10-Q: Quarterly report pursuant to Section 13 or 15(d)

Published on July 3, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the quarterly period ended May 31, 2024

or

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to

Commission File Number: 001-08495

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||||

(Address of principal executive offices) (Zip code)

(585 ) 678-7100

(Registrant’s telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||||||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☒ | Accelerated filer | ☐ | |||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | |||||||||

| Emerging growth company | |||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

There were 182,192,431 shares of Class A Common Stock and 25,541 shares of Class 1 Common Stock outstanding as of June 28, 2024.

TABLE OF CONTENTS

| Page | ||||||||

| DEFINED TERMS | ||||||||

| PART I – FINANCIAL INFORMATION | ||||||||

| Item 1. Financial Statements | ||||||||

| Consolidated Balance Sheets | ||||||||

| Consolidated Statements of Comprehensive Income (Loss) | ||||||||

| Consolidated Statements of Changes in Stockholders’ Equity | ||||||||

| Consolidated Statements of Cash Flows | ||||||||

| Notes to Consolidated Financial Statements | ||||||||

1. Basis of Presentation |

||||||||

2. Inventories |

||||||||

3. Derivative Instruments |

||||||||

4. Fair Value of Financial Instruments |

||||||||

5. Goodwill |

||||||||

6. Intangible Assets |

||||||||

7. Other Assets |

||||||||

8. Borrowings |

||||||||

9. Income Taxes |

||||||||

10. Stockholders' Equity |

||||||||

11. Net Income (Loss) Per Common Share Attributable to CBI |

||||||||

12. Comprehensive Income (Loss) Attributable to CBI |

||||||||

13. Business Segment Information |

||||||||

14. Accounting Guidance Not Yet Adopted |

||||||||

| Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations | ||||||||

| Item 3. Quantitative and Qualitative Disclosures About Market Risk | ||||||||

| Item 4. Controls and Procedures | ||||||||

| PART II – OTHER INFORMATION | ||||||||

| Item 2. Unregistered Sales of Equity Securities and Use of Proceeds | ||||||||

| Item 5. Other Information | ||||||||

| Item 6. Exhibits | ||||||||

| SIGNATURES | ||||||||

This Form 10-Q contains “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. These forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond our control, which could cause actual results to differ materially from those set forth in, or implied by, such forward-looking statements. For further information regarding such forward-looking statements, risks, and uncertainties, please see “Information Regarding Forward-Looking Statements” under MD&A.

Defined Terms

Unless the context otherwise requires, the terms “Company,” “CBI,” “we,” “our,” or “us” refer to Constellation Brands, Inc. and its subsidiaries. We use terms in this Form 10-Q and in our Notes that are specific to us or are abbreviations that may not be commonly known or used.

| Term | Meaning | ||||

| $ | U.S. dollars | ||||

| 2021 Authorization | authorization to repurchase up to $2.0 billion of our publicly traded common stock, approved by our Board of Directors in January 2021 | ||||

| 2022 Credit Agreement | tenth amended and restated credit agreement, dated as of April 14, 2022, that provides for an aggregate revolving credit facility of $2.25 billion, inclusive of October 2022 Credit Agreement Amendment | ||||

| 2023 Authorization | authorization to repurchase up to $2.0 billion of our publicly traded common stock, approved by our Board of Directors in November 2023 | ||||

| 2023 Canopy Promissory Note | C$100.0 million principal amount of 4.25% promissory note issued to us by Canopy in April 2023, exchanged, in part, for Exchangeable Shares in April 2024 | ||||

2024 Annual Report |

our Annual Report on Form 10-K for the fiscal year ended February 29, 2024 | ||||

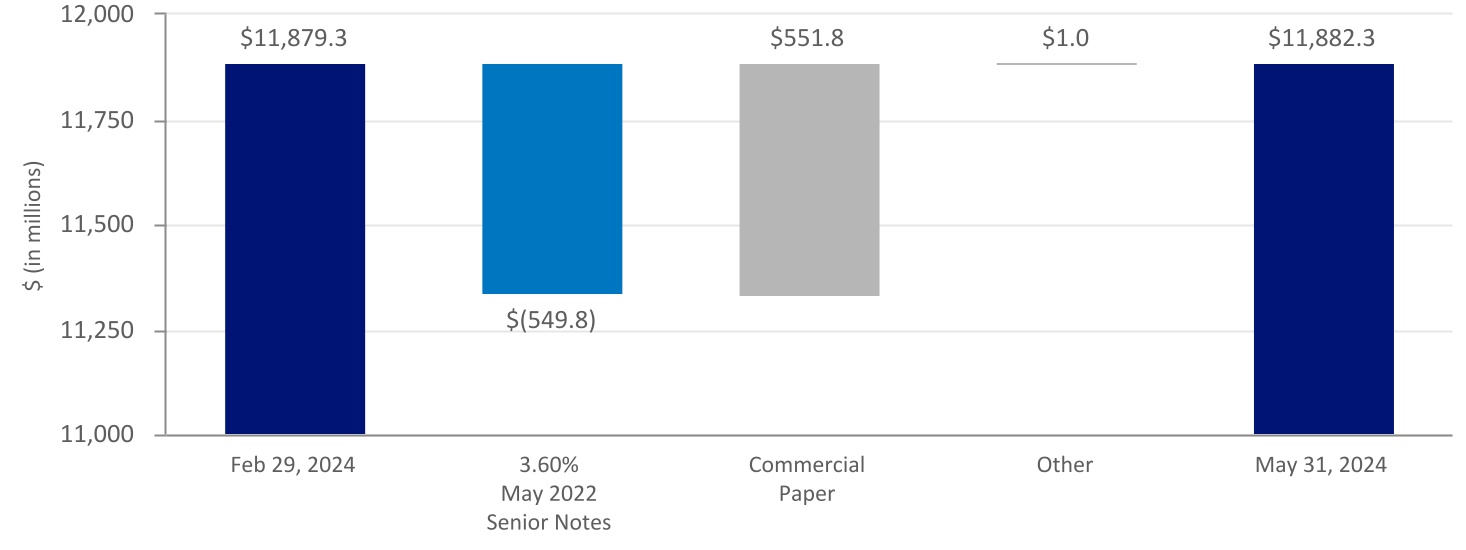

3.60% May 2022 Senior Notes |

$550.0 million principal amount of 3.60% senior notes issued in May 2022, now repaid in full | ||||

| 3-tier | distribution channel where products are sold to a distributor (wholesaler) who then sells to a retailer; the retailer sells the products to a consumer |

||||

| 3-tier eCommerce | digital commerce experience for consumers to purchase beverage alcohol from retailers | ||||

| ABA | alternative beverage alcohol | ||||

| Administrative Agent | Bank of America, N.A., as administrative agent for the senior credit facility | ||||

| Amended and Restated By-Laws | our amended and restated by-laws | ||||

| AOCI | accumulated other comprehensive income (loss) | ||||

| C$ | Canadian dollars | ||||

| Canopy | Canopy Growth Corporation, an Ontario, Canada-based public company in which we have an investment |

||||

| Canopy Debt Securities | debt securities issued by Canopy in June 2018, no longer outstanding | ||||

| Canopy Equity Method Investment | an investment in Canopy common shares, no longer applicable following conversion of Canopy common shares into Exchangeable Shares in April 2024 | ||||

CB International |

CB International Finance S.à r.l., a wholly-owned subsidiary of ours |

||||

| Class 1 Stock | our Class 1 Convertible Common Stock, par value $0.01 per share | ||||

| Class A Stock | our Class A Common Stock, par value $0.01 per share | ||||

| CODM | chief operating decision maker, our President and Chief Executive Officer | ||||

| Comparable Adjustments | certain items affecting comparability that have been excluded by management | ||||

| CPG | consumer packaged goods | ||||

| Craft Beer Divestitures | the Four Corners Divestiture and the Funky Buddha Divestiture, collectively | ||||

| Daleville Facility | production facility located in Roanoke, Virginia, sold in May 2023 | ||||

| Depletions | represent U.S. distributor shipments of our respective branded products to retail customers, based on third-party data |

||||

| Digital Business Acceleration | a multi-year initiative by the Company to create a cohesive digital strategy and build an advanced digital business | ||||

| DTC | direct-to-consumer inclusive of (i) a digital commerce experience for consumers to purchase directly from brand websites with inventory coming straight from the supplier and (ii) consumer purchases at hospitality locations (tasting rooms and tap rooms) from the supplier | ||||

| ESG | environmental, social, and governance | ||||

Constellation Brands, Inc. Q1 FY 2025 Form 10-Q |

#WORTHREACHINGFOR I i

|

||||

| Term | Meaning | ||||

| Exchangeable Shares | new class of non-voting and non-participating exchangeable shares in Canopy which are convertible into common shares of Canopy on a one-for-one basis | ||||

| Exchange Act | Securities Exchange Act of 1934, as amended | ||||

| FASB | Financial Accounting Standards Board | ||||

| Financial Statements | our consolidated financial statements and notes thereto included herein |

||||

First Quarter 2024 |

the Company’s three months ended May 31, 2023 |

||||

First Quarter 2025 |

the Company’s three months ended May 31, 2024 |

||||

| Fiscal 2024 | the Company’s fiscal year ended February 29, 2024 | ||||

| Fiscal 2025 | the Company’s fiscal year ending February 28, 2025 | ||||

| Fiscal 2026 | the Company’s fiscal year ending February 28, 2026 | ||||

| Fiscal 2027 | the Company’s fiscal year ending February 28, 2027 | ||||

| Fiscal 2028 | the Company’s fiscal year ending February 29, 2028 | ||||

| Fiscal 2029 | the Company’s fiscal year ending February 28, 2029 | ||||

Fiscal 2030 |

the Company’s fiscal year ending February 28, 2030 | ||||

| Form 10-Q | this Quarterly Report on Form 10-Q for the quarterly period ended May 31, 2024, unless otherwise specified |

||||

| Four Corners Divestiture | sale of the Four Corners craft beer business | ||||

| Funky Buddha Divestiture | sale of the Funky Buddha craft beer business | ||||

| GHG | greenhouse gas | ||||

| IRA | Inflation Reduction Act of 2022 | ||||

| IT | information technology | ||||

| MD&A |

Management’s Discussion and Analysis of Financial Condition and Results of Operations under Part I – Item 2. of this Form 10-Q

|

||||

Mexicali Brewery |

canceled brewery construction project located in Mexicali, Baja California, Mexico, closed on the sale of the remaining assets classified as held for sale in July 2024 |

||||

| Mexico Beer Projects | expansion, optimization, and/or construction activities at the Obregón Brewery, Nava Brewery, and Veracruz Brewery | ||||

| M&T | Manufacturers and Traders Trust Company | ||||

| NA | not applicable | ||||

| Nava | Nava, Coahuila, Mexico | ||||

| Nava Brewery | brewery located in Nava | ||||

| Net sales | gross sales less promotions, returns and allowances, and excise taxes | ||||

| NM | not meaningful | ||||

| Note(s) | notes to the consolidated financial statements | ||||

Obregón |

Obregón, Sonora, Mexico | ||||

Obregón Brewery |

brewery located in Obregón |

||||

| OCI | other comprehensive income (loss) | ||||

| October 2022 Credit Agreement Amendment | amendment dated as of October 18, 2022, to the 2022 Credit Agreement, effective in April 2024 | ||||

| Pre-issuance hedge contracts | treasury lock and/or swap lock contracts designated as cash flow hedges entered into to hedge treasury rate volatility on future debt issuances | ||||

Constellation Brands, Inc. Q1 FY 2025 Form 10-Q |

#WORTHREACHINGFOR I ii

|

||||

| Term | Meaning | ||||

| Sands Family Stockholders | RES Master LLC, RES Business Holdings LP, SER Business Holdings LP, RHT 2015 Business Holdings LP, RSS Master LLC, RSS Business Holdings LP, SSR Business Holdings LP, RSS 2015 Business Holdings LP, RCT 2015 Business Holdings LP, RCT 2020 Investments LLC, NSDT 2009 STZ LLC, NSDT 2011 STZ LLC, RSS Business Management LLC, SSR Business Management LLC, LES Lauren Holdings LLC, MES Mackenzie Holdings LLC, Abigail Bennett, Zachary Stern, A&Z 2015 Business Holdings LP (subsequently liquidated), Marilyn Sands Master Trust, MAS Business Holdings LP, Sands Family Foundation, Richard Sands, Robert Sands, WildStar Partners LLC, Astra Legacy LLC, AJB Business Holdings LP, and ZMSS Business Holdings LP |

||||

Sea Smoke |

Sea Smoke wine business, acquired by us |

||||

| SEC | Securities and Exchange Commission | ||||

| Securities Act | Securities Act of 1933, as amended | ||||

| SOFR | secured overnight financing rate administered by the Federal Reserve Bank of New York | ||||

| U.S. | United States of America | ||||

| Veracruz | Heroica Veracruz, Veracruz, Mexico | ||||

| Veracruz Brewery | a new brewery being constructed in Veracruz | ||||

Constellation Brands, Inc. Q1 FY 2025 Form 10-Q |

#WORTHREACHINGFOR I iii

|

||||

| FINANCIAL STATEMENTS | |||||

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements.

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(in millions, except share and per share data)

(unaudited)

| May 31, 2024 |

February 29, 2024 |

||||||||||

| ASSETS | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ |

|

$ | ||||||||

| Accounts receivable |

|

||||||||||

| Inventories |

|

||||||||||

| Prepaid expenses and other |

|

||||||||||

| Total current assets |

|

||||||||||

| Property, plant, and equipment |

|

||||||||||

| Goodwill |

|

||||||||||

| Intangible assets |

|

||||||||||

| Deferred income taxes |

|

||||||||||

| Other assets |

|

||||||||||

| Total assets | $ |

|

$ | ||||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||||||

| Current liabilities: | |||||||||||

| Short-term borrowings | $ |

|

$ | ||||||||

| Current maturities of long-term debt |

|

||||||||||

| Accounts payable |

|

||||||||||

| Other accrued expenses and liabilities |

|

||||||||||

| Total current liabilities |

|

||||||||||

| Long-term debt, less current maturities |

|

||||||||||

| Deferred income taxes and other liabilities |

|

||||||||||

| Total liabilities |

|

||||||||||

| Commitments and contingencies | |||||||||||

| CBI stockholders’ equity: | |||||||||||

|

Class A Stock, $

Issued,

|

|

||||||||||

| Additional paid-in capital |

|

||||||||||

| Retained earnings |

|

||||||||||

| Accumulated other comprehensive income (loss) |

|

||||||||||

Class A Stock in treasury, at cost, |

( |

( |

|||||||||

| Total CBI stockholders’ equity |

|

||||||||||

| Noncontrolling interests |

|

||||||||||

| Total stockholders’ equity |

|

||||||||||

| Total liabilities and stockholders’ equity | $ |

|

$ | ||||||||

The accompanying notes are an integral part of these statements.

| Constellation Brands, Inc. Q1 FY 2025 Form 10-Q |

#WORTHREACHINGFOR I 1

|

||||

| FINANCIAL STATEMENTS | |||||

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(in millions, except per share data)

(unaudited)

| For the Three Months Ended May 31, |

|||||||||||

| 2024 | 2023 | ||||||||||

| Sales | $ |

|

$ | ||||||||

| Excise taxes | ( |

( |

|||||||||

| Net sales |

|

||||||||||

| Cost of product sold | ( |

( |

|||||||||

| Gross profit |

|

||||||||||

| Selling, general, and administrative expenses | ( |

( |

|||||||||

| Operating income (loss) |

|

||||||||||

| Income (loss) from unconsolidated investments |

|

( |

|||||||||

Interest expense, net |

( |

( |

|||||||||

| Income (loss) before income taxes |

|

||||||||||

| (Provision for) benefit from income taxes | ( |

( |

|||||||||

| Net income (loss) |

|

||||||||||

| Net (income) loss attributable to noncontrolling interests | ( |

( |

|||||||||

| Net income (loss) attributable to CBI | $ |

|

$ | ||||||||

| Comprehensive income (loss) | $ |

|

$ | ||||||||

| Comprehensive (income) loss attributable to noncontrolling interests | ( |

( |

|||||||||

| Comprehensive income (loss) attributable to CBI | $ |

|

$ | ||||||||

Class A Stock: |

|||||||||||

Net income (loss) per common share attributable to CBI – basic |

$ |

|

$ | ||||||||

Net income (loss) per common share attributable to CBI – diluted |

$ |

|

$ | ||||||||

Weighted average common shares outstanding – basic |

|

||||||||||

Weighted average common shares outstanding – diluted |

|

||||||||||

Cash dividends declared per common share |

$ |

|

$ | ||||||||

The accompanying notes are an integral part of these statements.

| Constellation Brands, Inc. Q1 FY 2025 Form 10-Q |

#WORTHREACHINGFOR I 2

|

||||

| FINANCIAL STATEMENTS | |||||

|

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(in millions)

(unaudited)

| |||||||||||||||||||||||||||||||||||||||||

|

Class A

Stock

|

Additional Paid-in Capital |

Retained Earnings |

Accumulated Other Comprehensive Income (Loss) |

Treasury Stock |

Non-controlling Interests |

Total | |||||||||||||||||||||||||||||||||||

Balance at February 29, 2024 |

$ |

|

$ |

|

$ |

|

$ |

|

$ | ( |

$ |

|

$ |

|

|||||||||||||||||||||||||||

| Comprehensive income (loss): | |||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — |

|

— | — |

|

|

||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss), net of income tax effect | — | — | — | ( |

— |

|

( |

||||||||||||||||||||||||||||||||||

| Comprehensive income (loss) |

|

||||||||||||||||||||||||||||||||||||||||

| Repurchase of shares | — | — | — | — | ( |

— | ( |

||||||||||||||||||||||||||||||||||

| Dividends declared | — | — | ( |

— | — | — | ( |

||||||||||||||||||||||||||||||||||

| Non-controlling interest distributions | — | — | — | — | — | ( |

( |

||||||||||||||||||||||||||||||||||

| Shares issued under equity compensation plans | — |

|

— | — |

|

— |

|

||||||||||||||||||||||||||||||||||

| Stock-based compensation | — |

|

— | — | — | — |

|

||||||||||||||||||||||||||||||||||

Balance at May 31, 2024 |

$ |

|

$ |

|

$ |

|

$ |

|

$ | ( |

$ |

|

$ |

|

|||||||||||||||||||||||||||

| Balance at February 28, 2023 | $ | $ | $ | $ | $ | ( |

$ | $ | |||||||||||||||||||||||||||||||||

| Comprehensive income (loss): | |||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — | — | — | |||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss), net of income tax effect | — | — | — | — | |||||||||||||||||||||||||||||||||||||

| Comprehensive income (loss) | |||||||||||||||||||||||||||||||||||||||||

| Repurchase of shares | — | — | — | — | ( |

— | ( |

||||||||||||||||||||||||||||||||||

| Dividends declared | — | — | ( |

— | — | — | ( |

||||||||||||||||||||||||||||||||||

| Noncontrolling interest distributions | — | — | — | — | — | ( |

( |

||||||||||||||||||||||||||||||||||

| Shares issued under equity compensation plans | — | — | — | — | |||||||||||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||

| Balance at May 31, 2023 | $ | $ | $ | $ | $ | ( |

$ | $ | |||||||||||||||||||||||||||||||||

The accompanying notes are an integral part of these statements.

| Constellation Brands, Inc. Q1 FY 2025 Form 10-Q |

#WORTHREACHINGFOR I 3

|

||||

| FINANCIAL STATEMENTS | |||||

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in millions)

(unaudited)

| For the Three Months Ended May 31, |

|||||||||||

| 2024 | 2023 | ||||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | |||||||||||

| Net income (loss) | $ |

|

$ | ||||||||

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | |||||||||||

| Unrealized net (gain) loss on securities measured at fair value |

|

||||||||||

| Deferred tax provision (benefit) |

|

( |

|||||||||

| Depreciation |

|

||||||||||

| Stock-based compensation |

|

||||||||||

| Equity in (earnings) losses of equity method investees and related activities, net of distributed earnings |

|

||||||||||

| Noncash lease expense |

|

||||||||||

Impairment of equity method investments |

|

||||||||||

Net gain on conversion and exchange to Exchangeable Shares |

( |

||||||||||

| Change in operating assets and liabilities, net of effects from purchase and sale of business: | |||||||||||

| Accounts receivable | ( |

( |

|||||||||

| Inventories | ( |

( |

|||||||||

| Prepaid expenses and other current assets | ( |

( |

|||||||||

| Accounts payable |

|

||||||||||

| Deferred revenue |

|

||||||||||

| Other accrued expenses and liabilities | ( |

( |

|||||||||

| Other | ( |

||||||||||

| Total adjustments | ( |

||||||||||

| Net cash provided by (used in) operating activities |

|

||||||||||

| CASH FLOWS FROM INVESTING ACTIVITIES | |||||||||||

| Purchase of property, plant, and equipment | ( |

( |

|||||||||

| Investments in equity method investees and securities | ( |

( |

|||||||||

| Proceeds from sale of assets |

|

||||||||||

| Proceeds from sale of business |

|

||||||||||

| Other investing activities | ( |

||||||||||

| Net cash provided by (used in) investing activities | ( |

( |

|||||||||

| Constellation Brands, Inc. Q1 FY 2025 Form 10-Q |

#WORTHREACHINGFOR I 4

|

||||

| FINANCIAL STATEMENTS | |||||

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in millions)

(unaudited)

| For the Three Months Ended May 31, |

|||||||||||

| 2024 | 2023 | ||||||||||

| CASH FLOWS FROM FINANCING ACTIVITIES | |||||||||||

| Proceeds from issuance of long-term debt |

|

||||||||||

| Principal payments of long-term debt | ( |

( |

|||||||||

| Net proceeds from (repayments of) short-term borrowings |

|

( |

|||||||||

| Dividends paid | ( |

( |

|||||||||

| Purchases of treasury stock | ( |

( |

|||||||||

| Proceeds from shares issued under equity compensation plans |

|

||||||||||

| Payments of minimum tax withholdings on stock-based payment awards | ( |

( |

|||||||||

| Payments of debt issuance, debt extinguishment, and other financing costs |

|

( |

|||||||||

| Distributions to noncontrolling interests | ( |

( |

|||||||||

Payment of contingent consideration |

( |

||||||||||

| Net cash provided by (used in) financing activities | ( |

( |

|||||||||

| Effect of exchange rate changes on cash and cash equivalents |

|

||||||||||

| Net increase (decrease) in cash and cash equivalents | ( |

||||||||||

| Cash and cash equivalents, beginning of period |

|

||||||||||

| Cash and cash equivalents, end of period | $ |

|

$ | ||||||||

| Supplemental disclosures of noncash investing and financing activities | |||||||||||

| Additions to property, plant, and equipment | $ |

|

$ | ||||||||

The accompanying notes are an integral part of these statements.

| Constellation Brands, Inc. Q1 FY 2025 Form 10-Q |

#WORTHREACHINGFOR I 5

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

MAY 31, 2024

(unaudited)

1. BASIS OF PRESENTATION

We have prepared the Financial Statements, without audit, pursuant to the rules and regulations of the SEC applicable to quarterly reporting on Form 10-Q and reflect, in our opinion, all adjustments necessary to present fairly our financial information. All such adjustments are of a normal recurring nature. Certain information and footnote disclosures normally included in financial statements, prepared in accordance with generally accepted accounting principles, have been condensed or omitted as permitted by such rules and regulations. These Financial Statements should be read in conjunction with the consolidated financial statements and related notes included in the 2024 Annual Report. Results of operations for interim periods are not necessarily indicative of annual results.

Reclassification

We reclassified equity method investments to other assets on our consolidated balance sheet as of February 29, 2024, to conform with current year presentation.

2. INVENTORIES

Inventories are stated at the lower of cost (primarily computed in accordance with the first-in, first-out method) or net realizable value. Elements of cost include materials, labor, and overhead and consist of the following:

| May 31, 2024 |

February 29, 2024 |

||||||||||

| (in millions) | |||||||||||

| Raw materials and supplies | $ | $ | |||||||||

| In-process inventories | |||||||||||

| Finished case goods | |||||||||||

| $ | $ | ||||||||||

3. DERIVATIVE INSTRUMENTS

Overview

Our risk management and derivative accounting policies are presented in Notes 1 and 6 of our consolidated financial statements included in our 2024 Annual Report and have not changed significantly for the three months ended May 31, 2024.

The aggregate notional value of outstanding derivative instruments is as follows:

| May 31, 2024 |

February 29, 2024 |

||||||||||

| (in millions) | |||||||||||

| Derivative instruments designated as hedging instruments | |||||||||||

| Foreign currency contracts | $ | $ | |||||||||

| Derivative instruments not designated as hedging instruments | |||||||||||

| Foreign currency contracts | $ | $ | |||||||||

| Commodity derivative contracts | $ | $ | |||||||||

Credit risk

We are exposed to credit-related losses if the counterparties to our derivative contracts default. This credit risk is limited to the fair value of the derivative contracts. To manage this risk, we contract only with major

| Constellation Brands, Inc. Q1 FY 2025 Form 10-Q |

#WORTHREACHINGFOR I 6

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

financial institutions that have earned investment-grade credit ratings and with whom we have standard International Swaps and Derivatives Association agreements which allow for net settlement of the derivative contracts. We have also established counterparty credit guidelines that are regularly monitored. Because of these safeguards, we believe the risk of loss from counterparty default to be immaterial.

In addition, our derivative instruments are not subject to credit rating contingencies or collateral requirements. As of May 31, 2024, the estimated fair value of derivative instruments in a net liability position due to counterparties was $2.2 million. If we were required to settle the net liability position under these derivative instruments on May 31, 2024, we would have had sufficient available liquidity on hand to satisfy this obligation.

Results of period derivative activity

The estimated fair value and location of our derivative instruments on our balance sheets are as follows (see Note 4):

| Assets | Liabilities | |||||||||||||||||||||||||

| May 31, 2024 |

February 29, 2024 |

May 31, 2024 |

February 29, 2024 |

|||||||||||||||||||||||

| (in millions) | ||||||||||||||||||||||||||

| Derivative instruments designated as hedging instruments | ||||||||||||||||||||||||||

| Foreign currency contracts: | ||||||||||||||||||||||||||

| Prepaid expenses and other | $ | $ | Other accrued expenses and liabilities | $ | $ | |||||||||||||||||||||

| Other assets | $ | $ | Deferred income taxes and other liabilities | $ | $ | |||||||||||||||||||||

| Derivative instruments not designated as hedging instruments | ||||||||||||||||||||||||||

| Foreign currency contracts: | ||||||||||||||||||||||||||

| Prepaid expenses and other | $ | $ | Other accrued expenses and liabilities | $ | $ | |||||||||||||||||||||

| Commodity derivative contracts: | ||||||||||||||||||||||||||

| Prepaid expenses and other | $ | $ | Other accrued expenses and liabilities | $ | $ | |||||||||||||||||||||

| Other assets | $ | $ | Deferred income taxes and other liabilities | $ | $ | |||||||||||||||||||||

The principal effect of our derivative instruments designated in cash flow hedging relationships on our results of operations, as well as OCI, net of income tax effect, is as follows:

| Derivative Instruments in Designated Cash Flow Hedging Relationships |

Net Gain (Loss) Recognized in OCI |

Location of Net Gain (Loss) Reclassified from AOCI to Income (Loss) |

Net Gain (Loss) Reclassified from AOCI to Income (Loss) |

|||||||||||||||||

| (in millions) | ||||||||||||||||||||

| For the Three Months Ended May 31, 2024 | ||||||||||||||||||||

| Foreign currency contracts | $ | Sales | $ | |||||||||||||||||

| Cost of product sold | ||||||||||||||||||||

| $ | $ | |||||||||||||||||||

| For the Three Months Ended May 31, 2023 | ||||||||||||||||||||

| Foreign currency contracts | $ | Sales | $ | |||||||||||||||||

| Cost of product sold | ||||||||||||||||||||

| Pre-issuance hedge contracts | Interest expense, net |

( |

||||||||||||||||||

| $ | $ | |||||||||||||||||||

| Constellation Brands, Inc. Q1 FY 2025 Form 10-Q |

#WORTHREACHINGFOR I 7

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

We expect $128.3 million of net gains, net of income tax effect, to be reclassified from AOCI to our results of operations within the next 12 months.

The effect of our undesignated derivative instruments on our results of operations is as follows:

| Derivative Instruments Not Designated as Hedging Instruments |

Location of Net Gain (Loss) Recognized in Income (Loss) |

Net Gain (Loss) Recognized in Income (Loss) |

||||||||||||||||||

| (in millions) | ||||||||||||||||||||

| For the Three Months Ended May 31, 2024 | ||||||||||||||||||||

| Commodity derivative contracts | Cost of product sold | $ | ||||||||||||||||||

| Foreign currency contracts | Selling, general, and administrative expenses | |||||||||||||||||||

| $ | ||||||||||||||||||||

| For the Three Months Ended May 31, 2023 | ||||||||||||||||||||

| Commodity derivative contracts | Cost of product sold | $ | ( |

|||||||||||||||||

| Foreign currency contracts | Selling, general, and administrative expenses | |||||||||||||||||||

| $ | ( |

|||||||||||||||||||

4. FAIR VALUE OF FINANCIAL INSTRUMENTS

Authoritative guidance establishes a framework for measuring fair value, including a hierarchy for inputs used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that the most observable inputs be used when available. The hierarchy includes three levels:

•Level 1 inputs are quoted prices in active markets for identical assets or liabilities;

•Level 2 inputs include data points that are observable such as quoted prices for similar assets or liabilities in active markets, quoted prices for identical assets or similar assets or liabilities in markets that are not active, and inputs (other than quoted prices) such as volatility, interest rates, and yield curves that are observable for the asset or liability, either directly or indirectly; and

•Level 3 inputs are unobservable data points for the asset or liability, and include situations where there is little, if any, market activity for the asset or liability.

Fair value methodology

The following methods and assumptions are used to estimate the fair value of our financial instruments:

Foreign currency and commodity derivative contracts

The fair value is estimated using market-based inputs, obtained from independent pricing services, entered into valuation models. These valuation models require various inputs, including contractual terms, market foreign exchange prices, market commodity prices, interest-rate yield curves, and currency volatilities, as applicable (Level 2 fair value measurement).

Short-term borrowings

Our short-term borrowings consist of our commercial paper program and the revolving credit facility under our senior credit facility. The revolving credit facility is a variable interest rate bearing note with a fixed margin, adjustable based upon our debt rating (as defined in our senior credit facility). For these short-term borrowings, the carrying value approximates the fair value.

Long-term debt

The fair value of our fixed interest rate long-term debt is estimated by discounting cash flows using interest rates currently available for debt with similar terms and maturities (Level 2 fair value measurement). As of May 31, 2024, the carrying amount of long-term debt, including the current portion, was $11,089.1 million, compared with an estimated fair value of $10,176.1 million. As of February 29, 2024, the carrying amount of long-

| Constellation Brands, Inc. Q1 FY 2025 Form 10-Q |

#WORTHREACHINGFOR I 8

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

term debt, including the current portion, was $11,637.9 million, compared with an estimated fair value of $10,775.8 million.

The carrying amounts of certain of our financial instruments, including cash and cash equivalents, accounts receivable, and accounts payable, approximate fair value as of May 31, 2024, and February 29, 2024, due to the relatively short maturity of these instruments.

Recurring basis measurements

The following table presents our financial assets and liabilities measured at estimated fair value on a recurring basis:

| Fair Value Measurements Using | |||||||||||||||||||||||

| Quoted Prices in Active Markets (Level 1) |

Significant Other Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

Total | ||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

| May 31, 2024 | |||||||||||||||||||||||

| Assets: | |||||||||||||||||||||||

| Foreign currency contracts | $ | $ | $ | $ | |||||||||||||||||||

| Commodity derivative contracts | $ | $ | $ | $ | |||||||||||||||||||

| Liabilities: | |||||||||||||||||||||||

| Foreign currency contracts | $ | $ | $ | $ | |||||||||||||||||||

| Commodity derivative contracts | $ | $ | $ | $ | |||||||||||||||||||

| February 29, 2024 | |||||||||||||||||||||||

| Assets: | |||||||||||||||||||||||

| Foreign currency contracts | $ | $ | $ | $ | |||||||||||||||||||

| Commodity derivative contracts | $ | $ | $ | $ | |||||||||||||||||||

| Liabilities: | |||||||||||||||||||||||

| Foreign currency contracts | $ | $ | $ | $ | |||||||||||||||||||

| Commodity derivative contracts | $ | $ | $ | $ | |||||||||||||||||||

Nonrecurring basis measurements

The following table presents our assets and liabilities measured at estimated fair value on a nonrecurring basis for which an impairment assessment was performed for the periods presented:

| Fair Value Measurements Using | |||||||||||||||||||||||

| Quoted Prices in Active Markets (Level 1) |

Significant Other Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

Total Losses | ||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

| For the Three Months Ended May 31, 2023 | |||||||||||||||||||||||

| Equity method investments | $ | $ | $ | $ | |||||||||||||||||||

Equity method investments

We evaluated the Canopy Equity Method Investment as of May 31, 2023, and determined there was an other-than-temporary impairment. Our conclusion was based on several contributing factors, including: (i) the fair value being less than the carrying value and the uncertainty surrounding Canopy’s stock price recovering in the near-term, (ii) Canopy recorded significant costs in its fourth quarter of fiscal 2023 results designed to align its

| Constellation Brands, Inc. Q1 FY 2025 Form 10-Q |

#WORTHREACHINGFOR I 9

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

Canadian cannabis operations and resources in response to continued unfavorable market trends, (iii) the substantial doubt about Canopy’s ability to continue as a going concern, as disclosed by Canopy, and (iv) Canopy’s identification of material misstatements in certain of its previously reported financial results related to sales in its BioSteel Sports Nutrition Inc. reporting unit that were accounted for incorrectly, including the recording of a goodwill impairment during its restated second quarter of fiscal 2023. As a result, the Canopy Equity Method Investment with a carrying value of $266.2 million was written down to its estimated fair value of $142.7 million, resulting in an impairment of $123.5 million. This loss from impairment was included in income (loss) from unconsolidated investments within our consolidated results for the three months ended May 31, 2023. The estimated fair value was determined based on the closing price of the underlying equity security as of May 31, 2023. We no longer apply the equity method to our investment in Canopy following the April 2024 conversion of our Canopy common shares to Exchangeable Shares. See Note 7 for further discussion.

5. GOODWILL

The changes in the carrying amount of goodwill are as follows:

| Beer | Wine and Spirits | Consolidated | |||||||||||||||

| (in millions) | |||||||||||||||||

| Balance, February 28, 2023 | $ | $ | $ | ||||||||||||||

Purchase accounting allocations (1)

|

|||||||||||||||||

| Foreign currency translation adjustments | ( |

||||||||||||||||

| Balance, February 29, 2024 | |||||||||||||||||

| Foreign currency translation adjustments | |||||||||||||||||

| Balance, May 31, 2024 | $ | $ | $ | ||||||||||||||

(1)Purchase accounting allocations associated with the June 2023 acquisition of the Domaine Curry wine business.

If broader industry and market conditions decline and/or our expectations of future performance as reflected in our current strategic operating plans are not fully realized, a future impairment of Wine and Spirits goodwill is reasonably possible.

Subsequent event

Sea Smoke acquisition

In June 2024, we acquired the Sea Smoke business, including a California-based luxury wine brand, vineyards, and a production facility for $170.0 million, subject to adjustments. This transaction also included the acquisition of a trademark, inventory, and goodwill. The results of operations of Sea Smoke will be reported in the Wine and Spirits segment and will be included in our consolidated results of operations from the date of acquisition.

| Constellation Brands, Inc. Q1 FY 2025 Form 10-Q |

#WORTHREACHINGFOR I 10

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

6. INTANGIBLE ASSETS

The major components of intangible assets are as follows:

| May 31, 2024 | February 29, 2024 | ||||||||||||||||||||||

| Gross Carrying Amount |

Net Carrying Amount |

Gross Carrying Amount |

Net Carrying Amount |

||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

| Amortizable intangible assets | |||||||||||||||||||||||

| Customer relationships | $ | $ | $ | $ | |||||||||||||||||||

| Other | |||||||||||||||||||||||

| Total | $ | $ | |||||||||||||||||||||

| Nonamortizable intangible assets | |||||||||||||||||||||||

| Trademarks | |||||||||||||||||||||||

| Total intangible assets | $ | $ | |||||||||||||||||||||

We did not incur costs to renew or extend the term of acquired intangible assets for the three months ended May 31, 2024, and May 31, 2023. Net carrying amount represents the gross carrying value net of accumulated amortization.

7. OTHER ASSETS

The major components of other assets are as follows:

| May 31, 2024 |

February 29, 2024 |

||||||||||

| (in millions) | |||||||||||

| Operating lease right-of-use asset | $ | $ | |||||||||

| Derivative assets | |||||||||||

| Equity method investments | |||||||||||

| Exchangeable Shares | |||||||||||

Other investments in debt and equity securities |

|||||||||||

Assets held for sale |

|||||||||||

| Other | |||||||||||

| $ | $ | ||||||||||

Equity method investments

The carrying value of our equity method investments are as follows:

| May 31, 2024 |

February 29, 2024 |

||||||||||

| (in millions) | |||||||||||

Canopy Equity Method Investment (1)

|

$ | $ | |||||||||

| Other equity method investments | |||||||||||

| $ | $ | ||||||||||

(1)Following the April 2024 conversion to Exchangeable Shares we no longer apply the equity method.

| Constellation Brands, Inc. Q1 FY 2025 Form 10-Q |

#WORTHREACHINGFOR I 11

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

Exchangeable Shares

In April 2024, we elected to convert our 17.1 million Canopy common shares into Exchangeable Shares on a one-for-one basis. Additionally, in April 2024, we exchanged C$81.2 million of the principal amount of the C$100.0 million 4.25 % promissory note issued to us by Canopy for 9.1 million Exchangeable Shares and forgave all accrued but unpaid interest together with the remaining principal amount of the note. As a result of these transactions, we (i) have 26.3 million Exchangeable Shares and (ii) recognized an $83.3 million net gain in income (loss) from unconsolidated investments within our consolidated results of operations for the three months ended May 31, 2024. The fair value of Exchangeable Shares on the date of the conversion and exchange was estimated using a valuation model based primarily on the following inputs: (i) Canopy’s common share price, (ii) the expected volatility of Canopy’s common shares, and (iii) the probability and timing of U.S. federal legalization of recreational cannabis. As the Exchangeable Shares are an equity security without a readily determinable fair value, we elected to account for the Exchangeable Shares under the measurement alternative method. Future impairments, if any, will also be reported in income (loss) from unconsolidated investments within our consolidated results.

Other investments in debt and equity securities

We have multiple investments through our corporate venture capital function in debt and equity securities.

Subsequent event

Mexicali Brewery

In July 2024, we closed on the sale of the remaining assets classified as held for sale at the canceled Mexicali Brewery. These net assets had met held for sale criteria as of May 31, 2024, and February 29, 2024.

8. BORROWINGS

Borrowings consist of the following:

| May 31, 2024 | February 29, 2024 |

||||||||||||||||||||||

| Current | Long-term | Total | Total | ||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

| Short-term borrowings | |||||||||||||||||||||||

| Commercial paper | $ | $ | |||||||||||||||||||||

| $ | $ | ||||||||||||||||||||||

| Long-term debt | |||||||||||||||||||||||

| Senior notes | $ | $ | $ | $ | |||||||||||||||||||

| Other | |||||||||||||||||||||||

| $ | $ | $ | $ | ||||||||||||||||||||

Bank facilities

The Company, CB International, the Administrative Agent, and certain other lenders are parties to the 2022 Credit Agreement. The October 2022 Credit Agreement Amendment revised certain defined terms and covenants in the 2022 Credit Agreement and became effective in April 2024 following (i) the amendment by Canopy of its Articles of Incorporation, (ii) the conversion of our Canopy common shares into Exchangeable Shares, and (iii) the resignation of our nominees from the board of directors of Canopy.

| Constellation Brands, Inc. Q1 FY 2025 Form 10-Q |

#WORTHREACHINGFOR I 12

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

Information with respect to borrowings under the 2022 Credit Agreement is as follows:

| Outstanding borrowings |

Interest rate |

SOFR margin |

Outstanding letters of credit |

Remaining

borrowing

capacity (1)

|

|||||||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||||||||

May 31, 2024 |

|||||||||||||||||||||||||||||

Revolving credit facility (2) (3)

|

$ | % | % | $ | $ | ||||||||||||||||||||||||

| February 29, 2024 | |||||||||||||||||||||||||||||

Revolving credit facility (2) (3)

|

$ | % | % | $ | $ | ||||||||||||||||||||||||

(1)Net of outstanding revolving credit facility borrowings and outstanding letters of credit under the 2022 Credit Agreement and outstanding borrowings under our commercial paper program of $795.5 million and $241.5 million (excluding unamortized discount) as of May 31, 2024 and February 29, 2024, respectively (see “Commercial paper program” below).

(2)Contractual interest rate varies based on our debt rating (as defined in the agreement) and is a function of SOFR plus a margin and a credit spread adjustment, or the base rate plus a margin, or, in certain circumstances where SOFR cannot be adequately ascertained or available, an alternative benchmark rate plus a margin.

(3)We and/or CB International are the borrower under the $2,250.0 million revolving credit facility with a maturity date of April 14, 2027. Includes a sub-facility for letters of credit of up to $200.0 million.

We and our subsidiaries are subject to covenants that are contained in the 2022 Credit Agreement, including those restricting the incurrence of additional subsidiary indebtedness, additional liens, mergers and consolidations, transactions with affiliates, and sale and leaseback transactions, in each case subject to numerous conditions, exceptions, and thresholds. The financial covenants are limited to a minimum interest coverage ratio and a maximum net leverage ratio.

Commercial paper program

We have a commercial paper program which provides for the issuance of up to an aggregate principal amount of $2.25 billion of commercial paper. Our commercial paper program is backed by unused commitments under our revolving credit facility under our 2022 Credit Agreement. Accordingly, outstanding borrowings under our commercial paper program reduce the amount available under our revolving credit facility. Information with respect to our outstanding commercial paper borrowings is as follows:

| May 31, 2024 |

February 29, 2024 |

||||||||||

| (in millions) | |||||||||||

Outstanding borrowings (1)

|

$ | $ | |||||||||

| Weighted average annual interest rate | % | % | |||||||||

| Weighted average remaining term | |||||||||||

(1)Outstanding commercial paper borrowings are net of unamortized discount.

| Constellation Brands, Inc. Q1 FY 2025 Form 10-Q |

#WORTHREACHINGFOR I 13

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

Debt payments

As of May 31, 2024, the required principal repayments under long-term debt obligations (excluding unamortized debt issuance costs and unamortized discounts of $53.8 million and $22.8 million, respectively) for the remaining nine months of Fiscal 2025 and for each of the five succeeding fiscal years and thereafter are as follows:

| (in millions) | |||||

| Fiscal 2025 | $ | ||||

| Fiscal 2026 | |||||

| Fiscal 2027 | |||||

| Fiscal 2028 | |||||

| Fiscal 2029 | |||||

Fiscal 2030 |

|||||

| Thereafter | |||||

| $ | |||||

9. INCOME TAXES

Our effective tax rate for the three months ended May 31, 2024, and May 31, 2023, was 3.0 % and 39.6 %, respectively.

For the three months ended May 31, 2024, our effective tax rate was lower than the federal statutory rate of 21% primarily due to (i) a net income tax benefit recognized as a result of the resolution of various tax examinations and assessments related to prior periods, (ii) the benefit of lower effective tax rates applicable to our foreign businesses, and (iii) a decrease in the valuation allowance related to our investment in Canopy.

For the three months ended May 31, 2023, our effective tax rate was higher than the federal statutory rate of 21% primarily due to an increase in the valuation allowance related to our investment in Canopy, partially offset by (i) a net income tax benefit recognized as a result of a change in tax entity classification and (ii) the benefit of lower effective tax rates applicable to our foreign businesses.

The Organization for Economic Cooperation and Development introduced a framework under Pillar Two which includes a global minimum tax rate of 15%. Many jurisdictions in which we do business have started to enact laws implementing Pillar Two. We are monitoring these developments and currently do not believe these rules will have a material impact on our financial condition and/or consolidated results.

10. STOCKHOLDERS’ EQUITY

Common stock

The number of shares of common stock issued and treasury stock, and associated share activity, are as follows:

|

Class A

Stock

|

Class 1

Stock

|

Class A

Stock in

Treasury

|

|||||||||||||||

Balance at February 29, 2024 |

|||||||||||||||||

| Share repurchases | — | — | |||||||||||||||

| Exercise of stock options | — | ( |

|||||||||||||||

Vesting of restricted stock units (1)

|

— | — | ( |

||||||||||||||

Vesting of performance share units (1)

|

— | — | ( |

||||||||||||||

Balance at May 31, 2024 |

|||||||||||||||||

| Constellation Brands, Inc. Q1 FY 2025 Form 10-Q |

#WORTHREACHINGFOR I 14

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

|

Class A

Stock

|

Class 1

Stock

|

Class A

Stock in

Treasury

|

|||||||||||||||

Balance at February 28, 2023 |

|||||||||||||||||

| Share repurchases | — | — | |||||||||||||||

| Conversion of shares | ( |

— | |||||||||||||||

| Exercise of stock options | — | ( |

|||||||||||||||

Vesting of restricted stock units (1)

|

— | — | ( |

||||||||||||||

Vesting of performance share units (1)

|

— | — | ( |

||||||||||||||

Balance at May 31, 2023 |

|||||||||||||||||

(1)Net of the following shares withheld to satisfy tax withholding requirements:

| For the Three Months Ended May 31, |

|||||

| 2024 | |||||

| Restricted Stock Units | |||||

| Performance Share Units | |||||

| 2023 | |||||

| Restricted Stock Units | |||||

| Performance Share Units | |||||

Stock repurchases

In each of January 2021 and November 2023, our Board of Directors authorized the repurchase of up to $2.0

For the three months ended May 31, 2024, we repurchased 775,334 shares of Class A Stock pursuant to the 2021 Authorization through open market transactions at an aggregate cost of $200.0 million. Beginning May 31, 2024, we repurchased 187,843 shares of Class A Stock pursuant to the 2021 Authorization at an aggregate cost of $47.0 million through open market transactions made pursuant to a Rule 10b5-1 trading plan.

As of July 3, 2024, total shares repurchased under our board authorizations are as follows:

Class A Stock |

|||||||||||||||||

| Repurchase Authorization |

Dollar Value of Shares Repurchased |

Number of Shares Repurchased |

|||||||||||||||

| (in millions, except share data) | |||||||||||||||||

2021 Authorization (1)

|

$ | $ | |||||||||||||||

2023 Authorization (1)

|

$ | $ | |||||||||||||||

(1)As of July 3, 2024, $2,366.7 million remains available for future share repurchases, excluding the impact of Federal excise tax owed pursuant to the IRA.

11. NET INCOME (LOSS) PER COMMON SHARE ATTRIBUTABLE TO CBI

For the three months ended May 31, 2024, and May 31, 2023, net income (loss) per common share – basic for Class A Stock has been computed based on the weighted average shares of common stock outstanding during the period. Net income (loss) per common share – diluted for Class A Stock reflects the weighted average shares of common stock plus the effect of dilutive securities outstanding during the period using the treasury stock method.

| Constellation Brands, Inc. Q1 FY 2025 Form 10-Q |

#WORTHREACHINGFOR I 15

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

The effect of dilutive securities includes the impact of outstanding stock-based awards. The dilutive computation does not assume conversion, exercise, or contingent issuance of securities that would have an anti-dilutive effect on the net income (loss) per common share attributable to CBI. The computation of basic and diluted net income (loss) per common share for Class A Stock are as follows:

| For the Three Months Ended May 31, |

|||||||||||

| 2024 | 2023 | ||||||||||

| (in millions, except per share data) | |||||||||||

| Net income (loss) attributable to CBI | $ | $ | |||||||||

| Weighted average common shares outstanding – basic | |||||||||||

| Stock-based awards, primarily stock options | |||||||||||

| Weighted average common shares outstanding – diluted | |||||||||||

| Net income (loss) per common share attributable to CBI – basic | $ | $ | |||||||||

| Net income (loss) per common share attributable to CBI – diluted | $ | $ | |||||||||

12. COMPREHENSIVE INCOME (LOSS) ATTRIBUTABLE TO CBI

Comprehensive income (loss) consists of net income (loss), foreign currency translation adjustments, unrealized net gain (loss) on derivative instruments, pension/postretirement adjustments, and our share of OCI of equity method investments. The reconciliation of net income (loss) attributable to CBI to comprehensive income (loss) attributable to CBI is as follows:

| Before Tax Amount |

Tax (Expense) Benefit |

Net of Tax Amount |

|||||||||||||||

| (in millions) | |||||||||||||||||

| For the Three Months Ended May 31, 2024 | |||||||||||||||||

| Net income (loss) attributable to CBI | $ | ||||||||||||||||

| Other comprehensive income (loss) attributable to CBI: | |||||||||||||||||

| Foreign currency translation adjustments: | |||||||||||||||||

| Net gain (loss) | $ | $ | |||||||||||||||

| Amounts reclassified | |||||||||||||||||

| Net gain (loss) recognized in other comprehensive income (loss) | |||||||||||||||||

| Unrealized gain (loss) on cash flow hedges: | |||||||||||||||||

| Net derivative gain (loss) | ( |

||||||||||||||||

| Amounts reclassified | ( |

( |

|||||||||||||||

| Net gain (loss) recognized in other comprehensive income (loss) | ( |

( |

|||||||||||||||

| Share of OCI of equity method investments | |||||||||||||||||

| Net gain (loss) | |||||||||||||||||

| Amounts reclassified | ( |

( |

|||||||||||||||

| Net gain (loss) recognized in other comprehensive income (loss) | ( |

( |

|||||||||||||||

| Other comprehensive income (loss) attributable to CBI | $ | ( |

$ | ( |

|||||||||||||

| Comprehensive income (loss) attributable to CBI | $ | ||||||||||||||||

| Constellation Brands, Inc. Q1 FY 2025 Form 10-Q |

#WORTHREACHINGFOR I 16

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

| Before Tax Amount |

Tax (Expense) Benefit |

Net of Tax Amount |

|||||||||||||||

| (in millions) | |||||||||||||||||

| For the Three Months Ended May 31, 2023 | |||||||||||||||||

| Net income (loss) attributable to CBI | $ | ||||||||||||||||

| Other comprehensive income (loss) attributable to CBI: | |||||||||||||||||

| Foreign currency translation adjustments: | |||||||||||||||||

| Net gain (loss) | $ | $ | |||||||||||||||

| Amounts reclassified | |||||||||||||||||

| Net gain (loss) recognized in other comprehensive income (loss) | |||||||||||||||||

| Unrealized gain (loss) on cash flow hedges: | |||||||||||||||||

| Net derivative gain (loss) | ( |

||||||||||||||||

| Amounts reclassified | ( |

( |

|||||||||||||||

| Net gain (loss) recognized in other comprehensive income (loss) | ( |

||||||||||||||||

| Pension/postretirement adjustments: | |||||||||||||||||

| Net actuarial gain (loss) | ( |

( |

|||||||||||||||

| Amounts reclassified | |||||||||||||||||

| Net gain (loss) recognized in other comprehensive income (loss) | ( |

( |

|||||||||||||||

| Share of OCI of equity method investments | |||||||||||||||||

| Net gain (loss) | ( |

( |

|||||||||||||||

| Amounts reclassified | |||||||||||||||||

| Net gain (loss) recognized in other comprehensive income (loss) | ( |

( |

|||||||||||||||

| Other comprehensive income (loss) attributable to CBI | $ | $ | ( |

||||||||||||||

| Comprehensive income (loss) attributable to CBI | $ | ||||||||||||||||

Accumulated other comprehensive income (loss), net of income tax effect, includes the following components:

| Foreign Currency Translation Adjustments |

Unrealized Net Gain (Loss) on Derivative Instruments |

Pension/ Postretirement Adjustments |

Share of OCI of Equity Method Investments |

Accumulated Other Comprehensive Income (Loss) |

|||||||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||||||||

| Balance, February 29, 2024 | $ | $ | $ | ( |

$ | $ | |||||||||||||||||||||||

| Other comprehensive income (loss): | |||||||||||||||||||||||||||||

| Other comprehensive income (loss) before reclassification adjustments | |||||||||||||||||||||||||||||

| Amounts reclassified from accumulated other comprehensive income (loss) | ( |

( |

( |

||||||||||||||||||||||||||

| Other comprehensive income (loss) | ( |

( |

( |

||||||||||||||||||||||||||

| Balance, May 31, 2024 | $ | $ | $ | ( |

$ | $ | |||||||||||||||||||||||

13. BUSINESS SEGMENT INFORMATION

Our internal management financial reporting consists of two business divisions: (i) Beer and (ii) Wine and Spirits and we report our operating results in three segments: (i) Beer, (ii) Wine and Spirits, and (iii) Corporate Operations and Other. In the Beer segment, our portfolio consists of high-end imported beer brands and ABAs. We have an exclusive perpetual brand license to produce our Mexican beer portfolio and to import, market, and sell such portfolio in the U.S. In the Wine and Spirits segment, we sell a portfolio that includes higher-end wine brands

| Constellation Brands, Inc. Q1 FY 2025 Form 10-Q |

#WORTHREACHINGFOR I 17

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

complemented by certain higher-end spirits brands. Amounts included in the Corporate Operations and Other segment consist of costs of corporate development, corporate finance, corporate strategy, executive management, growth, human resources, internal audit, investor relations, IT, legal, and public relations, as well as our Canopy investment and investments made through our corporate venture capital function. All costs included in the Corporate Operations and Other segment are general costs that are applicable to the consolidated group and are, therefore, not allocated to the other reportable segments. All costs reported within the Corporate Operations and Other segment are not included in our CODM’s evaluation of the operating income (loss) performance of the other reportable segments. The business segments reflect how our operations are managed, how resources are allocated, how operating performance is evaluated by senior management, and the structure of our internal financial reporting. Long-lived tangible assets and total asset information by segment is not provided to, or reviewed by, our CODM as it is not used to make strategic decisions, allocate resources, or assess performance.

In addition, management excludes Comparable Adjustments from its evaluation of the results of each operating segment as these Comparable Adjustments are not reflective of core operations of the segments. Segment operating performance and the incentive compensation of segment management are evaluated based on core segment operating income (loss) which does not include the impact of these Comparable Adjustments.

We evaluate segment operating performance based on operating income (loss) of the respective business units. Comparable Adjustments that impacted comparability in our segment operating income (loss) for each period are as follows:

| For the Three Months Ended May 31, |

|||||||||||

| 2024 | 2023 | ||||||||||

| (in millions) | |||||||||||

| Cost of product sold | |||||||||||

| Net gain (loss) on undesignated commodity derivative contracts | $ | $ | ( |

||||||||

| Settlements of undesignated commodity derivative contracts | |||||||||||

| Flow through of inventory step-up | ( |

( |

|||||||||

| Comparable Adjustments, Cost of product sold | ( |

||||||||||

| Selling, general, and administrative expenses | |||||||||||

| Transition services agreements activity | ( |

( |

|||||||||

| Restructuring and other strategic business development costs | ( |

( |

|||||||||

| Transaction, integration, and other acquisition-related costs | ( |

( |

|||||||||

Other gains (losses) (1)

|

( |

||||||||||

| Comparable Adjustments, Selling, general, and administrative expenses | ( |

( |

|||||||||

| Comparable Adjustments, Operating income (loss) | $ | $ | ( |

||||||||

(1) |

Primarily includes the following: | |||||||||||||

| For the Three Months Ended May 31, |

||||||||||||||

| 2024 | 2023 | |||||||||||||

| (in millions) | ||||||||||||||

| Gain (loss) on sale of business | $ | $ | ( |

|||||||||||

| Constellation Brands, Inc. Q1 FY 2025 Form 10-Q |

#WORTHREACHINGFOR I 18

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

The accounting policies of the segments are the same as those described for the Company in Note 1 of our consolidated financial statements included in our 2024 Annual Report. Segment information is as follows:

| For the Three Months Ended May 31, |

|||||||||||

| 2024 | 2023 | ||||||||||

| (in millions) | |||||||||||

| Beer | |||||||||||

| Net sales | $ | $ | |||||||||

| Segment operating income (loss) | $ | $ | |||||||||

| Capital expenditures | $ | $ | |||||||||

| Depreciation and amortization | $ | $ | |||||||||

| Wine and Spirits | |||||||||||

| Net sales: | |||||||||||

| Wine | $ | $ | |||||||||

| Spirits | |||||||||||

| Net sales | $ | $ | |||||||||

| Segment operating income (loss) | $ | $ | |||||||||

| Income (loss) from unconsolidated investments | $ | $ | |||||||||

| Equity method investments | $ | $ | |||||||||

| Capital expenditures | $ | $ | |||||||||

| Depreciation and amortization | $ | $ | |||||||||

| Corporate Operations and Other | |||||||||||

| Segment operating income (loss) | $ | ( |

$ | ( |

|||||||

| Income (loss) from unconsolidated investments | $ | ( |

$ | ( |

|||||||

| Equity method investments | $ | $ | |||||||||

| Capital expenditures | $ | $ | |||||||||

| Depreciation and amortization | $ | $ | |||||||||

| Comparable Adjustments | |||||||||||

| Operating income (loss) | $ | $ | ( |

||||||||

| Income (loss) from unconsolidated investments | $ | $ | ( |

||||||||

| Consolidated | |||||||||||

| Net sales | $ | $ | |||||||||

| Operating income (loss) | $ | $ | |||||||||

Income (loss) from unconsolidated investments (1)

|

$ | $ | ( |

||||||||

| Equity method investments | $ | $ | |||||||||

| Capital expenditures | $ | $ | |||||||||

| Depreciation and amortization | $ | $ | |||||||||

| Constellation Brands, Inc. Q1 FY 2025 Form 10-Q |

#WORTHREACHINGFOR I 19

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

(1) |

Income (loss) from unconsolidated investments consists of: | ||||||||||||||||

| For the Three Months Ended May 31, |

|||||||||||||||||

| 2024 | 2023 | ||||||||||||||||

| (in millions) | |||||||||||||||||

Net gain on conversion and exchange to Exchangeable Shares (i)

|

$ | $ | |||||||||||||||

| Equity in earnings (losses) from other equity method investees and related activities | ( |

( |

|||||||||||||||

| Equity in earnings (losses) from Canopy and related activities | ( |

||||||||||||||||

Impairment of equity method investments |

( |

||||||||||||||||

Unrealized net gain (loss) on securities measured at fair value (i)

|

( |

||||||||||||||||

| $ | $ | ( |

|||||||||||||||

(i)Effective as of May 31, 2023, we determined that the 2023 Canopy Promissory Note did not have future economic value given the substantial doubt about Canopy’s ability to continue as a going concern, as disclosed by Canopy, prior to the maturity of the note. Accordingly, the fair value of the remaining balance for this instrument was determined to be zero . In April 2024, we exchanged the 2023 Canopy Promissory Note for Exchangeable Shares.

14. ACCOUNTING GUIDANCE NOT YET ADOPTED

Segment reporting

In November 2023, the FASB issued a standard requiring disclosures, on an annual and interim basis, of significant segment expenses and other segment items that are regularly provided to the CODM as well as the title and position of the CODM. We are required to adopt these disclosures for our annual period ending February 28, 2025, and interim periods beginning March 1, 2025, with early adoption permitted. The amendments in this standard will be applied retrospectively to all prior periods presented in the financial statements. We expect this standard to impact our disclosures with no material impacts to our results of operations, cash flows, or financial condition.

Income taxes

In December 2023, the FASB issued a standard aimed at improving tax disclosure requirements, primarily through enhanced disclosures related to the income tax rate reconciliation and income taxes paid. We are required to adopt these disclosures for our annual period ending February 28, 2026, with early adoption permitted and this standard may be applied retrospectively. We expect this standard to impact our disclosures with no material impacts to our results of operations, cash flows, or financial condition.

Climate

In March 2024, the SEC adopted final rules to require disclosures about certain climate-related information in registration statements and annual reports. In April 2024, the SEC issued an order to stay the rules pending the completion of judicial review of multiple petitions challenging the rules. The rules will require disclosure of, among other things, material climate-related risks, how the board of directors and management oversee and manage such risks, and the actual and potential material impacts of such risks on us. The rules also require disclosure about material climate-related targets and goals, Scope 1 and Scope 2 GHG emissions, and the financial impacts of severe weather events and other natural conditions. The SEC has indicated that it will publish a new effective date for the rules, if ultimately implemented, at the conclusion of the stay. These rules will be applied prospectively. We are currently assessing the impact of these rules on our SEC filings.

| Constellation Brands, Inc. Q1 FY 2025 Form 10-Q |

#WORTHREACHINGFOR I 20

|

||||

| MD&A | |||||

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Introduction

This MD&A provides additional information on our businesses, current developments, financial condition, cash flows, and results of operations. It should be read in conjunction with our Financial Statements and with our consolidated financial statements and notes included in our 2024 Annual Report. This MD&A is organized as follows:

Overview. This section provides a general description of our business, which we believe is important in understanding the results of our operations, financial condition, and potential future trends.

Strategy. This section provides a description of our strategy and a discussion of recent developments and significant divestitures and investments.

Results of operations. This section provides an analysis of our results of operations presented on a business segment basis for the three months ended May 31, 2024, and May 31, 2023. In addition, a brief description of significant transactions and other items that affect the comparability of the results is provided.

Liquidity and capital resources. This section provides an analysis of our cash flows, outstanding debt, and liquidity position. Included in the analysis of outstanding debt is a discussion of the financial capacity available to fund our on-going operations and future commitments, as well as a discussion of other financing arrangements.

Overview

We are an international producer and marketer of beer, wine, and spirits with operations in the U.S., Mexico, New Zealand, and Italy with powerful, consumer-connected, high-quality brands like Corona Extra, Modelo Especial, Robert Mondavi Winery, Kim Crawford, Meiomi, The Prisoner Wine Company, High West, Casa Noble, and Mi CAMPO. In the U.S., we are one of the top growth contributors at retail among beverage alcohol suppliers. We are the second-largest beer company in the U.S. and continue to strengthen our leadership position as the #1 share gainer in the high-end beer segment and the overall U.S. beer market. In Fiscal 2024, Modelo Especial became the #1 beer brand in the U.S. beer market in dollar sales and continues to hold that position. Within wine and spirits, we have reshaped our brand portfolio to a higher-end focused business and continue to expand our supply channels through DTC and international markets. The strength of our brands makes us a supplier of choice to many of our consumers and our customers, which include wholesale distributors, retailers, and on-premise locations. We conduct our business through entities we wholly own as well as through a variety of joint ventures and other entities.

Our internal management financial reporting consists of two business divisions: (i) Beer and (ii) Wine and Spirits and we report our operating results in three segments: (i) Beer, (ii) Wine and Spirits, and (iii) Corporate

| Constellation Brands, Inc. Q1 FY 2025 Form 10-Q |

#WORTHREACHINGFOR I 21

|

||||

| MD&A | |||||

Operations and Other. In the Beer segment, our portfolio consists of high-end imported beer brands and ABAs. We have an exclusive perpetual brand license to produce our Mexican beer portfolio and to import, market, and sell such portfolio in the U.S. In the Wine and Spirits segment, we sell a portfolio that includes higher-end wine brands complemented by certain higher-end spirits brands. Amounts included in the Corporate Operations and Other segment consist of costs of corporate development, corporate finance, corporate strategy, executive management, growth, human resources, internal audit, investor relations, IT, legal, and public relations, as well as our Canopy investment and investments made through our corporate venture capital function. All costs included in the Corporate Operations and Other segment are general costs that are applicable to the consolidated group and are, therefore, not allocated to the other reportable segments. All costs reported within the Corporate Operations and Other segment are not included in our CODM’s evaluation of the operating income (loss) performance of the other reportable segments. The business segments reflect how our operations are managed, how resources are allocated, how operating performance is evaluated by senior management, and the structure of our internal financial reporting.

Strategy

Business strategy

Our overall strategic vision is to consistently deliver industry-leading total stockholder returns over the long-term through a focus on these key pillars:

•continue building strong brands people love with advantaged routes to market;

•build a culture that is consumer-obsessed and leverages robust innovation capabilities to stay on the forefront of consumer trends;

•deploy capital in line with disciplined and balanced priorities;

•deliver on impactful ESG initiatives that we believe are not only good business, but also good for the world; and

•empower the whole enterprise to achieve best-in-class operational efficiency.

We will continue to strive for success by ensuring consumer-led decision making drives all aspects of our business; building a diverse talent pipeline with best-in-class people development; investing in infrastructure that supports and enables our business, including data systems and architecture; and exemplifying intentional and proactive fiscal management. We place focus on positioning our portfolio on higher-margin, higher-growth categories of the beverage alcohol industry to align with consumer-led premiumization, product, and purchasing trends, which we believe will continue to drive faster growth rates across beer, wine, and spirits. To continue capitalizing on consumer-led premiumization trends, become more competitive, and grow our business, we have employed a strategy dedicated to organic growth and supplemented by targeted investments and acquisitions. We also believe a key component to driving faster growth rates is to invest and strengthen our position within the DTC and 3-tier eCommerce channels. We believe our multi-year Digital Business Acceleration initiative will enable us to drive results by enhancing our technology capabilities in key areas. In Fiscal 2025, we continue to focus on end-to-end digital supply chain planning, logistics, and procurement, as well as introducing a new focus area, revenue growth management. Additionally, we believe our continued focus on maintaining a strong balance sheet provides a solid financial foundation to support our broader strategic initiatives.