10-Q: Quarterly report [Sections 13 or 15(d)]

Published on October 7, 2025

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the quarterly period ended August 31, 2025

or

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from_____________to_____________

Commission File Number: 001-08495

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||||

(Address of principal executive offices) (Zip code)

(585 ) 678-7100

(Registrant’s telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||||||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☒ | Accelerated filer | ☐ | |||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | |||||||||

| Emerging growth company | |||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

There were 175,013,336 shares of Class A Common Stock and 27,167 shares of Class 1 Common Stock outstanding as of September 30, 2025.

TABLE OF CONTENTS

| Page | ||||||||

| DEFINED TERMS | ||||||||

| PART I – FINANCIAL INFORMATION | ||||||||

| Item 1. Financial Statements | ||||||||

| Consolidated Balance Sheets | ||||||||

| Consolidated Statements of Comprehensive Income (Loss) | ||||||||

| Consolidated Statements of Changes in Stockholders’ Equity | ||||||||

| Consolidated Statements of Cash Flows | ||||||||

| Notes to Consolidated Financial Statements | ||||||||

1. Basis of Presentation | ||||||||

2. Acquisitions and Divestitures | ||||||||

3. Restructuring | ||||||||

4. Inventories | ||||||||

5. Prepaid Expenses and Other | ||||||||

6. Derivative Instruments | ||||||||

7. Fair Value of Financial Instruments | ||||||||

8. Goodwill | ||||||||

9. Intangible Assets | ||||||||

10. Other Assets | ||||||||

11. Borrowings | ||||||||

12. Income Taxes | ||||||||

13. Stockholders' Equity | ||||||||

14. Net Income (Loss) Per Common Share Attributable to CBI | ||||||||

15. Comprehensive Income (Loss) Attributable to CBI | ||||||||

16. Business Segment Information | ||||||||

17. Accounting Guidance Not Yet Adopted | ||||||||

| Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations | ||||||||

| Item 3. Quantitative and Qualitative Disclosures About Market Risk | ||||||||

| Item 4. Controls and Procedures | ||||||||

| PART II – OTHER INFORMATION | ||||||||

| Item 1. Legal Proceedings | ||||||||

| Item 2. Unregistered Sales of Equity Securities and Use of Proceeds | ||||||||

| Item 5. Other Information | ||||||||

| Item 6. Exhibits | ||||||||

| SIGNATURES | ||||||||

This Form 10-Q contains “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. These forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond our control, which could cause actual results to differ materially from those set forth in, or implied by, such forward-looking statements. For further information regarding such forward-looking statements, risks, and uncertainties, please see “Information Regarding Forward-Looking Statements” under MD&A.

Market positions and industry data discussed in this Form 10-Q are for the 52-weeks ending August 31, 2025.

DEFINED TERMS

Unless the context otherwise requires, the terms “Company,” “CBI,” “we,” “our,” or “us” refer to Constellation Brands, Inc. and its subsidiaries. We use terms in this Form 10-Q and in our Notes that are specific to us or are abbreviations that may not be commonly known or used.

| TERM | MEANING | ||||

| $ | U.S. dollars | ||||

| 10b5-1 Trading Plan | a pre-arranged trading plan intended to satisfy the affirmative defense conditions of Rule 10b5-1(c) of the Exchange Act | ||||

2025 Annual Report | our Annual Report on Form 10-K for the fiscal year ended February 28, 2025 | ||||

| 2025 Authorization | authorization to repurchase up to $4.0 billion of our publicly traded common stock, approved by our Board of Directors in April 2025 | ||||

| 2025 Credit Agreement | eleventh amended and restated credit agreement, dated as of April 28, 2025, that provides for a $2.25 billion aggregate revolving credit facility | ||||

| 2025 Restructuring Initiative | an enterprise-wide cost savings and restructuring initiative designed to help optimize the performance of our business, including through enhanced organizational efficiency and optimized expenditures across our organization, with the majority of the work expected to be completed within Fiscal 2026 and net annualized cost savings expected to be fully realized by Fiscal 2028 | ||||

| 2025 Term Credit Agreement | term loan credit agreement, dated as of May 9, 2025, that provides for a $500.0 million unsecured delayed draw term loan facility | ||||

| 2025 Wine Divestitures | sale and, in certain instances, exclusive license to use the trademarks of a portion of our wine and spirits business, primarily centered around our then-owned mainstream wine brands and associated inventory, wineries, vineyards, offices, and facilities on June 2, 2025 | ||||

| 3-tier | distribution channel where products are sold to a distributor (wholesaler) who then sells to a retailer; the retailer sells the products to a consumer | ||||

| 3-tier eCommerce | digital commerce experience for consumers to purchase beverage alcohol from retailers | ||||

| 4.75% December 2015 Senior Notes | $400.0 million principal amount of 4.75% senior notes issued in December 2015, now repaid in full | ||||

| 4.80% May 2025 Senior Notes | $500.0 million aggregate principal amount of senior notes issued in May 2025 | ||||

| 5.00% February 2023 Senior Notes | $500.0 million principal amount of 5.00% senior notes issued in February 2023, now repaid in full | ||||

| ABA | alternative beverage alcohol | ||||

| Administrative Agent | Bank of America, N.A., as administrative agent for the senior credit facility and the 2025 Term Credit Agreement | ||||

| AOCI | accumulated other comprehensive income (loss) | ||||

| Canopy | Canopy Growth Corporation, an Ontario, Canada-based public company in which we have an investment | ||||

CB International | CB International Finance S.à r.l., a wholly-owned subsidiary of ours | ||||

| Class 1 Stock | our Class 1 Convertible Common Stock, par value $0.01 per share | ||||

| Class A Stock | our Class A Common Stock, par value $0.01 per share | ||||

Constellation Brands, Inc. Q2 FY 2026 Form 10-Q | #WORTHREACHINGFOR I i | ||||

| TERM | MEANING | ||||

| CODM | chief operating decision maker, our President and Chief Executive Officer | ||||

| Comparable Adjustments | certain items affecting comparability that have been excluded because management uses this information in monitoring and evaluating the results and underlying business trends of the core operations of the Company and/or in internal goal setting | ||||

| CPG | consumer packaged goods | ||||

| CSR | corporate social responsibility | ||||

| Depletions | represent U.S. distributor shipments of our respective branded products to retail customers, based on third-party data | ||||

| DTC | direct-to-consumer inclusive of (i) a digital commerce experience for consumers to purchase directly from brand websites with inventory coming straight from the supplier and (ii) consumer purchases at hospitality locations (tasting rooms and tap rooms) from the supplier | ||||

| Exchangeable Shares | class of non-voting and non-participating exchangeable shares in Canopy which are convertible into common shares of Canopy on a one-for-one basis | ||||

| Exchange Act | Securities Exchange Act of 1934, as amended | ||||

| FASB | Financial Accounting Standards Board | ||||

| Financial Statements | our consolidated financial statements and notes thereto included herein | ||||

| Fiscal 2025 | the Company’s fiscal year ended February 28, 2025 | ||||

| Fiscal 2026 | the Company’s fiscal year ending February 28, 2026 | ||||

| Fiscal 2027 | the Company’s fiscal year ending February 28, 2027 | ||||

| Fiscal 2028 | the Company’s fiscal year ending February 29, 2028 | ||||

| Fiscal 2029 | the Company’s fiscal year ending February 28, 2029 | ||||

| Fiscal 2030 | the Company’s fiscal year ending February 28, 2030 | ||||

| Fiscal 2031 | the Company’s fiscal year ending February 28, 2031 | ||||

| Form 10-Q | this Quarterly Report on Form 10-Q for the quarterly period ended August 31, 2025, unless otherwise specified | ||||

| IRA | Inflation Reduction Act of 2022 | ||||

| IT | information technology | ||||

| Mainstream | wine that sells less than $11.00 per bottle at retail and sparkling wine and all other wine that sells less than $13.00 per bottle at retail | ||||

| MD&A | Management’s Discussion and Analysis of Financial Condition and Results of Operations under Part I – Item 2. of this Form 10-Q | ||||

Mexicali Brewery | canceled brewery construction project located in Mexicali, Baja California, Mexico, sold the remaining assets classified as held for sale in July 2024 | ||||

| Mexico Beer Projects | expansion, optimization, and/or construction activities at the Obregón Brewery, Nava Brewery, and Veracruz Brewery | ||||

| M&T | Manufacturers and Traders Trust Company | ||||

| Nava | Nava, Coahuila, Mexico | ||||

Constellation Brands, Inc. Q2 FY 2026 Form 10-Q | #WORTHREACHINGFOR I ii | ||||

| TERM | MEANING | ||||

| Nava Brewery | our brewery located in Nava | ||||

| Net sales | gross sales less promotions, returns and allowances, and excise taxes | ||||

| NM | not meaningful | ||||

| Non-GAAP | financial measures not calculated in accordance with U.S. GAAP, for example, comparable operating income (loss) | ||||

| Note(s) | notes to the consolidated financial statements | ||||

OB3 Act | One Big Beautiful Bill Act, signed into U.S. law on July 4, 2025 | ||||

| Obregón | Obregón, Sonora, Mexico | ||||

Obregón Brewery | our brewery located in Obregón | ||||

| OECD | Organization for Economic Cooperation and Development | ||||

| OCI | other comprehensive income (loss) | ||||

| Pre-issuance hedge contracts | treasury lock and/or swap lock contracts designated as cash flow hedges entered into to hedge treasury rate volatility on future debt issuances | ||||

| Premium | wine that sells between $11.00 to $24.99 per bottle at retail and sparkling wine that sells between $13.00 to $34.99 per bottle at retail | ||||

| SEC | Securities and Exchange Commission | ||||

Second Quarter 2025 | the Company’s three months ended August 31, 2024 | ||||

Second Quarter 2026 | the Company’s three months ended August 31, 2025 | ||||

| Securities Act | Securities Act of 1933, as amended | ||||

Six Months 2025 | the Company’s six months ended August 31, 2024 | ||||

Six Months 2026 | the Company’s six months ended August 31, 2025 | ||||

| SOFR | secured overnight financing rate administered by the Federal Reserve Bank of New York | ||||

| SVEDKA Divestiture | sale of the SVEDKA brand and related assets, primarily including inventory and equipment on January 6, 2025 | ||||

| U.S. | United States of America | ||||

| U.S. GAAP | generally accepted accounting principles in the U.S. | ||||

| Veracruz | Heroica Veracruz, Veracruz, Mexico | ||||

| Veracruz Brewery | our new brewery being constructed in Veracruz | ||||

Wine and Spirits Divestitures | the 2025 Wine Divestitures and the SVEDKA Divestiture, collectively | ||||

Constellation Brands, Inc. Q2 FY 2026 Form 10-Q | #WORTHREACHINGFOR I iii | ||||

| FINANCIAL STATEMENTS | |||||

PART I – FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS.

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(in millions, except share and per share data)

(unaudited)

CONSOLIDATED BALANCE SHEETS

(in millions, except share and per share data)

(unaudited)

| August 31, 2025 | February 28, 2025 | ||||||||||

ASSETS | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Accounts receivable | |||||||||||

| Inventories | |||||||||||

| Prepaid expenses and other | |||||||||||

| Assets held for sale | |||||||||||

| Total current assets | |||||||||||

Property, plant, and equipment, net of accumulated depreciation of $ | |||||||||||

| Goodwill | |||||||||||

| Intangible assets | |||||||||||

| Deferred income taxes | |||||||||||

| Other assets | |||||||||||

| Total assets | $ | $ | |||||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||||||

| Current liabilities: | |||||||||||

| Short-term borrowings | $ | $ | |||||||||

| Current maturities of long-term debt | |||||||||||

| Accounts payable | |||||||||||

| Other accrued expenses and liabilities | |||||||||||

| Total current liabilities | |||||||||||

| Long-term debt, less current maturities | |||||||||||

| Deferred income taxes and other liabilities | |||||||||||

| Total liabilities | |||||||||||

| Commitments and contingencies | |||||||||||

| CBI stockholders’ equity: | |||||||||||

Class A Stock, $ Issued, | |||||||||||

| Additional paid-in capital | |||||||||||

| Retained earnings | |||||||||||

| Accumulated other comprehensive income (loss) | ( | ( | |||||||||

Class A Stock in treasury, at cost, | ( | ( | |||||||||

| Total CBI stockholders’ equity | |||||||||||

| Noncontrolling interests | |||||||||||

| Total stockholders’ equity | |||||||||||

| Total liabilities and stockholders’ equity | $ | $ | |||||||||

The accompanying notes are an integral part of these statements.

| Constellation Brands, Inc. Q2 FY 2026 Form 10-Q | #WORTHREACHINGFOR I 1 | ||||

| FINANCIAL STATEMENTS | |||||

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(in millions, except per share data)

(unaudited)

| For the Six Months Ended August 31, | For the Three Months Ended August 31, | ||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||

NET INCOME (LOSS) ATTRIBUTABLE TO CBI | |||||||||||||||||||||||

| Sales | $ | $ | $ | $ | |||||||||||||||||||

| Excise taxes | ( | ( | ( | ( | |||||||||||||||||||

| Net sales | |||||||||||||||||||||||

| Cost of product sold | ( | ( | ( | ( | |||||||||||||||||||

| Gross profit | |||||||||||||||||||||||

| Selling, general, and administrative expenses | ( | ( | ( | ( | |||||||||||||||||||

Goodwill impairment | ( | ( | |||||||||||||||||||||

Asset impairment and related expenses | ( | ||||||||||||||||||||||

| Operating income (loss) | ( | ( | |||||||||||||||||||||

| Income (loss) from unconsolidated investments | ( | ( | ( | ||||||||||||||||||||

| Interest expense, net | ( | ( | ( | ( | |||||||||||||||||||

| Income (loss) before income taxes | ( | ( | |||||||||||||||||||||

| (Provision for) benefit from income taxes | ( | ( | |||||||||||||||||||||

| Net income (loss) | ( | ( | |||||||||||||||||||||

| Net (income) loss attributable to noncontrolling interests | ( | ( | ( | ( | |||||||||||||||||||

| Net income (loss) attributable to CBI | $ | $ | ( | $ | $ | ( | |||||||||||||||||

COMPREHENSIVE INCOME (LOSS) ATTRIBUTABLE TO CBI | |||||||||||||||||||||||

| Comprehensive income (loss) | $ | $ | ( | $ | $ | ( | |||||||||||||||||

| Comprehensive (income) loss attributable to noncontrolling interests | ( | ( | |||||||||||||||||||||

| Comprehensive income (loss) attributable to CBI | $ | $ | ( | $ | $ | ( | |||||||||||||||||

CLASS A STOCK | |||||||||||||||||||||||

| Net income (loss) per common share attributable to CBI – basic | $ | $ | ( | $ | $ | ( | |||||||||||||||||

| Net income (loss) per common share attributable to CBI – diluted | $ | $ | ( | $ | $ | ( | |||||||||||||||||

| Weighted average common shares outstanding – basic | |||||||||||||||||||||||

| Weighted average common shares outstanding – diluted | |||||||||||||||||||||||

| Cash dividends declared per common share | $ | $ | $ | $ | |||||||||||||||||||

The accompanying notes are an integral part of these statements.

| Constellation Brands, Inc. Q2 FY 2026 Form 10-Q | #WORTHREACHINGFOR I 2 | ||||

| FINANCIAL STATEMENTS | |||||

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY (in millions) (unaudited) | ||||||||||||||||||||||||||||||||||||||||||||

| Class A Stock | Additional Paid-in Capital | Retained Earnings | Accumulated Other Comprehensive Income (Loss) | Treasury Stock | Non-controlling Interests | Total | ||||||||||||||||||||||||||||||||||||||

| Balance at February 28, 2025 | $ | $ | $ | $ | ( | $ | ( | $ | $ | |||||||||||||||||||||||||||||||||||

Comprehensive income (loss): | ||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss), net of income tax effect | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||

| Comprehensive income (loss) | ||||||||||||||||||||||||||||||||||||||||||||

| Repurchase of shares | — | — | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||

| Dividends declared | — | — | ( | — | — | — | ( | |||||||||||||||||||||||||||||||||||||

| Noncontrolling interest distributions | — | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||||||||||

| Shares issued under equity compensation plans | — | ( | — | — | — | ( | ||||||||||||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||

Balance at May 31, 2025 | ( | ( | ||||||||||||||||||||||||||||||||||||||||||

| Comprehensive income (loss): | ||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss), net of income tax effect | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||

| Comprehensive income (loss) | ||||||||||||||||||||||||||||||||||||||||||||

| Repurchase of shares | — | — | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||

| Dividends declared | — | — | ( | — | — | — | ( | |||||||||||||||||||||||||||||||||||||

| Noncontrolling interest distributions | — | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||||||||||

| Shares issued under equity compensation plans | — | ( | — | — | — | |||||||||||||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||

| Balance at August 31, 2025 | $ | $ | $ | $ | ( | $ | ( | $ | $ | |||||||||||||||||||||||||||||||||||

| Constellation Brands, Inc. Q2 FY 2026 Form 10-Q | #WORTHREACHINGFOR I 3 | ||||

| FINANCIAL STATEMENTS | |||||

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY (in millions) (unaudited) | ||||||||||||||||||||||||||||||||||||||||||||

| Class A Stock | Additional Paid-in Capital | Retained Earnings | Accumulated Other Comprehensive Income (Loss) | Treasury Stock | Non-controlling Interests | Total | ||||||||||||||||||||||||||||||||||||||

| Balance at February 29, 2024 | $ | $ | $ | $ | $ | ( | $ | $ | ||||||||||||||||||||||||||||||||||||

| Comprehensive income (loss): | ||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss), net of income tax effect | — | — | — | ( | — | ( | ||||||||||||||||||||||||||||||||||||||

| Comprehensive income (loss) | ||||||||||||||||||||||||||||||||||||||||||||

| Repurchase of shares | — | — | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||

| Dividends declared | — | — | ( | — | — | — | ( | |||||||||||||||||||||||||||||||||||||

| Noncontrolling interest distributions | — | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||||||||||

| Shares issued under equity compensation plans | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||

Balance at May 31, 2024 | ( | |||||||||||||||||||||||||||||||||||||||||||

| Comprehensive income (loss): | ||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — | ( | — | — | ( | ||||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss), net of income tax effect | — | — | — | ( | — | ( | ( | |||||||||||||||||||||||||||||||||||||

| Comprehensive income (loss) | ( | |||||||||||||||||||||||||||||||||||||||||||

| Repurchase of shares | — | — | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||

| Dividends declared | — | — | ( | — | — | — | ( | |||||||||||||||||||||||||||||||||||||

| Noncontrolling interest distributions | — | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||||||||||

| Shares issued under equity compensation plans | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||

| Balance at August 31, 2024 | $ | $ | $ | $ | ( | $ | ( | $ | $ | |||||||||||||||||||||||||||||||||||

The accompanying notes are an integral part of these statements.

| Constellation Brands, Inc. Q2 FY 2026 Form 10-Q | #WORTHREACHINGFOR I 4 | ||||

| FINANCIAL STATEMENTS | |||||

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in millions)

(unaudited)

| For the Six Months Ended August 31, | |||||||||||

| 2025 | 2024 | ||||||||||

CASH FLOWS FROM OPERATING ACTIVITIES | |||||||||||

| Net income (loss) | $ | $ | ( | ||||||||

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | |||||||||||

| Deferred tax provision (benefit) | ( | ||||||||||

| Depreciation | |||||||||||

| Stock-based compensation | |||||||||||

| Noncash lease expense | |||||||||||

Asset impairment and related expenses | |||||||||||

| Net gain in connection with Exchangeable Shares | ( | ||||||||||

Goodwill impairment | |||||||||||

| Change in operating assets and liabilities, net of effects from purchase and sale of business: | |||||||||||

| Accounts receivable | ( | ||||||||||

| Inventories | ( | ||||||||||

| Prepaid expenses and other current assets | ( | ( | |||||||||

| Accounts payable | |||||||||||

| Contract liabilities | ( | ||||||||||

| Other accrued expenses and liabilities | ( | ( | |||||||||

| Other | ( | ( | |||||||||

| Total adjustments | |||||||||||

| Net cash provided by (used in) operating activities | |||||||||||

CASH FLOWS FROM INVESTING ACTIVITIES | |||||||||||

| Purchase of property, plant, and equipment | ( | ( | |||||||||

| Purchase of business, net of cash acquired | ( | ||||||||||

| Investments in equity method investees and securities | ( | ( | |||||||||

| Proceeds from sale of assets | |||||||||||

| Proceeds from sale of business | |||||||||||

| Other investing activities | ( | ||||||||||

| Net cash provided by (used in) investing activities | ( | ||||||||||

| Constellation Brands, Inc. Q2 FY 2026 Form 10-Q | #WORTHREACHINGFOR I 5 | ||||

| FINANCIAL STATEMENTS | |||||

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in millions)

(unaudited)

| For the Six Months Ended August 31, | |||||||||||

| 2025 | 2024 | ||||||||||

CASH FLOWS FROM FINANCING ACTIVITIES | |||||||||||

| Proceeds from issuance of long-term debt | |||||||||||

| Principal payments of long-term debt | ( | ( | |||||||||

| Net proceeds from (repayments of) short-term borrowings | ( | ||||||||||

| Dividends paid | ( | ( | |||||||||

| Purchases of treasury stock | ( | ( | |||||||||

| Proceeds from shares issued under equity compensation plans | |||||||||||

| Payments of minimum tax withholdings on stock-based payment awards | ( | ( | |||||||||

| Payments of debt issuance, debt extinguishment, and other financing costs | ( | ||||||||||

| Distributions to noncontrolling interests | ( | ( | |||||||||

| Payment of contingent consideration | ( | ( | |||||||||

| Net cash provided by (used in) financing activities | ( | ( | |||||||||

| Effect of exchange rate changes on cash and cash equivalents | |||||||||||

| Net increase (decrease) in cash and cash equivalents | ( | ||||||||||

| Cash and cash equivalents, beginning of period | |||||||||||

| Cash and cash equivalents, end of period | $ | $ | |||||||||

SUPPLEMENTAL DISCLOSURES OF NONCASH INVESTING AND FINANCING ACTIVITIES | |||||||||||

| Additions to property, plant, and equipment | $ | $ | |||||||||

The accompanying notes are an integral part of these statements.

| Constellation Brands, Inc. Q2 FY 2026 Form 10-Q | #WORTHREACHINGFOR I 6 | ||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

AUGUST 31, 2025

(unaudited)

1. BASIS OF PRESENTATION

We have prepared the Financial Statements, without audit, pursuant to the rules and regulations of the SEC applicable to quarterly reporting on Form 10-Q and reflect, in our opinion, all adjustments necessary to present fairly our financial information. All such adjustments are of a normal recurring nature. Certain information and footnote disclosures normally included in financial statements, prepared in accordance with generally accepted accounting principles, have been condensed or omitted as permitted by such rules and regulations. These Financial Statements should be read in conjunction with the consolidated financial statements and related notes included in the 2025 Annual Report. Results of operations for interim periods are not necessarily indicative of annual results.

2. ACQUISITIONS AND DIVESTITURES

ACQUISITION

Sea Smoke

In June 2024, we acquired the Sea Smoke business, including a California-based luxury wine brand, vineyards, and a production facility for $158.7 million, net of closing and post-closing adjustments. This transaction also included the acquisition of goodwill, inventory, and a trademark. The results of operations of Sea Smoke are reported in the Wine and Spirits segment and have been included in our consolidated results of operations from the date of acquisition.

DIVESTITURES

2025 Wine Divestitures

On June 2, 2025, we sold and, in certain instances, exclusively licensed the trademarks of a portion of our wine and spirits business, primarily centered around our then-owned mainstream wine brands and associated inventory, wineries, vineyards, offices, and facilities. The net cash proceeds from the 2025 Wine Divestitures were used for repayment of debt (see Note 11). Prior to the completion of the 2025 Wine Divestitures, we recorded the results of operations of the divested and exclusively licensed brands in the Wine and Spirits segment. The following table summarizes the net loss recognized in connection with this transaction:

| (in millions) | |||||||||||

| Cash received from buyer | $ | ||||||||||

| Net assets sold | ( | ||||||||||

| Direct costs to sell | ( | ||||||||||

Loss on sale of business (1) | $ | ( | |||||||||

(1)Included in selling, general, and administrative expenses within our consolidated results of operations.

SVEDKA Divestiture

On January 6, 2025, we sold the SVEDKA brand and related assets, primarily including inventory and equipment. The net cash proceeds from the SVEDKA Divestiture were used for general corporate purposes, including funding share repurchases, capital expenditures, and repayment of debt. Prior to the SVEDKA Divestiture, we recorded the results of operations of the SVEDKA brand in the Wine and Spirits segment.

Mexicali Brewery sale

In July 2024, we sold the remaining assets classified as held for sale at the canceled Mexicali Brewery.

| Constellation Brands, Inc. Q2 FY 2026 Form 10-Q | #WORTHREACHINGFOR I 7 | ||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

Assets held for sale

Certain wine and spirits net assets met the held for sale criteria largely in connection with the 2025 Wine Divestitures. The carrying values of these assets held for sale consisted of the following:

| February 28, 2025 | |||||

(in millions) | |||||

| ASSETS | |||||

| Inventories | $ | ||||

| Prepaid expenses and other | |||||

| Property, plant, and equipment | |||||

| Intangible assets | |||||

Less: Asset impairment | ( | ||||

| Assets held for sale | |||||

| LIABILITIES | |||||

Other accrued expenses and liabilities (1) | |||||

| Net assets held for sale | $ | ||||

(1)Liabilities held for sale are included in the consolidated balance sheets within other accrued expenses and liabilities.

3. RESTRUCTURING

The 2025 Restructuring Initiative is an enterprise-wide cost savings and restructuring initiative designed to help optimize the performance of our business, including through enhanced organizational efficiency and optimized expenditures across our organization. The majority of the work associated with the 2025 Restructuring Initiative is expected to be completed within the year ending February 28, 2026, and is estimated to result in $80 million to $100 million of cumulative pre-tax costs once all phases are fully implemented. This range is estimated to be comprised of (i) employee termination costs (60 %) and (ii) consulting services as well as other costs, which primarily include contract termination costs (40 %).

We recognized pre-tax restructuring costs in connection with the 2025 Restructuring Initiative as follows:

| Results of Operations Location | For the Six Months Ended August 31, 2025 | For the Three Months Ended August 31, 2025 | |||||||||||||||

(in millions) | |||||||||||||||||

| Consulting services | Selling, general, and administrative expenses | $ | $ | ||||||||||||||

| Other costs | Selling, general, and administrative expenses | ||||||||||||||||

| $ | $ | ||||||||||||||||

Since the inception of the 2025 Restructuring Initiative, we have incurred the following pre-tax restructuring costs:

Cumulative Costs as of August 31, 2025 | Percent of Total Costs | ||||||||||

(in millions) | |||||||||||

Employee termination | $ | % | |||||||||

| Consulting services | % | ||||||||||

| Other costs | % | ||||||||||

| $ | % | ||||||||||

| Constellation Brands, Inc. Q2 FY 2026 Form 10-Q | #WORTHREACHINGFOR I 8 | ||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

The activity for the restructuring costs discussed above and the related accruals are as follows:

| Employee Termination | Consulting Services | Other | Total | ||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

| Balance at February 28, 2025 | $ | $ | $ | $ | |||||||||||||||||||

Restructuring costs | |||||||||||||||||||||||

| Cash payments | ( | ( | ( | ||||||||||||||||||||

Balance at August 31, 2025 (1) | $ | $ | $ | $ | |||||||||||||||||||

(1)The total accrual was recorded in accrued restructuring within other accrued expenses and liabilities in our consolidated balance sheets.

4. INVENTORIES

Inventories are stated at the lower of cost (primarily computed in accordance with the first-in, first-out method) or net realizable value. Elements of cost include materials, labor, and overhead and consist of the following:

| August 31, 2025 | February 28, 2025 | ||||||||||

| (in millions) | |||||||||||

| Raw materials and supplies | $ | $ | |||||||||

| In-process inventories | |||||||||||

| Finished case goods | |||||||||||

| $ | $ | ||||||||||

5. PREPAID EXPENSES AND OTHER

The major components of prepaid expenses and other are as follows:

| August 31, 2025 | February 28, 2025 | ||||||||||

| (in millions) | |||||||||||

| Value added taxes receivable | $ | $ | |||||||||

| Prepaid excise and sales taxes | |||||||||||

| Derivative assets | |||||||||||

Prepaid advertising | |||||||||||

Prepaid insurance | |||||||||||

| Other | |||||||||||

| $ | $ | ||||||||||

6. DERIVATIVE INSTRUMENTS

Overview

Our risk management and derivative accounting policies are presented in Notes 1 and 6 of our consolidated financial statements included in our 2025 Annual Report and have not changed significantly for the six months and three months ended August 31, 2025.

| Constellation Brands, Inc. Q2 FY 2026 Form 10-Q | #WORTHREACHINGFOR I 9 | ||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

The aggregate notional value of outstanding derivative instruments is as follows:

| August 31, 2025 | February 28, 2025 | ||||||||||

| (in millions) | |||||||||||

| Derivative instruments designated as hedging instruments | |||||||||||

| Foreign currency contracts | $ | $ | |||||||||

| Pre-issuance hedge contracts | $ | $ | |||||||||

| Net investment hedge contracts | $ | $ | |||||||||

| Derivative instruments not designated as hedging instruments | |||||||||||

| Foreign currency contracts | $ | $ | |||||||||

| Commodity derivative contracts | $ | $ | |||||||||

Net investment hedge contracts

In April 2025, we entered into cross-currency swaps to hedge portions of our net investment in certain of our non-U.S. operations against fluctuations in foreign currency exchange rates. These cross-currency swaps are designated as net investment hedges and mature between April 2028 and April 2029. The changes in the fair value of these swaps are recognized as a component of other comprehensive income (loss) and reported in accumulated other comprehensive income (loss) in our consolidated balance sheets. The gain or loss will be subsequently reclassified into net earnings when the hedged net investment is either sold, liquidated, or substantially liquidated. We assess the effectiveness of our cross-currency swaps using the spot method. Under this method, the periodic interest settlements are recorded directly in earnings through interest expense, net. Accordingly, we recorded interest income of $0.8 million and $0.5 million during the six months and three months ended August 31, 2025, respectively.

Credit risk

We are exposed to credit-related losses if the counterparties to our derivative contracts default. This credit risk is limited to the fair value of the derivative contracts. To manage this risk, we contract only with major financial institutions that have earned investment-grade credit ratings and with whom we have standard International Swaps and Derivatives Association agreements which allow for net settlement of the derivative contracts. We have also established counterparty credit guidelines that are regularly monitored. Because of these safeguards, we believe the risk of loss from counterparty default to be immaterial.

In addition, our derivative instruments are not subject to credit rating contingencies or collateral requirements. As of August 31, 2025, the estimated fair value of derivative instruments in a net liability position due to counterparties was $0.6 million. If we were required to settle the net liability position under these derivative instruments on August 31, 2025, we would have had sufficient available liquidity on hand to satisfy this obligation.

Results of period derivative activity

The estimated fair value and location of our derivative instruments on our balance sheets are as follows (see Note 7):

| Assets | Liabilities | |||||||||||||||||||||||||

| August 31, 2025 | February 28, 2025 | August 31, 2025 | February 28, 2025 | |||||||||||||||||||||||

| (in millions) | ||||||||||||||||||||||||||

| Derivative instruments designated as hedging instruments | ||||||||||||||||||||||||||

| Foreign currency contracts: | ||||||||||||||||||||||||||

| Prepaid expenses and other | $ | $ | Other accrued expenses and liabilities | $ | $ | |||||||||||||||||||||

| Other assets | $ | $ | Deferred income taxes and other liabilities | $ | $ | |||||||||||||||||||||

| Constellation Brands, Inc. Q2 FY 2026 Form 10-Q | #WORTHREACHINGFOR I 10 | ||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

| Assets | Liabilities | |||||||||||||||||||||||||

| August 31, 2025 | February 28, 2025 | August 31, 2025 | February 28, 2025 | |||||||||||||||||||||||

| (in millions) | ||||||||||||||||||||||||||

| Pre-issuance hedge contracts: | ||||||||||||||||||||||||||

| Prepaid expenses and other | $ | $ | Other accrued expenses and liabilities | $ | $ | |||||||||||||||||||||

| Net investment hedge contracts: | ||||||||||||||||||||||||||

| Other assets | $ | $ | Deferred income taxes and other liabilities | $ | $ | |||||||||||||||||||||

| Derivative instruments not designated as hedging instruments | ||||||||||||||||||||||||||

| Foreign currency contracts: | ||||||||||||||||||||||||||

| Prepaid expenses and other | $ | $ | Other accrued expenses and liabilities | $ | $ | |||||||||||||||||||||

| Commodity derivative contracts: | ||||||||||||||||||||||||||

| Prepaid expenses and other | $ | $ | Other accrued expenses and liabilities | $ | $ | |||||||||||||||||||||

| Other assets | $ | $ | Deferred income taxes and other liabilities | $ | $ | |||||||||||||||||||||

The principal effect of our derivative instruments designated in cash flow hedging relationships on our results of operations, as well as OCI, net of income tax effect, is as follows:

| Derivative Instruments in Designated Cash Flow Hedging Relationships | Net Gain (Loss) Recognized in OCI | Location of Net Gain (Loss) Reclassified from AOCI to Income (Loss) | Net Gain (Loss) Reclassified from AOCI to Income (Loss) | |||||||||||||||||

| (in millions) | ||||||||||||||||||||

| For the Six Months Ended August 31, 2025 | ||||||||||||||||||||

| Foreign currency contracts | $ | Sales | $ | |||||||||||||||||

| Cost of product sold | ||||||||||||||||||||

| Selling, general, and administrative expenses | ||||||||||||||||||||

| Pre-issuance hedge contracts | ( | Interest expense, net | ( | |||||||||||||||||

| $ | $ | |||||||||||||||||||

| For the Six Months Ended August 31, 2024 | ||||||||||||||||||||

| Foreign currency contracts | $ | ( | Sales | $ | ||||||||||||||||

| Cost of product sold | ||||||||||||||||||||

| $ | ( | $ | ||||||||||||||||||

| For the Three Months Ended August 31, 2025 | ||||||||||||||||||||

| Foreign currency contracts | $ | Sales | $ | |||||||||||||||||

| Cost of product sold | ||||||||||||||||||||

| Pre-issuance hedge contracts | Interest expense, net | ( | ||||||||||||||||||

| $ | $ | |||||||||||||||||||

| Constellation Brands, Inc. Q2 FY 2026 Form 10-Q | #WORTHREACHINGFOR I 11 | ||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

| Derivative Instruments in Designated Cash Flow Hedging Relationships | Net Gain (Loss) Recognized in OCI | Location of Net Gain (Loss) Reclassified from AOCI to Income (Loss) | Net Gain (Loss) Reclassified from AOCI to Income (Loss) | |||||||||||||||||

| (in millions) | ||||||||||||||||||||

| For the Three Months Ended August 31, 2024 | ||||||||||||||||||||

| Foreign currency contracts | $ | ( | Sales | $ | ||||||||||||||||

| Cost of product sold | ||||||||||||||||||||

| $ | ( | $ | ||||||||||||||||||

We expect $66.4 million of net gains, net of income tax effect, to be reclassified from AOCI to our results of operations within the next 12 months.

The effect of our undesignated derivative instruments on our results of operations is as follows:

| Derivative Instruments Not Designated as Hedging Instruments | Location of Net Gain (Loss) Recognized in Income (Loss) | Net Gain (Loss) Recognized in Income (Loss) | ||||||||||||

| (in millions) | ||||||||||||||

| For the Six Months Ended August 31, 2025 | ||||||||||||||

| Commodity derivative contracts | Cost of product sold | $ | ( | |||||||||||

| Foreign currency contracts | Selling, general, and administrative expenses | |||||||||||||

| Interest rate swap contracts | Interest expense, net | ( | ||||||||||||

| $ | ||||||||||||||

| For the Six Months Ended August 31, 2024 | ||||||||||||||

| Commodity derivative contracts | Cost of product sold | $ | ( | |||||||||||

| Foreign currency contracts | Selling, general, and administrative expenses | ( | ||||||||||||

| $ | ( | |||||||||||||

| For the Three Months Ended August 31, 2025 | ||||||||||||||

| Commodity derivative contracts | Cost of product sold | $ | ||||||||||||

| Foreign currency contracts | Selling, general, and administrative expenses | |||||||||||||

| Interest rate swap contracts | Interest expense, net | ( | ||||||||||||

| $ | ||||||||||||||

| For the Three Months Ended August 31, 2024 | ||||||||||||||

| Commodity derivative contracts | Cost of product sold | $ | ( | |||||||||||

| Foreign currency contracts | Selling, general, and administrative expenses | ( | ||||||||||||

| $ | ( | |||||||||||||

7. FAIR VALUE OF FINANCIAL INSTRUMENTS

Authoritative guidance establishes a framework for measuring fair value, including a hierarchy for inputs used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that the most observable inputs be used when available. The hierarchy includes three levels:

•Level 1 inputs are quoted prices in active markets for identical assets or liabilities;

•Level 2 inputs include data points that are observable such as quoted prices for similar assets or liabilities in active markets, quoted prices for identical assets or similar assets or liabilities in markets that are not active,

| Constellation Brands, Inc. Q2 FY 2026 Form 10-Q | #WORTHREACHINGFOR I 12 | ||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

and inputs (other than quoted prices) such as volatility, interest rates, and yield curves that are observable for the asset or liability, either directly or indirectly; and

•Level 3 inputs are unobservable data points for the asset or liability, and include situations where there is little, if any, market activity for the asset or liability.

FAIR VALUE METHODOLOGY

The following methods and assumptions are used to estimate the fair value of our financial instruments:

Derivative instruments

Our derivative instruments consist of foreign currency forward and option contracts, commodity swap contracts, cross-currency swap contracts, interest rate swap contracts, and Pre-issuance hedge contracts. The fair value is estimated based on quoted market prices from respective counterparties. Quotes are corroborated by using discounted cash flow calculations based upon forward interest-rate yield curves, which are obtained from independent pricing services (Level 2 fair value measurement).

Short-term borrowings

Our short-term borrowings consist of our commercial paper program and the revolving credit facility under our senior credit facility. The revolving credit facility is a variable interest rate bearing note with a fixed margin, adjustable based upon our debt rating (as defined in our senior credit facility). For these short-term borrowings, the carrying value approximates the fair value.

Long-term debt

The fair value of our fixed interest rate long-term debt is estimated by discounting cash flows using interest rates currently available for debt with similar terms and maturities (Level 2 fair value measurement). As of August 31, 2025, the carrying amount of long-term debt, including the current portion, was $10,292.4 million, compared with an estimated fair value of $9,677.9 million. As of February 28, 2025, the carrying amount of long-term debt, including the current portion, was $10,691.0 million, compared with an estimated fair value of $9,999.0 million.

The carrying amounts of certain of our financial instruments, including cash and cash equivalents, accounts receivable, and accounts payable, approximate fair value as of August 31, 2025, and February 28, 2025, due to the relatively short maturity of these instruments.

Recurring basis measurements

The following table presents our financial assets and liabilities measured at estimated fair value on a recurring basis:

| Fair Value Measurements Using | |||||||||||||||||||||||

| Quoted Prices in Active Markets (Level 1) | Significant Other Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | Total | ||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

| August 31, 2025 | |||||||||||||||||||||||

| Assets: | |||||||||||||||||||||||

| Foreign currency contracts | $ | $ | $ | $ | |||||||||||||||||||

| Commodity derivative contracts | $ | $ | $ | $ | |||||||||||||||||||

| Liabilities: | |||||||||||||||||||||||

| Foreign currency contracts | $ | $ | $ | $ | |||||||||||||||||||

| Commodity derivative contracts | $ | $ | $ | $ | |||||||||||||||||||

| Net investment hedge contracts | $ | $ | $ | $ | |||||||||||||||||||

| Constellation Brands, Inc. Q2 FY 2026 Form 10-Q | #WORTHREACHINGFOR I 13 | ||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

| Fair Value Measurements Using | |||||||||||||||||||||||

| Quoted Prices in Active Markets (Level 1) | Significant Other Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | Total | ||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

| February 28, 2025 | |||||||||||||||||||||||

| Assets: | |||||||||||||||||||||||

| Foreign currency contracts | $ | $ | $ | $ | |||||||||||||||||||

| Commodity derivative contracts | $ | $ | $ | $ | |||||||||||||||||||

| Pre-issuance hedge contracts | $ | $ | $ | $ | |||||||||||||||||||

| Liabilities: | |||||||||||||||||||||||

| Foreign currency contracts | $ | $ | $ | $ | |||||||||||||||||||

| Commodity derivative contracts | $ | $ | $ | $ | |||||||||||||||||||

Nonrecurring basis measurements

The following table presents our assets and liabilities measured at estimated fair value on a nonrecurring basis for which an impairment assessment was performed for the period presented:

| Fair Value Measurements Using | ||||||||||||||||||||||||||

| Balance Sheet Classification | Quoted Prices in Active Markets (Level 1) | Significant Other Observable Inputs (Level 2) | Significant Unobservable Inputs (Level 3) | Total Losses | ||||||||||||||||||||||

| (in millions) | ||||||||||||||||||||||||||

| For the Six Months Ended August 31, 2025 | ||||||||||||||||||||||||||

| Assets held for sale and related net assets | Assets held for sale | $ | $ | $ | $ | |||||||||||||||||||||

Equity method investments | Other assets | |||||||||||||||||||||||||

| Total | $ | $ | $ | $ | ||||||||||||||||||||||

| For the Six Months Ended August 31, 2024 | ||||||||||||||||||||||||||

Goodwill | Goodwill | $ | $ | $ | $ | |||||||||||||||||||||

Equity method investments | Other assets | |||||||||||||||||||||||||

| Total | $ | $ | $ | $ | ||||||||||||||||||||||

Assets held for sale and related net assets

For the three months ended May 31, 2025, largely in connection with the 2025 Wine Divestitures, then-existing assets held for sale and related net assets were adjusted to their current estimated fair value of $897.7 million, less costs to sell, resulting in a $52.1 million net loss. This net loss was included in asset impairment and related expenses within our consolidated results for the six months ended August 31, 2025. Our estimated fair value of the then-existing assets held for sale was largely based on the expected proceeds from the 2025 Wine Divestitures as of May 31, 2025.

Goodwill

As of August 31, 2024, in connection with negative trends within our Wine and Spirits business primarily attributable to our U.S. wholesale market, driven by declines in both the overall wine market and in our then-owned mainstream and premium wine brands, management updated its Fiscal 2025 outlook for this reporting unit. The updated forecast indicated it was more likely than not the fair value of the Wine and Spirits reporting unit might be below its carrying value. Accordingly, we performed an interim quantitative assessment for goodwill impairment. This assessment indicated that the carrying value of the Wine and Spirits reporting unit exceeded its estimated fair value, resulting in a

| Constellation Brands, Inc. Q2 FY 2026 Form 10-Q | #WORTHREACHINGFOR I 14 | ||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

$2,250.0

When performing a quantitative assessment for impairment of goodwill, we measure the amount of impairment by calculating the amount by which the carrying value of the reporting unit exceeds its estimated fair value. The estimated fair value is determined based on the discounted cash flow calculation. The most significant assumptions used in the discounted cash flow calculation were: (i) a 9 % discount rate, (ii) a 1.5 % expected long-term growth rate, and (iii) the annual cash flow projections.

Equity method investments

8. GOODWILL

The changes in the carrying amount of goodwill are as follows:

| Beer | Wine and Spirits | Consolidated | |||||||||||||||

| (in millions) | |||||||||||||||||

| Balance at February 29, 2024 | $ | $ | $ | ||||||||||||||

Purchase accounting allocations (1) | |||||||||||||||||

| Foreign currency translation adjustments | ( | ( | |||||||||||||||

Goodwill impairment (2) | ( | ( | |||||||||||||||

SVEDKA Divestiture (3) | ( | ( | |||||||||||||||

| Balance at February 28, 2025 | |||||||||||||||||

| Foreign currency translation adjustments | |||||||||||||||||

| Balance at August 31, 2025 | $ | $ | $ | ||||||||||||||

(1)Purchase accounting allocations associated with the Sea Smoke acquisition.

(2)In connection with continued negative trends within our Wine and Spirits business primarily attributable to our U.S. wholesale market, driven by declines in both the overall wine market and in our then-owned mainstream and premium wine brands, management updated its Fiscal 2025 outlook and financial projections for this reporting unit. Based on the aforementioned factors, we performed quantitative assessments that led to goodwill impairments which resulted in the carrying value being written down to zero.

(3)Amount was based on the relative fair value of the portion of the business sold and the remaining wine and spirits portfolio. The relative fair values were determined using the transaction price and the income approach based on assumptions, including projected revenue growth, terminal growth, and discount rates and other projected financial information.

| Constellation Brands, Inc. Q2 FY 2026 Form 10-Q | #WORTHREACHINGFOR I 15 | ||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

9. INTANGIBLE ASSETS

The major components of intangible assets are as follows:

| August 31, 2025 | February 28, 2025 | ||||||||||||||||||||||

| Gross Carrying Amount | Net Carrying Amount | Gross Carrying Amount | Net Carrying Amount | ||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

| Amortizable intangible assets | |||||||||||||||||||||||

| Customer relationships | $ | $ | $ | $ | |||||||||||||||||||

| Other | |||||||||||||||||||||||

| Total | $ | $ | |||||||||||||||||||||

| Nonamortizable intangible assets | |||||||||||||||||||||||

Trademarks | |||||||||||||||||||||||

| Total intangible assets | $ | $ | |||||||||||||||||||||

We did not incur costs to renew or extend the term of acquired intangible assets for the six months and three months ended August 31, 2025, and August 31, 2024. Net carrying amount represents the gross carrying value net of accumulated amortization.

10. OTHER ASSETS

The major components of other assets are as follows:

| August 31, 2025 | February 28, 2025 | ||||||||||

| (in millions) | |||||||||||

| Operating lease right-of-use asset | $ | $ | |||||||||

Income taxes receivable | |||||||||||

| Equity method investments | |||||||||||

| Derivative assets | |||||||||||

| Other investments in debt and equity securities | |||||||||||

| Exchangeable Shares | |||||||||||

| Other | |||||||||||

| $ | $ | ||||||||||

Equity method investments

We acquired several investments which are being accounted for under the equity method, largely in connection with prior Wine and Spirits segment acquisitions. The primary investment consists of Opus One Winery, a 50 % owned joint venture arrangement.

Other investments in debt and equity securities

We have multiple investments through our corporate venture capital function in debt and equity securities. As of August 31, 2025, and February 28, 2025, we evaluated certain investments, primarily driven by business underperformance and solvency concerns, and concluded they should be written down to zero .

Exchangeable Shares

Following the April 2024 conversion of our Canopy common shares and exchange a portion of the principal amount of a promissory note issued to us by Canopy, we (i) have 26.3 million Exchangeable Shares and (ii) recognized an

| Constellation Brands, Inc. Q2 FY 2026 Form 10-Q | #WORTHREACHINGFOR I 16 | ||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

$83.3 million net gain in income (loss) from unconsolidated investments within our consolidated results for the six months ended August 31, 2024. The fair value of Exchangeable Shares on the date of the conversion and exchange was estimated using a valuation model based primarily on the following inputs: (i) Canopy’s common share price, (ii) the expected volatility of Canopy’s common shares, and (iii) the probability and timing of U.S. federal legalization of recreational cannabis. As the Exchangeable Shares are an equity security without a readily determinable fair value, we elected to account for the Exchangeable Shares under the measurement alternative method. As of February 28, 2025, we evaluated the Exchangeable Shares for impairment primarily due to the continued decline in Canopy’s common share price. We concluded that an impairment did exist, and accordingly, the Exchangeable Shares were written down to their estimated fair value of $21.2 million. The estimated fair value was determined using the same valuation model as of the date of conversion and exchange as noted above. Future impairments, if any, will also be reported in income (loss) from unconsolidated investments within our consolidated results.

11. BORROWINGS

Borrowings consist of the following:

| August 31, 2025 | February 28, 2025 | ||||||||||||||||||||||

| Current | Long-term | Total | Total | ||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

| Short-term borrowings | |||||||||||||||||||||||

| Commercial paper | $ | $ | |||||||||||||||||||||

| $ | $ | ||||||||||||||||||||||

| Long-term debt | |||||||||||||||||||||||

| Senior notes | $ | $ | $ | $ | |||||||||||||||||||

| Other | |||||||||||||||||||||||

| $ | $ | $ | $ | ||||||||||||||||||||

BANK FACILITIES

2025 Credit Agreement

In April 2025, the Company, CB International, the Administrative Agent, and certain other lenders entered into the 2025 Restatement Agreement that amended and restated our then-existing credit facility (as amended and restated by the 2025 Restatement Agreement, the 2025 Credit Agreement). The principal changes effected by the 2025 Restatement Agreement were (i) refinancing the existing $2.25 billion revolving credit facility, (ii) extending its maturity to April 28, 2030, and (iii) refining certain negative covenants.

2025 Term Credit Agreement

In May 2025, the Company, the Administrative Agent, and certain other lenders entered into the 2025 Term Credit Agreement. The 2025 Term Credit Agreement provides for a six-month delayed draw $500.0 million term loan facility, available in up to two draws. The balance is due and payable two years after the initial funding date, if any, occurs. The proceeds, if drawn, from the 2025 Term Credit Agreement are intended to be used for general corporate purposes, including the repayment of debt.

| Constellation Brands, Inc. Q2 FY 2026 Form 10-Q | #WORTHREACHINGFOR I 17 | ||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

Information with respect to borrowings under our bank facilities is as follows:

| Outstanding borrowings | Interest rate | SOFR margin | Outstanding letters of credit | Remaining borrowing capacity | |||||||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||||||||

| August 31, 2025 | |||||||||||||||||||||||||||||

Revolving credit facility (1) (2) (3) | $ | % | % | $ | $ | ||||||||||||||||||||||||

| February 28, 2025 | |||||||||||||||||||||||||||||

Revolving credit facility (2) (3) (4) | $ | % | % | $ | $ | ||||||||||||||||||||||||

(1)Net of outstanding revolving credit facility borrowings and outstanding letters of credit under the 2025 Credit Agreement, and outstanding borrowings under our commercial paper program of $252.7 million (excluding unamortized discount) (see “Commercial paper program” below).

(2)Contractual interest rate varies based on our debt rating (as defined in the agreement) and is a function of SOFR plus a margin and a credit spread adjustment, or the base rate plus a margin, or, in certain circumstances where SOFR cannot be adequately ascertained or available, an alternative benchmark rate plus a margin.

(3)We and/or CB International are the borrower under the $2,250.0 million revolving credit facility. Includes a sub-facility for letters of credit of up to $200.0 million.

(4)Net of outstanding revolving credit facility borrowings and outstanding letters of credit under our then-existing senior credit facility, and outstanding borrowings under our commercial paper program of $808.0 million (excluding unamortized discount) (see “Commercial paper program” below).

We and our subsidiaries are subject to covenants that are contained in the 2025 Credit Agreement and the 2025 Term Credit Agreement, including those restricting the incurrence of additional subsidiary indebtedness, additional liens, mergers and consolidations, transactions with affiliates, and sale and leaseback transactions, in each case subject to numerous conditions, exceptions, and thresholds. The financial covenants are limited to a minimum interest coverage ratio and a maximum net leverage ratio.

Commercial paper program

We have a commercial paper program which provides for the issuance of up to an aggregate principal amount of $2.25 billion of commercial paper. Our commercial paper program is backed by unused commitments under our revolving credit facility under our 2025 Credit Agreement. Accordingly, outstanding borrowings under our commercial paper program reduce the amount available under our revolving credit facility. Information with respect to our outstanding commercial paper borrowings is as follows:

| August 31, 2025 | February 28, 2025 | ||||||||||

| (in millions) | |||||||||||

Outstanding borrowings (1) | $ | $ | |||||||||

| Weighted average annual interest rate | % | % | |||||||||

| Weighted average remaining term | |||||||||||

(1)Outstanding commercial paper borrowings are net of unamortized discount.

Senior notes

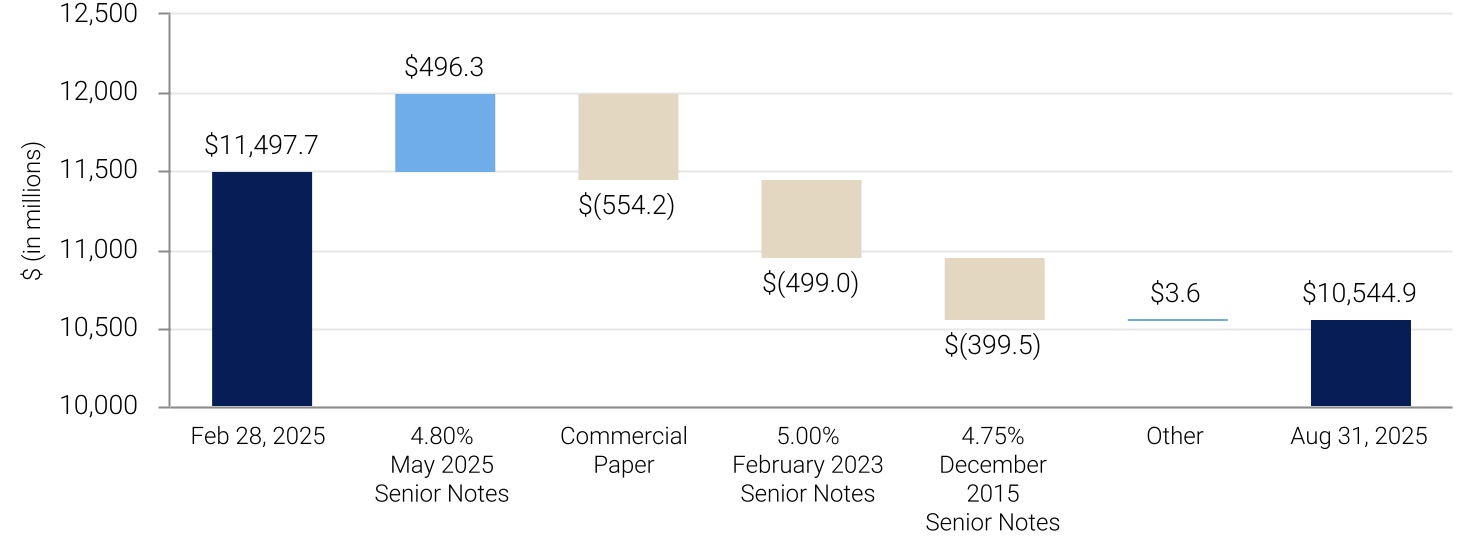

In May 2025, we issued $500.0 million aggregate principal amount of 4.80 % senior notes due May 2030. Proceeds from this offering, net of discount and debt issuance costs, were $496.0 million. Interest on the 4.80 % May 2025 Senior Notes is payable semiannually on May 1 and November 1 of each year, beginning November 1, 2025. The 4.80 % May 2025 Senior Notes are redeemable, in whole or in part, at our option at any time prior to April 1, 2030, at a redemption price equal to 100 % of the outstanding principal amount, plus accrued and unpaid interest and a make-

| Constellation Brands, Inc. Q2 FY 2026 Form 10-Q | #WORTHREACHINGFOR I 18 | ||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

whole payment based on the present value of the future payments at the adjusted treasury rate, as defined in the applicable indenture, plus 20 basis points. On or after April 1, 2030, we may redeem the 4.80 % May 2025 Senior Notes, in whole or in part, at our option at any time at a redemption price equal to 100 % of the outstanding principal amount, plus accrued and unpaid interest. The 4.80 % May 2025 Senior Notes are senior unsecured obligations which rank equally in right of payment to all of our existing and future senior unsecured indebtedness.

On July 2, 2025, we repaid in full $400.0 million aggregate principal amount of 4.75 % December 2015 Senior Notes, using proceeds from the 2025 Wine Divestitures and cash on hand. On June 12, 2025, we repaid in full $500.0 million aggregate principal amount of 5.00 % February 2023 Senior Notes, using proceeds from the 2025 Wine Divestitures. Each of these notes were redeemed prior to maturity at a redemption price equal to 100 % of the outstanding principal amount plus accrued and unpaid interest.

Debt payments

As of August 31, 2025, the required principal repayments under long-term debt obligations (excluding unamortized debt issuance costs and unamortized discounts of $44.9 million and $20.0 million, respectively) for the remaining six months of Fiscal 2026 and for each of the five succeeding fiscal years and thereafter are as follows:

| (in millions) | |||||

| Fiscal 2026 | $ | ||||

| Fiscal 2027 | |||||

| Fiscal 2028 | |||||

| Fiscal 2029 | |||||

| Fiscal 2030 | |||||

| Fiscal 2031 | |||||

| Thereafter | |||||

| $ | |||||

12. INCOME TAXES

Overview

Our effective tax rate for the six months ended August 31, 2025, was 27.6 % of tax expense compared with 30.0 % of tax benefit for the six months ended August 31, 2024. Our effective tax rate for the three months ended August 31, 2025, was 37.9 % of tax expense compared with 11.4 % of tax benefit for the three months ended August 31, 2024.

For the six months and three months ended August 31, 2025, our effective tax rate was higher than the federal statutory rate of 21% largely due to changes in valuation allowances related to net operating losses and tax legislation updates, partially offset by (i) a net income tax benefit recognized as a result of the resolution of various tax examinations and assessments related to prior periods and (ii) the benefit of lower effective tax rates applicable to our foreign businesses.

For the six months ended August 31, 2024, our effective tax rate did not approximate the federal statutory rate of 21% largely due to (i) a net income tax benefit recognized as a result of the resolution of various tax examinations and assessments related to prior periods and (ii) the benefit of lower effective tax rates applicable for foreign businesses, partially offset by a net income tax impact resulting from the non-deductible portion of the Wine and Spirits goodwill impairment.

For the three months ended August 31, 2024, our effective tax rate did not approximate the federal statutory rate of 21% largely due to a net income tax impact resulting from the non-deductible portion of the Wine and Spirits goodwill impairment.

| Constellation Brands, Inc. Q2 FY 2026 Form 10-Q | #WORTHREACHINGFOR I 19 | ||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

Tax Legislation

OB3 Act

On July 4, 2025, the OB3 Act was signed into U.S. law. The OB3 Act extends and modifies several provisions originally introduced under the Tax Cuts and Jobs Act of 2017, while also implementing additional changes to U.S. federal tax law. Key provisions of the OB3 Act include (i) the permanent extension of 100% bonus depreciation for qualifying assets, (ii) the elimination of the requirement to capitalize and amortize U.S.-based research and experimental expenditures, allowing for immediate expensing, (iii) changes to the limitation on the deductibility of interest expense, and (iv) modifications to the taxation of foreign earnings and other international income tax provisions. The OB3 Act contains multiple effective dates, with certain provisions taking effect beginning in calendar year 2025 and others phased in through calendar year 2027.

We have performed an initial evaluation of the impact of the OB3 Act on our consolidated financial statements, including the effects on our annual effective tax rate, deferred tax assets and liabilities, and cash flows. Based on this initial analysis and activities performed in response to the legislation, we believe there will be a negative impact on our effective tax rate for Fiscal 2026, primarily driven by the changes to the limitation on the deductibility of interest expense.

Additionally, for the six months and three months ended August 31, 2025, we recognized a valuation allowance against our deferred tax asset related to prior year interest expense limitations. We will continue to assess the implications of the OB3 Act, and our income tax provision may continue to be impacted as additional clarifications or interpretive guidance related to the OB3 Act is released.

Pillar Two

The OECD introduced a framework under Pillar Two which includes a 15% global minimum tax rate. Many jurisdictions in which we do business have started to enact laws implementing Pillar Two. We are monitoring these developments and currently do not believe these rules will have a material impact on our financial condition and/or consolidated results.

13. STOCKHOLDERS’ EQUITY

Common stock

The number of shares of common stock issued and treasury stock, and associated share activity, are as follows:

| Class A Stock | Class 1 Stock | Class A Stock in Treasury | |||||||||||||||

| Balance at February 28, 2025 | |||||||||||||||||

| Share repurchases | — | — | |||||||||||||||

| Exercise of stock options | — | ( | |||||||||||||||

Vesting of restricted stock units (1) | — | — | ( | ||||||||||||||

| Balance at May 31, 2025 | |||||||||||||||||

| Share repurchases | — | — | |||||||||||||||

| Exercise of stock options | — | — | ( | ||||||||||||||

| Employee stock purchases | — | — | ( | ||||||||||||||

Vesting of restricted stock units (1) | — | — | ( | ||||||||||||||

| Balance at August 31, 2025 | |||||||||||||||||

| Constellation Brands, Inc. Q2 FY 2026 Form 10-Q | #WORTHREACHINGFOR I 20 | ||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

| Class A Stock | Class 1 Stock | Class A Stock in Treasury | |||||||||||||||

| Balance at February 29, 2024 | |||||||||||||||||

| Share repurchases | — | — | |||||||||||||||

| Exercise of stock options | — | ( | |||||||||||||||

Vesting of restricted stock units (1) | — | — | ( | ||||||||||||||

Vesting of performance share units (1) | — | — | ( | ||||||||||||||

| Balance at May 31, 2024 | |||||||||||||||||

| Share repurchases | — | — | |||||||||||||||

| Exercise of stock options | — | ( | |||||||||||||||

| Employee stock purchases | — | — | ( | ||||||||||||||

Vesting of restricted stock units (1) | — | — | ( | ||||||||||||||

| Balance at August 31, 2024 | |||||||||||||||||

(1)Net of the following shares withheld to satisfy tax withholding requirements:

| For the Three Months Ended May 31, | For the Three Months Ended August 31, | For the Six Months Ended August 31, | |||||||||||||||

| 2025 | |||||||||||||||||

| Restricted Stock Units | |||||||||||||||||

| 2024 | |||||||||||||||||

| Restricted Stock Units | |||||||||||||||||

| Performance Share Units | |||||||||||||||||

Stock repurchases

In April 2025, our Board of Directors authorized the repurchase of up to $4.0 billion of our publicly traded common stock under the 2025 Authorization, which expires in February 2028. Shares repurchased under this authorization become treasury shares. For the six months ended August 31, 2025, we repurchased 3,375,602 shares of Class A Stock pursuant to the 2025 Authorization through open market transactions at an aggregate cost of $604.0 million.

As of August 31, 2025, total shares repurchased under our board authorization is as follows:

| Class A Stock | |||||||||||||||||

| Repurchase Authorization | Dollar Value of Shares Repurchased | Number of Shares Repurchased | |||||||||||||||

| (in millions, except share data) | |||||||||||||||||

2025 Authorization (1) | $ | $ | |||||||||||||||

(1)As of August 31, 2025, $3,396.0 million remains available for future share repurchases, excluding the impact of Federal excise tax owed pursuant to the IRA.

| Constellation Brands, Inc. Q2 FY 2026 Form 10-Q | #WORTHREACHINGFOR I 21 | ||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

14. NET INCOME (LOSS) PER COMMON SHARE ATTRIBUTABLE TO CBI

Net income (loss) per common share attributable to CBI (hereafter referred to as “net income (loss) per common share”) – basic for Class A Stock has been computed based on the weighted average shares of common stock outstanding during the period. Net income (loss) per common share – diluted for Class A Stock reflects the weighted average shares of common stock plus the effect of dilutive securities outstanding during the period using the treasury stock method. The effect of dilutive securities includes the impact of outstanding stock-based awards. The dilutive computation does not assume conversion, exercise, or contingent issuance of securities that would have an anti-dilutive effect on the net income (loss) per common share. The computation of basic and diluted net income (loss) per common share for Class A Stock are as follows:

| For the Six Months Ended August 31, | For the Three Months Ended August 31, | ||||||||||||||||||||||

| 2025 | 2024 | 2025 | 2024 | ||||||||||||||||||||

| (in millions, except per share data) | |||||||||||||||||||||||

| Net income (loss) attributable to CBI | $ | $ | ( | $ | $ | ( | |||||||||||||||||

| Weighted average common shares outstanding – basic | |||||||||||||||||||||||

Stock-based awards, primarily stock options (1) | |||||||||||||||||||||||

| Weighted average common shares outstanding – diluted | |||||||||||||||||||||||

| Net income (loss) per common share attributable to CBI – basic | $ | $ | ( | $ | $ | ( | |||||||||||||||||

| Net income (loss) per common share attributable to CBI – diluted | $ | $ | ( | $ | $ | ( | |||||||||||||||||

(1)We have excluded the following weighted average common shares outstanding from the calculation of diluted net loss per common share, as the effect of including these would have been anti-dilutive, in millions:

For the Six Months Ended August 31, 2024 | For the Three Months Ended August 31, 2024 | ||||||||||

| Stock-based awards, primarily stock options | |||||||||||

15. COMPREHENSIVE INCOME (LOSS) ATTRIBUTABLE TO CBI

Comprehensive income (loss) consists of net income (loss), foreign currency translation adjustments, unrealized net gain (loss) on derivative instruments, including cash flow and net investment hedges, pension/postretirement adjustments, and our share of OCI of equity method investments. The reconciliation of net income (loss) attributable to CBI to comprehensive income (loss) attributable to CBI is as follows:

| Before Tax Amount | Tax (Expense) Benefit | Net of Tax Amount | |||||||||||||||

| (in millions) | |||||||||||||||||

| For the Six Months Ended August 31, 2025 | |||||||||||||||||

| Net income (loss) attributable to CBI | $ | ||||||||||||||||

| Other comprehensive income (loss) attributable to CBI: | |||||||||||||||||

| Foreign currency translation adjustments: | |||||||||||||||||

| Net gain (loss) | $ | $ | |||||||||||||||

| Amounts reclassified | |||||||||||||||||

| Net gain (loss) recognized in other comprehensive income (loss) | |||||||||||||||||

| Constellation Brands, Inc. Q2 FY 2026 Form 10-Q | #WORTHREACHINGFOR I 22 | ||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

| Before Tax Amount | Tax (Expense) Benefit | Net of Tax Amount | |||||||||||||||

| (in millions) | |||||||||||||||||

| Unrealized gain (loss) on cash flow hedges: | |||||||||||||||||

Net cash flow hedge gain (loss) | ( | ||||||||||||||||

| Amounts reclassified | ( | ( | |||||||||||||||

| Net gain (loss) recognized in other comprehensive income (loss) | ( | ||||||||||||||||

Unrealized gain (loss) on net investment hedges: | |||||||||||||||||

Net investment hedge gain (loss) | ( | ( | |||||||||||||||

Amounts reclassified | |||||||||||||||||

| Net gain (loss) recognized in other comprehensive income (loss) | ( | ( | |||||||||||||||

| Pension/postretirement adjustments: | |||||||||||||||||

| Net actuarial gain (loss) | ( | ( | |||||||||||||||

| Amounts reclassified | |||||||||||||||||

| Net gain (loss) recognized in other comprehensive income (loss) | ( | ( | |||||||||||||||

| Share of OCI of equity method investments: | |||||||||||||||||

| Net gain (loss) | |||||||||||||||||

| Amounts reclassified | ( | ( | |||||||||||||||

| Net gain (loss) recognized in other comprehensive income (loss) | ( | ( | |||||||||||||||

| Other comprehensive income (loss) attributable to CBI | $ | $ | ( | ||||||||||||||

| Comprehensive income (loss) attributable to CBI | $ | ||||||||||||||||

| For the Six Months Ended August 31, 2024 | |||||||||||||||||

| Net income (loss) attributable to CBI | $ | ( | |||||||||||||||

| Other comprehensive income (loss) attributable to CBI: | |||||||||||||||||

| Foreign currency translation adjustments: | |||||||||||||||||

| Net gain (loss) | $ | ( | $ | ( | |||||||||||||

| Amounts reclassified | |||||||||||||||||

| Net gain (loss) recognized in other comprehensive income (loss) | ( | ( | |||||||||||||||

| Unrealized gain (loss) on cash flow hedges: | |||||||||||||||||

Net cash flow hedge gain (loss) | ( | ( | |||||||||||||||

| Amounts reclassified | ( | ( | |||||||||||||||

| Net gain (loss) recognized in other comprehensive income (loss) | ( | ( | |||||||||||||||

| Pension/postretirement adjustments: | |||||||||||||||||

| Net actuarial gain (loss) | ( | ||||||||||||||||

| Amounts reclassified | |||||||||||||||||

| Net gain (loss) recognized in other comprehensive income (loss) | ( | ||||||||||||||||

Share of OCI of equity method investments: | |||||||||||||||||

| Net gain (loss) | |||||||||||||||||

| Amounts reclassified | ( | ( | ( | ||||||||||||||

| Net gain (loss) recognized in other comprehensive income (loss) | ( | ( | ( | ||||||||||||||

| Other comprehensive income (loss) attributable to CBI | $ | ( | $ | ( | |||||||||||||