DEF 14A: Definitive proxy statements

Published on June 19, 2006

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the Securities Exchange Act of

1934

Filed

by

the Registrant [X]

Filed

by

a Party other than the Registrant [ ]

Check

the

appropriate box:

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [X] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Pursuant to Section 240.14a-12 |

CONSTELLATION

BRANDS, INC.

(Name

of

Registrant as Specified in its Charter)

_____________________________________________________

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

| [X] | No fee required. | |

|

[

]

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

|

|

(1)

|

Title of each class of securities to which transaction applies: |

| ____________________________________________ | ||

|

|

(2)

|

Aggregate number of securities to which transaction applies: |

| ____________________________________________ | ||

|

|

||

|

|

(3)

|

Per unit price or other underlying value of

transaction computed pursuant to Exchange Act Rule 0-11 (Set forth

the

amount

on which the filing fee is calculated and state how it was

determined):

|

| ____________________________________________ | ||

|

(4)

|

Proposed maximum aggregate value of transaction: | |

| ____________________________________________ | ||

|

|

(5)

|

Total fee paid: |

| [ ] | Fee paid previously with preliminary materials. | |

| [ ] | Check box if any part of the fee is offset as

provided by Exchange Act Rule 0-11(a)(2) and identify the filing

for which

the offsetting fee was paid previously.

Identify

the previous filing by registration statement number, or the Form

or

Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid: | |

| ____________________________________________ | ||

|

(2)

|

Form, Schedule or Registration Statement No.: | |

| ____________________________________________ | ||

|

(3)

|

Filing Party: | |

| ____________________________________________ | ||

|

(4)

|

Date Filed: | |

| ____________________________________________ |

|

|

|

ANNUAL

MEETING OF

STOCKHOLDERS

|

June

7,

2006

To

Our Stockholders:

You

are

cordially invited to attend the Annual Meeting of Stockholders of Constellation

Brands, Inc. at the Rochester

Riverside Convention Center,

123

East Main Street, Rochester, New York, on Thursday, July 27, 2006 at 11:00

a.m. (local time).

The

accompanying Notice of Annual Meeting of Stockholders and Proxy Statement

describe in detail the matters expected to be acted upon at the meeting. Also

contained in this package is the Company’s 2006 Annual Report to Stockholders

that contains important business and financial information concerning the

Company.

We

hope

you are able to attend this year’s Annual Meeting.

| Very truly yours, |

| /s/ Richard Sands |

| RICHARD SANDS |

|

Chairman of the Board

|

| and Chief Executive Officer |

Please

note that the Rochester Riverside Convention Center is located at the corner

of

East Main Street and South Avenue in downtown Rochester, New York. Parking

is

available at the St. Joseph Garage, which is located at 72 North Clinton Avenue.

A shuttle bus will be available to take you to the meeting. Additional parking

is also available at other public garages in the

area.

CONSTELLATION

BRANDS, INC.

|

NOTICE

OF ANNUAL MEETING OF STOCKHOLDERS

TO

BE HELD JULY 27, 2006

|

NOTICE

IS

HEREBY GIVEN that the Annual Meeting of Stockholders of CONSTELLATION BRANDS,

INC. (the “Company”) will be held at the Rochester Riverside Convention Center,

123 East Main Street, Rochester, New York, on Thursday, July 27, 2006 at 11:00

a.m. (local time) for the following purposes more fully described in the

accompanying Proxy Statement:

|

1.

|

To

elect directors of the Company (Proposal No. 1).

|

|

2.

|

To

consider and act upon a proposal to ratify the selection of KPMG

LLP,

Certified Public Accountants, as the Company’s independent public

accountants for the fiscal year ending February 28, 2007 (Proposal

No.

2).

|

|

3.

|

To

consider and act upon a proposal to approve The Constellation Brands

UK

Sharesave Scheme (Proposal No. 3).

|

|

4.

|

To

transact such other business as may properly come before the Meeting

or

any adjournment thereof.

|

The

Board

of Directors has fixed the close of business on May 31, 2006 as the record

date

for the determination of stockholders entitled to notice of and to vote at

the

Annual Meeting or any adjournment thereof.

A

Proxy

Statement and proxy card or proxy cards are enclosed.

WE

HOPE

YOU WILL ATTEND THIS MEETING IN PERSON, BUT IF YOU CANNOT, PLEASE SIGN AND

DATE

THE ENCLOSED PROXY CARD(S). RETURN THE PROXY CARD(S) IN THE ENCLOSED ENVELOPE,

WHICH REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES.

| BY ORDER OF THE BOARD OF DIRECTORS |

| /s/ David S. Sorce |

| DAVID S. SORCE, Secretary |

Fairport,

New York

June

7,

2006

[This

Page Intentionally Left Blank]

CONSTELLATION

BRANDS, INC.

370

Woodcliff Drive, Suite 300

Fairport,

New York 14450

|

PROXY

STATEMENT

|

2006

ANNUAL MEETING OF STOCKHOLDERS

This

Proxy Statement is being furnished to the stockholders of the common stock

of

CONSTELLATION BRANDS, INC. (the “Company”) in connection with the solicitation

of proxies by the Board of Directors of the Company. The proxies are for use

at

the 2006 Annual Meeting of Stockholders of the Company and at any adjournment

thereof (the “Meeting”). The Meeting will be held on Thursday, July 27, 2006 at

11:00 a.m. (local time) at the Rochester Riverside Convention Center, 123 East

Main Street, Rochester, New York.

The

shares represented by your proxy, if the proxy is properly executed and

returned, and not revoked, will be voted at the Meeting as therein specified.

You may revoke your proxy at any time before the proxy is exercised by

delivering to the Secretary of the Company a written revocation or a duly

executed proxy bearing a later date. You may also revoke your proxy by attending

the Meeting and voting in person.

The

shares represented by your proxy will be voted FOR

the

election of the director nominees named herein (Proposal No. 1), unless you

specifically withhold authority to vote for one or more of the director

nominees. Further, unless you indicate otherwise, the shares represented by

your

proxy will be voted FOR

the

ratification of the selection of KPMG LLP as the Company’s independent public

accountants for the fiscal year ending February 28, 2007 (Proposal No. 2) and

FOR

the

approval of The Constellation Brands UK Sharesave Scheme (Proposal No.

3).

The

outstanding capital common stock of the Company consists of Class A Common

Stock, par value $.01 per share (“Class A Stock”), and Class B Common Stock, par

value $.01 per share (“Class B Stock”). Accordingly, the Company has enclosed

with the proxy materials a Class A Stock proxy card and/or a Class B Stock

proxy

card, depending on the holdings of the stockholder to whom proxy materials

are

mailed. Stockholders who receive both a Class A Stock proxy card and a Class

B

Stock proxy card must sign and return both

proxy

cards in accordance with their respective instructions to ensure the voting

of

the shares of each class owned. All

share, option and similar information included in this Proxy Statement reflects

the effect of the Company’s two-for-one stock splits that were distributed in

the form of stock dividends on May 13, 2005 to stockholders of record on April

29, 2005.

This

Proxy Statement and the accompanying proxy cards are being first mailed to

stockholders on or about June 19, 2006.

The

cost

of soliciting proxies will be borne by the Company. In addition to solicitation

by use of the mail, directors, officers or regular employees of the Company,

without extra compensation, may solicit proxies in person or by telephone,

facsimile, internet or electronic mail. The Company has requested persons

holding stock for others in their names or in the names of nominees to forward

these

materials

to the beneficial owners of such shares. If requested, the Company will

reimburse such persons for their reasonable expenses in forwarding these

materials.

VOTING

SECURITIES

The

total

outstanding capital common stock of the Company, as of May 31, 2006 (the “Record

Date”), consisted of 199,922,154 shares of Class A Stock and 23,845,338 shares

of Class B Stock. Each share of Class B Stock is convertible into one share

of

Class A Stock at any time at the option of the holder.

Of

the

199,922,154 shares of Class A Stock outstanding on the Record Date, 2,337,791

shares were held by CHESS

Depositary Nominees Pty Ltd. (ACN 071 346 506) (“CDN”), a wholly-owned

subsidiary of the Australian

Stock Exchange Limited (ACN 008 624 691) (the “ASX”).

CDN has

issued Constellation CHESS Depositary Interests (“Constellation CDIs”) that

represent beneficial interests in the Class A Stock held by CDN. Constellation

CDIs are traded on the electronic transfer and settlement system operated by

the

ASX. As of the Record Date there were 23,377,910 Constellation CDIs outstanding

that were held by 820 holders of record. All references in this Proxy Statement

to outstanding shares of Class A Stock include the shares of Class A Stock

held

by CDN and all references to holders of Class A Stock include CDN.

Holders

of Constellation CDIs receive all the economic benefits of actual ownership

of

Class A Stock at a ratio of ten (10) Constellation CDIs to each share of

Constellation Class A Stock. Constellation CDIs can be converted to Class A

Stock at any time at the option of the holder of the Constellation CDI at a

ratio of one share of Class A Stock for each ten (10) Constellation CDIs.

Holders of Constellation CDIs have

the

right

to

attend stockholders’ meetings of the Company and to direct the vote of the

underlying shares of Class A Stock represented by their Constellation CDIs.

CDN,

as the holder of record of the underlying shares of Class A Stock represented

by

the Constellation CDIs, will vote such shares in accordance with the directions

of the holders of the Constellation CDIs. If CDN does not receive a direction

from a holder of Constellation CDIs as to how to vote the underlying shares

represented by those Constellation CDIs, those shares will not be voted and

will

not be considered present at the Meeting for quorum purposes. A holder of

Constellation CDIs will be entitled to vote at the stockholders’ meeting only if

such holder directs CDN to designate such holder as proxy to vote the underlying

shares of Class A Stock represented by the Constellation CDIs held by such

holder. A form to be used to direct CDN how to vote underlying shares of Class

A

Stock represented by Constellation CDIs is being delivered with this Proxy

Statement to each holder of Constellation CDIs.

Only

holders of record of Class A Stock and Class B Stock on the books of the Company

at the close of business on May 31, 2006, the Record Date for eligibility to

vote at the Meeting, are entitled to notice of and to vote at the Meeting and

at

any adjournment thereof. Under arrangements established between the Company

and

CDN in connection with the issuance of Constellation CDIs, the holders of

Constellation CDIs are entitled to notice of and to attend the Meeting but

may

only vote at the Meeting as proxy for CDN in the circumstances described above.

Except as otherwise required by Delaware law, the holders of Class A Stock

and

the holders of Class B Stock vote together as a single class on all matters

other than the election of the group of directors who are elected solely by

the

holders of the Class A Stock. Each holder of Class A Stock is entitled to one

(1) vote for each share of Class A Stock registered in such holder’s name, and

each holder of Class B Stock is entitled to ten (10) votes for each share of

Class B Stock registered in such holder’s name. Therefore, holders of Class A

Stock are entitled to cast a total of 199,922,154 votes and holders of Class

B

Stock are entitled to cast a total of 238,453,380 votes at the

Meeting.

2

The

holders of a majority of the outstanding aggregate voting power of Class A

Stock

(including the underlying shares represented by Constellation CDIs) and

Class B Stock present at the Meeting, in person or by proxy, will

constitute a quorum. Shares represented by proxies marked as abstentions will

be

counted toward determining the presence of a quorum. Proxies relating to shares

held in “street name” by brokers or other nominees that may be voted with

respect to some, but not all, matters without instruction from the beneficial

owner (“broker non-votes”) are counted as shares present for determining a

quorum. Under the rules of the New York Stock Exchange, brokers and nominees

are

generally permitted to vote with respect to Proposal No. 1 and Proposal No.

2

without receiving direction from the beneficial owner of Class A Stock or Class

B Stock but are not permitted to vote with respect to Proposal No. 3 unless

such

direction is received. Accordingly, the Company expects to receive broker

non-votes with respect to Proposal No. 3 but does not expect to receive broker

non-votes with respect to Proposal No. 1 or Proposal No. 2 unless one or more

beneficial owners have withheld discretionary authority from their respective

brokers or nominees.

Under

Delaware law and the Company’s Restated Certificate of Incorporation and

By-laws, directors are elected by a plurality of the votes cast (the highest

number of votes cast) by the holders of the shares entitled to vote, and

actually voting, in person or by proxy. Pursuant to the Company’s Restated

Certificate of Incorporation, the holders of Class A Stock (including the

underlying shares represented by Constellation CDIs), voting as a separate

class, are entitled to elect one-fourth of the number of directors to be elected

at the Meeting (rounded up to the next number if the total number of directors

to be elected is not evenly divisible by four). The holders of Class A Stock

(including the underlying shares represented by Constellation CDIs) and Class

B

Stock, voting as a single class, are entitled to elect the remaining number

of

directors to be elected at the Meeting, with holders of Class A Stock having

one

(1) vote per share and holders of Class B Stock having ten (10) votes per share.

Since the Board of Directors nominated seven (7) directors, the holders of

Class

A Stock will be entitled to elect two (2) directors and the holders of Class

A

Stock and Class B Stock, voting as a single class, will be entitled to elect

five (5) directors. Because the directors are elected by a plurality of the

votes cast in each election, votes that are withheld (including broker

non-votes, if any) will not be counted and, therefore, will not affect the

outcome of the elections.

The

ratification of the selection of KPMG LLP as the Company’s independent public

accountants for the fiscal year ending February 28, 2007 (Proposal No. 2)

requires the affirmative vote of a majority of the votes entitled to be cast

by

stockholders present in person or represented by proxy at the Meeting. With

respect to this proposal, holders of Class A Stock (including the underlying

shares represented by Constellation CDIs) and Class B Stock are entitled to

vote

as a single class at the Meeting, with holders of Class A Stock having one

(1)

vote per share and holders of Class B Stock having ten (10) votes per share.

Therefore, abstentions will have the effect of negative votes. However, because

broker non-votes, if any, are not considered entitled to vote, they will not

affect the outcome of the vote.

The

approval of The Constellation Brands UK Sharesave Scheme (Proposal No. 3)

requires the affirmative vote of the holders of a majority of the votes entitled

to be cast by stockholders present in person or represented by proxy at the

Meeting. With respect to this proposal, holders of Class A Stock (including

the

underlying shares represented by Constellation CDIs) and Class B Stock are

entitled to vote as a single class at the Meeting, with holders of Class A

Stock

having one (1) vote per share and holders of the Class B Stock having ten (10)

votes per share. Therefore, abstentions will have the effect of negative votes.

However, because broker non-votes are not considered entitled to vote, they

will

not affect the outcome of the vote.

3

BENEFICIAL

OWNERSHIP

As

of May

31, 2006, the following tables and notes set forth (i) the persons known to

the

Company to beneficially own more than 5% of Class A Stock or Class B Stock,

(ii)

the number of shares beneficially owned by them, and (iii) the percent of

such class so owned, rounded to the nearest one-tenth of one percent. This

information is based on information furnished to the Company by or on behalf

of

each person concerned. Unless otherwise noted, the percentages of ownership

were

calculated on the basis of 199,922,154 shares of Class A Stock and 23,845,338

shares of Class B Stock outstanding as of the close of business on May 31,

2006.

Class

A Stock

|

Name

and Address of Beneficial Owner

|

Amount

and Nature

of

Beneficial Ownership (1)

|

Percent

of

Class

(1)

|

||

|

Sole

Power

to

Vote

or

Dispose

|

Shared

Power

to

Vote

or

Dispose

|

Total

|

||

|

Richard

Sands

370 Woodcliff Drive, Suite 300

Fairport, NY 14450

|

2,147,856

(2)

|

601,424 (2)

|

2,749,280

|

1.4%

|

|

Robert

Sands

370 Woodcliff Drive, Suite 300

Fairport, NY 14450

|

2,073,912

(4)

|

601,424 (4)

|

2,675,336

|

1.3%

|

|

CWC

Partnership-I

370 Woodcliff Drive, Suite 300

Fairport, NY 14450

|

-

|

472,376 (5)

|

472,376

|

0.2%

|

|

Trust

for the benefit of Andrew Stern,

M.D.

under the will of Laurie Sands

370 Woodcliff Drive, Suite 300

Fairport, NY 14450

|

-

|

472,376 (6)

|

472,376

|

0.2%

|

|

Stockholders

Group Pursuant to

Section

13(d)(3) of the

Securities

Exchange Act of 1934,

as

amended (7)

|

-

|

4,823,192

(7)

|

4,823,192

|

2.4%

|

|

FMR

Corp.

82 Devonshire Street

Boston, MA 02109 (8)

|

(8)

|

(8)

|

16,646,339 (8)

|

8.3%

|

|

Capital

Research and Management Company

333 South Hope Street

Los Angeles, CA 90071 (9)

|

(9)

|

(9)

|

10,034,000 (9)

|

5.0%

|

4

Class

B Stock

|

Name

and Address of Beneficial Owner

|

Amount

and Nature

of

Beneficial Ownership (1)

|

Percent

of

Class

(1)

|

||

|

Sole

Power to

Vote

or

Dispose

|

Shared

Power

to

Vote

or Dispose

|

Total

|

||

|

Richard

Sands

370 Woodcliff Drive, Suite 300

Fairport, NY 14450

|

5,908,232

(2)

|

10,860,144

(2)

|

16,768,376

|

70.3%

|

|

Robert

Sands

370 Woodcliff Drive, Suite 300

Fairport, NY 14450

|

5,902,592

(4)

|

10,860,144

(4)

|

16,762,736

|

70.3%

|

|

Trust

for the benefit of Andrew Stern,

M.D.

under the will of Laurie Sands

370 Woodcliff Drive, Suite 300

Fairport, NY 14450

|

-

|

6,662,712

(6)

|

6,662,712

|

27.9%

|

|

CWC

Partnership-I

370 Woodcliff Drive, Suite 300

Fairport, NY 14450

|

-

|

6,099,080

(5)

|

6,099,080

|

25.6%

|

|

Trust

for the benefit of the Grandchildren

of

Marvin and Marilyn Sands

370 Woodcliff Drive, Suite 300

Fairport, NY 14450

|

-

|

4,050,000 (10)

|

4,050,000

|

17.0%

|

|

Stockholders

Group Pursuant to

Section

13(d)(3) of the Securities

Exchange

Act of 1934, as amended (7)

|

-

|

22,670,968

(7)

|

22,670,968

|

95.1%

|

______________________________

|

(1)

|

The

number of shares and the percentage of ownership set forth in the

Class A

Stock table includes the number of shares of Class A Stock that can

be

purchased by exercising stock options that are exercisable on May

31, 2006

or become exercisable within sixty (60) days thereafter (“presently

exercisable”) and reflects acceleration of the vesting of certain stock

options as discussed in footnote three of the Option Grants in Last

Fiscal

Year Table appearing at page 10 of this Proxy Statement. Additionally,

such number does not include the shares of Class A Stock issuable

pursuant

to the conversion feature of Class B Stock beneficially owned by

each

person. The number of shares and percentage of ownership assuming

conversion of Class B Stock into Class A Stock are contained in the

footnotes. For purposes of calculating the percentage of ownership

of

Class A Stock in the table and in the footnotes, additional shares

of

Class A Stock equal to the number of presently exercisable options

and, as

appropriate, the number of shares of Class B Stock owned by each

person

are assumed to be outstanding pursuant to Rule 13d-3(d)(1) under

the

Securities Exchange Act. Where the footnotes reflect shares of Class

A

Stock as being included, such shares are included only in the Class

A

Stock table and where the footnotes reflect shares of Class B Stock

as

being included, such shares are included only in the Class B Stock

table.

As of May 31, 2006, none of the beneficial owners of the Company’s Class A

Stock have reported any interest in the Company’s 5.75% Mandatory

Convertible Preferred Stock.

|

|

(2)

|

The

amount reflected as shares of Class A Stock over which Richard Sands

has

the sole power to vote or dispose includes 1,701,000 shares of Class

A

Stock issuable upon the exercise of options that are presently exercisable

by Mr. Sands and 1,000,000 shares of Class B Stock owned by a grantor

retained annuity trust, for which Richard Sands serves as trustee.

The

amounts reflected as shares over which Mr. Sands shares power to

vote or

dispose include, as applicable, 471,608 shares of Class A Stock and

5,431,712 shares of Class B Stock owned by CWC Partnership-I, a New

York

general partnership (“CWCP-I”), of which Richard Sands is a managing

partner, 147,432 shares of Class B Stock owned by the Marvin Sands

Master

Trust (the “Master Trust”), of which Richard Sands is a trustee and

|

5

|

|

beneficiary,

768 shares of Class A Stock and 667,368 shares of Class B Stock

owned by

M, L, R, & R, a New York general partnership (“MLR&R”), of which

Mr. Sands and the Master Trust are general partners, 563,632 shares

of

Class B Stock owned by CWC Partnership-II, a New York general partnership

(“CWCP-II”), of which Mr. Sands is a trustee of the managing partner,

4,050,000 shares of Class B Stock owned by the trust described

in footnote

(10) below, and 129,048 shares of Class A Stock owned by The Sands

Family

Foundation, Inc., a Virginia corporation (the “Sands Foundation”), of

which Mr. Sands is a director and officer. Mr. Sands disclaims

beneficial

ownership of all of the foregoing shares except to the extent of

his

ownership interest in CWCP-I and MLR&R and his beneficial interest in

the Master Trust. The amounts reflected do not include 29,120 shares

of

Class A Stock owned by Mr. Sands’ wife, individually and as custodian for

their children, the remainder interest Mr. Sands has in 1,433,336

of the

4,300,008 shares of Class A Stock subject to the life estate held

by

Marilyn Sands described in footnote (3) below or the remainder

interest of

CWCP-II in 1,447,812 of such shares. Mr. Sands disclaims beneficial

ownership with respect to all such shares. Assuming the conversion

of

Class B Stock beneficially owned by Mr. Sands into Class A Stock,

Mr.

Sands would beneficially own 19,517,656 shares of Class A Stock,

representing 8.9% of the outstanding Class A Stock after such

conversion.

|

|

(3)

|

Marilyn

Sands is the beneficial owner of a life estate in 4,300,008 shares

of

Class A Stock that includes the right to receive income from and

the power

to vote and dispose of such shares. The remainder interest in such

shares

is held by Richard Sands, Robert Sands and

CWCP-II.

|

|

(4)

|

The

amount reflected as shares of Class A Stock over which Robert Sands

has

the sole power to vote or dispose includes 1,491,600 shares of Class

A

Stock issuable upon the exercise of options that are presently exercisable

by Mr. Sands and 1,000,000 shares of Class B Stock owned by a grantor

retained annuity trust, for which Robert Sands serves as trustee.

The

amounts reflected as shares over which Mr. Sands shares power to

vote or

dispose include, as applicable, 471,608 shares of Class A Stock and

5,431,712 shares of Class B Stock owned by CWCP-I, of which Robert

Sands

is a managing partner, 147,432 shares of Class B Stock owned by the

Master

Trust, of which Robert Sands is a trustee and beneficiary, 768 shares

of

Class A Stock and 667,368 shares of Class B Stock owned by MLR&R, of

which Mr. Sands and the Master Trust are general partners, 563,632

shares

of Class B Stock owned by CWCP-II, of which Mr. Sands is a trustee

of the

managing partner, 4,050,000 shares of Class B Stock owned by the

trust

described in footnote (10) below, and 129,048 shares of Class A Stock

owned by the Sands Foundation, of which Mr. Sands is a director and

officer. Mr. Sands disclaims beneficial ownership of all of the foregoing

shares except to the extent of his ownership interest in CWCP-I and

MLR&R and his beneficial interest in the Master Trust. The amounts

reflected do not include 183,520 shares of Class A Stock owned by

Mr.

Sands’ wife, individually and as custodian for their children, the

remainder interest Mr. Sands has in 1,418,860 of the 4,300,008 shares

of

Class A Stock subject to the life estate held by Marilyn Sands described

in footnote (3) above or the remainder interest of CWCP-II in 1,447,812

of

such shares. Mr. Sands disclaims beneficial ownership with respect

to all

such shares. Assuming the conversion of Class B Stock beneficially

owned

by Mr. Sands into Class A Stock, Mr. Sands would beneficially own

19,438,072 shares of Class A Stock, representing 8.9% of the outstanding

Class A Stock after such

conversion.

|

|

(5)

|

The

amounts reflected include, as applicable, 768 shares of Class A Stock

and

667,368 shares of Class B Stock owned by MLR&R, of which CWCP-I is a

general partner. The shares owned by CWCP-I are included in the number

of

shares beneficially owned by Richard Sands and Robert Sands, the

managing

partners of CWCP-I, the Marital Trust (defined in footnote (6) below),

a

partner of CWCP-I which owns a majority in interest of the CWCP-I

partnership interests, and the group described in footnote (7) below.

The

other partners of CWCP-I are trusts for the benefit of Laurie Sands’

children. Assuming the conversion of Class B Stock beneficially owned

by

CWCP-I into Class A Stock, CWCP-I would beneficially own 6,571,456

shares

of Class A Stock, representing 3.2% of the outstanding Class A Stock

after

such conversion.

|

|

(6)

|

The

amounts reflected include, as applicable, 471,608 shares of Class

A Stock

and 5,431,712 shares of Class B Stock owned by CWCP-I, in which the

Trust

for the benefit of Andrew Stern, M.D. under the will of Laurie Sands

(the

“Marital Trust”) is a partner and owns a majority in interest of the

CWCP-I partnership interests, 563,632 shares of Class B Stock owned

by

CWCP-II, in which the Marital Trust is

|

6

|

|

a partner and owns a majority in interest of the CWCP-II partnership interests, and 768 shares of Class A Stock and 667,368 shares of Class B Stock owned by MLR&R, of which CWCP-I is a general partner. The Marital Trust disclaims beneficial ownership with respect to all of the foregoing shares except to the extent of its ownership interest in CWCP-I and CWCP-II. The amounts reflected do not include the remainder interest CWCP-II has in 1,447,812 of the 4,300,008 shares of Class A Stock subject to the life estate held by Marilyn Sands described in footnote (3) above. The Marital Trust disclaims beneficial ownership with respect to all such shares. Assuming the conversion of Class B Stock beneficially owned by the Marital Trust into Class A Stock, the Marital Trust would beneficially own 7,135,088 shares of Class A Stock, representing 3.5% of the outstanding Class A Stock after such conversion. |

|

(7)

|

The

group, as reported, consists of Richard Sands, Robert Sands, CWCP-I,

CWCP-II, and the trust described in footnote (10) (collectively,

the

“Group”). The basis for the Group consists of: (i) a Stockholders

Agreement among Richard Sands, Robert Sands and CWCP-I and (ii) the

fact

that the familial relationship between Richard Sands and Robert Sands,

their actions in working together in the conduct of the business

of the

Company and their capacity as partners and trustees of the other

members

of the Group may be deemed to constitute an agreement to “act in concert”

with respect to the Company’s shares. The members of the Group disclaim

that an agreement to act in concert exists. Except with respect to

the

shares subject to the Stockholders Agreement, the shares owned by

CWCP-I

and CWCP-II, and the shares held by the trust described in footnote

(10)

below and the Master Trust, no member of the Group is required to

consult

with any other member of the Group with respect to the voting or

disposition of any shares of the Company. Assuming the conversion

of Class

B Stock beneficially owned by the Group into Class A Stock, the Group

would beneficially own 27,494,160 shares of Class A Stock, representing

12.2% of the outstanding Class A Stock after such conversion. Of

the

shares of Class A Stock and Class B Stock held by the Group, 1,190,232

shares of Class A Stock and 5,405,893 shares of Class B Stock have

been

pledged under a credit facility with a financial institution by certain

members of the Group as collateral for loans made to such members

of the

Group and certain other Sands-related entities. In the event of

noncompliance with certain covenants under the credit facility, the

financial institution has the right to sell the pledged shares subject

to

certain protections afforded to the

pledgors.

|

|

(8)

|

The

number of shares equals the number of shares of Class A Stock reported

to

be beneficially owned by FMR Corp. and Edward C. Johnson 3d (collectively,

“FMR”) in its Schedule 13G (Amendment No. 4) dated February 14, 2006.

The

percentage of ownership reflected in the table is calculated on the

basis

of 199,922,154 shares of Class A Stock outstanding on May 31, 2006.

The

Schedule 13G (Amendment No. 4) indicates that of the 16,646,339 shares

beneficially owned by FMR through its control of various entities,

FMR has

sole voting power with respect to 550,339 shares and sole dispositive

power with respect to 16,646,339 shares. For further information

pertaining to FMR, reference should be made to FMR’s Schedule 13G

(Amendment No. 4) filed with the Securities and Exchange Commission.

With

respect to the information contained herein pertaining to shares

of Class

A Stock beneficially owned by FMR, the Company has relied solely

on the

information reported in FMR’s Schedule 13G (Amendment No. 4) and has not

independently verified FMR’s beneficial ownership as of May 31, 2006.

|

|

(9)

|

The

number of shares equals the number of shares of Class A Stock reported

to

be beneficially owned by Capital Research and Management Company

(“CRMC”)

in its Schedule 13G dated February 6, 2006. The percentage of ownership

reflected in the table is calculated on the basis of 199,922,154

shares of

Class A Stock outstanding on May 31, 2006. The Schedule 13G indicates

that

of the 10,034,000 shares beneficially owned by CRMC in its capacity

as an

investment advisor, CRMC has sole voting power with respect to 6,834,000

shares and has sole dispositive power with respect to 10,034,000

shares.

For further information pertaining to CRMC, reference should be made

to

CRMC’s Schedule 13G filed with the Securities and Exchange Commission.

With respect to the information contained herein pertaining to shares

of

Class A Stock beneficially owned by CRMC, the Company has relied

solely on

the information reported in CRMC’s Schedule 13G and has not independently

verified CRMC’s beneficial ownership as of May 31, 2006.

|

7

|

(10)

|

The

trust was created by Marvin Sands under the terms of an Irrevocable

Trust

Agreement dated November 18, 1987 (the “Trust”). The Trust is for the

benefit of the present and future grandchildren of Marvin and Marilyn

Sands. The Co-Trustees of the Trust are Richard Sands and Robert

Sands.

Unanimity of the Co-Trustees is required with respect to voting and

disposing of Class B Stock owned by the Trust. The shares owned by

the

Trust are included in the number of shares beneficially owned by

Richard

Sands, Robert Sands and the Group. Assuming the conversion of Class

B

Stock beneficially owned by the Trust into Class A Stock, the Trust

would

beneficially own 4,050,000 shares of Class A Stock, representing

2.0% of

the outstanding Class A Stock after such

conversion.

|

EXECUTIVE

COMPENSATION

Summary

Compensation

The

following table summarizes the annual and long-term compensation paid to the

Company’s Chief Executive Officer and the other four most highly compensated

executive officers (as determined at the end of the fiscal year ended February

28, 2006 (collectively, the “Named Executives”)) for the fiscal years ended

February 28, 2006, February 28, 2005 and February 29, 2004.

Summary

Compensation Table

|

Annual

Compensation

|

Long-Term

Compensation

Awards

(2)

|

|||||

|

Name

and Principal Position

|

Year

|

Salary

|

Bonus

|

Other

Annual Compen-

sation

(1)

|

Securities

Underlying

Options

(3)

|

All

Other

Compen-

sation

(4)

|

|

Richard

Sands,

Chairman of the Board and

Chief Executive Officer

|

2006

2005

2004

|

$1,000,000

950,000

875,500

|

$1,228,817

1,154,250

868,715

|

$161,178

(5)

121,524

(5)

88,729

(5)

|

156,200

282,800

212,200

|

$83,357

77,620

64,514

|

|

Robert

Sands,

President

and Chief

Operating Officer

|

2006

2005

2004

|

$820,000

750,000

618,000

|

$1,006,944

911,250

613,211

|

$147,196

(6)

113,850

(6)

-

|

128,000

231,800

167,600

|

$69,335

62,431

46,497

|

|

Stephen

B. Millar,

Chief Executive Officer,

Constellation Wines

(7)

|

2006

2005

2004

|

$690,715

652,834

553,703

|

$473,278

590,684

263,452

|

$74,753

(8)

54,934

(8)

98,796

(8)

|

64,800

141,400

431,212

|

$138,143

128,893

139,023

|

|

Alexander

L. Berk,

Chief Executive Officer,

Constellation Beers and Spirits

(9)

|

2006

2005

2004

|

$584,768

562,277

545,900

|

$493,310

630,200

610,731

|

-

-

-

|

53,800

84,600

81,000

|

$53,310

52,267

50,352

|

|

Thomas

S. Summer,

Executive Vice President and

Chief Financial Officer

|

2006

2005

2004

|

$441,334

424,360

412,000

|

$325,463

412,478

327,046

|

-

-

-

|

40,600

103,800

123,000

|

$40,291

37,778

32,997

|

_________________________

|

(1)

|

None

of the Named Executives, other than as indicated, received any individual

perquisites or other personal benefits exceeding the lesser of $50,000

or

10% of the total salary and bonus reported for such executive officer

during the periods covered by the Summary Compensation Table.

|

|

(2)

|

None

of the Named Executives received any restricted stock awards or any

pay-outs under long-term incentive plans during the periods covered

by the

Summary Compensation Table.

|

|

(3)

|

The

securities consist of shares of Class A Stock underlying stock options.

|

|

(4)

|

Amounts reported for 2006 consist of: |

|

•

|

Company

401(k) contributions under the Company’s 401(k) and Profit Sharing Plan:

Richard Sands $6,531; Robert Sands $6,381; Alexander Berk $6,412;

and

Thomas Summer $6,378.

|

8

|

•

|

Company

profit sharing contributions under the Company’s 401(k) and Profit Sharing

Plan: Richard Sands $16,149; Robert Sands $16,149; Alexander Berk

$16,842;

and Thomas Summer $16,149.

|

|

•

|

Company

contributions under the Company’s 2005 Supplemental Executive Retirement

Plan: Richard Sands $60,677; Robert Sands $46,805; Alexander Berk

$30,056;

and Thomas Summer $17,764.

|

|

•

|

Company contributions to the Superannuation Plan for Stephen Millar: $138,143. |

|

(5)

|

The

amounts shown include $152,509 in 2006, $114,324 in 2005 and $83,959

in

2004 for use of the corporate

aircraft.

|

|

(6)

|

The

amounts shown include $135,047 in 2006 and $105,564 in 2005 for use

of the

corporate aircraft. No amount is shown for use of the corporate aircraft

in 2004.

|

|

(7)

|

Mr.

Millar joined the Company in April 2003 with the acquisition of BRL

Hardy

Limited (now known as Hardy Wine Company Limited) at which time he

became

an executive officer of the Company. Mr. Millar remains an employee

of

Hardy Wine Company Limited, even following his retirement on February

28,

2006, from the position Chief Executive Officer, Constellation Wines.

The

reported information for 2004 is the amount paid to him during the

portion

of the 2004 fiscal year that he was an executive officer of the Company.

As Mr. Millar remained an executive officer through the end of the

Company’s 2006 fiscal year, the reported information for 2006 is the

amount paid to him during the entire 2006 fiscal year. Mr. Millar

is paid

in Australian dollars. The amounts appearing in the table and footnotes

are converted into United States dollars using the weighted average

exchange rate for the indicated fiscal year. Specifically, amounts

were

converted to US dollars from Australian dollars at the weighted average

exchange rate of 0.7513 for 2006, the weighted average exchange rate

of

0.7385 for 2005 and the weighted average exchange rate of 0.7057

for 2004.

|

|

(8)

|

The

amounts shown include use of a motor vehicle in the amount of $60,399

in

2006, $42,301 in 2005 and $29,826 in 2004, and air transportation

services

in the amount of $55,184 in 2004.

|

|

(9)

|

Mr.

Berk is employed by Barton Incorporated, a wholly-owned subsidiary

of the

Company.

Mr.

Berk is also President and Chief Executive Officer of Barton

Incorporated.

|

Stock

Options

The

following table contains information concerning stock option grants to the

Named

Executives during the fiscal year ended February 28, 2006. No stock appreciation

rights (“SARs”) were granted to any of the Named Executives in that year. The

columns labeled “Potential Realizable Value” are based on hypothetical 5% and

10% growth assumptions, as required by the Securities and Exchange Commission.

The Company cannot predict the actual growth rate of its Common

Stock.

9

Option

Grants In Last Fiscal Year

|

Individual

Grants

|

Potential

Realizable

Value

at Assumed

Annual

Rates

of

Stock Price

Appreciation

for

Option

Term

|

|||||

|

Name

|

Number

of

Securities

Underlying

Options

Granted

(1)

|

%

of Total

Options

Granted

to

Employees

in

Fiscal

Year

|

Exercise

or Base Price ($/Sh) (2)

|

Expiration

Date

|

||

|

5%

|

10%

|

|||||

|

Richard

Sands

|

156,200

(3)

|

4.0

%

|

$

27.235

|

04/07/15

|

$

2,675,385

|

$

6,779,951

|

|

Robert

Sands

|

128,000

(3)

|

3.2

%

|

$

27.235

|

04/07/15

|

$

2,192,377

|

$

5,555,914

|

|

Stephen

B. Millar

|

64,800 (3)

|

1.6

%

|

$

27.235

|

04/07/15

|

$

1,109,891

|

$

2,812,681

|

|

Alexander

L. Berk

|

53,800 (3)

|

1.4

%

|

$

27.235

|

04/07/15

|

$

921,483

|

$

2,335,220

|

|

Thomas

S. Summer

|

40,600 (3)

|

1.0

%

|

$

27.235

|

04/07/15

|

$

695,395

|

$

1,762,266

|

__________________

|

(1)

|

The

securities consist of shares of Class A Stock underlying non-qualified

stock options that were granted pursuant to the Company’s Long-Term Stock

Incentive Plan, as amended (the “LTSIP”). The stock options were granted

for terms of no greater than 10 years, subject to earlier termination

upon

the occurrence of certain events related to termination of employment.

Under the LTSIP, the vesting of stock options accelerates in the

event of

a change of control, as defined in the LTSIP.

|

|

(2)

|

The

exercise price per share of each option is equal to the closing market

price of a share of Class A Stock on the date of grant.

|

|

(3)

|

This

option is 100% vested and fully exercisable as a result of action

taken by

the Board of Directors to accelerate, effective February 16, 2006,

all

stock options with a market condition performance accelerator based

on the

price of the Company’s Class A Stock (“PASOs”). As more fully discussed in

a Current Report on Form 8-K filed with the Securities and Exchange

Commission on February 23, 2006, the Board of Directors, on February

16,

2006, approved the acceleration of the vesting of certain unvested

options

to purchase shares of the Company’s Class A Stock previously granted to

the employees, including its executive officers, under the Company’s LTSIP

and the Company’s Incentive Stock Option Plan. The acceleration of vesting

was effective for (i) all unvested PASOs outstanding on February

16, 2006

and (ii) certain unvested options that do not contain a market condition

performance accelerator (“non-PASOs”), including those non-PASOs held by

Mr. Millar. The purpose of the vesting acceleration of the PASOs

was to

enable the Company to prevent potential earnings volatility that

can be

caused by an unpredictable market condition performance accelerator.

The

acceleration of PASOs and non-PASOs also resulted in compensation

expense

not being recorded in the Company’s income statements for future periods

with respect to such options. All of Mr. Millar’s non-PASO options were

accelerated in connection with his retirement as Chief Executive

Officer,

Constellation Wines. The Stock Ownership of Management Table appearing

at

page 19 of this Proxy Statement also reflects these

accelerations.

|

The

following table sets forth information regarding: (i) shares acquired and the

value realized upon the exercise of stock options by the Named Executives during

the fiscal year ended February 28, 2006; and (ii) the number and value of

exercisable and unexercisable stock options held by the Named Executives as

of

February 28, 2006. There are no outstanding SARs.

10

Aggregated

Option Exercises In Last Fiscal Year

And

Fiscal Year-End Option Values

|

Name

|

Shares

Acquired

on

Exercise

|

Value

Realized

|

Number

of Securities

Underlying

Unexercised

Options

at

FY-End (1)

|

Value

of Unexercised

In-the-Money

Options

at

FY-End (2)

|

||

|

Exercisable

|

Unexercisable

|

Exercisable

|

Unexercisable

|

|||

|

Richard

Sands

|

633,600

|

$

13,925,239

|

1,686,000

|

30,000

|

$

25,923,350

|

$

437,700

|

|

Robert

Sands

|

593,600

|

$

13,235,983

|

1,476,600

|

30,000

|

$

23,264,182

|

$

437,700

|

|

Stephen

B. Millar

|

50,000

|

$

786,295

|

537,412

|

-

|

$

5,855,535

|

-

|

|

Alexander

L. Berk

|

-

|

-

|

632,680

|

-

|

$

9,694,992

|

-

|

|

Thomas

S. Summer

|

325,440

|

$

6,768,976

|

337,400

|

30,000

|

$

3,715,333

|

$

437,700

|

________________________

|

(1)

|

The

securities consist of shares of Class A Stock underlying stock

options that were granted pursuant to Company plans that were approved

by

its stockholders.

|

|

(2)

|

The

indicated dollar values are calculated by determining the difference

between the closing price of the Class A Stock on the New York Stock

Exchange at the end of fiscal 2006 and the exercise price of each

indicated option.

|

Hardy

Wine Company Superannuation Plan

Mr.

Millar participates in the defined benefit component of the Hardy Wine Company

(“Hardy”) Superannuation Plan (the “Hardy Plan”), which provides for a lump sum

payment to him upon his retirement from Hardy. This benefit will be an amount

equal to twenty percent of (i) Mr. Millar’s average salary (salary being the

same for purposes of the Hardy Plan as that which appears in the Summary

Compensation Table above) for his three final years of employment prior to

retirement (“final average salary”), multiplied by (ii) Mr. Millar’s years of

service with Hardy. As of February 28, 2006, Mr. Millar was credited with 15

years of service for purposes of the Hardy Plan. Based on service through

February 28, 2006, the Company estimates that the amount of the benefit to

which

Mr. Millar would be entitled if he had then retired would be AUD$2,529,828.

Mr.

Millar has announced that he will retire from the Company effective February

9,

2007 and the Company estimates that his final average salary for purposes of

calculating his benefit amount will be AUD$907,753. Such amounts are not subject

to deduction or offset for any other private or public retirement benefit to

which Mr. Millar is entitled. As Mr. Millar will be age 63 at the date of his

announced retirement, the Company estimates that his retirement benefit under

the Hardy Plan will be AUD$2,762,354. If converted into United States dollars

using the weighted average exchange rate for the 2006 fiscal year, these amounts

would be, respectively, $1,900,660 and $681,995 and $2,075,357.

Report

with Respect to Executive Compensation

The

following report is required by the Securities and Exchange Commission’s

executive compensation rules in order to standardize the reporting of executive

compensation by public companies. This information shall not be deemed

incorporated by reference in any filing under the federal securities laws by

virtue of any general incorporation of this Proxy Statement by reference and

shall not otherwise be treated as filed under the securities laws.

11

General

The

Human

Resources Committee of the Board of Directors administers the Company’s

executive compensation program. The Human Resources Committee is composed of

Jeananne Hauswald, Thomas McDermott and Paul Smith, each of whom is

an

independent, non-management

director. Management personnel within the Company’s Human Resources Department

support the Human Resources Committee in its work. In addition, the Human

Resources Committee has the authority under its Charter to retain external

consultants to assist in the evaluation of Chief Executive Officer or senior

executive officer compensation. In accordance with this authority, the Human

Resources Committee has engaged Mercer Human Resource Consulting, Inc. as a

consultant to assist the Committee in its review and analysis of executive

compensation data and to advise the Human Resources Committee on matters

relating to Chief Executive Officer and other executive officer compensation.

A

company affiliated with Mercer Human Resource Consulting, Inc. provides

administration and recordkeeping services to the Company’s 401(k) and Profit

Sharing Plan.

The

objectives of the Company’s executive compensation program are to (i) be

competitive with the pay practices of other companies of comparable size and

status, including those in the beverage alcohol industry, and (ii) attract,

motivate and retain key executives who are vital to the long-term success of

the

Company. As discussed in detail below, the Company’s executive compensation

program consists of both fixed (base salary) and variable, incentive-based

compensation elements. These elements are designed to operate together to

comprise performance-based annual cash compensation and stock-based compensation

which align the interests of the Company’s executives with the interests of its

stockholders.

Executive

incentive compensation is determined in light of the Company’s performance

during the fiscal year and takes into account compensation data of comparable

companies. Specifically considered in fiscal 2006 with respect to annual

management incentives was the Company’s operating income for fiscal 2006,

adjusted for certain items, as compared to that set forth in its fiscal 2006

operating plan.

Base

Salary

With

respect to annual compensation, the fundamental objective in setting base salary

levels for the Company’s senior management is to pay competitive rates to

attract and retain high quality, competent executives. Competitive pay levels

are determined based upon input of compensation consultants, independent

industry surveys, proxy disclosures, salaries paid to attract new managers

and

past experience. The Human Resources Committee reviews data generated by Mercer

Human Resource Consulting, Inc., a consultant to the Human Resources Committee,

for competitive analyses. Base salary levels are determined based upon factors

such as individual performance (e.g., leadership, level of responsibility,

management skills and industry activities), Company performance and competitive

pay data.

Annual

Management Incentives

In

addition to their base salary, the Company’s executives have the opportunity to

earn an annual cash bonus under the Company’s Annual Management Incentive Plan.

The annual bonus for executive officers, including the Chief Executive Officer,

for fiscal 2006 was based on three variables: the participant’s management

position, salary and achieved Company performance for the plan year. Performance

targets were based on operating income, using the first-in, first-out method

of

accounting for inventory valuation before adjustments are made for reserves.

Awards were based on a percentage of base salary, with target awards ranging

from 60% to 100% of base salaries for executive officers. The purpose of

the

annual bonus is to motivate and provide an incentive to management to achieve

12

specific

business objectives and initiatives as set forth in the

Company’s annual operating plan and budget. Because the financial performance of

the Company met or exceeded the established targeted goals, actual bonuses

paid

to executive officers exceeded the target awards. For fiscal 2006, annual cash

bonuses were awarded to each of the Named Executives in the amounts indicated

in

the Summary Compensation Table.

Future

cash bonuses for the participating executives will be determined by the Human

Resources Committee pursuant to, or in a manner similar to that contemplated

by,

the Company’s Annual Management Incentive Plan. Pursuant to that Plan, the

Committee would award cash bonuses to the participating executives in the event

that the Company attains one or more pre-set performance targets.

Stock

Options, SARs and Restricted Stock

In

connection with the executive compensation program, long-term incentive awards

in the form of, among others, stock options, stock appreciation rights and

restricted stock are available for grant under the Company’s Long-Term Stock

Incentive Plan and Incentive Stock Option Plan. Awards have been primarily

in

the form of non-qualified stock options granted under the Company’s Long-Term

Stock Incentive Plan. These arrangements balance the annual operating objectives

of the annual cash incentive plan with the Company’s longer-term stockholder

value building strategies. The Human Resources Committee and the Board of

Directors grant these stock-based incentive awards from time to time for the

purpose of attracting and retaining key executives, motivating them to attain

the Company’s long-range financial objectives, and closely aligning their

financial interests with long-term stockholder interests and share value.

The

Company believes that through the use of stock options, executives’ interests

are directly tied to enhanced stockholder value. The Human Resources Committee

of the Board (as well as the full Board) has the flexibility of awarding

non-qualified stock options, restricted stock, stock appreciation rights and

other stock-based awards under the Company’s Long-Term Stock Incentive Plan and

incentive stock options under the Company’s Incentive Stock Option Plan. This

flexibility enables the Company to fine-tune its grants in order to maximize

the

alignment of the interests of the stockholders and management.

During

fiscal 2006, the Human Resources Committee awarded non-qualified options to

all

executive officers, including the Company’s Chief Executive Officer, taking into

account relevant market survey data, their position with the Company and the

financial performance of the Company. In recognition of the efforts expected

in

connection with the consummation of a significant acquisition by the Company,

in

April 2006 the Human Resources Committee awarded additional non-qualified

options to six (6) executive officers, including the Company’s Chief Executive

Officer. The exercise price of the stock options awarded was equal to the market

value of the underlying shares on the date of grant, and these options will

not

vest unless the acquisition is consummated within a specific timeframe.

Accordingly, the value of the award depends solely upon future growth in the

share value of the Company’s Class A Stock.

Compensation

of Chief Executive Officer

For

fiscal 2006, the compensation of Richard Sands, the Company’s Chief Executive

Officer, was based on a variety of factors, as noted above. In this regard,

the

Human Resources Committee considered the Company’s performance, as well as Mr.

Sands’ individual performance. In addition, the compensation packages of chief

executive officers of certain comparable companies selected by Mercer Human

Resource Consulting, Inc. were considered. Also taken into account was the

Company’s current executive salary and compensation structure.

13

Richard

Sands’ base salary is believed to be in line with salaries of executives of

similar companies and chief executive officers with similar responsibilities.

Pursuant to the Company’s Annual Management Incentive Plan, Mr. Sands’ annual

cash incentive attributable to fiscal 2006 was a percentage of his base salary

based upon the Company’s fiscal 2006 operating income (using the first-in,

first-out method of accounting for inventory valuation before adjustments are

made for reserves), as compared to that set forth in the Company’s fiscal 2006

operating plan. The range for Mr. Sands’ cash incentive award, from threshold,

target and maximum (25%, 100% and 200%, respectively), was comparable to

industry compensation survey data for executives in Richard Sands’ position. For

the fiscal year ended February 28, 2006, Richard Sands received a bonus of

$1,228,817, which is equal to 123.0% of his salary. As noted elsewhere in this

Proxy Statement, during fiscal 2006, Mr. Sands also received stock options

to

purchase up to 156,200 shares of Class A Stock of the Company.

Deductibility

of Executive Compensation

Section

162(m) of the Internal Revenue Code provides that certain compensation in excess

of $1 million per year paid to a company’s chief executive officer and four

other most highly paid executive officers may not be deductible by the company

unless it qualifies as performance-based compensation. The Human Resources

Committee recognizes the benefits of structuring executive compensation so

that

Section 162(m) does not limit the Company’s tax deductions for such

compensation, and the Company’s Long-Term Stock Incentive Plan, Incentive Stock

Option Plan and Annual Management Incentive Plan have been designed so that

the

Human Resources Committee may award performance-based compensation that is

not

subject to the limits imposed by Section 162(m). Under certain circumstances,

the Human Resources Committee may decide to award executive compensation in

an

amount and form that is not deductible under Section 162(m).

The

foregoing report is given by the members of the Human Resources

Committee.

| Human Resources Committee |

| Thomas C. McDermott (Chair) |

| Jeananne K. Hauswald |

| Paul L. Smith |

Compensation

Committee Interlocks and Insider Participation

As

described above, during fiscal 2006, Jeananne Hauswald, Thomas McDermott and

Paul Smith served as members of the Human Resources Committee of the Company’s

Board of Directors. None of these individuals are or have ever been officers

or

employees of the Company.

14

Stock

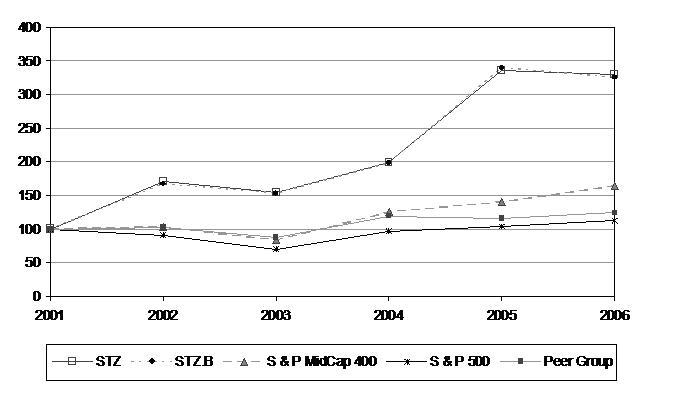

Price Performance Graph

Set

forth

below is a line graph comparing, for the fiscal years ended the last day of

February 2002, 2003, 2004, 2005 and 2006, the cumulative total stockholder

return of the Company’s Class A Stock and Class B Stock, with the cumulative

total return of the S&P MidCap 400 Index, the S&P 500 Index and a peer

group index comprised of companies in the beverage industry (the “Selected Peer

Group Index”) (see footnote (1) to the graph). The graph assumes the investment

of $100.00 on February 28, 2001 in the Company’s Class A Stock, the Company’s

Class B Stock, the S&P MidCap 400 Index, the S&P 500 Index and the

Selected Peer Group Index, and also assumes the reinvestment of all dividends.

The comparison to the S&P MidCap 400 Index is provided for transitional

purposes as the Company was included in that index until it was added to the

S&P 500 Index of companies in July 2005.

Comparison

of Five Year Cumulative Total Return

|

2001

|

2002

|

2003

|

2004

|

2005

|

2006

|

|

|

STZ

|

$100.00

|

$170.24

|

$154.30

|

$198.59

|

$335.35

|

$330.02

|

|

STZ.B

|

100.00

|

166.69

|

153.13

|

198.13

|

339.44

|

325.00

|

|

S

& P MidCap 400 Index

|

100.00

|

102.70

|

83.54

|

125.07

|

140.25

|

164.58

|

|

S

& P 500 Index

|

100.00

|

90.49

|

69.96

|

96.92

|

103.68

|

112.38

|

|

Peer

Group Index

|

100.00

|

102.33

|

87.05

|

119.09

|

115.83

|

123.91

|

___________________________

1

The

Selected

Peer Group Index

is

weighted according to the respective issuer's stock market capitalization and

is

comprised of the following companies: Anheuser-Busch Companies, Inc.; The Boston

Beer Company, Inc.; Brown-Forman Corporation (Class A and Class B Shares);

Cadbury Schweppes plc; Coca-Cola Bottling Co. Consolidated; The Coca-Cola

Company; Coca-Cola Enterprises Inc.; Diageo plc; LVMH Moet Hennessy Louis

Vuitton; Molson Coors Brewing Company (Class B Shares); PepsiCo, Inc.; and

PepsiAmericas, Inc.

15

There

can

be no assurance that the Company’s stock performance will continue into the

future with the same or similar trends depicted by the graph above. The Company

neither makes nor endorses any predictions as to future stock

performance.

The

Stock

Price Performance Graph set forth above shall not be deemed incorporated

by

reference in any filing under the federal securities laws by virtue of any

general incorporation of this Proxy Statement by reference and shall not

otherwise be treated as filed under the securities laws.

Certain

Relationships and Related Transactions

Alexander

Berk and Barton Incorporated (“Barton”), a wholly-owned subsidiary of the

Company, are parties to an employment agreement dated as of September 1,

1990,

as amended on November 11, 1996 and October 20, 1998, that provides for Mr.

Berk’s compensation and sets forth the terms and conditions of Mr. Berk’s

employment with Barton. Under his employment agreement, Mr. Berk serves as

the

President and Chief Executive Officer of Barton and, by virtue of his current

responsibilities with Barton and his designation by the Company as Chief

Executive Officer, Constellation Beers and Spirits, he is deemed an executive

officer of the Company. While the initial term of the employment agreement

expired on February 28, 2001, in accordance with the agreement, the term

is

automatically extended for one-year periods unless either Mr. Berk or Barton

notifies the other that such party does not wish to extend it. The agreement

will terminate prior to the expiration of the current term (i) upon Mr. Berk’s

death or Retirement, (ii) at Barton’s election, for Cause or upon Mr. Berk’s

Complete Disability, and (iii) at Mr. Berk’s election, for Good Reason (all as

set forth in the agreement). If Barton decides not to extend the term of

the

agreement, or if the agreement terminates by reason of Mr. Berk’s death,

Complete Disability, or Retirement, or for Good Reason, Barton is obligated

to

pay to Mr. Berk a post-termination benefit equal to 100% of his then current

base salary plus the amount of the bonus paid to him for the immediately

preceding fiscal year. If Mr. Berk decides not to extend the term of the

agreement, then Barton is obligated to pay to Mr. Berk a post-termination

benefit equal to one-half of the foregoing amount. In the event that Mr.

Berk’s

employment is terminated for Good Reason, or is terminated by Barton for

reasons

other than death, Complete Disability, Cause, or Barton’s decision not to extend

the term of the agreement, then Mr. Berk is entitled to be paid (i) if the

applicable conditions are satisfied, a supplementary post-termination benefit

equal to what he otherwise would have been entitled to receive as his share

of

Barton’s contribution to its profit-sharing and retirement plan for the fiscal

year in which such termination occurs and (ii) an amount equal to the product

of

his then current base salary multiplied by the number of years remaining

in the

then current term of the agreement. Post-termination benefits are payable

to Mr.

Berk in a lump sum as soon as practicable after his employment terminates,

except that any supplementary post-termination benefit is payable promptly

after

Barton’s contribution to the retirement plan. The agreement requires Mr. Berk to

keep certain information with respect to the Company confidential during

and

after his employment with the Company.

Stephen

Millar and BRL Hardy Limited (now known as Hardy Wine Company Limited) had

entered into an Memorandum of Agreement (Service Contract) dated as of June

11,

1996 (the “Service Contract”) that provides for Mr. Millar’s compensation and

sets forth terms and conditions of his employment with BRL Hardy Limited.

Mr.

Millar and BRL Hardy Limited also entered into a Non-Competition Agreement

effective April 4, 2003. Effective April 8, 2003, BRL Hardy Limited became

a

wholly-owned subsidiary of the Company and is now known as Hardy Wine Company

Limited (“Hardy”). Mr. Millar and the Company entered into a letter agreement

under which Mr. Millar served as the Chief Executive Officer, Constellation

Wines and by virtue of these responsibilities, he was deemed an executive

officer of the Company. The letter agreement provided for certain of Mr.

Millar’s compensation arrangements and provided for additional terms and

conditions of his employment. Those provisions of the 1996 Service Contract

not

inconsistent with the letter agreement continued. Pursuant to the Service

Contract, Mr. Millar may receive a remuneration entitlement

16

consisting

of his annual salary and benefits package in the event his position becomes

redundant, including redundancy associated with a change in control of Hardy.

The Service Contract requires Mr. Millar to keep certain information with

respect to Hardy confidential during and after his employment, and the

Non-Competition Agreement restrains Mr. Millar from engaging in certain

activities in competition with the Company for a period of twelve (12) months

following termination of his employment. In February 2006, the Company and

Mr.

Millar entered into an Agreement whereby Mr. Millar ceased to hold the position

of Chief Executive Officer, Constellation Wines at the conclusion of the

Company’s fiscal year on February 28, 2006, while still retaining a

non-executive employment relationship with the Company until February 9,

2007,

consistent with the terms and conditions of the 1996 Service Contract. Upon

termination of Mr. Millar’s Service Contract on February 9, 2007, he will be

paid in accordance with its terms, including a termination payment in the

aggregate amount of AUD$3,681,984, together with an additional bonus in the

amount of US$100,000 in recognition of his contributions to the Company.

He will

also be entitled to retirement benefits under the Hardy Wine Company

Superannuation Plan in accordance with the terms of that Plan.

Under

the

terms of a letter agreement between the Company and Thomas Summer, Executive

Vice President and Chief Financial Officer of the Company, if Mr. Summer’s

employment is terminated without cause or if he voluntarily resigns within

thirty (30) days after a demotion or a material diminishment in his

responsibilities, in either case without cause, or if there is a change in

control of the Company, he will be entitled to receive severance compensation

equal to his then current base compensation for a period of twelve (12)

months.

By

an

Agreement dated December 20, 1990, the Company entered into a split-dollar

insurance agreement with a trust established by Marvin Sands of which Robert

Sands is the trustee. Pursuant to the Agreement, in prior years the Company

has

paid the annual premium on an insurance policy (the “Policy”) held in the trust,

and the trust has reimbursed the Company for the portion of the premium equal

to

the “economic benefit” to Marvin and/or Marilyn Sands, calculated in accordance

with the United States Treasury Department rules then in effect. The Policy

is a

joint life policy payable upon the death of Marilyn Sands, as the survivor

of

the two insureds, with a face value of $5 million. Pursuant to the terms

of the

trust, Richard Sands, Robert Sands (in his individual capacity) and the children

of Laurie Sands (the deceased sister of Richard and Robert Sands) will each

receive one-third of the proceeds of the Policy (after the repayment of the

indebtedness to the Company out of such proceeds as described below), if

they

survive Marilyn Sands. While the Company made no premium payment on behalf

of

the trust in fiscal 2006, from the inception of the agreement through the

end of

fiscal 2006, the Company has paid aggregate premiums, net of reimbursements,

of

$2,382,327. The aggregate amount of such unreimbursed premiums constitutes

indebtedness from the trust to the Company and is secured by a collateral

assignment of the Policy. Upon the termination of the Agreement, whether