10-Q: Quarterly report pursuant to Section 13 or 15(d)

Published on October 6, 2021

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the quarterly period ended August 31, 2021

or

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from to

Commission File Number: 001-08495

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||||

(Address of principal executive offices) (Zip code)

(585 ) 678-7100

(Registrant’s telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||||||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ☒ | Accelerated filer | ☐ | |||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | |||||||||

| Emerging growth company | |||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

There were 164,264,039 shares of Class A Common Stock, 23,221,678 shares of Class B Common Stock, and 614,353 shares of Class 1 Common Stock outstanding as of October 1, 2021.

TABLE OF CONTENTS

| Page | ||||||||

| DEFINED TERMS | ||||||||

| PART I - FINANCIAL INFORMATION | ||||||||

| Item 1. Financial Statements | ||||||||

| Consolidated Balance Sheets | ||||||||

| Consolidated Statements of Comprehensive Income (Loss) | ||||||||

| Consolidated Statements of Changes in Stockholders’ Equity | ||||||||

| Consolidated Statements of Cash Flows | ||||||||

| Notes to Consolidated Financial Statements | ||||||||

1. Basis of Presentation |

||||||||

2. Inventories |

||||||||

3. Acquisitions and Divestitures |

||||||||

4. Derivative Instruments |

||||||||

5. Fair Value of Financial Instruments |

||||||||

6. Goodwill |

||||||||

7. Intangible Assets |

||||||||

8. Equity Method Investments |

||||||||

9. Borrowings |

||||||||

10. Income Taxes |

||||||||

11. Stockholders' Equity |

||||||||

12. Net Income (Loss) Per Common Share Attributable to CBI |

||||||||

13. Comprehensive Income (Loss) Attributable to CBI |

||||||||

14. Business Segment Information |

||||||||

| Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations | ||||||||

| Item 3. Quantitative and Qualitative Disclosures About Market Risk | ||||||||

| Item 4. Controls and Procedures | ||||||||

| PART II – OTHER INFORMATION | ||||||||

| Item 2. Unregistered Sales of Equity Securities and Use of Proceeds | ||||||||

| Item 4. Mine Safety Disclosures | NA | |||||||

| Item 6. Exhibits | ||||||||

| INDEX TO EXHIBITS | ||||||||

| SIGNATURES | ||||||||

This Quarterly Report on Form 10-Q contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond the Company’s control, that could cause actual results to differ materially from those set forth in, or implied by, such forward-looking statements. For further information regarding such forward-looking statements, risks and uncertainties, please see “Information Regarding Forward-Looking Statements” under Part I – Item 2. “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Defined Terms

Unless the context otherwise requires, the terms “Company,” “CBI,” “we,” “our,” or “us” refer to Constellation Brands, Inc. and its subsidiaries. We use terms in this Quarterly Report on Form 10-Q and in our notes to the consolidated financial statements that are specific to us or are abbreviations that may not be commonly known or used.

| Term | Meaning | ||||

| $ | U.S. dollars | ||||

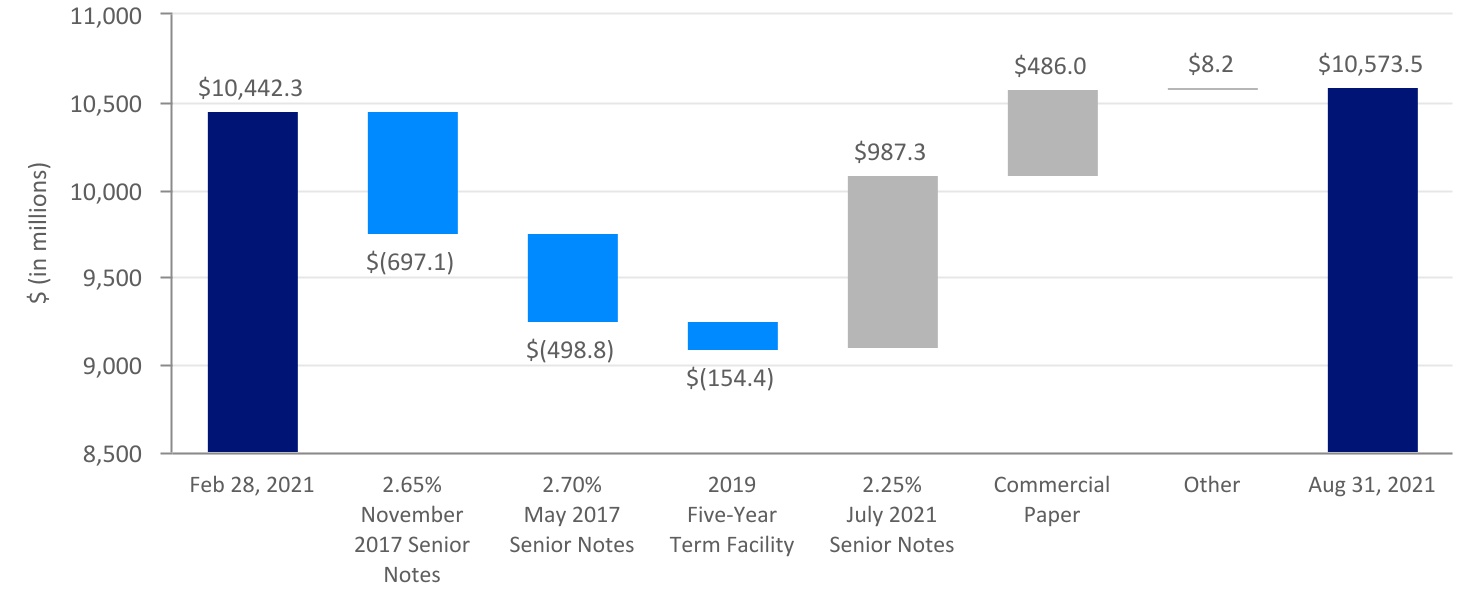

| 2.25% July 2021 Senior Notes | $1,000.0 million principal amount of 2.25% senior notes issued in July 2021 | ||||

| 2.65% November 2017 Senior Notes | $700.0 million principal amount of 2.65% senior notes issued in November 2017 and redeemed in August 2021, prior to maturity | ||||

| 2.70% May 2017 Senior Notes | $500.0 million principal amount of 2.70% senior notes issued in May 2017 and redeemed in August 2021, prior to maturity | ||||

| 2018 Authorization | authority to repurchase up to $3.0 billion of our Class A Common Stock and Class B Convertible Common Stock, authorized in January 2018 by our Board of Directors | ||||

| 2019 Five-Year Term Facility | a $491.3 million, five-year term loan facility under the June 2021 Term Credit Agreement, originally entered into in June 2019 | ||||

| 2020 Credit Agreement | ninth amended and restated credit agreement, dated as of March 26, 2020, provides for an aggregate revolving credit facility of $2.0 billion | ||||

| 2020 U.S. wildfires | significant wildfires that broke out in California, Oregon, and Washington states which affected the 2020 U.S. grape harvest | ||||

| 2021 Annual Report | our Annual Report on Form 10-K for the fiscal year ended February 28, 2021, unless otherwise specified | ||||

| 2021 Authorization | authority to repurchase up to $2.0 billion of our Class A Common Stock and Class B Convertible Common Stock, authorized in January 2021 by our Board of Directors | ||||

| ABA | alternative beverage alcohol | ||||

| Acreage | Acreage Holdings, Inc. | ||||

| Acreage Financial Instrument | a call option for Canopy Growth Corporation to acquire 70% of the shares of Acreage Holdings, Inc., at a fixed exchange ratio and 30% at a floating exchange ratio | ||||

| Acreage Transaction | Canopy Growth Corporation’s intention to acquire Acreage Holdings, Inc. upon U.S. federal cannabis legalization, subject to certain conditions | ||||

| Administrative Agent | Bank of America, N.A., as administrative agent for the senior credit facility and term credit agreement | ||||

| AOCI | accumulated other comprehensive income (loss) | ||||

| ASR | accelerated share repurchase agreement with a third-party financial institution |

||||

| Ballast Point Divestiture | sale of Ballast Point craft beer business, including a number of its associated production facilities and brewpubs | ||||

| C$ | Canadian dollars | ||||

| Canopy | we made an investment in Canopy Growth Corporation, an Ontario, Canada-based public company |

||||

| Canopy Debt Securities | convertible debt securities issued by Canopy Growth Corporation | ||||

| Canopy Equity Method Investment | November 2017 Canopy Investment, November 2018 Canopy Investment, and May 2020 Canopy Investment, collectively |

||||

| CARES Act | Coronavirus Aid, Relief, and Economic Security Act | ||||

CB International |

CB International Finance S.à r.l., a wholly-owned subsidiary of ours |

||||

| CODM | chief operating decision maker | ||||

| Comparable Adjustments | certain items affecting comparability that have been excluded by management | ||||

Concentrate Business Divestiture |

sale of certain brands used in our concentrates and high-color concentrate business, and certain related intellectual property, inventory, interests in certain contracts, and other assets |

||||

| Constellation Brands, Inc. Q2 FY 2022 Form 10-Q |

#WORTHREACHINGFOR I i

|

||||

| Term | Meaning | ||||

| Copper & Kings | Copper & Kings American Brandy Company, acquired by us |

||||

| CSR | corporate social responsibility | ||||

| DTC | direct-to-consumer | ||||

| Empathy Wines | Empathy Wines business, including a digitally-native wine brand, acquired by us |

||||

| ERP | enterprise resource planning system | ||||

| Financial Statements | our consolidated financial statements and notes thereto included herein |

||||

| Fiscal 2021 | the Company’s fiscal year ended February 28, 2021 |

||||

| Fiscal 2022 | the Company’s fiscal year ending February 28, 2022 |

||||

| June 2021 Term Credit Agreement | March 2020 Term Credit Agreement, inclusive of amendment dated as of June 10, 2021 | ||||

| Lender | Bank of America, N.A., as lender for the term credit agreement | ||||

| LIBOR | London Interbank Offered Rate | ||||

| March 2020 Term Credit Agreement | amended and restated term loan credit agreement, dated as of March 26, 2020, that provided for aggregate facilities of $491.3 million, consisting of the 2019 Five-Year Term Facility | ||||

| May 2020 Canopy Investment | May 2020 exercise of the November 2017 Canopy Warrants at an exercise price of C$12.98 per warrant share | ||||

| MD&A | Management’s Discussion and Analysis of Financial Condition and Results of Operations under Item 2. of this quarterly report on Form 10-Q | ||||

Mexicali Brewery |

brewery originally planned to be located in Mexicali, Baja California, Mexico |

||||

| Mexico Beer Projects | expansion activities at the Obregon Brewery and Nava Brewery | ||||

| My Favorite Neighbor | we made an investment in My Favorite Neighbor, LLC | ||||

| NA | not applicable | ||||

| Nava Brewery | brewery located in Nava, Coahuila, Mexico | ||||

| Net sales | gross sales less promotions, returns and allowances, and excise taxes | ||||

| NM | not meaningful | ||||

| Nobilo Wine Divestiture | sale of New Zealand-based Nobilo Wine brand and certain related assets |

||||

| Note(s) | notes to the consolidated financial statements | ||||

| November 2017 Canopy Investment | our initial investment for 18.9 million in common shares of Canopy Growth Corporation | ||||

| November 2017 Canopy Warrants |

warrants which gave us the option to purchase 18.9 million common shares of Canopy Growth Corporation, exercised May 1, 2020

|

||||

| November 2018 Canopy Investment | our incremental investment for 104.5 million in common shares of Canopy Growth Corporation | ||||

| November 2018 Canopy Transaction | November 2018 Canopy Investment and the purchase by us of the November 2018 Canopy Warrants, collectively |

||||

| November 2018 Canopy Warrants | Tranche A Warrants, Tranche B Warrants, and Tranche C Warrants, collectively | ||||

Obregon Brewery |

brewery located in Obregon, Sonora, Mexico |

||||

| OCI | other comprehensive income (loss) | ||||

| Paul Masson Divestiture | sale of Paul Masson Grande Amber Brandy brand, related inventory, and interests in certain contracts |

||||

| SEC | Securities and Exchange Commission | ||||

| Second Quarter 2021 | the Company’s three months ended August 31, 2020 |

||||

| Second Quarter 2022 | the Company’s three months ended August 31, 2021 |

||||

| Six Months 2021 | the Company’s six months ended August 31, 2020 |

||||

| Six Months 2022 | the Company’s six months ended August 31, 2021 |

||||

| Tranche A Warrants | warrants which give us the option to purchase 88.5 million common shares of Canopy Growth Corporation expiring November 1, 2023 | ||||

| Constellation Brands, Inc. Q2 FY 2022 Form 10-Q |

#WORTHREACHINGFOR I ii

|

||||

| Term | Meaning | ||||

| Tranche B Warrants | warrants which give us the option to purchase 38.4 million common shares of Canopy Growth Corporation expiring November 1, 2026 | ||||

| Tranche C Warrants | warrants which give us the option to purchase 12.8 million common shares of Canopy Growth Corporation expiring November 1, 2026 | ||||

TSX |

Toronto Stock Exchange |

||||

| U.S. | United States of America | ||||

| U.S. GAAP | generally accepted accounting principles in the United States of America | ||||

VWAP Exercise Price |

volume-weighted average of the closing market price of Canopy’s common shares on the Toronto Stock Exchange for the five trading days immediately preceding the exercise date |

||||

Wine and Spirits Divestiture |

sale of a portion of our wine and spirits business, including lower-margin, lower growth wine and spirits brands, related inventory, interests in certain contracts, wineries, vineyards, offices, and facilities |

||||

Wine and Spirits Divestitures |

Wine and Spirits Divestiture and the Nobilo Wine Divestiture, collectively |

||||

| Constellation Brands, Inc. Q2 FY 2022 Form 10-Q |

#WORTHREACHINGFOR I iii

|

||||

| FINANCIAL STATEMENTS | |||||

PART I – FINANCIAL INFORMATION

Item 1. Financial Statements.

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(in millions, except share and per share data)

(unaudited)

| August 31, 2021 |

February 28, 2021 |

||||||||||

| ASSETS | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ |

|

$ | ||||||||

| Accounts receivable |

|

||||||||||

| Inventories |

|

||||||||||

| Prepaid expenses and other |

|

||||||||||

| Total current assets |

|

||||||||||

| Property, plant, and equipment |

|

||||||||||

| Goodwill |

|

||||||||||

| Intangible assets |

|

||||||||||

| Equity method investments |

|

||||||||||

| Securities measured at fair value |

|

||||||||||

| Deferred income taxes |

|

||||||||||

| Other assets |

|

||||||||||

| Total assets | $ |

|

$ | ||||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||||||

| Current liabilities: | |||||||||||

| Short-term borrowings | $ |

|

$ | ||||||||

| Current maturities of long-term debt |

|

||||||||||

| Accounts payable |

|

||||||||||

| Other accrued expenses and liabilities |

|

||||||||||

| Total current liabilities |

|

||||||||||

| Long-term debt, less current maturities |

|

||||||||||

| Deferred income taxes and other liabilities |

|

||||||||||

| Total liabilities |

|

||||||||||

| Commitments and contingencies | |||||||||||

| CBI stockholders’ equity: | |||||||||||

Class A Common Stock, $ |

|

||||||||||

Class B Convertible Common Stock, $ |

|

||||||||||

| Additional paid-in capital |

|

||||||||||

| Retained earnings |

|

||||||||||

| Accumulated other comprehensive income (loss) | ( |

( |

|||||||||

|

|

|||||||||||

| Less: Treasury stock – | |||||||||||

Class A Common Stock, at cost, |

( |

( |

|||||||||

Class B Convertible Common Stock, at cost, |

( |

( |

|||||||||

| ( |

( |

||||||||||

| Total CBI stockholders’ equity |

|

||||||||||

| Noncontrolling interests |

|

||||||||||

| Total stockholders’ equity |

|

||||||||||

| Total liabilities and stockholders’ equity | $ |

|

$ | ||||||||

The accompanying notes are an integral part of these statements.

| Constellation Brands, Inc. Q2 FY 2022 Form 10-Q |

#WORTHREACHINGFOR I 1

|

||||

| FINANCIAL STATEMENTS | |||||

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(in millions, except per share data)

(unaudited)

| For the Six Months Ended August 31, |

For the Three Months Ended August 31, |

||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| Sales | $ |

|

$ | $ |

|

$ | |||||||||||||||||

| Excise taxes | ( |

( |

( |

( |

|||||||||||||||||||

| Net sales |

|

|

|||||||||||||||||||||

| Cost of product sold | ( |

( |

( |

( |

|||||||||||||||||||

| Gross profit |

|

|

|||||||||||||||||||||

| Selling, general, and administrative expenses | ( |

( |

( |

( |

|||||||||||||||||||

| Impairment of brewery construction in progress | ( |

|

|||||||||||||||||||||

| Impairment of assets held for sale |

|

( |

|

||||||||||||||||||||

| Operating income (loss) |

|

|

|||||||||||||||||||||

| Income (loss) from unconsolidated investments | ( |

( |

( |

( |

|||||||||||||||||||

| Interest expense | ( |

( |

( |

( |

|||||||||||||||||||

| Loss on extinguishment of debt | ( |

( |

( |

( |

|||||||||||||||||||

| Income (loss) before income taxes | ( |

|

|||||||||||||||||||||

| (Provision for) benefit from income taxes | ( |

( |

( |

( |

|||||||||||||||||||

| Net income (loss) | ( |

|

|||||||||||||||||||||

| Net income (loss) attributable to noncontrolling interests | ( |

( |

( |

( |

|||||||||||||||||||

| Net income (loss) attributable to CBI | $ | ( |

$ | $ |

|

$ | |||||||||||||||||

| Comprehensive income (loss) | $ | ( |

$ | ( |

$ | ( |

$ | ||||||||||||||||

| Comprehensive (income) loss attributable to noncontrolling interests | ( |

( |

( |

||||||||||||||||||||

| Comprehensive income (loss) attributable to CBI | $ | ( |

$ | ( |

$ | ( |

$ | ||||||||||||||||

| Net income (loss) per common share attributable to CBI: | |||||||||||||||||||||||

| Basic – Class A Common Stock | $ | ( |

$ | $ |

|

$ | |||||||||||||||||

| Basic – Class B Convertible Common Stock | $ | ( |

$ | $ |

|

$ | |||||||||||||||||

| Diluted – Class A Common Stock | $ | ( |

$ | $ |

|

$ | |||||||||||||||||

| Diluted – Class B Convertible Common Stock | $ | ( |

$ | $ |

|

$ | |||||||||||||||||

| Weighted average common shares outstanding: | |||||||||||||||||||||||

| Basic – Class A Common Stock |

|

|

|||||||||||||||||||||

| Basic – Class B Convertible Common Stock |

|

|

|||||||||||||||||||||

| Diluted – Class A Common Stock |

|

|

|||||||||||||||||||||

| Diluted – Class B Convertible Common Stock |

|

|

|||||||||||||||||||||

| Cash dividends declared per common share: | |||||||||||||||||||||||

| Class A Common Stock | $ |

|

$ | $ |

|

$ | |||||||||||||||||

| Class B Convertible Common Stock | $ |

|

$ | $ |

|

$ | |||||||||||||||||

The accompanying notes are an integral part of these statements.

| Constellation Brands, Inc. Q2 FY 2022 Form 10-Q |

#WORTHREACHINGFOR I 2

|

||||

| FINANCIAL STATEMENTS | |||||

|

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(in millions)

(unaudited)

| |||||||||||||||||||||||||||||||||||||||||||||||

| Common Stock | Additional Paid-in Capital |

Retained Earnings |

Accumulated Other Comprehensive Income (Loss) |

Treasury Stock |

Non-controlling Interests |

Total | |||||||||||||||||||||||||||||||||||||||||

| Class A | Class B | ||||||||||||||||||||||||||||||||||||||||||||||

| Balance at February 28, 2021 | $ |

|

$ |

|

$ |

|

$ |

|

$ | ( |

$ | ( |

$ |

|

$ |

|

|||||||||||||||||||||||||||||||

| Comprehensive income (loss): | |||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — | — | ( |

— | — |

|

( |

|||||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss), net of income tax effect | — | — | — | — |

|

— |

|

|

|||||||||||||||||||||||||||||||||||||||

| Comprehensive income (loss) | ( |

||||||||||||||||||||||||||||||||||||||||||||||

| Repurchase of shares | — | — | — | — | — | ( |

— | ( |

|||||||||||||||||||||||||||||||||||||||

| Dividends declared | — | — | — | ( |

— | — | — | ( |

|||||||||||||||||||||||||||||||||||||||

| Noncontrolling interest distributions | — | — | — | — | — | — | ( |

( |

|||||||||||||||||||||||||||||||||||||||

| Shares issued under equity compensation plans |

|

|

( |

— | — |

|

— |

|

|||||||||||||||||||||||||||||||||||||||

| Stock-based compensation | — | — |

|

— | — | — | — |

|

|||||||||||||||||||||||||||||||||||||||

| Balance at May 31, 2021 |

|

|

|

|

( |

( |

|

|

|||||||||||||||||||||||||||||||||||||||

| Comprehensive income (loss): | |||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — | — |

|

— | — |

|

|

|||||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss), net of income tax effect | — | — | — | — | ( |

— | ( |

( |

|||||||||||||||||||||||||||||||||||||||

| Comprehensive income (loss) | ( |

||||||||||||||||||||||||||||||||||||||||||||||

| Repurchase of shares | — | — | — | — | — | ( |

— | ( |

|||||||||||||||||||||||||||||||||||||||

| Dividends declared | — | — | — | ( |

— | — | — | ( |

|||||||||||||||||||||||||||||||||||||||

| Noncontrolling interest distributions | — | — | — | — | — | — | ( |

( |

|||||||||||||||||||||||||||||||||||||||

| Shares issued under equity compensation plans |

|

|

|

— | — |

|

— |

|

|||||||||||||||||||||||||||||||||||||||

| Stock-based compensation | — | — |

|

— | — | — | — |

|

|||||||||||||||||||||||||||||||||||||||

| Balance at August 31, 2021 | $ |

|

$ |

|

$ |

|

$ |

|

$ | ( |

$ | ( |

$ |

|

$ |

|

|||||||||||||||||||||||||||||||

| Balance at February 29, 2020 | $ | $ | $ | $ | $ | ( |

$ | ( |

$ | $ | |||||||||||||||||||||||||||||||||||||

| Comprehensive income (loss): | |||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — | — | ( |

— | — | ( |

||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss), net of income tax effect | — | — | — | — | ( |

— | ( |

( |

|||||||||||||||||||||||||||||||||||||||

| Comprehensive income (loss) | ( |

||||||||||||||||||||||||||||||||||||||||||||||

| Dividends declared | — | — | — | ( |

— | — | — | ( |

|||||||||||||||||||||||||||||||||||||||

| Shares issued under equity compensation plans | ( |

— | — | — | ( |

||||||||||||||||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||

| Balance at May 31, 2020 | ( |

( |

|||||||||||||||||||||||||||||||||||||||||||||

| Comprehensive income (loss): | |||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss), net of income tax effect | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||

| Comprehensive income (loss) | |||||||||||||||||||||||||||||||||||||||||||||||

| Dividends declared | — | — | — | ( |

— | — | — | ( |

|||||||||||||||||||||||||||||||||||||||

| Noncontrolling interest distributions | — | — | — | — | — | — | ( |

( |

|||||||||||||||||||||||||||||||||||||||

| Shares issued under equity compensation plans | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||

| Balance at August 31, 2020 | $ | $ | $ | $ | $ | ( |

$ | ( |

$ | $ | |||||||||||||||||||||||||||||||||||||

The accompanying notes are an integral part of these statements.

| Constellation Brands, Inc. Q2 FY 2022 Form 10-Q |

#WORTHREACHINGFOR I 3

|

||||

| FINANCIAL STATEMENTS | |||||

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in millions)

(unaudited)

| For the Six Months Ended August 31, |

|||||||||||

| 2021 | 2020 | ||||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | |||||||||||

| Net income (loss) | $ | ( |

$ | ||||||||

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | |||||||||||

| Unrealized net (gain) loss on securities measured at fair value |

|

||||||||||

| Deferred tax provision (benefit) | ( |

||||||||||

| Depreciation |

|

||||||||||

| Stock-based compensation |

|

||||||||||

| Equity in (earnings) losses of equity method investees and related activities, net of distributed earnings |

|

||||||||||

| Noncash lease expense |

|

||||||||||

| Amortization of debt issuance costs and loss on extinguishment of debt |

|

||||||||||

| Impairment of brewery construction in progress |

|

||||||||||

| Impairment of assets held for sale |

|

||||||||||

| Loss on inventory and related contracts associated with business optimization |

|

||||||||||

| Loss on settlement of treasury lock contracts |

|

( |

|||||||||

| Change in operating assets and liabilities, net of effects from purchase and sale of business: | |||||||||||

| Accounts receivable | ( |

( |

|||||||||

| Inventories | ( |

||||||||||

| Prepaid expenses and other current assets |

|

||||||||||

| Accounts payable |

|

||||||||||

| Deferred revenue |

|

||||||||||

| Other accrued expenses and liabilities | ( |

( |

|||||||||

| Other | ( |

( |

|||||||||

| Total adjustments |

|

||||||||||

| Net cash provided by (used in) operating activities |

|

||||||||||

| CASH FLOWS FROM INVESTING ACTIVITIES | |||||||||||

| Purchase of property, plant, and equipment | ( |

( |

|||||||||

| Purchase of business, net of cash acquired |

|

( |

|||||||||

| Investments in equity method investees and securities | ( |

( |

|||||||||

| Proceeds from sale of assets |

|

||||||||||

| Proceeds from sale of business |

|

||||||||||

| Other investing activities | ( |

||||||||||

| Net cash provided by (used in) investing activities | ( |

( |

|||||||||

| Constellation Brands, Inc. Q2 FY 2022 Form 10-Q |

#WORTHREACHINGFOR I 4

|

||||

| FINANCIAL STATEMENTS | |||||

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in millions)

(unaudited)

| For the Six Months Ended August 31, |

|||||||||||

| 2021 | 2020 | ||||||||||

| CASH FLOWS FROM FINANCING ACTIVITIES | |||||||||||

| Proceeds from issuance of long-term debt |

|

||||||||||

| Principal payments of long-term debt | ( |

( |

|||||||||

| Net proceeds from (repayments of) short-term borrowings |

|

( |

|||||||||

| Dividends paid | ( |

( |

|||||||||

| Purchases of treasury stock | ( |

||||||||||

| Proceeds from shares issued under equity compensation plans |

|

||||||||||

| Payments of minimum tax withholdings on stock-based payment awards | ( |

( |

|||||||||

| Payments of debt issuance, debt extinguishment, and other financing costs | ( |

( |

|||||||||

| Distributions to noncontrolling interests | ( |

( |

|||||||||

| Net cash provided by (used in) financing activities | ( |

( |

|||||||||

| Effect of exchange rate changes on cash and cash equivalents |

|

||||||||||

| Net increase (decrease) in cash and cash equivalents | ( |

||||||||||

| Cash and cash equivalents, beginning of period |

|

||||||||||

| Cash and cash equivalents, end of period | $ |

|

$ | ||||||||

| Supplemental disclosures of noncash investing and financing activities | |||||||||||

| Additions to property, plant, and equipment | $ |

|

$ | ||||||||

The accompanying notes are an integral part of these statements.

| Constellation Brands, Inc. Q2 FY 2022 Form 10-Q |

#WORTHREACHINGFOR I 5

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

AUGUST 31, 2021

(unaudited)

1. BASIS OF PRESENTATION

2. INVENTORIES

Inventories are stated at the lower of cost (primarily computed in accordance with the first-in, first-out method) or net realizable value. Elements of cost include materials, labor, and overhead and consist of the following:

| August 31, 2021 |

February 28, 2021 |

||||||||||

| (in millions) | |||||||||||

| Raw materials and supplies | $ | $ | |||||||||

| In-process inventories | |||||||||||

| Finished case goods | |||||||||||

| $ | $ | ||||||||||

We assess the valuation of our inventories and reduce the carrying value of those inventories that are obsolete or in excess of our forecasted usage to their estimated net realizable value based on analyses and assumptions including, but not limited to, historical usage, future demand, and market requirements. We reduced the carrying value of certain inventories and recognized losses of $82.6 million and $8.6 million for the six months ended August 31, 2021, and August 31, 2020, respectively, and $66.6 million and $3.9 million for the three months ended August 31, 2021, and August 31, 2020, respectively. The increase in obsolescence was predominantly from excess inventory of hard seltzers within the Beer segment, resulting from a slowdown in the overall category. These losses were included in cost of product sold within our consolidated results of operations.

3. ACQUISITIONS AND DIVESTITURES

Acquisitions

Copper & Kings

In September 2020, we acquired the remaining ownership interest in Copper & Kings American Brandy Company. This acquisition included a collection of traditional and craft batch-distilled American brandies and other select spirits. The transaction primarily included the acquisition of inventory and property, plant, and equipment. The results of operations of Copper & Kings are reported in the Wine and Spirits segment and have been included in our consolidated results of operations from the date of acquisition.

Empathy Wines

In June 2020, we acquired the Empathy Wines business, including the acquisition of a digitally-native wine brand which strengthens our position in the DTC and eCommerce markets. This transaction primarily included the acquisition of goodwill, trademarks, and inventory. In addition, the purchase price for Empathy Wines includes an earn-out over five years based on performance. The results of operations of Empathy Wines are reported in the

| Constellation Brands, Inc. Q2 FY 2022 Form 10-Q |

#WORTHREACHINGFOR I 6

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

Wine and Spirits segment and have been included in our consolidated results of operations from the date of acquisition.

Divestitures

Paul Masson Divestiture

On January 12, 2021, we sold the Paul Masson Grande Amber Brandy brand, related inventory, and interests in certain contracts. The cash proceeds were used for general corporate purposes. Prior to the Paul Masson Divestiture, we recorded the results of operations of our Paul Masson Grande Amber Brandy business in the Wine and Spirits segment. The following table summarizes the net gain recognized in connection with this divestiture:

| (in millions) | |||||

| Cash received from buyer | $ | ||||

| Net assets sold | ( |

||||

| Contract termination | ( |

||||

| Direct costs to sell | ( |

||||

| Gain on sale of business | $ | ||||

Wine and Spirits Divestitures

On January 5, 2021, we sold a portion of our wine and spirits business, including lower-margin, lower growth wine and spirits brands, related inventory, interests in certain contracts, wineries, vineyards, offices, and facilities. We have the potential to earn an incremental $250 million of contingent consideration if certain brand performance targets are met over a two-year period after closing. Also on January 5, 2021, in a separate, but related transaction with the same buyer, we sold the New Zealand-based Nobilo Wine brand and certain related assets. The cash proceeds were utilized to reduce outstanding debt and for other general corporate purposes.

Prior to the Wine and Spirits Divestitures, we recorded the results of operations for this portion of our business in the Wine and Spirits segment. The following table summarizes the net loss recognized in connection with these divestitures:

| (in millions) | |||||

| Cash received from buyer | $ | ||||

| Net assets sold | ( |

||||

| Transition services agreements | ( |

||||

| Direct costs to sell | ( |

||||

| AOCI reclassification adjustments, primarily foreign currency translation | ( |

||||

| Other | ( |

||||

| Loss on sale of business | $ | ( |

|||

Concentrate Business Divestiture

On December 29, 2020, we sold certain brands used in our concentrates and high-color concentrate business, and certain related intellectual property, inventory, interests in certain contracts, and other assets. Prior to the Concentrate Business Divestiture, we recorded the results of operations of our concentrates and high-color concentrate business in the Wine and Spirits segment.

Ballast Point Divestiture

On March 2, 2020, we sold the Ballast Point craft beer business, including a number of its associated production facilities and brewpubs. Prior to the Ballast Point Divestiture, we recorded the results of operations of the Ballast Point craft beer business in the Beer segment. We received cash proceeds of $41.1 million, which were primarily utilized to reduce outstanding borrowings.

| Constellation Brands, Inc. Q2 FY 2022 Form 10-Q |

#WORTHREACHINGFOR I 7

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

4. DERIVATIVE INSTRUMENTS

Overview

Our risk management and derivative accounting policies are presented in Notes 1 and 6 of our consolidated financial statements included in our 2021 Annual Report and have not changed significantly for the six months and three months ended August 31, 2021.

We have an investment in certain equity securities and other rights which provide us with the option to purchase an additional ownership interest in the equity securities of Canopy (see Note 8). This investment is included in securities measured at fair value and are accounted for at fair value, with the net gain (loss) from the changes in fair value of this investment recognized in income (loss) from unconsolidated investments (see Note 5).

The aggregate notional value of outstanding derivative instruments is as follows:

| August 31, 2021 |

February 28, 2021 |

||||||||||

| (in millions) | |||||||||||

| Derivative instruments designated as hedging instruments | |||||||||||

| Foreign currency contracts | $ | $ | |||||||||

| Derivative instruments not designated as hedging instruments | |||||||||||

| Foreign currency contracts | $ | $ | |||||||||

| Commodity derivative contracts | $ | $ | |||||||||

Credit risk

We are exposed to credit-related losses if the counterparties to our derivative contracts default. This credit risk is limited to the fair value of the derivative contracts. To manage this risk, we contract only with major financial institutions that have earned investment-grade credit ratings and with whom we have standard International Swaps and Derivatives Association agreements which allow for net settlement of the derivative contracts. We have also established counterparty credit guidelines that are regularly monitored. Because of these safeguards, we believe the risk of loss from counterparty default to be immaterial.

In addition, our derivative instruments are not subject to credit rating contingencies or collateral requirements. As of August 31, 2021, the estimated fair value of derivative instruments in a net liability position due to counterparties was $0.1 million. If we were required to settle the net liability position under these derivative instruments on August 31, 2021, we would have had sufficient available liquidity on hand to satisfy this obligation.

Results of period derivative activity

The estimated fair value and location of our derivative instruments on our balance sheets are as follows (see Note 5):

| Assets | Liabilities | |||||||||||||||||||||||||

| August 31, 2021 |

February 28, 2021 |

August 31, 2021 |

February 28, 2021 |

|||||||||||||||||||||||

| (in millions) | ||||||||||||||||||||||||||

| Derivative instruments designated as hedging instruments | ||||||||||||||||||||||||||

| Foreign currency contracts: | ||||||||||||||||||||||||||

| Prepaid expenses and other | $ | $ | Other accrued expenses and liabilities | $ | $ | |||||||||||||||||||||

| Other assets | $ | $ | Deferred income taxes and other liabilities | $ | $ | |||||||||||||||||||||

| Constellation Brands, Inc. Q2 FY 2022 Form 10-Q |

#WORTHREACHINGFOR I 8

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

| Assets | Liabilities | |||||||||||||||||||||||||

| August 31, 2021 |

February 28, 2021 |

August 31, 2021 |

February 28, 2021 |

|||||||||||||||||||||||

| (in millions) | ||||||||||||||||||||||||||

| Derivative instruments not designated as hedging instruments | ||||||||||||||||||||||||||

| Foreign currency contracts: | ||||||||||||||||||||||||||

| Prepaid expenses and other | $ | $ | Other accrued expenses and liabilities | $ | $ | |||||||||||||||||||||

| Commodity derivative contracts: | ||||||||||||||||||||||||||

| Prepaid expenses and other | $ | $ | Other accrued expenses and liabilities | $ | $ | |||||||||||||||||||||

| Other assets | $ | $ | Deferred income taxes and other liabilities | $ | $ | |||||||||||||||||||||

The principal effect of our derivative instruments designated in cash flow hedging relationships on our results of operations, as well as OCI, net of income tax effect, is as follows:

| Derivative Instruments in Designated Cash Flow Hedging Relationships |

Net Gain (Loss) Recognized in OCI |

Location of Net Gain (Loss) Reclassified from AOCI to Income (Loss) |

Net Gain (Loss) Reclassified from AOCI to Income (Loss) |

|||||||||||||||||

| (in millions) | ||||||||||||||||||||

| For the Six Months Ended August 31, 2021 | ||||||||||||||||||||

| Foreign currency contracts | $ | Sales | $ | ( |

||||||||||||||||

| Cost of product sold | ||||||||||||||||||||

| Treasury lock contracts | Interest expense | ( |

||||||||||||||||||

| $ | $ | |||||||||||||||||||

| For the Six Months Ended August 31, 2020 | ||||||||||||||||||||

| Foreign currency contracts | $ | ( |

Sales | $ | ||||||||||||||||

| Cost of product sold | ( |

|||||||||||||||||||

| Interest rate swap contracts | ( |

Interest expense | ( |

|||||||||||||||||

| Treasury lock contracts | ( |

Interest expense | ( |

|||||||||||||||||

| $ | ( |

$ | ( |

|||||||||||||||||

| For the Three Months Ended August 31, 2021 | ||||||||||||||||||||

| Foreign currency contracts | $ | ( |

Sales | $ | ( |

|||||||||||||||

| Cost of product sold | ||||||||||||||||||||

| Treasury lock contracts | Interest expense | ( |

||||||||||||||||||

| $ | ( |

$ | ||||||||||||||||||

| For the Three Months Ended August 31, 2020 | ||||||||||||||||||||

| Foreign currency contracts | $ | Sales | $ | |||||||||||||||||

| Cost of product sold | ( |

|||||||||||||||||||

| Interest rate swap contracts | ( |

Interest expense | ( |

|||||||||||||||||

| Treasury lock contracts | Interest expense | ( |

||||||||||||||||||

| $ | $ | ( |

||||||||||||||||||

We expect $28.4 million of net gains, net of income tax effect, to be reclassified from AOCI to our results of operations within the next 12 months.

| Constellation Brands, Inc. Q2 FY 2022 Form 10-Q |

#WORTHREACHINGFOR I 9

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

The effect of our undesignated derivative instruments on our results of operations is as follows:

| Derivative Instruments Not Designated as Hedging Instruments |

Location of Net Gain (Loss) Recognized in Income (Loss) |

Net Gain (Loss) Recognized in Income (Loss) |

||||||||||||||||||

| (in millions) | ||||||||||||||||||||

| For the Six Months Ended August 31, 2021 | ||||||||||||||||||||

| Commodity derivative contracts | Cost of product sold | $ | ||||||||||||||||||

| Foreign currency contracts | Selling, general, and administrative expenses | ( |

||||||||||||||||||

| $ | ||||||||||||||||||||

| For the Six Months Ended August 31, 2020 | ||||||||||||||||||||

| Commodity derivative contracts | Cost of product sold | $ | ( |

|||||||||||||||||

| Foreign currency contracts | Selling, general, and administrative expenses | ( |

||||||||||||||||||

| $ | ( |

|||||||||||||||||||

| For the Three Months Ended August 31, 2021 | ||||||||||||||||||||

| Commodity derivative contracts | Cost of product sold | $ | ||||||||||||||||||

| Foreign currency contracts | Selling, general, and administrative expenses | ( |

||||||||||||||||||

| $ | ||||||||||||||||||||

| For the Three Months Ended August 31, 2020 | ||||||||||||||||||||

| Commodity derivative contracts | Cost of product sold | $ | ||||||||||||||||||

| Foreign currency contracts | Selling, general, and administrative expenses | |||||||||||||||||||

| $ | ||||||||||||||||||||

5. FAIR VALUE OF FINANCIAL INSTRUMENTS

Authoritative guidance establishes a framework for measuring fair value, including a hierarchy for inputs used in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that the most observable inputs be used when available. The hierarchy includes three levels:

•Level 1 inputs are quoted prices in active markets for identical assets or liabilities;

•Level 2 inputs include data points that are observable such as quoted prices for similar assets or liabilities in active markets, quoted prices for identical assets or similar assets or liabilities in markets that are not active, and inputs (other than quoted prices) such as volatility, interest rates, and yield curves that are observable for the asset and liability, either directly or indirectly; and

•Level 3 inputs are unobservable data points for the asset or liability, and include situations where there is little, if any, market activity for the asset or liability.

Fair value methodology

The following methods and assumptions are used to estimate the fair value for each class of our financial instruments:

Foreign currency and commodity derivative contracts

The fair value is estimated using market-based inputs, obtained from independent pricing services, entered into valuation models. These valuation models require various inputs, including contractual terms, market foreign exchange prices, market commodity prices, interest-rate yield curves, and currency volatilities, as applicable (Level 2 fair value measurement).

| Constellation Brands, Inc. Q2 FY 2022 Form 10-Q |

#WORTHREACHINGFOR I 10

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

Canopy investment

Equity securities, Warrants – The November 2018 Canopy Warrants consist of three tranches of warrants, including 88.5 million Tranche A Warrants expiring November 1, 2023, which are currently exercisable, 38.4 million Tranche B Warrants expiring November 1, 2026, and 12.8 million Tranche C Warrants expiring November 1, 2026. The inputs used to estimate the fair value of the November 2018 Canopy Warrants are as follows (1) (2):

| August 31, 2021 | February 28, 2021 | ||||||||||||||||||||||

|

Tranche A

Warrants (3)

|

Tranche B

Warrants (4)

|

Tranche A

Warrants (3)

|

Tranche B

Warrants (4)

|

||||||||||||||||||||

Exercise price (5)

|

C$ | C$ | C$ | C$ | |||||||||||||||||||

Valuation date stock price (6)

|

C$ | C$ | C$ | C$ | |||||||||||||||||||

Remaining contractual term (7)

|

|||||||||||||||||||||||

Expected volatility (8)

|

% | % | % | % | |||||||||||||||||||

Risk-free interest rate (9)

|

% | % | % | % | |||||||||||||||||||

Expected dividend yield (10)

|

% | % | % | % | |||||||||||||||||||

(1)The exercise price for the Tranche C Warrants is based on the VWAP Exercise Price. The Tranche C Warrants are not included in the table as there is no fair value assigned.

(2)In connection with the Acreage Transaction, we obtained other rights which include a share repurchase credit. If Canopy has not purchased the lesser of 27,378,866 Canopy common shares, or C$1,583.0 million worth of Canopy common shares for cancellation between April 18, 2019, and two-years after the full exercise of the Tranche A Warrants, we will be credited an amount that will reduce the aggregate exercise price otherwise payable upon each exercise of the Tranche B Warrants and Tranche C Warrants. The credit will be an amount equal to the difference between C$1,583.0 million and the actual price paid by Canopy in purchasing its common shares for cancellation. The likelihood of receiving the share repurchase credit if we were to fully exercise the Tranche A Warrants is remote, therefore, no fair value has been assigned.

(3)The fair value is estimated using the Black-Scholes option-pricing model (Level 2 fair value measurement).

(4)The fair value is estimated using Monte Carlo simulations (Level 2 fair value measurement).

(5)Based on the exercise price from the applicable underlying agreements.

(6)Based on the closing market price for Canopy common stock on the TSX as of the applicable date.

(7)Based on the expiration date of the warrants.

(8)Based on consideration of historical and/or implied volatility levels of the underlying equity security and limited consideration of historical peer group volatility levels.

(9)Based on the implied yield currently available on Canadian Treasury zero coupon issues with a remaining term equal to the expiration date of the applicable warrants.

(10)Based on historical dividend levels.

Debt securities, Convertible – We have elected the fair value option to account for the Canopy Debt Securities acquired in June 2018 for C$200.0 million, or $150.5 million. Interest income on the Canopy Debt Securities is calculated using the effective interest method and is recognized separately from the changes in fair value in interest expense. The Canopy Debt Securities have a contractual maturity of five years from the date of issuance but may be converted prior to maturity by either party upon the occurrence of certain events. At settlement, the Canopy Debt Securities can be settled at the option of the issuer, in cash, equity shares of the issuer, or a combination thereof. The fair value is estimated using a binomial lattice option-pricing model (Level 2 fair value measurement), which includes an estimate of the credit spread based on market spreads using bond data as of the valuation date.

| Constellation Brands, Inc. Q2 FY 2022 Form 10-Q |

#WORTHREACHINGFOR I 11

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

The inputs used to estimate the fair value of the Canopy Debt Securities are as follows:

| August 31, 2021 |

February 28, 2021 |

||||||||||

Conversion price (1)

|

C$ | C$ | |||||||||

Valuation date stock price (2)

|

C$ | C$ | |||||||||

Remaining term (3)

|

|||||||||||

Expected volatility (4)

|

% | % | |||||||||

Risk-free interest rate (5)

|

% | % | |||||||||

Expected dividend yield (6)

|

% | % | |||||||||

(1)Based on the rate which the Canopy Debt Securities may be converted into equity shares, or the equivalent amount of cash, at the option of the issuer.

(2)Based on the closing market price for Canopy common stock on the TSX as of the applicable date.

(3)Based on the contractual maturity date of the notes.

(4)Based on consideration of historical and/or implied volatility levels of the underlying equity security, adjusted for certain risks associated with debt securities, as appropriate.

(5)Based on the implied yield currently available on Canadian Treasury zero coupon issues with a term equal to the remaining contractual term of the Canopy Debt Securities.

(6)Based on historical dividend levels.

Short-term borrowings

Our short-term borrowings consist of our commercial paper program and the revolving credit facility under our 2020 Credit Agreement. The revolving credit facility is a variable interest rate bearing note with a fixed margin, adjustable based upon our debt rating (as defined in our senior credit facility). For these short-term borrowings the carrying value approximates the fair value.

Long-term debt

The term loan under our June 2021 Term Credit Agreement is a variable interest rate bearing note with a fixed margin, adjustable based upon our debt rating. The carrying value approximates the fair value of the term loan. The fair value of the remaining fixed interest rate long-term debt is estimated by discounting cash flows using interest rates currently available for debt with similar terms and maturities (Level 2 fair value measurement).

The carrying amounts of certain of our financial instruments, including cash and cash equivalents, accounts receivable, and accounts payable, approximate fair value as of August 31, 2021, and February 28, 2021, due to the relatively short maturity of these instruments. As of August 31, 2021, the carrying amount of long-term debt, including the current portion, was $10,087.5 million, compared with an estimated fair value of $11,197.6 million. As of February 28, 2021, the carrying amount of long-term debt, including the current portion, was $10,442.3 million, compared with an estimated fair value of $11,580.9 million.

| Constellation Brands, Inc. Q2 FY 2022 Form 10-Q |

#WORTHREACHINGFOR I 12

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

Recurring basis measurements

The following table presents our financial assets and liabilities measured at estimated fair value on a recurring basis:

| Fair Value Measurements Using | |||||||||||||||||||||||

| Quoted Prices in Active Markets (Level 1) |

Significant Other Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

Total | ||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

| August 31, 2021 | |||||||||||||||||||||||

| Assets: | |||||||||||||||||||||||

| Foreign currency contracts | $ | $ | $ | $ | |||||||||||||||||||

| Commodity derivative contracts | $ | $ | $ | $ | |||||||||||||||||||

Equity securities (1)

|

$ | $ | $ | $ | |||||||||||||||||||

Canopy Debt Securities (1)

|

$ | $ | $ | $ | |||||||||||||||||||

| Liabilities: | |||||||||||||||||||||||

| Foreign currency contracts | $ | $ | $ | $ | |||||||||||||||||||

| Commodity derivative contracts | $ | $ | $ | $ | |||||||||||||||||||

| February 28, 2021 | |||||||||||||||||||||||

| Assets: | |||||||||||||||||||||||

| Foreign currency contracts | $ | $ | $ | $ | |||||||||||||||||||

| Commodity derivative contracts | $ | $ | $ | $ | |||||||||||||||||||

Equity securities (1)

|

$ | $ | $ | $ | |||||||||||||||||||

Canopy Debt Securities (1)

|

$ | $ | $ | $ | |||||||||||||||||||

| Liabilities: | |||||||||||||||||||||||

| Foreign currency contracts | $ | $ | $ | $ | |||||||||||||||||||

| Commodity derivative contracts | $ | $ | $ | $ | |||||||||||||||||||

(1) |

Unrealized net gain (loss) from the changes in fair value of our securities measured at fair value recognized in income (loss) from unconsolidated investments, are as follows: | ||||||||||||||||||||||||||||

| For the Six Months Ended August 31, |

For the Three Months Ended August 31, |

||||||||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||||||||

November 2017 Canopy Warrants (i)

|

$ | $ | ( |

$ | $ | ||||||||||||||||||||||||

| November 2018 Canopy Warrants | ( |

( |

( |

( |

|||||||||||||||||||||||||

| Canopy Debt Securities | ( |

( |

( |

||||||||||||||||||||||||||

| $ | ( |

$ | ( |

$ | ( |

$ | ( |

||||||||||||||||||||||

(i) |

In May 2020, we exercised warrants obtained in November 2017 which gave us the option to purchase |

||||||||||||||||||||||||||||

| Constellation Brands, Inc. Q2 FY 2022 Form 10-Q |

#WORTHREACHINGFOR I 13

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

Nonrecurring basis measurements

The following table presents our assets and liabilities measured at estimated fair value on a nonrecurring basis for which an impairment assessment was performed for the periods presented:

| Fair Value Measurements Using | |||||||||||||||||||||||

| Quoted Prices in Active Markets (Level 1) |

Significant Other Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

Total Losses | ||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

| For the Six Months Ended August 31, 2021 | |||||||||||||||||||||||

| Long-lived assets | $ | $ | $ | $ | |||||||||||||||||||

| For the Six Months Ended August 31, 2020 | |||||||||||||||||||||||

| Long-lived assets held for sale | $ | $ | $ | $ | |||||||||||||||||||

Long-lived assets

In April 2021, our Board of Directors authorized management to sell or abandon the Mexicali Brewery. Subsequently, management determined that we will be unable to use or repurpose certain assets at the Mexicali Brewery. Accordingly, for the first quarter of Fiscal 2022, long-lived assets with a carrying value of $685.9 million were written down to their estimated fair value of $20.0 million, resulting in an impairment of $665.9 million. This impairment was included in impairment of brewery construction in progress within our consolidated results of operations for the six months ended August 31, 2021. Our estimate of fair value was determined based on the expected salvage value of the assets. The Mexicali Brewery is a component of the Beer segment. We are continuing to work with government officials in Mexico to (i) determine next steps for our suspended Mexicali Brewery construction project and (ii) pursue various forms of recovery for capitalized costs and additional expenses incurred in establishing the brewery, however, there can be no assurance of any recoveries. In the medium-term, under normal operating conditions, we have ample capacity at the Nava and Obregon breweries to meet consumer needs based on current growth forecasts and current and planned production capabilities. To align with our anticipated future growth expectations we are also working with the Mexican government to explore options to add further capacity at other locations in Mexico where there is ample water and a skilled workforce to meet our long-term needs.

Long-lived assets held for sale

For the first quarter of Fiscal 2021, in connection with the Wine and Spirits Divestitures and the Concentrate Business Divestiture, long-lived assets held for sale were written down to their estimated fair value, less cost to sell, resulting in a loss of $25.0 million. Subsequently, for the second quarter of Fiscal 2021, a reduction to the loss on long-lived assets held for sale of $22.0 million was recognized. The long-lived assets held for sale with a carrying value of $798.2 million were written down to their estimated fair value of $795.2 million, less costs to sell, resulting in a total loss of $3.0 million for the six months ended August 31, 2020. This loss was included in impairment of assets held for sale within our consolidated results of operations. These assets consisted primarily of goodwill, intangible assets, and certain winery and vineyard assets which had satisfied the conditions necessary to be classified as held for sale. Our estimated fair value was determined based on the expected proceeds primarily from the Wine and Spirits Divestitures and the Concentrate Business Divestiture as of August 31, 2020, excluding the contingent consideration, which we will recognize when it is determined to be realizable.

| Constellation Brands, Inc. Q2 FY 2022 Form 10-Q |

#WORTHREACHINGFOR I 14

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

6. GOODWILL

The changes in the carrying amount of goodwill are as follows:

| Beer | Wine and Spirits | Consolidated | |||||||||||||||

| (in millions) | |||||||||||||||||

| Balance, February 29, 2020 | $ | $ | $ | ||||||||||||||

Purchase accounting allocations (1)

|

|||||||||||||||||

| Foreign currency translation adjustments | ( |

( |

|||||||||||||||

Reclassified from assets held for sale (2)

|

|||||||||||||||||

| Balance, February 28, 2021 | |||||||||||||||||

Purchase accounting allocations (1)

|

|||||||||||||||||

| Foreign currency translation adjustments | ( |

||||||||||||||||

| Balance, August 31, 2021 | $ | $ | $ | ||||||||||||||

(1)Purchase accounting allocations associated with the acquisition of Empathy Wines.

(2)Primarily in connection with the Wine and Spirits Divestitures, goodwill associated with the businesses being sold was reclassified from assets held for sale based on the changes to relative fair values of the portion of the business being sold and the remaining wine and spirits and beer portfolios. The relative fair values were determined using the income approach based on assumptions, including projected revenue growth rates, terminal growth rate, and discount rate and other projected financial information.

7. INTANGIBLE ASSETS

The major components of intangible assets are as follows:

| August 31, 2021 | February 28, 2021 | ||||||||||||||||||||||

| Gross Carrying Amount |

Net Carrying Amount |

Gross Carrying Amount |

Net Carrying Amount |

||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

| Amortizable intangible assets | |||||||||||||||||||||||

| Customer relationships | $ | $ | $ | $ | |||||||||||||||||||

| Other | |||||||||||||||||||||||

| Total | $ | $ | |||||||||||||||||||||

| Nonamortizable intangible assets | |||||||||||||||||||||||

| Trademarks | |||||||||||||||||||||||

| Total intangible assets | $ | $ | |||||||||||||||||||||

We did not incur costs to renew or extend the term of acquired intangible assets for the six months and three months ended August 31, 2021, and August 31, 2020. Net carrying amount represents the gross carrying value net of accumulated amortization.

| Constellation Brands, Inc. Q2 FY 2022 Form 10-Q |

#WORTHREACHINGFOR I 15

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

8. EQUITY METHOD INVESTMENTS

Our equity method investments are as follows:

| August 31, 2021 | February 28, 2021 | ||||||||||||||||||||||

| Carrying Value | Ownership Percentage | Carrying Value | Ownership Percentage | ||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

Canopy Equity Method Investment (1) (2)

|

$ | % | $ | % | |||||||||||||||||||

| Other equity method investments | |||||||||||||||||||||||

| $ | $ | ||||||||||||||||||||||

(1)The fair value based on the closing price of the underlying equity security as of August 31, 2021, and February 28, 2021, was $2,448.1 million and $4,679.3 million, respectively.

(2)Includes the following:

| Common Shares | Purchase Price | ||||||||||

| (in millions) | |||||||||||

November 2017 Canopy Investment |

$ | ||||||||||

| November 2018 Canopy Investment | |||||||||||

May 2020 Canopy Investment |

|||||||||||

| $ | |||||||||||

Canopy Equity Method Investment

We complement our beverage alcohol strategy with our investment in Canopy, a leading provider of medicinal and recreational cannabis products. Equity in earnings (losses) from the Canopy Equity Method Investment and related activities (see table below) include, among other items, restructuring and other strategic business development costs, the amortization of the fair value adjustments associated with the definite-lived intangible assets over their estimated useful lives, and unrealized gains (losses) associated with changes in our Canopy ownership percentage resulting from periodic equity issuances made by Canopy. Amounts included in our consolidated results of operations for each period are as follows:

| For the Six Months Ended August 31, |

For the Three Months Ended August 31, |

||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

| Equity in earnings (losses) from Canopy and related activities | $ | ( |

$ | ( |

$ | $ | ( |

||||||||||||||||

Canopy has various equity and convertible debt securities outstanding, including primarily equity awards granted to its employees, and options and warrants issued to various third parties, including our November 2018 Canopy Warrants, Canopy Debt Securities, and the Acreage Financial Instrument. As of August 31, 2021, the exercise and/or conversion of certain of these outstanding securities could have a significant effect on our share of Canopy’s reported earnings or losses and our ownership interest in Canopy.

We have evaluated the Canopy Equity Method Investment as of August 31, 2021, and determined that there was not an other-than-temporary-impairment. Our conclusion was based on several contributing factors, including: (i) the period of time for which the fair value has been less than the carrying value, (ii) an expectation that Canopy’s results will improve, (iii) an expectation that the Canopy stock price will recover in the near term, and (iv) our ability and intent to hold the investment until that recovery. We will continue to review the Canopy Equity Method Investment for an other-than-temporary impairment. There may be a future impairment of our Canopy Equity Method Investment if Canopy’s stock price does not recover in the near term or our expectations about Canopy’s prospective results and cash flows decline, which could be influenced by a variety of factors including adverse market conditions and the economic impact of COVID-19.

| Constellation Brands, Inc. Q2 FY 2022 Form 10-Q |

#WORTHREACHINGFOR I 16

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

The following table presents summarized financial information for Canopy prepared in accordance with U.S. GAAP. We recognize our equity in earnings (losses) for Canopy on a two-month lag. Accordingly, we recognized our share of Canopy’s earnings (losses) for the periods January through June 2021 and January through June 2020 in our six months ended August 31, 2021, and August 31, 2020, results, respectively. We recognized our share of Canopy’s earnings (losses) for the periods April through June 2021 and April through June 2020 in our three months ended August 31, 2021, and August 31, 2020, results, respectively. The amounts shown represent 100% of Canopy’s reported results for the respective periods.

| For the Six Months Ended August 31, |

For the Three Months Ended August 31, |

||||||||||||||||||||||

| 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

| Net sales | $ | $ | $ | $ | |||||||||||||||||||

| Gross profit (loss) | $ | $ | ( |

$ | $ | ||||||||||||||||||

| Net income (loss) | $ | ( |

$ | ( |

$ | $ | ( |

||||||||||||||||

| Net income (loss) attributable to Canopy | $ | ( |

$ | ( |

$ | $ | ( |

||||||||||||||||

Other equity method investment

My Favorite Neighbor

In April 2020, we invested in My Favorite Neighbor, a super-luxury, DTC focused wine business which we account for under the equity method. We recognize our share of their equity in earnings (losses) in our consolidated financial statements in the Wine and Spirits segment.

9. BORROWINGS

Borrowings consist of the following:

| August 31, 2021 | February 28, 2021 |

||||||||||||||||||||||

| Current | Long-term | Total | Total | ||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||

| Short-term borrowings | |||||||||||||||||||||||

| Commercial paper | $ | $ | |||||||||||||||||||||

| $ | $ | ||||||||||||||||||||||

| Long-term debt | |||||||||||||||||||||||

| Term loan credit facilities | $ | $ | $ | $ | |||||||||||||||||||

| Senior notes | |||||||||||||||||||||||

| Other | |||||||||||||||||||||||

| $ | $ | $ | $ | ||||||||||||||||||||

Bank facilities

The Company, CB International, the Administrative Agent, and certain other lenders are parties to a credit agreement, as amended and restated, the 2020 Credit Agreement. Also, the Company and the Administrative Agent and Lender are parties to the June 2021 Term Credit Agreement. The principal change effected by the June 2021 amendment was a reduction in LIBOR margin from 0.88 % to 0.63 % from June 1, 2021, through December 31, 2021.

| Constellation Brands, Inc. Q2 FY 2022 Form 10-Q |

#WORTHREACHINGFOR I 17

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

As of August 31, 2021, aggregate credit facilities under the 2020 Credit Agreement and the June 2021 Term Credit Agreement consist of the following:

| Amount | Maturity | ||||||||||

| (in millions) | |||||||||||

| 2020 Credit Agreement | |||||||||||

Revolving credit facility (1) (2)

|

$ | Sept 14, 2023 | |||||||||

| June 2021 Term Credit Agreement | |||||||||||

2019 Five-Year Term Facility (1) (3)

|

$ | Jun 28, 2024 | |||||||||

(1)Contractual interest rate varies based on our debt rating (as defined in the respective agreement) and is a function of LIBOR plus a margin, or the base rate plus a margin, or, in certain circumstances where LIBOR cannot be adequately ascertained or available, an alternative benchmark rate plus a margin.

(2)We and/or CB International are the borrower under the $2,000.0 million revolving credit facility. Includes a sub-facility for letters of credit of up to $200.0 million.

(3)We are the borrower under the 2019 Five-Year Term Facility.

As of August 31, 2021, information with respect to borrowings under the 2020 Credit Agreement and the June 2021 Term Credit Agreement is as follows:

| Outstanding borrowings |

Interest rate |

LIBOR margin |

Outstanding letters of credit |

Remaining

borrowing

capacity (1)

|

|||||||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||||||||

| 2020 Credit Agreement | |||||||||||||||||||||||||||||

| Revolving credit facility | $ | % | % | $ | $ | ||||||||||||||||||||||||

| June 2021 Term Credit Agreement | |||||||||||||||||||||||||||||

2019 Five-Year Term Facility (2) (3)

|

$ | % | % | ||||||||||||||||||||||||||

(1)Net of outstanding revolving credit facility borrowings, outstanding letters of credit under the 2020 Credit Agreement, and outstanding borrowings under our commercial paper program of $486.0 million (excluding unamortized discount) (see “Commercial paper program” below).

(2)Outstanding term loan facilities borrowings are net of unamortized debt issuance costs.

(3)Outstanding borrowings reflect a $142.1 million partial prepayment of the 2019 Five-Year Term Facility under our June 2021 Term Credit Agreement.

We and our subsidiaries are subject to covenants that are contained in the 2020 Credit Agreement and the June 2021 Term Credit Agreement, including those restricting the incurrence of additional indebtedness, additional liens, mergers and consolidations, transactions with affiliates, and sale and leaseback transactions, in each case subject to numerous conditions, exceptions, and thresholds. The financial covenants are limited to a minimum interest coverage ratio and a maximum net leverage ratio.

Commercial paper program

We have a commercial paper program which provides for the issuance of up to an aggregate principal amount of $2.0 billion of commercial paper. Our commercial paper program is backed by unused commitments under our revolving credit facility under our 2020 Credit Agreement. Accordingly, outstanding borrowings under our commercial paper program reduce the amount available under our revolving credit facility. As of August 31, 2021, we had $486.0 million outstanding borrowings, net of unamortized discount, under our commercial paper program with a weighted average annual interest rate of 0.2 % and a weighted average remaining term of 15 days.

Senior notes

In July 2021, we issued $1,000.0 million aggregate principal amount of 2.25 % senior notes due August 2031. Proceeds from this offering, net of discount and debt issuance costs, were $987.4 million. Interest on

| Constellation Brands, Inc. Q2 FY 2022 Form 10-Q |

#WORTHREACHINGFOR I 18

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

the 2.25 % July 2021 Senior Notes is payable semiannually on February 1 and August 1 of each year, beginning February 1, 2022. The 2.25 % July 2021 Senior Notes are redeemable, in whole or in part, at our option at any time prior to May 1, 2031, at a redemption price equal to 100 % of the outstanding principal amount, plus accrued and unpaid interest and a make-whole payment based on the present value of the future payments at the adjusted Treasury Rate plus 15 basis points. On or after May 1, 2031, we may redeem the 2.25 % July 2021 Senior Notes, in whole or in part, at our option at any time at a redemption price equal to 100 % of the outstanding principal amount, plus accrued and unpaid interest. The 2.25 % July 2021 Senior Notes are senior unsecured obligations which rank equally in right of payment to all of our existing and future senior unsecured indebtedness.

In May 2017, we issued $500.0 million aggregate principal amount of 2.70 % senior notes due May 2022. In November 2017, we issued $700.0 million aggregate principal amount of 2.65 % senior notes due November 2022. On August 25, 2021, we repaid the 2.70 % May 2017 Senior Notes and 2.65 % November 2017 Senior Notes with proceeds from the 2.25 % July 2021 Senior Notes and cash on hand. These notes were redeemed prior to maturity at a redemption price equal to 100 26.6

10. INCOME TAXES

Our effective tax rate for the six months ended August 31, 2021, and August 31, 2020, was (15.3 )% and 40.7 %, respectively. Our effective tax rate for the three months ended August 31, 2021, and August 31, 2020, was 91.7 % and 20.6 %, respectively.

For the six months ended August 31, 2021, our effective tax rate was lower than the federal statutory rate of 21% primarily due to:

•valuation allowances on a portion of the unrealized net loss from changes in fair value of our investment in Canopy and Canopy equity in earnings (losses), and

•the impact of the long-lived asset impairment of brewery construction in progress.

For the three months ended August 31, 2021, our effective tax rate was higher than the federal statutory rate of 21% primarily due to:

•valuation allowances on the unrealized net loss from changes in fair value of our investment in Canopy and Canopy equity in earnings (losses); partially offset by

•the benefit of lower effective tax rates applicable to our foreign businesses.

For the six months ended August 31, 2020, our effective tax rate was higher than the federal statutory rate of 21% primarily due to:

•valuation allowances on the unrealized net loss from changes in fair value of our investment in Canopy and Canopy equity in earnings (losses), and

•valuation allowances on existing capital loss carryforwards; partially offset by

•the recognition of a net income tax benefit from stock-based compensation award activity.

For the three months ended August 31, 2020, our effective tax rate approximated the federal statutory rate of 21% as the recognition of a net income tax benefit from stock-based compensation award activity was largely offset by (i) valuation allowances on the unrealized net loss from the changes in fair value of our investment in Canopy and Canopy equity in earnings (losses) and (ii) higher effective tax rates from our foreign businesses.

| Constellation Brands, Inc. Q2 FY 2022 Form 10-Q |

#WORTHREACHINGFOR I 19

|

||||

| FINANCIAL STATEMENTS | NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | |||||||

11. STOCKHOLDERS’ EQUITY

Common stock

The number of shares of common stock issued and treasury stock, and associated share activity, are as follows:

| Common Stock | Treasury Stock | ||||||||||||||||||||||||||||

| Class A | Class B | Class 1 | Class A | Class B | |||||||||||||||||||||||||

| Balance at February 28, 2021 | |||||||||||||||||||||||||||||

| Share repurchases | — | — | — | — | |||||||||||||||||||||||||

| Conversion of shares | ( |

( |

— | — | |||||||||||||||||||||||||

| Exercise of stock options | — | — | ( |

— | |||||||||||||||||||||||||

Vesting of restricted stock units (1)

|

— | — | — | ( |

— | ||||||||||||||||||||||||

Vesting of performance share units (1)

|

— | — | — | ( |

— | ||||||||||||||||||||||||

| Balance at May 31, 2021 | |||||||||||||||||||||||||||||

| Share repurchases | — | — | — | — | |||||||||||||||||||||||||

| Exercise of stock options | — | — | ( |

— | |||||||||||||||||||||||||

| Employee stock purchases | — | — | — | ( |