10-K: Annual report pursuant to Section 13 and 15(d)

Published on April 23, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| (Mark One) | |||||

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended February 29 , 2024

or

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to

Commission file number 001-08495

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||||

(Address of principal executive offices) (Zip code)

Registrant’s telephone number, including area code (585 ) 678-7100

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||||||

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☒ | Accelerated filer | ☐ |

|||||||||

| Non-accelerated filer | ☐ |

Smaller reporting company | |||||||||

| Emerging growth company | |||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant, based upon the closing sales prices of the registrant’s Class A Common Stock and Class B Common Stock as reported on the New York Stock Exchange as of the last business day of the registrant’s most recently completed second fiscal quarter was $42.0 billion.

The number of shares outstanding with respect to each of the classes of common stock of Constellation Brands, Inc., as of April 16, 2024, is set forth below: | |||||

| Class | Number of Shares Outstanding | ||||

| Class A Common Stock, par value $.01 per share | |||||

| Class 1 Common Stock, par value $.01 per share | |||||

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement of Constellation Brands, Inc. to be issued for the 2024 Annual Meeting of Stockholders are incorporated by reference in Part III to the extent described therein.

TABLE OF CONTENTS

| Page | ||||||||

| FORWARD-LOOKING STATEMENTS | ||||||||

| DEFINED TERMS | ||||||||

| PART I | ||||||||

| Item 1. | Business | |||||||

| Item 1A. | Risk Factors | |||||||

| Item 1B. | Unresolved Staff Comments | NA | ||||||

| Item 1C. | Cybersecurity | |||||||

| Item 2. | Properties | |||||||

| Item 3. | Legal Proceedings | |||||||

| Item 4. | Mine Safety Disclosures | NA | ||||||

| PART II | ||||||||

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities |

|||||||

| Item 6. | [Reserved] | NA | ||||||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |||||||

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | |||||||

| Item 8. | Financial Statements and Supplementary Data | |||||||

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | NA | ||||||

| Item 9A. | Controls and Procedures | |||||||

| Item 9B. | Other Information | |||||||

| Item 9C. | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | NA | ||||||

| PART III | ||||||||

| Item 10. | Directors, Executive Officers, and Corporate Governance | |||||||

| Item 11. | Executive Compensation | |||||||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |||||||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | |||||||

| Item 14. | Principal Accountant Fees and Services | |||||||

| PART IV | ||||||||

| Item 15. | Exhibits and Financial Statement Schedules | |||||||

| Item 16. | Form 10-K Summary | |||||||

| INDEX TO EXHIBITS | ||||||||

| SIGNATURES | ||||||||

Market positions and industry data discussed in this Form 10-K are as of calendar 2023 and have been obtained or derived from industry and government publications and our estimates. The industry and government publications include: Beer Marketers Insights; Beverage Information Group; Impact Databank Review and Forecast; International Wine and Spirits Research (IWSR); Circana; Beer Institute; and National Alcohol Beverage Control Association. We have not independently verified the data from the industry and government publications. Unless otherwise noted, all references to market positions are based on U.S. dollar sales.

Forward-Looking Statements

This Form 10-K contains “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. These forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond our control, which could cause actual results to differ materially from those set forth in, or implied by, such forward-looking statements. All statements other than statements of historical fact included in this Form 10-K are forward-looking statements, including without limitation:

•The statements under Item 1. “Business” and Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” regarding:

◦our mission, core values, business strategy, strategic vision, growth plans, innovation and Digital Business Acceleration initiatives, NPDs, future operations, financial position, net sales, expenses, hedging programs, cost savings initiatives, capital expenditures, effective tax rates and anticipated tax liabilities, expected volume, inventory, supply and demand levels, balance, and trends, long-term financial model, access to capital markets, liquidity and capital resources, and prospects, plans, and objectives of management;

◦our beer expansion, optimization, and/or construction activities, including anticipated scope, capacity, costs, capital expenditures, and timeframes for completion;

◦the potential sale of the remaining assets at the Mexicali Brewery;

◦the anticipated availability of water, agricultural and other raw materials, and packaging materials;

◦our ESG strategy, sustainability initiatives, environmental stewardship targets, and human capital and DEI objectives and ambitions;

◦anticipated inflationary pressures, changing prices, and reductions in consumer discretionary income as well as other unfavorable global and regional economic conditions, and geopolitical events, and our responses thereto;

◦the potential impact to supply, production levels, and costs due to global supply chain disruptions and constraints, and shifting consumer behaviors;

◦expected or potential actions of third parties, including possible changes to laws, rules, and regulations;

◦the potential impact of climate-related severe weather events;

◦unfavorable trends in the wine market and for certain of our wine and spirits brands, the expected timeframes for improvement of such trends, and our associated actions to improve marketing execution and sales performance;

◦the availability of a supply chain finance program;

◦the manner, timing, and duration of the share repurchase program and source of funds for share repurchases;

◦the amount and timing of future dividends; and

◦our target net leverage ratio.

•The statements regarding the impacts of recent accounting pronouncements;

•The statements regarding our future accounting treatment for our investment in Canopy, including the expected gain related to the conversion of our Canopy common shares into Exchangeable Shares and exchange of the 2023 Canopy Promissory Note for Exchangeable Shares; and

•The statements regarding the future reclassification of net gains from AOCI.

When used in this Form 10-K, the words “anticipate,” “expect,” “intend,” “will,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. All forward-looking statements speak only as of the date of this Form 10-K. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. In addition to the risks and uncertainties of ordinary business operations and conditions in the general economy and markets in which we

Constellation Brands, Inc. FY 2024 Form 10-K |

#WORTHREACHINGFOR I i

|

||||

compete, our forward-looking statements contained in this Form 10-K are also subject to the risk, uncertainty, and possible variance from our current expectations regarding:

•water, agricultural and other raw material, and packaging material supply, production, and/or shipment difficulties which could adversely affect our ability to supply our customers;

•the ability to respond to anticipated inflationary pressures, including reductions in consumer discretionary income and our ability to pass along rising costs through increased selling prices;

•the actual impact to supply, production levels, and costs from global supply chain disruptions and constraints, transportation challenges (including from labor strikes or other labor activities), shifting consumer behaviors, wildfires, and severe weather events;

•reliance on complex information systems and third‐party global networks as well as risks associated with cybersecurity and AI;

•economic and other uncertainties associated with our international operations;

•dependence on limited facilities for production of our Mexican beer brands, including beer operations expansion, optimization, and/or construction activities, scope, capacity, supply, costs (including impairments), capital expenditures, and timing;

•results of the potential sale of the remaining assets at the Mexicali Brewery or obtaining other forms of recovery;

•operational disruptions or catastrophic loss to our breweries, wineries, other production facilities, or distribution systems;

•the impact of the military conflicts, geopolitical tensions, and responses, including on inflation, supply chains, commodities, energy, and cybersecurity;

•climate change, ESG regulatory compliance and failure to meet emissions, stewardship, and other ESG targets, objectives, or ambitions;

•reliance on wholesale distributors, major retailers, and government agencies;

•contamination and degradation of product quality from diseases, pests, weather, and other conditions;

•communicable disease outbreaks, pandemics, or other widespread public health crises and associated governmental containment actions;

•effects of employee labor activities that could increase our costs;

•a potential decline in the consumption of products we sell and our dependence on sales of our Mexican beer brands;

•impacts of our acquisition, divestiture, investment, and NPD strategies and activities;

•dependence upon our trademarks and proprietary rights, including the failure to protect our intellectual property rights;

•potential damage to our reputation;

•competition in our industry and for talent;

•our indebtedness and interest rate fluctuations;

•our international operations, worldwide and regional economic trends and financial market conditions, geopolitical uncertainty, or other governmental rules and regulations;

•class action or other litigation we may face;

•potential write-downs of our intangible assets, such as goodwill and trademarks;

•changes to tax laws, fluctuations in our effective tax rate, accounting for tax positions, the resolution of tax disputes, changes to accounting standards, elections, assertions, or policies, and the impact of a global minimum tax rate;

•the amount, timing, and source of funds for any share repurchases;

•the amount and timing of future dividends; and

•ownership of our Class A Stock by the Sands Family Stockholders and their Board of Director nomination rights as well as the choice-of-forum provision in our Amended and Restated By-laws.

For additional information about risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by our forward-looking statements contained in this Form 10-K are those described in Item 1A. “Risk Factors” and elsewhere in this Form 10-K and in our other filings with the SEC.

Constellation Brands, Inc. FY 2024 Form 10-K |

#WORTHREACHINGFOR I ii

|

||||

Defined Terms

Unless the context otherwise requires, the terms “Company,” “CBI,” “we,” “our,” or “us” refer to Constellation Brands, Inc. and its subsidiaries. We use terms in this Form 10-K and in our Notes that are specific to us or are abbreviations that may not be commonly known or used.

| Term | Meaning | ||||

| $ | U.S. dollars | ||||

| 3.20% February 2018 Senior Notes | $600.0 million principal amount of 3.20% senior notes issued in February 2018, partially tendered in May 2022, and fully redeemed in June 2022, prior to maturity | ||||

| 4.25% May 2013 Senior Notes | $1,050.0 million principal amount of 4.25% senior notes issued in May 2013, partially tendered in May 2022, and fully redeemed in June 2022, prior to maturity | ||||

| 2018 Authorization | authorization to repurchase up to $3.0 billion of our publicly traded common stock, approved by our Board of Directors in January 2018 and fully utilized during Fiscal 2023 |

||||

| 2021 Authorization | authorization to repurchase up to $2.0 billion of our publicly traded common stock, approved by our Board of Directors in January 2021 |

||||

| 2022 Credit Agreement | tenth amended and restated credit agreement, dated as of April 14, 2022, provides for an aggregate revolving credit facility of $2.25 billion | ||||

| 2022 Restatement Agreement | restatement agreement, dated as of April 14, 2022, that amended and restated our ninth amended and restated credit agreement, dated as of March 26, 2020, which was our then-existing senior credit facility as of February 28, 2022 |

||||

2023 Authorization |

authorization to repurchase up to $2.0 billion of our publicly traded common stock, approved by our Board of Directors in November 2023 |

||||

| 2023 Canopy Promissory Note | C$100.0 million principal amount of 4.25% promissory note issued to us by Canopy in April 2023, exchanged for Exchangeable Shares in April 2024 |

||||

| 3-tier | distribution channel where products are sold to a distributor (wholesaler) who then sells to a retailer; the retailer sells the products to a consumer |

||||

| 3-tier eCommerce | digital commerce experience for consumers to purchase beverage alcohol from retailers | ||||

| ABA | alternative beverage alcohol | ||||

| Administrative Agent | Bank of America, N.A., as administrative agent for the senior credit facility and term loan credit agreements |

||||

| AI | artificial intelligence | ||||

| Amended and Restated By-Laws | our amended and restated by-laws |

||||

| Amended and Restated Charter | our amended and restated certificate of incorporation |

||||

| AOCI | accumulated other comprehensive income (loss) | ||||

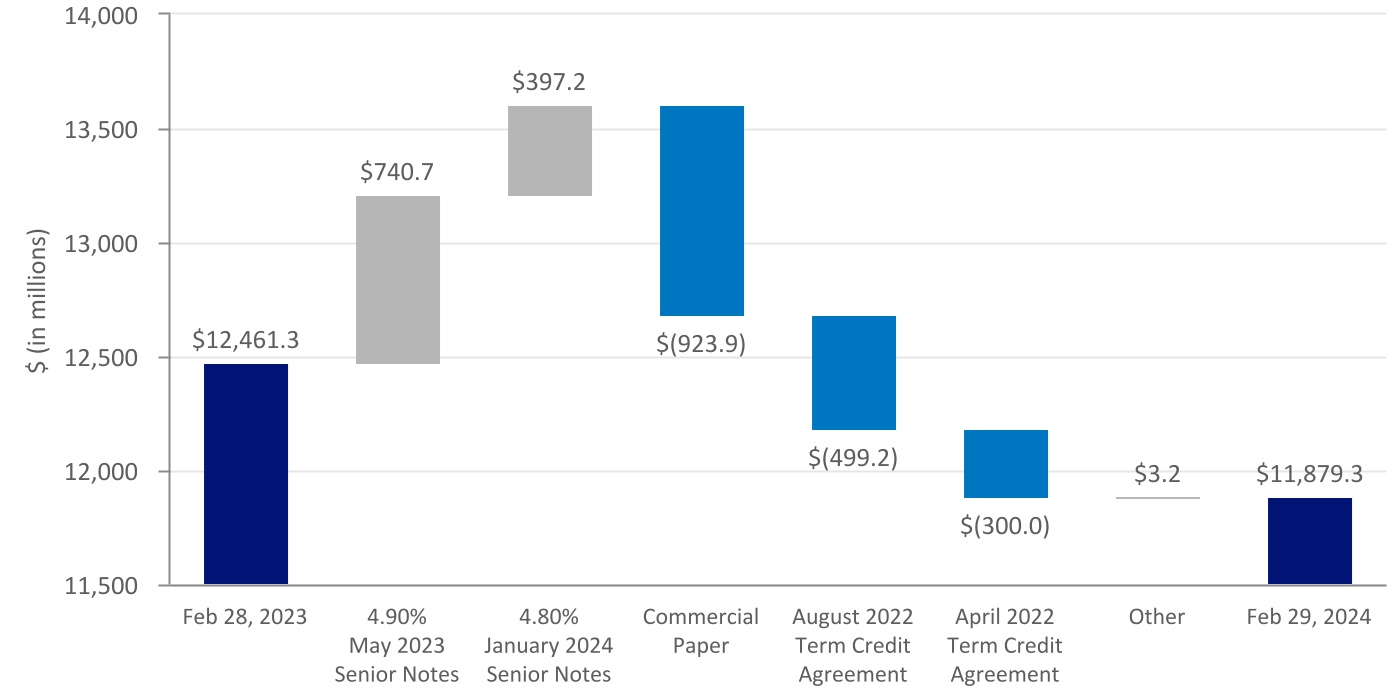

| April 2022 Term Credit Agreement | amended and restated term loan credit agreement, dated as of March 26, 2020, that provided for aggregate facilities of $491.3 million, consisting of a five-year term loan facility, inclusive of amendments dated as of June 10, 2021, and April 14, 2022, now repaid in full |

||||

| August 2022 Term Credit Agreement | term loan credit agreement, dated as of August 9, 2022, that provided for a $1.0 billion unsecured delayed draw three-year term loan facility, now repaid in full |

||||

| Austin Cocktails | we made an initial investment in the Austin Cocktails business and subsequently acquired the remaining ownership interest | ||||

| BioSteel | BioSteel Sports Nutrition Inc., formerly a subsidiary of Canopy | ||||

| BRG(s) | business resource group(s) | ||||

| C$ | Canadian dollars | ||||

California |

the state of California (U.S.) unless otherwise specified |

||||

| Canopy | Canopy Growth Corporation, an Ontario, Canada-based public company in which we have an investment |

||||

Constellation Brands, Inc. FY 2024 Form 10-K |

#WORTHREACHINGFOR I iii

|

||||

| Term | Meaning | ||||

| Canopy Amendment | an amendment to Canopy’s share capital which created Exchangeable Shares and provided for the conversion of Canopy common shares into Exchangeable Shares on a one-for-one basis at any time and at the option of the holder of such shares |

||||

| Canopy Debt Securities | debt securities issued by Canopy in June 2018, no longer outstanding |

||||

| Canopy Equity Method Investment | an investment in Canopy common shares, no longer applicable following conversion of Canopy common shares into Exchangeable Shares in April 2024 |

||||

Canopy Transaction |

corporate transaction by Canopy, including the creation of Exchangeable Shares, designed to accelerate its entry into the U.S. cannabis market |

||||

CB International |

CB International Finance S.à r.l., a wholly-owned subsidiary of ours |

||||

CDIO |

Chief Data and Information Officer |

||||

CISO |

Chief Information Security Officer |

||||

| Class 1 Stock | our Class 1 Convertible Common Stock, par value $0.01 per share | ||||

| Class A Stock | our Class A Common Stock, par value $0.01 per share | ||||

| Class B Stock | our Class B Convertible Common Stock, par value $0.01 per share, eliminated on November 10, 2022, pursuant to the Reclassification | ||||

CMP |

crisis management plan | ||||

| CODM | chief operating decision maker, our President and Chief Executive Officer |

||||

| Comparable Adjustments | certain items affecting comparability that have been excluded by management | ||||

| Consent Agreement | an agreement between Canopy and (i) Greenstar Canada Investment Limited Partnership and (ii) CBG Holdings LLC, our indirect, wholly-owned subsidiaries | ||||

| CPG | consumer packaged goods | ||||

Craft Beer Divestitures |

the Four Corners Divestiture and the Funky Buddha Divestiture, collectively |

||||

| Crown | Crown Imports LLC, a wholly-owned subsidiary of ours | ||||

| CSR | corporate social responsibility | ||||

| current Mexican breweries | the Nava Brewery and the Obregon Brewery, collectively | ||||

| Daleville Facility | production facility located in Roanoke, Virginia, sold May 2023 |

||||

| DEI | diversity, equity, and inclusion | ||||

| Depletions | represent U.S. distributor shipments of our respective branded products to retail customers, based on third-party data |

||||

| DGCL | General Corporation Law of the State of Delaware | ||||

| Digital Business Acceleration | a multi-year initiative by the Company to create a cohesive digital strategy and build an advanced digital business |

||||

Domaine Curry |

Domaine Curry wine business, acquired by us |

||||

| DTC | direct-to-consumer inclusive of (i) a digital commerce experience for consumers to purchase directly from brand websites with inventory coming straight from the supplier and (ii) consumer purchases at hospitality locations (tasting rooms and tap rooms) from the supplier | ||||

| Effective Time | the time that the Amended and Restated Charter was duly filed with the Secretary of State of the State of Delaware on November 10, 2022 | ||||

| EHS | environmental, health, and safety |

||||

| Employee Stock Purchase Plan | the Company’s 1989 Employee Stock Purchase Plan, under which 9,000,000 shares of Class A Stock may be issued | ||||

ERM |

enterprise risk management |

||||

| ESG | environmental, social, and governance | ||||

| Exchangeable Shares | new class of non-voting and non-participating exchangeable shares in Canopy which are convertible into common shares of Canopy on a one-for-one basis |

||||

| Exchange Act | Securities Exchange Act of 1934, as amended | ||||

| FASB | Financial Accounting Standards Board | ||||

| February 2023 Senior Notes | $500.0 million aggregate principal amount of senior notes issued in February 2023 | ||||

| Financial Statements | our consolidated financial statements and notes thereto included herein |

||||

Constellation Brands, Inc. FY 2024 Form 10-K |

#WORTHREACHINGFOR I iv

|

||||

| Term | Meaning | ||||

Fiscal 2021 |

the Company’s fiscal year ended February 28, 2021 |

||||

Fiscal 2022 |

the Company’s fiscal year ended February 28, 2022 |

||||

Fiscal 2023 |

the Company’s fiscal year ended February 28, 2023 |

||||

Fiscal 2024 |

the Company’s fiscal year ended February 29, 2024 |

||||

Fiscal 2025 |

the Company’s fiscal year ending February 28, 2025 |

||||

Fiscal 2026 |

the Company’s fiscal year ending February 28, 2026 |

||||

Fiscal 2027 |

the Company’s fiscal year ending February 28, 2027 |

||||

Fiscal 2028 |

the Company’s fiscal year ending February 29, 2028 |

||||

Fiscal 2029 |

the Company’s fiscal year ending February 28, 2029 |

||||

| Form 10-K | this Annual Report on Form 10-K for Fiscal 2024 unless otherwise specified |

||||

Four Corners Divestiture |

sale of the Four Corners craft beer business |

||||

Funky Buddha Divestiture |

sale of the Funky Buddha craft beer business |

||||

| GHG | greenhouse gas | ||||

| GILTI | global intangible low-taxed income | ||||

| Glass Plant | glass production plant in Nava operated through an equally-owned joint venture with Owens-Illinois | ||||

| IRA | Inflation Reduction Act of 2022 |

||||

IRP |

IT incident response plan | ||||

| IT | information technology | ||||

January 2024 Senior Notes |

$400.0 million aggregate principal amount of senior notes issued in January 2024 |

||||

| June 2021 Term Credit Agreement | amended and restated term loan credit agreement, dated as of March 26, 2020, inclusive of amendment dated as of June 10, 2021 |

||||

| Lender | Bank of America, N.A., as lender for the April 2022 Term Credit Agreement | ||||

| LIBOR | London Interbank Offered Rate | ||||

| Lingua Franca | Lingua Franca wine business, acquired by us |

||||

| Long-Term Stock Incentive Plan | a stockholder-approved omnibus incentive plan that provides the ability to grant various types of equity and cash awards to eligible plan participants | ||||

| May 2023 Senior Notes | $750.0 million aggregate principal amount of senior notes issued in May 2023 |

||||

| MD&A | Management’s Discussion and Analysis of Financial Condition and Results of Operations under Part II — Item 7. of this Form 10-K | ||||

Mexicali Brewery |

canceled brewery construction project located in Mexicali, Baja California, Mexico |

||||

| Mexico Beer Projects | expansion, optimization, and/or construction activities at the Obregon Brewery, Nava Brewery, and Veracruz Brewery | ||||

| M&T | Manufacturers and Traders Trust Company | ||||

| My Favorite Neighbor | we made an initial investment in the My Favorite Neighbor wine business and subsequently acquired the remaining ownership interest |

||||

| NA | not applicable | ||||

| Nava | Nava, Coahuila, Mexico | ||||

| Nava Brewery | brewery located in Nava | ||||

| Net sales | gross sales less promotions, returns and allowances, and excise taxes | ||||

| NM | not meaningful | ||||

| Note(s) | notes to the consolidated financial statements under Item 8. of this Form 10-K | ||||

| November 2018 Canopy Warrants | warrants acquired in November 2018 which gave us the option to purchase common shares of Canopy, now expired |

||||

| NPD | new product development | ||||

| Obregon | Obregon, Sonora, Mexico |

||||

Obregon Brewery |

brewery located in Obregon |

||||

| OCI | other comprehensive income (loss) | ||||

Constellation Brands, Inc. FY 2024 Form 10-K |

#WORTHREACHINGFOR I v

|

||||

| Term | Meaning | ||||

October 2022 Credit Agreement Amendment |

amendment dated as of October 18, 2022, to the 2022 Credit Agreement | ||||

OECD |

Organization for Economic Cooperation and Development |

||||

| Owens-Illinois | O-I Glass, Inc., the ultimate parent of the company with which we have an equally-owned joint venture to operate the Glass Plant | ||||

| Pre-issuance hedge contracts | treasury lock and/or swap lock contracts designated as cash flow hedges entered into to hedge treasury rate volatility on future debt issuances | ||||

| Proxy Statement | Proxy Statement for Fiscal 2024 to be issued in connection with the 2024 Annual Meeting of Stockholders of our Company |

||||

Purple-team Tests |

testing involving collaboration between offensive and defensive cybersecurity teams |

||||

| Reclassification | the reclassification, exchange, and conversion of the Company’s common stock to eliminate the Class B Stock pursuant to the terms and conditions of the Reclassification Agreement |

||||

| Reclassification Agreement | reclassification agreement in support of the Reclassification, dated June 30, 2022, among the Company and the Sands Family Stockholders |

||||

| Registration Rights Agreement | Registration Rights Agreement, dated as of November 10, 2022, by and among the Company and the Sands Family Stockholders | ||||

Registration Statement on Form S-4 |

our Registration Statement on Form S-4, including our proxy statement/prospectus, in connection with the Reclassification declared effective by the SEC on September 21, 2022 | ||||

| RTD | ready-to-drink | ||||

| Sands Family Stockholders | RES Master LLC, RES Business Holdings LP, SER Business Holdings LP, RHT 2015 Business Holdings LP, RSS Master LLC, RSS Business Holdings LP, SSR Business Holdings LP, RSS 2015 Business Holdings LP, RCT 2015 Business Holdings LP, RCT 2020 Investments LLC, NSDT 2009 STZ LLC, NSDT 2011 STZ LLC, RSS Business Management LLC, SSR Business Management LLC, LES Lauren Holdings LLC, MES Mackenzie Holdings LLC, Abigail Bennett, Zachary Stern, A&Z 2015 Business Holdings LP (subsequently liquidated), Marilyn Sands Master Trust, MAS Business Holdings LP, Sands Family Foundation, Richard Sands, Robert Sands, WildStar, Astra Legacy LLC, AJB Business Holdings LP, and ZMSS Business Holdings LP |

||||

| Scope 1 | direct GHG emissions from sources that are owned or controlled by a company, such as emissions associated with furnaces or vehicles |

||||

| Scope 2 | indirect GHG emissions associated with the purchase of electricity, steam, heat, or cooling |

||||

| SEC | Securities and Exchange Commission | ||||

| Securities Act | Securities Act of 1933, as amended | ||||

| SKU | stock-keeping unit, a scannable bar code, most often seen printed on product labels in a retail store | ||||

SOFR |

secured overnight financing rate administered by the Federal Reserve Bank of New York | ||||

| Specified Time | such time as the domestic sale of marijuana could not reasonably be expected to violate the Controlled Substances Act, the Civil Asset Forfeiture Reform Act (as it relates to violation of the Controlled Substances Act), and all related applicable anti-money laundering laws | ||||

| U.S. | United States of America | ||||

| U.S. GAAP | generally accepted accounting principles in the U.S. | ||||

| Veracruz | Heroica Veracruz, Veracruz, Mexico | ||||

| Veracruz Brewery | a new brewery being constructed in Veracruz | ||||

| WildStar | WildStar Partners LLC |

||||

Wine Divestiture |

sale of certain mainstream and premium wine brands and related inventory |

||||

Constellation Brands, Inc. FY 2024 Form 10-K |

#WORTHREACHINGFOR I vi

|

||||

| PART I | ITEM 1. BUSINESS | Table of Contents |

||||||

Item 1. Business

Introduction

We are an international producer and marketer of beer, wine, and spirits with operations in the U.S., Mexico, New Zealand, and Italy with powerful, consumer-connected, high-quality brands like Corona Extra, Modelo Especial, Robert Mondavi Winery, Kim Crawford, Meiomi, The Prisoner Wine Company, High West, Casa Noble, and Mi CAMPO. In the U.S., we are one of the top growth contributors at retail among beverage alcohol suppliers. We are the second-largest beer company in the U.S. and continue to strengthen our leadership position as the #1 share gainer in the high-end beer segment and the overall U.S. beer market. In Fiscal 2024, Modelo Especial became the #1 beer brand in the U.S. beer market in dollar sales. Within wine and spirits, we have reshaped our brand portfolio to a higher-end focused business and continue to expand our supply channels through DTC and international markets. The strength of our brands makes us a supplier of choice to many of our consumers and our customers, which include wholesale distributors, retailers, and on-premise locations. We conduct our business through entities we wholly own as well as through a variety of joint ventures and other entities.

Our mission is to build brands that people love because we believe elevating human connections is Worth Reaching For. It is worth our dedication, hard work, and calculated risks to anticipate market trends and deliver more for our consumers, shareholders, employees, and industry. This dedication is what has driven us to become one of the fastest-growing, large CPG companies in the U.S. at retail. Our core values guide our pursuits:

People

True strength is achieved when everyone has a voice. That is why we build our culture on a foundation that encourages inclusion and diversity in background and thought and aspire to foster an environment where everyone feels empowered to bring their true selves and different points of view to the workplace to drive us forward

Customers

We work relentlessly to anticipate what consumers want today, tomorrow, and well into the future

Entrepreneurship

As an industry leader, we act with a bold, calculated approach to realize our vision and unlock new growth opportunities

Quality

Our promise is to pursue quality in our processes and products by continuously seeking to enhance what we do and how we do it

Integrity

It is about more than achieving goals. How we achieve them is also important. We aspire to act with high moral and ethical standards and always do the right thing, even when it is the hard thing

Headquartered in Victor, New York, through May 2024 and in Rochester, New York thereafter, we are a Delaware corporation incorporated in 1972, as the successor to a business founded in 1945.

Strategy

Our overall strategic vision is to consistently deliver industry-leading total stockholder returns over the long-term through a focus on these key pillars:

•continue building strong brands people love with advantaged routes to market;

•build a culture that is consumer-obsessed and leverages robust innovation capabilities to stay on the forefront of consumer trends;

•deploy capital in line with disciplined and balanced priorities;

•deliver on impactful ESG initiatives that we believe are not only good business, but also good for the world; and

•empower the whole enterprise to achieve best-in-class operational efficiency.

Constellation Brands, Inc. FY 2024 Form 10-K |

#WORTHREACHINGFOR I 1

|

||||

| PART I | ITEM 1. BUSINESS | Table of Contents |

||||||

We will continue to strive for success by ensuring consumer-led decision making drives all aspects of our business; building a diverse talent pipeline with best-in-class people development; investing in infrastructure that supports and enables our business, including data systems and architecture; and exemplifying intentional and proactive fiscal management. We place focus on positioning our portfolio on higher-margin, higher-growth categories of the beverage alcohol industry to align with consumer-led premiumization, product, and purchasing trends, which we believe will continue to drive faster growth rates across beer, wine, and spirits. To continue capitalizing on consumer-led premiumization trends, become more competitive, and grow our business, we have employed a strategy dedicated to organic growth and supplemented by targeted investments and acquisitions. We also believe a key component to driving faster growth rates is to invest and strengthen our position within the DTC and 3-tier eCommerce channels. We have launched a multi-year Digital Business Acceleration initiative, which we believe will enable us to drive results by enhancing our technology capabilities in key areas. In Fiscal 2024, we continued to focus on procurement, end-to-end supply chain planning, as well as introducing a new focus area, logistics. We believe our continued focus on maintaining a strong balance sheet provides a solid financial foundation to support our broader strategic initiatives. As a result of this strategy, we have realized impacts on each segment of our business.

In our beer business, we focus on upholding our leadership position in the U.S. beer market, including the high-end segment, and continuing to grow our high-end imported beer brands through maintenance of leading margins, enhancements to our results of operations and operating cash flow, and exploring new avenues for growth. This includes continued focus on growing our beer portfolio in the U.S. through expanding distribution for key brands, including within the 3-tier eCommerce channel, as well as investing in the next increment of modular capacity additions required to sustain our momentum. We continue to focus on consumer-led innovation by creating new line extensions behind celebrated, trusted brands and package formats, as well as new to world brands, that are intended to meet emerging needs.

In our wine and spirits business, we continue to focus on higher-end brands, improving margins, and creating operating efficiencies. We have reshaped our portfolio primarily through an enhanced focus on higher-margin, higher-growth wine and spirits brands. Our business is organized into two distinct commercial teams, one focused on our fine wine and craft spirits brands and the other focused on our mainstream and premium brands. While each team has its own distinct strategy, both remain aligned to the goal of accelerating performance by growing organic net sales and expanding margins. In addition, we are advancing our aim to become a global, omni-channel competitor in line with consumer preferences. Our business continues to progressively expand into DTC channels (including hospitality), 3-tier eCommerce, and international markets, while remaining a major supplier in U.S. 3-tier brick-and-mortar distribution.

For further information on our strategy, see “Overview” within MD&A.

Divestitures, acquisitions, and investments

In connection with executing our strategy as outlined above, during Fiscal 2024 we completed the following transactions:

| Date | Strategic Contribution | ||||||||||||||||

| Beer segment | |||||||||||||||||

|

Craft Beer Divestitures |

June

2023

|

Divestitures of the Four Corners and Funky Buddha craft beer businesses; supported our focus on continuing to grow our high-end imported beer brands. |

||||||||||||||

|

Daleville Facility |

May

2023

|

Sale of the Daleville Facility in connection with our decision to exit the craft beer business; supported our focus on continuing to grow our high-end imported beer brands. |

||||||||||||||

| Wine and Spirits segment | |||||||||||||||||

|

Domaine Curry |

June

2023

|

Acquisition of a luxury Napa Valley wine business; supported our focus on consumer-led premiumization trends and meeting the evolving needs of consumers. |

||||||||||||||

Constellation Brands, Inc. FY 2024 Form 10-K |

#WORTHREACHINGFOR I 2

|

||||

| PART I | ITEM 1. BUSINESS | Table of Contents |

||||||

For further information about our significant Fiscal 2024, Fiscal 2023, and Fiscal 2022 transactions, refer to (i) “Overview” within MD&A and (ii) Note 2.

Business segments

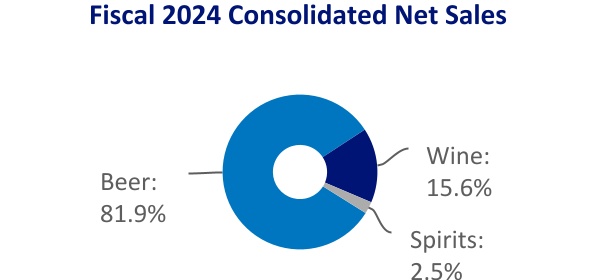

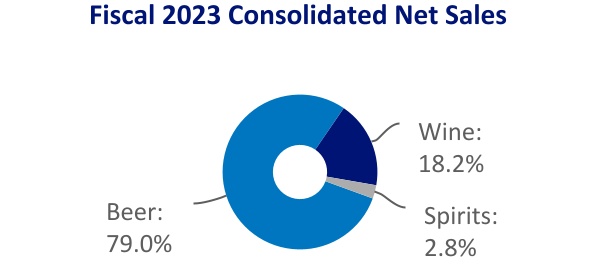

We report our operating results in three segments: (i) Beer, (ii) Wine and Spirits, and (iii) Corporate Operations and Other. The business segments reflect how our operations are managed, how resources are allocated, how operating performance is evaluated by senior management, and the structure of our internal financial reporting.

We report net sales in two reportable segments, as follows:

| For the Years Ended | |||||||||||

| February 29, 2024 |

February 28, 2023 |

||||||||||

| (in millions) | |||||||||||

| Beer | $ | 8,162.6 | $ | 7,465.0 | |||||||

| Wine and Spirits: | |||||||||||

| Wine | 1,552.1 | 1,722.7 | |||||||||

| Spirits | 247.1 | 264.9 | |||||||||

| Total Wine and Spirits | 1,799.2 | 1,987.6 | |||||||||

| Consolidated Net Sales | $ | 9,961.8 | $ | 9,452.6 | |||||||

Beer segment

We are the #1 brewer and seller of imported beer in the U.S. market. We are also the leader in the high-end segment of the U.S. beer market, which includes the imported and ABA categories. We have the exclusive right to import, market, and sell our Mexican beer brands in all 50 states of the U.S., of which include the following:

| Corona Brand Family | Modelo Brand Family | Victoria Brand Family | Other Import Brand | ||||||||||||||||||||

Corona Extra |

Corona Non-Alcoholic |

Modelo Especial |

Victoria | Pacifico |

|||||||||||||||||||

Corona Familiar |

Corona Premier |

Modelo Chelada |

Vicky Chamoy | ||||||||||||||||||||

Corona Hard Seltzer |

Corona Refresca |

Modelo Negra |

|||||||||||||||||||||

Corona Light |

Modelo Oro |

||||||||||||||||||||||

Notable achievements in the U.S. include the following: (i) we have 7 of the top 15 share gaining brands across the total beer category, (ii) Modelo Especial is the best-selling beer overall, (iii) Corona Extra is the second largest imported beer and fifth best-selling beer overall, and (iv) Pacifico and Corona Familiar are tied for the fastest growing major imported beer brand.

Constellation Brands, Inc. FY 2024 Form 10-K |

#WORTHREACHINGFOR I 3

|

||||

| PART I | ITEM 1. BUSINESS | Table of Contents |

||||||

During Fiscal 2024, we spent over $900 million on (i) the completion of planned expansions and execution of optimization initiatives, increasing total capacity in Mexico from approximately 42 million hectoliters to approximately 48 million hectoliters, and (ii) ongoing construction of the Veracruz Brewery. Expansion, optimization, and/or construction activities continue at our breweries in Mexico to support expected future business needs. We expect to spend approximately $3 billion over Fiscal 2025 through Fiscal 2028 on such activities. We believe these investments allow us the opportunity to further expand our leadership position in the high-end segment of the U.S. beer market. For further information about our Mexico Beer Projects, refer to (i) “Production” below, (ii) MD&A, and (iii) Note 5.

We are also building on the success of our leading import brand families through our innovation strategy. For example, our Modelo Chelada brands have become an important growth contributor to our portfolio as the leading chelada in the U.S. beer market. In Fiscal 2024, we continued to build on our successful innovation platform with the launch of new products aligned with consumer-led premiumization, betterment, and flavor trends, including: (i) Modelo Oro, a light and lower-calorie Mexican beer, (ii) Modelo Chelada Sandía Picante, a watermelon and chile pepper michelada-style beer, (iii) Modelo Chelada Variety Pack, a 12 ounce, 12-pack format offering of certain of our chelada flavors, and (iv) Corona Non-Alcoholic. Additionally, we announced the following products will be launched across select markets in Fiscal 2025: (i) Modelo Spiked Aguas Frescas, a blend of real fruit juice with a light spike inspired by the classic aguas frescas from Mexico, (ii) Corona Sunbrew, a beer brewed with real citrus peels and a splash of real citrus juice, and (iii) two new Modelo Chelada flavors, Fresa Picante and Negra con Chile.

Wine and Spirits segment

We are a major, higher-end wine and spirits company in the U.S. market, with a portfolio that includes higher-margin, higher-growth wine and spirits brands. Our wine portfolio is supported by grapes purchased from independent growers, primarily in the U.S. and New Zealand, and vineyard holdings in the U.S., New Zealand, and Italy. Our wine and spirits are primarily marketed in the U.S. and also sold in Canada, New Zealand, and other major world markets.

In the U.S., we have 7 of the 100 top-selling higher-end wine brands, with Meiomi and Kim Crawford achieving the 4th and 10th spots, respectively. Some of our well-known wine and spirits brands and portfolio of brands include:

| Wine Brands | Wine Portfolio of Brands | Spirits Brands | ||||||||||||||||||

Cook’s California Champagne |

Mount Veeder |

My Favorite Neighbor |

Casa Noble |

Mi CAMPO |

||||||||||||||||

Kim Crawford |

Ruffino |

Robert Mondavi Winery |

Copper & Kings |

Nelson’s Green Brier |

||||||||||||||||

Meiomi |

SIMI |

Schrader |

High West |

SVEDKA |

||||||||||||||||

The Prisoner Wine Company |

||||||||||||||||||||

In Fiscal 2024, the broader wine category experienced deceleration in both the U.S. wholesale and international markets, and, as a result, our largest mainstream and premium brands experienced a decline. We believe this deceleration is temporary. Despite this dynamic, our fine wine and craft spirits portfolio delivered

Constellation Brands, Inc. FY 2024 Form 10-K |

#WORTHREACHINGFOR I 4

|

||||

| PART I | ITEM 1. BUSINESS | Table of Contents |

||||||

muted gains and we achieved growth in DTC channels. Additionally, we have been actively working to address mainstream headwinds affecting our two largest volume brands, Woodbridge and SVEDKA, and anticipate these efforts to extend over the medium-term. We continue to believe that over the medium-term our wine and spirits business will return to net sales growth supported by the transformation undertaken over the last few years to better align our portfolio with broader consumer-led premiumization trends, expand our omni-channel capabilities, and extend into select international markets.

Over the last few years, we have been increasing our development of on-trend product innovation as we believe this is one of the key drivers of growth within the wine and spirits category. Our innovation strategy has evolved to introducing fewer new items which we believe will have the most success for our business. We focus our resources on brand line extensions aligned with consumer-led premiumization and betterment trends that have remained among the top new products in the wine category over the past couple of years, such as: Meiomi Red Blend, Meiomi Bright Pinot Noir, and Kim Crawford Prosecco.

Corporate Operations and Other segment

The Corporate Operations and Other segment includes traditional corporate-related items including costs of corporate development, corporate finance, corporate strategy, executive management, growth, human resources, internal audit, investor relations, IT, legal, and public relations, as well as our Canopy investment and investments made through our corporate venture capital function.

For further information regarding net sales and operating income (loss) of our business segments and geographic areas, refer to (i) MD&A and (ii) Note 22.

Marketing and distribution

To focus on their respective product categories, build brand equity, and increase sales, we employ full-time, in-house marketing, sales, and customer service functions for our (i) Beer and (ii) Wine and Spirits segments. These functions engage in a range of marketing activities and strategies, including market research, consumer and trade advertising, price promotions, point-of-sale materials, event sponsorship, on-premise activations, and public relations.

When we advertise our products to consumers, we use a combination of methods to forecast the number of advertising impressions made on individuals at or above the legal drinking age. Through our media placement agencies, we leverage recognized audience measurement services such as Nielsen and ComScore to measure audience composition data on a regular and frequent basis. This data helps us to ensure that our advertising placements are purchased in media outlets and audience buying platforms (i.e., programmatic digital buys) that are primarily targeted toward legal drinking age consumers and, when appropriate, specifically targeted to audiences that are age-verified as of the legal drinking age. Our Global Code of Responsible Practices for Beverage Alcohol Advertising and Marketing provides the fundamental framework for responsible brand advertising and marketing that helps ensure our messages are directed at legal drinking age consumers.

We are a corporate member of Responsibility.org, a national not-for-profit that aims to empower adults to make a lifetime of responsible alcohol choices. As part of our efforts to promote responsible beverage alcohol consumption, our brand websites redirect a visitor who self-identifies as being under the legal drinking age to Responsibility.org for information on prevention of underage drinking, ending drunk driving, and drinking responsibly.

In Fiscal 2024, we had zero:

•instances of non-compliance with industry or regulatory labeling and/or marketing codes; and

•monetary losses as a result of legal proceedings associated with marketing and/or labeling practice.

In the U.S., our products are primarily distributed by wholesale distributors, and we generally use separate distribution networks for (i) our beer portfolio and (ii) our wine and spirits portfolio. In addition, in states where the government acts as the distributor, we distribute our products through state alcohol beverage control agencies, which set the retail prices of our products. As is the case with all other beverage alcohol companies,

Constellation Brands, Inc. FY 2024 Form 10-K |

#WORTHREACHINGFOR I 5

|

||||

| PART I | ITEM 1. BUSINESS | Table of Contents |

||||||

products sold through these agencies are subject to obtaining and maintaining listings to sell our products in that agency’s state. State governments can also affect prices paid by consumers for our products through the imposition of taxes.

Trademarks and distribution agreements

Trademarks are an important aspect of our business. We sell products under a number of trademarks, which we own or use under license. We also have various licenses and distribution agreements for the sale, or the production and sale, of our products and products of others. These licenses and distribution agreements have varying terms and durations.

Within the Beer segment, we have an exclusive sub-license to use trademarks related to our Mexican beer brands in the U.S. This sub-license agreement is perpetual.

Competition

The beverage alcohol industry is highly competitive. We compete on the basis of quality, price, brand recognition and reputation, and distribution strength. Our beverage alcohol products compete with other alcoholic and non-alcoholic beverages for consumer purchases, as well as shelf space in retail stores, restaurant presence, and wholesaler attention. We compete with numerous multinational producers and distributors of beverage alcohol products, some of which have greater resources than we do. Our principal competitors include:

| Beer | Anheuser-Busch InBev, The Boston Beer Company, Heineken, Mark Anthony, Molson Coors | ||||

| Wine | Deutsch Family Wine & Spirits, Duckhorn Portfolio, E. & J. Gallo Winery, Ste. Michelle Wine Estates, Treasury Wine Estates, Trinchero Family Estates, The Wine Group | ||||

| Spirits | Bacardi USA, Beam Suntory, Brown-Forman, Diageo, E. & J. Gallo Winery, Fifth Generation, Pernod Ricard, Sazerac Company |

||||

Production

As of February 29, 2024, our production capacity at our Mexican breweries was approximately 48 million hectoliters. By the end of Fiscal 2028, we expect to increase our capacity in Mexico to approximately 65 million hectoliters to support the growth of our high-end beer brands through continued expansion, optimization, and/or construction activities at our Mexican breweries. For further information on these expansion, optimization, and/or construction activities, refer to (i) MD&A and (ii) Note 5.

In the U.S., we operate 12 wineries using many varieties of grapes grown principally in the Napa, Sonoma, Monterey, and San Joaquin regions of California as well as the Willamette Valley region of Oregon. We also operate two wineries in New Zealand and five wineries in Italy. Grapes are normally harvested and crushed in August through November in the U.S. and Italy, and in February through May in New Zealand and stored as wine until packaged for sale under our brand names or sold in bulk. The inventories of wine are usually at their highest levels during and after the crush of each year’s grape harvest and are reduced as sold throughout the year.

We currently operate five distilleries in the U.S. for the production of our spirits: two facilities for High West whiskey and one facility each for Copper & Kings American brandies, Nelson’s Green Brier bourbon and whiskey products, and Austin Cocktails RTDs. The requirements for agricultural products, neutral grain spirits, and bulk spirits used in the production of our spirits are purchased from various suppliers.

Certain of our wines and spirits must be aged for multiple years. Therefore, our inventories of wines and spirits may be larger in relation to sales and total assets than in many other businesses.

Constellation Brands, Inc. FY 2024 Form 10-K |

#WORTHREACHINGFOR I 6

|

||||

| PART I | ITEM 1. BUSINESS | Table of Contents |

||||||

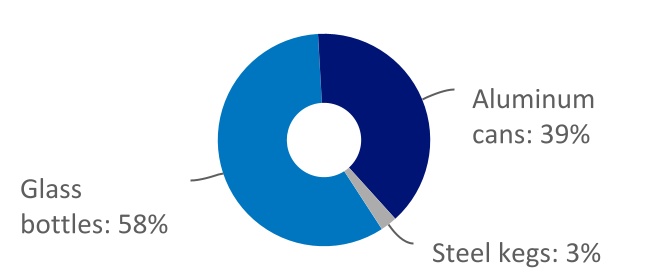

Resources and availability of production materials

The principal components in the production of our Mexican beer brands include water; agricultural products, such as yeast and grains; and packaging materials, which include glass, aluminum, and cardboard.

For our Mexican beer brands, packaging materials are the largest cost component of production, with glass bottles representing the largest cost component of our packaging materials. We aim to reduce operational waste and enhance our use of returnable, recyclable, or renewable packaging. In Fiscal 2024, we transitioned from hi-cone plastic rings to recyclable paperboard for all applicable 4-pack and 6-pack SKUs across our beer portfolio. Additionally, our current Mexican breweries are in the process of being evaluated for TRUE Certification for Zero Waste.

For Fiscal 2024, the package format mix of our Mexican beer volume sold in the U.S. was as follows:

As part of our long-term beer glass sourcing strategy, we are a partner in an equally-owned joint venture with Owens-Illinois, one of the leading manufacturers of glass containers in the world. The joint venture owns a state-of-the-art Glass Plant adjacent to our Nava Brewery in Mexico. The Glass Plant supplies nearly 60% of the total annual glass bottle supply for our Mexican beer brands. We also have long-term glass supply agreements with other glass producers.

The current Mexican breweries each receive water originating from separate and distinct aquifers. We believe we have adequate access to water to support these breweries’ ongoing requirements, as well as future requirements after the completion of planned expansion, optimization, and/or construction activities at our breweries. These breweries employ comprehensive water management practices that focus on water efficiency and wastewater treatment operations to reuse water consumed as part of the production process.

The principal components in the production of our wine and spirits products are agricultural products, such as grapes and grain, and packaging materials, primarily glass.

Most of our annual grape requirements are satisfied by grower purchases from each year’s harvest. We receive grapes from approximately 430 independent growers located in the U.S. and 40 independent growers in New Zealand and Italy. We enter into purchase agreements with a majority of these growers with pricing that generally varies year-to-year and is largely based on then-current market prices.

As of February 29, 2024, we owned or leased approximately 18,200 acres of land and vineyards, either fully bearing or under development, in the U.S., New Zealand, and Italy. This acreage supplies only a small percentage of our overall total grape needs for wine production. However, most of this acreage is used to supply a large portion of the grapes used for the production of certain of our higher-end wines. We continue to consider the purchase or lease of additional vineyards, and additional land for vineyard plantings, to supplement our grape supply.

All of our owned and leased vineyards in California routinely adhere to documented water management plans as required by Sustainable Grape Growing Certifications including the California Sustainable Winegrowing Alliance and Fish Friendly Farming. We use the guidance of these plans to identify the designated beneficial use of the water body based on grape growing goals set before the growing season that account for soil types, slopes, irrigation water availability and quality, and energy efficiency.

We believe that we have adequate sources of grape supplies to meet our sales expectations. However, when demand for certain wine products exceeds expectations, we look to source the extra requirements from the bulk wine markets around the world.

Constellation Brands, Inc. FY 2024 Form 10-K |

#WORTHREACHINGFOR I 7

|

||||

| PART I | ITEM 1. BUSINESS | Table of Contents |

||||||

The distilled spirits manufactured and imported by us require various agricultural products, neutral grain spirits, and bulk spirits, which we fulfill through purchases from various sources by contractual arrangement and through purchases on the open market. We believe that adequate supplies of the aforementioned products are available at the present time.

We utilize glass and polyethylene terephthalate bottles and other materials such as caps, corks, capsules, labels, and cardboard cartons in the bottling and packaging of our wine and spirits products. After grape purchases, glass bottles are the largest component of our cost of product sold, comprising more than 95% of our package format mix of our wine and spirits portfolio volume sold for Fiscal 2024. In the U.S., the glass bottle industry is highly concentrated with only a small number of producers. We have traditionally obtained, and continue to obtain, our glass requirements from a limited number of producers under long-term supply arrangements. Currently, one producer supplies most of our glass container requirements for our U.S. operations. We have been able to satisfy our requirements with respect to the foregoing and consider our sources of supply to be adequate at this time.

We have implemented plans to enhance our use of circular packaging and reduce waste across our wine and spirits portfolio in connection with our commitments to (i) reduce our ratio of total packaging weight versus the product weight of wine or spirits liquid by 10% across our portfolio between the periods Fiscal 2022 to Fiscal 2025 and (ii) ensure that 80% of packaging from our portfolio is returnable, recyclable, or renewable. In Fiscal 2024, we activated 40 wine and spirits sustainable packaging projects across more than 190 SKUs to optimize material consumption, decrease packaging weights, and enable reductions in consumer waste.

Government regulations

We are subject to a range of laws and regulations in the countries in which we operate. Where we produce products, we are subject to environmental laws and regulations, and may be required to obtain environmental and alcohol beverage permits and licenses to operate our facilities. Where we market and sell products, we may be subject to laws and regulations on brand registration, packaging and labeling, distribution methods and relationships, pricing and price changes, sales promotions, advertising, and public relations. The countries in which we operate impose duties, excise taxes, and other taxes on beverage alcohol products, and on certain raw materials used to produce our beverage alcohol products, in varying amounts. We are also subject to rules and regulations relating to changes in officers or directors, ownership, or control.

We believe we are in compliance in all material respects with all applicable governmental laws and regulations in the countries in which we operate. We also believe that the cost of administration and compliance with, and liability under, such laws and regulations does not have, and is not expected to have, a material adverse impact on our financial condition, results of operations, and/or cash flows.

Seasonality

The beverage alcohol industry is subject to seasonality in each major category. As a result, in response to wholesaler and retailer demand which precedes consumer purchases, our beer sales are typically highest during the first and second quarters of our fiscal year, which correspond to the Spring and Summer periods in the U.S. Our wine and spirits sales are typically highest during the third quarter of our fiscal year, primarily due to seasonal holiday buying.

ESG

During the course of our history, we have been committed to safeguarding our environment, making a positive difference in our communities, and advocating for responsible consumption of beverage alcohol products. We believe our ESG strategy enables us to better meet stakeholder expectations and create and protect value for our business, reflects our Company values, and directly addresses pressing environmental and societal needs that are important to our shareholders, communities, consumers, and employees.

Constellation Brands, Inc. FY 2024 Form 10-K |

#WORTHREACHINGFOR I 8

|

||||

| PART I | ITEM 1. BUSINESS | Table of Contents |

||||||

Specifically, we have focused on areas where we believe we have the greatest opportunities to make meaningful, positive impacts for people and the planet in a manner that strengthens our Company, and we dedicate our resources towards:

Serving as good stewards of our environment and natural resources

Improving water availability and resilience for our communities where we operate; reducing GHG emissions through energy conservation and renewable energy initiatives; and reducing operational waste and enhancing our use of returnable, recyclable, or renewable packaging

Enhancing social equity within our industry and communities

Championing the professional development and advancement of women in beverage alcohol industry and our communities; enhancing economic development and prosperity in disadvantaged communities; and championing an inclusive workplace culture, characterized by diversity in background and thought, which reflects our consumers and the communities where we live and work

Promoting responsible beverage alcohol consumption

Ensuring the responsible promotion and marketing of our products; and empowering adults to make responsible choices in their alcohol (substance) consumption by supporting fact-based education, engagement programs, and policies

We developed targets in connection with our strategy to serve as good stewards of our environment and natural resources. As of February 29, 2024, we are progressing towards our targets to:

•restore 5 billion gallons of water withdrawals from local watersheds near our production facilities, while improving accessibility and quality of water for communities where we operate between the periods Fiscal 2023 to Fiscal 2025;

•reduce Scope 1 (direct) and Scope 2 (indirect) GHG emissions by 15% between the periods Fiscal 2020 to Fiscal 2025;

•obtain a TRUE Certification for Zero Waste to Landfill in key operating facilities by Fiscal 2025; and

•significantly enhance our use of circular packaging across our beverage alcohol portfolio by Fiscal 2025.

During Fiscal 2024 we (i) published our 2023 ESG Impact Report where we highlighted notable progress in our ESG focus areas and (ii) took various steps to advance our ESG strategy, including the following:

Serving as good stewards of our environment and natural resources

•completed the transition from hi-cone plastic rings to recyclable paperboard for all applicable 4-pack and 6-pack SKUs across our beer portfolio

•collaborated on the Tecklenburg Groundwater Recharge project in California which will recharge groundwater, help to manage groundwater stress in the communities around our Woodbridge Winery and Lodi Distribution Center as well as in a region from which we source approximately 7% of our U.S. grape supply, and provide volumetric benefits toward our water restoration goal

•invested in a project in Nogales, Arizona, which we estimate will positively impact approximately 25,000 people, to address river borne trash to help improve the quality of water for communities near where we operate

Enhancing social equity within our industry and communities

•committed $100,000 to UnidosUS’ HOME initiative, a program whose goal is to transform the economic trajectory of Latinx families by advancing systemic change to create 4 million new homeowners by calendar 2030

•committed an additional $100,000 to support capacity building for Dress for Success Worldwide and its affiliates and expand direct support to five additional affiliates representing our major markets

Promoting responsible beverage alcohol consumption

•partnered with Uber to provide safe rides vouchers for U.S. employees celebrating during certain holidays and seasonal activities as part of our Safe Ride Home program

•in collaboration with Responsibility.org we shared responsible consumption messaging during certain holidays and seasonal activities with employees and external audiences

Constellation Brands, Inc. FY 2024 Form 10-K |

#WORTHREACHINGFOR I 9

|

||||

| PART I | ITEM 1. BUSINESS | Table of Contents |

||||||

As part of our brewery expansion efforts and commitment to making a positive impact on the communities where we operate, we plan to continue working with local authorities and community-based organizations on sustainability initiatives that benefit local residents. Critical local projects are identified through community collaboration and input and guidance from third-party water restoration organizations. This is in addition to other benefits we provide, including local job creation and fueling economic development.

For further information about our ESG advancements refer to (i) “Human capital resources” below and (ii) “Capital resources” within MD&A.

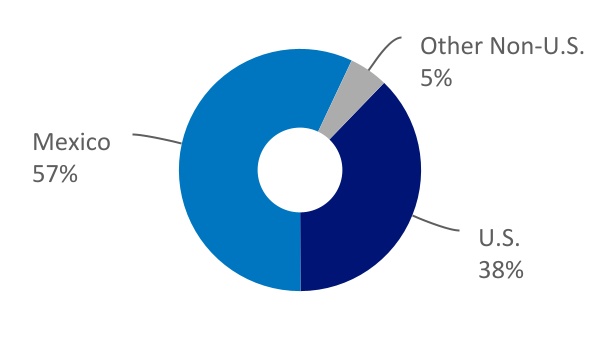

Human capital resources

As of February 29, 2024, we had approximately 10,600 employees, including approximately 1,300 employees through our equally-owned joint venture with Owens-Illinois. The number of employees may change throughout the year, as we employ additional workers during the grape crushing seasons. Approximately 20% of the employees are covered by collective bargaining agreements. Collective bargaining agreements expiring within one year are minimal. We consider our employee relations generally to be good.

Employee geographic data is as follows:

Diversity, equity, and inclusion

Our DEI strategic priorities are as follows:

Cultivate a best-in-class, diverse, and equitable workforce

Recruit diverse talent to reflect the richness of the communities in which we live and work and engage their insights and perspectives to create a sustainable competitive advantage, benefiting our stakeholders

Foster a winning, inclusive work culture

Foster an inclusive and equitable work culture that drives connection through proximity - to our work and each other - and actively promotes the sharing and leveraging of diverse perspectives, backgrounds, and experiences in relevant and meaningful ways

Enhance social equity within our industry and communities

Extend our influence to enhance social equity within the beverage alcohol industry and our surrounding communities by creating globally consistent and locally relevant opportunities that support our ESG goals and initiatives

We provide opportunities for our employees to unite around common interests, identities, perspectives, and shared experiences through a growing community of BRGs. Our BRGs are intended to advance our DEI strategic priorities and are supported at the highest level with sponsorships from our executives. See “Information about our Executive Officers” below. Each BRG is tasked with making a business impact on behalf of the represented group and welcomes allies. In Fiscal 2024, approximately 60% of our U.S. salaried employees were members of one or more BRGs and we expanded our BRGs to Mexico and New Zealand.

Constellation Brands, Inc. FY 2024 Form 10-K |

#WORTHREACHINGFOR I 10

|

||||

| PART I | ITEM 1. BUSINESS | Table of Contents |

||||||

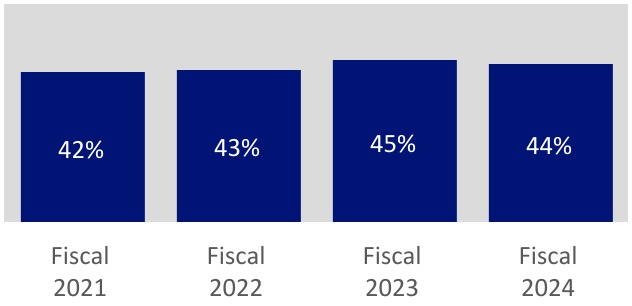

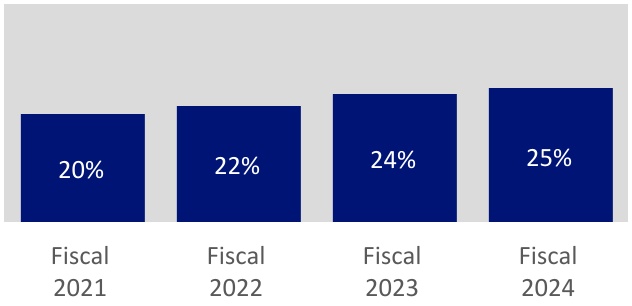

We measure gender and ethnic representation to understand diversity at various levels across the organization, assess progress over time, and drive continuous improvement. We continue to make progress towards our ambitions to enhance both gender representation and overall ethnic diversity among our self-disclosed, U.S. salaried employee population by Fiscal 2026 as follows:

U.S. Salaried Female

Workforce Representation

Ambition of 50%

U.S. Salaried Ethnic Diversity

Workforce Representation

Ambition of 30%

Additionally, we utilize a DEI growth dashboard for our U.S. salaried employee base, centered around identifying and addressing workforce diversity representation opportunities, utilizing 2020 U.S. Census data as a benchmark. This dashboard is shared with our executives and with certain committees of the Board of Directors on a semi-annual basis enabling them to monitor the progress made and to provide guidance on next steps designed to attain our representation ambitions. We also assess metrics throughout the human resource lifecycle to identify potential bias and barriers in our processes, including talent acquisition, turnover, engagement scores, or participation in BRG events.

Compensation and benefits

We strive to provide pay, benefits, and services that meet the needs of our employees. The main components of compensation are: (i) base pay, (ii) long-term incentives dependent on a number of factors such as geographic location and management level which can include restricted stock units, stock options, and performance share units, (iii) short-term incentives, and (iv) recognition awards. Base and incentive compensation is reviewed on an annual basis ensuring it is competitive in the market and gives employees opportunities to earn more for exceeding expectations. Our total rewards program also offers valuable benefits, tools, and resources designed to help employees stay healthy and well, while achieving security, growth, satisfaction, and success.

Professional development

Building diverse talent pipelines, delivering best-in-class people development, and championing professional advancement are key components of our human capital strategy which is designed to position our business for long-term growth. We are committed to offering programs, resources, and experiences that empower employees to grow their careers. The University of Constellation Brands, our learning and development center, allows employees to find opportunities to grow, develop, gain new skills and insights, explore, and expand interests through regularly updated curricula. In Fiscal 2024, we (i) spent approximately $17 million in development and training costs, including the delivery of one executive development program, one leadership development program, two women’s focused development programs, and a newly-launched leadership coaching workshop for our people leaders and (ii) produced nearly 375 matched relationships under our formal career development mentoring program.

Succession planning

We have a comprehensive succession planning process, led by our human resources team and overseen by the Human Resources Committee of our Board of Directors. In addition to the Human Resources Committee’s enhanced focus on executive, senior leader, and high-potential employee succession, our full Board of Directors is also involved in Chief Executive Officer succession planning as well as succession and people development for the broader employee population. As part of the succession planning process, we review and discuss potential successors to key roles and examine backgrounds, capabilities, and appropriate developmental opportunities.

Constellation Brands, Inc. FY 2024 Form 10-K |

#WORTHREACHINGFOR I 11

|

||||

| PART I | ITEM 1. BUSINESS | Table of Contents |

||||||

Employee engagement

We assess employee engagement through global engagement and targeted pulse surveys, which provide feedback on a variety of topics, such as company direction and strategy, resources, support, enablement, empowerment, and well-being.

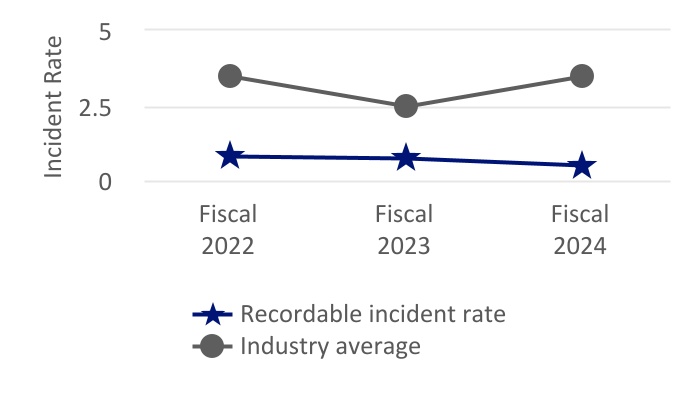

Safety

We are committed to ensuring the safety of our employees. Our global EHS policy describes our dedication to providing a safe and healthy working environment and developing and maintaining a culture where all employees take responsibility for their own safety as well as the safety of others while minimizing our impact on the environment in the communities where we live and work. With a focus on continuous improvement, we are developing more robust EHS management systems, strengthening employee awareness and training, and ensuring senior leadership engagement on safety. Work-related injuries resulting from the production of our beer, wine, and spirits products are well below industry average. Our recordable incident rate as compared to the industry average is as follows:

The recordable incident rate is defined as total number of worldwide CBI work-related injuries (cases beyond first aid) per 100 full-time employees. The industry average is calculated by taking the weighted average of the most recent (2022) U.S. Bureau of Labor Statistics data for wineries, breweries, and distilleries based on our portfolio mix in February 2024, February 2023, and February 2022 for the years ended February 29, 2024, February 28, 2023, and February 28, 2022, respectively.

Empowering our employees to give back

Giving back to our communities is a value instilled by our founder, Marvin Sands, and remains core to our Company’s DNA. We empower our employees to engage in the communities where they live and work in a variety of ways, including volunteering time and through a charitable matching program available to all U.S. employees.

We match donations ranging from a maximum of $5,000 to $50,000 per year, depending on employee level, to charitable organizations.

$4.2 million | ||

Fiscal 2024 corporate charitable contributions, including Company match of employee donations | ||

Constellation Brands, Inc. FY 2024 Form 10-K |

#WORTHREACHINGFOR I 12

|

||||

| PART I | ITEM 1. BUSINESS | Table of Contents |

||||||

Information about our Executive Officers

Executive officers of the Company are generally chosen or elected to their positions annually and hold office until the earlier of their removal or resignation or until their successors are chosen and qualified. Information with respect to our executive officers as of April 23, 2024, is as follows:

William A. Newlands

Age 65

|

President and Chief Executive Officer

Mr. Newlands has served as Chief Executive Officer of the Company and as a director since March 2019 and as President since February 2018. He served as Chief Operating Officer from January 2017 through February 2019 and as Executive Vice President of the Company from January 2015 until February 2018. From January 2016 to January 2017 he performed the role of President, Wine and Spirits Division and from January 2015 through January 2016 he performed the role of Chief Growth Officer. Mr. Newlands joined the Company in January 2015. Prior to that he served from October 2011 until August 2014 as Senior Vice President and President, North America of Beam Inc., as Senior Vice President and President, North America of Beam Global Spirits & Wine, Inc. from December 2010 to October 2011, and as Senior Vice President and President, USA of Beam Global Spirits & Wine, Inc. from February 2008 to December 2010. Beam Inc., a producer and seller of branded distilled spirits products, merged with a subsidiary of Suntory Holding Limited, a Japanese company, in 2014. Prior to October 2011, Beam Global Spirits & Wine, Inc. was the spirits operating segment of Fortune Brands, Inc., which was a leading consumer products company that made and sold branded consumer products worldwide in the distilled spirits, home and security, and golf markets.

BRG sponsorship - ECP supporting our early career professionals

|

||||

James O. Bourdeau

Age 59

|

Executive Vice President and Chief Legal Officer

Mr. Bourdeau is the Executive Vice President and Chief Legal Officer of the Company, having served in the role since December 2017 and as the Company’s Secretary since April 2017. Prior to that, he served as the Company’s Senior Vice President and General Counsel, Corporate Development, having performed that role from September 2014 until December 2017. Before joining the Company in September 2014, Mr. Bourdeau was an attorney with the law firm of Nixon Peabody LLP from July 2000 through September 2014, and a partner from February 2005 through September 2014. Mr. Bourdeau was associated with another law firm from 1995 to 2000.

BRG sponsorship - WISE supporting our female employees and communities

|

||||

K. Kristann Carey

Age 54

|

Executive Vice President and Chief Human Resources Officer