EX-99.2

Published on November 2, 2023

2023 VICE PRESIDEN T, INVESTOR RELATIONS JOSEPH SUAREZ This presentation, including the oral statements made in connection herewith, contain forward-looking statements that are based on certain assumptions, estimates, expectations, plans, analyses, and opinions made by management in light of their experience and perception of historical trends, current conditions, and expected future developments, as well as other factors management believes are appropriate in the circumstances. These forward-looking statements are subject to various risks and uncertainties, many of which are beyond our control, and which could cause actual results to differ materially from those set forth in, or implied by, such forward-looking statements. When used in this presentation, words such as “anticipate,” “intend,” “expect,” “plan,” “continue,” ”estimate,” “exceed,” “may,” “will,” “project,” “predict,” “propose,” “potential,” “targeting,” “exploring,” “goal,” “outlook,” “forecast,” “trend,” “path,” “scheduled,” “implementing,” “ongoing,” “seek,” “could,” “might,” “should,” “believe,” “vision,” and similar words or expressions are intended to identify forward-looking statements, although not all forward- looking statements contain such identifying words. Although we believe that the estimates, expectations, plans, and timetables reflected in the forward-looking statements are reasonable, they may vary from management’s current estimates, expectations, plans, and timetables, and we can give no assurance that such estimates, expectations, plans, and timetables will prove to be correct, as actual results and future events and timetables could differ materially from those anticipated in such statements. Information provided in this presentation is necessarily summarized and may not contain all available material information. All statements other than statements of historical fact in this presentation may be forward-looking statements, including without limitation statements regarding or applicable to our business strategy and vision, value proposition and opportunity, growth plans and growth drivers, innovation, new products, tools, and capabilities, brand building, digital leadership and capabilities, including through our Digital Business Acceleration initiative, future marketing strategies and spend, future focus areas, demographic and consumer projections and trends, future sales, space, partnership, distribution, and supply chain initiatives, our beer expansion, optimization, and/or construction activities, including anticipated scope, capacity, supply, costs, capital expenditures, and timeframes for completion, capital allocation priorities and commitments, future operations, financial position, liquidity and capital resources, net sales, costs, expenses, cost savings initiatives, operating income, operating margins, leverage ratios, including target net leverage ratio, dividend payout ratio, depreciation, equity in earnings, interest expense, tax rates, non- controlling interests, diluted shares outstanding, EPS, cash flows, capital expenditures, and other financial metrics, expected volume, inventory, price/mix, and depletion trends, near- and medium-term financial models and targets, the continued refinement of our wine and spirits portfolio, wine and spirits optimization and efficiency initiatives, future acquisition, disposition, and investment activities, our ESG approach, corporate social responsibility and sustainability initiatives, environmental stewardship targets, and human capital and DEI objectives, ambitions, and priorities, the manner, timing, and duration of our share repurchase program and source of funds for share repurchases, the amount and timing of future dividends, anticipated inflationary pressures, changing prices, and reductions in consumer discretionary income as well as other unfavorable global and regional economic conditions, geopolitical events, and military conflicts, and our responses thereto, and prospects, plans, and objectives of management. FORWARD-LOOKING STATEMENTS

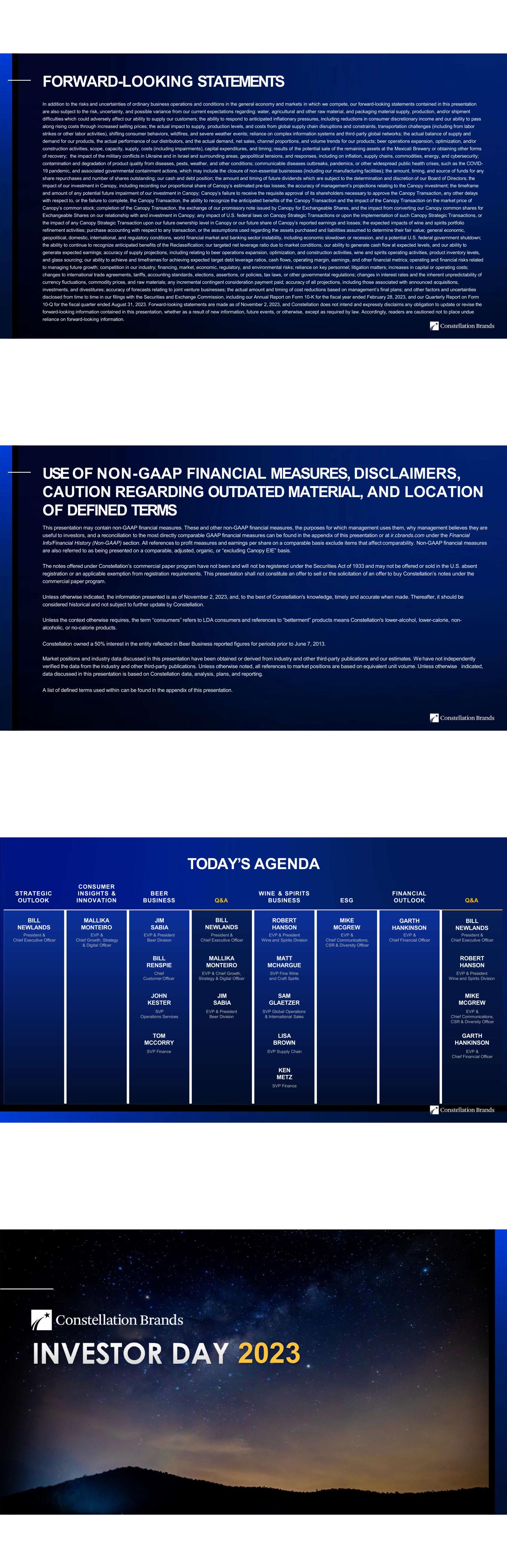

In addition to the risks and uncertainties of ordinary business operations and conditions in the general economy and markets in which we compete, our forward-looking statements contained in this presentation are also subject to the risk, uncertainty, and possible variance from our current expectations regarding: water, agricultural and other raw material, and packaging material supply, production, and/or shipment difficulties which could adversely affect our ability to supply our customers; the ability to respond to anticipated inflationary pressures, including reductions in consumer discretionary income and our ability to pass along rising costs through increased selling prices; the actual impact to supply, production levels, and costs from global supply chain disruptions and constraints, transportation challenges (including from labor strikes or other labor activities), shifting consumer behaviors, wildfires, and severe weather events; reliance on complex information systems and third‐party global networks; the actual balance of supply and demand for our products, the actual performance of our distributors, and the actual demand, net sales, channel proportions, and volume trends for our products; beer operations expansion, optimization, and/or construction activities, scope, capacity, supply, costs (including impairments), capital expenditures, and timing; results of the potential sale of the remaining assets at the Mexicali Brewery or obtaining other forms of recovery; the impact of the military conflicts in Ukraine and in Israel and surrounding areas, geopolitical tensions, and responses, including on inflation, supply chains, commodities, energy, and cybersecurity; contamination and degradation of product quality from diseases, pests, weather, and other conditions; communicable diseases outbreaks, pandemics, or other widespread public health crises, such as the COVID- 19 pandemic, and associated governmental containment actions, which may include the closure of non-essential businesses (including our manufacturing facilities); the amount, timing, and source of funds for any share repurchases and number of shares outstanding; our cash and debt position; the amount and timing of future dividends which are subject to the determination and discretion of our Board of Directors; the impact of our investment in Canopy, including recording our proportional share of Canopy’s estimated pre-tax losses; the accuracy of management’s projections relating to the Canopy investment; the timeframe and amount of any potential future impairment of our investment in Canopy; Canopy’s failure to receive the requisite approval of its shareholders necessary to approve the Canopy Transaction, any other delays with respect to, or the failure to complete, the Canopy Transaction, the ability to recognize the anticipated benefits of the Canopy Transaction and the impact of the Canopy Transaction on the market price of Canopy’s common stock; completion of the Canopy Transaction, the exchange of our promissory note issued by Canopy for Exchangeable Shares, and the impact from converting our Canopy common shares for Exchangeable Shares on our relationship with and investment in Canopy; any impact of U.S. federal laws on Canopy Strategic Transactions or upon the implementation of such Canopy Strategic Transactions, or the impact of any Canopy Strategic Transaction upon our future ownership level in Canopy or our future share of Canopy’s reported earnings and losses; the expected impacts of wine and spirits portfolio refinement activities; purchase accounting with respect to any transaction, or the assumptions used regarding the assets purchased and liabilities assumed to determine their fair value; general economic, geopolitical, domestic, international, and regulatory conditions, world financial market and banking sector instability, including economic slowdown or recession, and a potential U.S. federal government shutdown; the ability to continue to recognize anticipated benefits of the Reclassification; our targeted net leverage ratio due to market conditions, our ability to generate cash flow at expected levels, and our ability to generate expected earnings; accuracy of supply projections, including relating to beer operations expansion, optimization, and construction activities, wine and spirits operating activities, product inventory levels, and glass sourcing; our ability to achieve and timeframes for achieving expected target debt leverage ratios, cash flows, operating margin, earnings, and other financial metrics; operating and financial risks related to managing future growth; competition in our industry; financing, market, economic, regulatory, and environmental risks; reliance on key personnel; litigation matters; increases in capital or operating costs; changes to international trade agreements, tariffs, accounting standards, elections, assertions, or policies, tax laws, or other governmental regulations; changes in interest rates and the inherent unpredictability of currency fluctuations, commodity prices, and raw materials; any incremental contingent consideration payment paid; accuracy of all projections, including those associated with announced acquisitions, investments, and divestitures; accuracy of forecasts relating to joint venture businesses; the actual amount and timing of cost reductions based on management’s final plans; and other factors and uncertainties disclosed from time to time in our filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the fiscal year ended February 28, 2023, and our Quarterly Report on Form 10-Q for the fiscal quarter ended August 31, 2023. Forward-looking statements are made as of November 2, 2023, and Constellation does not intend and expressly disclaims any obligation to update or revise the forward-looking information contained in this presentation, whether as a result of new information, future events, or otherwise, except as required by law. Accordingly, readers are cautioned not to place undue reliance on forward-looking information. FORWARD-LOOKING STATEMENTS This presentation may contain non-GAAP financial measures. These and other non-GAAP financial measures, the purposes for which management uses them, why management believes they are useful to investors, and a reconciliation to the most directly comparable GAAP financial measures can be found in the appendix of this presentation or at ir.cbrands.com under the Financial Info/Financial History (Non-GAAP) section. All references to profit measures and earnings per share on a comparable basis exclude items that affect comparability. Non-GAAP financial measures are also referred to as being presented on a comparable, adjusted, organic, or “excluding Canopy EIE” basis. The notes offered under Constellation’s commercial paper program have not been and will not be registered under the Securities Act of 1933 and may not be offered or sold in the U.S. absent registration or an applicable exemption from registration requirements. This presentation shall not constitute an offer to sell or the solicitation of an offer to buy Constellation’s notes under the commercial paper program. Unless otherwise indicated, the information presented is as of November 2, 2023, and, to the best of Constellation's knowledge, timely and accurate when made. Thereafter, it should be considered historical and not subject to further update by Constellation. Unless the context otherwise requires, the term “consumers” refers to LDA consumers and references to “betterment” products means Constellation's lower-alcohol, lower-calorie, non- alcoholic, or no-calorie products. Constellation owned a 50% interest in the entity reflected in Beer Business reported figures for periods prior to June 7, 2013. Market positions and industry data discussed in this presentation have been obtained or derived from industry and other third-party publications and our estimates. We have not independently verified the data from the industry and other third-party publications. Unless otherwise noted, all references to market positions are based on equivalent unit volume. Unless otherwise indicated, data discussed in this presentation is based on Constellation data, analysis, plans, and reporting. A list of defined terms used within can be found in the appendix of this presentation. USE OF NON-GAAP FINANCIAL MEASURES, DISCLAIMERS, CAUTION REGARDING OUTDATED MATERIAL, AND LOCATION OF DEFINED TERMS TODAY’S AGENDA CONSUMER STRATEGIC INSIGHTS & BEER WINE & SPIRITS FINANCIAL OUTLOOK INNOVATION BUSINESS Q&A BUSINESS ESG OUTLOOK Q&A BILL NEWLANDS MALLIKA MONTEIRO JIM SABIA BILL NEWLANDS ROBERT HANSON MIKE MCGREW GARTH HANKINSON BILL NEWLANDS President & Chief Executive Officer EVP & Chief Growth, Strategy & Digital Officer EVP & President Beer Division President & Chief Executive Officer EVP & President Wine and Spirits Division EVP & Chief Communications, CSR & Diversity Officer EVP & Chief Financial Officer President & Chief Executive Officer BILL RENSPIE MALLIKA MONTEIRO MATT MCHARGUE ROBERT HANSON Chief Customer Officer EVP & Chief Growth, Strategy & Digital Officer SVP Fine Wine and Craft Spirits EVP & President Wine and Spirits Division JOHN KESTER JIM SABIA SAM GLAETZER MIKE MCGREW SVP Operations Services EVP & President Beer Division SVP Global Operations & International Sales EVP & Chief Communications, CSR & Diversity Officer TOM MCCORRY LISA BROWN GARTH HANKINSON SVP Finance SVP Supply Chain EVP & Chief Financial Officer KEN METZ SVP Finance 2023

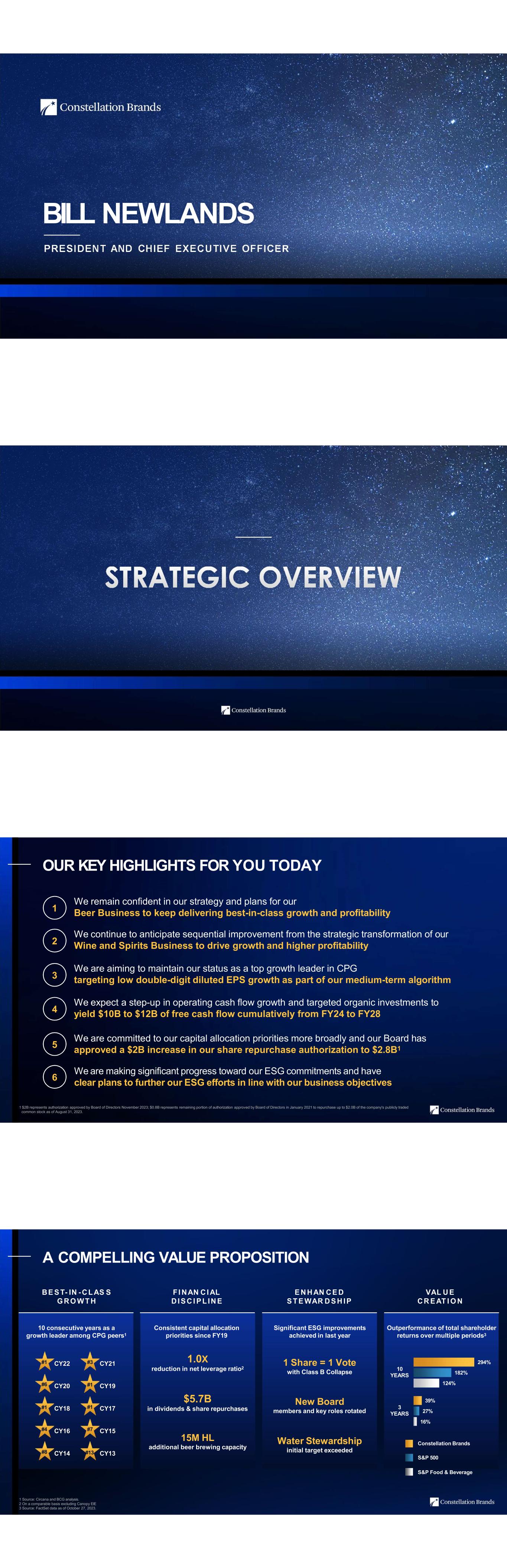

PRESIDENT AND CHIEF EXECUTIVE OFFICER BILL NEWLANDS OUR KEY HIGHLIGHTS FOR YOU TODAY 1 We remain confident in our strategy and plans for our Beer Business to keep delivering best-in-class growth and profitability 2 We continue to anticipate sequential improvement from the strategic transformation of our Wine and Spirits Business to drive growth and higher profitability 3 We are aiming to maintain our status as a top growth leader in CPG targeting low double-digit diluted EPS growth as part of our medium-term algorithm 5 We are committed to our capital allocation priorities more broadly and our Board has approved a $2B increase in our share repurchase authorization to $2.8B1 6 We are making significant progress toward our ESG commitments and have clear plans to further our ESG efforts in line with our business objectives 4 We expect a step-up in operating cash flow growth and targeted organic investments to yield $10B to $12B of free cash flow cumulatively from FY24 to FY28 1 $2B represents authorization approved by Board of Directors November 2023; $0.8B represents remaining portion of authorization approved by Board of Directors in January 2021 to repurchase up to $2.0B of the company's publicly traded common stock as of August 31, 2023. A COMPELLING VALUE PROPOSITION BE S T- IN -CL AS S G RO WT H 10 consecutive years as a growth leader among CPG peers1 1 Source: Circana and BCG analysis. 2 On a comparable basis excluding Canopy EIE 3 Source: FactSet data as of October 27, 2023. FI NAN CI AL D I S C I P L IN E Consistent capital allocation priorities since FY19 1.0X reduction in net leverage ratio2 $5.7B in dividends & share repurchases 15M HL additional beer brewing capacity E N HAN CE D S T E WAR D S H IP Significant ESG improvements achieved in last year 1 Share = 1 Vote with Class B Collapse New Board members and key roles rotated Water Stewardship initial target exceeded VAL U E CR E AT I O N 182% 124% 39% 27% 16% 294% 3 YEARS 10 YEARS Outperformance of total shareholder returns over multiple periods3 CY22 CY21 CY20 CY19 CY18 CY17 CY16 CY15 CY14 CY13 #1 #3 #6 #1 #1 #1 #4 #7 #8 #13 Constellation Brands S&P 500 S&P Food & Beverage

DELIVERING ON OUR COMMITMENTS DRIVING RELENTLESSGROWTH IN OUR BEERBUSINESS OVER A DECADE of achieving consecutive quarters of depletion growth FY11 +3.0% FY14 +7.6% FY13 +4.5% FY12 +5.5% FY19 +8.8% FY18 +9.8% FY17 +12.0% FY16 +12.6% FY15 +6.0% FY20 +7.5% FY21 +6.3% FY22 +8.9% FY23 +7.5% Q1 Q2 FY11 FY24 Source: Company quarterly depletion growth rates from FY11 through Q2 FY24; highlighted percentages represent the depletion growth for the fiscal year and half year for H1 FY24; excludes import brands no longer within portfolio (St. Pauli Girl, Tsingtao, and Somersby). H1 FY24 +6.8% DELIVERING ON OUR COMMITMENTS DRIVING RELENTLESSGROWTH IN OUR BEERBUSINESS FY19 BEER BUSINESS ANNUAL DEPLETION GROWTH FY11 12% 0% 2% 4% 6% 8% 10% Conviction and execution in our Beer Business have maintained its momentum Source: Company annual depletion growth rates from FY11 through FY19 excluding import brands no longer within portfolio (St. Pauli Girl, Tsingtao, and Somersby); company shipment data; Circana, Total U.S. Multi-Outlet + Convenience, 52 weeks ending March 3, 2019. F Y 1 9 BRAND IN U.S. BEER MARKET HIGH-END BEER IN U.S. MARKET BRAND IN U.S. BEER MARKET HIGH-END BEER IN U.S. MARKET MILLION CASES SHIPPED BRAND IN U.S. BEER MARKET HIGH-END BEER IN U.S. MARKET ~110 MILLION CASES SHIPPED #6 #2 ~110 #7 #3 ~10 #33 #17 MILLION CASES SHIPPED ~8% FY11 TO FY19 CAGR DELIVERING ON OUR COMMITMENTS DRIVING RELENTLESSGROWTH IN OUR BEERBUSINESS Conviction and execution in our Beer Business have maintained its momentum H1 FY24FY19 0% 2% 4% 6% 8% 10% Source: Company annual depletion growth rates from FY19 through H1 FY24 excluding import brands no longer within portfolio (St. Pauli Girl, Tsingtao, and Somersby); company shipment data for H1 FY24 LTM; Circana, Total U.S. Multi-Outlet + Convenience, 26 weeks ending September 3, 2023. NO W BRAND IN U.S. BEER MARKET HIGH-END BEER IN U.S. MARKET BRAND IN U.S. BEER MARKET HIGH-END BEER IN U.S. MARKET MILLION CASES SHIPPED BRAND IN U.S. BEER MARKET HIGH-END BEER IN U.S. MARKET ~180 MILLION CASES SHIPPED #1 #1 ~120 #5 #3 ~20 #20 #9 MILLION CASES SHIPPED BEER BUSINESS ANNUAL DEPLETION GROWTH ~8% FY19 TO H1 FY24 LTM CAGR DELIVERING ON OUR COMMITMENTS DRIVING RELENTLESSGROWTH IN OUR BEERBUSINESS DOLLAR SALES SHARE OF BEER Q2 FY24 LTM vs FY19 +331BPS +391BPS DOLLAR SALES SHARE OF BEER FY19 vs FY11 +46BPS DOLLAR SALES SHARE OF BEER Q2 FY24 LTM vs FY19 +98BPS DOLLAR SALES SHARE OF BEER FY19 vs FY11 +35BPS DOLLAR SALES SHARE OF BEER Q2 FY24 LTM vs FY19 +14BPS DOLLAR SALES SHARE OF BEER FY19 vs FY11 Conviction and execution in our Beer Business have maintained its momentum Source: Circana, Total U.S. Multi-Outlet + Convenience, 52 weeks ending September 3, 2023, 52 weeks ending March 3, 2019, and 52 weeks ending February 28, 2010.

DELIVERING ON OUR COMMITMENTS TRANSFORMING OUR WINE AND SPIRITS BUSINESS FY12 FY13 FY14 FY15 FY16 FY17 FY18 FY19 FY20 FY21 FY22 FY23 Divested Canadian Wine Business Divested Canadian Whisky Divested over 30 mainstream brands to Gallo Divested multiple mainstream brands and non-core premium brands to The Wine Group Acquired Meiomi Acquired The Prisoner and High WestAcquired Casa Noble Acquired Lingua Franca and Austin Cocktails Acquired My Favorite Neighbor Acquired Ruffino Remaining Equity Interest WI N E AN D S P I R I T S B US IN E S S N E T S AL E S Source: Company reported annual net sales from FY12 through FY23. $0B $1B $2B $3B Divested Brands (Predominantly Mainstream) Higher-End BrandsLower-End Brands DELIVERING ON OUR COMMITMENTS TRANSFORMING OUR WINE AND SPIRITS BUSINESS Our investments in scalable Wine and Spirits higher-end brands are delivering strong growth +30% DOLLAR SALES CAGR SINCE ACQUISITION +25% DOLLAR SALES CAGR SINCE ACQUISITION +28% DOLLAR SALES CAGR SINCE ACQUISITION +33% DOLLAR SALES CAGR SINCE ACQUISITION +23% DOLLAR SALES CAGR SINCE ACQUISITION Source: Circana, Total U.S. Multi-Outlet + Convenience, 52 weeks ending August 31, 2014 (Casa Noble), August 2, 2015 (Meiomi), October 2, 2016 (The Prisoner, High West), November 14, 2021 (My Favorite Neighbor), and September 3, 2023. DELIVERING ON OUR COMMITMENTS TRANSFORMING OUR WINE AND SPIRITS BUSINESS More recent Wine and Spirits actions have accelerated the transformation of the Business LARGEST BRANDS GROWTH PROFILE MARGIN PROFILE SCALE & DISTRIBUTION STRATEGIC RELEVANCE FY21 DIVESTITURES FY23 DIVESTITURES Weak Intermediate Strong DELIVERING ON OUR COMMITMENTS TRANSFORMING OUR WINE AND SPIRITS BUSINESS More recent Wine and Spirits actions have accelerated the transformation of the Business FINE WINE PREMIUM WINE MAINSTREAM WINE & SPIRITS CURRENT PORTFOLIO LARGEST BRANDS GROWTH PROFILE MARGIN PROFILE SCALE & DISTRIBUTION STRATEGIC RELEVANCE CRAFT SPIRITS NOW GOAL NOW GOAL NOW GOAL NOW GOAL Weak Intermediate Strong H IG H E R - E N D L O W E R - E N D

DELIVERING ON OUR COMMITMENTS TRANSFORMING OUR WINE AND SPIRITS BUSINESS FINE WINE & CRAFT SPIRITS PREMIUM WINE MAINSTREAM WINE & SPIRITS 11 BRANDS 8% OF NET SALES ~11% 1-YEAR DOLLAR SALES GROWTH 12 BRANDS 44% OF NET SALES ~9% 1-YEAR DOLLAR SALES GROWTH 34 BRANDS 58% OF NET SALES ~0% 1-YEAR DOLLAR SALES GROWTH 22 BRANDS 23% OF NET SALES ~13% 1-YEAR DOLLAR SALES GROWTH 5 BRANDS 42% OF NET SALES ~3% 1-YEAR DOLLAR SALES GROWTH 4 BRANDS 35% OF NET SALES ~(5)% 1-YEAR DOLLAR SALES CHANGE Source: Net Sales percentage represents portion of the Wine and Spirits Business; Circana, Total U.S. Multi-Outlet + Convenience, 52 weeks ending March 3, 2019 and September 3, 2023. FY19 FY24 Q2 LTM H IG H E R -E N D L O W E R -E N D DELIVERING ON OUR COMMITMENTS A SOLID TRACK RECORD OF FOCUSED INNOVATION Two clear consumer-led focus areas established to drive our innovation efforts FY 19 BE T TE RM E NT O FF E R I NG S F L AV O R OF F E R I NG S BE T TE RM E NT O FF E R I NG S F L AV O R O F F E R I N G S DELIVERING ON OUR COMMITMENTS A SOLID TRACK RECORD OF FOCUSED INNOVATION Significantly expanded innovation offerings aligned with two consumer-led focus areas NOW DELIVERING ON OUR COMMITMENTS A SOLID TRACK RECORD OF FOCUSED INNOVATION Strong share of growth delivered by focused, consumer-led innovation efforts BE E R B US I NE S S I NN OVAT I O N WI N E & S P I RI T S BU S I NE S S I NN O VAT I O N Source: Constellation Brands CY23 mid-year innovation analysis; Circana, Total U.S. Multi-Outlet + Convenience, 52 weeks ending July 22, 2018 and July 16, 2023. 81% CAGR FIVE-YEAR TRACKED CHANNELS ANALYS IS 95% CAGR FIVE-YEAR TRACKED CHANNELS ANALYS IS

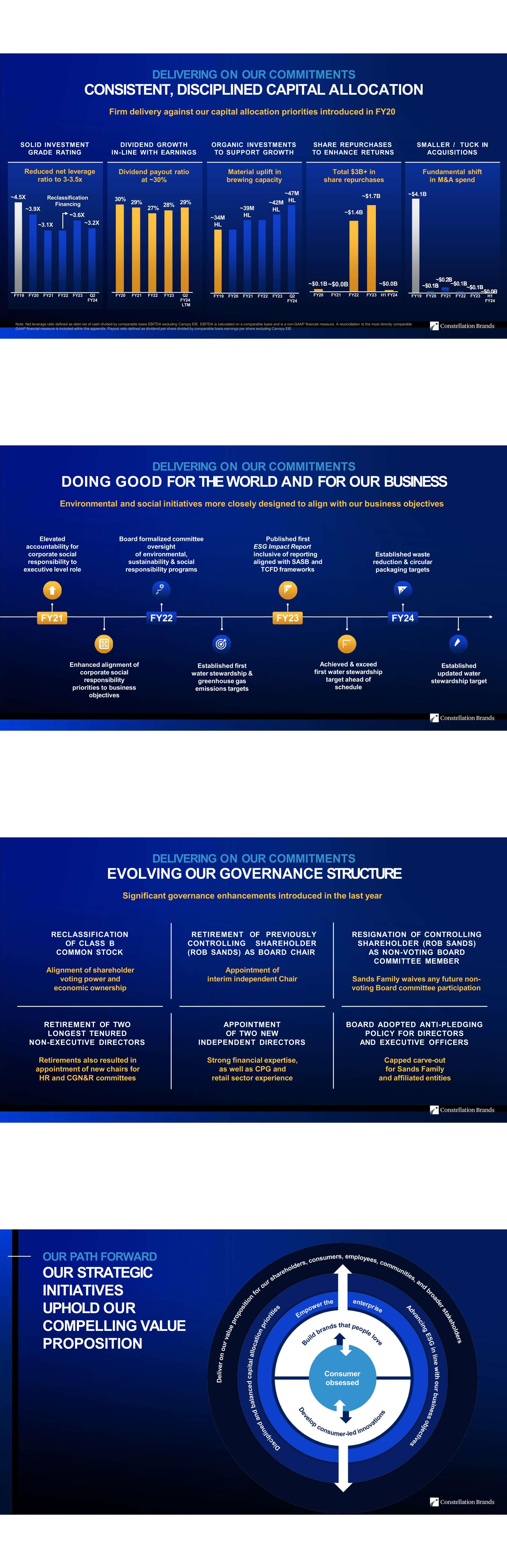

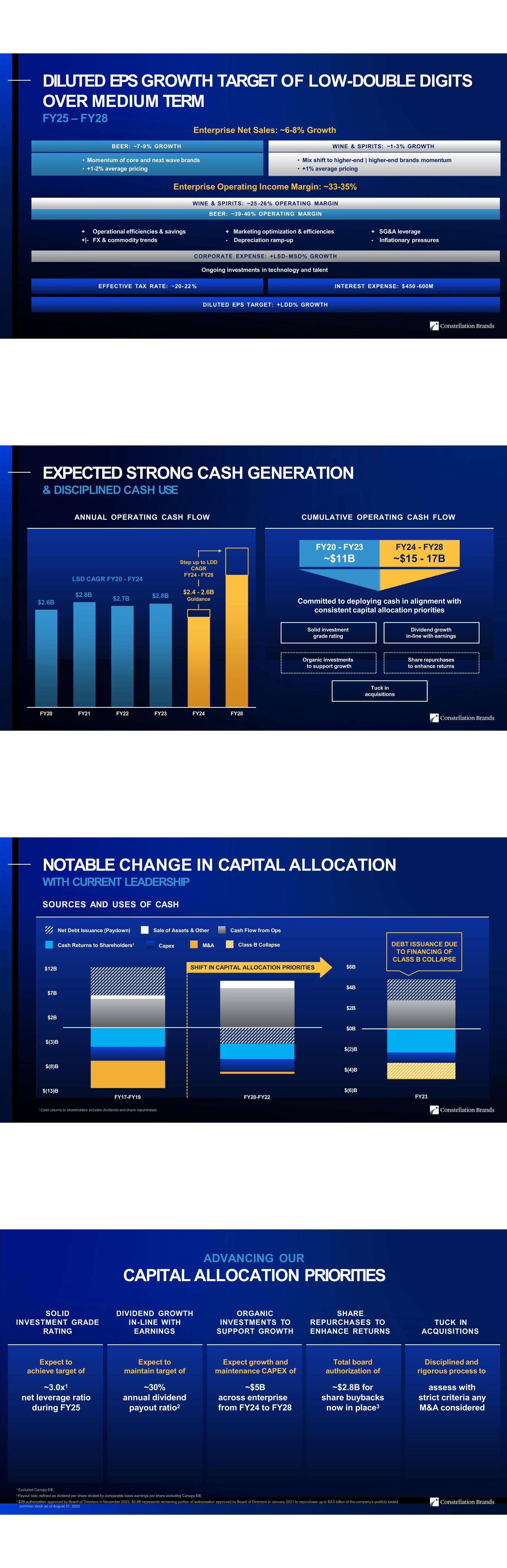

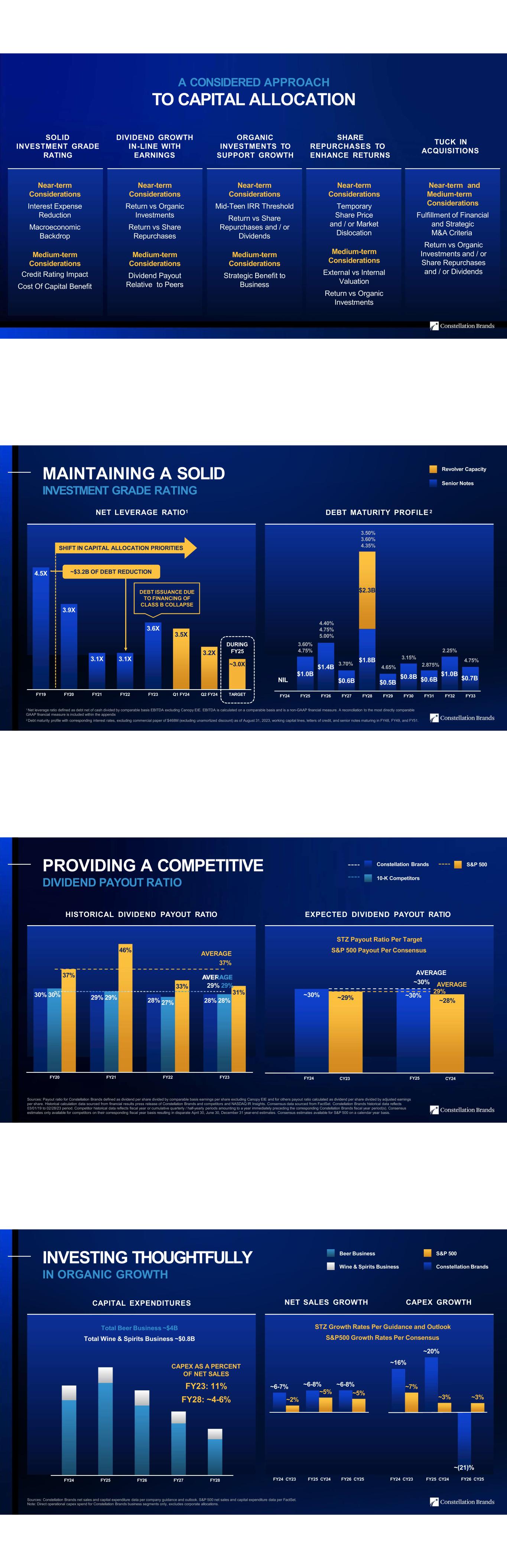

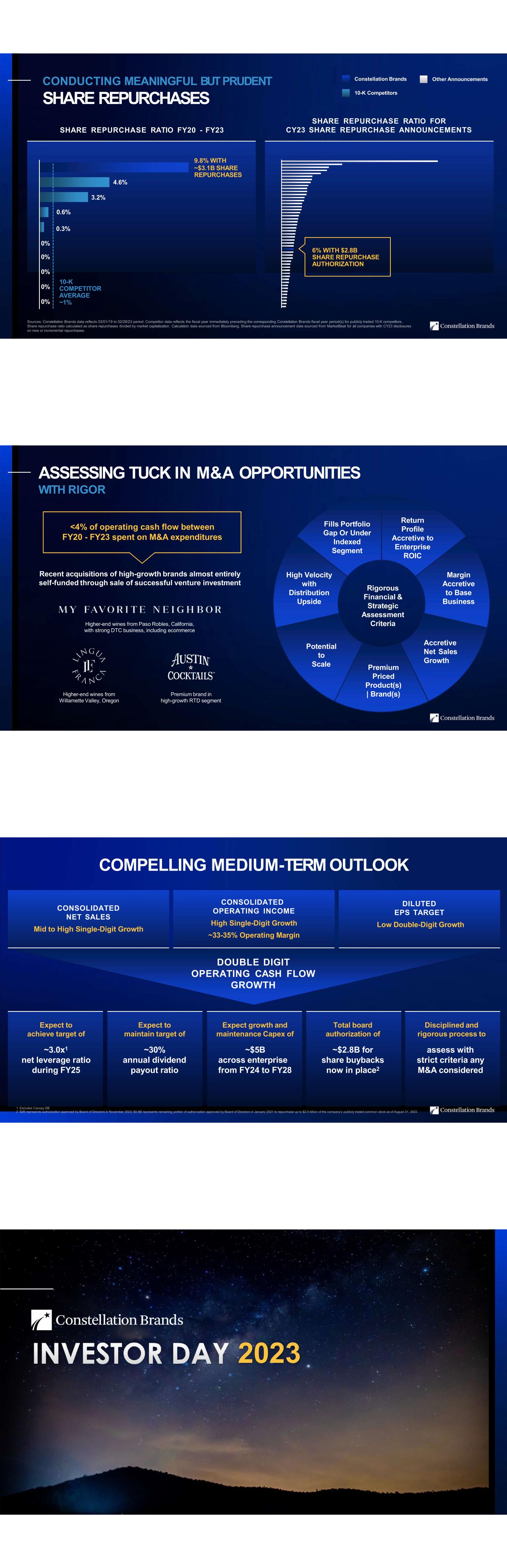

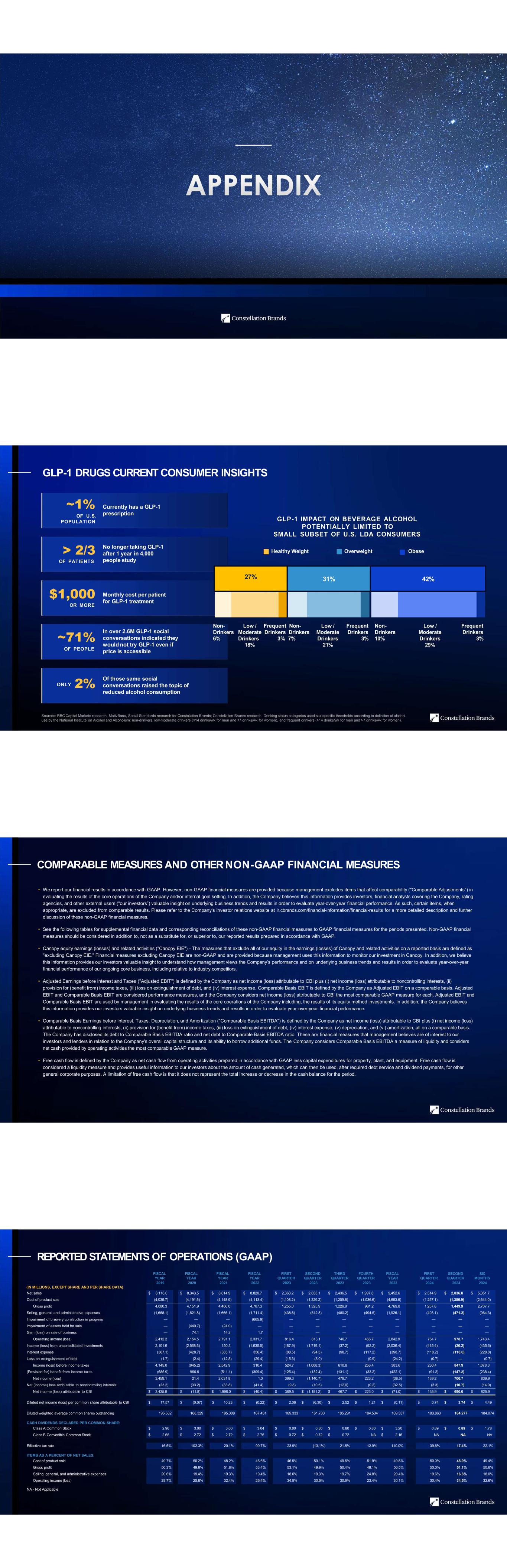

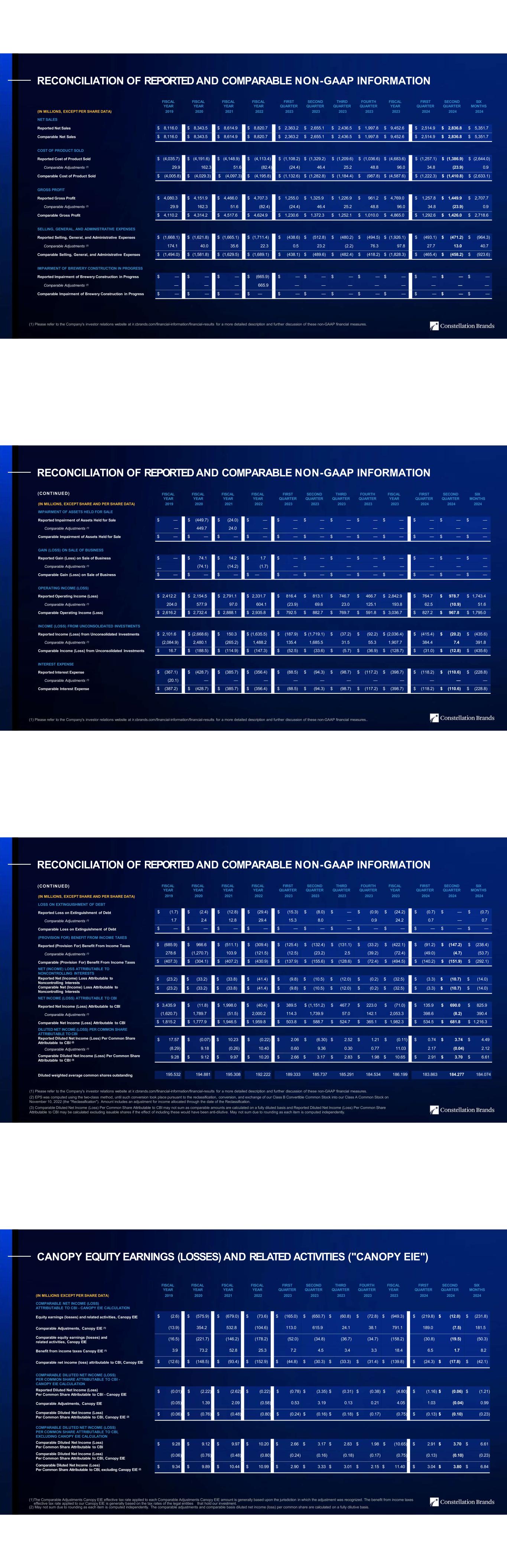

DELIVERING ON OUR COMMITMENTS CONSISTENT, DISCIPLINED CAPITAL ALLOCATION Firm delivery against our capital allocation priorities introduced in FY20 SOLID INVESTMENT GRADE RATING DIVIDEND GROWTH IN-LINE WITH EARNINGS ORGANIC INVESTMENTS TO SUPPORT GROWTH SMALLER / TUCK IN ACQUISITIONS ~3.1X ~3.2X FY19 FY20 FY21 FY22 FY23 Q2 FY24 ~34M HL ~39M HL ~42M HL ~47M HL FY19 FY20 FY21 FY22 FY23 Q2 FY24 Material uplift in brewing capacity 30% 29% 27% 28% 29% FY20 FY21 FY22 FY23 Q2 FY24 LTM Dividend payout ratio at ~30% SHARE REPURCHASES TO ENHANCE RETURNS ~$0.0B FY20 FY21 FY22 FY23 H1 FY24 Total $3B+ in share repurchases ~$1.7B ~$1.4B Reduced net leverage ratio to 3-3.5x ~4.5X Reclassification Financing ~3.9X ~3.6X ~$0.1B ~$0.2B ~$0.1B ~$0.1B ~$0.0B FY19 FY20 FY21 FY22 FY23 H1 FY24 Fundamental shift in M&A spend ~$4.1B ~$0.1B~$0.0B Note: Net leverage ratio defined as debt net of cash divided by comparable basis EBITDA excluding Canopy EIE. EBITDA is calculated on a comparable basis and is a non-GAAP financial measure. A reconciliation to the most directly comparable GAAP financial measure is included within the appendix. Payout ratio defined as dividend per share divided by comparable basis earnings per share excluding Canopy EIE. DELIVERING ON OUR COMMITMENTS DOING GOOD FOR THEWORLD AND FOR OUR BUSINESS Environmental and social initiatives more closely designed to align with our business objectives Enhanced alignment of corporate social responsibility priorities to business objectives FY21 Board formalized committee oversight of environmental, sustainability & social responsibility programs Elevated accountability for corporate social responsibility to executive level role FY22 Established first water stewardship & greenhouse gas emissions targets Published first ESG Impact Report inclusive of reporting aligned with SASB and TCFD frameworks FY23 FY24 Established updated water stewardship target Achieved & exceed first water stewardship target ahead of schedule Established waste reduction & circular packaging targets DELIVERING ON OUR COMMITMENTS EVOLVING OUR GOVERNANCE STRUCTURE Significant governance enhancements introduced in the last year RECLASSIFICATION OF CLASS B COMMON STOCK Alignment of shareholder voting power and economic ownership RETIREMENT OF TWO LONGEST TENURED NON-EXECUTIVE DIRECTORS Retirements also resulted in appointment of new chairs for HR and CGN&R committees APPOINTMENT OF TWO NEW INDEPENDENT DIRECTORS Strong financial expertise, as well as CPG and retail sector experience RETIREMENT OF PREVIOUSLY CONTROLLING SHAREHOLDER (ROB SANDS) AS BOARD CHAIR Appointment of interim independent Chair BOARD ADOPTED ANTI-PLEDGING POLICY FOR DIRECTORS AND EXECUTIVE OFFICERS Capped carve-out for Sands Family and affiliated entities RESIGNATION OF CONTROLLING SHAREHOLDER (ROB SANDS) AS NON-VOTING BOARD COMMITTEE MEMBER Sands Family waives any future non- voting Board committee participation OUR PATH FORWARD OUR STRATEGIC INITIATIVES UPHOLD OUR COMPELLING VALUE PROPOSITION Consumer obsessed

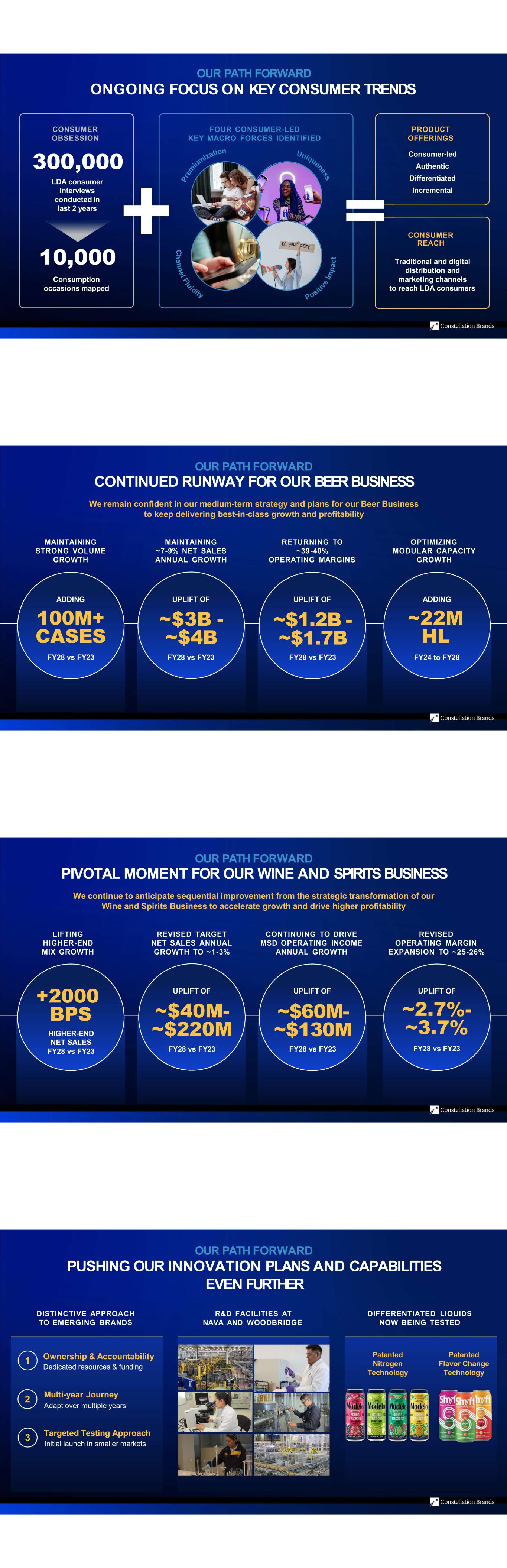

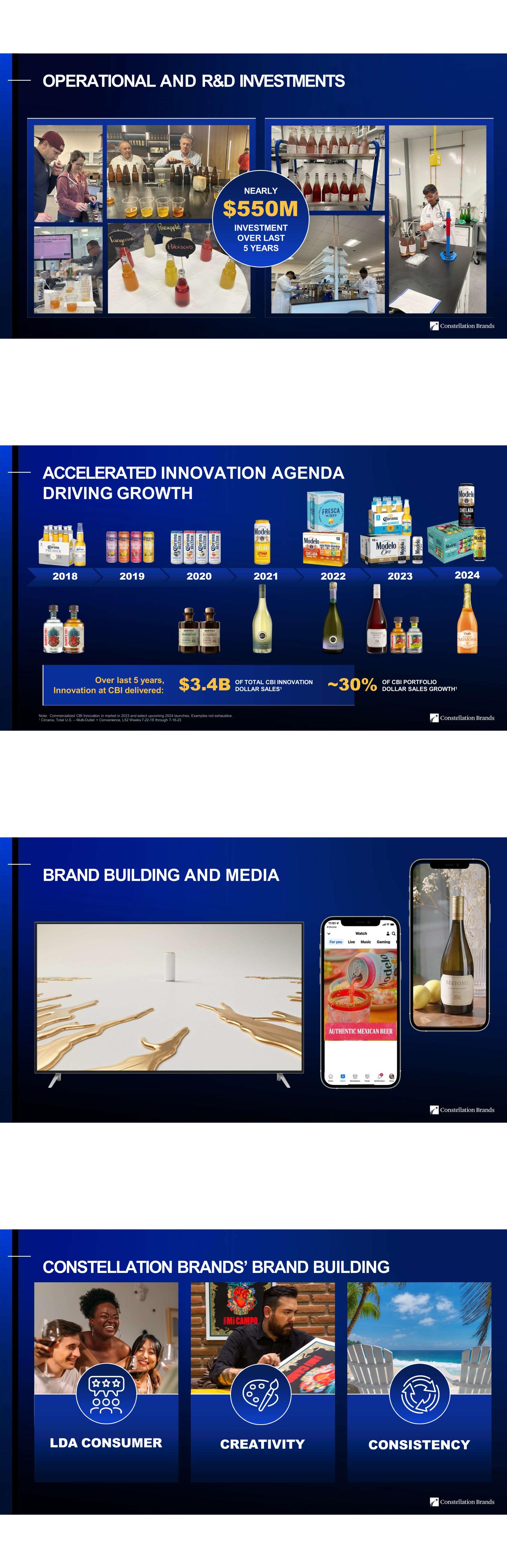

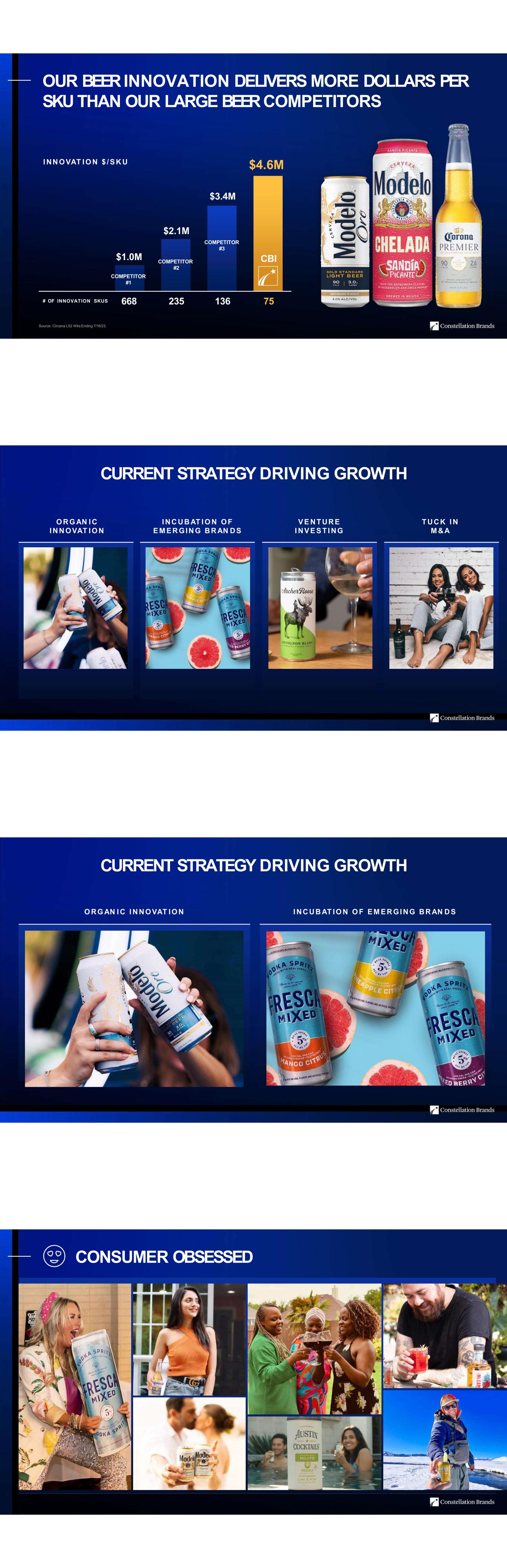

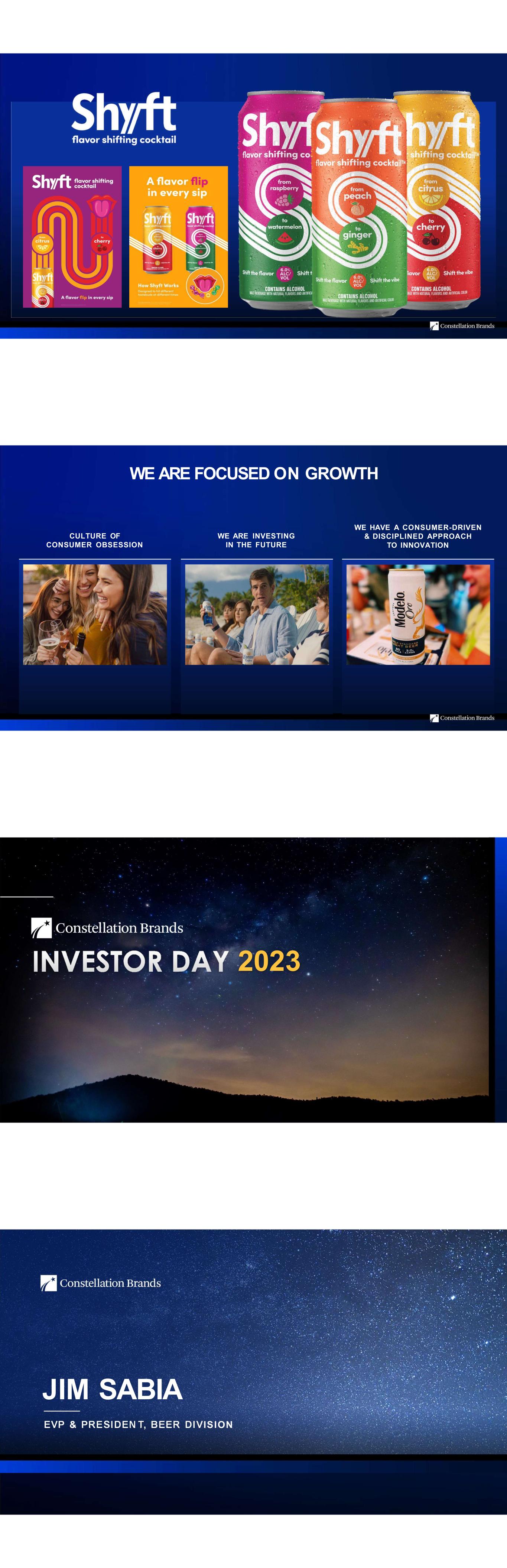

OUR PATH FORWARD ONGOING FOCUS ON KEY CONSUMER TRENDS 300,000 LDA consumer interviews conducted in last 2 years 10,000 Consumption occasions mapped Consumer-led Authentic Differentiated Incremental Traditional and digital distribution and marketing channels to reach LDA consumers CONSUMER REACH PRODUCT OFFERINGS FOUR CONSUMER-LED KEY MACRO FORCES IDENTIFIED CONSUMER OBSESSION OUR PATH FORWARD CONTINUED RUNWAY FOR OUR BEERBUSINESS We remain confident in our medium-term strategy and plans for our Beer Business to keep delivering best-in-class growth and profitability MAINTAINING STRONG VOLUME GROWTH RETURNING TO ~39-40% OPERATING MARGINS OPTIMIZING MODULAR CAPACITY GROWTH MAINTAINING ~7-9% NET SALES ANNUAL GROWTH 100M+ CASES FY28 vs FY23 ADDING ~$3B - ~$4B FY28 vs FY23 UPLIFT OF ~$1.2B - ~$1.7B FY28 vs FY23 UPLIFT OF ~22M HL FY24 to FY28 ADDING OUR PATH FORWARD PIVOTAL MOMENT FOR OUR WINE AND SPIRITS BUSINESS We continue to anticipate sequential improvement from the strategic transformation of our Wine and Spirits Business to accelerate growth and drive higher profitability LIFTING HIGHER-END MIX GROWTH CONTINUING TO DRIVE MSD OPERATING INCOME ANNUAL GROWTH REVISED OPERATING MARGIN EXPANSION TO ~25-26% REVISED TARGET NET SALES ANNUAL GROWTH TO ~1-3% +2000 BPS HIGHER-END NET SALES FY28 vs FY23 ~$40M- ~$220M FY28 vs FY23 UPLIFT OF ~$60M- ~$130M FY28 vs FY23 UPLIFT OF ~2.7%- ~3.7% FY28 vs FY23 UPLIFT OF OUR PATH FORWARD PUSHING OUR INNOVATION PLANS AND CAPABILITIES EVEN FURTHER DISTINCTIVE APPROACH TO EMERGING BRANDS DIFFERENTIATED LIQUIDS NOW BEING TESTED R&D FACILITIES AT NAVA AND WOODBRIDGE Patented Nitrogen Technology 1 Ownership & Accountability Dedicated resources & funding 2 Multi-year Journey Adapt over multiple years 3 Targeted Testing Approach Initial launch in smaller markets Patented Flavor Change Technology

OUR PATH FORWARD REINFORCED CAPITAL ALLOCATION PRIORITIES SOLID INVESTMENT GRADE RATING ORGANIC INVESTMENTS TO SUPPORT GROWTH SHARE REPURCHASES TO ENHANCE RETURNS DIVIDEND GROWTH IN-LINE WITH EARNINGS TUCK IN ACQUISITIONS Disciplined and rigorous process to assess with strict criteria any M&A considered Total board authorization of ~$2.8B for share buybacks now in place1 Expect total growth and maintenance Capex of ~$4B in Beer Business from FY24 to FY28 Expect to maintain target of ~30% annual dividend payout ratio Expect to achieve target of ~3.0x net leverage ratio during FY25 Note: Net leverage ratio defined as debt net of cash divided by comparable basis EBITDA excluding Canopy EIE. EBITDA is calculated on a comparable basis and is a non-GAAP financial measure. A reconciliation to the most directly comparable GAAP financial measure is included within the appendix. Payout ratio defined as dividend per share divided by comparable basis earnings per share excluding Canopy EIE. 1 $2B represents authorization approved by Board of Directors November 2023; $0.8B represents remaining portion of authorization approved by Board of Directors in January 2021 to repurchase up to $2.0B of the company's publicly traded common stock as of August 31, 2023. OUR PATH FORWARD ESG PROGRESS ALIGNED WITH OUR BUSINESS OBJECTIVES MODELING WATER STEWARDSHIP REDUCING WASTE AND ENHANCING PACKAGING FOSTERING AN INCLUSIVE CULTURE REDUCING GHG EMISSIONS FURTHER ENHANCING OUR BOARD Process underway to appoint new independent Board Chair Continuing to work toward our ambition for a more diverse, equitable workforce Expecting to attain TRUE Certification for Zero Waste to landfill and enhance circular packaging by FY25 Continuing to work toward target of 15% reduction in Scope 1 and 2 GHG emissions by FY25 Increasing our restoration target from 1.1B to ~5B gallons of water between FY23 and FY25 7 OUR PATH FORWARD SIGNIFICANT VALUE UPLIFT OPPORTUNITY TOTAL S&P 500 TOP-LINE 503 177 per NTM consensus 138 per NTM consensus 43 per NTM consensus SECTOR Consumer staples / discretionary DIVIDEND ~30% payout ratio EARNINGS Double-digit diluted EPS growth Mid to high single- digit sales growth 19.4x 26.4x 17.4x 22.0x 16.7x 21.8x 16.1X 23.5x 15.9x 22.3x 15.3x 19.5x 13.2x 15.9X 14.2x 18.1x EV/EBITDA NTM P/E NTM STZ PROFILE (OR BETTER)KEY MEASURE NUMBER OF COMPANIES Source: FactSet data as of October 27, 2023. COMPARABLE COMPANIES OUR PATH FORWARD COMMITTED LEADERSHIP DRIVING A CONSISTENT STRATEGY TO DELIVER RESULTS BILL NEWLANDS President & Chief Executive Officer ROBERT HANSON EVP & President Wine & Spirits JIM BOURDEAU EVP & Chief Legal Officer MICHAEL MCGREW EVP & Chief Communications, CSR and Diversity Officer KRIS CAREY EVP & Chief Human Resources Officer MALLIKA MONTEIRO EVP & Chief Growth, Strategy & Digital Officer GARTH HANKINSON EVP & Chief Financial Officer JIM SABIA EVP & President Beer

2023 EVP, CHIEF GROWTH, STRATEGY & DIGITAL OFFICER MALLIKA MONTEIRO WE ARE FOCUSED ON GROWTH CULTURE OF CONSUMER OBSESSION

CONSTELLATION BRANDS IS CONSUMER OBSESSED BUILT ON DEEP CONSUMER UNDERSTANDING, INSIGHTS AND ANALYTICS +300K LDA CONSUMER CONVERSATIONS 2.5M CONSUMERS 240M U.S. LDA ADULTS1 Source: Constellation Brands data, analyses, and plans. AND GROUNDED IN THE NEEDS AND MOTIVATIONS OF TODAY'S CONSUMER C U LT U R E CO N S U M E R B E HAV I O R ON - P R E M I S E T RE ND S CO N S UM E R E X P E C TAT I O N S WITH ON-THE-GROUND MARKET INTELLIGENCE

WE UNDERSTAND LUXURY WINE DRINKERS $2T PURCHASING POWER 50M U.S. LDA DRINKERS BY 2030 60% OF TOTAL U.S. POPULATION GROWTH LARGEST AFFLUENT U.S. GEN Z CONSUMERS HISPANIC CONSUMERS CONTINUE TO BE A CRITICAL GROWTH DRIVER FOR CONSTELLATION BRANDS Source: Constellation Brands data, analyses, and plans. GENERAL MARKET CONSUMERS CONNECT TO OUR BEERBRANDS 1 Circana Hispanic Insights Advantage (HIA) database and Total US Food-Convenience L52W ending 9/10/23. +50% CONSTELLATION BEER DOLLARS1 ~70% CONSTELLATION BEER GROWTH1 TURNING OUR CONSUMER OBSESSION INTO ACTION

TURNING OUR CONSUMER OBSESSION INTO ACTION 1 Circana L12W ending 9/10/23 2 Circana HIA, Total US Food+Conv; L52W week ending 10/15/23 AUTHENTIC FLAVOR & TASTE 150 HISPANIC CONSUMER INDEX #1 AHEAD OF TOP 5 NATIONAL FMBs2 NITRO TECHNOLOGY #1 NEW FMB IN LAS VEGAS1 #1 REPEAT RATE AMONG HISPANICS2 +18% HH PENETRATION GROWTH OVER LAST 3 YEARS2 ~40% NET SALES BEYOND RED BLEND3 NE W & E X I S T I NG BR AN D E X TE NS I O NS $3B CIRCANA DOLLAR SALES SINCE 20181 S I NC E AC Q UI S I T I ON : +260% NET SALES TURNING OUR CONSUMER OBSESSION INTO RESULTS 1 Circana MULO+C L52 Weeks ending 7/22/18 through 7/16/23 2 Circana Consumer and Shopper Insights Advantage (CSIA) database; L52W ending 9/10/23 3 Constellation Brands data, analyses, and plans. NEXT GENERATION TOOLS & CAPABILITIES WE ARE FOCUSED ON GROWTH INNOVATION AND R&D BRAND BUILDING AND MEDIA DIGITAL BUSINESS ACCELERATION NEXT GENERATION TOOLS AND CAPABILITIES

OPERATIONAL AND R&D INVESTMENTS $550M INVESTMENT OVER LAST 5 YEARS NEARLY ACCELERATED INNOVATION AGENDA DRIVING GROWTH Note: Commercialized CBI Innovation in market in 2023 and select upcoming 2024 launches. Examples not exhaustive. 1 Circana, Total U.S. – Multi-Outlet + Convenience, L52 Weeks 7-22-18 through 7-16-23 2018 2019 2020 2021 2022 2023 2024 Over last 5 years, Innovation at CBI delivered: OF TOTAL CBI INNOVATION DOLLAR SALES1$3.4B OF CBI PORTFOLIO DOLLAR SALES GROWTH1~30% BRAND BUILDING AND MEDIA CONSTELLATION BRANDS’ BRAND BUILDING LDA CONSUMER CREATIVITY CONSISTENCY

~$750M PROFIT $2.50 ROI CONSTELLATION BRANDS' BRAND BUILDING = HIGH MEDIA ROI IN BEER1 1 Source: Constellation Brands data, analyses, and plans. CONSTELLATION BRANDS WAS AN EARLY ADOPTER IN DIGITAL COMMERCE 1 Circana L52 Wks Ending 9/10/23. Circana ePOS tracked accounts = Albertsons, Amazon, Lowes Foods, Giant Eagle, Kroger, Meijer, Raley’s, Schnucks, SEG, Target, Total Wine & More, and Walgreens 3% CATEGORY GROWTH CONSTELLATION BRANDS PORTFOLIO BEVERAGE ALCOHOL CATEGORY PERFORMANCE 1 3-Tier eCommerce 3.8% 2.4% TOTAL BEER CATEGORY GROWTH CONSTELLATION BEER PORTFOLIO BEER CATEGORY PERFORMANCE 1 3-Tier eCommerce 10.2% ACCELERATING OUR DIGITAL LEADERSHIP PROCUREMENT SUPPLY CHAIN MARKETING • $60M - $80M planned investment in first 2 years of program • Technology, Data and Analytics, Talent and Agile Delivery ACCELERATING OUR DIGITAL LEADERSHIP • Data Transparency and Automation • $60M savings (FY23 and FY24) • Sustained OTIF improvement • $0.02 per case efficiency savings • 8% sales uplift for Pacifico • Expansion to Corona and Modelo PROCUREMENT SUPPLY CHAIN MARKETING Source: Constellation Brands data, analyses, and plans.

INNOVATION & EMERGING BRANDS WE ARE FOCUSED ON GROWTH #1 INNOVATION BRAND1 #1 NEW SINGLE SERVE1 2.5x CBI BETTERMENT PRODUCTS GROWING2 INNOVATION AND EMERGING BRANDS 1 Source: Circana, Total U.S. Multi-Outlet + Convenience, 12 weeks ending 9/10/23; Ranking based on brands introduced nationally this year. 2Circana L52W ending 6/18/23. Note: Betterment Wine is defined as still wine, in a bottle, popular+ price segment, below 10% ABV, including core varietals but excluding flavored wines Ventures investments outgrowing segments1 +101pp NA BEER +71pp ULTRA PREMIUM WINE +6pp MEZCAL+43pp GIN +136pp LUXURY WINE INNOVATION AND EMERGING BRANDS 1 Circana, Total U.S. – Multi-Outlet + Convenience, L52W ending 6/18/23; Outperformance compares Circana segment growth to Ventures brand Internal Net Sales data CURRENT STRATEGY DRIVING GROWTH CBI OF CBI PORTFOLIO DOLLAR SALES GROWTH1 INNOVATION DROVE ~30% OF TOTAL CBI INNOVATION DOLLAR SALES1 DELIVERING $3.4B Innovation Non-Innovation Net Growth/Decline C B I T O TA L P O R T F O L I O C O R E AN D I N N O VAT I O N V S C O M P E T I T I V E S E T 2 OVER LAST 5 YEARS D O L L A R S A L E S C H A N G E V S P R IO R Y E A R C O M P E T I T O R S R A N K E D B Y T O T A L N E T G R O W T H / D E C L I N E 1 Circana, Total U.S. – Multi-Outlet + Convenience, L52 Weeks 7-22-18 through 7-16-23. 2 Circana, Total U.S. – Multi-Outlet + Convenience, L52 Weeks through 7-16-23

OUR BEERINNOVATION DELIVERS MORE DOLLARS PER SKU THAN OUR LARGE BEERCOMPETITORS Source: Circana L52 Wks Ending 7/16/23. CBI I NN O VAT I O N $ / S K U $4.6M $3.4M $2.1M $1.0M # OF INNOVATION SKUS 668 235 136 75 COMPETITOR #2 COMPETITOR #1 COMPETITOR #3 O RG AN I C I NN OVAT I O N I NC UB AT I O N O F E M E R GIN G BR AN DS V E NT UR E I NV E S TI NG T UCK I N M &A CURRENT STRATEGY DRIVING GROWTH O RG AN I C I N NO VAT IO N I NCUB AT IO N O F E M E R GI NG BR AN D S CURRENT STRATEGY DRIVING GROWTH CONSUMER OBSESSED

HIGH GROWTH MARKET SEGMENTS FLAVORS & BETTERMENT READY TO SERVE & BETTERMENT Note: For Flavors: Beer Flavors segment defined as flavored malt beverages, malt/sugar seltzers, flavored beer, and cider. For Beer Betterment: Beer Betterment segment defined as high-end light beers and non-alcoholic beers. For Wine Betterment: Wine Betterment segment defined as still wine, in a bottle, popular+ price segment, below 10% ABV, including core varietals but excluding flavored wines 1 Circana, Total U.S. – Multi-Outlet + Convenience, L12 Weeks through 9-10-23 2 Circana, L52 Weeks through 6-18-23 KC Illuminate + Meiomi Bright up 56% vs Betterment Category up 21%2 Corona Non-Alcoholic is the #1 share-gaining brand in non-alcoholic Beer category1 PRIORITIZE BRAND EXTENSIONS 1 Circana, L52 Weeks through 7-16-23 CBI INNOVATION GENERATES 20x INNOVATION GROWTH OF 2 OTHER TOP BEER SUPPLIERS1 AUTHENTIC & UNIQUE LIQUIDS TESTTO LEARN

DISCIPLINED 1 Source: Circana, Multi-Outlet + Convenience across entire Beer Imports Portfolio, L52 weeks through 9/17/2023 CBI GENERATES 5x THE SALES PER SKU OF THE TWO OTHER TOP BEER SUPPLIERS1 INCREMENTAL VALUE CREATION 1 Circana Custom Study provided to Constellation Brands, Inc CBI INCREMENTALITY ABOVE 30-40% INDUSTRY AVERAGE1 EMERGING BRANDS AT CONSTELLATION EMERGING BRANDS AT CONSTELLATION OWNERSHIP & ACCOUNTABILITY PATIENCE & MULTI-YEAR JOURNEY TARGETED TEST MARKETS

WE ARE INVESTING IN THE FUTURE WE HAVE A CONSUMER-DRIVEN & DISCIPLINED APPROACH TO INNOVATION WE ARE FOCUSED ON GROWTH CULTURE OF CONSUMER OBSESSION 2023 EVP & PRESIDEN T, BEER DIVISION JIM SABIA

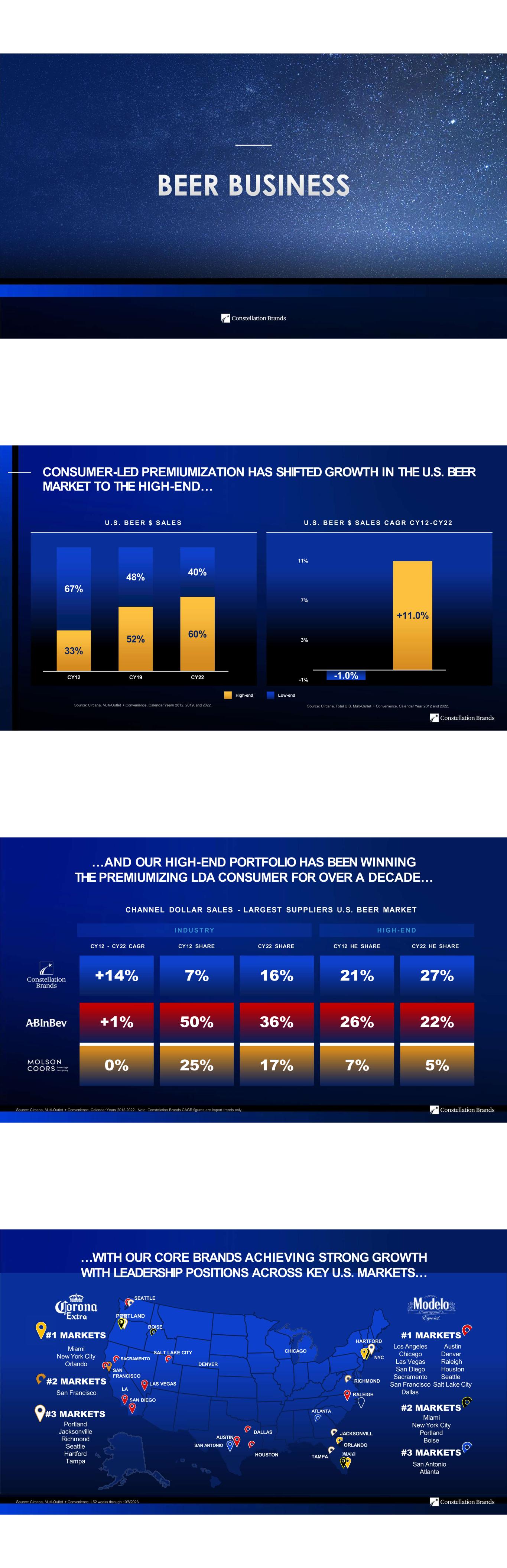

CONSUMER-LED PREMIUMIZATION HAS SHIFTED GROWTH IN THE U.S. BEER MARKET TO THE HIGH-END… 33% 52% 60% 67% 48% 40% CY12 CY19 CY22 U . S . B E E R $ S AL E S U . S . B E E R $ S AL E S C AG R C Y 1 2 - C Y 2 2 High-end Low-end -1.0% +11.0% -1% 3% 7% 11% Source: Circana, Multi-Outlet + Convenience, Calendar Years 2012, 2019, and 2022. Source: Circana, Total U.S. Multi-Outlet + Convenience, Calendar Year 2012 and 2022. …AND OUR HIGH-END PORTFOLIO HAS BEEN WINNING THE PREMIUMIZING LDA CONSUMER FOR OVER A DECADE… Source: Circana, Multi-Outlet + Convenience, Calendar Years 2012-2022. Note: Constellation Brands CAGR figures are Import trends only. CHANNEL DOLLAR SALES - LARGEST SUPPLIERS U. S. BEER MARKET CY12 - CY22 CAGR CY12 SHARE CY22 SHARE CY12 HE SHARE CY22 HE SHARE +14% 7% 16% 21% 27% +1% 50% 36% 26% 22% 0% 25% 17% 7% 5% I N D U S T RY H I G H - E N D 0 …WITH OUR CORE BRANDS ACHIEVING STRONG GROWTH WITH LEADERSHIP POSITIONS ACROSS KEY U.S. MARKETS… Source: Circana, Multi-Outlet + Convenience, L52 weeks through 10/8/2023 DALLAS LA LAS VEGAS SAN DIEGO SACRAMENTO HOUSTON RALEIGH NYC BOISE SALT LAKE CITY AUSTIN SAN ANTONIO DENVER CHICAGO ATLANTA MIiAaMmIiTAMPA RICHMOND JACKSONVILL E ORLANDO SEATTLE PORTLAND #1 MARKETS Miami New York City Orlando SAN FRANCISCO #2 MARKETS San Francisco #3 MARKETS Portland Jacksonville Richmond Seattle Hartford Tampa HARTFORD Los Angeles Chicago Las Vegas San Diego Sacramento Austin Denver Raleigh Houston Seattle #1 MARKETS San Francisco Salt Lake City Dallas #2 MARKETS Miami New York City Portland Boise #3 MARKETS San Antonio Atlanta

…AND OUR LARGEST BRAND RECENTLY RISING TO THE OVERALL #1 SPOT IN THE U.S. BEERMARKET… Note: Modelo Especial’s #1 Position is based from Tracked Channel data and is in Dollar Sales Bud Light Loses Title as Top-Selling U.S. Beer …PREMIUMIZATION REMAINS A DRIVING FORCE AND WE STILLSEEPLENTY OF OPPORTUNITY AHEAD! Source: Circana, Multi-Outlet + Convenience, L52 weeks through 9/17/2023. Source: Circana, Multi-Outlet + Convenience, Calendar Years 2021 and 2022. T H E U . S . C O N T I N U E S T O P R E M I U M I Z E STATES WITH +60% HE SHARE STATES ADDING 3+ HIGH-END SHARE POINTS OVER LAST TWO YEARS GROWTH DRIVERS LIQUID PRICE -PACK ~40-50% SIMPLE EFFECTIVE 30% OF GROWTH OVER THE LAST 5 YEARS OF EXPECTED VOLUME GROWTH LDA GENERAL MARKET 50% OF CURRENT CONSUMER MIX ~20-30% OF EXPECTED VOLUME GROWTH HISPANIC LDA CONSUMER 50% OF CURRENT CONSUMER MIX ~20-40% OF EXPECTED VOLUME GROWTH STRATEGIC GROWTH IMPERATIVES GO-FORWARD VISION DRIVE GROWTH WITH THE COR E Lead the high-end and drive differentiated, incremental portfolio growth BUILD FOCUSED APPROACH TO FLAV ORS Unlock new occasions and LDA consumers in order to diversify our long-term sources of growth ACCELERATE GROWTH IN BETTERMEN T Leverage portfolio breadth to address shifting consumer demands for betterment options

STRATEGIC GROWTH IMPERATIVES GO-FORWARD VISION Source: Constellation Brands data, analyses, and plans. MAXIMIZE MOMENTUM • Large-scale, mature brands • Market-leading share & equity • Commercial prioritization • Majority of investment ACCELERATE MOMENTUM • Developing, mid-scale brand with high growth potential • Emerging equity & awareness • Over-index investment & commercial prioritization FY23 DEPLETIONS ~180M CASES ~120M CASES ~19M CASES FY24-28 OUTLOOK MSD-HSD ANNUAL GROWTH LSD ANNUAL GROWTH LDD ANNUAL GROWTH DRIVE GROWTH WI T H TH E C O RE Lead the high-end and drive differentiated, incremental portfolio growth Source: Constellation Brands data, analyses, and plans. DEVELOPING, MID-SCALE BRANDS with high growth potential SMALL-SCALE BRANDS with growth upside in high potential segments FY23 DEPLETIONS 18M CASE MILESTONE FY24-28 OUTLOOK LDD ANNUAL GROWTH BUILD FOCUSED APPROACH TO F L AV O R S Unlock new occasions and LDA consumers to diversify our long-term sources of growth FOCUSED INVESTMENT in key tactics, regions, and DMAs STRATEGIC GROWTH IMPERATIVES GO-FORWARD VISION *Source: Morning Consult Survey April 2023. **Source: Circana, Multi-Outlet + Convenience, Calendar Years 2012-2022. ***Source: Circana, Multi-Outlet + Convenience, L52 Weeks through 8/16/2023 ACCELERATE GROWTH I N BE T T E RM E N T Leverage portfolio breadth to address shifting consumer demands for betterment options 50%+ CONSUMERS SEEKING HEALTHIER OPTIONS* 10% CAGR OVER LAST 10 YEARS (HIGH-END LIGHT)** 1/3 OF INDUSTRY IN “LIGHT” OFFERINGS*** STRATEGIC GROWTH IMPERATIVES GO-FORWARD VISION EFFICIENCY & EARNINGS DRIVERS GO-FORWARD VISION FOCUSED & DISCIPLINED P O R T F O L I O AR C HI T E CT U RE Maintain an efficient set of brands and SKUs while developing new price points for the LDA consumer to access our brands EFFECTIVE & ENHANCED M AR K E T I N G I N V E S T M E N T S Continue to grow investments in marketing while enhancing their effectiveness and returns EVOLVED & OPTIMIZED S U P P LY N E T W O R K Advance modular brewing capacity expansions while optimizing production and supply chain footprint and capabilities

FOCUSED PORTFOLIO OF BRANDS AND SKUS Source: Circana, Multi-Outlet + Convenience, L52 weeks through 9/17/2023 D I S C I P L I N E D G O - F O RWAR D AP P RO AC H TO R E C E N T S K U E X T E N S I O N S 5 150 $54M/SKU 100 1,500+ $10.25M/SKU 50 750+ $10.9M/SKU BRAND FAMILIES SKUs NET SALES PER SKU ACHIEVING EVEN GREATER MARKETING EFFECTIVENESS ENHANCED GO-FORWARD APPROACH TO G RO W TH I N M AR KE T I N G I NV E S TM E NTS ~9% OF ANNUAL NET SALES TO BE REINVESTED IN MARKETING FY24 - FY28 DIGITAL MEDIA OPTIMIZATION MEDIA AGENCY PARTNERSHIPS S T R A T E G IE S A N D T O O L S MARKETING EFFECTIVENESS BILL RENSPIE Chief Customer Officer JOHN KESTER SVP, Operations Services TOM McCORRY SVP, Beer Finance CHIEF CUSTOMER OFFICER BILL RENSPIE

BEERINDUSTRY SEGMENT DYNAMICS DOLLAR SHARE CHANGE 13WK ENDING 9/10/2023 Source: Circana Total MULO + C-Store, 13 WKS Ending 9-10-2023 IMPORT DOM. SUPER PREM.CRAFT PREMIUM CIDERSUB- PREM NON-ALC FMB SELTZER 2.4 -0.3 -0.6 -1.0 -0.1 0.2 0.0 1.1 -1.8 TOP 3 DOMESTIC LIGHTS -1.9% EXPAND CONTRACT OPTIMIZE Expected Fall & Spring Retail Space Impact Source: Circana Total MULO + C-Store, Constellation Fiscal Year 2024 Ending 09-24-2023 CONSTELLATION BEER WEEKLY SHARE GAINS FYTD 2024 0.00 0.50 1.00 1.50 2.00 2.50 3.00 3/5 3/12 3/19 3/26 4/2 7/9 7/16 7/23 7/30 8/6 8/13 8/20 8/27 9/3 9/10 9/17 9/244/9 4/16 4/23 4/30 5/7 5/14 5/21 5/28 6/4 6/11 6/18 6/25 7/2 2023 - W E E K E NDI N G SALES INITIATIVES - DISTRIBUTION & SPACE Source: Constellation Brands data, analyses, and plans. ALIGNMENT TO COMPANY GOALS • Top-Line Sales & Bottom-Line Return Expectations • Strategic Goals & Innovation Objectives for Sustained Growth 700K+ Incremental Off-prem Effective PODs Since 2019 +25% Increase in On-Prem Simple PODs Since Covid Linear Feet Gained since 2021 +57K SFS Three-Pillar Resets since 2018 EXPECTED TO LEAD TO… 101.5% +100K Avg. Volume Plan Attainment for the Past 3yrs DATA DRIVEN TARGETS ‘Precise Targets, Exact Execution’ COLLABORATION TARGETED GOALS CONSISTENT TRACKING Distribution & space are embedded in every conversation, action, and activity by the sales team and our Gold Network partners. Robust Goal Setting of Top-two Sales Priorities Expected to Lead to the Delivery of Volume Plan & Achievement of Strategic Objectives SPACE INITIATIVE: STRATEGIC GOAL SETTING SPACE STRATEGIC IMPERATIVES Defend & Grow The Core Win With Innovation Adjacencies Balancing Retailer Incrementality & Consumer Access 1 2 3 Velocity Needed on Existing SKUs Distribution Growth Planned CBI Space Growth Goal • Cold Linear Feet per Account • Average CBI PODs per Account • Gap between CBI Volume Share & Cooler Share • Market Nuances, Risks & Dependencies • Historical Space Growth SUPPLEMENTAL PLANNING FACTORS Utilizing velocity and distribution runway to build targeted goals designed to deliver on volume plan GOAL SETTING OBJECTIVE Set space growth goals to achieve overarching volume plan

Source: Constellation Brands data, analyses, and plans. SFS OFF-PREMISE BEER CATEGORY PROGRAM S F S S T R AT E G I C R E TA I L E R PA R T N E R S H I P S RESULTS • Improve Shopability of Category to Make Buying Easy and Intuitive • Build Holding Power for High-Growth Brands • Offer Right Selection to Meet Consumer Needs +4-6% AVG. RETAILER $ SALES LIFT SPACE ASSORTMENT FLOW B E F O R E A F T E R 4,443 6,703 13,979 17,200 0 5,000 10,000 15,000 20,000 25,000 500 FY19 FY20 FY21 FY22 FY23 FY24 SFS Resets TOTAL ~60,000 SFS RESETS FOR CHAIN AND INDEPENDENT ACCOUNTS SHOPPER-FIRST SHELF A truly objective approach to category management with proven results for CBI’s Distributors & Retailers PROJECTED ~21,000 STRATEGIC CATEGORY PARTNERSHIPS Source: Constellation Brands data, analyses, and plans. BROADENING OUR POSITION AS THE LEADING CATEGORY PARTNER T O P 2 5 B E E R R E TA I L E R S Retailer Count by Partnership Position and Share of Depletions in Retailers Counted in Each Partnership Position F Y 23 F Y 19 CAPTAIN CO- CAPTAIN VALIDATOR INFLUENCER 2 1 8 14 6% 2% 44% 48% CO-CAPTAINCAPTAIN VALIDATOR A L L G E O G R A P H I E S S E L E C T A R E A S A L L G E O G R A P H I E S S E L E C T A R E A S CAPTAIN CO- CAPTAIN VALIDATOR INFLUENCER 11 1 8 5 51% 2% 25% 22% SPACE FY23 RESULTS & FY24 PROGRESS Source: Constellation Brands data, analyses, and plans. FY 2 3 R E S ULT S F Y 2 4 P RO GR E S S Y TD +2.2 Pts CBI COOLER SHARE GROWTH I N D E P E N D E N T A C C O U N T S P A C E R E S U L T S I N D E P E N D E N T A C C O U N T S P A C E R E S U L T S 17,200 SHOPPER-FIRST SHELF RESETS ACROSS CHAIN & INDEPENDENT ACCOUNTS +3.1 Pts CBI COOLER SHARE GROWTH 18,400 SHOPPER-FIRST SHELF RESETS ACROSS CHAIN & INDEPENDENT ACCOUNTS ~21,000 PROJECTED RESETS BY YEAR- END DISTRIBUTION GROWTH RUNWAY FY24-FY28 DISTRIBUTION GAIN OUTLOOK Future innovation + Oro, Aguas Frescas & Fresca Mixed not considered part of existing brands and provide additional distribution upside Source: Constellation Brands data, analyses, and plans. INCREMENTAL POINTS OF DISTRIBUTION BY BUSINESS UNIT REGIONS WEST 100k+ CENTRAL 120k+ SOUTH 125k+ SOUTHEAST 125k+ EAST 40k+ 54% 46% 44% 43% 28% 72% 60% 40% 56% 44% MODELO ESPECIAL OTHER INCREMENTAL SHARE OF POINT OF DISTRIBUTION GAINS FY23 SOUTH SOUTHEAST CENTRAL WEST EAST FY28 Incremental points of distribution, inclusive of respective modeled velocities, expected to contribute ~40-50%+ of anticipated volume growth

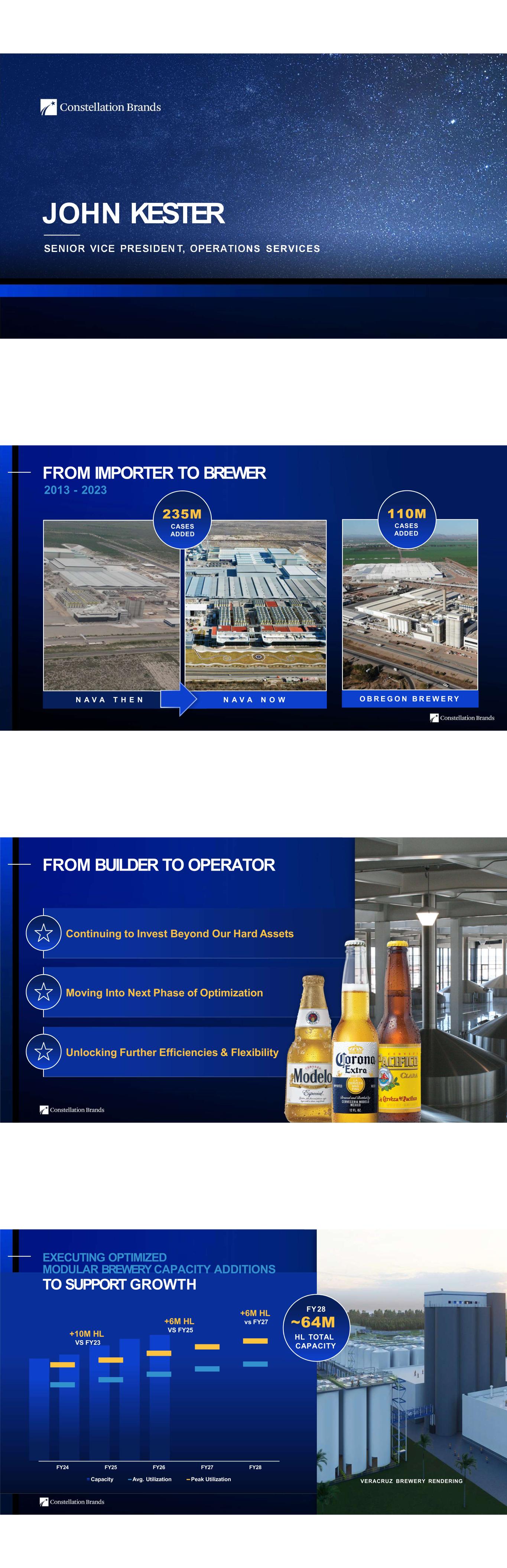

SENIOR VICE PRESIDEN T, OPERATIONS SERVICES JOHN KESTER FROM IMPORTER TO BREWER 2013 - 2023 N A V A T H E N N A V A N O W O B R E G O N B R E W E R Y CASES ADDED CASES ADDED 235M 110M FROM BUILDER TO OPERATOR Continuing to Invest Beyond Our Hard Assets Moving Into Next Phase of Optimization Unlocking Further Efficiencies & Flexibility EXECUTING OPTIMIZED MODULAR BREWERY CAPACITY ADDITIONS TO SUPPORT GROWTH FY24 FY25 FY26 FY27 FY28 Capacity Avg. Utilization Peak Utilization FY28 ~64M HL TOTAL CAPACITY +10M HL VS FY23 +6M HL VS FY25 +6M HL vs FY27 VERACRUZ BREWERY RENDERING

ENHANCING DIGITAL CAPABILITIES TO TRANSFORM OUR BUSINESS FY24 investments in digital platforms to support logistics are expected to have full net savings payback in less than 3 years CLOUD-BASED TRACK AND TRACE TOOLS PREDICTIVE ANALYTI CS TOOLS PRESCRIPTIVE ANALYTI CS TOOLS COMMERCIAL BENCHMARKING TOOLS END TO END PLANNING & FULFILLMENT OPTIMIZATION STRATEGY Deliver a quantitative, efficient decision-making process that links high level strategic plans with day-to-day operations in preparation for the ability to deliver +100M cases PROCUREMENT COMMERCIAL WORKING CAPITAL DRIVING DOWN COSTS THOUGH EFFICIENCY UNLOCKING GREATER VALUE THROUGH DBA AND BEYOND PROCUREMENT LOGISTICS INTEGRATED BUSINESS PLANNING & EXECUTION CROSS-FUNCTIONAL COLLABORATION Implemented organizational reset Accelerating savings through data transparency and automation Undergoing transformation following procurement model Delivering efficiencies and savings through TMS & WMS Drastic advancement of all facets of IBP&E Improved demand forecast accuracy by 15-20% nationally Implementation of reusable pallets and double-stacking Conversion from 50 to 60’ railcars At least $300M in savings anticipated FY24 - FY28 THE FRAMEWORK FOR OUR FUTURE SUPPLY CHAIN TRUE END TO END CUSTOMER CENTRICITY & AGILITY PROFITABILITY RESILIENCY QUALITY & SUSTAINABILITY 100M+ CASES Right beer, right place, right time, right cost

SENIOR VICE PRESIDEN T, BEER FINANCE TOM McCORRY CONSISTENT AND SUSTAINABLE GROWTH, PROFITABILITY, AND CASH GENERATION Volume growth + pricing increases + efficiency and cost initiatives expected to offset expansions’ depreciation and fixed costs + inflation to drive positive operating leverage near-term and maintain profitability over medium-term FY24 - FY28 FY19 - FY23 SUSTAINABLE NET SALES GROWTH ACHIEVED 9.4% CAGR TARGET ~7-9% Annually BEST-IN-CLASS OPERATING MARGINS ACHIEVED 39.7% Avg. TARGET ~39-40% $0B $3B $6B $9B $12B F Y 19 F Y 20 F Y 21 F Y 22 F Y 23 F Y 24 F Y 28 CONTINUE TO TARGET ~7-9% ANNUAL NET SALES GROWTH OVER THE NEXT FIVE YEARS KEY GROWTH DRIVERS Continued growth of core brands Contributions from consumer-led innovation (Flavors & Betterment) Consistent ~1-2% annual average price increases 1 2 3 9.4% CAGR FY24 Revised Guidance ~8-9% Growth Target ~7-9% Annual Growth FY24 – FY28 N E T S A L E S BEST-IN-CLASS ~39-40% OPERATING MARGIN STILL EXPECTED ON AVERAGE OVER NEXT FIVE YEARS KEY MARGIN VARIABLES DRIVERS • Marketing investment • SG&A ANNUAL MARGINS AFFECTED BY VARIABLES BUT AVERAGE EXPECTED TO REMAIN WITHIN TARGETED RANGE DRAGS • Volume growth • Annual pricing increase • Cost / ops. efficiencies • Incremental capacity depreciation • COGS inflation OTHER FACTORS • MXN-USD FX rate 37% 38% 39% 40% 41% 42% F Y 19 F Y 20 F Y 21 F Y 22 F Y 23 F Y 24 F Y 25 F Y 26 F Y 27 F Y 28 Margin favorability FY19-FY22 driven by materials costs, FX impact, glass joint venture, and optimization projects TARGET ~39-40% OPERATING MARGIN IMPLIED FY24 GUIDANCE Material costs and general inflation impacts expected to be mitigated though renegotiation with suppliers and cost savings agenda

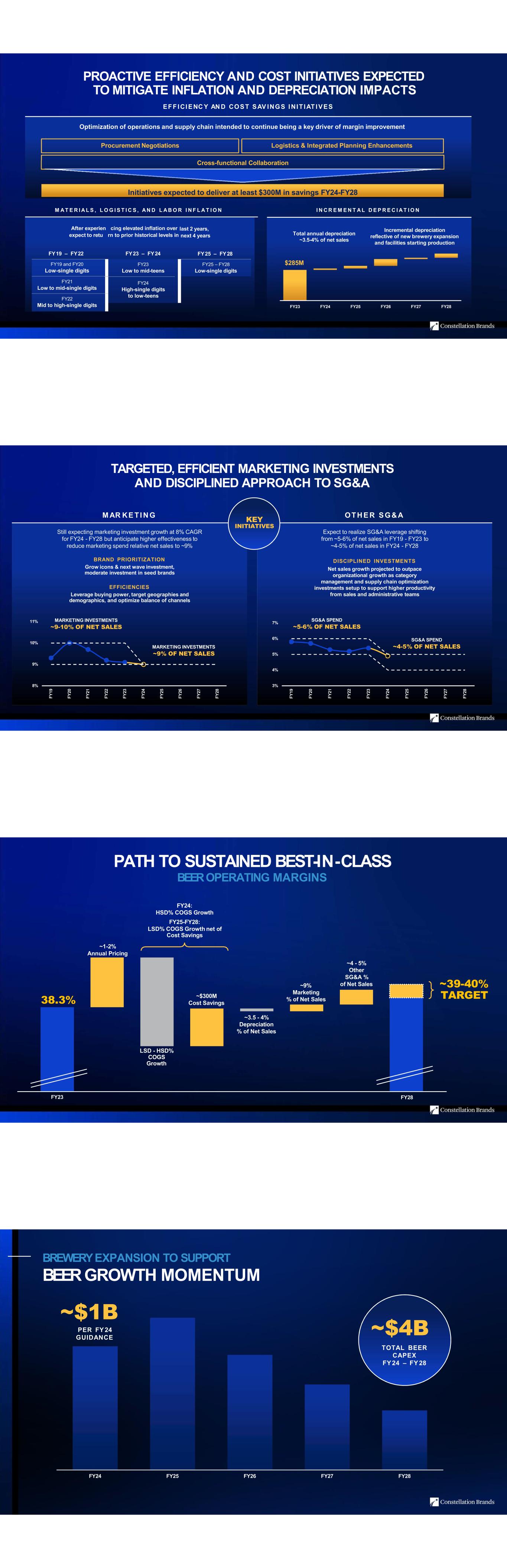

PROACTIVE EFFICIENCY AND COST INITIATIVES EXPECTED TO MITIGATE INFLATION AND DEPRECIATION IMPACTS EF F ICI ENC Y AN D COST SAV INGS I NIT I AT I VES M A T E R I A L S , L O G I S T I C S , A N D L A B O R I N F L A T I O N I N C R E M E N T A L D E P R E C I A T I O N Procurement Negotiations Logistics & Integrated Planning Enhancements Optimization of operations and supply chain intended to continue being a key driver of margin improvement Cross-functional Collaboration Initiatives expected to deliver at least $300M in savings FY24-FY28 Total annual depreciation ~3.5-4% of net sales Incremental depreciation reflective of new brewery expansion and facilities starting production After experien expect to retu FY19 – FY22 cing elevated inflation over rn to prior historical levels in FY23 – FY24 last 2 years, next 4 years FY25 – FY28 FY19 and FY20 Low-single digits FY23 Low to mid-teens FY25 – FY28 Low-single digits FY21 Low to mid-single digits FY24 High-single digits to low-teens FY22 Mid to high-single digits $285M TARGETED, EFFICIENT MARKETING INVESTMENTS AND DISCIPLINED APPROACH TO SG&A M AR KE TI N G OT H E R S G &A Still expecting marketing investment growth at 8% CAGR for FY24 - FY28 but anticipate higher effectiveness to reduce marketing spend relative net sales to ~9% Expect to realize SG&A leverage shifting from ~5-6% of net sales in FY19 - FY23 to ~4-5% of net sales in FY24 - FY28 BRAND PRIORITIZATION Grow icons & next wave investment, moderate investment in seed brands EFFICIENCIES Leverage buying power, target geographies and demographics, and optimize balance of channels KEY INITIATIVES DISCIPLINED INVESTMENTS Net sales growth projected to outpace organizational growth as category management and supply chain optimization investments setup to support higher productivity from sales and administrative teams 8% 9% 10% 11% F Y 19 F Y 20 F Y 21 F Y 22 F Y 23 F Y 24 F Y 25 F Y 26 F Y 27 F Y 28 MARKETING INVESTMENTS ~9-10% OF NET SALES MARKETING INVESTMENTS ~9% OF NET SALES 3% 4% 5% 6% 7% F Y 19 F Y 20 F Y 21 F Y 22 F Y 23 F Y 24 F Y 25 F Y 26 F Y 27 F Y 28 SG&A SPEND ~5-6% OF NET SALES SG&A SPEND ~4-5% OF NET SALES PATH TO SUSTAINED BEST-IN-CLASS BEEROPERATING MARGINS FY23 FY28 38.3% ~$300M Cost Savings LSD - HSD% COGS Growth ~9% Marketing % of Net Sales ~4 - 5% Other SG&A % of Net Sales ~39-40% TARGET ~3.5 - 4% Depreciation % of Net Sales FY24: HSD% COGS Growth FY25-FY28: LSD% COGS Growth net of Cost Savings ~1-2% Annual Pricing BREWERYEXPANSION TO SUPPORT BEERGROWTH MOMENTUM FY24 FY25 FY26 FY27 FY28 ~$1B TOTAL BEER CAPEX FY 24 – FY 28 ~$4BPER FY 24 GUIDANCE

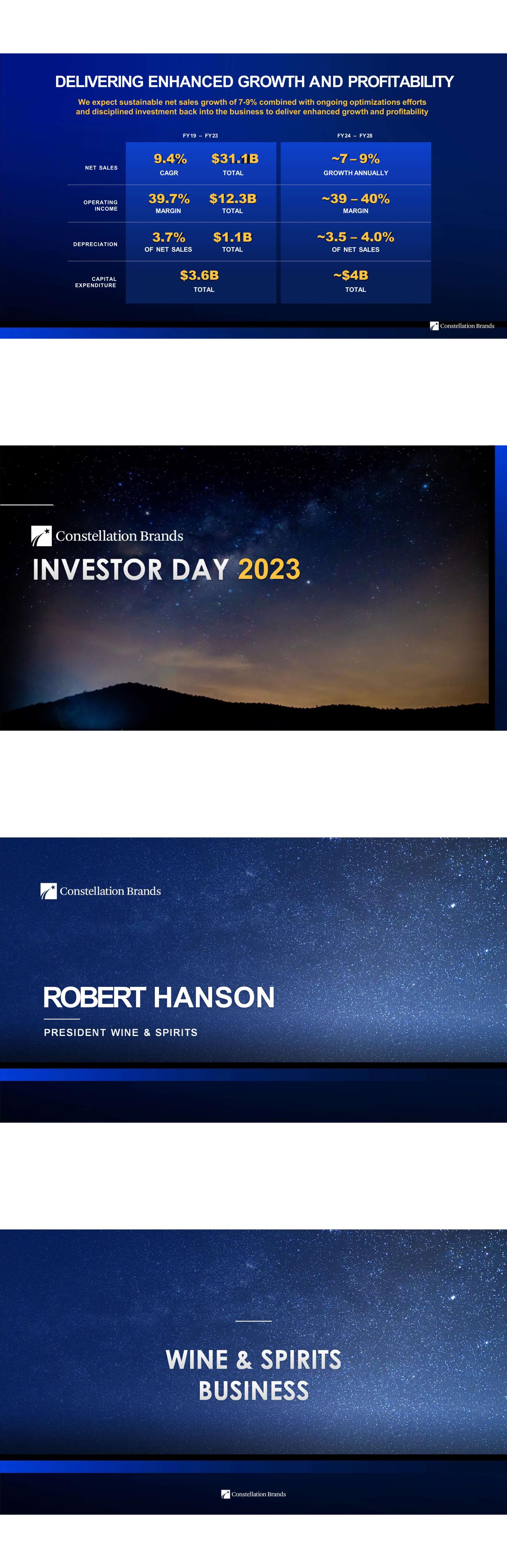

DELIVERING ENHANCED GROWTH AND PROFITABILITY We expect sustainable net sales growth of 7-9% combined with ongoing optimizations efforts and disciplined investment back into the business to deliver enhanced growth and profitability FY24 – FY28FY19 – FY23 NET SALES 9.4% $31.1B CAGR TOTAL ~7 – 9% GROWTH ANNUALLY OPERATING INCOME 39.7% $12.3B MARGIN TOTAL ~39 – 40% MARGIN DEPRECIATION 3.7% $1.1B OF NET SALES TOTAL ~3.5 – 4.0% OF NET SALES CAPITAL EXPENDITURE $3.6B TOTAL ~$4B TOTAL 2023 PRESIDENT WINE & SPIRITS ROBERT HANSON

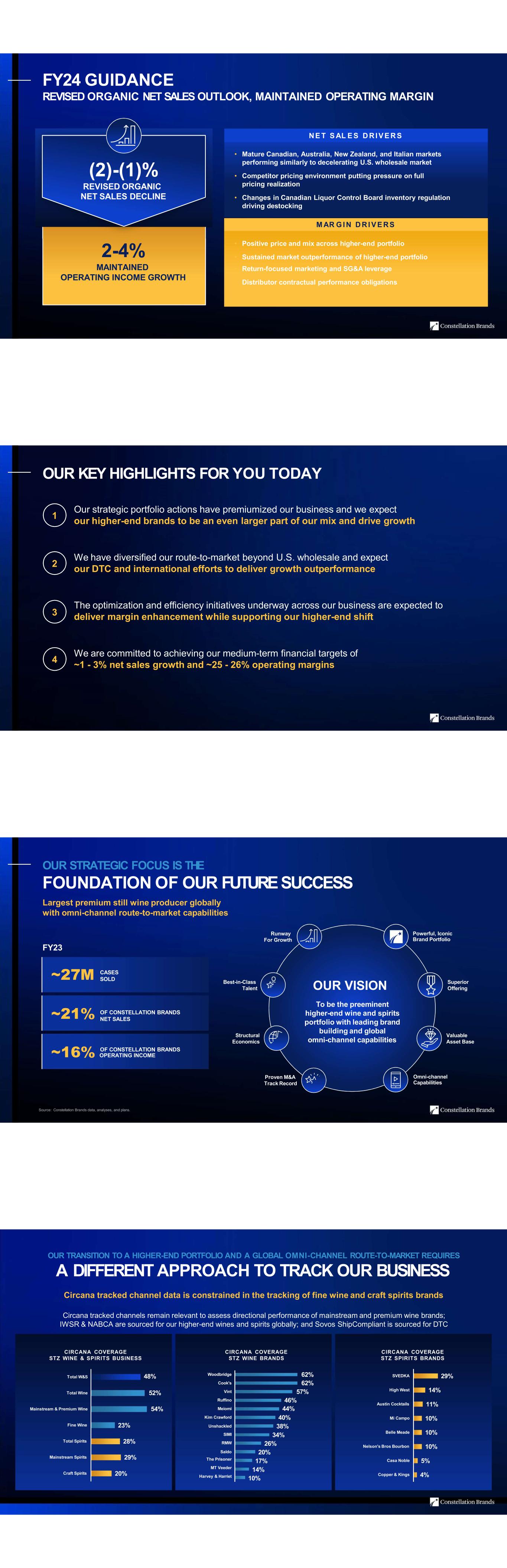

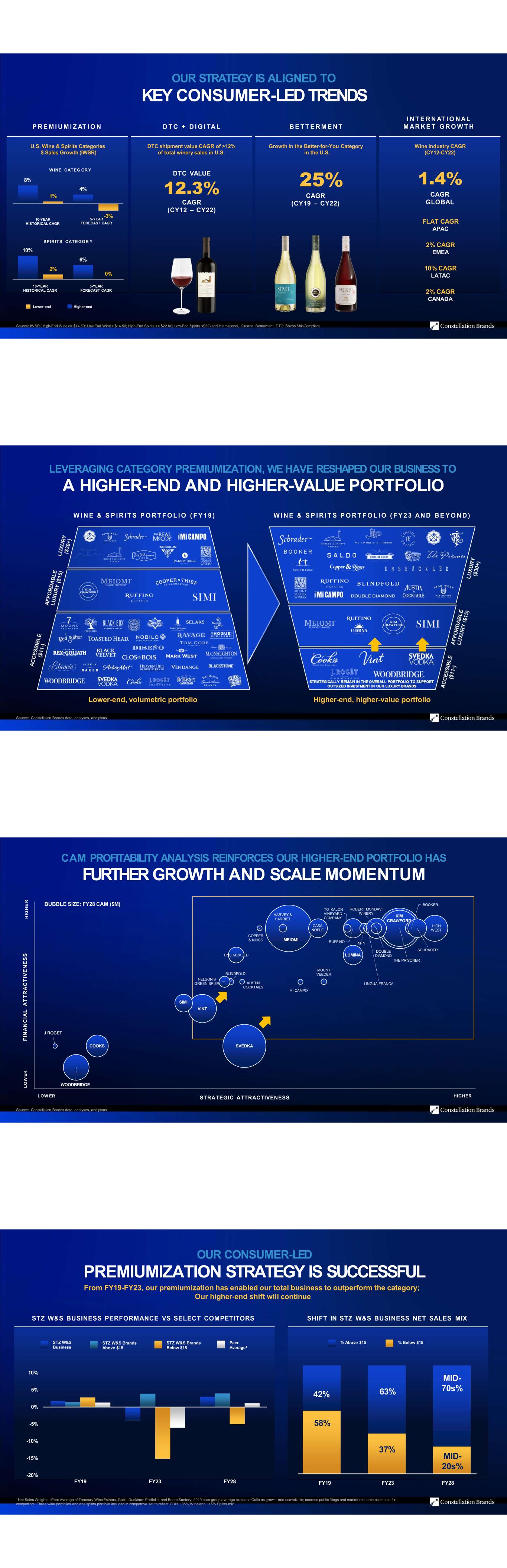

2-4% MAINTAINED OPERATING INCOME GROWTH FY24 GUIDANCE REVISED ORGANIC NET SALES OUTLOOK, MAINTAINED OPERATING MARGIN NE T S AL E S D RI V E R S M AR G I N D RI V E RS (2)-(1)% REVISED ORGANIC NET SALES DECLINE • Mature Canadian, Australia, New Zealand, and Italian markets performing similarly to decelerating U.S. wholesale market • Competitor pricing environment putting pressure on full pricing realization • Changes in Canadian Liquor Control Board inventory regulation driving destocking • Positive price and mix across higher-end portfolio • Sustained market outperformance of higher-end portfolio • Return-focused marketing and SG&A leverage Distributor contractual performance obligations OUR KEY HIGHLIGHTS FOR YOU TODAY 1 Our strategic portfolio actions have premiumized our business and we expect our higher-end brands to be an even larger part of our mix and drive growth 2 We have diversified our route-to-market beyond U.S. wholesale and expect our DTC and international efforts to deliver growth outperformance 3 The optimization and efficiency initiatives underway across our business are expected to deliver margin enhancement while supporting our higher-end shift 4 We are committed to achieving our medium-term financial targets of ~1 - 3% net sales growth and ~25 - 26% operating margins OUR STRATEGIC FOCUS IS THE FOUNDATION OF OUR FUTURESUCCESS Source: Constellation Brands data, analyses, and plans. FY23 Largest premium still wine producer globally with omni-channel route-to-market capabilities OUR VISION To be the preeminent higher-end wine and spirits portfolio with leading brand building and global omni-channel capabilities Runway For Growth Powerful, Iconic Brand Portfolio Best-in-Class Talent Structural Economics Proven M&A Track Record Superior Offering Valuable Asset Base Omni-channel Capabilities ~21% ~27M OF CONSTELLATION BRANDS~16% OPERATING INCOME OF CONSTELLATION BRANDS NET SALES CASES SOLD OUR TRANSITION TO A HIGHER-END PORTFOLIO AND A GLOBAL OMNI-CHANNEL ROUTE-TO-MARKET REQUIRES A DIFFERENT APPROACH TO TRACK OUR BUSINESS 23% 28% 29% 20% Fine Wine Total Spirits Mainstream Spirits Craft Spirits 40% 38% 34% 26% 20% 17% 14% 10% Total W&S 48% Woodbridge 62% Cook's 62% Total Wine 52% Vint 57% Ruffino 46% Mainstream & Premium Wine 54% Meiomi 44% Kim Crawford Unshackled SIMI RMW Saldo The Prisoner MT Veeder Harvey & Harriet 29% 14% 11% 10% 10% 10% 5% 4% SVEDKA High West Austin Cocktails Mi Campo Belle Meade Nelson's Bros Bourbon Casa Noble Copper & Kings CIRCANA COVERAGE STZ WINE & SPIRITS BUSINESS CIRCANA COVERAGE STZ WINE BRANDS CIRCANA COVERAGE STZ SPIRITS BRANDS Circana tracked channel data is constrained in the tracking of fine wine and craft spirits brands Circana tracked channels remain relevant to assess directional performance of mainstream and premium wine brands; IWSR & NABCA are sourced for our higher-end wines and spirits globally; and Sovos ShipCompliant is sourced for DTC

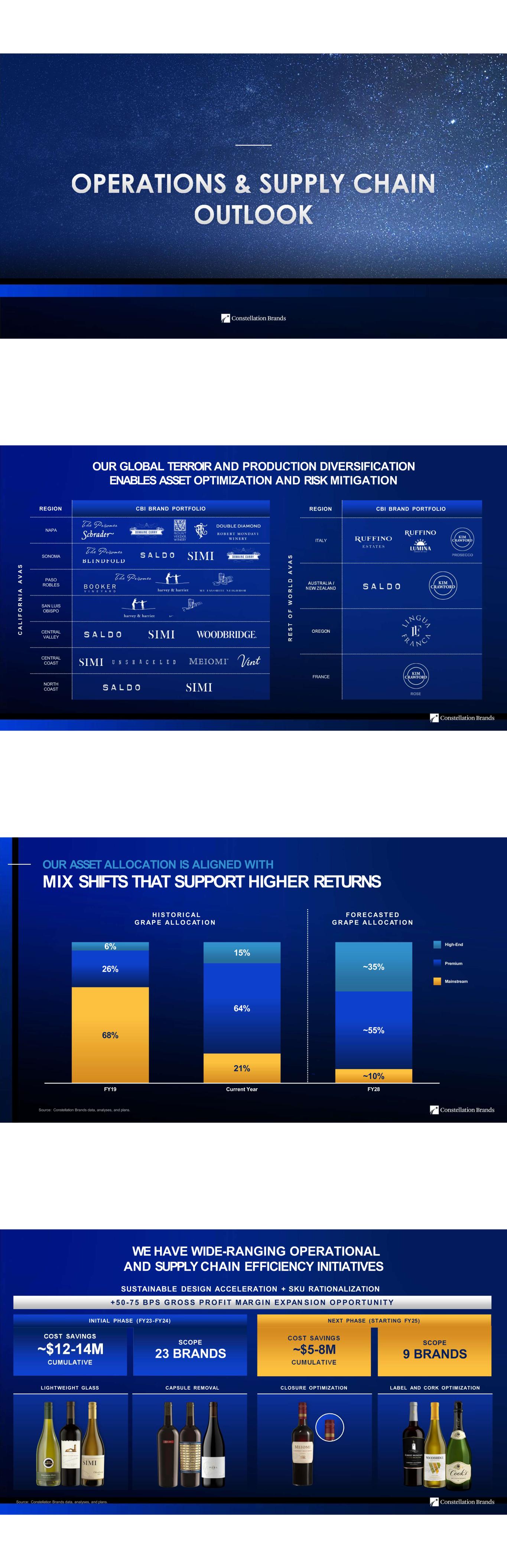

OUR STRATEGY IS ALIGNED TO KEY CONSUMER-LED TRENDS Source: IWSR ( High-End Wine >= $14.50; Low-End Wine < $14.50; High-End Spirits >= $22.00; Low-End Spirits <$22) and International, Circana: Betterment, DTC: Sovos ShipCompliant P R E M I U M I Z AT I O N D T C + D I G I TA L B E T T E R M E N T I N T E R N AT I O N AL M AR K E T G R O W T H Lower-end Higher-end 25% CAGR (CY19 – CY22) Growth in the Better-for-You Category in the U.S. 1.4% CAGR GLOBAL Wine Industry CAGR (CY12-CY22) U.S. Wine & Spirits Categories $ Sales Growth (IWSR) DTC shipment value CAGR of >12% of total winery sales in U.S. DTC VALUE 12.3% CAGR (CY12 – CY22) 8% 4% 1% -3% 10-YEAR HISTORICAL CAGR 5-YEAR FORECAST CAGR W INE CATEG OR Y 10% 6% 2% 0% 10-YEAR HISTORICAL CAGR 5-YEAR FORECAST CAGR SPIRITS CATEGOR Y FLAT CAGR APAC 2% CAGR EMEA 10% CAGR LATAC 2% CAGR CANADA LEVERAGING CATEGORY PREMIUMIZATION, WE HAVE RESHAPED OUR BUSINESS TO A HIGHER-END AND HIGHER-VALUE PORTFOLIO Source: Constellation Brands data, analyses, and plans. STRATEGICALLY REMAIN IN THE OVERALL PORTFOLIO TO SUPPORT OUTSIZED INVESTMENT IN OUR LUXURY BRANDS W I N E & S P I R I T S P O RT F O L I O ( F Y 1 9 ) W I N E & S P I R I T S P O R T F O L I O ( F Y 2 3 AN D B E Y O N D ) Lower-end, volumetric portfolio Higher-end, higher-value portfolio CAM PROFITABILITY ANALYSIS REINFORCES OUR HIGHER-END PORTFOLIO HAS FURTHER GROWTH AND SCALE MOMENTUM Source: Constellation Brands data, analyses, and plans. MEIOMI KIM CRAWFORD LUMINA SIMI VINT WOODBRIDGE SVEDKACOOKS J ROGET THE PRISONER UNSHACKLED BLINDFOLD HIGH WEST CASA NOBLE MI CAMPO NELSON’S GREEN BRIER COPPER & KINGS AUSTIN COCKTAILS RUFFINO MFN BOOKER LINGUA FRANCA ROBERT MONDAVI WINERY MOUNT VEEDER HARVEY & HARRIET DOUBLE DIAMOND SCHRADER TO KALON VINEYARD COMPANY F IN A N C IA L A T T R A C T IV E N E S S STRATEGIC ATTRACTIVENESS BUBBLE SIZE: FY28 CAM ($M) LOW ER HIGHER L O W E R H IG H E R OUR CONSUMER-LED PREMIUMIZATION STRATEGY IS SUCCESSFUL 1 Net Sales Weighted Peer Average of Treasury Wine Estates, Gallo, Duckhorn Portfolio, and Beam Suntory; 2019 peer group average excludes Gallo as growth rate unavailable; sources public filings and market research estimates for competitors. Three wine portfolios and one spirits portfolio included in competitive set to reflect CBI's ~85% Wine and ~15% Spirits mix. STZ W&S BUSINESS PERFORMANCE VS SELECT COMPETITORS SHIFT IN STZ W&S BUSINESS NET SALES MIX -20% -15% -10% -5% 0% 5% 10% FY19 FY23 FY28 STZ W&S Business STZ W&S Brands Below $15 STZ W&S Brands Above $15 Peer Average1 From FY19-FY23, our premiumization has enabled our total business to outperform the category; Our higher-end shift will continue % Above $15 % Below $15 58% 42% 37% 63% MID- 20s% MID- 70s% FY19 FY23 FY28

WE HAVE A PROVEN AND SUCCESSFUL M&A AND INNOVATION TRACK RECORD 1 Net Sales CAGR from first full year since acquisition date to FY23. 2 Meiomi Bright and Mi Campo RTS CAGRs include full-year growth estimate for FY24 as both brands launched within FY23. M&A TRACK RECORD INNOVATION / ORGANIC GROWTH NET SALES CAGR SINCE ACQUISITION 1 Proven ability to integrate and scale acquisitions Net sales from NPD over last three years represents 7% of our FY23 organic net sales NET SALES CAGR OVER RECENT PERIODS 2 +13% FY17 - FY23 +16% FY18 - FY23 +29% FY17 - FY23 +9% FY19 - FY23 +121% FY 23 +46% FY21 - FY23 +52% EXPECTED THROUGH FY24 READY-TO-SERVE B E T T E R M E N T +138% FY21 - FY23 +46% EXPECTED THROUGH FY24 S H O U L D E R E X T E N S I O N S U.S. WHOLESALE CBI is actual and long-range plan; 2) Market: IWSR for wholesale and international, Sovos ShipCompliant for DTC MID-TEENS MID-TEENS FY19 FY23 FY28 90% 86% LOW 70s% 8% 10%2% 4% International U.S. Wholesale and Other DTC 4% 2% 1% 0.1% INTERNATIONALDTC FY19 - FY23 STZ % CHG FY19 - FY23 Industry % CHG FY24 - FY28 STZ % CHG FY24 - FY28 Industry % CHG 17% 5% 30% 3% FY19 - FY23 STZ % CHG FY19 - FY23 Industry % CHG FY24 - FY28 STZ % CHG FY24 - FY28 Industry % CHG 2% 0.4% 9% 2% FY19 - FY23 STZ % CHG FY19 - FY23 Industry % CHG FY24 - FY28 STZ % CHG FY24 - FY28 Industry % CHG SHIFTING OUR GEOGRAPHIC AND CHANNEL MIX To emphasize international and DTC growth aligned with consumer preferences and category tailwinds SHIFT IN STZ W&S BUSINESS NET SALES MIX NET SALES GROWTH US WHOLESALE DTC INTERNATIONAL OUR GLOBAL OMNI-CHANNEL STRATEGY POSITIONS US FOR FUTURE GROWTH Source: Constellation Brands data, analyses, and plans. Scaling underpenetrated channels Optimizing multi-channel DTC capability Key cities strategy driving meaningful, profitable net sales growth • Shift toward higher-end portfolio in FY20-FY23 resulted in 38% operating income growth • $200M net sales poised to double in the medium- term • Higher-end wine portfolio expected to represent >90% of mix from 65% today Hospitality: Investing in key visitor centers and scaling corporate, private and trade • ~10% net sales CAGR and 60%+ gross margin Ecommerce: Investing in underdeveloped channel, affiliate marketing, and personalization • ~Mid-40s% net sales CAGR and 40%+ gross margin Loyalty: Category-leading wine club, corporate and events strategy delivering • ~Mid-40s% net sales CAGR and 55%+ gross margin • Built key account plans for top 10 key national accounts • Plan to shift mix to underpenetrated channels – General market off-premise share of mix +500Bps – On-premise share of mix +600Bps – 3-tier ecommerce share of mix +200bps ~25-26% OPERATING MARGIN OUR STRATEGY SUPPORTS AND IS ALIGNED TO OUR MEDIUM-TERM ALGORITHM NE T S AL E S D RI V E R S M AR G I N D RI V E RS ~1-3% NET SALES GROWTH • Higher-End Brand and Product Mix • Innovation • U.S. Wholesale National Accounts, General Market, On-Premise and 3TE Penetration • Combined DTC & International Double-Digit Growth • Consumer-Led Premiumization • End-To-End Supply Chain Cost Optimization Optimized Marketing

S E N I O R V I C E P RE S I D E N T B RAN D M AN AG E M E N T MATT McHARGUE S E N I O R V I C E P RE S I D E N T G L O B AL O PE R AT I O N S & I N T E R N AT I O N AL S AL E S SAM GLAETZER OUR HIGHER-END PORTFOLIO AND KEY BRANDS HAVE OUTPERFORMED Source: W&S FY23 results, Market - Circana 5.5% 14.0% 1.0% 2.6% 10.3% 9.3% 1.7% 10.1% 10.6% 4.4% 30.1% 2.6% FY23 CIRCANA $ SALES GROWTH HIGHER- END W INE HIGHER- END SPIRITS STZ Higher-end Portfolio Category Segment PREM IUM W INE -5.2% FINE WINE HIGHER- E ND S P IRITS Category Segment The Prisoner Kim Crawford Meiomi Category Segment Casa Noble High West Mi Campo Category Segment CONTINUING THE SUCCESS OF OUR HIGHER-END WINE BRANDS Source: Constellation Brands data, analyses, and plans. BUILDING UPON OUR SUCCESSFUL THE PRISONER WINE COMPANY NOW HOUSE OF BRANDS INNOVATION STRATEGY GROWTH 30% CAGR FY19 - 23 (U.S. NET SALES) PROFITABILITY 62% GROSS MARGIN FY23 The Prisoner and Blindfold are market makers leading ACV penetration Unshackled has significant opportunity with 88% of Decoy penetration gap Saldo targeting to maintain lead over Rombauer Zinfandel penetration O P T I M I Z E AC C E L E R AT E DRIVERS • Volume: +Mid 20s% • Net Sales: +Mid 20s% • Price/Mix: +LSD% • Distribution: +Mid Teens% • Velocity: +HSD% • Innovation: +MSD% annually DRIVERS • Volume: +Low 30s% • Net Sales: +Mid 30s% • Price/Mix: +MSD% • Distribution: +Low 30s% • Velocity: +MSD% • Innovation: +MSD% annually DRIVERS • Volume: +High Teens% • Net Sales: +Mid 20's% • Price/Mix: +MSD% • Distribution: +MSD% • Velocity: +Low Teens% • Innovation: +LSD% annually DRIVERS • Volume: + >100% • Net Sales: + >100% • Price/Mix: +HSD% • Distribution: + >70% • Velocity: +Mid 20s% • Innovation: +Mid Teens% annually #1 S UP E R L UX URY RE D BL END (T HE P RI S O NE R) I N U . S . #1 S UP ER L UX URY Z I NF ANDE L (SAL DO ) I N U . S . #1 L UX URY RE D BL END (UNS HACKL E D) I N U . S .

CONTINUING THE SUCCESS OF OUR HIGHER-END WINE BRANDS Source: Circana; ShopperLoyaltyPanel; All Shopper Loyalty Venues; 52 weeks ending August 13, 2023. Source: Constellation Brands data, analyses, and plans. GROWTH 15% CAGR FY19 - 23 (U.S. SALES) PROFITABILITY 60% GROSS MARGIN FY23 DRIVERS • Volume: +LDD% • Net Sales: +High Teens% • Price/Mix: +MSD% • Distribution: +MSD% • Velocity: +LSD% • Innovation:+MSD% annually • Penetration: Close distribution gap to Josh Continued success in our market leading and incremental betterment innovation GROWTH 14% CAGR FY19 - 23 (U.S. SALES) PROFITABILITY 56% GROSS MARGIN FY23 DRIVERS • Volume: +LDD% • Net Sales: +Low 20s% • Price/Mix: +HSD% • Distribution: +MSD% • Velocity: +LSD% • Innovation: +MSD% annually • Penetration: Close distribution gap to Josh 7%14%79% B U Y E R O V E R L A P 65% of KC Illuminate SB Buyers bought KC Illuminate SB exclusively and not KC SB #1 NE W ZE AL AND WI NE BRAND I N T HE U. S . 94% 3% 3% 50% of Meiomi Bright PN Buyers bought Meiomi Bright PN exclusively and not Meiomi PN B U Y E R O V E R L A P #1 UL T R A-P RE M I UM WI NE BRAND I N T HE U. S . #1 S AUV I G NO N BL ANC I N U. S . #1 P I NO T NO I R I N U. S . #5 UL T R A-P RE M I UM CHARDO NNAY I N U. S . #3 S UP ER P RE MI UM P RO S ECCO I N U. S . CONTINUING THE SUCCESS OF OUR HIGHER-END WINE BRANDS Source: Constellation Brands data, analyses, and plans. TEQUILA – CASA NOBLE | MI CAMPO COMBINED GROWTH 19% CAGR FY19 - 23 (U.S. SALES) COMBINED PROFITABILITY 43% GROSS MARGIN FY23 DRIVERS • Volume: + >40% • Net Sales: + >50% • Price/Mix: + HSD% • Distribution: + 20s% • Velocity +Mid-Teens% • Innovation: +MSD% annually • Penetration: Close distribution gap to Don Julio #3 HIGHER-END AM ERICAN RYE WHISKEY IN U.S. TOP TRENDING TEQUILA IN U.S. WHISKEY – HIGH WEST 59% DEPLETION GROWTH IN FY23 DRIVERS • Volume: + >100% • Net Sales: + >100% • Price/Mix: +MSD% • Distribution: + >50% • Velocity: +30s% • Innovation: +Low Teens% annually • Penetration: Close distribution gap to Espolon DRIVERS • Volume: +30s% • Net Sales: +Mid 30s% • Price/Mix: +MSD% • Distribution: +LDD% • Velocity: +Mid-Teens% • Innovation: +MSD% • Penetration: Close distribution gaps to Basil Hayden & Angel's Envy GROWTH 21% CAGR FY19 - 23 (U.S. SALES) PROFITABILITY 57% GROSS MARGIN FY23 TRANSFORMING OUR MAINSTREAM BRANDS Source: Constellation Brands data, analyses, and plans. Returning to SVEDKA’s original essence: PURE SEDUCTION Targeting LDD net sales growth, beating price segment, and improving margin from Mid 40s% to 50s% F R O M TO • Unfocused and dilutive flavor innovation • Mainstream and commoditized vodka • Focused and elevated 80 Proof & SVEDKA Martini Collection • Distinctive affordable luxury vodka • Channel growth in on-premise, liquor, key states and cities SVEDKA AND WOODBRIDGE SVEDKA WOODBRIDGE Transforming into a modernized & accessible wine brand Hold share in a declining market segment • Traditional mainstream wine brand • Heritage sensory misaligned with target consumer expectations • Margin-dilutive at low 20% GP • Contemporary broadly appealing wine brand • Sweeter sensory aligned with target consumer preferences • Channel growth in grocery and convenience • Margin improvement to Mid 20s% GP F R O M TO STRENGTHENING OUR POSITION IN MATURE U.S. WHOLESALE MARKET Source: Constellation Brands data, analyses, and plans. • Ultra-Premium grow HSD; Mainstream decline MSD • Core SKU ACV to 85-90% from 60-65% • Triple shoulder SKUs ACV from >20% to >60% • RGM driving 50-100bps of annual pricing • Targeting innovation growing at HSD% annually KEY ACCOUNT PLANS IN PLACE FOR ALL NATIONAL CUSTOMERS GROW GENERAL MARKET >500BPS GROW ON-PREMISE >600BPS FOCUSED ON UNDERPENETRATED CHANNELS OUTPERFORMING TOTAL U.S. WHOLESALE

OUR OMNI-CHANNEL STRATEGY Source: Constellation Brands data, analyses, and plans. POSITIONS US FOR GROWTH AHEAD Our new cross-channel DTC strategy drove +29% growth in FY23 through brand awareness, recurring net sales, customer engagement, and first-person data; optimizing this strategy aims to sustain ~20-30% net sales CAGR HOSPITALITY ECOMMERCE LOYALTY • Net Sales +>10% • Gross Margin >60% • Capex for Robert Mondavi Winery, The Prisoner, Lingua Franca, High West, Nelson’s Green Brier and Casa Noble • Scaling corporate, private and trade events • High avg. order value: Tasting Room >$300 • Net Sales +>40% • Gross Margin >40% • Accelerating affiliate marketing and personalization • Net Sales +>40% • Gross Margin >55% • Enhancing personalization across Wine Club, Corporate, Ambassador Programs, Events • High Club avg. order value of >$250 | Corporate >$600 TARGETING OUTSIZED GROWTH WITH OUR INTERNATIONAL STRATEGY Source: Constellation Brands data, analyses, and plans. Scaling our international business with prioritized markets and brands to deliver strong growth FULL FINE / ULTRA- PREMIUM WINE AND CRAFTS SPIRITS PORTFOLIO FINE WINE FOCUS • Prioritize fine wine investment • Launch craft spirits in key markets • Develop ecommerce, DTC in key markets • Implement global RTM, shift to net pricing • Invest in ultra-premium wine portfolio • Accelerate growth of fine wine • Global brand management • Grow cross-functional process $200M NET SALES DOUBLE MEDIUM-TERM PRIORITIZING OUR HIGHER-END BRANDS We are strategically focused on expanding our higher-end brands across our targeted international markets 10% or Below 90+% MainstreamPremium + 21% International Markets Net Sales (FY23) 79% International Markets Net Sales (FY28) OUR KEY CITIES EXPANSION STRATEGY PROVIDES FOCUS AND RUNWAY FOR GROWTH Source: Constellation Brands data, analyses, and plans. OUR FOCUSED CITY GROWTH STRATEGY Identify Cities Identify Accounts Map Consumer & Portfolio Ops Focus On Distributor Capability Consumer Engagement Cities with high growth and premium potential Analyze key competitors and distributors Develop marketing around key luxury target groups Assess distributor capability and route-to-market Develop ambassador / influencer network Mature Emerging LATAC CBI: +9% VS. MARKET: +2% ASIA CBI: +13% VS. MARKET: +6% NZA CBI: +6% VS. MARKET: +2% +1% EMEA CBI: +10% VS. CANADA MARKET: CBI: +6% VS. MARKET: +3% Expect HSD annual growth in international business for FY25-FY28 (outpacing expected average LSD growth for corresponding markets) OUR GLOBAL FOOTPRINT PROVIDES OPPORTUNITY IN HIGHER -GROWTH EMERGING MARKETS AND RUNWAY TO FURTHER SCALE MORE MATURE MARKETS S E N I O R V I C E P RE S I D E N T G L O B AL O PE R AT I O N S & I N T E R N AT I O N AL S AL E S SAM GLAETZER LISA BROWN S E N I O R V I C E P R ES I D E N T S U P P LY CH AI N

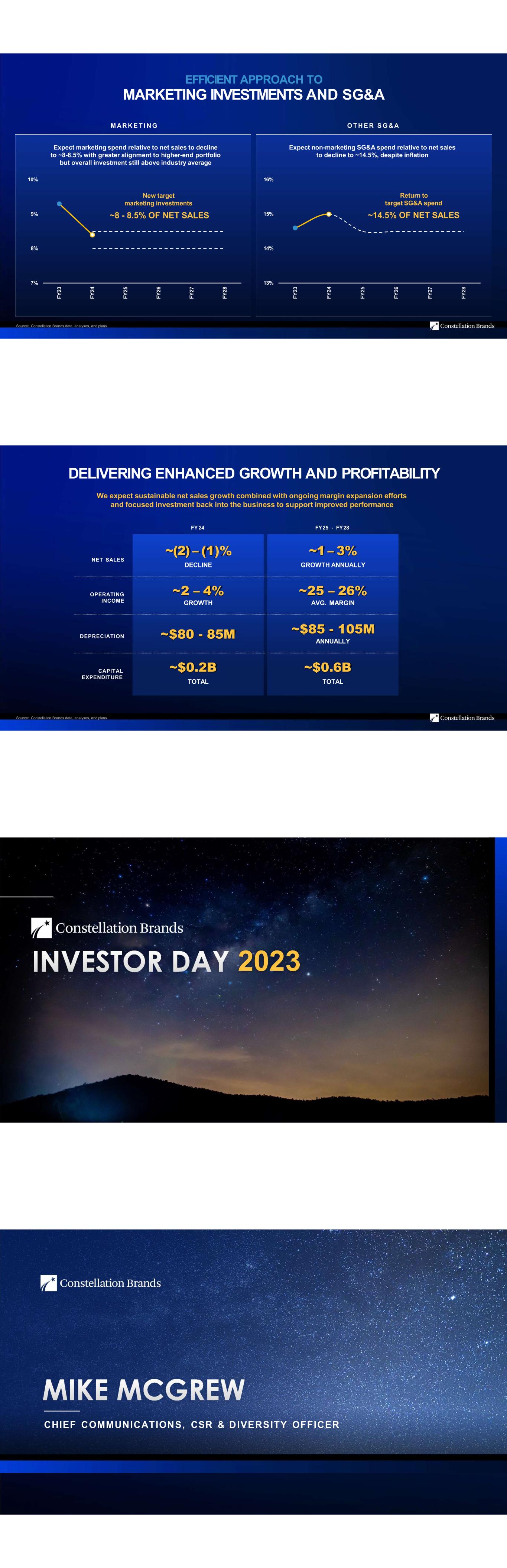

OUR GLOBAL TERROIR AND PRODUCTION DIVERSIFICATION ENABLES ASSET OPTIMIZATION AND RISK MITIGATION REGION CBI BRAND PORTFOLIO NAPA SONOMA PASO ROBLES SAN LUIS OBISPO CENTRAL VALLEY CENTRAL COAST NORTH COAST C A L I F O R N I A A V A S REGION CBI BRAND PORTFOLIO ITALY AUSTRALIA / NEW ZEALAND OREGON FRANCE R E S T O F W O R L D A V A S OUR ASSET ALLOCATION IS ALIGNED WITH MIX SHIFTS THAT SUPPORT HIGHER RETURNS Source: Constellation Brands data, analyses, and plans. ~ 68% 21% ~10% 26% 64% ~55% 6% 15% ~35% FY19 Current Year FY28 H I S T O RI C AL G R AP E AL L O C AT I O N F O R E C AS T E D G R AP E AL L O C AT I O N Premium Mainstream High-End Source: Constellation Brands data, analyses, and plans. CLOSURE OPTIMIZATION LABEL AND CORK OPTIMIZATION WE HAVE WIDE-RANGING OPERATIONAL AND SUPPLY CHAIN EFFICIENCY INITIATIVES SUSTAINABLE DESIGN ACCELERATION + SKU RATIONALIZATION LIGHTWEIGHT GLASS CAPSULE REMOVAL +5 0 - 75 B P S G RO S S P RO FI T M AR G I N E X PAN S I O N O P P O RTU NI T Y COST SAVINGS ~$12-14M CUMULATIVE SCOPE 23 BRANDS COST SAVINGS ~$5-8M CUMULATIVE SCOPE 9 BRANDS INITIAL PHASE (FY23-FY24) NEXT PHASE (STARTING FY25)

PRODUCTION FACILITY & SUPPLY CHAIN NETWORK OPTIMIZATION +2 5- 35 B P S G RO S S P RO FI T M AR G I N E X PAN S I O N O P P O RTU NI T Y Source: Constellation Brands data, analyses, and plans. • Recommissioning Napa Bottling Center, insourcing our bottling capability to reduce cost 20% versus outsourcing • Supply chain network rationalized from multi-location CA warehouses to Lodi and Chicago, driving a rate per case reduction of $0.11/case • Further opportunity to optimize cellar capacity and supplement with third-party crush during variable harvest conditions D I S T R I B U T I O N C E N T E R A S S I G N M E N T LODI CHICAGO LDC CHI 49% EAST COAST 26% MIDWEST / SOUTH 25% WEST WE HAVE WIDE-RANGING OPERATIONAL AND SUPPLY CHAIN EFFICIENCY INITIATIVES Source: Constellation Brands data, analyses, and plans. • Spirits production optimization by relocating High West bottling and insourcing components of SVEDKA production; $7-10M annual savings opportunity • Joint investment in Tequila capacity to scale the tequila portfolio with production benefits driving 25% ROIC • Insourcing supply chain for Schrader results in $1-1.5M average annualized savings, implying $7-10M cumulative opportunity when scaled across DTC portfolio CURRENT 80 P FUTURE 80P AND FLAV ORS SPIRITS PRODUCTION AND DTC INSOURCING +4 5- 55 B P S G RO S S P RO FI T M AR G I N E X PAN S I O N O P P O RTU NI T Y SVEDKA Dry Goods & Product Optimization • $1-1.5M annualized savings from FY26 • $22M in capex cost avoidance via 3rd party business model DTC Internalization - Schrader Example • In FY24 Schrader DTC was insourced to Lodi Distribution Center • Annualized savings from $560K in FY24 to $1-1.5M FY25+ • Extending across total DTC implies $7-10M cumulative savings opportunity WE HAVE WIDE-RANGING OPERATIONAL AND SUPPLY CHAIN EFFICIENCY INITIATIVES SENIOR VICE PRESIDENT FINANCE

COMMITTED TO ACHIEVING OUR MEDIUM-TERM FINANCIAL TARGETS Source: Constellation Brands data, analyses, and plans. Growth and operating leverage expected over the medium-term driven by mix and channel shift + pricing increases + efficiency and cost initiatives more than offsetting mainstream U.S. Wholesale headwinds + inflation CONTINUED OPERATING MARGIN IMPROVEMENT PIVOT TO NET SALES GROWTH TARGET ~1-3% ANNUALLY TARGET ~25-26% TARGETING ~1-3% ANNUAL NET SALES GROWTH Source: Constellation Brands data, analyses, and plans. KEY GROWTH DRIVERS Continued growth of higher-end brands Contributions from higher growth DTC & International Consistent ~1% annual average price increases 1 2 3 $1.0B $1.2B $1.4B $1.6B $1.8B $2.0B $2.2B F Y 23 W IN E D IV E S T IT U R E F Y 23 O R G A N IC F Y 24 F Y 28 TARGET ~1-3% ANNUAL GROWTH FY24 UPDATED GUIDANCE (2)-(1)% DECLINE 22% 23% 24% 25% 26% 27% F Y 23 W IN E D IV E S T IT U R E F Y 2 3 A D J F Y 24 IM P L IE D G U ID A N C E F Y 25 F Y 26 F Y 27 F Y 28 TARGETING ~25-26% OPERATING MARGINS Source: Constellation Brands data, analyses, and plans. DRIVERS • Marketing investment • SG&A ANNUAL MARGINS AFFECTED BY VARIABLES BUT EXPECTED TO BE WITHIN TARGETED RANGE ON AVERAGE DRAGS • Continued mix shift to higher-end • Annual pricing increase • Cost / ops. efficiencies • COGS inflation • Depreciation OTHER FACTORS • EUR-USD | NZD-USD FX rates Benefits from higher-end mix shift and efficiency and cost savings initiatives expected to offset general inflation NEW TARGET ~25-26% OP. MARGIN KEY MARGIN VARIABLES $(20)M CAM ADJ. INCREASED PRODUCTIVITY EXPECTED TO SUPPORT MARGIN EXPANSION Source: Constellation Brands data, analyses, and plans. EFFICIENCY AND COST SAVINGS INITIATIVES After experiencing elevated inflation over last 2 years, expect to return to prior historical levels in next 4 years Initiatives Expected to Deliver ~$125-150M in Cumulative Savings FY24-FY28 Optimization of operations and supply chain will continue being a key driver of margin improvement AVERAGE ANNUAL INFLATION FY19 - FY21 LSD FY22 - FY24 HSD-LDD FY25 - FY28 LSD-MSD FY24 FY25 FY26 FY27 FY28 Maintenance Organic growth CAPEX TARGET ~$0.8B TOTAL FY24-FY28 FY24 FY25 FY26 FY27 FY28 DEPRECIATION TARGET ~$85-105 M ANNUALLY MATERIALS, LOGISTICS, AND LABOR INFLATION MAINTENANCE & HOSPITALITY INVESTMENTS DEPRECIATION Sustainable design acceleration Spirits production and DTC insourcing Production facilities optimization Supply chain network optimization Tail SKU and targeted low margin SKU rationalization Other initiatives

EFFICIENT APPROACH TO MARKETING INVESTMENTS AND SG&A Source: Constellation Brands data, analyses, and plans. M AR K E T I N G O T H E R S G & A Expect marketing spend relative to net sales to decline to ~8-8.5% with greater alignment to higher-end portfolio but overall investment still above industry average Expect non-marketing SG&A spend relative to net sales to decline to ~14.5%, despite inflation 7% 8% 9% 10% F Y 23 F Y 24 F Y 25 F Y 26 F Y 27 F Y 28 New target marketing investments ~8 - 8.5% OF NET SALES 13% 14% 15% 16% F Y 23 F Y 24 F Y 25 F Y 26 F Y 27 F Y 28 Return to target SG&A spend ~14.5% OF NET SALES DELIVERING ENHANCED GROWTH AND PROFITABILITY Source: Constellation Brands data, analyses, and plans. FY25 - FY28 We expect sustainable net sales growth combined with ongoing margin expansion efforts and focused investment back into the business to support improved performance FY 24 NET SALES ~(2) – (1)% DECLINE ~1 – 3% GROWTH ANNUALLY OPERATING INCOME ~2 – 4% GROWTH ~25 – 26% AVG. MARGIN DEPRECIATION ~$80 - 85M ~$85 - 105M ANNUALLY CAPITAL EXPENDITURE ~$0.2B TOTAL ~$0.6B TOTAL 2023 CHIEF COMMUNICATIONS, CSR & DIVERSITY OFFICER

BOLSTERED SUPPORT CENTRAL IZED RESPON SIBI LI TY EL EVAT ED OV ERSIGH T EMBEDDED INTO BUSINESS PLAN NING EVOLVING OUR APPROACH RAISING THE BAR OVER THE YEARS EVOLVING OUR APPROACH HONING OUR FOCUS 1 PwC Consumer Intelligence Series June 2, 2021 CONSUMER OBSESSED CONSUMERS EXPECT MORE BRANDS ALIGNED WITH VALUES AND PASSIONS CREATE AND PROTECT VALUE FOR OUR BUSINESS 83% OF CONSUMERS THINK COMPANIES SHOULD BE ACTIVELY SHAPING ESG BEST PRACTICES1 CREATING A FUTURE WORTH REACHING FOR 1 2 3 SAFEGUARDING OUR ENVIRONMENT AND NATURAL RESOURCES Improving water availability Reducing greenhouse gas emissions Commitment to waste reduction and circular packaging ENHANCING SOCIAL EQUITY WITHIN OUR INDUSTRY AND COMMUNITIES Championing professional development Enhancing economic development Fostering an inclusive culture ADVOCATING FOR RESPONSIBLE BEVERAGE ALCOHOL CONSUMPTION Ensuring responsible promotion and marketing Empowering responsible alcohol consumption choices by LDA adults