DEF 14A: Definitive proxy statements

Published on June 15, 2012

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |||||

| ¨ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||||

| x | Definitive Proxy Statement | |||||

| ¨ | Definitive Additional Materials | |||||

| ¨ | Soliciting Material Under §240.14a-12 | |||||

CONSTELLATION BRANDS, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

ANNUAL MEETING OF STOCKHOLDERS

June 8, 2012

To Our Stockholders:

You are cordially invited to attend the Annual Meeting of Stockholders of Constellation Brands, Inc. in the Callahan Theater at the Nazareth College Arts Center, 4245 East Avenue, Rochester, New York 14618, on Friday, July 27, 2012 at 11:00 a.m. (local time). The Arts Center doors will open at 10:30 a.m.

The Nazareth College Arts Center is located on the campus of Nazareth College in the Town of Pittsford, New York. Parking is available in Parking Lot A off South Campus Drive.

The attached Notice of Annual Meeting of Stockholders and Proxy Statement describe in detail the matters expected to be acted upon at the meeting. Also contained in this package is the Companys Annual Report to stockholders, consisting of the Companys 2012 Summary Annual Report and Annual Report on Form 10-K for the fiscal year ended February 29, 2012, that contains important business and financial information concerning the Company.

We hope you are able to attend this years Annual Meeting.

Very truly yours,

RICHARD SANDS

Chairman of the Board

Table of Contents

CONSTELLATION BRANDS, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JULY 27, 2012

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (the Meeting) of CONSTELLATION BRANDS, INC. (the Company) will be held in the Town of Pittsford in the Callahan Theater at the Nazareth College Arts Center, 4245 East Avenue, Rochester, New York 14618, on Friday, July 27, 2012 at 11:00 a.m. (local time) for the following purposes as more fully described in the attached Proxy Statement:

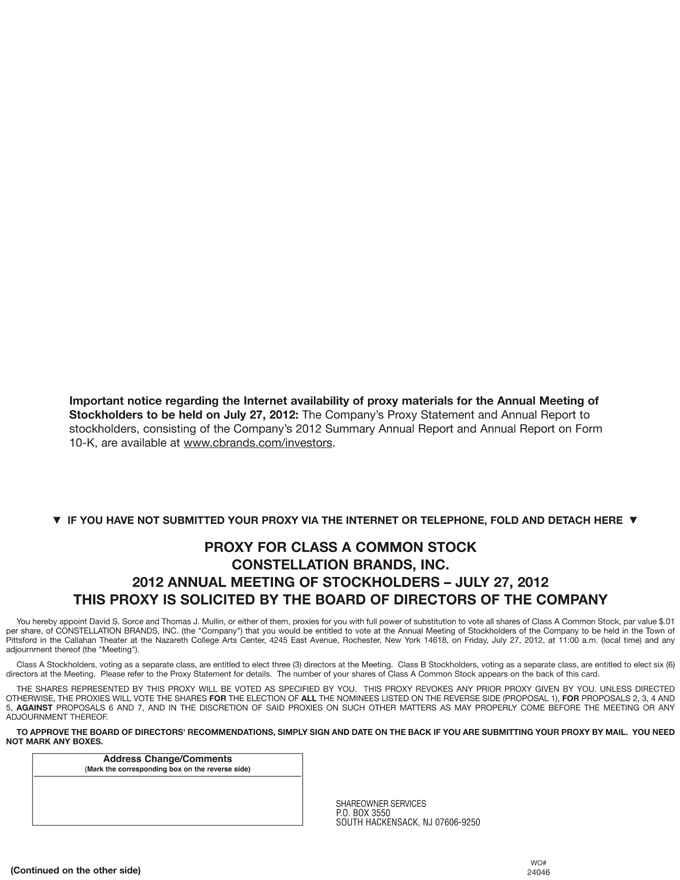

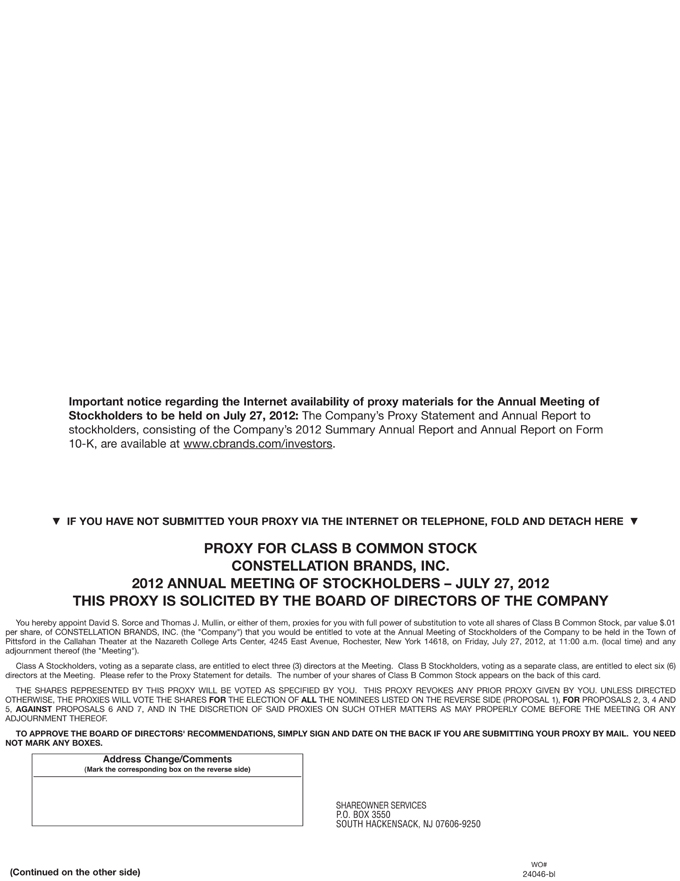

| 1. | To elect as directors of the Company the nominees named in the Proxy Statement; |

| 2. | To ratify the selection of KPMG LLP as the Companys independent registered public accounting firm for the fiscal year ending February 28, 2013; |

| 3. | To approve, by an advisory vote, the compensation of the Companys named executive officers as disclosed in the Proxy Statement; |

| 4. | To approve the amendment and restatement of the Companys Annual Management Incentive Plan; |

| 5. | To approve the amendment and restatement of the Companys Long-Term Stock Incentive Plan; |

| 6. | To consider a stockholder proposal concerning Equal Shareholder Voting, if properly presented at the Meeting; |

| 7. | To consider a stockholder proposal concerning Multiple Performance Metrics, if properly presented at the Meeting; and |

| 8. | To transact such other business as may properly come before the Meeting or any adjournment thereof. |

The Board of Directors has fixed the close of business on May 29, 2012 as the record date for the determination of stockholders entitled to notice of and to vote at the Meeting or any adjournment thereof.

Your vote is important. Kindly sign, date and return the enclosed proxy card(s) in the postage-paid envelope provided or submit your proxy by telephone or via the Internet by following the instructions on your proxy card(s). This will allow your shares to be voted even if you cannot attend the Meeting.

BY ORDER OF THE BOARD OF DIRECTORS

DAVID S. SORCE, Secretary

June 8, 2012

Table of Contents

i

Table of Contents

CONSTELLATION BRANDS, INC.

207 High Point Drive, Building 100

Victor, New York 14564

PROXY STATEMENT

2012 ANNUAL MEETING OF STOCKHOLDERS

This Proxy Statement is being furnished to the holders of the common stock of CONSTELLATION BRANDS, INC. (the Company, we, our or us) in connection with the solicitation of proxies by the Board of Directors of the Company (the Board). The proxies are for use at the Annual Meeting of Stockholders of the Company and at any adjournment thereof (the Meeting). The Meeting will be held on Friday, July 27, 2012 at 11:00 a.m. (local time) in the Town of Pittsford in the Callahan Theater at the Nazareth College Arts Center, 4245 East Avenue, Rochester, New York 14618.

This Proxy Statement and the accompanying proxy card(s) are being mailed to stockholders beginning on or about June 18, 2012.

You may submit your proxy by properly executing and returning the accompanying proxy card(s) or by following the instructions on the accompanying proxy card(s) to submit your proxy by telephone or via the Internet. The shares represented by your proxy, if the proxy is properly submitted and not revoked, will be voted at the Meeting as directed by your proxy. You may revoke your proxy at any time before the proxy is exercised by delivering to the Secretary of the Company a written revocation or by submitting a proxy bearing a later date by telephone, via the Internet or in writing. You may also revoke your proxy by attending the Meeting and voting in person.

The shares represented by your proxy will be voted FOR the election of the director nominees named herein (Proposal 1), unless you specifically withhold authority to vote for one or more of the director nominees. Further, unless you properly direct otherwise, the shares represented by your proxy will be voted FOR the ratification of the selection of KPMG LLP as the Companys independent registered public accounting firm for the fiscal year ending February 28, 2013 (Proposal 2), FOR the approval, by an advisory vote, of the compensation of the Companys named executive officers as disclosed herein (Proposal 3), FOR the approval of the amendment and restatement of the Companys Annual Management Incentive Plan (Proposal 4), FOR the approval of the amendment and restatement of the Companys Long-Term Stock Incentive Plan (Proposal 5), and AGAINST the stockholder proposals as described herein (Proposal 6 and Proposal 7).

As of the close of business on May 29, 2012 (the Record Date), the outstanding common stock of the Company consisted of Class A Common Stock, par value $.01 per share (Class A Stock), Class B Common Stock, par value $.01 per share (Class B Stock), and Class 1 Common Stock, par value $.01 per share (Class 1 Stock). Holders of Class 1 Stock have limited voting rights, and only holders of Class A Stock and Class B Stock are entitled to vote on Proposals 1 through 7 described in this Proxy Statement. As appropriate, the Company has enclosed with the proxy materials a Class A Stock proxy card and/or a Class B Stock proxy card, depending on the holdings of the

1

Table of Contents

stockholder to whom proxy materials are mailed. Stockholders who receive both a proxy card for Class A Stock and a proxy card for Class B Stock must sign and return both proxy cards in accordance with their respective instructions or submit a proxy by telephone or via the Internet with respect to both Class A Stock and Class B Stock in order to ensure the voting of the shares of each class owned.

The cost of soliciting proxies will be borne by the Company. In addition to solicitation by use of the mail, directors, officers or regular employees of the Company, without extra compensation, may solicit proxies in person or by telephone, facsimile, Internet or electronic mail. The Company has requested persons holding stock for others in their names or in the names of nominees to forward these materials to the beneficial owners of such shares. If requested, the Company will reimburse such persons for their reasonable expenses in forwarding these materials.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JULY 27, 2012

This Proxy Statement and the Companys Annual Report to stockholders, consisting of the Companys 2012 Summary Annual Report and Annual Report on Form 10-K for the fiscal year ended February 29, 2012, are available on the Investors page of our website at www.cbrands.com/investors.

The capital stock of the Company entitled to be voted at the Meeting that was outstanding as of the Record Date consisted of 153,459,643 shares of Class A Stock and 23,540,335 shares of Class B Stock. Each share of Class B Stock is convertible into one share of Class A Stock at any time at the option of the holder. Shares of Class 1 Stock have limited voting rights, and holders of Class 1 Stock are not entitled to vote on Proposals 1 through 7 described in this Proxy Statement.

Only holders of record of Class A Stock and Class B Stock on the books of the Company at the close of business on May 29, 2012, the Record Date for determining eligibility to vote at the Meeting, are entitled to notice of and to vote at the Meeting. Except as otherwise required by Delaware law, the holders of Class A Stock and the holders of Class B Stock will vote together as a single class on all matters other than the election of directors as set forth below. Each holder of Class A Stock is entitled to one (1) vote for each share of Class A Stock registered in such holders name, and each holder of Class B Stock is entitled to ten (10) votes for each share of Class B Stock registered in such holders name. Therefore, holders of Class A Stock are entitled to cast a total of 153,459,643 votes at the Meeting and holders of Class B Stock are entitled to cast a total of 235,403,350 votes at the Meeting.

The holders of shares representing a majority of the outstanding aggregate voting power of Class A Stock and Class B Stock, present at the Meeting in person or by proxy, will constitute a quorum. Shares represented by proxies marked as abstentions will be counted toward determining the presence of a quorum. Broker non-votes occur when brokers or other nominees submit proxies relating to shares held in street name that they may vote with respect to at least one of, but not all, the matters to be considered at the Meeting because they have not received instructions from the respective beneficial owners of the shares. Shares with respect to which broker non-votes occur would be counted as shares present for purposes of determining whether a quorum is present at the Meeting. Under the rules of the New York Stock Exchange, brokers and nominees will not be permitted to vote with respect to Proposals 1, 3, 4, 5, 6 or 7 without receiving direction from the beneficial owners of the Class A Stock or Class B Stock held by such broker or nominee; however, authorized brokers and nominees will be permitted to vote with respect to Proposal 2 without receiving such direction.

2

Table of Contents

Accordingly, the Company may receive broker non-votes with respect to Proposals 1, 3, 4, 5, 6 or 7 but does not expect to receive broker non-votes with respect to Proposal 2 unless one or more beneficial owners have withheld discretionary authority from their respective brokers or nominees.

Under Delaware law and the Companys certificate of incorporation and by-laws, directors are elected by a plurality of the votes cast (the highest number of votes cast) by the holders of the shares entitled to vote, and actually voting, in person or by proxy. Pursuant to the Companys certificate of incorporation and based on the number of shares of Class A Stock and Class B Stock that were outstanding on the Record Date, the holders of Class A Stock, voting as a separate class, are entitled to elect one-fourth of the number of directors to be elected at the Meeting (rounded up to the next number if the total number of directors to be elected is not evenly divisible by four). The holders of Class B Stock, voting as a separate class, are entitled to elect the remaining number of directors to be elected at the Meeting. Since the Board nominated nine (9) directors, the holders of Class A Stock will be entitled to elect three (3) directors and the holders of Class B Stock will be entitled to elect six (6) directors. Because the directors are elected by a plurality of the votes cast in each election, votes that are withheld (including broker non-votes) will not be counted and, therefore, will not affect the outcome of the elections.

The ratification of the selection of KPMG LLP as the Companys independent registered public accounting firm for the fiscal year ending February 28, 2013 (Proposal 2), the approval, by an advisory vote, of the compensation of the Companys named executive officers as disclosed in this Proxy Statement (Proposal 3), the approval of the amendment and restatement of the Companys Annual Management Incentive Plan (Proposal 4), the approval of the amendment and restatement of the Companys Long-Term Stock Incentive Plan (Proposal 5), and the adoption of the stockholder proposals described in this Proxy Statement (Proposal 6 and Proposal 7) each requires the affirmative vote of a majority of the votes entitled to be cast by stockholders present in person or represented by proxy at the Meeting. With respect to these proposals, holders of Class A Stock and Class B Stock are entitled to vote as a single class at the Meeting, with holders of Class A Stock having one (1) vote per share and holders of Class B Stock having ten (10) votes per share. Abstentions will have the effect of negative votes. However, because broker non-votes, if any, are not considered entitled to vote, they will not affect the outcome of these votes.

This section presents information concerning the beneficial ownership of our common stock by certain individuals, entities and groups. Determinations as to whether a particular individual, entity or group is the beneficial owner of our common stock have been made in accordance with Rule 13d-3 under the Securities Exchange Act of 1934. Under Rule 13d-3, a person is deemed to be the beneficial owner of any shares as to which such person: (i) directly or indirectly has or shares voting power or investment power, or (ii) has the right to acquire such voting or investment power within 60 days through the exercise of any stock option or other right. The fact that a person is the beneficial owner of shares for purposes of Rule 13d-3 does not necessarily mean that such person would be the beneficial owner of securities for other purposes. The percentages of beneficial ownership reported in this section were calculated on the basis of 153,459,643 shares of Class A Stock, 23,540,335 shares of Class B Stock, and 11,652 shares of Class 1 Stock outstanding as of the close of business on May 29, 2012, subject to adjustment as appropriate in each particular case in accordance with Rule 13d-3.

3

Table of Contents

Beneficial Security Ownership of More Than 5% of the Companys Voting Common Stock

The following tables present, as of May 29, 2012, information regarding the beneficial ownership of Class A Stock or Class B Stock by each person who is known to be the beneficial owner of more than 5% of the Class A Stock or Class B Stock. Because many shares reported in the following tables are held by various Sands-related family partnerships, family trusts and a foundation in which more than one of the beneficial owners listed below serves as a partner, trustee, director or officer, many of those shares are reflected in the tables more than once. The information reported for the stockholders group in the tables and footnotes below effectively represents the aggregate shares beneficially owned by Robert and Richard Sands without counting any shares more than once. This stockholders group beneficially owns an aggregate of 32,261,477 shares of Class A Stock and Class B Stock. The outstanding shares included in this number represent approximately 17% of the combined outstanding Class A Stock and Class B Stock and approximately 60% of the combined voting power of the outstanding Class A Stock and Class B Stock when voting together as a single class. Except as otherwise noted below, the address of each person or entity listed in the tables is c/o Constellation Brands, Inc., 207 High Point Drive, Building 100, Victor, New York 14564.

Class A Stock

| Name and Address of Beneficial Owner |

Amount and Nature of Beneficial Ownership | Percent of Class (1) | ||||||||||||||||||||||||||||||||||

| Sole Power to Vote |

Shared Power to Vote |

Sole Power to Dispose |

Shared Power to Dispose |

Total Shares (1) | ||||||||||||||||||||||||||||||||

| Class A Only |

If Class B Converted |

Class A Only |

If Class

B Converted |

|||||||||||||||||||||||||||||||||

| Robert Sands |

3,878,348 | (2) | 153,234 | (3) | 1,445,055(2) | 2,072,654 | (3) | 5,951,002 | 21,251,025 | 3.9% | 12.5% | |||||||||||||||||||||||||

| Richard Sands |

3,717,500 | (4) | 153,234 | (5) | 1,359,623(4) | 2,072,654 | (5) | 5,790,154 | 21,095,818 | 3.7% | 12.4% | |||||||||||||||||||||||||

| Abigail Bennett |

107,403 | 1,919,420 | (6) | 107,403 | 4,667,804 | (7) | 6,694,627 | 24,529,755 | 4.4% | 14.3% | ||||||||||||||||||||||||||

| Zachary Stern |

106,492 | 1,919,420 | (6) | 106,492 | | 2,025,912 | 8,021,256 | 1.3% | 5.0% | |||||||||||||||||||||||||||

| CWC Partnership-I |

| 768 | (8) | | 472,376 | (8) | 472,376 | 6,571,456 | 0.3% | 4.1% | ||||||||||||||||||||||||||

| Trust for the benefit of Andrew Stern, M.D. under the Will of Laurie Sands | | 768 | (9) | | 1,920,188 | (9) | 1,920,188 | 8,582,900 | 1.3% | 5.4% | ||||||||||||||||||||||||||

| Stockholders Group Pursuant to Section13(d)(3) of the Securities Exchange Act of 1934 (10) | | 7,749,082 | (10) | | 4,877,332 | (10) | 9,668,502 | 32,261,477 | 6.2% | 18.1% | ||||||||||||||||||||||||||

| FMR LLC 82 Devonshire Street |

61,765 | | 21,883,361 | | 21,883,361 | NA | 14.3% | NA | ||||||||||||||||||||||||||||

| AllianceBernstein L.P. 1345 Avenue of the Americas |

12,984,305 | | 16,546,324 | 6,606 | 16,552,930 | NA | 10.8% | NA | ||||||||||||||||||||||||||||

| BlackRock, Inc. 40 East 52nd Street New York, NY 10022 (13) |

13,952,041 | | 13,952,041 | | 13,952,041 | NA | 9.1% | NA | ||||||||||||||||||||||||||||

| The Vanguard Group, Inc. 100 Vanguard Blvd. |

250,091 | | 10,715,615 | 250,091 | 10,965,706 | NA | 7.1% | NA | ||||||||||||||||||||||||||||

4

Table of Contents

Class B Stock

| Name and Address of Beneficial Owner |

Amount and Nature of Beneficial Ownership | Percent of Class |

||||||||||||||||||||||||

| Sole to Vote |

Shared Power to Vote |

Sole Power |

Shared Power to Dispose |

Total | ||||||||||||||||||||||

| Robert Sands |

7,287,311 | (2) | 2,017,368(3) | 1,367,419(2) | 8,012,712 | (3) | 15,300,023 | 65.0% | ||||||||||||||||||

| Richard Sands |

7,292,952 | (4) | 2,017,368(5) | 1,373,060(4) | 8,012,712 | (5) | 15,305,664 | 65.0% | ||||||||||||||||||

| Abigail Bennett |

| 5,995,344(6) | | 11,839,784 | (7) | 17,835,128 | 75.8% | |||||||||||||||||||

| Zachary Stern |

| 5,995,344(6) | | | 5,995,344 | 25.5% | ||||||||||||||||||||

| CWC Partnership-I |

| 667,368(8) | | 6,099,080 | (8) | 6,099,080 | 25.9% | |||||||||||||||||||

| Trust for the benefit of Andrew Stern, M.D. under the Will of Laurie Sands |

| 667,368(9) | | 6,662,712 | (9) | 6,662,712 | 28.3% | |||||||||||||||||||

| RES Business Holdings LP |

| 5,300,000(15) | | 5,300,000 | (15) | 5,300,000 | 22.5% | |||||||||||||||||||

| RES Business Management LLC |

| 5,300,000(16) | | 5,300,000 | (16) | 5,300,000 | 22.5% | |||||||||||||||||||

| RSS Business Holdings LP |

| 5,300,000(17) | | 5,300,000 | (17) | 5,300,000 | 22.5% | |||||||||||||||||||

| RSS Business Management LLC |

| 5,300,000(18) | | 5,300,000 | (18) | 5,300,000 | 22.5% | |||||||||||||||||||

|

Stockholders Group Pursuant to Section 13(d)(3) of the Securities Exchange Act of 1934 (10) |

| 16,597,631(10) | | 10,753,191 | (10) | 22,592,975 | 96.0% | |||||||||||||||||||

| (1) | The numbers and percentages reported do not take into account shares of Class A Stock that can be received upon the conversion of shares of Class 1 Stock that can be purchased by exercising stock options that are exercisable on or within sixty (60) days after May 29, 2012 (the Class 1 Option Shares). These shares are not taken into account because, in accordance with the Companys certificate of incorporation, any shares of Class A Stock issued upon conversion of shares of Class 1 Stock must be sold immediately in connection with the conversion and, therefore, cannot be held by the beneficial owner of the Class 1 Option Shares. However, the numbers of shares and percentages of ownership taking into account the shares of Class A Stock that can be received upon the conversion of Class 1 Option Shares are provided in footnotes where appropriate. |

| (2) | The reported shares of Class A Stock with respect to which Robert Sands has sole power to vote or dispose (i) include 1,086,293 shares of Class A Stock that can be purchased by exercising stock options that are exercisable on or within sixty (60) days after May 29, 2012, and 154,728 shares of Class A Stock held by family limited liability companies of which Robert Sands is the general manager, and (ii) as noted in footnote (1), exclude 1,232,243 shares of Class A Stock that can be received upon conversion of Class 1 Option Shares. The reported shares of Class B Stock over which Robert Sands has the sole power to vote or dispose includes 1,350,000 shares held by a family trust of which Robert Sands is the sole trustee, and the reported shares of Class A Stock and Class B Stock over which Robert Sands has the sole power to vote include, as applicable, 5,300,000 shares of Class B Stock held by RSS Business Holdings LP and 2,333,902 shares of Class A Stock and 619,892 shares of Class B Stock held by another family partnership. The reporting of these shares as beneficially owned by Mr. Sands shall not be construed as an admission that Mr. Sands is the beneficial owner of such shares for purposes of Sections 13(d) or 13(g) of the Securities Exchange Act of 1934 or otherwise. If the shares of Class A Stock that can be received upon the conversion of Mr. Sands Class 1 Option Shares were included in the shares of Class A Stock beneficially owned by Mr. Sands, Mr. Sands would beneficially own a total of (i) 7,183,245 shares of Class A Stock, representing 4.6% of the outstanding Class A Stock, if the shares of Class B Stock beneficially owned by Mr. Sands were not converted, and (ii) 22,483,268 shares of Class A Stock, representing 13.1% of the outstanding Class A Stock, if the shares of Class B Stock beneficially owned by Mr. Sands were converted. |

| (3) | The reported shares are held by various family partnerships, family trusts and a foundation where, in most cases, Robert Sands serves as a partner, trustee, director or officer. The reporting of these shares as beneficially owned by Mr. Sands shall not be construed as an admission that Mr. Sands is the beneficial owner of such shares for purposes of Sections 13(d) or 13(g) of the Securities Exchange Act of 1934 or otherwise. The reported shares are also included in the shares reported as beneficially owned by Richard Sands and the stockholders group described in footnote (10), and the shares reported as beneficially owned by CWC Partnership-I and the trust described in footnote (9) are included in the reported shares. Amounts reflected in the tables above do not include 28,792 shares of Class A Stock owned by Mr. Sands spouse. Mr. Sands disclaims beneficial ownership of such shares. |

| (4) | The reported shares of Class A Stock with respect to which Richard Sands has sole power to vote or dispose (i) include 1,246,293 shares of Class A Stock that can be purchased by exercising stock options that are exercisable on or within sixty (60) days after May 29, 2012, and (ii) as noted in footnote (1), exclude 1,471,338 shares of Class A Stock that can |

5

Table of Contents

| be received upon conversion of Class 1 Option Shares. The reported shares of Class B Stock over which Richard Sands has the sole power to vote or dispose includes 1,350,000 shares held by a family trust of which Richard Sands is the sole trustee, and the reported shares of Class A Stock and Class B Stock over which Richard Sands has the sole power to vote include, as applicable, 5,300,000 shares of Class B Stock held by RES Business Holdings LP and 2,333,902 shares of Class A Stock and 619,892 shares of Class B Stock held by another family partnership. The reporting of these shares as beneficially owned by Mr. Sands shall not be construed as an admission that Mr. Sands is the beneficial owner of such shares for purposes of Sections 13(d) or 13(g) of the Securities Exchange Act of 1934 or otherwise. If the shares of Class A Stock that can be received upon the conversion of Mr. Sands Class 1 Option Shares were included in the shares of Class A Stock beneficially owned by Mr. Sands, Mr. Sands would beneficially own a total of (i) 7,261,492 shares of Class A Stock, representing 4.6% of the outstanding Class A Stock, if the shares of Class B Stock beneficially owned by Mr. Sands were not converted, and (ii) 22,567,156 shares of Class A Stock, representing 13.2% of the outstanding Class A Stock, if the shares of Class B Stock beneficially owned by Mr. Sands were converted. |

| (5) | The reported shares are held by various family partnerships, family trusts and a foundation where, in most cases, Richard Sands serves as a partner, trustee, director or officer. The reporting of these shares as beneficially owned by Mr. Sands shall not be construed as an admission that Mr. Sands is the beneficial owner of such shares for purposes of Sections 13(d) or 13(g) of the Securities Exchange Act of 1934 or otherwise. The reported shares are also included in the shares reported as beneficially owned by Robert Sands and the stockholders group described in footnote (10), and the shares reported as beneficially owned by CWC Partnership-I and the trust described in footnote (9) are included in the reported shares. Amounts reflected in the tables above do not include 15,720 shares of Class A Stock owned by Mr. Sands spouse. Mr. Sands disclaims beneficial ownership of such shares. |

| (6) | Abigail Bennett and Zachary Stern are the niece and nephew, respectively, of Robert Sands and Richard Sands. The amounts reflected as shares of Class A Stock and Class B Stock over which Ms. Bennett and Mr. Stern each have shared power to vote represent 471,608 shares of Class A Stock and 5,431,712 shares of Class B Stock held by CWC Partnership-I and 1,447,812 shares of Class A Stock and 563,632 shares of Class B Stock held by another family partnership. The reporting of such shares as beneficially owned by Ms. Bennett and Mr. Stern shall not be construed as an admission that either of them is the beneficial owner of such shares for purposes of Sections 13(d) or 13(g) of the Securities Exchange Act of 1934 or otherwise. Ms. Bennett and Mr. Stern have shared voting power with respect to these shares pursuant to a Voting Agreement between the two partnerships that survives so long as either partnership owns any shares unless the agreement is otherwise terminated. Ms. Bennett and Mr. Stern must exercise such voting power jointly and were granted an irrevocable proxy enabling them to vote the shares directly. In the event of the death or incapacity of either of Ms. Bennett or Mr. Stern, the other would have the unilateral power to vote the shares. The Voting Agreement provides for the appointment of successor proxies and establishes mechanics for the voting of the shares in the event of a dispute between Ms. Bennett and Mr. Stern as to the voting of the shares. |

| (7) | The amount reflected as shares of Class A Stock and Class B Stock over which Abigail Bennett has the shared power to dispose includes 2,333,902 shares of Class A Stock and 619,892 shares of Class B Stock held by SER Business Holdings LP, 2,333,902 shares of Class A Stock and 619,892 shares of Class B Stock held by SSR Business Holdings LP, 5,300,000 shares of Class B Stock held by RES Business Holdings LP, and 5,300,000 shares of Class B Stock held by RSS Business Holdings LP. Ms. Bennett disclaims beneficial ownership with respect to all such shares. |

| (8) | CWC Partnership-I is a New York general partnership of which Robert Sands and Richard Sands are managing partners. The reported shares include 768 shares of Class A Stock and 667,368 shares of Class B Stock owned by a partnership in which CWC Partnership-I is a partner. The reporting of such shares as beneficially owned by CWC Partnership-I shall not be construed as an admission that CWC Partnership-I is the beneficial owner of such shares for purposes of Sections 13(d) or 13(g) of the Securities Exchange Act of 1934 or otherwise. The reported shares are also included in the shares reported as beneficially owned by Robert Sands, Richard Sands, the trust described in footnote (9) and the stockholders group described in footnote (10), and 471,608 shares of Class A Stock and 5,431,712 shares of Class B Stock included in the reported shares are also included in the shares reported as beneficially owned by Abigail Bennett and Zachary Stern. |

| (9) | The reported shares are directly or indirectly held by various family partnerships in which the trust is a partner. The reporting of these shares as beneficially owned by the trust shall not be construed as an admission that the trust is the beneficial owner of such shares for purposes of Sections 13(d) or 13(g) of the Securities Exchange Act of 1934 or otherwise. The reported shares are also included in the shares reported as beneficially owned by Robert Sands, Richard Sands and the stockholders group described in footnote (10) and, of the reported shares, 1,919,420 shares of Class A Stock and 5,995,344 shares of Class B Stock are also included in the shares reported as beneficially owned by Abigail Bennett and Zachary Stern. In addition, the shares reported as beneficially owned by CWC Partnership-I are included in the reported shares. |

| (10) | The stockholders group, as reported, consists of Robert Sands, Richard Sands, CWC Partnership-I and another family partnership. The reporting of shares as beneficially owned by the stockholders group shall not be construed as an admission that an agreement to act in concert exists or that the stockholders group is the beneficial owner of such shares for purposes of Sections 13(d) or 13(g) of the Securities Exchange Act of 1934 or otherwise. The shares reported as beneficially owned by Robert Sands, Richard Sands, CWC Partnership-I, and the trust described in footnote (9) are |

6

Table of Contents

| included in the shares reported as beneficially owned by the stockholders group. If the shares of Class A Stock that can be received upon the conversion of Robert Sands and Richard Sands Class 1 Option Shares were included in the shares of Class A Stock beneficially owned by the stockholders group, the stockholders group would beneficially own a total of (i) 12,372,083 shares of Class A Stock, representing 7.8% of the outstanding Class A Stock, if the shares of Class B Stock beneficially owned by the stockholders group were not converted, and (ii) 34,965,058 shares of Class A Stock, representing 19.3% of the outstanding Class A Stock, if the shares of Class B Stock beneficially owned by the stockholders group were converted. Certain shares of Class A Stock and Class B Stock were pledged as of May 29, 2012 as follows: (i) an aggregate of 8,168,694 shares of Class B Stock were pledged to a financial institution to secure obligations of a Sands family investment vehicle (the Borrower) under a credit facility, (ii) an aggregate of 5,000,000 shares of Class A Stock (which number includes 355,889 shares not reported as beneficially owned by the stockholders group) and 5,000,000 shares of Class B Stock were pledged to a second financial institution to secure obligations of the Borrower under a separate credit facility, (iii) an aggregate of 4,550,000 shares of Class B Stock were pledged to two additional financial institutions to secure obligations of the Borrower under a separate credit facility, (iv) an aggregate of 2,144,876 shares of Class A Stock were pledged to a fifth financial institution to secure obligations of the Borrower under a separate credit facility, and (v) an aggregate of 294,018 shares of Class B Stock were pledged to an affiliate of the second financial institution to secure a loan made by such affiliate to a third party in which Richard Sands has an economic interest. Except as noted above, all of these pledged shares are included in the shares reported as beneficially owned by the stockholders group. Subject to the terms of the various credit facilities, the number of shares of Class A Stock and Class B Stock pledged to secure the credit facilities may increase or decrease from time to time and may be moved by the applicable pledgors among the various financial institutions from time to time. In the event of noncompliance with certain covenants under the credit facilities, the financial institutions have certain remedies including the right to sell the pledged shares subject to certain protections afforded to the borrowers and pledgors. |

| (11) | Information concerning FMR LLC presented in the table is based solely on the information reported in Amendment 11 to the Schedule 13G of FMR LLC filed on February 14, 2012 (the FMR Filing). The number of shares equals the number of shares of Class A Stock reported to be beneficially owned by FMR LLC and Edward C. Johnson 3d. The FMR Filing indicates that each of FMR LLC and Mr. Johnson, through control over various entities, has sole dispositive power with respect to all 21,883,361shares. The FMR Filing further indicates that FMR LLC has sole voting power with respect to 61,765 of these shares; however, the FMR Filing is internally inconsistent as to the number of shares with respect to which Mr. Johnson has sole voting power. |

| (12) | Information concerning AllianceBernstein L.P. presented in the table is based solely on the information reported in Amendment 1 to the Schedule 13G of AllianceBernstein L.P. filed on February 13, 2012. |

| (13) | Information concerning BlackRock, Inc. presented in the table is based solely on the information reported in Amendment 2 to the Schedule 13G of BlackRock Inc. filed on February 13, 2012. |

| (14) | Information concerning The Vanguard Group, Inc. presented in the table is based solely on the information reported in the Schedule 13G of The Vanguard Group, Inc. filed on February 8, 2012. |

| (15) | The shares held by RES Business Holdings LP are included in the number of shares beneficially owned by Richard Sands, the stockholders group described in footnote (10), RES Business Management LLC and Abigail Bennett. Assuming the conversion of Class B Stock beneficially owned by RES Business Holdings LP into Class A Stock, RES Business Holdings LP would beneficially own 5,300,000 shares of Class A Stock, representing 3.3% of the outstanding Class A Stock after such conversion. |

| (16) | The amount reflected represents 5,300,000 shares of Class B Stock held by RES Business Holdings LP. Assuming the conversion of Class B Stock beneficially owned by RES Business Management LLC into Class A Stock, RES Business Management LLC would beneficially own 5,300,000 shares of Class A Stock, representing 3.3% of the outstanding Class A Stock after such conversion. |

| (17) | The shares owned by RSS Business Holdings LP are included in the number of shares beneficially owned by Robert Sands, the stockholders group described in footnote (10), RSS Business Management LLC and Abigail Bennett. Assuming the conversion of Class B Stock beneficially owned by RSS Business Holdings LP into Class A Stock, RSS Business Holdings LP would beneficially own 5,300,000 shares of Class A Stock, representing 3.3% of the outstanding Class A Stock after such conversion. |

| (18) | The amount reflected represents 5,300,000 shares of Class B Stock owned by RSS Business Holdings LP. Assuming the conversion of Class B Stock beneficially owned by RSS Business Management LLC into Class A Stock, RSS Business Management LLC would beneficially own 5,300,000 shares of Class A Stock, representing 3.3% of the outstanding Class A Stock after such conversion. |

7

Table of Contents

Beneficial Security Ownership of Directors and Executive Officers

The Board has established guidelines for the minimum amounts of our common stock that our non-management directors and executive officers should beneficially own. These guidelines for stock ownership consider the length of a directors tenure on the Board or an executive officers tenure as an executive officer. We allow individuals five years in which to reach the applicable ownership guideline. Ownership guidelines can be satisfied through the ownership of stock, including restricted stock, and vested stock options.

The guideline for non-management directors is the beneficial ownership of five (5) times the annual cash retainer fee paid to them. The guideline for executive officers is based on each officers position in the organization and is a multiple of annual base salary. The Chairman of the Board and the President and Chief Executive Officer each has a stock ownership guideline of six (6) times his annual base salary. Each of the other executive officers has a stock ownership guideline of three (3) times his annual base salary. As of February 29, 2012, each of our non-management directors and each of our executive officers had either met his or her respective target or was within the five-year window for doing so.

The following table sets forth, as of May 29, 2012, the beneficial ownership of Class A Stock, Class B Stock, and Class 1 Stock by our directors, the named executive officers (as defined under the heading Compensation Tables and Related Information below) and all of our directors and executive officers as a group. The Class A Stock information in the table below does not include shares of Class A Stock that are issuable upon the conversion of either Class B Stock or Class 1 Stock, although such information is provided in footnotes where applicable. Unless otherwise noted, the individuals listed in the table have sole voting and dispositive power with respect to the shares attributed to them.

| Name

of Beneficial Owner |

Class A Stock (1) | Class B Stock | Class 1 Stock (1) | |||||||||||||

| Shares Beneficially Owned | Percent

of Class Beneficially Owned |

Shares Beneficially Owned |

Percent

of Class Beneficially Owned |

Shares Acquirable within 60 days (3) |

Percent

of Class Beneficially Owned (4) |

|||||||||||

| Outstanding Shares |

Shares Acquirable within 60 days (2) |

Total Shares |

||||||||||||||

|

Robert Sands (5) |

4,864,709 | 1,086,293 | 5,951,002 | 3.9% | 15,300,023 | 65.0% | 1,232,243 | 99.1% | ||||||||

|

Richard Sands (5) |

4,543,861 | 1,246,293 | 5,790,154 | 3.7% | 15,305,664 | 65.0% | 1,471,338 | 99.2% | ||||||||

| Robert Ryder |

77,864 | | 77,864 | *(6) | | * | 531,909 | 97.9% | ||||||||

| W. Keith Wilson |

26,702 | 297,050 | 323,752 | *(6) | | * | 168,903 | 93.5% | ||||||||

|

John A. (Jay) Wright |

123,046 | 81,400 | 204,446 | *(6) | | * | 276,033 | 95.9% | ||||||||

| Jerry Fowden |

8,420 | | 8,420 | *(6) | | * | 16,730 | 58.9% | ||||||||

| Barry A. Fromberg |

21,513 | 3,737 | 25,250 | *(6) | | * | 38,000 | 76.5% | ||||||||

|

Jeananne K. Hauswald |

16,005 | 13,563 | 29,568 | *(6) | | * | 38,000 | 76.5% | ||||||||

| James A. Locke III |

36,759 | 13,563 | 50,322 | *(6)(7) | 264 | * | 38,000 | 76.5% | ||||||||

| Paul L. Smith (8) |

22,938 | 9,049 | 31,987 | *(6) | | * | 38,000 | 76.5% | ||||||||

| Keith E.Wandell |

2,793 | | 2,793 | *(6) | | * | 6,517 | 35.9% | ||||||||

| Mark Zupan |

14,899 | | 14,899 | *(6) | | * | 36,321 | 75.7% | ||||||||

| All Executive Officers and Directors as a Group (14 persons) (9) | 7,795,706 | 3,581,120 | 11,376,826 | 7.2% (9) | 22,593,239 | 96.0% | 4,636,275 | 99.7% | ||||||||

| * | Percentage does not exceed one percent (1%) of the outstanding shares of such class. |

| (1) | The numbers and percentages reported with respect to Class A Stock do not take into account shares of Class A Stock that can be received upon the conversion of Class 1 Option Shares. These shares are not taken into account because, in accordance with the Companys certificate of incorporation, any shares of Class A Stock issued upon conversion of |

8

Table of Contents

| shares of Class 1 Stock must be sold immediately in connection with the conversion and, therefore, cannot be held by the beneficial owner of the Class 1 Option Shares. However, the numbers of shares and percentages of ownership taking into account the shares of Class A Stock that can be received upon the conversion of Class 1 Option Shares are provided in footnotes where appropriate. |

| (2) | Reflects the number of shares of Class A Stock that can be purchased by exercising stock options that are exercisable on or within sixty (60) days after May 29, 2012. |

| (3) | Reflects the number of shares of Class 1 Stock that can be purchased by exercising stock options that are exercisable on or within sixty (60) days after May 29, 2012. |

| (4) | In accordance with Rule 13d-3 of the Securities Exchange Act of 1934, the percentages reported with respect to Class 1 Stock are calculated on the basis that (i) the relevant director, executive officer or group holds the shares of Class 1 Stock that can be purchased by exercising Class 1 Option Shares that are exercisable on or within sixty (60) days after May 29, 2012 by such director, executive officer or group, and (ii) the only outstanding shares of Class 1 Stock are the shares deemed to be held by such director, executive or group, as applicable, and the 11,652 shares of Class 1 Stock outstanding as of May 29, 2012. The high percentages reported for each director, executive and group are a function of the small number of shares of Class 1 Stock outstanding as of May 29, 2012 and this calculation methodology. |

| (5) | See tables and footnotes under the heading Beneficial Security Ownership of More Than 5% of the Companys Voting Common Stock for information with respect to sole and shared voting or dispositive power and for the numbers and percentages of shares of Class A Stock that would be beneficially owned if Class 1 Option Shares were included in the number of shares of Class A Stock beneficially owned and assuming the conversion of Class B Stock into Class A Stock. Of the number of shares reported, 2,072,654 shares of Class A Stock and 8,012,712 shares of Class B Stock are included in the numbers reported by both Robert Sands and Richard Sands. Of the shares reported as beneficially owned by Robert Sands as of May 29, 2012, 4,380,305 shares of Class A Stock and 11,362,712 shares of Class B Stock were pledged, and of the shares reported as beneficially owned by Richard Sands as of May 29, 2012, 4,328,102 shares of Class A Stock and 11,662,712 shares of Class B Stock were pledged. Of the shares described as pledged in the preceding sentence, 1,919,420 shares of Class A Stock and 5,012,712 shares of Class B Stock are included in the shares reported as beneficially owned by both Robert Sands and Richard Sands. All of the shares described as pledged are pledged under the facilities described in footnote (10) to the table under the heading Beneficial Security Ownership of More Than 5% of the Companys Voting Common Stock. |

| (6) | If the shares of Class A Stock that can be received upon the conversion of the named individuals Class 1 Option Shares were included in the shares of Class A Stock beneficially owned by the individual, the individual would beneficially own the shares of Class A Stock as noted below, which for each individual represents less than one percent (1%) of the outstanding Class A Stock: Mr. Ryder 609,773; Mr. Wilson 492,655; Mr. Wright 480,479; Mr. Fowden 25,150; Mr. Fromberg 63,250; Ms. Hauswald 67,568; Mr. Locke 88,322; Mr. Smith 69,987; Mr. Wandell 9,310; and Mr. Zupan 51,220. |

| (7) | Assuming the conversion of Mr. Lockes 264 shares of Class B Stock into Class A Stock, Mr. Locke would beneficially own 50,586 shares of Class A Stock (88,586 shares of Class A Stock if the shares of Class A Stock that can be received upon the conversion of Mr. Lockes Class 1 Option Shares were included), representing less than one percent (1%) of the outstanding Class A Stock after such conversion. |

| (8) | Of the number of shares reported as beneficially owned by Mr. Smith, 19,535 shares of Class A Stock have been pledged. |

| (9) | This group consists of our executive officers and directors as of May 29, 2012. Assuming the conversion into Class A Stock of a total of 22,593,239 shares of Class B Stock beneficially owned by the executive officers and directors as of May 29, 2012 as a group, this group would beneficially own 33,970,065 shares of Class A Stock, representing 18.9% of the outstanding Class A Stock after such conversion. If the shares of Class A Stock that can be received upon the conversion of this groups Class 1 Option Shares were included in the shares of Class A Stock beneficially owned by this group of executive officers and directors, this group would beneficially own (i) 16,013,101 shares of Class A Stock, representing 9.9% of the outstanding Class A Stock, if the shares of Class B Stock beneficially owned by this group were not converted, and (ii) 38,606,340 shares of Class A Stock, representing 21.0% of the outstanding Class A Stock, if the shares of Class B Stock beneficially owned by this group were converted. |

9

Table of Contents

Information concerning the Companys executive officers and their terms of office can be found in Part I of the Annual Report on Form 10-K for the fiscal year ended February 29, 2012 (the 2012 Form 10-K).

Compensation Discussion and Analysis

Note Regarding Our Fiscal Years

Our fiscal year ends on the last day of February of each calendar year. Throughout this proxy statement, fiscal years are referred to by the calendar year in which a fiscal year ends. For example, the fiscal year beginning March 1, 2011 and ending February 29, 2012, which is the primary focus of this Compensation Discussion and Analysis, is referred to as fiscal 2012.

Executive Summary

The purpose of our executive compensation program is to provide competitive remuneration as our named executive officers implement our strategy, by focusing on what we call our strategic imperatives, and create stockholder value. Our executive compensation programs seek to promote the achievement of our strategic imperatives focusing for fiscal 2012 on our profitability and cash flow generation and are designed to align executive compensation to our performance. The short-term bonus and the long-term equity-based compensation opportunities result in compensation that varies with, and ties the compensation of our executives directly to, the performance of our company and its Class A Stock. We believe this provides a strong link between executive compensation and the performance of our company.

The Human Resources Committee of our Board of Directors, or the Committee, reviews and approves the elements of our executive compensation program on an annual basis and may modify particular elements of the program to maintain proper alignment with our goals and strategies and with market practices. In connection with the Committees ongoing efforts, the following events have occurred since the commencement of fiscal 2012:

Key Executive Compensation Actions During Fiscal 2012

| | Base Salaries: In setting fiscal 2012 base salaries for our named executive officers, the Committee approved increases of 2.5% for named executive officers other than our Chairman of the Board (who received no increase). The Committee also completed a special review of the compensation of Mr. Wright in July 2011 in connection with his appointment as our Chief Operating Officer and approved an off-cycle adjustment of approximately 10% effective to June 1 when Mr. Wright assumed the role of Chief Operating Officer. These increases are believed to be in line with the market. |

| | Short-Term Cash Bonus Awards: In April 2012, the Committee reviewed our performance for fiscal 2012 and approved cash bonus payments to our named executive officers pursuant to our Annual Management Incentive Plan, or AMIP. In light of our strategic imperatives of improving profitability and maximizing the generation of cash flow, these payments rewarded achievement in comparable earnings before interest and taxes, or |

10

Table of Contents

| EBIT, and free cash flow, or FCF. Based on our fiscal 2012 results, the cash bonus awards for fiscal 2012 represented payments at 112.8% of the target award levels the Committee set for the named executive officers. Fiscal 2012 AMIP results are summarized in the table below: |

| $ in Millions |

Weighting | Threshold Performance Level |

Target Performance Level |

Maximum Performance Level |

Actual 2012 |

Resulting Payout |

Resulting Weighted Payout As a Percentage of Each Executives Target Bonus |

|||||||

|

Comparable EBIT |

80% | $724.7 | $775.0 | $813.8 | $768.5 | 0.94 | 75.2% | |||||||

|

FCF |

20% | $575.0 | $650.0 | $725.0 | $715.7 | 1.88 | 37.6% | |||||||

|

Total |

112.8% |

| | Long-Term Equity-Based Incentives: In fiscal 2012, the Committee granted all of our named executive officers (except for our Chairman of the Board) a combination of performance share units, or PSUs, restricted stock, and stock options. Our Chairman received all of his equity awards in the form of stock options. The Committee granted these awards in order to directly link the value of compensation they earn to stockholder value creation and to align their interests with those of our stockholders. The Committee again selected earnings per share, or EPS, as the performance measure for these PSUs, as it believed EPS would provide a link to our strategic plan and to stockholder value creation, would be a measure of managements performance, and would not duplicate the performance metrics already used in our short-term cash bonus plan. In April 2012, the Committee reviewed our EPS results for fiscal 2012 and certified achievement at 200% of the target award levels set by the Committee in April 2011. In order to receive a payout of these awards, a named executive officer must satisfy service vesting terms generally requiring continued employment with us until May 2014. |

| | Clawback Provisions: Our fiscal 2012 stock option awards included a provision designed to allow us to clawback or recoup any awards to the extent required by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 or other law. |

| | Peer Group Revisions: In light of the sale of a majority of our businesses in the United Kingdom and Australia, the Committee undertook with the assistance of its independent compensation consultant a review of the composition of our compensation peer group. At the conclusion of this review in July 2011, the Committee approved a revised peer group selected from companies involved with managing and marketing premium brands and having gross revenues generally between 0.5 and 2.5 times those of the Company. This new peer group is described in more detail below. |

| | Stock Ownership Guidelines: The Board of Directors adopted revised stock ownership guidelines which increased the ownership requirements applicable to our directors and executive officers. |

Key Executive Compensation Changes for Fiscal 2013

| | Base Salaries: For fiscal 2013, each named executive officer, including our Chairman, received an increase of 2.5% to his base salary. These increases are believed to be in line with the market. |

11

Table of Contents

| | Short-Term Cash Bonus Award Changes: For fiscal 2013, the Committee has approved the addition of organic net sales growth, along with comparable EBIT and FCF, as the expected means of determining cash bonus payments. The Committee also approved the addition of a requirement that at least threshold comparable EBIT performance be achieved in order for the approval of any fiscal 2013 bonus payout to our named executive officers. The Committee made these refinements in order to better align our bonus program with our evolving strategic imperatives, which are focused primarily on growing market share and profitability. In addition, the Committee has approved, subject to the receipt of stockholder approval at the Meeting, the changes to our short-term bonus plan, the AMIP, as described in Proposal 4 below. |

| | Long-Term Equity-Based Incentive Award Changes: First, while the Committee again decided to grant PSUs to all named executive officers, except for our Chairman, to further enhance the linkage between executive compensation and stockholder value creation, the Committee decided to tie the vesting levels of these awards to our stock price appreciation relative to the companies included in the S&P 500 Index. This PSU performance measure will be based on fiscal 2013-2015 performance and any payouts will require the satisfaction of a service vesting requirement, generally requiring continued service with us until May 1, 2015. Second, the Committee reviewed our overall equity grant levels for our named executive officers in connection with a larger review of our equity granting practices with respect to our U.S. employees. In connection with that review, the Committee reduced the stock option award factors by approximately 10% for all named executive officers, except for our Chairman whose stock option award factor was reduced by approximately 5% due to the fact that he receives his entire annual equity award in the form of options. Third, instead of granting restricted stock to our named executive officers, other than our Chairman, the Committee decided to grant restricted stock units, or RSUs, as part of the fiscal 2013 equity awards. This change to RSUs will utilize fewer shares as compared to grants of restricted stock, will simplify the payment of taxes on these awards, and is consistent with the types of restricted equity awards we grant to non-executives. Finally, the Committee has approved, subject to the receipt of stockholder approval at the Meeting, the changes to our Long-Term Stock Incentive Plan as described in Proposal 5 below. |

| | Clawback Provisions: All fiscal 2013 stock option, RSU and PSU awards included a provision designed to allow us to clawback or recoup any awards to the extent required by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 or other law. |

2011 Say-on-Pay Vote

At the 2011 Annual Meeting of Stockholders, we conducted our initial vote to approve, on an advisory basis, the compensation of our named executive officers as disclosed in the 2011 Proxy Statement. Stockholders approved our executive compensation at that time with more than 94% of the vote being cast in favor of approval. The Committee considered the results of that vote and did not make any changes to our named executive officer compensation program in response to the vote.

Philosophy and Objectives

We operate in a highly competitive, complex and international business environment. The ability to attract, motivate and retain employees throughout the organization is critical to our long-term

12

Table of Contents

success. Accordingly, the objective of our executive compensation program is to attract, motivate and retain key executives by providing a compensation package that is competitive with the pay practices of other companies of comparable size, status, and industry with a comparable business model.

The compensation program for our named executive officers consists of fixed compensation (base salary), variable compensation (cash bonus payments and equity awards), and certain perquisites and other benefits. We have designed the elements of executive compensation to operate together in a manner that seeks to reward our named executive officers for their respective abilities and day-to-day service, assistance with the achievement of annual goals and financial targets, and contributions toward enhancing long-term stockholder value.

We feel the overall design of our executive compensation program has provided the intended results, and we continue to periodically review the program elements in an effort to maintain or improve the alignment of the executive compensation program with our strategic imperatives. We believe our compensation is market competitive and has resulted in the attraction and retention of executives who can contribute to our future success. In addition, we believe the program creates a strong linkage between pay and performance through our bonus and equity awards such that executives will receive higher compensation in our more successful periods and lower compensation during less successful periods.

How Executive Compensation is Established

The Committee discharges the Boards responsibilities relating to executive compensation, including the annual review and approval of named executive officer compensation. Management personnel within our Human Resources Department support the Committee in its work. Executive officers, including the Chairman of the Board, the President and Chief Executive Officer, and the Executive Vice President and Chief Human Resources and Administrative Officer, make recommendations and provide information to, and answer questions from, the Committee as the Committee fulfills its responsibilities regarding executive compensation during each fiscal year. The Committee engages an independent compensation consultant to assist with its review and analysis of executive compensation and to provide data and advice on matters relating to executive officer compensation. Since August 2008, Towers Watson has served as the Committees consultant.

Peer Group

In making its executive compensation decisions, the Committee evaluates each element of our executive compensation program, including comparing our practices against those of a specific peer group of consumer product companies. In establishing this peer group, the Committee worked with its independent compensation consultant and sought to ensure that the group consisted of companies of appropriate size, type and complexity by reviewing metrics such as gross revenues, enterprise value, international operations, and market capitalization. The Committee determined that the inclusion of a pro rata share of the revenues of our domestic and international joint ventures was appropriate for the purpose of determining the composition of the peer group.

13

Table of Contents

The peer group considered by the Committee for most of its key fiscal 2012 named executive officer compensation decisions (including prior to setting base salaries, short-term incentive targets and equity grants for fiscal 2012 in April 2011) consisted of the following companies:

|

Brown-Forman Corporation |

Hershey Company (The) |

|

|

Campbell Soup Company |

Hormel Foods Corporation |

|

|

ConAgra Foods, Inc. |

Kellogg Company |

|

|

Dean Foods Company |

Lorillard, Inc. |

|

|

Del Monte Foods Company |

Molson Coors Brewing Company |

|

|

Dr. Pepper Snapple Group, Inc. |

Reynolds American Inc. |

|

|

Fortune Brands, Inc.* |

J. M. Smucker Company (The) |

|

| H. J. Heinz Company |

| * | now known as Beam Inc. |

In June and July 2011, the Committee reviewed the composition of our peer group and established a revised peer group of companies listed below:

|

Beam Inc. |

Harley-Davidson, Inc. |

|

|

Brown-Forman Corporation |

H. J. Heinz Company |

|

|

Campbell Soup Company |

Hershey Company (The) |

|

|

Church & Dwight Co., Inc. |

Lorillard, Inc. |

|

|

Clorox Company (The) |

McCormick & Company, Inc. |

|

|

Coach, Inc. |

Mead Johnson Nutrition Company |

|

|

Diageo plc |

Molson Coors Brewing Company |

|

|

Dr. Pepper Snapple Group, Inc. |

Ralph Lauren Corporation |

|

|

Energizer Holdings, Inc. |

Revlon, Inc. |

|

| Estée Lauder Companies Inc. (The) |

J. M. Smucker Company (The) |

In establishing this revised peer group, the Committee sought to identify companies that manage and market portfolios of premium brands and that are of appropriate size, type and complexity. In doing so, the Committee reviewed metrics such as gross revenues (targeting companies between 0.5 and 2.5 times those of the Company) and margin structure. The Committee determined that a pro rata portion of revenues from our Crown Imports LLC joint venture should be considered for the purpose of establishing this peer group. To the extent possible, the Committee also sought to include a number of peers from the beverage alcohol industry. The Committee reviewed data regarding this new peer group prior to making an off-cycle salary adjustment for Mr. Wright in July 2011 and prior to setting base salaries, short-term incentive targets, and equity grants for fiscal 2013.

In addition to its review of peer group executive compensation data, the Committee may receive general executive compensation survey data when insufficient peer group data is available for a specific executive position or as another means of performing market checks of its overall compensation program or the individual components thereof. This information helps ensure that the Committee makes well-informed decisions regarding executive compensation matters. Throughout this Compensation Discussion and Analysis, the peer group and other survey data is sometimes referred to as applicable market data.

14

Table of Contents

Compensation of Named Executive Officers (other than the Chairman of the Board)

The Committee reviews the executive compensation program on an annual basis with awards and adjustments being made at a regularly scheduled meeting of the Committee, usually in early April. Compensation decisions may be made at other times of the year in the case of promotions, new hires, or changes in responsibilities. For example, the Committee completed a special review of Mr. Wrights salary in July 2011, and decided to make an adjustment at that time in connection with his appointment as our Chief Operating Officer. In making these determinations, the Committee may consider our performance, the performance of our named executive officers, executive compensation information from its independent compensation consultant, and compensation and benefit recommendations from management. The Committee also annually reviews tally sheets comparing current and proposed base salaries, short-term cash bonus awards, and long-term equity-based incentive awards.

Our executive compensation program generally aims to provide our named executive officers with target cash compensation approximating the midpoint of that of our peer group companies. In order to align the interests of our named executive officers with those of our stockholders, the Committee allocates a majority of the annual compensation opportunity for our named executive officers to performance based awards in the form of short-term cash bonuses and long-term equity-based incentive awards. However, other than the fact that cash bonuses and equity grants are based upon base salary amounts, the Committee does not have a policy regarding the specific allocation of compensation between short-term and long-term compensation or between cash and non-cash compensation.

The Committee places an emphasis on long-term equity-based incentive awards in our executive compensation program, and on stock options and PSUs in particular, as it believes this causes executives to focus on long-term stockholder value. With respect to stock options, for example, named executive officers will only realize compensation from these awards to the extent our stock price appreciates. In April 2010, the Committee decided to allocate equity compensation to our named executive officers (other than the Chairman of the Board) on the following basis starting in fiscal 2011 approximately 50% in options, 25% in restricted stock and 25% in PSUs. At that time, these equity grants for named executive officers were generally positioned at or above the 75th percentile of the applicable market data with our Chief Executive Officer positioned between the 50th and 75th percentile of the applicable market data. During fiscal 2012, the Committee reconsidered equity award levels as part of a larger review of equity-based compensation within our U.S. organization. In connection with that review, the Committee lowered the formula for issuing stock option awards starting in fiscal 2013 for all of our named executive officers.

Compensation of the Chairman of the Board

Prior to July 2007, Richard Sands served as our Chairman of the Board and Chief Executive Officer. He transitioned from the role of Chief Executive Officer in July 2007 and has remained our Chairman of the Board and a member of management since that time.

The Committee determined that, starting in fiscal 2011, the total direct compensation opportunity (that is, salary, potential bonus at target level and equity awards) for the Chairman of the Board should approximate 85% of the Chief Executive Officers total direct compensation opportunity. The Committee received data from its independent compensation consultant indicating that this level of compensation approximates the median of the applicable market data. As a result of this determination, the Committee decided not to increase Mr. Sands salary for fiscal 2011 or fiscal 2012

15

Table of Contents

in order to bring the Chairmans compensation in line with this target. For these same years, the Committee decided to provide Mr. Sands with 100% of his equity awards in the form of stock options since this form of equity award provides a stronger link to the creation of long-term stockholder value than restricted stock or PSUs based on EPS performance.

The Committee reviewed this approach with its independent compensation consultant in January 2012 and agreed to continue the practice of targeting the Chairmans compensation at 85% of that of the Chief Executive Officer. As the Chairmans targeted level of compensation had been achieved at that time, in April 2012 the Committee decided to award the Chairman a fiscal 2013 salary increase of 2.5% in order to maintain this level of compensation. The Committee also determined that Mr. Sands should continue to receive all of his equity awards in the form of stock options.

Elements of Compensation and Analysis of Compensation Decisions

The elements of compensation for our named executive officers consist of the following:

| | base salary; |

| | short-term cash bonus awards; |

| | long-term equity-based incentive awards; and |

| | perquisites and other benefits. |

Pay Mix

The Committee believes that a significant portion of each named executive officers compensation opportunity should be at risk in order to align the interests of our executives with those of our stockholders. As shown below, approximately 76% to 83% of our named executive officers total annual compensation opportunity is at risk and dependent on our performance results since it is received in the form of short-term cash bonus incentives and long-term equity-based incentives.

Fiscal 2012 Named Executive Officer Pay Mix

(Excluding Chairman of the Board)

Base Salary

The Committee considers base salary adjustments on an annual basis as part of its comprehensive review of executive compensation matters, usually in early April. In April 2011, the Committee approved a 2.5% increase for each named executive officer at that time (other than the

16

Table of Contents

Chairman of the Board) based on the Committees consideration of market practices and our performance. The Committee may also approve mid-year base salary adjustments in the event of a new hire, promotion or other significant change in responsibilities. Mr. Wright received such an increase effective in June 2011 after the Committee completed a special compensation review in connection with Mr. Wrights elevation to the role of Chief Operating Officer. Salaries for our named executive officers for fiscal 2012 appear in the Summary Compensation Table below.

In April 2012, the Committee also awarded each named executive officer (including the Chairman of the Board) a salary increase of 2.5% for fiscal 2013 after considering market practices and our performance.

We set base salary levels for our named executive officers to provide current compensation for their day-to-day services during the fiscal year, taking into account their individual roles and responsibilities as well as their respective experience and abilities. We generally seek to pay our named executive officers base compensation near the 50th percentile suggested by the applicable market data. The Committee may decide, however, to set an individual executives salary at an amount above or below this level. These variations may occur due to reasons such as the specific expertise of an executive, the complexity or criticality of the business managed by the executive, an executives tenure in the role, and concerns regarding internal pay equity.

Short-Term Cash Bonus Awards

In addition to their base salaries, our named executive officers, like other eligible members of management, have the opportunity to earn short-term cash bonuses based on Company performance. The Committee views these bonuses as an integral element of the entire compensation package.

Annual Management Incentive Plan Fiscal 2012

The AMIP serves as the primary mechanism for short-term performance based incentive bonuses. The Committee administers an annual program under the plan in order to accomplish the following objectives:

| | to motivate executive officers to achieve our profit and other key goals; |

| | to support our annual planning, budget and strategic planning processes; |

| | to provide compensation opportunities that are competitive with those of other beverage alcohol, industry-related or peer companies in order to attract and retain key executives; and |

| | to design a portion of our annual compensation expense to be variable and based on our performance rather than fixed. |

We believe these goals have been achieved during fiscal 2012. As described below, the Committee ultimately awarded bonus payments for fiscal 2012 based on comparable EBIT at between threshold and target levels and FCF performance above the target level and near the maximum level established at the beginning of the year.

The AMIP allows the Committee to exercise negative discretion to reduce, but not increase, an award under the plan. In April 2011, the Committee established an eligible bonus pool under the plan for fiscal 2012 equal to 0.50% of our EBIT for each of Mr. Robert Sands and Mr. Richard Sands and

17

Table of Contents

0.25% of our EBIT for each other named executive officer. The plan defines EBIT as the sum of our operating income plus equity in earnings of equity method investees, and the Company views this as a measure of its profitability. In each case in accordance with the provisions of Internal Revenue Code Section 162(m), the plan provides that the effects of extraordinary items, such as certain unusual or nonrecurring items of gain or loss, the effects of mergers, acquisitions, divestitures, spin-offs or significant transactions, among other items specified in the plan, are excluded in calculating EBIT for this purpose. Consistent with the plan, no individual award for a fiscal year may exceed $5 million and the Committee reserved the right to exercise its negative discretion at the end of fiscal 2012 to reduce or eliminate an award to any named executive officer and to consider such quantitative and qualitative factors it deems appropriate in making such determinations.

In April 2012, the Committee met to review our actual fiscal 2012 performance and to consider payouts to participants. After reviewing our fiscal year performance against the applicable performance criteria, the Committee confirmed that, prior to any application of negative discretion by the Committee, our fiscal 2012 EBIT and corresponding eligible bonus pools for each named executive officer were as follows:

Annual Management Incentive Plan

Results for Fiscal 2012 Prior to the Application of Negative Discretion

| Named Executive Officer |

Eligible Bonus Pool Calculation | Fiscal 2012 EBIT (as Calculated Pursuant to the Plan) |

Eligible Bonus Pool (Before the Application of Negative Discretion) |

|||

| Chairman of the Board; and President and Chief Executive Officer | 0.50% of fiscal 2012 EBIT | $768,500,000 | $3,842,500 | |||

| Each other named executive officer | 0.25% of fiscal 2012 EBIT | $768,500,000 | $1,921,250 |

The Committee then considered whether and how to apply negative discretion to these amounts. In doing so, the Committee took into account the following:

| | the named executive officers position; |

| | the named executive officers base salary earned in fiscal 2012; and |

| | Company performance for fiscal 2012 with respect to certain specified financial performance goals the Committee established at the beginning of the year. |

The Committee first considered individual incentive award opportunities depending on the executives position. The Committee established these opportunities as a percentage of each named executive officers fiscal 2012 base salary with the understanding that they were competitive with the market and placed at risk an appropriate amount of the executives compensation.

Annual Management Incentive Plan

Fiscal 2012 Award Levels for the Application of Negative Discretion

| Named Executive Officer |

Threshold | Target | Maximum | |||

| Chairman of the Board; and President and Chief Executive Officer | 30% | 120% | 240% | |||

| Each other named executive officer | 17.5% | 70% | 140% |

18

Table of Contents

These percentages assume that the same threshold, target or maximum performance is achieved for each applicable performance criteria utilized by the Committee in its application of negative discretion. Accordingly, an incentive award payment under the Committees application of negative discretion for fiscal 2012 could have been less than the threshold percentage set forth above if a threshold level was not achieved for one or more of the criteria.

The Committee chose comparable EBIT and FCF as the applicable performance criteria to use in its application of negative discretion, as these criteria represent key drivers of our short-term business success. We believe that comparable EBIT serves as a measure of our profitability, while FCF reflects our ability to generate the cash required to operate the business and pay down debt. Comparable EBIT is EBIT excluding restructuring charges, acquisition-related integration costs and unusual items. The Committee can also make further adjustments for restructuring and acquisition-related activities that, had they been known at the beginning of the performance period, would have impacted the Companys projections. FCF is equal to net cash provided by (used in) operating activities less purchases of property, plant and equipment. For all named executive officers, these criteria are reviewed on a company-wide basis. In exercising their negative discretion right, the Committee elected to apply the following criteria weightings to determine awards for named executive officers: 80% for comparable EBIT and 20% for FCF.