constellation Shares (referred to in this Scheme Booklet as the Scrip Consideration Cap).

Accordingly, if you elect to receive Scrip Consideration for all or a specified number of your BRL Shares and the total number of Constellation Shares which would be required to be issued to satisfy this and all other Elections for Scrip Consideration exceeds the Scrip Consideration Cap, the number of Constellation Shares you are entitled to receive will be scaled back on a pro rata basis and you will receive Cash Consideration with respect to such scaled back BRL Shares.

This is illustrated by the example below:

Suppose you elect to receive Scrip Consideration for your total holding of 1,000 BRL Shares and the total number of Constellation Shares which would be required to be issued to satisfy all Elections for Scrip Consideration in full was 18,750,000, the scale back provisions would apply.

The number of BRL Shares for which you would receive Scrip Consideration would be calculated as 15,000,000 ÷ 18,750,000 x 1,000 = 800 BRL Shares. You would receive Cash Consideration for the remaining 200 BRL Shares.

For further details see Section 1.2.

Q9

What happens if the Constellation CDIs cannot be traded on the ASX?

A

In the event that the Constellation CDIs are not listed by ASX, then all consideration payable under the Share Scheme will be paid in the form of Cash Consideration. Constellation has no reason to believe that the Constellation CDIs will not be listed by ASX.

6

Q10

If I elect to receive Scrip Consideration, can I expect to receive cash dividends declared from Constellation?

A

While you will be entitled to receive any dividends declared by Constellation in the future, you should note that:

Constellation has not paid a cash dividend since its initial public offering in 1973;

Constellation currently has a policy of not paying cash dividends but instead retaining all of its earnings to finance the development and expansion of its business;

Constellation does not currently intend to change its dividend policy; and

Constellations existing and new senior credit facilities and bridging facility and its indentures for its senior notes and senior subordinated notes limit the payment of cash dividends (see Section 3.6(c) for more details).

If Constellation does pay dividends in the future, they will not be franked for Australian tax purposes.

Q11

How will fractional shares be treated?

A

If, pursuant to the Merger, you become entitled to a fraction of a Constellation Share, the number of Constellation Shares to which you are entitled will be rounded down to the next lowest whole number, and you will receive cash in lieu of all fractional shares to which you are entitled. For further details see clause 5.7 of the Share Scheme at Section 13.

Q12

Will I have to pay brokerage fees or stamp duty?

A

You will not have to pay brokerage or stamp duty in connection with the Merger.

Q13

When will I receive my consideration?

A

Cheques in respect of any Cash Consideration due to you will be despatched to you within 5 Business Days after the Implementation Date.

Holding statements in respect of any Constellation CDIs due to you will be despatched within the same period although you will be entitled to trade the Constellation CDIs to which you are entitled before that time on a deferred settlement basis (see Section 7 for details about Constellation CDIs).

Q14

If the Merger is implemented will this be a taxable transaction for Australian tax purposes?

A

The exchange of your BRL Shares pursuant to this Merger may be a taxable transaction to you. However, Australian resident BRL Shareholders who receive Scrip Consideration pursuant to the Merger should be entitled to receive CGT rollover relief with respect to that Scrip Consideration.

BRL Shareholders who elect to receive cash or who receive cash due to a pro rata scale back (refer section 1.2(c)) may be eligible to apply a discount to any capital gain which arises on the transfer of BRL Shares pursuant to this Merger.

Further details of the tax implications of the transaction are set out in Section 10 of this Scheme Booklet. BRL Shareholders should seek their own independent professional advice in relation to the precise tax consequences in respect of their own particular circumstances.

7

Questions about voting

Q15

When and where will the Share Scheme Meeting be held?

A

The Share Scheme Meeting will be held on 20 March 2003 at The Auditorium, Adelaide Town Hall, King William Street, Adelaide, South Australia, Australia, commencing at 10.00am

Q16

Am I entitled to vote?

A

If you are registered as a BRL Shareholder by the BRL Share Registry as at 10.00pm on 18 March 2003, you will be entitled to vote at the Share Scheme Meeting. You may vote in person at the meeting or by completing and lodging the proxy form accompanying this Scheme Booklet.

Q17

What is the opinion of the Independent Expert?

A

The Independent Expert has concluded that, in the absence of a higher offer, the Share Scheme is in the best interests of BRL Shareholders as a whole.

Q18

What voting majority is required to approve the Share Scheme proposal?

A

The voting majority to approve the Share Scheme requires votes in favour of the Share Scheme to be received from:

a majority in number (more than 50%) of BRL Shareholders present and voting at the Share Scheme Meeting (in person, by proxy, by attorney or, in the case of corporate BRL Shareholders, by corporate representative); and

BRL Shareholders who together hold at least 75% of the total number of BRL Shares voted at the Share Scheme Meeting.

Q19

Should I vote?

A

You do not have to vote. However, the BRL Board believes that the Share Scheme is important to all BRL Shareholders and urges you to read this Scheme Booklet carefully and vote in favour of the Share Scheme.

Q20

What happens if I do not vote, or if I vote against the Share Scheme proposal?

A

If you are a BRL Shareholder as at 10.00 pm on the Record Date and the Share Scheme proposal is implemented your BRL Shares will be transferred pursuant to the Share Scheme and you will be entitled to receive the Share Scheme Consideration notwithstanding that you did not vote or voted against the Share Scheme. You will also be entitled to make an election to receive Cash Consideration, Scrip Consideration or a combination thereof provided your Election is returned on or before 5.00pm (Adelaide time) on 4 April 2003.

Q21

When will the result of the meeting be known?

A

The result of the votes cast at the Share Scheme Meeting will be available shortly after the conclusion of the Share Scheme Meeting and will be announced to the ASX once available. The results will also be published on BRL Hardys website on the day following the Share Scheme Meeting.

You should be aware that the Share Scheme is subject to the approval of the Court, in exercising its supervisory jurisdiction. The Court hearing for approving the Share Scheme is expected to be held on 27 March 2003.

8

Other questions

Q22

What if the Share Scheme is not implemented on or before 30 April 2003?

A

If the Share Scheme is not implemented on or before 30 April 2003, either Constellation or BRL Hardy may terminate the Implementation Deed. If this occurs the Merger will not proceed.

Q23

What is the purpose of the General Meeting?

A

The General Meeting for BRL Shareholders is to consider and, if thought fit, to approve the financial assistance BRL Hardy is proposing to provide to Constellation in connection with the Share Scheme. The Directors believe that by agreeing to pay for the cancellation of the Options and the Non-Executive Options, and by agreeing to borrow funds from Constellation to do so and incurring an obligation to repay and to pay interest on the funds so borrowed, BRL Hardy is financially assisting Constellation to acquire BRL Shares under the Share Scheme. Such assistance will be in breach of the Corporations Act unless sanctioned by a special resolution of BRL Shareholders passed at a general meeting. For further details see Section 2.13.

Q24

If the Share Scheme is implemented will I receive a final dividend in respect of BRL Hardys financial period ended 31 December 2002?

A

It is a condition of the Implementation Deed that BRL Hardy does not declare or pay any dividend or make any other distribution of its profits, or assets. Therefore, if the Share Scheme is implemented, BRL Shareholders will not receive a final dividend in respect of the financial period ended 31 December 2002.

Q25

Have any major shareholders indicated their intentions?

A

The Responsible Entity of IWIF, the largest shareholder of BRLHardy, has resolved, subject to unit holder approval and to no higher offer being received, to vote in favour of the Share Scheme. Their decision is also subject to final details of the Merger being released.

Q26

Who can help answer my questions about the Merger?

A

If you have any questions about the Merger, or if you would like additional copies of this Scheme Booklet or the proxy form or the Election Form, please contact the BRL Hardy shareholder information line on:

1300 666 724 - Australia only; or

+61 292 407 513 - outside Australia,

or consult your legal, financial or other professional adviser without delay.

9

An introduction to Constellation

Constellation, headquartered in Fairport, New York, is principally engaged in the production and marketing of beverage alcohol brands in North America and the United Kingdom.

Constellation is listed on the New York Stock Exchange with a market capitalisation of approximately US$2.3 billion as at 31 January 2003.

With a broad portfolio of wine, spirits and imported beer, Constellation is the largest single-source supplier of these products in the United States. In the United Kingdom, Constellation is a leading producer and marketer of wine and of cider and a leading independent drinks wholesaler.

Since July 2001, Constellation and BRL Hardy have operated the Pacific Wine Partners joint venture, which produces and distributes wine in the U.S. and is the primary distributor for BRL Hardy products in the U.S. market.

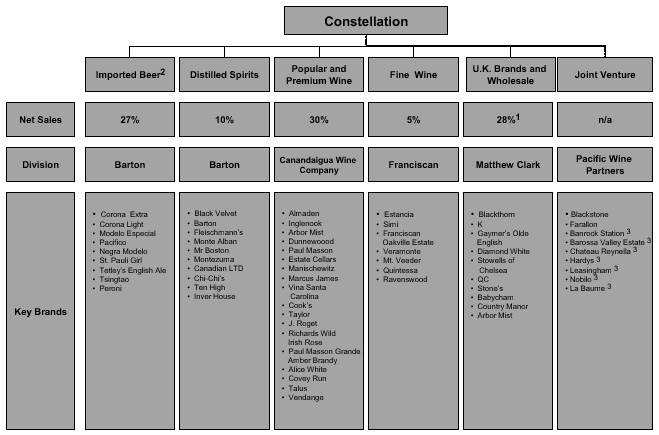

Constellations businesses

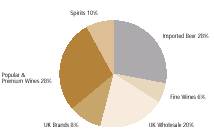

Constellation has a broad portfolio, with leading brands sold in the United States, the United Kingdom and more than 70 other countries.

Constellations portfolio generates a balanced earnings stream, with growth in its Fine Wine, Imported Beer and UK Wholesale businesses supported by the more stable earnings and cash flow of the U.S. Spirits and Popular and Premium Wine businesses and the UK Branded business.

For the latest 12 months ended 30 November 2002, Constellation generated net sales revenue of approximately US$2.7 billion and earnings before interest, taxes, depreciation and amortisation, including equity income from joint ventures (EBITDA), of approximately US$472 million.

|

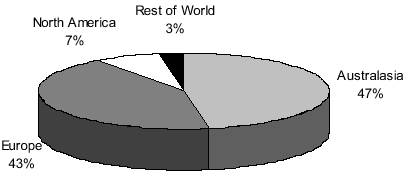

Net Sales (Latest 12 Months ended 30 November 2002) |

EBITDA (Latest 12 Months ended 30 November 2002) |

|

|

|

U.S. Imported Beer

Constellation number 3 by volume

Leading brands (Corona Extra, Negra Modelo, Peroni, St Pauli Girl)

Strong growth

U.S. Wine

Constellation number 2 by volume

Strong position in Popular and Premium Wine

Strong growth in Fine Wine

Pacific Wine Partners joint venture

Blackstone number 3 brand over US$11 per 750ml bottle

Distribution of BRL Hardys Australian and New Zealand products

Strong growth

UK Brands and Wholesale

Number 1 independent drinks wholesaler to the on-premise market

Number 2 in cider by volume

Stowells of Chelsea number 1 on-premise, number 3 off-premise

Strong growth in table wine and wholesale

U.S. Spirits

Constellation number 3 by volume

Key brands in the U.S. and Canada

Strong cashflow and returns

10

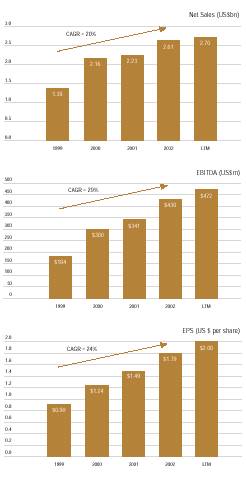

Constellations Financial Performance

Constellation has a strong track record of sales and earnings growth. The following graphs depict Constellations compound annual growth rates (CAGR) in net sales, EBITDA and earnings per share (EPS) for the four fiscal years in the period ended 28 February 2002 and the latest twelve months (LTM) ended 30 November 2002.

Notes:

Constellations fiscal year ends on the last day of February

Net Sales adjusted for EITF 01-09. See discussion of EITF01-09 in Section 3.4.

EPS is on a diluted basis. See Constellations Consolidated Financial Statements included as Annexure 1 to this Scheme Booklet.

EPS for 1999 and 2002 is before extraordinary item. See Constellations Consolidated Financial Statements.

EPS adjusted for U.S. Statement of Financial Accounting Standards No.142 (Goodwill and Other Intangible Assets). See Notes to Constellations Consolidated Financial Statements.

EPS adjusted to give retroactive effect to the May 2001 and May 2002 two-for-one stock splits.

Constellation generated free cash flow (cash flow from operating activities less capital expenditures) of approximately US$161 million for the latest 12 months ended 30 November 2002 and approximately US$142 million for the fiscal year ended 28 February 2002.

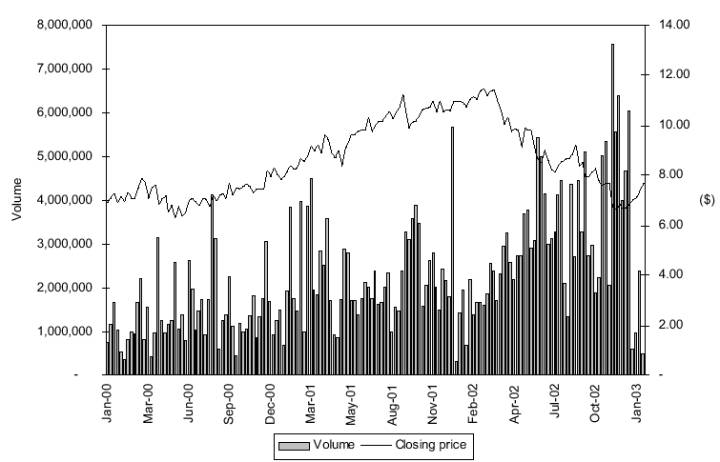

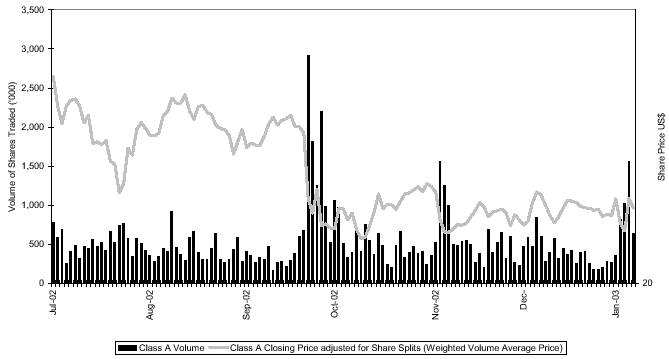

Performance of Constellation Shares

Constellations share price has increased at an average rate of more than 20% per annum over the last ten years.

Source: Bloomberg

Note: Share price adjusted to give retroactive effect to the May 2001 and May 2002 two-for-one stock splits.

No assurance can be given that changes in Constellations share price historically is indicative of future changes in Constellations share price.

Prospects for the Merged Group

A merger of BRL Hardy and Constellation will bring together two complementary businesses that share common growth orientation and operating philosophy. In particular the merger:

is expected to improve long term growth trends

Enhances Constellations revenue growth potential in the UK, Europe and other strategic international markets

Increases product breadth and geographic reach

Addition of fast growing New World wines to Constellations portfolio

Beer and spirits divisions maintain their strong market positions

Enhances scale, industry strength and competitiveness

Create the worlds largest wine company by sales

Total sales of US$3.2 billion, with wine group contributing US$1.7 billion in sales

Number 1 in wine in the UK by volume with 8 of the top 20 off-premise brands

Number 1 in wine in Australia by volume.

Strengthened number 2 position by volume in wine in the US.

The above information about Constellation and the Prospects for the Merged Group should be read in conjunction with Section 3, Section 5, the Risk Factors in Section 6 and Constellations Consolidated Financial Statements and Notes included as Annexure 1.

11

Action Required of BRL Shareholders and Option Holders

1 Please read this Scheme Booklet carefully.

If you do not understand it or are in any doubt as to the course of action you should follow, you should contact your legal, financial or other professional adviser immediately.

2 How to Vote - BRL Shareholders and Option Holders

You may vote by attending the Share Scheme Meeting, General Meeting or Option Scheme Meeting (as applicable to you) in person or by completing a proxy form.

(i) Voting in person

To vote in person at the Share Scheme Meeting, you must attend the Share Scheme Meeting at 10.00 am on 20 March 2003 at The Auditorium, Adelaide Town Hall, King William Street, Adelaide, South Australia, Australia.

To vote in person at the General Meeting, you must attend the General Meeting at 10.30 am on 20 March 2003 at The Auditorium, Adelaide Town Hall, King William Street, Adelaide, South Australia, Australia or as soon thereafter as the Share Scheme Meeting is concluded or adjourned.

To vote in person at the Option Scheme Meeting, you must attend the Option Scheme Meeting at 11.00 am on 20 March 2003 at The Auditorium, Adelaide Town Hall, King William Street, Adelaide, South Australia, Australia or as soon thereafter as the General Meeting is concluded or adjourned.

If you are a corporation, your authorised corporate representative may attend and vote at the relevant meeting.

You must disclose your name at the point of entry to the meeting. You will then be given a voting card and admitted to the meeting.

(ii)Voting by proxy

If you cannot attend the Share Scheme Meeting or otherwise wish to vote by proxy, you may appoint a proxy by completing the blue personalised proxy form accompanying this Scheme Booklet and returning it to the BRL Share Registry by 10.30 am (Adelaide time) on 18 March 2003, being 47.5 hours prior to the scheduled commencement of the meeting.

If you cannot attend the General Meeting or otherwise wish to vote by proxy, you may appoint a proxy by completing the blue personalised proxy form accompanying this Scheme Booklet and returning it to the BRL Share Registry by 10.30 am (Adelaide time) on 18 March 2003, being 48 hours prior to the scheduled commencement of the meeting.

The proxy forms for the Share Scheme Meeting and the General Meeting are on the same form.

If you cannot attend the Option Scheme Meeting or otherwise wish to vote by proxy, you may appoint a proxy by completing the green personalised proxy form accompanying this Scheme Booklet and returning it to the BRL Share Registry by 11.00 am (Adelaide time) on 18 March 2003, being 48 hours prior to the scheduled commencement of the meeting.

The proxy appointed by you must disclose his or her name at the point of entry to the meeting. They will then be given a voting card and admitted to the meeting.

Appointing a proxy will not preclude you from attending the meeting in person and voting at the meeting instead of your proxy.

(iii) Return of proxies

If you choose to vote by proxy, please return your proxy form to the BRL Share Registry by posting it in the reply paid envelope provided, delivering it to the relevant address below, or by faxing it to (08) 8236 2305 (within Australia) or +61 8 8236 2305 (international), but you will only be able to exercise your vote by proxy if it is received by 10.30 am (Adelaide time) on 18 March 2003 in respect of the Share Scheme Meeting and the General Meeting and by 11.00am (Adelaide time) on 18 March 2003 in respect of the Option Scheme Meeting.

By mail:

BRL Hardy Limited

C/- Computershare Investor Services Pty Ltd

GPO Box 242, Melbourne, Victoria 8060

By hand delivery:

BRL Hardy Limited

C/- Computershare Investor Services Pty Ltd

Level Five, 115 Grenfell Street, Adelaide SA 5000

or

BRL Hardy Limited

C/- Company Secretary

Reynell Road

Reynella SA 5161

12

3 Election of form of Share Scheme Consideration

This Scheme Booklet is accompanied by an Election Form under which you may elect to receive Scrip Consideration or a combination of Scrip Consideration and Cash Consideration for your BRL Shares. If you wish to receive Cash Consideration for all your BRL Shares, you do not need to return your Election Form. If you do make an Election, you should note that:

(a) you may elect to receive Scrip Consideration in respect of all or a specified number of your BRL Shares;

(b) an Election to receive Scrip Consideration may be made by you by returning the Election Form before 5.00 pm on the Record Date;

(c) if you do not make an Election prior to 5.00 pm on the Record Date, you will be deemed to have elected to receive Cash Consideration in respect of all of your BRL Shares;

(d) if you elect to receive any part of the Share Scheme Consideration to which you are entitled in the form of Scrip Consideration, the number of Constellation Shares which you are entitled to receive may be subject to scaling back in accordance with the terms of the Share Scheme and as summarised in Section 1.2(c);

(e) if the Australian Listing Condition is not satisfied by 8.00 am on the Second Court Date then, in accordance with the terms of the Share Scheme, all Scheme Shareholders will receive Cash Consideration whether or not they have elected to receive Scrip Consideration.

If you wish to make an Election, you should return your Election Form to the BRL Share Registry by 5.00 pm (Adelaide time) on 4 April 2003. You may return your Election Form to the BRL Share Registry by posting it in the reply paid envelope provided, by delivering it to the relevant address below, or by faxing it to (08) 8236 2305 (within Australia) or +61 8 8236 2305 (international), but your Election will only be valid if it is received by 5.00pm (Adelaide time) on 4 April 2003.

By mail:

BRL Hardy Limited

C/- Computershare Investor Services Pty Ltd

GPO Box 242, Melbourne, Victoria 8060

By hand delivery:

BRL Hardy Limited

C/- Computershare Investor Services Pty Ltd

Level Five, 115 Grenfell Street, Adelaide SA 5000

or

BRL Hardy Limited

C/- Company Secretary

Reynell Road

Reynella SA 5161

13

Forward Looking Statements

This Scheme Booklet includes certain forward looking statements which have been based on Constellations current expectations about future events. The profile of the combined group, the stated intentions of Constellation in the event of a Merger of Constellation Australia with BRL Hardy and other information other than historical facts are among the forward looking statements contained in this document. These forward looking statements and the operations and financial performance of Constellation, BRL Hardy and the Merged Group are, however, subject to risks, uncertainties and assumptions that could cause actual events or results to differ materially from the expectations expressed or implied by such statements. These factors include, among other things, those risks identified in Section 6 (Risk Factors), Section 5.7 (Cautionary Statements Regarding Forward Looking Information) and other investment considerations, as well as other matters not yet known to BRL Hardy or Constellation or not currently considered material by BRL Hardy or Constellation. These statements speak only as at the date of this Scheme Booklet. Subject to the Corporations Act and the Listing Rules and any other applicable laws or regulations, BRL Hardy and Constellation disclaim any duty to update these statements other than with respect to information BRL Hardy or Constellation becomes aware of prior to the Scheme Meetings which is material to the making of a decision by:

a BRL Shareholder regarding whether or not to vote in favour of the Share Scheme; or

an Option Holder regarding whether or not to vote in favour of the Option Scheme.

For discussions of important risk factors, refer to Section 6 and Section 5.7 of this document.

BRL Hardy Results for the year ending 31 December 2002

BRL Hardy is required by the Listing Rules to release to ASX its financial results for the 12 months ending 31 December 2002 by no later than 14 March 2003. In order to ensure that BRL Shareholders have a reasonable opportunity to review these results prior to voting at the Scheme Meetings, BRL Hardy intends to ensure that these results are released to the ASX by no later than 11 March 2003. A copy of the results will also be made available on BRL Hardys website, www.brlhardy.com.au from the date of release onwards and will be made available for inspection from that date as referred to in Section 11.1.

Investment Decision

This Scheme Booklet does not take into account the individual investment objectives, financial situation and particular needs of each BRL Shareholder and Option Holder. You may wish to seek independent legal, financial and taxation advice before making a decision as to whether or not to vote in favour of the Share Scheme or the Option Scheme (as applicable to you) and, if you are a BRL Shareholder, whether Constellation Scrip is an appropriate investment for you.

You should read this Scheme Booklet in its entirety before making a decision as to how to vote on the resolutions to be considered at the Share Scheme Meeting and the Option Scheme Meeting and before making an Election pursuant to the Share Scheme.

The Corporations Act and the Corporations Rules 2000 of South Australia provide a procedure for BRL Shareholders and Option Holders to oppose the approval by the Court of the Share Scheme and the Option Scheme respectively. If you wish to oppose the approval of either of the Schemes at the Second Court Hearing you may do so by filing with the Court and serving on BRL Hardy a notice of appearance in the prescribed form together with any affidavit on which you wish to rely at the hearing. The notice of appearance and affidavit must be served on BRL Hardy at least one day before the date fixed for the Second Court Hearing. That date is currently scheduled to occur on 27 March 2003. Any change to this date will be announced through the ASX and notified on BRL Hardys website, www.brlhardy.com.au.

Responsibility for Information

The information contained in this Scheme Booklet (BRL Information) has been prepared by BRL Hardy and its advisers and is the responsibility of BRL Hardy, other than:

the information concerning Constellation contained in Section 3, Section 5, Section 6 and Section 7 and Sections 11.7, 11.8, 11.10, 11.11, and 11.14 of this Scheme Booklet, which has been prepared by Constellation and its advisers and is the responsibility of Constellation (Constellation Information);

the Independent Experts Report in relation to the Schemes contained in Section 19 of this Scheme Booklet, which has been prepared by Deloitte Corporate Finance Pty Limited, and Deloitte Corporate Finance Pty Limited takes responsibility for that Section;

14

the information about US law set out in these Important Notices and the information about the US taxation implications of the Schemes contained in Section 10 of this Scheme Booklet which has been prepared by McDermott, Will & Emery, and McDermott, Will & Emery takes responsibility for that information; and

the details of the Australian taxation implications of the Schemes contained in Section 10 of this Scheme Booklet, which has been prepared by Clayton Utz, and Clayton Utz takes responsibility for those portions of that Section.

Neither Constellation nor any of its directors, officers or advisers (other than as referred to above), assumes any responsibility for the accuracy or completeness of the BRL Information nor the details in Section 10. Likewise, neither BRL Hardy nor its directors, officers or advisers assumes any responsibility for the accuracy or completeness of the Constellation Information nor the details in Section 10.

ASIC, the Court and the ASX

A copy of this Scheme Booklet has been examined by ASIC. ASIC has been requested to provide a statement, in accordance with Section 411(17)(b) of the Corporations Act, that ASIC has no objection to the Schemes. If ASIC provides that statement, then it will be produced to the Court at the Court Hearing Time. Neither ASIC nor any of its officers takes any responsibility for the contents of this Scheme Booklet.

The Schemes have not been proposed by BRL Hardy or Constellation for the purpose of enabling any person to avoid the operation of any of the provisions of Chapter 6 of the Corporations Act. Among the reasons for which the Schemes have been proposed are to facilitate:

(i) the offering of Constellation Shares subject to the Scrip Consideration Cap and the mechanism for the allocation of the Constellation Shares if the Scrip Consideration Cap is exceeded;

(ii) the ability of Constellation to rely on an exemption under Section 3(a)(10) under the U.S. Securities Act from the requirement to register Constellation Shares to be issued under the Share Scheme under the U.S. Securities Act. This exemption would not be available if the transaction were structured other than as a court approved scheme of arrangement; and

(iii) the cancellation of the Options in accordance with the Option Scheme.

If the Supreme Court of South Australia approves the Share Scheme, its approval will constitute the basis for the Constellation Shares to be issued without the need for registration under the U.S. Securities Act, in reliance on the exemption from the registration requirements provided by Section 3(a)(10) of the U.S. Securities Act. The Court does not take any responsibility for the contents of the Explanatory Statement included in this Scheme Booklet.

A copy of this Scheme Booklet has been lodged with the ASX. Neither the ASX nor any of its officers takes any responsibility for the contents of this Scheme Booklet.

Notice to U.S. Persons

The Constellation Shares to be issued pursuant to the Share Scheme have not been, and will not be, registered under the U.S. Securities Act or the securities laws of any other jurisdiction. The Constellation Shares issued pursuant to the Share Scheme will be issued in reliance on the exemption from the registration requirements of the U.S. Securities Act provided in Section 3(a)(10) of the U.S. Securities Act based on the approval of the Share Scheme by the Court.

If the Court approves the Share Scheme, its approval will constitute the basis for the Constellation Shares to be issued without registration under the U.S. Securities Act, in reliance on the exemption from the registration requirements of the U.S. Securities Act provided by Section 3(a)(10) of the U.S. Securities Act.

The transaction is subject to the disclosure requirements of Australia. This document has been prepared in accordance with Australian requirements and style, which differ from the requirements and style in the United States for disclosure documents prepared for business combination transactions. Financial information included in this document has been prepared in accordance with Australian accounting standards (unless otherwise indicated) and may not be comparable to the financial statements prepared in accordance with U.S. accounting standards.

For BRL Shareholders who are subject to United States taxation, the exchange of BRL Shares will be fully taxable for United States tax purposes regardless of whether such holder receives the Scrip Consideration or the Cash Consideration. Each such holder is strongly urged to review the description of the tax consequences to the BRL Shareholders who are subject to United States taxation which is set forth in Section 10.2 of this Scheme Booklet and to consult their United States tax advisor as to the United States tax consequences of the transaction.

Resale of Constellation Shares under U.S. Federal Securities Laws

If at the time the Share Scheme is submitted to a vote of BRL Shareholders, you are an affiliate of BRL Hardy or Constellation, then under Rule 145 of the U.S. Securities Act you may not offer or sell or otherwise dispose of the Constellation Shares or Constellation CDIs issued to you under the Share Scheme in the United States or to U.S. Persons unless that offer or sale or other disposition has been registered under the U.S. Securities Act or is made in conformity with Rule 145 under the U.S. Securities Act or pursuant to any other applicable exemption from the registration requirements of the U.S. Securities Act. For these purposes, an affiliate includes the directors, executive officers and controlling stockholders of BRL Hardy or Constellation.

Notice to other persons outside Australia

The transaction is subject to the disclosure requirements of Australia. This document has been prepared in accordance with Australian requirements and style, and differs from the requirements and style in jurisdictions outside Australia for disclosure documents prepared for business combination transactions and offerings of securities. Financial information included in this document has been prepared in accordance with Australian or US accounting standards and may not be comparable to the financial statements prepared in accordance with the accounting standards in jurisdictions outside Australia or the United States.

15

Explanatory Statement

This Explanatory Statement has been prepared pursuant to section 412(1) of the Corporations Act to explain the effect of the Schemes and the Resolution and includes all information that is material to the making of a decision by:

a BRL Shareholder about how to vote in respect of the Share Scheme;

a BRL Shareholder about how to vote in respect of the Resolution; and

an Option Holder about how to vote in respect of the Option Scheme.

The Share Scheme and the Option Scheme are set out in Section 13 and Section 15 of this Scheme Booklet respectively. The Resolution is set out in the Notice of General Meeting at Section 17 and explained in Section 2.13.

16

Key Features Of Share Scheme and Considerations for BRL Shareholders

Section 1

17

1 Key Features Of Scheme and Considerations for BRL Shareholders

This Section should be read in conjunction with the remainder of this Scheme Booklet.

1.1 Overview

On 17 January 2003, BRL Hardy and Constellation announced a proposal to merge. Under the proposal:

Constellation Australia, an indirect wholly owned subsidiary of Constellation, will acquire all of the BRL Shares by way of scheme of arrangement; and

all of the Options will be cancelled by way of scheme of arrangement.

The Share Scheme is subject to a number of conditions including:

approval of the Share Scheme by BRL Shareholders; and

approval of the Share Scheme by the Court.

The other conditions to the Share Scheme are discussed in Section 1.9 and are set out in full in the copy of the Implementation Deed which is set out in Section 12.

If the Share Scheme is implemented, BRL Hardy will become an indirect wholly owned subsidiary of Constellation and will be de-listed from the ASX.

The Option Scheme is subject to a number of conditions including:

approval of the Share Scheme, by the Court;

approval of the Resolution, by the requisite majority of BRL Shareholders; and

approval of the Option Scheme, by the Court.

(a) Overview

Under the Share Scheme, you are able to choose to receive the following consideration alternatives for your BRL Shares:

Cash Consideration of $10.50 per BRL Share;

Scrip Consideration, being a number of Constellation Shares or Constellation CDIs per BRL Share; or

a combination of Cash Consideration and Scrip Consideration.

To make your choice you should tick the appropriate box on the Election Form. If you elect to receive a combination of Cash Consideration and Scrip Consideration, you will need to specify the number of your BRL Shares in respect of which you wish to receive Scrip Consideration. You should also note the restrictions set out in paragraphs (c), (d), (e) and (f) below.

(b) Scrip Exchange Ratio

If you elect to receive Scrip Consideration in respect of all or a specified number of your BRL Shares, the number of Constellation Shares that you will be entitled to receive (subject to paragraphs (c), (d), (e) and (f)) for each of those BRL Shares (Scrip Exchange Ratio) will depend upon two variables, being the Constellation VWAP and the Exchange Rate.

The Constellation VWAP is an average share price of Constellation Shares traded on the NYSE over the ten day trading period ending prior to the Second Court Date. The Exchange Rate is an average US$/A$ exchange rate quoted by Bloomberg for the New York market over the same period. The actual Constellation VWAP and Exchange Rate will be announced by BRL Hardy to the ASX and posted on BRL Hardys website at the conclusion of the ten day trading period.

The Scrip Exchange Ratio will be determined as follows:

|

If the Constellation VWAP is: |

|

Scrip Exchange Ratio - For each BRL |

|

above US$27.50 |

|

the fraction of a Constellation Share which equals a value of $10.50 based on an assumed price per Constellation Share of US$27.50 converted at the Exchange Rate |

|

|

|

|

|

from US$22.50 to |

|

the fraction of a Constellation Share which equals a value of $10.50 based on the actual Constellation VWAP converted at the Exchange Rate |

|

|

|

|

|

below US$22.50 |

|

the fraction of a Constellation Share which equals a value of $10.50 based on an assumed price per Constellation Share of US$22.50 converted at the Exchange Rate |

Set out below is a Ready Reckoner which illustrates the application of the above method of calculating the Scrip Exchange Ratio.

The Ready Reckoner shows the fraction of a Constellation Share which would be issued based on each Constellation VWAP listed in the first column at each of the Exchange Rates listed in the top row.

Scrip Consideration - Ready Reckoner

(The Scrip Exchange Ratio or fraction of a Constellation Share you will be entitled to receive for each BRL Share held, is shown in gold)

|

Constellation VWAP (US$ |

|

|

US$/A$ Exchange Rate |

|

||||||

|

|

|

0.5600 |

|

0.5800 |

|

0.6000 |

|

0.6200 |

|

|

|

22.50 or less |

|

0.2613 |

|

0.2707 |

|

0.2800 |

|

0.2893 |

|

|

|

23.00 |

|

0.2557 |

|

0.2648 |

|

0.2739 |

|

0.2830 |

|

|

|

24.00 |

|

0.2450 |

|

0.2538 |

|

0.2625 |

|

0.2713 |

|

|

|

25.00 |

|

0.2352 |

|

0.2436 |

|

0.2520 |

|

0.2604 |

|

|

|

26.00 |

|

0.2262 |

|

0.2342 |

|

0.2423 |

|

0.2504 |

|

|

|

27.00 |

|

0.2178 |

|

0.2256 |

|

0.2333 |

|

0.2411 |

|

|

|

27.50 or higher |

|

0.2138 |

|

0.2215 |

|

0.2291 |

|

0.2367 |

|

|

The following are some examples shown in the Ready Reckoner:

if the Constellation VWAP is US$22.50 or lower and the Exchange Rate is $0.58, then the Scrip Exchange Ratio will be 0.2707

18

Constellation Shares for every one BRL Hardy share held;

if the Constellation VWAP is exactly US$25.00 and the Exchange Rate is $0.60, then the Scrip Exchange Ratio will be 0.2520 Constellation Shares for every one BRL Hardy share held;

if the Constellation VWAP is US$27.50 or higher and the Exchange Rate is $0.62, then the Scrip Exchange Ratio will be 0.2367 Constellation Shares for every one BRL Hardy share held.

Your entitlement to Constellation Shares as determined above will be issued to you in the form of Constellation CDIs if your address on the Register is in Australia, Hong Kong, New Zealand, Singapore or the United Kingdom as at 10.00 pm on the Record Date. If so, you will be issued Constellation CDIs at the ratio of 10 Constellation CDIs for every one Constellation Share to which you are entitled (subject to confirmation by the ASX). Further details of Constellation CDIs are set out in Section 7.2.

If your address on the Register is in the United States as at 10.00pm on the Record Date, you will receive Constellation Shares.

(c) Scale back

The maximum number of shares Constellation will issue to BRL Shareholders who elect to receive Scrip Consideration under the Share Scheme is 15,000,000 Constellation Shares (referred to in this Scheme Booklet as the Scrip Consideration Cap).

If the total number of Constellation Shares (Total Scrip Election) which Constellation would otherwise be required to issue to satisfy Elections from BRL Shareholders for Scrip Consideration exceeds the Scrip Consideration Cap, then the number of BRL Hardy Shares with respect to which Elections to receive Scrip Consideration will be satisfied will be scaled back on a pro rata basis. The pro rata scale-back applicable to each BRL Shareholder will be determined by multiplying the number of BRL Shares in respect of which such BRL Shareholder made an Election to receive Scrip Consideration by the ratio of the Scrip Consideration Cap to the Total Scrip Election.

This is illustrated by the example below:

Suppose you elect to receive Scrip Consideration for your total holding of 1,000 BRL Shares and the Total Scrip Election was 18.75 million, the scale back provisions would apply.

The number of BRL Shares for which you would receive Scrip Consideration would be calculated as 15,000,000 ÷ 18,750,000 x 1,000 = 800 BRL Shares. You would receive Cash Consideration for the remaining 200 BRL Shares.

(d) Fractional Entitlements

Entitlements to less than whole numbers of Constellation Shares will be rounded down to the nearest whole number and fractional entitlements will be paid in the form of cash (for further details see clause 5.7 of the Share Scheme in Section 13).

(e) Foreign Scheme Shareholders

BRL Shareholders whose address in the Register as at 10.00 pm on the Record Date is a place outside Australia, Hong Kong, New Zealand, Singapore, the United Kingdom and the United States will be treated as Foreign Scheme Shareholders for the purpose of the Share Scheme.

If a Foreign Scheme Shareholder makes an Election to receive Scrip Consideration for all or a specified number of their BRL Shares then the Constellation Shares which would otherwise be required to be issued to the Foreign Scheme Shareholder will be issued to a nominee appointed by Constellation. Constellation will cause the nominee to offer these Constellation Shares on the NYSE at such price and on such terms as the nominee shall determine and to remit to Constellation the proceeds of sale. Constellation will then account to the Foreign Scheme Shareholders for the proceeds received after deduction of any applicable brokerage, taxes and other costs of sale. Foreign Scheme Shareholders will receive the proceeds in U.S. dollars. For further details see clause 5.6 of the Share Scheme in Section 13.

(f) Failure to satisfy Australian Listing Conditions

If the Australian Listing Condition is not satisfied by 8.00 am on the Second Court Date then, in accordance with the terms of the Share Scheme, all Scheme Shareholders will receive Cash Consideration whether or not they have elected to receive Scrip Consideration. Constellation has no reason to believe that the Constellation CDIs will not be listed by ASX.

(g) Failure to elect

If an Election is not made by a BRL Shareholder prior to 5.00 pm on the Record Date, then that BRL Shareholder will be deemed to have elected to receive Cash Consideration in respect of all its BRL Shares.

(h) Settlement date

Settlement of the Share Scheme Consideration, whether in Cash Consideration or Scrip Consideration, will be made within 5 Business Days after the Implementation Date.

Cash Consideration will be paid by cheque drawn in Australian dollars.

The full terms relating to the payment of the Share Scheme Consideration are contained in the Share Scheme set out in Section 13 and the Deed Poll set out in Section 14. Further information concerning Constellation CDIs and the rights attaching to the underlying Constellation Shares is set out in Section 7.

19

Your Directors believe that the proposed Merger is in the best interests of BRL Shareholders and your Directors unanimously recommend that, in the absence of a higher offer, you vote in favour of the Share Scheme. The reasons for your Directors recommendation are outlined below.

All Directors who hold BRL Shares intend to vote in favour of the Share Scheme.

Details of the interests of Directors are provided in Section 11.4.

1.4 Reasons to vote in favour of the Share Scheme

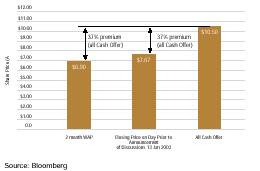

(a) Substantial premium to recent BRL Hardy share price

The $10.50 value of the Share Scheme Consideration represents a substantial premium to the price at which BRL Shares traded prior to the announcement that the parties were in discussions with respect to the Merger:

A 37% premium to the closing share price of BRL Shares on 13 January 2003, the last day immediately prior to the announcement that the parties were in discussions with respect to the Merger; and

A 52% premium to the volume weighted average share price of BRL Shares over the two months immediately prior to 13 January 2003.

(b) Independent Expert Opinion

Deloitte Corporate Finance Pty Limited was appointed by BRL Hardy to prepare an Independent Experts Report in relation to the Schemes. It has concluded that, in the absence of a higher offer, the Share Scheme is in the best interests of BRL Shareholders as a whole. In reaching this conclusion, the Independent Expert has also made the following statements:

the Cash Consideration represents a significant premium over and above the recent share market price of BRL Shares (page 88 of the Independent Experts Report).

the Cash Consideration is within our estimated fair market value range of a BRL Share on a control basis (page 88 of the Independent Experts Report).

The Independent Expert has estimated the fair market value of a BRL Share to be in the range of $9.76 to $10.77 inclusive of a premium for control.

The Independent Experts Report is set out in full in Section 19.

(c) If the Merger is not approved, there is a risk that BRL Hardys share price will fall

BRL Hardys share price rose following the announcement of discussions with respect to the proposed Merger with Constellation. On 13 January 2003, the day prior to this announcement, the closing price of BRL Shares was $7.67. As at 7 February 2003 the BRL Hardy share price closed at $10.33.

Your Directors believe there is a risk that the BRL Hardy share price will fall if the Merger is not approved.

20

1.5 Assessing the Choice of Consideration

Whilst your Directors unanimously recommend that, in the absence of a higher offer, you vote in favour of the Share Scheme, they make no recommendation as to the form of Share Scheme Consideration that you should elect to receive. In making your Election, you should take into account the factors outlined below and your own personal tax position and other circumstances. If in doubt you should consult your legal, financial or other professional adviser.

(a) Factors relating to Cash Consideration

(i) Benefits

Receiving Cash Consideration will provide BRL Shareholders with the benefit of certainty of the value of the consideration received. In other words, BRL Shareholders who elect to receive Cash Consideration will receive $10.50 per BRL Share held as at the Record Date.

(ii) Other Considerations

Receiving Cash Consideration could trigger an immediate CGT liability for some BRL Shareholders which could otherwise be deferred. Further details of the tax implications of the Share Scheme are set out in Section 10.

(b) Factors relating to Scrip Consideration

(i) Benefits

Receiving Scrip Consideration will provide you with the following benefits:

Exposure to Constellation - BRL Shareholders will gain exposure to the assets, operations and growth prospects of Constellation, the largest single-source supplier of wine, spirits and imported beer in the United States.

Continuing participation in the future of the Merged Group - BRL Shareholders who receive Scrip Consideration will not only retain exposure to the assets, operations and growth prospects of BRL Hardy, but will also be able to participate in:

the creation of the worlds largest wine company by sales; and

the synergies between Constellation and BRL Hardy which are expected to be realised as a result of the Merger.

Details of the profile of Constellation and the expected profile of the Merged Group are set out in Sections 3 and 5, respectively.

CGT rollover relief - the Share Scheme is expected to satisfy the general requirements of the CGT scrip for scrip rollover provision of the Income Tax Assessment Act. As a result, CGT rollover relief should be available to Australian resident BRL Shareholders who receive Scrip Consideration (but not in respect of any proportion of their holding for which they receive Cash Consideration, including as a result of their Election or the pro rata scale back referred to in Section 1.2(c) or if the Australian Listing Conditions is not satisfied). Further details of the tax implications of the Merger are set out in Section 10.

ASX listing - BRL Shareholders who receive Constellation CDIs will be able to trade their Constellation CDIs on the ASX.

(ii) Risks

You should be aware of the following risks if you are considering electing to receive Scrip Consideration:

The increased level of gearing that BRL Shareholders will be exposed to should they receive Scrip Consideration (for further information see Sections 5 and 6).

For BRL Shareholders who receive Constellation CDIs, Constellation CDIs are likely to have lower liquidity on the ASX as compared with the existing liquidity of BRL Shares on the ASX and Constellation Shares on the NYSE. However, Constellation CDIs can be converted into Constellation Shares and traded on the NYSE (for further information see Section 7.2(d)).

21

(iii) Other considerations

You should also consider the following if you are considering electing to receive Scrip Consideration:

Value of your consideration will fluctuate - -Unlike the Cash Consideration, the value of the Scrip Consideration that BRL Shareholders will receive will fluctuate with movements in the price of Constellation Shares or Constellation CDIs. It follows that the value of the Scrip Consideration issued to BRL Shareholders could when issued, be lower or higher than the value it would have had as at the date of this Scheme Booklet.

Dividend policy - BRL Hardy has historically paid fully franked dividends to its shareholders on a regular basis. In contrast, Constellation has a policy of not paying dividends to Constellation Shareholders but reinvesting earnings in the growth of the business and Constellations existing and new senior credit facilities and bridging facility and its indentures for its senior notes and senior subordinated notes limit the payment of cash dividends (see Section 3.6(c) for more details). As a result, BRL Shareholders who receive Scrip Consideration are likely to experience a cessation in payment of dividends. If Constellation does pay dividends in the future, they will not be franked for Australian tax purposes and are likely to be subject to US withholding tax.

Different business profile - BRL Shareholders who receive Scrip Consideration will be exposed to a different mix of businesses than they are currently exposed to through their shareholdings in BRL Hardy. In particular, whereas BRL Hardy is a pure wine business, Constellations business encompasses production and marketing of wine, spirits and beer. This means that the risk and return characteristics of their investment will be different from that which is currently the case.

Rights attaching to Constellation Shares -BRL Shareholders who receive Scrip Consideration will receive an entitlement to Constellation Shares. Constellation also has Constellation B Shares on issue which carry different rights from Constellation Shares (in particular, Constellation B Shares carry enhanced voting rights and enhanced rights to elect directors). A summary of Constellations share capital and the differences between Constellation Shares and Constellation B Shares is set out in Sections 7.3 and 7.4.

Controlling shareholder group - Unlike BRL Hardy, Constellation has a controlling shareholder group (the Sands family). For further details, refer to Section 7.6.

Diluted percentage holding - BRL Shareholders who receive Scrip Consideration in exchange for BRL Shares will receive a smaller percentage holding in Constellation than the percentage holding in BRL Hardy represented by the BRL Shares they exchange.

(iv) Performance of Constellation Shares

The table below shows the following prices for Constellation Shares on the NYSE:

Closing price on 7 February 2003 (latest recorded sale price before the Scheme Booklet was lodged for registration with ASIC);

Highest and lowest recorded sale prices during the period 7 November 2002 to 7 February 2003;

Closing price on 16 January 2003 (latest recorded sale price prior to announcement of the Merger); and

Closing price on 10 January 2003 (latest recorded sale price prior to announcement that the parties were in discussions with respect to the Merger).

|

Date |

|

Constellation Share |

|

|

|

Closing price 7 February 2003 |

|

$ |

24.50 |

|

|

Highest recorded sale price (22 January 2003) |

|

$ |

26.26 |

|

|

Lowest recorded sale price (6 January 2003) |

|

$ |

22.30 |

|

|