10-Q: Quarterly report pursuant to Section 13 or 15(d)

Published on October 6, 2022

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the quarterly period ended August 31, 2022

or

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to

Commission File Number: 001-08495

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||||

(Address of principal executive offices) (Zip code)

(585 ) 678-7100

(Registrant’s telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||||||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☒ | Accelerated filer | ☐ | |||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | |||||||||

| Emerging growth company | |||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

There were 161,224,498 shares of Class A Common Stock, 23,205,885 shares of Class B Common Stock, and 51,965 shares of Class 1 Common Stock outstanding as of September 30, 2022.

TABLE OF CONTENTS

| Page | ||||||||

| DEFINED TERMS | ||||||||

| PART I – FINANCIAL INFORMATION | ||||||||

| Item 1. Financial Statements | ||||||||

| Consolidated Balance Sheets | ||||||||

| Consolidated Statements of Comprehensive Income (Loss) | ||||||||

| Consolidated Statements of Changes in Stockholders’ Equity | ||||||||

| Consolidated Statements of Cash Flows | ||||||||

| Notes to Consolidated Financial Statements | ||||||||

1. Basis of Presentation |

||||||||

2. Inventories |

||||||||

3. Derivative Instruments |

||||||||

4. Fair Value of Financial Instruments |

||||||||

5. Goodwill |

||||||||

6. Intangible Assets |

||||||||

7. Equity Method Investments |

||||||||

8. Borrowings |

||||||||

9. Income Taxes |

||||||||

10. Stockholders' Equity |

||||||||

11. Net Income (Loss) Per Common Share Attributable to CBI |

||||||||

12. Comprehensive Income (Loss) Attributable to CBI |

||||||||

13. Business Segment Information |

||||||||

| Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations | ||||||||

| Item 3. Quantitative and Qualitative Disclosures About Market Risk | ||||||||

| Item 4. Controls and Procedures | ||||||||

| PART II – OTHER INFORMATION | ||||||||

| Item 1A. Risk Factors | ||||||||

| Item 2. Unregistered Sales of Equity Securities and Use of Proceeds | ||||||||

| Item 6. Exhibits | ||||||||

| INDEX TO EXHIBITS | ||||||||

| SIGNATURES | ||||||||

This Form 10-Q contains “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. These forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond the Company’s control, that could cause actual results to differ materially from those set forth in, or implied by, such forward-looking statements. For further information regarding such forward-looking statements, risks, and uncertainties, please see “Information Regarding Forward-Looking Statements” under Part I – Item 2. “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Defined Terms

Unless the context otherwise requires, the terms “Company,” “CBI,” “we,” “our,” or “us” refer to Constellation Brands, Inc. and its subsidiaries. We use terms in this Form 10-Q and in our Notes that are specific to us or are abbreviations that may not be commonly known or used.

| Term | Meaning | ||||

| $ | U.S. dollars | ||||

| 2.65% November 2017 Senior Notes | $700.0 million principal amount of 2.65% senior notes issued in November 2017 and redeemed in August 2021, prior to maturity | ||||

| 2.70% May 2017 Senior Notes | $500.0 million principal amount of 2.70% senior notes issued in May 2017 and redeemed in August 2021, prior to maturity | ||||

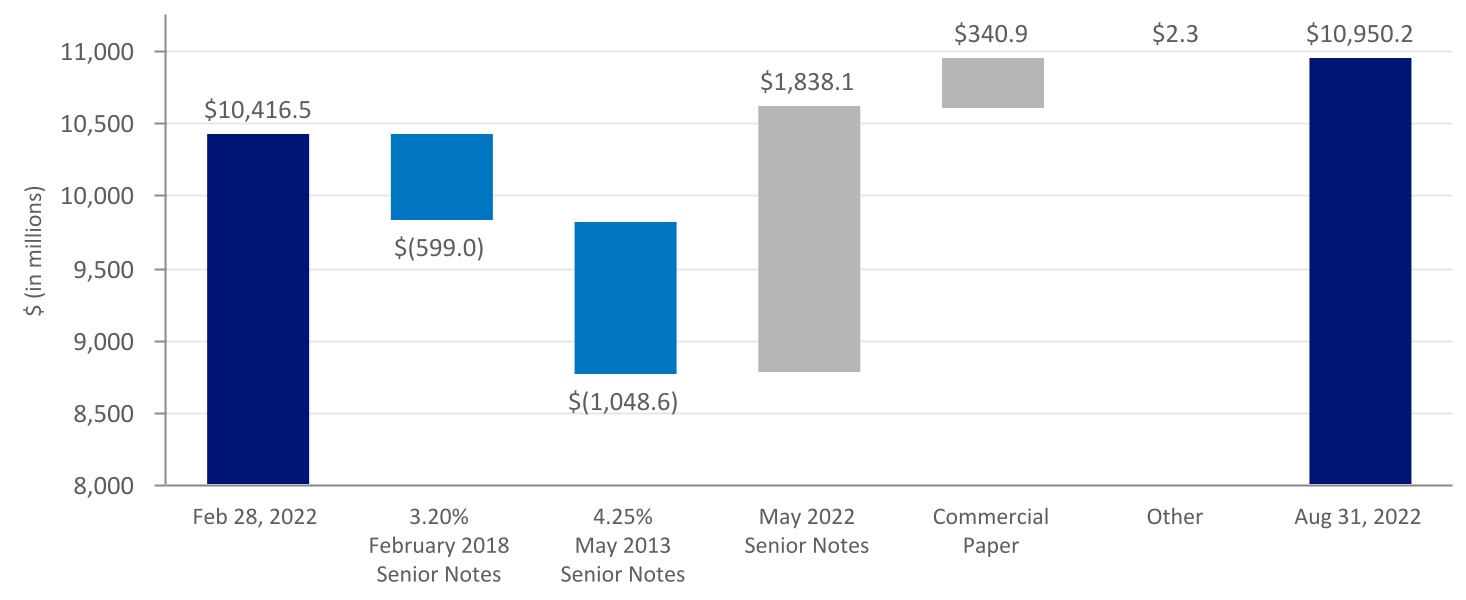

| 3.20% February 2018 Senior Notes | $600.0 million principal amount of 3.20% senior notes issued in February 2018, partially tendered in May 2022, and fully redeemed in June 2022, prior to maturity | ||||

| 4.25% May 2013 Senior Notes | $1,050.0 million principal amount of 4.25% senior notes issued in May 2013, partially tendered in May 2022, and fully redeemed in June 2022, prior to maturity | ||||

| 2018 Authorization | authority to repurchase up to $3.0 billion of our Class A Stock and Class B Stock, authorized in January 2018 by our Board of Directors | ||||

| 2020 U.S. wildfires | significant wildfires that broke out in California, Oregon, and Washington states which affected the 2020 U.S. grape harvest | ||||

| 2021 Authorization | authority to repurchase up to $2.0 billion of our Class A Stock and Class B Stock, authorized in January 2021 by our Board of Directors | ||||

| 2022 Annual Report | our Annual Report on Form 10-K for the fiscal year ended February 28, 2022 | ||||

| 2022 Credit Agreement | tenth amended and restated credit agreement, dated as of April 14, 2022, that provides for an aggregate revolving credit facility of $2.25 billion | ||||

| 2022 Restatement Agreement | restatement agreement, dated as of April 14, 2022, that amended and restated the ninth amended and restated agreement, dated as of March 26, 2020, which was our then-existing senior credit facility as of February 28, 2022 | ||||

| 2022 Wine Divestiture | sale of certain mainstream and premium wine brands and related inventory |

||||

| 3-tier | distribution channel where products are sold to a distributor (wholesaler) who then sells to a retailer; the retailer sells the products to a consumer |

||||

| 3-tier eCommerce | digital commerce experience for our consumers to purchase beverage alcohol from retailers | ||||

| ABA | alternative beverage alcohol | ||||

| Acreage | Acreage Holdings, Inc. | ||||

| Acreage Financial Instrument | a call option for Canopy to acquire 70% of the shares of Acreage at a fixed exchange ratio and 30% at a floating exchange ratio | ||||

| Acreage Transaction | Canopy’s intention to acquire Acreage upon U.S. federal cannabis permissibility, subject to certain conditions | ||||

| Administrative Agent | Bank of America, N.A., as administrative agent for the senior credit facility and term loan credit agreements | ||||

| Amended and Restated Charter | form of our amended and restated certificate of incorporation, attached to the Registration Statement on Form S-4, which will effectuate the Reclassification and be in effect at and following the Effective Time | ||||

| AOCI | accumulated other comprehensive income (loss) | ||||

| April 2022 Term Credit Agreement | June 2021 Term Credit Agreement, inclusive of amendment dated as of April 14, 2022 | ||||

| ASR | accelerated share repurchase agreement with a third-party financial institution |

||||

| August 2022 Term Credit Agreement | term loan credit agreement, dated as of August 9, 2022, that provides for a $1.0 billion unsecured delayed draw three-year term loan facility | ||||

| Austin Cocktails | we made an initial investment in the Austin Cocktails business and subsequently acquired the remaining ownership interest | ||||

Constellation Brands, Inc. Q2 FY 2023 Form 10-Q |

#WORTHREACHINGFOR I i

|

||||

| Term | Meaning | ||||

| C$ | Canadian dollars | ||||

| Canopy | we made an investment in Canopy Growth Corporation, an Ontario, Canada-based public company |

||||

| Canopy Debt Securities | debt securities issued by Canopy, as amended to remove Canopy's right to settle such debt securities on conversion into Canopy common shares | ||||

| Canopy Equity Method Investment | November 2017 Canopy Investment, November 2018 Canopy Investment, May 2020 Canopy Investment, and July 2022 Canopy Investment, collectively | ||||

| Canopy Strategic Transaction(s) | any potential acquisition, divestiture, investment, or other similar transaction made by Canopy, including but not limited to the Acreage Transaction | ||||

| CARES Act | Coronavirus Aid, Relief, and Economic Security Act | ||||

CB International |

CB International Finance S.à r.l., a wholly-owned subsidiary of ours |

||||

| Class 1 Stock | our Class 1 Convertible Common Stock, par value $0.01 per share | ||||

| Class A Stock | our Class A Common Stock, par value $0.01 per share | ||||

| Class B Stock | our Class B Convertible Common Stock, par value $0.01 per share | ||||

| CODM | chief operating decision maker | ||||

| Comparable Adjustments | certain items affecting comparability that have been excluded by management | ||||

| DEI | diversity, equity, and inclusion | ||||

| Depletions | represent U.S. domestic distributor shipments of our respective branded products to retail customers, based on third-party data |

||||

| Digital Business Acceleration | a phased initiative by the Company to create a cohesive digital strategy and build an advanced digital business in the coming years | ||||

| DTC | direct-to-consumer inclusive of (i) a digital commerce experience for consumers to purchase directly from brand websites with inventory coming straight from the supplier and (ii) consumer purchases at hospitality locations (tasting rooms and tap rooms) from the supplier | ||||

| Effective Time | the time that the Amended and Restated Charter has been duly filed with the Secretary of State of the State of Delaware (or such later time as we and WildStar Partners LLC will agree and set forth in the Amended and Restated Charter) | ||||

| ERP | enterprise resource planning system | ||||

| ESG | environmental, social, and governance | ||||

| Exchange Act | Securities Exchange Act of 1934, as amended | ||||

| Financial Statements | our consolidated financial statements and notes thereto included herein |

||||

| Fiscal 2022 | the Company’s fiscal year ended February 28, 2022 | ||||

| Fiscal 2023 | the Company’s fiscal year ending February 28, 2023 | ||||

| Fiscal 2024 | the Company’s fiscal year ending February 29, 2024 | ||||

| Fiscal 2025 | the Company’s fiscal year ending February 28, 2025 | ||||

| Fiscal 2026 | the Company’s fiscal year ending February 28, 2026 | ||||

| Fiscal 2027 | the Company’s fiscal year ending February 28, 2027 | ||||

| Fiscal 2028 | the Company’s fiscal year ending February 29, 2028 | ||||

| Five-Year Term Facility | a five-year term loan facility under the April 2022 Term Credit Agreement | ||||

| Form 10-Q | this Quarterly Report on Form 10-Q for the quarterly period ended August 31, 2022, unless otherwise specified |

||||

| GHG | greenhouse gas | ||||

| July 2022 Canopy Investment | in July 2022, we received 29.2 million common shares of Canopy through the exchange of C$100.0 million principal amount of our Canopy Debt Securities | ||||

| June 2021 Term Credit Agreement | amended and restated term loan credit agreement, dated as of March 26, 2020, that provided for aggregate facilities of $491.3 million, consisting of the Five-Year Term Facility, inclusive of amendment dated as of June 10, 2021 | ||||

Constellation Brands, Inc. Q2 FY 2023 Form 10-Q |

#WORTHREACHINGFOR I ii

|

||||

| Term | Meaning | ||||

| Lender | Bank of America, N.A., as lender for the April 2022 Term Credit Agreement | ||||

| LIBOR | London Interbank Offered Rate | ||||

| Lingua Franca | Lingua Franca, LLC business, acquired by us | ||||

| May 2020 Canopy Investment | in May 2020, we made an incremental investment for 18.9 million common shares of Canopy through the exercise of warrants obtained in November 2017 | ||||

| May 2022 Senior Notes | $1,850.0 million aggregate principal amount of senior notes issued in May 2022 | ||||

| MD&A | Management’s Discussion and Analysis of Financial Condition and Results of Operations under Item 2. of this Form 10-Q | ||||

Mexicali Brewery |

canceled brewery construction project located in Mexicali, Baja California, Mexico |

||||

| Mexico Beer Projects | expansion, optimization, and/or construction activities at the Obregon Brewery, Nava Brewery, and Veracruz Brewery | ||||

| M&T | Manufacturers and Traders Trust Company | ||||

| My Favorite Neighbor | we made an initial investment in My Favorite Neighbor, LLC and subsequently acquired the remaining ownership interest | ||||

| NA | not applicable | ||||

| Nava | Nava, Coahuila, Mexico | ||||

| Nava Brewery | brewery located in Nava | ||||

| Net sales | gross sales less promotions, returns and allowances, and excise taxes | ||||

| NM | not meaningful | ||||

| Note(s) | notes to the consolidated financial statements | ||||

| November 2017 Canopy Investment | in November 2017, we made an initial investment for 18.9 million common shares of Canopy | ||||

| November 2018 Canopy Investment | in November 2018, we made an incremental investment for 104.5 million common shares of Canopy | ||||

| November 2018 Canopy Warrants | Tranche A Warrants, Tranche B Warrants, and Tranche C Warrants, collectively | ||||

| NYSE | New York Stock Exchange | ||||

| Obregon | Obregon, Sonora, Mexico | ||||

Obregon Brewery |

brewery located in Obregon |

||||

| OCI | other comprehensive income (loss) | ||||

| Pre-issuance hedge contracts | treasury lock and/or swap lock contracts designated as cash flow hedges entered into to hedge treasury rate volatility on future debt issuances | ||||

| Reclassification | the plan to reclassify the Company’s common stock to eliminate the existing Class B Stock pursuant to the terms and conditions of the Reclassification Agreement |

||||

| Reclassification Agreement | reclassification agreement in support of the Reclassification, dated June 30, 2022, among the Company and the Sands Family Stockholders |

||||

| Reclassification Proposal | proposal to approve and adopt the Amended and Restated Charter, which will effectuate the Reclassification | ||||

Registration Statement on Form S-4 |

our Registration Statement on Form S-4, including our proxy statement/prospectus, in connection with the Reclassification declared effective by the SEC on September 21, 2022, as may be amended or supplemented from time to time | ||||

| RTD | ready-to-drink | ||||

| SEC | Securities and Exchange Commission | ||||

| Sands Family Stockholders | RES Master LLC, RES Business Holdings LP, SER Business Holdings LP, RHT 2015 Business Holdings LP, RSS Master LLC, RSS Business Holdings LP, SSR Business Holdings LP, RSS 2015 Business Holdings LP, RCT 2015 Business Holdings LP, RCT 2020 Investments LLC, NSDT 2009 STZ LLC, NSDT 2011 STZ LLC, RSS Business Management LLC, SSR Business Management LLC, LES Lauren Holdings LLC, MES Mackenzie Holdings LLC, Abigail Bennett, Zachary Stern, A&Z 2015 Business Holdings LP, Marilyn Sands Master Trust, MAS Business Holdings LP, Sands Family Foundation, Richard Sands, Robert Sands, WildStar Partners LLC, and Astra Legacy LLC |

||||

Constellation Brands, Inc. Q2 FY 2023 Form 10-Q |

#WORTHREACHINGFOR I iii

|

||||

| Term | Meaning | ||||

| Second Quarter 2022 | the Company’s three months ended August 31, 2021 |

||||

| Second Quarter 2023 | the Company’s three months ended August 31, 2022 |

||||

| Securities Act | Securities Act of 1933, as amended | ||||

| Six Months 2022 | the Company’s six months ended August 31, 2021 |

||||

| Six Months 2023 | the Company’s six months ended August 31, 2022 |

||||

SOFR |

secured overnight financing rate administered by the Federal Reserve Bank of New York |

||||

| THC | tetrahydrocannabinol | ||||

| Tranche A Warrants | warrants which give us the option to purchase 88.5 million common shares of Canopy expiring November 1, 2023 | ||||

| Tranche B Warrants | warrants which give us the option to purchase 38.4 million common shares of Canopy expiring November 1, 2026 | ||||

| Tranche C Warrants | warrants which give us the option to purchase 12.8 million common shares of Canopy expiring November 1, 2026 | ||||

TSX |

Toronto Stock Exchange |

||||

| U.S. | United States of America | ||||

| U.S. GAAP | generally accepted accounting principles in the U.S. | ||||

| Veracruz | Heroica Veracruz, Veracruz, Mexico | ||||

| Veracruz Brewery | a new brewery to be constructed in Veracruz | ||||

VWAP Exercise Price |

volume-weighted average of the closing market price of Canopy’s common shares on the TSX for the five trading days immediately preceding the exercise date |

||||

Constellation Brands, Inc. Q2 FY 2023 Form 10-Q |

#WORTHREACHINGFOR I iv

|

||||

| FINANCIAL STATEMENTS | |||||

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements.

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(in millions, except share and per share data)

(unaudited)

| August 31, 2022 |

February 28, 2022 |

||||||||||

| ASSETS | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ |

|

$ | ||||||||

| Accounts receivable |

|

||||||||||

| Inventories |

|

||||||||||

| Prepaid expenses and other |

|

||||||||||

| Total current assets |

|

||||||||||

| Property, plant, and equipment |

|

||||||||||

| Goodwill |

|

||||||||||

| Intangible assets |

|

||||||||||

| Equity method investments |

|

||||||||||

| Securities measured at fair value |

|

||||||||||

| Deferred income taxes |

|

||||||||||

| Other assets |

|

||||||||||

| Total assets | $ |

|

$ | ||||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||||||

| Current liabilities: | |||||||||||

| Short-term borrowings | $ |

|

$ | ||||||||

| Current maturities of long-term debt |

|

||||||||||

| Accounts payable |

|

||||||||||

| Other accrued expenses and liabilities |

|

||||||||||

| Total current liabilities |

|

||||||||||

| Long-term debt, less current maturities |

|

||||||||||

| Deferred income taxes and other liabilities |

|

||||||||||

| Total liabilities |

|

||||||||||

| Commitments and contingencies | |||||||||||

| CBI stockholders’ equity: | |||||||||||

Class A Stock, $ |

|

||||||||||

Class B Stock, $ |

|

||||||||||

| Additional paid-in capital |

|

||||||||||

| Retained earnings |

|

||||||||||

| Accumulated other comprehensive income (loss) | ( |

( |

|||||||||

|

|

|||||||||||

| Less: Treasury stock – | |||||||||||

Class A Stock, at cost, |

( |

( |

|||||||||

Class B Stock, at cost, |

( |

( |

|||||||||

| ( |

( |

||||||||||

| Total CBI stockholders’ equity |

|

||||||||||

| Noncontrolling interests |

|

||||||||||

| Total stockholders’ equity |

|

||||||||||

| Total liabilities and stockholders’ equity | $ |

|

$ | ||||||||

The accompanying notes are an integral part of these statements.

| Constellation Brands, Inc. Q2 FY 2023 Form 10-Q |

#WORTHREACHINGFOR I 1

|

||||

| FINANCIAL STATEMENTS | |||||

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(in millions, except per share data)

(unaudited)

| For the Six Months Ended August 31, |

For the Three Months Ended August 31, |

||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||

| Sales | $ |

|

$ | $ |

|

$ | |||||||||||||||||

| Excise taxes | ( |

( |

( |

( |

|||||||||||||||||||

| Net sales |

|

|

|||||||||||||||||||||

| Cost of product sold | ( |

( |

( |

( |

|||||||||||||||||||

| Gross profit |

|

|

|||||||||||||||||||||

| Selling, general, and administrative expenses | ( |

( |

( |

( |

|||||||||||||||||||

| Impairment of brewery construction in progress |

|

( |

|

||||||||||||||||||||

| Operating income (loss) |

|

|

|||||||||||||||||||||

| Income (loss) from unconsolidated investments | ( |

( |

( |

( |

|||||||||||||||||||

| Interest expense | ( |

( |

( |

( |

|||||||||||||||||||

| Loss on extinguishment of debt | ( |

( |

( |

( |

|||||||||||||||||||

| Income (loss) before income taxes | ( |

( |

( |

||||||||||||||||||||

| (Provision for) benefit from income taxes | ( |

( |

( |

( |

|||||||||||||||||||

| Net income (loss) | ( |

( |

( |

||||||||||||||||||||

| Net (income) loss attributable to noncontrolling interests | ( |

( |

( |

( |

|||||||||||||||||||

| Net income (loss) attributable to CBI | $ | ( |

$ | ( |

$ | ( |

$ | ||||||||||||||||

| Comprehensive income (loss) | $ | ( |

$ | ( |

$ | ( |

$ | ( |

|||||||||||||||

| Comprehensive (income) loss attributable to noncontrolling interests | ( |

( |

( |

( |

|||||||||||||||||||

| Comprehensive income (loss) attributable to CBI | $ | ( |

$ | ( |

$ | ( |

$ | ( |

|||||||||||||||

| Net income (loss) per common share attributable to CBI: | |||||||||||||||||||||||

| Basic – Class A Stock | $ | ( |

$ | ( |

$ | ( |

$ | ||||||||||||||||

| Basic – Class B Stock | $ | ( |

$ | ( |

$ | ( |

$ | ||||||||||||||||

| Diluted – Class A Stock | $ | ( |

$ | ( |

$ | ( |

$ | ||||||||||||||||

| Diluted – Class B Stock | $ | ( |

$ | ( |

$ | ( |

$ | ||||||||||||||||

| Weighted average common shares outstanding: | |||||||||||||||||||||||

| Basic – Class A Stock |

|

|

|||||||||||||||||||||

| Basic – Class B Stock |

|

|

|||||||||||||||||||||

| Diluted – Class A Stock |

|

|

|||||||||||||||||||||

| Diluted – Class B Stock |

|

|

|||||||||||||||||||||

| Cash dividends declared per common share: | |||||||||||||||||||||||

| Class A Stock | $ |

|

$ | $ |

|

$ | |||||||||||||||||

| Class B Stock | $ |

|

$ | $ |

|

$ | |||||||||||||||||

The accompanying notes are an integral part of these statements.

| Constellation Brands, Inc. Q2 FY 2023 Form 10-Q |

#WORTHREACHINGFOR I 2

|

||||

| FINANCIAL STATEMENTS | |||||

|

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(in millions)

(unaudited)

| |||||||||||||||||||||||||||||||||||||||||||||||

| Stock | Additional Paid-in Capital |

Retained Earnings |

Accumulated Other Comprehensive Income (Loss) |

Treasury Stock |

Non-controlling Interests |

Total | |||||||||||||||||||||||||||||||||||||||||

| Class A | Class B | ||||||||||||||||||||||||||||||||||||||||||||||

| Balance at February 28, 2022 | $ |

|

$ |

|

$ |

|

$ |

|

$ | ( |

$ | ( |

$ |

|

$ |

|

|||||||||||||||||||||||||||||||

| Comprehensive income (loss): | |||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — | — |

|

— | — |

|

|

|||||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss), net of income tax effect | — | — | — | — |

|

— |

|

|

|||||||||||||||||||||||||||||||||||||||

| Comprehensive income (loss) |

|

||||||||||||||||||||||||||||||||||||||||||||||

| Repurchase of shares | — | — | — | — | — | ( |

— | ( |

|||||||||||||||||||||||||||||||||||||||

| Dividends declared | — | — | — | ( |

— | — | — | ( |

|||||||||||||||||||||||||||||||||||||||

| Noncontrolling interest distributions | — | — | — | — | — | — | ( |

( |

|||||||||||||||||||||||||||||||||||||||

| Shares issued under equity compensation plans | — | — | ( |

— | — |

|

— |

|

|||||||||||||||||||||||||||||||||||||||

| Stock-based compensation | — | — |

|

— | — | — | — |

|

|||||||||||||||||||||||||||||||||||||||

| Balance at May 31, 2022 |

|

|

|

|

( |

( |

|

|

|||||||||||||||||||||||||||||||||||||||

| Comprehensive income (loss): | |||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — | — | ( |

— | — |

|

( |

|||||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss), net of income tax effect | — | — | — | — | ( |

— | ( |

( |

|||||||||||||||||||||||||||||||||||||||

| Comprehensive income (loss) | ( |

||||||||||||||||||||||||||||||||||||||||||||||

| Repurchase of shares | — | — | — | — | — | ( |

— | ( |

|||||||||||||||||||||||||||||||||||||||

| Dividends declared | — | — | — | ( |

— | — | — | ( |

|||||||||||||||||||||||||||||||||||||||

| Noncontrolling interest distributions | — | — | — | — | — | — | ( |

( |

|||||||||||||||||||||||||||||||||||||||

| Shares issued under equity compensation plans | — | — |

|

— | — |

|

— |

|

|||||||||||||||||||||||||||||||||||||||

| Stock-based compensation | — | — |

|

— | — | — | — |

|

|||||||||||||||||||||||||||||||||||||||

| Balance at August 31, 2022 | $ |

|

$ |

|

$ |

|

$ |

|

$ | ( |

$ | ( |

$ |

|

$ |

|

|||||||||||||||||||||||||||||||

| Constellation Brands, Inc. Q2 FY 2023 Form 10-Q |

#WORTHREACHINGFOR I 3

|

||||

| FINANCIAL STATEMENTS | |||||

|

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(in millions)

(unaudited)

| |||||||||||||||||||||||||||||||||||||||||||||||

| Stock | Additional Paid-in Capital |

Retained Earnings |

Accumulated Other Comprehensive Income (Loss) |

Treasury Stock |

Non-controlling Interests |

Total | |||||||||||||||||||||||||||||||||||||||||

| Class A | Class B | ||||||||||||||||||||||||||||||||||||||||||||||

| Balance at February 28, 2021 | $ | $ | $ | $ | $ | ( |

$ | ( |

$ | $ | |||||||||||||||||||||||||||||||||||||

| Comprehensive income (loss): | |||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — | — | ( |

— | — | ( |

||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss), net of income tax effect | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

| Comprehensive income (loss) | ( |

||||||||||||||||||||||||||||||||||||||||||||||

| Repurchase of shares | — | — | — | — | — | ( |

— | ( |

|||||||||||||||||||||||||||||||||||||||

| Dividends declared | — | — | — | ( |

— | — | — | ( |

|||||||||||||||||||||||||||||||||||||||

| Noncontrolling interest distributions | — | — | — | — | — | — | ( |

( |

|||||||||||||||||||||||||||||||||||||||

| Shares issued under equity compensation plans | — | — | ( |

— | — | — | |||||||||||||||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||

| Balance at May 31, 2021 | ( |

( |

|||||||||||||||||||||||||||||||||||||||||||||

| Comprehensive income (loss): | |||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss), net of income tax effect | — | — | — | — | ( |

— | ( |

( |

|||||||||||||||||||||||||||||||||||||||

| Comprehensive income (loss) | ( |

||||||||||||||||||||||||||||||||||||||||||||||

| Repurchase of shares | — | — | — | — | — | ( |

— | ( |

|||||||||||||||||||||||||||||||||||||||

| Dividends declared | — | — | — | ( |

— | — | — | ( |

|||||||||||||||||||||||||||||||||||||||

| Noncontrolling interest distributions | — | — | — | — | — | — | ( |

( |

|||||||||||||||||||||||||||||||||||||||

| Shares issued under equity compensation plans | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||

| Balance at August 31, 2021 | $ | $ | $ | $ | $ | ( |

$ | ( |

$ | $ | |||||||||||||||||||||||||||||||||||||

The accompanying notes are an integral part of these statements.

| Constellation Brands, Inc. Q2 FY 2023 Form 10-Q |

#WORTHREACHINGFOR I 4

|

||||

| FINANCIAL STATEMENTS | |||||

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in millions)

(unaudited)

| For the Six Months Ended August 31, |

|||||||||||

| 2022 | 2021 | ||||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | |||||||||||

| Net income (loss) | $ | ( |

$ | ( |

|||||||

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | |||||||||||

| Unrealized net (gain) loss on securities measured at fair value |

|

||||||||||

| Deferred tax provision (benefit) |

|

( |

|||||||||

| Depreciation |

|

||||||||||

| Stock-based compensation |

|

||||||||||

| Equity in (earnings) losses of equity method investees and related activities, net of distributed earnings |

|

||||||||||

| Noncash lease expense |

|

||||||||||

| Amortization of debt issuance costs and loss on extinguishment of debt |

|

||||||||||

| Impairment of Canopy Equity Method Investment |

|

||||||||||

| Impairment of brewery construction in progress |

|

||||||||||

| Gain (loss) on settlement of Pre-issuance hedge contracts |

|

||||||||||

| Change in operating assets and liabilities, net of effects from purchase and sale of business: | |||||||||||

| Accounts receivable | ( |

( |

|||||||||

| Inventories | ( |

( |

|||||||||

| Prepaid expenses and other current assets |

|

||||||||||

| Accounts payable |

|

||||||||||

| Deferred revenue |

|

||||||||||

| Other accrued expenses and liabilities | ( |

( |

|||||||||

| Other |

|

( |

|||||||||

| Total adjustments |

|

||||||||||

| Net cash provided by (used in) operating activities |

|

||||||||||

| CASH FLOWS FROM INVESTING ACTIVITIES | |||||||||||

| Purchase of property, plant, and equipment | ( |

( |

|||||||||

| Purchase of business, net of cash acquired | ( |

||||||||||

| Investments in equity method investees and securities | ( |

( |

|||||||||

| Proceeds from sale of assets |

|

||||||||||

| Proceeds from sale of business |

|

||||||||||

| Other investing activities |

|

( |

|||||||||

| Net cash provided by (used in) investing activities | ( |

( |

|||||||||

| Constellation Brands, Inc. Q2 FY 2023 Form 10-Q |

#WORTHREACHINGFOR I 5

|

||||

| FINANCIAL STATEMENTS | |||||

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in millions)

(unaudited)

| For the Six Months Ended August 31, |

|||||||||||

| 2022 | 2021 | ||||||||||

| CASH FLOWS FROM FINANCING ACTIVITIES | |||||||||||

| Proceeds from issuance of long-term debt |

|

||||||||||

| Principal payments of long-term debt | ( |

( |

|||||||||

| Net proceeds from (repayments of) short-term borrowings |

|

||||||||||

| Dividends paid | ( |

( |

|||||||||

| Purchases of treasury stock | ( |

( |

|||||||||

| Proceeds from shares issued under equity compensation plans |

|

||||||||||

| Payments of minimum tax withholdings on stock-based payment awards | ( |

( |

|||||||||

| Payments of debt issuance, debt extinguishment, and other financing costs | ( |

( |

|||||||||

| Distributions to noncontrolling interests | ( |

( |

|||||||||

| Net cash provided by (used in) financing activities | ( |

( |

|||||||||

| Effect of exchange rate changes on cash and cash equivalents | ( |

||||||||||

| Net increase (decrease) in cash and cash equivalents | ( |

( |

|||||||||

| Cash and cash equivalents, beginning of period |

|

||||||||||

| Cash and cash equivalents, end of period | $ |

|

$ | ||||||||

| Supplemental disclosures of noncash investing and financing activities | |||||||||||

| Additions to property, plant, and equipment | $ |

|

$ | ||||||||

The accompanying notes are an integral part of these statements.

| Constellation Brands, Inc. Q2 FY 2023 Form 10-Q |

#WORTHREACHINGFOR I 6

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

AUGUST 31, 2022

(unaudited)

1. BASIS OF PRESENTATION

2. INVENTORIES

Inventories are stated at the lower of cost (primarily computed in accordance with the first-in, first-out method) or net realizable value. Elements of cost include materials, labor, and overhead and consist of the following:

| August 31, 2022 |

February 28, 2022 |

||||||||||

| (in millions) | |||||||||||

| Raw materials and supplies | $ | $ | |||||||||

| In-process inventories | |||||||||||

| Finished case goods | |||||||||||

| $ | $ | ||||||||||

We assess the valuation of our inventories and reduce the carrying value of those inventories that are obsolete or in excess of our forecasted usage to their estimated net realizable value based on analyses and assumptions including, but not limited to, historical usage, future demand, and market requirements. We evaluated the carrying value of certain inventories and recognized the following in cost of product sold within our consolidated results of operations:

| For the Six Months Ended August 31, |

For the Three Months Ended August 31, |

||||||||||||||||||||||

| 2022 |

2021 (1)

|

2022 |

2021 (1)

|

||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

| Loss on inventory write-down | $ | $ | $ | $ | |||||||||||||||||||

(1)We recognized a loss predominantly from excess inventory of hard seltzers, within the Beer segment, largely resulting from a slowdown in the overall category which occurred in Fiscal 2022.

3. DERIVATIVE INSTRUMENTS

Overview

Our risk management and derivative accounting policies are presented in Notes 1 and 6 of our consolidated financial statements included in our 2022 Annual Report and have not changed significantly for the six months and three months ended August 31, 2022.

We have an investment in certain equity securities and other rights which provide us with the option to purchase an additional ownership interest in the equity securities of Canopy (see Note 7). This investment is

| Constellation Brands, Inc. Q2 FY 2023 Form 10-Q |

#WORTHREACHINGFOR I 7

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

included in securities measured at fair value and is accounted for at fair value, with the net gain (loss) from the changes in fair value of this investment recognized in income (loss) from unconsolidated investments (see Note 4).

The aggregate notional value of outstanding derivative instruments is as follows:

| August 31, 2022 |

February 28, 2022 |

||||||||||

| (in millions) | |||||||||||

| Derivative instruments designated as hedging instruments | |||||||||||

| Foreign currency contracts | $ | $ | |||||||||

| Pre-issuance hedge contracts | $ | $ | |||||||||

| Derivative instruments not designated as hedging instruments | |||||||||||

| Foreign currency contracts | $ | $ | |||||||||

| Commodity derivative contracts | $ | $ | |||||||||

Credit risk

We are exposed to credit-related losses if the counterparties to our derivative contracts default. This credit risk is limited to the fair value of the derivative contracts. To manage this risk, we contract only with major financial institutions that have earned investment-grade credit ratings and with whom we have standard International Swaps and Derivatives Association agreements which allow for net settlement of the derivative contracts. We have also established counterparty credit guidelines that are regularly monitored. Because of these safeguards, we believe the risk of loss from counterparty default to be immaterial.

In addition, our derivative instruments are not subject to credit rating contingencies or collateral requirements. As of August 31, 2022, the estimated fair value of derivative instruments in a net liability position due to counterparties was $17.9 million. If we were required to settle the net liability position under these derivative instruments on August 31, 2022, we would have had sufficient available liquidity on hand to satisfy this obligation.

Results of period derivative activity

The estimated fair value and location of our derivative instruments on our balance sheets are as follows (see Note 4):

| Assets | Liabilities | |||||||||||||||||||||||||

| August 31, 2022 |

February 28, 2022 |

August 31, 2022 |

February 28, 2022 |

|||||||||||||||||||||||

| (in millions) | ||||||||||||||||||||||||||

| Derivative instruments designated as hedging instruments | ||||||||||||||||||||||||||

| Foreign currency contracts: | ||||||||||||||||||||||||||

| Prepaid expenses and other | $ | $ | Other accrued expenses and liabilities | $ | $ | |||||||||||||||||||||

| Other assets | $ | $ | Deferred income taxes and other liabilities | $ | $ | |||||||||||||||||||||

| Pre-issuance hedge contracts: | ||||||||||||||||||||||||||

| Other assets | $ | $ | Deferred income taxes and other liabilities | $ | $ | |||||||||||||||||||||

| Constellation Brands, Inc. Q2 FY 2023 Form 10-Q |

#WORTHREACHINGFOR I 8

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

| Assets | Liabilities | |||||||||||||||||||||||||

| August 31, 2022 |

February 28, 2022 |

August 31, 2022 |

February 28, 2022 |

|||||||||||||||||||||||

| (in millions) | ||||||||||||||||||||||||||

| Derivative instruments not designated as hedging instruments | ||||||||||||||||||||||||||

| Foreign currency contracts: | ||||||||||||||||||||||||||

| Prepaid expenses and other | $ | $ | Other accrued expenses and liabilities | $ | $ | |||||||||||||||||||||

| Commodity derivative contracts: | ||||||||||||||||||||||||||

| Prepaid expenses and other | $ | $ | Other accrued expenses and liabilities | $ | $ | |||||||||||||||||||||

| Other assets | $ | $ | Deferred income taxes and other liabilities | $ | $ | |||||||||||||||||||||

The principal effect of our derivative instruments designated in cash flow hedging relationships on our results of operations, as well as OCI, net of income tax effect, is as follows:

| Derivative Instruments in Designated Cash Flow Hedging Relationships |

Net Gain (Loss) Recognized in OCI |

Location of Net Gain (Loss) Reclassified from AOCI to Income (Loss) |

Net Gain (Loss) Reclassified from AOCI to Income (Loss) |

|||||||||||||||||

| (in millions) | ||||||||||||||||||||

| For the Six Months Ended August 31, 2022 | ||||||||||||||||||||

| Foreign currency contracts | $ | Sales | $ | ( |

||||||||||||||||

| Cost of product sold | ||||||||||||||||||||

| Pre-issuance hedge contracts | Interest expense | ( |

||||||||||||||||||

| $ | $ | |||||||||||||||||||

| For the Six Months Ended August 31, 2021 | ||||||||||||||||||||

| Foreign currency contracts | $ | Sales | $ | ( |

||||||||||||||||

| Cost of product sold | ||||||||||||||||||||

| Pre-issuance hedge contracts | Interest expense | ( |

||||||||||||||||||

| $ | $ | |||||||||||||||||||

| For the Three Months Ended August 31, 2022 | ||||||||||||||||||||

| Foreign currency contracts | $ | ( |

Sales | $ | ( |

|||||||||||||||

| Cost of product sold | ||||||||||||||||||||

| Pre-issuance hedge contracts | Interest expense | ( |

||||||||||||||||||

| $ | ( |

$ | ||||||||||||||||||

| For the Three Months Ended August 31, 2021 | ||||||||||||||||||||

| Foreign currency contracts | $ | ( |

Sales | $ | ( |

|||||||||||||||

| Cost of product sold | ||||||||||||||||||||

| Pre-issuance hedge contracts | Interest expense | ( |

||||||||||||||||||

| $ | ( |

$ | ||||||||||||||||||

We expect $35.3 million of net gains, net of income tax effect, to be reclassified from AOCI to our results of operations within the next 12 months.

| Constellation Brands, Inc. Q2 FY 2023 Form 10-Q |

#WORTHREACHINGFOR I 9

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

The effect of our undesignated derivative instruments on our results of operations is as follows:

| Derivative Instruments Not Designated as Hedging Instruments |

Location of Net Gain (Loss) Recognized in Income (Loss) |

Net Gain (Loss) Recognized in Income (Loss) |

||||||||||||||||||

| (in millions) | ||||||||||||||||||||

| For the Six Months Ended August 31, 2022 | ||||||||||||||||||||

| Commodity derivative contracts | Cost of product sold | $ | ||||||||||||||||||

| Foreign currency contracts | Selling, general, and administrative expenses | ( |

||||||||||||||||||

| $ | ||||||||||||||||||||

| For the Six Months Ended August 31, 2021 | ||||||||||||||||||||

| Commodity derivative contracts | Cost of product sold | $ | ||||||||||||||||||

| Foreign currency contracts | Selling, general, and administrative expenses | ( |

||||||||||||||||||

| $ | ||||||||||||||||||||

| For the Three Months Ended August 31, 2022 | ||||||||||||||||||||

| Commodity derivative contracts | Cost of product sold | $ | ( |

|||||||||||||||||

| Foreign currency contracts | Selling, general, and administrative expenses | ( |

||||||||||||||||||

| $ | ( |

|||||||||||||||||||

| For the Three Months Ended August 31, 2021 | ||||||||||||||||||||

| Commodity derivative contracts | Cost of product sold | $ | ||||||||||||||||||

| Foreign currency contracts | Selling, general, and administrative expenses | ( |

||||||||||||||||||

| $ | ||||||||||||||||||||

4. FAIR VALUE OF FINANCIAL INSTRUMENTS

Authoritative guidance establishes a framework for measuring fair value, including a hierarchy for inputs used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that the most observable inputs be used when available. The hierarchy includes three levels:

•Level 1 inputs are quoted prices in active markets for identical assets or liabilities;

•Level 2 inputs include data points that are observable such as quoted prices for similar assets or liabilities in active markets, quoted prices for identical assets or similar assets or liabilities in markets that are not active, and inputs (other than quoted prices) such as volatility, interest rates, and yield curves that are observable for the asset and liability, either directly or indirectly; and

•Level 3 inputs are unobservable data points for the asset or liability, and include situations where there is little, if any, market activity for the asset or liability.

Fair value methodology

The following methods and assumptions are used to estimate the fair value for each class of our financial instruments:

Foreign currency and commodity derivative contracts

The fair value is estimated using market-based inputs, obtained from independent pricing services, entered into valuation models. These valuation models require various inputs, including contractual terms, market foreign exchange prices, market commodity prices, interest-rate yield curves, and currency volatilities, as applicable (Level 2 fair value measurement).

| Constellation Brands, Inc. Q2 FY 2023 Form 10-Q |

#WORTHREACHINGFOR I 10

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

Interest rate swap and Pre-issuance hedge contracts

The fair value is estimated based on quoted market prices from respective counterparties. Quotes are corroborated by using discounted cash flow calculations based upon forward interest-rate yield curves, which are obtained from independent pricing services (Level 2 fair value measurement).

Canopy investment

Equity securities, Warrants – The November 2018 Canopy Warrants consist of three tranches of warrants, including 88.5 million Tranche A Warrants expiring November 1, 2023, which are currently exercisable, 38.4 million Tranche B Warrants expiring November 1, 2026, and 12.8 million Tranche C Warrants expiring November 1, 2026. The inputs used to estimate the fair value of the November 2018 Canopy Warrants are as follows (1) (2):

| August 31, 2022 | February 28, 2022 | ||||||||||||||||||||||

|

Tranche A

Warrants (3)

|

Tranche B

Warrants (4)

|

Tranche A

Warrants (3)

|

Tranche B

Warrants (4)

|

||||||||||||||||||||

Exercise price (5)

|

C$ | C$ | C$ | C$ | |||||||||||||||||||

Valuation date stock price (6)

|

C$ | C$ | C$ | C$ | |||||||||||||||||||

Remaining contractual term (7)

|

|||||||||||||||||||||||

Expected volatility (8)

|

% | % | % | % | |||||||||||||||||||

Risk-free interest rate (9)

|

% | % | % | % | |||||||||||||||||||

Expected dividend yield (10)

|

% | % | % | % | |||||||||||||||||||

(1)The exercise price for the Tranche C Warrants is based on the VWAP Exercise Price. The Tranche C Warrants are not included in the table as there is no fair value assigned.

(2)In connection with the Acreage Transaction, we obtained other rights which include a share repurchase credit. If Canopy has not purchased the lesser of 27,378,866 Canopy common shares, or C$1,583.0 million worth of Canopy common shares for cancellation between April 18, 2019, and two-years after the full exercise of the Tranche A Warrants, we will be credited an amount that will reduce the aggregate exercise price otherwise payable upon each exercise of the Tranche B Warrants and Tranche C Warrants. The credit will be an amount equal to the difference between C$1,583.0 million and the actual price paid by Canopy in purchasing its common shares for cancellation. The likelihood of receiving the share repurchase credit if we were to fully exercise the Tranche A Warrants is remote, therefore, no fair value has been assigned.

(3)The fair value is estimated using the Black-Scholes option-pricing model (Level 2 fair value measurement).

(4)The fair value is estimated using Monte Carlo simulations (Level 2 fair value measurement).

(5)Based on the exercise price from the applicable underlying agreements.

(6)Based on the closing market price for Canopy common shares on the TSX as of the applicable date.

(7)Based on the expiration date of the warrants.

(8)Based on consideration of historical and/or implied volatility levels of the underlying equity security and limited consideration of historical peer group volatility levels.

(9)Based on the implied yield currently available on Canadian Treasury zero coupon issues with a remaining term equal to the expiration date of the applicable warrants.

(10)Based on historical dividend levels.

Debt securities – We have elected the fair value option to account for the Canopy Debt Securities. Interest income on the Canopy Debt Securities is calculated using the effective interest method and is recognized separately from the changes in fair value in interest expense. The Canopy Debt Securities have a contractual maturity of five years from the date of issuance but may be settled prior to maturity by either party upon the occurrence of certain events. The fair value is estimated using a binomial lattice option-pricing model (Level 2 fair value measurement), which includes an estimate of the credit spread based on market spreads using bond data as of the valuation date. For additional information on the Canopy Debt Securities refer to Note 7.

| Constellation Brands, Inc. Q2 FY 2023 Form 10-Q |

#WORTHREACHINGFOR I 11

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

The inputs used to estimate the fair value of the Canopy Debt Securities are as follows:

| August 31, 2022 |

February 28, 2022 |

||||||||||

Settlement price (1)

|

C$ | C$ | |||||||||

Valuation date stock price (2)

|

C$ | C$ | |||||||||

Remaining term (3)

|

|||||||||||

Expected volatility (4)

|

% | % | |||||||||

Risk-free interest rate (5)

|

% | % | |||||||||

Expected dividend yield (6)

|

% | % | |||||||||

(1)Based on the rate which the Canopy Debt Securities may be settled. In June 2022, the Canopy Debt Securities were amended to remove Canopy’s right to settle the Canopy Debt Securities on conversion into Canopy common shares. As a result, the Canopy Debt Securities may only be settled in cash. Prior to the June 2022 amendment, the Canopy Debt Securities could be settled, at Canopy’s option, in cash, Canopy common shares, or a combination thereof.

(2)Based on the closing market price for Canopy common shares on the TSX as of the applicable date.

(3)Based on the contractual maturity date of the notes.

(4)Based on consideration of historical and/or implied volatility levels of the underlying equity security, adjusted for certain risks associated with debt securities, as appropriate.

(5)Based on the implied yield currently available on Canadian Treasury zero coupon issues with a term equal to the remaining contractual term of the Canopy Debt Securities.

(6)Based on historical dividend levels.

Short-term borrowings

Our short-term borrowings consist of our commercial paper program and the revolving credit facility under our senior credit facility. The revolving credit facility is a variable interest rate bearing note with a fixed margin, adjustable based upon our debt rating (as defined in our senior credit facility). For these short-term borrowings, the carrying value approximates the fair value.

Long-term debt

The term loans under our term loan credit agreements are variable interest rate bearing notes with a fixed margin, adjustable based upon our debt rating. The carrying values approximate the fair value of the term loans. The fair value of the remaining fixed interest rate long-term debt is estimated by discounting cash flows using interest rates currently available for debt with similar terms and maturities (Level 2 fair value measurement).

The carrying amounts of certain of our financial instruments, including cash and cash equivalents, accounts receivable, and accounts payable, approximate fair value as of August 31, 2022, and February 28, 2022, due to the relatively short maturity of these instruments. As of August 31, 2022, the carrying amount of long-term debt, including the current portion, was $10,286.3 million, compared with an estimated fair value of $9,609.1 million. As of February 28, 2022, the carrying amount of long-term debt, including the current portion, was $10,093.5 million, compared with an estimated fair value of $10,345.3 million.

| Constellation Brands, Inc. Q2 FY 2023 Form 10-Q |

#WORTHREACHINGFOR I 12

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

Recurring basis measurements

The following table presents our financial assets and liabilities measured at estimated fair value on a recurring basis:

| Fair Value Measurements Using | |||||||||||||||||||||||

| Quoted Prices in Active Markets (Level 1) |

Significant Other Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

Total | ||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

| August 31, 2022 | |||||||||||||||||||||||

| Assets: | |||||||||||||||||||||||

| Foreign currency contracts | $ | $ | $ | $ | |||||||||||||||||||

| Commodity derivative contracts | $ | $ | $ | $ | |||||||||||||||||||

November 2018 Canopy Warrants (1)

|

$ | $ | $ | $ | |||||||||||||||||||

Canopy Debt Securities (1)

|

$ | $ | $ | $ | |||||||||||||||||||

| Liabilities: | |||||||||||||||||||||||

| Foreign currency contracts | $ | $ | $ | $ | |||||||||||||||||||

| Commodity derivative contracts | $ | $ | $ | $ | |||||||||||||||||||

| February 28, 2022 | |||||||||||||||||||||||

| Assets: | |||||||||||||||||||||||

| Foreign currency contracts | $ | $ | $ | $ | |||||||||||||||||||

| Commodity derivative contracts | $ | $ | $ | $ | |||||||||||||||||||

November 2018 Canopy Warrants (1)

|

$ | $ | $ | $ | |||||||||||||||||||

Canopy Debt Securities (1)

|

$ | $ | $ | $ | |||||||||||||||||||

| Liabilities: | |||||||||||||||||||||||

| Foreign currency contracts | $ | $ | $ | $ | |||||||||||||||||||

| Commodity derivative contracts | $ | $ | $ | $ | |||||||||||||||||||

| Pre-issuance hedge contracts | $ | $ | $ | $ | |||||||||||||||||||

(1) |

Unrealized net gain (loss) from the changes in fair value of our securities measured at fair value recognized in income (loss) from unconsolidated investments, are as follows: | ||||||||||||||||||||||||||||

| For the Six Months Ended August 31, |

For the Three Months Ended August 31, |

||||||||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||||||||

| November 2018 Canopy Warrants | $ | ( |

$ | ( |

$ | ( |

$ | ( |

|||||||||||||||||||||

Canopy Debt Securities (i)

|

( |

( |

( |

( |

|||||||||||||||||||||||||

| $ | ( |

$ | ( |

$ | ( |

$ | ( |

||||||||||||||||||||||

(i) |

In July 2022, we received |

||||||||||||||||||||||||||||

| Constellation Brands, Inc. Q2 FY 2023 Form 10-Q |

#WORTHREACHINGFOR I 13

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

Nonrecurring basis measurements

The following table presents our assets and liabilities measured at estimated fair value on a nonrecurring basis for which an impairment assessment was performed for the periods presented:

| Fair Value Measurements Using | |||||||||||||||||||||||

| Quoted Prices in Active Markets (Level 1) |

Significant Other Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

Total Losses | ||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

| For the Six Months Ended August 31, 2022 | |||||||||||||||||||||||

| Equity method investments | $ | $ | $ | $ | |||||||||||||||||||

| For the Six Months Ended August 31, 2021 | |||||||||||||||||||||||

| Long-lived assets | $ | $ | $ | $ | |||||||||||||||||||

Equity method investments

As of August 31, 2022, we evaluated the Canopy Equity Method Investment and determined there was an other-than-temporary impairment based on several contributing factors, including: (i) the period of time for which the fair value had been less than the carrying value and the uncertainty surrounding Canopy’s stock price recovering in the near-term, (ii) Canopy recording a significant impairment of goodwill related to its cannabis operations during its three months ended June 30, 2022, and (iii) the uncertainty of U.S. federal cannabis permissibility. As a result, the Canopy Equity Method Investment with a carrying value of $1,695.1 million was written down to its estimated fair value of $634.8 million, resulting in an impairment of $1,060.3

Long-lived assets

In April 2021, our Board of Directors authorized management to sell or abandon the Mexicali Brewery. Subsequently, management determined that we will be unable to use or repurpose certain assets at the Mexicali Brewery. Accordingly, for the first quarter of Fiscal 2022, long-lived assets with a carrying value of $685.9 million were written down to their estimated fair value of $20.0 million, resulting in an impairment of $665.9 million. This impairment was included in impairment of brewery construction in progress within our consolidated results of operations for the six months ended August 31, 2021. Our estimate of fair value was determined based on the expected salvage value of the assets. The Mexicali Brewery is a component of the Beer segment. In April 2022, we announced that, with the assistance of the Mexican government and state and local officials in Mexico, we acquired land in Veracruz for the construction of the Veracruz Brewery where there is ample water and we will have a skilled workforce to meet our long-term needs. The design and development process for the Veracruz Brewery is underway. We continue to work with government officials in Mexico to (i) determine next steps for our canceled Mexicali Brewery construction project and (ii) pursue various forms of recovery for capitalized costs and additional expenses incurred in establishing the brewery, however, there can be no assurance of any recoveries. In the medium-term, under normal operating conditions, we have ample capacity at the Nava and Obregon breweries to meet consumer needs based on current growth forecasts and current and planned production capabilities. Expansion, optimization, and/or construction activities continue at our current brewery locations under our Mexico Beer Projects to align with our anticipated future growth expectations.

| Constellation Brands, Inc. Q2 FY 2023 Form 10-Q |

#WORTHREACHINGFOR I 14

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

5. GOODWILL

The changes in the carrying amount of goodwill are as follows:

| Beer | Wine and Spirits | Consolidated | |||||||||||||||

| (in millions) | |||||||||||||||||

| Balance, February 28, 2021 | $ | $ | $ | ||||||||||||||

Purchase accounting allocations (1)

|

|||||||||||||||||

| Foreign currency translation adjustments | ( |

( |

( |

||||||||||||||

| Balance, February 28, 2022 | |||||||||||||||||

Purchase accounting allocations (2)

|

|||||||||||||||||

| Foreign currency translation adjustments | ( |

||||||||||||||||

| Balance, August 31, 2022 | $ | $ | $ | ||||||||||||||

(1)Preliminary purchase accounting allocations associated with the acquisition of My Favorite Neighbor and purchase accounting allocations associated with the acquisition of Empathy Wines.

(2)Preliminary purchase accounting allocations associated with the acquisitions of Austin Cocktails and Lingua Franca and purchase accounting allocations associated with the acquisition of My Favorite Neighbor.

Acquisitions

Austin Cocktails

In April 2022, we acquired the remaining 73 % ownership interest in Austin Cocktails, which included a portfolio of small batch, RTD cocktails. This transaction primarily included the acquisition of goodwill and a trademark. In addition, the purchase price for Austin Cocktails includes an earn-out over five years based on performance. The results of operations of Austin Cocktails are reported in the Wine and Spirits segment and have been included in our consolidated results of operations from the date of acquisition.

Lingua Franca

In March 2022, we acquired the Lingua Franca business, including a collection of Oregon-based luxury wines, a vineyard, and a production facility. This transaction also includes the acquisition of a trademark and inventory. In addition, the purchase price for Lingua Franca includes an earn-out over seven years based on performance. The results of operations of Lingua Franca are reported in the Wine and Spirits segment and have been included in our consolidated results of operations from the date of acquisition.

My Favorite Neighbor

In November 2021, we acquired the remaining 65 % ownership interest in My Favorite Neighbor, a super-luxury, DTC focused wine business as well as certain wholesale distributed brands. This transaction primarily included the acquisition of goodwill, trademarks, inventory, and property, plant, and equipment. In addition, the My Favorite Neighbor transaction includes an earn-out over 10 years based on performance, with a 50 % minimum guarantee due at the end of the earn-out period. The results of operations of My Favorite Neighbor are reported in the Wine and Spirits segment and have been included in our consolidated results of operations from the date of acquisition.

Subsequent event

2022 Wine Divestiture

On October 6, 2022, we sold certain of our mainstream and premium wine brands and related inventory. We expect to use the net cash proceeds from the 2022 Wine Divestiture primarily to reduce outstanding borrowings and for general corporate purposes, including working capital, funding capital expenditures, and other business opportunities.

| Constellation Brands, Inc. Q2 FY 2023 Form 10-Q |

#WORTHREACHINGFOR I 15

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

6. INTANGIBLE ASSETS

The major components of intangible assets are as follows:

| August 31, 2022 | February 28, 2022 | ||||||||||||||||||||||

| Gross Carrying Amount |

Net Carrying Amount |

Gross Carrying Amount |

Net Carrying Amount |

||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

| Amortizable intangible assets | |||||||||||||||||||||||

| Customer relationships | $ | $ | $ | $ | |||||||||||||||||||

| Other | |||||||||||||||||||||||

| Total | $ | $ | |||||||||||||||||||||

| Nonamortizable intangible assets | |||||||||||||||||||||||

| Trademarks | |||||||||||||||||||||||

| Total intangible assets | $ | $ | |||||||||||||||||||||

We did not incur costs to renew or extend the term of acquired intangible assets for the six months and three months ended August 31, 2022, and August 31, 2021. Net carrying amount represents the gross carrying value net of accumulated amortization.

7. EQUITY METHOD INVESTMENTS

Our equity method investments are as follows:

| August 31, 2022 | February 28, 2022 | ||||||||||||||||||||||

| Carrying Value | Ownership Percentage | Carrying Value | Ownership Percentage | ||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

Canopy Equity Method Investment (1) (2)

|

$ | % | $ | % | |||||||||||||||||||

| Other equity method investments | |||||||||||||||||||||||

| $ | $ | ||||||||||||||||||||||

(1)The fair value based on the closing price of the underlying equity security as of August 31, 2022, and February 28, 2022, was $634.8 million and $1,014.8 million, respectively. The balance at August 31, 2022, is net of a $1,060.3

(2)Includes the following:

| Common Shares | Purchase Price | |||||||||||||

| (in millions) | ||||||||||||||

November 2017 Canopy Investment |

$ | |||||||||||||

| November 2018 Canopy Investment | ||||||||||||||

May 2020 Canopy Investment |

||||||||||||||

July 2022 Canopy Investment (i)

|

||||||||||||||

| $ | ||||||||||||||

(i) |

In June 2022, certain holders of Canopy Debt Securities agreed to exchange C$ |

|||||||||||||

| Constellation Brands, Inc. Q2 FY 2023 Form 10-Q |

#WORTHREACHINGFOR I 16

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

Canopy Equity Method Investment

We complement our beverage alcohol strategy with our investment in Canopy, a leading provider of medicinal and recreational cannabis products. Equity in earnings (losses) from the Canopy Equity Method Investment and related activities is determined by recording the effect of basis differences. Amounts included in our consolidated results of operations for each period are as follows:

| For the Six Months Ended August 31, |

For the Three Months Ended August 31, |

||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

Equity in earnings (losses) from Canopy and related activities (1)

|

$ | ( |

$ | ( |

$ | ( |

$ | ||||||||||||||||

(1)Includes a $460.8

We evaluated the Canopy Equity Method Investment as of August 31, 2022, and determined there was an other-than-temporary impairment. Our conclusion was based on several contributing factors, including: (i) the period of time for which the fair value had been less than the carrying value and the uncertainty surrounding Canopy’s stock price recovering in the near-term, (ii) Canopy recording a significant impairment of goodwill related to its cannabis operations during its three months ended June 30, 2022, and (iii) the uncertainty of U.S. federal cannabis permissibility.

Canopy has various equity and convertible debt securities outstanding, including primarily equity awards granted to its employees, and options and warrants issued to various third parties, including our November 2018 Canopy Warrants, and the Acreage Financial Instrument (a call option for Canopy to acquire 70 % of the shares of Acreage at a fixed exchange ratio and 30 % at a floating exchange ratio). As of August 31, 2022, the exercise and/or conversion of certain of these outstanding securities could have a significant effect on our share of Canopy’s reported earnings or losses and our ownership interest in Canopy.

The following table presents summarized financial information for Canopy prepared in accordance with U.S. GAAP. We recognize our equity in earnings (losses) for Canopy on a two-month lag. Accordingly, we recognized our share of Canopy’s earnings (losses) for the periods January through June 2022 and January through June 2021 in our six months ended August 31, 2022, and August 31, 2021, results, respectively. We recognized our share of Canopy’s earnings (losses) for the periods April through June 2022 and April through June 2021 in our three months ended August 31, 2022, and August 31, 2021, results, respectively. The six months and three months ended August 31, 2022, includes a goodwill impairment related to Canopy’s cannabis operations. The six months ended August 31, 2022, also includes substantial costs designed to drive efficiency and accelerate Canopy’s path to profitability. The amounts shown represent 100% of Canopy’s reported results of operations for the respective periods.

| For the Six Months Ended August 31, |

For the Three Months Ended August 31, |

||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

| Net sales | $ | $ | $ | $ | |||||||||||||||||||

| Gross profit (loss) | $ | ( |

$ | $ | ( |

$ | |||||||||||||||||

| Net income (loss) | $ | ( |

$ | ( |

$ | ( |

$ | ||||||||||||||||

| Net income (loss) attributable to Canopy | $ | ( |

$ | ( |

$ | ( |

$ | ||||||||||||||||

| Constellation Brands, Inc. Q2 FY 2023 Form 10-Q |

#WORTHREACHINGFOR I 17

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

8. BORROWINGS

Borrowings consist of the following:

| August 31, 2022 | February 28, 2022 |

||||||||||||||||||||||

| Current | Long-term | Total | Total | ||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

| Short-term borrowings | |||||||||||||||||||||||

| Commercial paper | $ | $ | |||||||||||||||||||||

| $ | $ | ||||||||||||||||||||||

| Long-term debt | |||||||||||||||||||||||

| Term loan credit facilities | $ | $ | $ | $ | |||||||||||||||||||

| Senior notes | |||||||||||||||||||||||

| Other | |||||||||||||||||||||||

| $ | $ | $ | $ | ||||||||||||||||||||

Bank facilities

Senior credit facility

In April 2022, the Company, CB International, the Administrative Agent, and certain other lenders entered into the 2022 Restatement Agreement that amended and restated our then-existing senior credit facility (as amended and restated by the 2022 Restatement Agreement, the 2022 Credit Agreement). The principal changes effected by the 2022 Restatement Agreement were:

•The refinance and increase of the existing revolving credit facility from $2.0 billion to $2.25 billion and extension of its maturity to April 14, 2027;

•The refinement of certain negative covenants; and

•The replacement of LIBOR rates with rates based on term SOFR.

Term loan credit agreements

In April 2022, the Company, the Administrative Agent, and the Lender amended the June 2021 Term Credit Agreement (as amended, the April 2022 Term Credit Agreement). The principal changes effected by the amendment were the refinement of certain negative covenants and replacement of LIBOR rates with rates based on term SOFR.

In August 2022, the Company, the Administrative Agent, and certain other lenders entered into the August 2022 Term Credit Agreement. The August 2022 Term Credit Agreement provides for a $1.0 billion delayed single draw -year term loan facility and is not subject to amortization payments, with the balance due and payable on the earliest of (i) three years after the funding date (as defined in the August 2022 Term Credit Agreement) and (ii) December 31, 2025. The proceeds, if drawn, from the August 2022 Term Credit Agreement will be used to partially fund the aggregate cash payment to holders of Class B Stock in connection with the Reclassification and to pay related fees as well as fees related to closing the August 2022 Term Credit Agreement.

| Constellation Brands, Inc. Q2 FY 2023 Form 10-Q |

#WORTHREACHINGFOR I 18

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

As of August 31, 2022, aggregate credit facilities under the 2022 Credit Agreement, the April 2022 Term Credit Agreement, and the August 2022 Term Credit Agreement consist of the following:

| Amount | Maturity | ||||||||||

| (in millions) | |||||||||||

| 2022 Credit Agreement | |||||||||||

Revolving credit facility (1) (2)

|

$ | Apr 14, 2027 | |||||||||

| April 2022 Term Credit Agreement | |||||||||||

Five-Year Term Facility (1) (3)

|

$ | Jun 28, 2024 | |||||||||

| August 2022 Term Credit Agreement | |||||||||||

Three-year term facility (1) (3)

|

$ | (4) |

|||||||||

(1)Contractual interest rate varies based on our debt rating (as defined in the respective agreement) and is a function of SOFR plus a margin and a credit spread adjustment, or the base rate plus a margin, or, in certain circumstances where SOFR cannot be adequately ascertained or available, an alternative benchmark rate plus a margin.

(2)We and/or CB International are the borrower under the $2,250.0 million revolving credit facility. Includes a sub-facility for letters of credit of up to $200.0 million.

(3)We are the borrower under the term loan credit agreements.

(4)The August 2022 Term Credit Agreement will mature on the earliest of (i) three years after the funding date (as defined in the August 2022 Term Credit Agreement) and (ii) December 31, 2025.

As of August 31, 2022, information with respect to borrowings under the 2022 Credit Agreement and the April 2022 Term Credit Agreement is as follows:

| Outstanding borrowings |

Interest rate |

SOFR margin |

Outstanding letters of credit |

Remaining

borrowing

capacity (1)

|

|||||||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||||||||

| 2022 Credit Agreement | |||||||||||||||||||||||||||||

| Revolving credit facility | $ | % | % | $ | $ | ||||||||||||||||||||||||

| April 2022 Term Credit Agreement | |||||||||||||||||||||||||||||

| Five-Year Term Facility | $ | % | % | ||||||||||||||||||||||||||

(1)Net of outstanding revolving credit facility borrowings and outstanding letters of credit under the 2022 Credit Agreement and outstanding borrowings under our commercial paper program of $664.5 million (excluding unamortized discount) (see “Commercial paper program” below).

We and our subsidiaries are subject to covenants that are contained in the 2022 Credit Agreement, the April 2022 Term Credit Agreement, and the August 2022 Term Credit Agreement, including those restricting the incurrence of additional subsidiary indebtedness, additional liens, mergers and consolidations, transactions with affiliates, and sale and leaseback transactions, in each case subject to numerous conditions, exceptions, and thresholds. The financial covenants are limited to a minimum interest coverage ratio and a maximum net leverage ratio.

Commercial paper program

We have a commercial paper program which provides for the issuance of up to an aggregate principal amount of $2.0 billion of commercial paper. Our commercial paper program is backed by unused commitments under our revolving credit facility under our 2022 Credit Agreement. Accordingly, outstanding borrowings under our commercial paper program reduce the amount available under our revolving credit facility. As of August 31,

| Constellation Brands, Inc. Q2 FY 2023 Form 10-Q |

#WORTHREACHINGFOR I 19

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

2022, we had $663.9 million of outstanding borrowings, net of unamortized discount, under our commercial paper program with a weighted average annual interest rate of 3.0 % and a weighted average remaining term of 12 days.

Pre-issuance hedge contracts